0001829966

false

0001829966

2023-09-15

2023-09-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 15, 2023

___________________________

EBET, Inc.

(Exact name of registrant as specified in its

charter)

___________________________

| Nevada |

001-40334 |

85-3201309 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

3960

Howard Hughes Parkway, Las Vegas,

NV 89169

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (888) 411-2726

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

___________________________

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading

Symbols(s) |

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

EBET |

The NASDAQ Stock Market LLC |

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information set forth

in Item 2.03 is incorporated by reference into this Item 1.01.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On

November 29, 2021, EBET, Inc. (the “Company”) and the subsidiaries of the Company (the “Guarantors”) entered a

credit agreement (the “Credit Agreement”) with CP BF Lending, LLC (“Lender”), pursuant to which the Lender agreed

to make a single loan to the Company in the original amount of $30,000,000 (the “Loan”). The Loan required the Company to

maintain certain minimum liquidity and other financial and other covenants. As previously disclosed, the Company has received multiple

waivers from the Lender in the past with respect to such covenants with the final waiver expiring on June 30, 2023.

On

June 30, 2023, the Company, the subsidiaries of the Company and the Lender entered into a forbearance agreement (the “Forbearance

Agreement”). Pursuant to the Forbearance Agreement, the Company acknowledged, among other items, that, as June 30, 2023, it was

in default under the Credit Agreement, the Lender had the right to accelerate the Loan, and the Lender had the right to impose the default

rate of interest under the Credit Agreement. Pursuant to the Forbearance Agreement, the Lender agreed to forbear from exercising its rights

and remedies against the Company and the Guarantors under the Credit Documents until the earlier of September 15, 2023 (the “Forbearance

Date”), or until a termination event occurs pursuant to the Forbearance Agreement. A termination event under the Forbearance Agreement

consists of the filing of a bankruptcy proceeding by the Company or any Guarantor, the occurrence of a new event of default under the

Credit Agreement, or the failure by the Company or any Guarantor to perform any material requirement, covenant, or obligation under the

Forbearance Agreement. During the forbearance period, the Lender agreed, among other items, not to accelerate the Loan, initiate any bankruptcy

filings, or apply any default rates of interest. As partial consideration for the Lender agreeing to enter into the Forbearance Agreement,

the Company paid a forbearance fee equal to 50 basis points of the outstanding principal amount of the Loan. In addition, on June 30,

2023, the Company made a prepayment of the Loan in the amount of $2.0 million.

On

September 15, 2023, the Company, the subsidiaries of the Company and the Lender entered into an amendment number 1 to the Forbearance

Agreement (the “Amendment”). The Amendment extended the Forbearance Date from September 15, 2023 until October 31, 2023. As

partial consideration for the Lender agreeing to enter into the Amendment, the Company paid a forbearance fee of $90,000, which was added

to the outstanding principal amount of the Loan. Upon the execution of the Amendment and after the receipt of the forbearance fee, the

principal amount of the Loan is $26,361,567.82.

In

connection with the Forbearance Agreement, the Lender agreed to provide the Company with a revolving line of credit in the amount of $2.0

million (the “Revolving Note”), with any advances under the Revolving Note to be made in the sole discretion of the Lender.

The Revolving Note will have a maturity date of November 29, 2024 and carry an interest rate of 15.0% per annum, provided that upon an

occurrence of default the interest rate will increase to the default rate under the Loan. The Revolving Note shall be an Obligation as

defined in the Credit Agreement and as such shall be secured by the collateral in which the Borrower and the Guarantors have granted liens

and security interests to the Lender in connection with the Loan. All discretionary advances shall terminate automatically and all outstanding

principal together with accrued but unpaid interest and fees shall become immediately due and payable, without notice to or action by

any party, on the earlier of the termination date of the Forbearance Agreement, or the maturity date of the Revolving Note, unless otherwise

extended by the Lender. As of the date of the Amendment, the principal amount of the Revolving Note is $1,400,000.00.

| Item 9.01 | Financial Statements and Exhibits. |

| 10.1 |

Forbearance Agreement dated June 30, 2023 between EBET, Inc., certain

subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed July 3, 2023) |

| 10.2 |

Forbearance Agreement Amendment No. 1 dated September 15, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Schedules

and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company will furnish a copy of any omitted schedule or exhibit

to the SEC upon request.

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

EBET, INC. |

| |

|

| |

|

| Date: September 19, 2023 |

|

| |

By: /s/

Matthew

Lourie |

| |

Matthew Lourie |

| |

Chief Financial Officer |

Exhibit 10.2

FORBEARANCE AGREEMENT AMENDMENT NO. 1

among

EBET, INC. F/K/A ESPORTS TECHNOLOGIES, INC.

as the Borrower,

the SUBSIDIARIES OF THE BORROWER,

as Guarantors

and

CP BF LENDING, LLC,

as Lender

Dated as of September 15, 2023

This FORBEARANCE AGREEMENT

AMENDMENT NO. 1 (this “Agreement”) is entered into as of September 15, 2023 by and between EBET, INC. f/k/a

ESPORTS TECHNOLOGIES, INC., a Nevada corporation (the “Borrower”), the Guarantors, and CP BF LENDING, LLC,

a Delaware limited liability company (the “Lender”).

WHEREAS, the Lender and

the Borrower are parties to that certain Credit Agreement dated as of November 29, 2021, (the “Credit Agreement”) whereby

the Lender advanced a term loan to the Borrower in the original principal amount of THIRTY MILLION DOLLARS and 00/100 CENTS (US$30,000,000.00)

(the “Loan” as defined in the Credit Agreement) which Loan and other Obligations under the Credit Agreement have

been unconditionally guaranteed by the Guarantors;

WHEREAS, the Lender,

the Borrower and the Guarantors have entered into a Forbearance Agreement dated as of June 30, 2023 (the “Forbearance Agreement”),

whereby the Borrower and the Guarantors acknowledged the existence of certain Specified Events of Default and acknowledged and confirmed

certain other matters referenced in the Forbearance Agreement, and in consideration therefore, the Lender agreed to enter into the Forbearance

Agreement and to forbear from exercising its rights and remedies during the Forbearance Period;

WHEREAS, at the request

of the Borrower and in conjunction with the Forbearance Agreement, the Lender agreed to extend a TWO MILLION DOLLAR and 00/100 (US$2,000,000.00)

discretionary revolving line of credit to the Borrower subject to the terms of the Forbearance Agreement and the Credit Documents as amended

to reflect the additional extension of credit;

WHEREAS, the Borrower

and the Guarantors have requested that the Lender extend the Forbearance Period, and Lender has agreed, subject to the terms of this Agreement

and provided that no Default or Event of Default that is not otherwise designated as a Specified Event of Default has occurred prior to

the date of this Agreement;

WHEREAS, on February

13, 2023, via electronic mail, a copy of which is attached hereto as Exhibit A and incorporated herein and as amended thereafter

on April 28, 2023 in the Fifteenth Limited Waiver Agreement, on May 12, 2023 in the Sixteenth Limited Waiver Agreement, on May 26, 2023

in the Seventeenth Limited Waiver Agreement, on June 9, 2023 in the Eighteenth Limited Waiver Agreement, on June 20 in the Nineteenth

Limited Waiver Agreement, and on June 30, 2023 in the Forbearance Agreement (the “2/13 Email”), Lender agreed on a

limited basis to defer the ongoing requirement to provide Aspire Excess Cash Flow Certificates for the period of time provided for therein

and on the terms and conditions contained therein;

WHEREAS, on February

14, 2023, via electronic mail, a copy of which is attached hereto as Exhibit B and incorporated herein and as amended thereafter

on April 28, 2023 in the Fifteenth Limited Waiver Agreement, on May 12, 2023 in the Sixteenth Limited Waiver Agreement, on May 26, 2023

in the Seventeenth Limited Waiver Agreement, on June 9, 2023 in the Eighteenth Limited Waiver Agreement, on June 20 in the Nineteenth

Limited Waiver Agreement, and on June 30, 2023 in the Forbearance Agreement (the “2/14 Email”), Borrower and Lender

agreed that certain adjustments would be made to the Warrant on May 3, 2023 as provided for in the 2/14 Email in respect of June 2022

adjustments to the Preferred Stock Warrants and with respect to a Note Conversion Option Agreement that became effective following the

February 2023 equity issuance;

WHEREAS, Lender and the

Credit Parties further wish to set forth their mutual acknowledgements, confirmations and agreements in this Agreement subject to the

understanding that except as modified in this Agreement, nothing in this Agreement constitutes or will constitute a modification, amendment

or other change to the terms of the Credit Documents previously executed between the Lender and the Credit Parties, and that this Agreement

may not, in any circumstance, be regarded as a moratorium or novation of any obligations of the Credit Parties.

NOW, THEREFORE,

in consideration of the foregoing and the mutual covenants herein contained, and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the Lender and the Credit Parties hereby agree as follows:

1. Defined Terms. Capitalized

terms used herein and not otherwise defined in the recitals shall have the meanings ascribed to them in the Credit Documents.

2. Borrower Acknowledgements.

a. Defaults.

Borrower and Guarantors acknowledge that the Specified Events of Default identified on the list attached hereto as Exhibit C hereto

have occurred or will occur during the term of this Agreement and that the Specified Events of Default in existence as of the date of

this Agreement are continuing.

b. Credit Documents.

The Credit Documents and all other agreements, instruments and other documents executed in connection with or relating to the Obligations

or the Collateral are legal, valid, binding and enforceable against Borrower and Guarantors in accordance with their terms. The terms

of the Credit Documents as in effect immediately prior to the effectiveness of this Agreement remain unchanged, except as modified by

this Agreement.

c. No Lending

Obligations. As a result of the Specified Events of Default, the Lender has no obligation to make loans or otherwise extend credit

to Borrower, except as expressly contemplated under the Forbearance Agreement, and that any extensions of credit made during the Forbearance

Period (as defined below) are to be made in the sole discretion of the Lender and shall not constitute a waiver of any of Lender’s

rights under the Credit Documents.

d. Right to Accelerate

Obligations. As a result of the Specified Events of Default, the Lender has the immediate right to accelerate the maturity and demand

immediate payment of the Obligations.

e. Default Notice.

To the extent a notice of default is required by the Credit Documents to be provided to the Borrower and the Guarantors, the Borrower

and the Guarantors acknowledge that this Agreement shall constitute such notice under the Credit Documents. The Borrower and the Guarantors

further acknowledge that such notice is received timely and properly, that the Lender reserves all rights and remedies available to it

under the Credit Documents and at law. The Borrower and the Guarantors hereby waive any rights to receive further notice solely in connection

with the Specified Events of Default. All applicable cure periods relating to the Specified Events of Default are waived by the Borrower

and the Guarantors.

f. Default Interest

Rate. By reason of the Specified Events of Default, the Lender has the right, as of the Effective Date (as defined below), to impose

the default rate of interest under Section 2.4(c) of the Credit Agreement commencing from the date of the occurrence of the initial Specified

Event of Default.

g. No Waiver

of Defaults. Neither this Agreement, nor any actions taken in accordance with this Agreement or the Credit Documents, including the

Lender’s willingness to extend credit to the Borrower pursuant to the terms of this Agreement, shall be construed as a waiver of

or consent to the Specified Events of Default or any other existing or future defaults under the Credit Documents, as to which the Lender’s

rights shall remain reserved.

h. Preservation

of Rights and Remedies. Upon expiration of the Forbearance Period, all of the Lender’s rights and remedies under the Credit

Documents and at law and in equity shall be available without restriction or modification, as if the forbearance had not occurred.

i. Lender Conduct.

The Lender has fully and timely performed all of its obligations and duties in compliance with the Credit Documents and applicable law,

and has acted in good faith under the circumstances.

j. Request to

Forbear. The Borrower and the Guarantors have requested the Lender’s forbearance as provided herein, which shall inure to their

direct and substantial benefit.

3. Forbearance Period.

Section 3(i) of the Forbearance Agreement is amended to delete the date “September 15, 2023” and to substitute the date “October

31, 2023” in place thereof.

4. Compliance Certificate.

Until such time as further notified by the Lender, the Lender waives each requirement contained in the Credit Agreement for the delivery

to the Lender of a Compliance Certificate, provided, however, that at all times this waiver is in effect, the Borrower and the Guarantors

agree that all changes, modifications, additions, and updates to Collateral that would have been reported on either an exhibit to a Compliance

Certificate or an amendment to the Information Certificate at any time or times a Compliance Certificate would have been delivered absent

this waiver, shall be reported to the Lender no later than two (2) business days after such changes, modifications, additions, or updates

have been made unless such changes, modifications, additions, or updates required prior consent of the Lender pursuant to the Credit Documents

prior to implementation in which case the consent provisions of the Credit Documents shall control.

5. Conditions Precedent.

This Agreement shall not become effective unless and until the date (the "Effective Date") that each of the following

conditions shall have been satisfied in the Lender’s sole discretion, unless waived in writing by the Lender:

a. Delivery of Documents.

The Borrower and the Guarantors shall deliver or cause to be delivered the following documents, each in substance and form acceptable

to the Lender:

i. a copy of this

Agreement, duly executed by the Borrower and the Guarantors; and

ii. an updated Information

Certificate reflecting any changes having occurred since June 30, 2023 duly executed by an Authorized Officer of the Borrower, if any.

b. Forbearance Fee.

As consideration for the Lender’s agreement to forbear as set forth herein, the Borrower shall have paid a forbearance fee of NINETY

THOUSAND DOLLARS and 00/100 CENTS (US$90,000.00). The Forbearance Fee shall be capitalized and shall be added to the outstanding principal

balance of the Loan.

c. Professional Fees and

other Expenses. As consideration for the Lender’s agreement to forbear as set forth herein, Borrower shall have paid or reimbursed

Lender for all of all of Lender’s fees and expenses (including fees and expenses of counsel incurred in connection with the drafting

and negotiation of this Agreement).

6. Amendments.

a. The 2/14 Email as amended

is further amended to delete the date “September 15, 2023” and to substitute the date “October 31, 2023” in place

thereof.

b. The 2/13 Email as amended

is further amended to i) delete the date “September 15, 2023” and to substitute the date “October 31, 2023” in

place thereof, and ii) delete the date “September 18, 2023” and to substitute the date “November 23, 2023” in

place thereof.

c. Section 11(b)(i) of the Forbearance

Agreement is amended to delete the date “October 24, 2023” and to substitute the date “November 28, 2023” in place

thereof.

7. Reaffirmation of Loan

Balance. The Borrower confirms that, as of the date hereof, upon giving effect to this Agreement and capitalizing the forbearance

fee required in Section 5(b), it is indebted to the Lender in respect of the Loan in the principal amount of TWENTY-SIX MILLION THREE

HUNDRED SIXTY-ONE THOUSAND FIVE HUNDRED SIXTY-SEVEN DOLLARS and 82/100 CENTS(US$26,361,567.82), together with interest accrued and

unpaid thereon (including PIK interest), and in respect of the Revolving Loan in the principal amount of ONE MILLION FOUR HUNDRED THOUSAND

DOLLARS and 00/100 CENTS(US$1,400,000.00), together with interest accrued and unpaid thereon, together with all fees, costs, expenses

and other charges due and owing by the Borrower under the Credit Documents and that all such amounts are unconditionally owing by the

Borrower to the Lender, without offset, defense or counterclaim of any kind, nature or description whatsoever.

8. Credit Documents.

This Agreement, constitutes a “Credit Document” as defined in the Credit Agreement, as the same may be amended from time to

time. All references in the Credit Agreement to “this Agreement”, “hereunder”, “hereof” or words of

like import referring to the Credit Agreement, and each reference in the other Credit Documents to the Credit Agreement, “thereunder”,

“thereof” or words of like import referring to the Credit Agreement shall be deemed to refer to the Credit Agreement as modified

by this Agreement. For the avoidance of doubt, any default by the Borrower or any Guarantor under the terms of this Agreement shall constitute

an Event of Default under the Credit Agreement.

9. Governing Law, Jurisdiction,

Counterparts, Jury Trial Waiver Confidentiality. This Agreement shall be governed by, and construed in accordance with, the law of

New York without reference to its conflicts of law principles (other than Section 5-1401 of the New York General Obligations Law). The

provisions of Sections 9.7, 9.8, 9.9 and 9.16 of the Credit Agreement are hereby incorporated by reference as if fully set

forth herein and shall apply mutatis mutandis.

10. Effect on Credit Documents.

The Credit Agreement and each of the other Credit Documents shall be and remain in full force and effect in accordance with their respective

terms and are hereby ratified and confirmed in all respects. The execution, delivery, and performance of this Agreement shall not operate,

except as expressly set forth herein, as a modification or waiver of any right, power, or remedy of the Lender under the Credit Agreement,

or any other Credit Document. The amendments contained in this Agreement are limited to the specifics hereof, shall not apply with respect

to any facts or occurrences other than those on which the same are based, shall not excuse future non-compliance by the Borrower or any

Guarantor with respect to any Credit Document to which it is a party, and shall not operate as a waiver or forbearance to any further

or other matter under the Credit Documents. Each Credit Party hereby ratifies and reaffirms (i) the validity, legality and enforceability

of the Credit Documents; (ii) that its reaffirmation of the Credit Documents is a material inducement to the Lender to enter into this

Agreement; and (iii) that its obligations under the Credit Documents shall remain in full force and effect until all the Obligations have

been paid in full. Guarantors expressly agree that the Guaranty of each extends to all Obligations under the Credit Documents, including

Obligations under the Revolving Note. The Borrower and each Credit Party represents and warrants that the representations and warranties

contained in this Agreement, Credit Agreement and in the other Credit Documents are true and correct in all material respects (except

that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by

materiality in the text thereof), except to the extent such representations and warranties specifically relate to an earlier date, in

which case such representations and warranties were true and correct on and as of such earlier date.

11. Successors and Assigns.

This Agreement binds and benefits the respective successors and assigns of the parties, except that neither the Borrower nor any Guarantor

may assign or delegate any of its rights or obligations under this Agreement without the prior written consent of the Lender. The Lender

may assign all or a portion of all of its rights and obligations under this Agreement.

12. No Amendment. Any

amendment, or waiver of, or any consent given under, any provision of this Agreement shall be in writing and, in the case of any amendment,

signed by the parties or their permitted successors and assigns.

13. Entire Agreement.

This Agreement and the other Credit Documents represent the final and complete agreement of the parties hereto with respect to the subject

matter herein, and all prior negotiations, representations, understandings, writings and statements of any nature with respect thereto

are hereby superseded in their entirety by the terms of this Agreement and the other Credit Documents.

14. Further Assurances.

The Borrower and each Guarantor shall execute and deliver any and all reasonable additional documents, agreements and instruments, and

take such additional reasonable action (including the filing and recording of financing statements) as may be reasonably requested by

the Lender, without payment of further consideration, to effectuate the intent and purpose of this Agreement and consistent with the provisions

of, and limitations contained in, the Credit Documents. The Borrower and each Guarantor agree to cooperate with, and shall cause their

Subsidiaries and their advisors to cooperate with, any financial advisors or appraisers that may from time to time be retained by or on

behalf of the Lender, including, without limitation, providing reasonable access (upon reasonable advance notice) to their premises, personnel

and books and records.

15. Advice of Counsel.

Each Credit Party has freely and voluntarily entered into this Agreement with the advice of legal counsel of its choosing, or has knowingly

waived the right to do so.

16. Reimbursement of Costs

and Expenses. Each Credit Party agrees to pay all costs, fees and expenses of the Lender (including attorneys' fees), expended or

incurred by the Lender in connection with the negotiation, preparation, administration and enforcement of this Agreement, the Credit Documents,

the Obligations, any of the Collateral and all fees, costs and expenses incurred in connection with any bankruptcy or insolvency proceeding

(including, without limitation, any adversary proceeding, contested matter or motion brought by the Lender or any other Person). Without

in any way limiting the foregoing, each Credit Party hereby reaffirms its agreement under the applicable Credit Documents to pay or reimburse

the Lender for certain costs and expenses incurred by the Lender. The Credit Parties are jointly and severally liable for their obligations

under this Section 16.

17. Release. The Borrower

and each Guarantor hereby release, waive, and forever relinquish all claims, demands, obligations, liabilities and causes of action of

whatever kind or nature, whether known or unknown, which any of them have, may have, or might assert at the time of execution of the Agreement

against the Lender and/or its parents, affiliates, participants, officers, directors, employees, agents, attorneys, accountants, consultants,

successors and assigns, directly or indirectly, which occurred, existed, was taken, permitted or begun prior to the execution of this

Agreement, arising out of, based upon, or in any manner connected with (i) any transaction, event, circumstance, action, failure to act

or occurrence of any sort or type, whether known or unknown, with respect to the Credit Agreement, any other Credit Document and/or the

administration thereof or the Obligations created thereby; (ii) any discussions, commitments, negotiations, conversations or communications

with respect to the refinancing, restructuring or collection of any Obligations related to the Credit Agreement, any other Credit Document

and/or the administration thereof or the Obligations created thereby, or (iii) any matter related to the foregoing, in each case, prior

to the execution of this Agreement.

[signature pages follow]

IN WITNESS WHEREOF, the

parties hereto have caused this Agreement to be duly executed and delivered by their respective officers thereunto duly authorized as

of the date first written above.

| |

LENDER: |

| |

|

| |

CP BF LENDING, LLC |

| |

By: CP Business Finance GP, LLC, its manager, |

| |

By: Columbia Pacific Advisors, LLC, its manager |

| |

|

| |

|

| |

|

| |

By: /s/ Brad Shain |

| |

Name: Brad

Shain |

| |

Title: Fund Manager |

[signature page to Forbearance Agreement Amendment

No.1]

| |

BORROWER: |

|

| |

|

|

| |

EBET, INC. F/K/A ESPORTS TECHNOLOGIES, INC. |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

By: |

/s/ Aaron Speech |

|

| |

|

Name: |

Aaron Speach |

|

| |

|

Title: |

CEO |

|

[signature page to

Forbearance Agreement Amendment no. 1]

GUARANTORS:

| |

GLOBAL E-SPORTS ENTERTAINMENT GROUP LLC |

|

| |

By: |

/s/ Aaron Speech |

|

| |

|

Name: |

Aaron Speach |

|

| |

|

Title: |

CEO |

|

| |

ESPORTSBOOK TECHNOLOGIES LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

ESEG LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

ESPORTS

PRODUCT TECHNOLOGIES MALTA LTD

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

ESPORTS

MARKETING TECHNOLOGIES LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

[signature page to Forbearance Agreement Amendment

No. 1]

| |

GOGAWI ENTERTAINMENT GROUP LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

KARAMBA LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

ESPORTS PRODUCT TRADING MALTA LIMITED

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

ESPORTS TECHNOLOGIES (ISRAEL) LTD

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

| |

|

|

| |

|

|

| |

EBET CURACAO N.V.

|

| |

|

| |

By: |

/s/ Aaron Speech |

| |

Name: |

Aaron Speach |

| |

Title: |

CEO |

[signature page to Forbearance Agreement

Amendment No. 1]

v3.23.3

Cover

|

Sep. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 15, 2023

|

| Entity File Number |

001-40334

|

| Entity Registrant Name |

EBET, Inc.

|

| Entity Central Index Key |

0001829966

|

| Entity Tax Identification Number |

85-3201309

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

3960

Howard Hughes Parkway,

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89169

|

| City Area Code |

(888)

|

| Local Phone Number |

411-2726

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

EBET

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

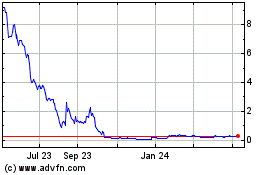

EBET (QB) (USOTC:EBET)

Historical Stock Chart

From Mar 2024 to Apr 2024

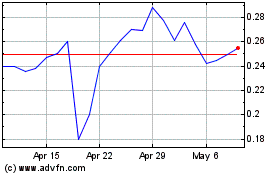

EBET (QB) (USOTC:EBET)

Historical Stock Chart

From Apr 2023 to Apr 2024