0001882781

false

2023

FY

--06-30

false

0001882781

2022-07-01

2023-06-30

0001882781

2022-12-31

0001882781

2023-09-18

0001882781

2023-06-30

0001882781

2022-06-30

0001882781

2021-07-01

2022-06-30

0001882781

us-gaap:CommonStockMember

2021-06-30

0001882781

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001882781

us-gaap:RetainedEarningsMember

2021-06-30

0001882781

2021-06-30

0001882781

us-gaap:CommonStockMember

2022-06-30

0001882781

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001882781

us-gaap:RetainedEarningsMember

2022-06-30

0001882781

us-gaap:CommonStockMember

2021-07-01

2022-06-30

0001882781

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2022-06-30

0001882781

us-gaap:RetainedEarningsMember

2021-07-01

2022-06-30

0001882781

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001882781

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001882781

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001882781

us-gaap:CommonStockMember

2023-06-30

0001882781

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001882781

us-gaap:RetainedEarningsMember

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE FISCAL YEAR ENDED June 30, 2023

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period

from ______ to _________

COMMISSION FILE NUMBER: 000-56340

C2

Blockchain,Inc.

(Exact name of registrant as specified in its charter)

| |

Nevada |

00-0000000 |

|

| |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

| |

c/o Levi Jacobson

123 SE 3rd Ave, #130 Miami, Florida |

33131 |

|

| |

(Address of Principal Executive Offices) |

(Zip Code) |

|

Securities to be registered under Section 12(b) of

the Act:

| |

Title of each class |

Name of each exchange on which registered |

|

| |

Common Stock, $0.001 |

N/A |

|

Securities to be registered under Section 12(g) of

the Exchange Act:

Common stock, par value of $0.001 par value

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

[X] Yes [ ] No

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

| Smaller reporting company ☒ |

|

Emerging growth company ☒ |

|

|

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act).

[X] Yes [ ] No

As of December 31, 2022, the last business day

of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held

by non-affiliates of the registrant was approximately $1,682,813

based on the closing price per share (or $0.0659), of the registrant’s common stock as reported by OTC Markets Group Inc.

Indicate the number of shares outstanding of each of the issuer’s

classes of stock, as of the latest practicable date:

253,936,005 shares of common

stock, $0.001 par value, issued and outstanding as of September 18, 2023

0 shares of preferred stock,

$0.001 par value, issued and outstanding as of September 18, 2023.

Table of Contents

TABLE

OF CONTENTS

C2

Blockchain, Inc.

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements and information included in

this Annual Report on Form 10-K for the year ended June 30, 2023 (this “Report”), contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Forward-looking

statements are not statements of historical facts, but rather reflect our current expectations concerning future events and results. We

generally use the words “may,” “should,” “believe,” “expect,” “intend,” “plan,”

“anticipate,” “likely,” “estimate,” “potential,” “continue,” “will,”

and similar expressions to identify forward-looking statements. Such forward-looking statements, including those concerning our expectations,

involve risks, uncertainties and other factors, some of which are beyond our control, which may cause our actual results, performance,

or achievements, or industry results to be materially different from any future results, performance, or achievements expressed or implied

by such forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this Report.

GLOSSARY OF TERMS AND

INDUSTRY DATA

“We,” “us,” “our,”

“the Registrant,” the “Company,” and “C2 Blockchain” are synonymous with C2 Blockchain, Inc., unless otherwise

indicated.

“Bitcoin” — A type of digital asset based

on an open source math-based protocol existing onthe Bitcoin Network and utilizing cryptographic security.

“Bitcoin Exchange” — An electronic marketplace

where exchange participants may trade, buyand sell bitcoins based on bid-ask trading. The largest Bitcoin Exchanges are online and typically

trade on a 24-hour basis, publishing transaction prices and volume data.

“Bitcoin Exchange Market” — The global Bitcoin

Exchange market for the trading of bitcoins, which consists of transactions on electronic Bitcoin Exchanges.

“Bitcoin Network” — The online, end-user-to-end-user

network hosting the public transaction ledger, known as the Blockchain, and the source code comprising the basis for the math-based protocols

and cryptographic security governing the Bitcoin Network.

“Blockchain” — The public transaction ledger

of the Bitcoin Network on which miners or mining pools solve algorithmic equations, allowing them to add records of recent transactions

(called “blocks”) to the chain of transactions in exchange for an award of bitcoins from the Bitcoin Network and the payment

of transaction fees, if any, from users whose transactions are recorded in the block being added.

“CEA” — Commodity Exchange Act of 1936, as

amended.

“CFTC” — The US Commodity Futures Trading

Commission, an independent agency with the mandate to regulate commodity futures and option markets in the United States.

“Code” — The US Internal Revenue Code of 1986,

as amended.

“Digital Asset” — Collectively, all digital

assets based upon a computer-generated math-based and/or cryptographic protocol that may, among other things, be used to buy and sell

goods or pay for services. Bitcoins represent one type of digital asset.

“DDoS Attack” — Distributed denial of service

attacks are coordinated hacking attempts to disrupt websites, web servers or computer networks in which an attacker bombards an online

target with a large quantity of external requests, thus precluding the target from processing requests from genuine users.

“Exchange Act” — The Securities Exchange Act

of 1934, as amended.

“FDIC” — The Federal Deposit Insurance Corporation.

“FinCEN” — The Financial Crimes Enforcement

Network, a bureau of the US Department of the Treasury.

“FINRA” — The Financial Industry Regulatory

Authority, Inc., which is the primary regulator in the United States for broker-dealers.

“Fiat Currency” — Currency that a government

has declared to be legal tender but is not backed by a physical commodity. The value of fiat money is derived from the relationship between

supply and demand rather than the value of the material that the money is made of.

“Hash Rate”— A measure of the computational

power on a blockchain network. Hash rate is determined by how many guesses are made per second. The overall hash rate helps determine

the security and mining difficulty of a blockchain network.

“IRS” — The US Internal Revenue Service, a

bureau of the US Department of the Treasury.

“Mining” — The process by which Bitcoins are

created involving programmers solving complex math problems with the computers in the Bitcoin Network.

“SEC” — The US Securities and Exchange Commission.

“Securities Act” — The Securities Act of 1933,

as amended.

“SIPC” — The Securities Investor Protection

Corporation.

Table of Contents

PART I

Item 1. Business.

(a) Business Development

C2 Blockchain, Inc. was incorporated on June 30, 2021 in the State of Nevada.

On June 30, 2021, Levi Jacobson was appointed Chief Executive Officer, Chief Financial Officer, and Director of C2 Blockchain, Inc.

On

March 31, 2022, the Company entered into a “Agreement and Plan of Merger”, whereas it agreed to, and subsequently participated

in, a Nevada holding company reorganization pursuant to NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250 (“Reorganization”).

The constituent corporations in the Reorganization were American Estate Management Company (“AEMC” or “Predecessor”),

C2 Blockchain, Inc. (“Successor” or “CBLO”), and AEMC Merger Sub, Inc. (“Merger Sub”). Our director

is, and was, the sole director/officer of each constituent corporation in the Reorganization.

C2

Blockchain, Inc. issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of its common stock

to C2 Blockchain, Inc. immediately prior to the Reorganization. As such, immediately prior to the merger, C2 Blockchain, Inc. became a

wholly owned direct subsidiary of American Estate Management Company and Merger Sub became a wholly owned and direct subsidiary of C2

Blockchain, Inc.

On

March 31, 2022, Merger Sub filed Articles of Merger with the Nevada Secretary of State. The merger became

effective on April 1, 2022 at 4:00 PM PST (“Effective Time”). At the Effective Time, Predecessor was merged with and into

Merger Sub (the “Merger), and Predecessor became the surviving corporation. Each share of Predecessor common stock issued and outstanding

immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of C2 Blockchain, Inc.’s (“Successors”) common stock.

On

May 23, 2022, C2 Blockchain, Inc., as successor issuer to American Estate Management Company began a quoted market in its common

stock which was the market effective date for our corporate action.

The

Company believes that the Reorganization, deemed effective on April 1, 2022, was not a transaction of the type described in subparagraph

(a) of Rule 145 under the Securities Act of 1933 and the consummation of the Reorganization will not be deemed to involve an “offer”,

“offer to sell”, “offer for sale” or “sale” within the meaning of Section 2(3) of the Securities Act

of 1933. The Reorganization was consummated without the vote or consent of the Company’s stockholders. In addition, the provisions

of NRS 92A.180 did not provide a stockholder of the Company with appraisal rights in connection with the Reorganization. The Company believes

that in the absence of any right of any of the Company’s stockholders to vote with respect to the Reorganization or to insist that

their shares be purchased for fair value, the Reorganization could not be deemed to involve an “offer” “offer to sell”;

or “sale” within the meaning of Section 2(3) of the Securities Act of 1933.”

On

April 1, 2022, after the completion of the Holding Company Reorganization, we cancelled all of the stock we held in AEMC resulting in

AEMC as a stand-alone company. Pursuant to the holding company merger agreement and effects of merger, all of the assets and liabilities,

if any, remain with AEMC after the Reorganization. Levi Jacobson, the Director of AEMC, did not discover any assets of AEMC from the time

he was appointed Director until the completion of the Reorganization and subsequent separation of AEMC as a stand-alone company.

Given

that the former business plan and objectives of AEMC and the present day business plan and objectives of CBLO substantially differ from

one another, we conducted the corporate separation with AEMC immediately after the effective time of the Reorganization in order to avoid

any shareholder confusion. The former business plan of AEMC under the leadership of its former directors, does not, in any way, represent

the current day business plan of CBLO. The result of corporate separation ameliorated shareholder confusion about our identity

and/or corporate objectives. Furthermore, we wanted to continue trading in the OTC MarketPlace.

On April 1, 2022, the Company transmuted its business plan from that of

a blank check shell company to a business combination related shell company with a holding company formation pursuant to a reorganization

with American Estate Management Company.

The

corporate actions taken by the Company, including, but not limited to, the corporate structuring of the transactions, was deemed, in the

discretion of our sole director, to be for the benefit of the corporation and its shareholders. Former shareholders of AEMC are now the

shareholders of CBLO. Each and every shareholder of AEMC became a shareholder of CBLO with each share of capital stock of AEMC held by

former AEMC shareholder becoming an equivalent amount of capital stock held in CBLO. The former shareholders of AEMC now have the opportunity

to benefit under our business plan and we have the opportunity to grow organically from our shareholder base and new leadership under

our sole director.

FINRA

completed its review of our corporate action pursuant to our Reorganization. On April 26, 2022, CBLO was given a CUSIP number by CUSIP

Global Services of 12675R 109. The announcement of our Predecessor’s corporate action was posted on the FINRA daily list on May

20, 2022. The Market Effective date was May 23, 2022.

Our

Common Stock is currently quoted on the OTC Markets Group Inc’s Pink® Open Market under the symbol “CBLO”.

After completion of the Holding Company Reorganization and separation

of AEMC as a wholly owned subsidiary, the Company reverted back to a blank check shell company.

Currently, we no longer believe we are deemed to be a blank check

shell company, but rather a shell company as we have a bona fide business plan at this time. The Company’s business plan is to

concentrate on cryptocurrency related investments and development opportunities including but not limited to cryptocurrency mining, primarily

for Bitcoin, for our own account, investments in private and/or public entities, joint ventures and acquisitions of blockchain related

companies. We have not commenced our planned principal operations.

Currently,

Mendel Holdings, LLC, a Delaware Limited Liability Company, owned and controlled by Levi Jacobson, our sole director is our controlling

shareholder, owning 200,000,000 shares of our common stock representing approximately 78.76 % voting control.

- 1 -

Table of Contents

At this time our office space is provided to us rent free by our director. Our office space is located at 123 SE 3RD Ave, #130, Miami,

FL 33131.

The Company has elected June 30th as its fiscal

year end.

At this time we have no employees and we

have no intellectual property.

(b) Business Summary

We have not yet commenced any material operations. The Company

plans to build a 14 MW Bitcoin mining facility in Georgia U.S. specifically designed for hosting cryptocurrency mining equipment and

mining Bitcoin for our own account. Cryptocurrency mining (e.g. bitcoin mining) entails

running ASIC (application-specific integrated circuit) servers or other specialized servers which solve a set of prescribed complex

mathematical calculations in order to add a block to a blockchain and thereby confirm digital asset transactions. A party which is

successful in adding a block to the blockchain is awarded a fixed number of digital assets in return.

At this time, we own no real estate. Since our inception, June 30,

2021, we have not generated any revenues.

In order to implement our plan of operations for the next

twelve-month period, we require a minimum of $200,000 in funding. At present, we plan to to acquire the aforementioned funding from

the sale of our common stock pursuant to a Tier II Regulation A Offering we seek to conduct in the near future. At present, the

Offering Statement pursuant to the Tier II Regulation Offering remains in review by the Securities and Exchange Commission. It is

not yet qualified. The Offering Circular and related documentation was filed on July 5, 2023. At this time, we cannot accurately

forecast when the Offering may be qualified and or subsequently conducted.

The number of computers that we may purchase or lease for

mining bitcoin will depend on how quickly we are able to raise funds through the aforementioned Offering. We expect the proceeds

from the Offering will be sufficient for us to implement our business plan and that no additional funding will be needed to

implement our business plan, however there is no guarantee that this may be the case. We may be unsuccessful in raising any capital

from the Offering, and thus we may need to seek out alternate sources of financing. The scalability of our business plan also

depends entirely on our ability to secure funds for future operations.

Our plan of operations for the next twelve (12) months is as follows:

We are seeking up to a maximum of $60,000,000 in

funding from our pending Regulation A Offering to jumpstart our cryptocurrency mining operation including the purchase of ASIC

computers, land, and construction of a warehouse to host our mining operation. The following plan for the next 12 months assumes

that we receive $60,000,000. As mentioned, we believe a minimum of $200,000 is needed to commence material operations, albeit on a

smaller scale than what may be proposed below. There is a possibility that we do not obtain the necessary funding to carry out our

business plan. If this is to occur we may need to reconsider the feasibility of our business plan, or reconsider how

we allocate funds available to us.

The amount we may spend on any of the various endeavors

below is subject to change and depends entirely on our future financial condition of the Company.

Six Months

| |

● |

Capital Raise pursuant to Tier II Regulation A offering |

| |

● |

Purchase of real estate land in Georgia, U.S.A to host our crypto mining operation |

Twelve Months

| |

● |

Buildout of Warehouse |

| |

● |

Purchase of Mining Hardware |

| |

● |

Purchase and set up of ASIC Computers (application-specific integrated circuit) |

| |

● |

Purchase of Mining Software |

| |

● |

Source Electricity with Municipality. |

| |

● |

Commence Mining of Cryptocurrency |

The anticipated budgets required to achieve the milestones are provided

in the table below:

| Uses |

|

Amount |

|

| Purchase of real estate land in Georgia, U.S.A to host our crypto mining operation |

|

$ |

5,000,000 |

|

| Building and Construction of Warehouse for Cryptocurrency Datacenter |

|

$ |

10,000,000 |

|

| Mining Hardware/Machines |

|

$ |

10,000,000 |

|

| Mining Software |

|

$ |

5,000,000 |

|

| Cost of Electricity |

|

$ |

10,000,000 |

|

| Other Expenses / Working Capital |

|

$ |

10,000,000 |

|

| Salaries, General Admin, & Professional Fees |

|

$ |

10,000,000 |

|

| Total Uses |

|

$ |

60,000,000 |

|

The amounts that we actually spend for any

specific purpose may vary significantly, and will depend on a number of factors including, but not limited to, the amount of money

that we actually receive from our pending Regulation A Offering, the pace of progress of our development efforts, actual needs with

respect to product testing, research and development, market conditions, and changes in or revisions to our marketing strategies, as

well as any legal or regulatory changes which may ensue. You will be relying on the judgment of our management regarding the

application of the proceeds of any sale of our common stock.

If management is unable to implement our proposed

business plan or employ alternative financing strategies, it does not presently have any alternative proposals. In that event, investors

should anticipate that their investment may be lost and there may be no ability to profit from this investment.

We cannot assure you that our planned mining operation

for bitcoin or any other digital coin will ever happen or that we will ever earn revenues sufficient to support our operations or that

we will ever be profitable. Furthermore, since we have no committed source of financing, we cannot assure you that we will be able to

raise money as and when we need it to continue our operations. If we cannot raise funds as and when we need them, we may be required to

severely curtail, or even to cease our operations.

- 2 -

Table of Contents

(c) Reports to security holders.

| |

(1) |

The Company is not required to deliver an annual report to security holders and at this time does not anticipate the distribution of such a report. |

| |

(2) |

The

Company will continue to file reports with the SEC. The Company is an SEC reporting company and complies with the requirements of

the Exchange Act. |

| |

(3) |

The public may read and copy any materials the Company files with the SEC in the SEC's Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov. |

Emerging Growth Company

We are an emerging growth company under the JOBS Act. We shall continue

to be deemed an emerging growth company until the earliest of:

| |

(a) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,070,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; |

| |

(b) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective IPO registration statement; |

| |

(c) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or |

| |

(d) the date on which such issuer is deemed to be a large accelerated filer, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. |

As an emerging growth company, we are exempt from Section 404(b) of Sarbanes

Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal

control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls

and procedures. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment

on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company, we are also exempt from Section 14A (a)

and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have elected to use the extended transition period for complying with

new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting

standards that have different effective dates for public and private companies until those standards apply to private companies. As a

result of this election, our financial statements may not be comparable to companies that comply with public company effective dates,

- 3 -

Table of Contents

Item 1A. Risk Factors.

The Company qualifies as a smaller reporting company, as defined by Item

10 of Regulation S-K and, thus, is not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We currently neither rent nor own any properties. We

currently utilize office space and equipment of our management at no cost.

Item 3. Legal Proceedings.

From time to time, we may become party to litigation

or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal

proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition, or results

of operations. To the best of our knowledge, no adverse legal activity is anticipated or threatened.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

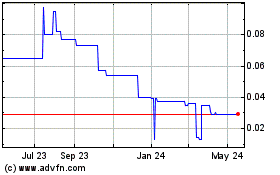

Our Common Stock is quoted on the OTC Markets Group Inc.’s Pink®

Open Market. Our ticker symbol is “CBLO”.

There is currently a limited trading market in the Company’s shares of Common Stock. Generally speaking, our shares of common stock

are, and have been thinly traded, meaning our shares cannot be easily purchased or sold and have a low volume of shares trading per day

which can lead to volatile changes in price per share.

Over-the-counter

market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual

transactions.

| Quarter

Ended |

High

Bid |

Low

Bid |

| June

30, 2023 |

$0.068 |

$0.04 |

| March

31, 2023 |

$0.07 |

$0.04 |

| December

31, 2022 |

$0.10 |

$0.0271 |

| September

30, 2022 |

$0.13 |

$0.02 |

| June

30, 2022 |

$0.42 |

$0.02 |

1 We

were a party to a corporate reorganization, legally effective as of April 1, 2022. Information regarding this reorganization is detailed

herein on page 1. Prior to this reorganization, we have no information to report pursuant to the above table.

Holders

As

of the date of this Annual Report, we have 253,936,005 shares of Common Stock, $0.001 par value, issued and outstanding and 0 shares

of Preferred stock, $0.001 par value, issued and outstanding.

We

have approximately 29 stockholders of record.

Voting

Each share of common stock has voting rights of one

vote per share.

Dividends and Share Repurchases

We have not paid any dividends to our stockholders.

There are no restrictions, which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

We do not have any equity compensation plans, either

approved or not approved, by our security holders.

Recent Sales of Unregistered Securities; Uses of Proceeds from Registered

Securities

None.

Purchases of Equity Securities by the Issuer and

Affiliated Purchasers

None.

- 4 -

Table of Contents

Item 6. Selected Financial Data.

As a “smaller reporting company”, we

are not required to provide the information required by this Item.

Item 7. Management’s Discussion

and Analysis of Financial Condition and Results of Operations.

We have not yet commenced any material operations. The Company

plans to build a 14 MW Bitcoin mining facility in Georgia U.S. specifically designed for hosting cryptocurrency mining equipment and

mining Bitcoin for our own account. Cryptocurrency mining (e.g. bitcoin mining) entails

running ASIC (application-specific integrated circuit) servers or other specialized servers which solve a set of prescribed complex

mathematical calculations in order to add a block to a blockchain and thereby confirm digital asset transactions. A party which is

successful in adding a block to the blockchain is awarded a fixed number of digital assets in return.

At this time, we own no real estate. Since our inception, June 30,

2021, we have not generated any revenues.

In order to implement our plan of operations for the next

twelve-month period, we require a minimum of $200,000 in funding. At present, we plan to to acquire the aforementioned funding from

the sale of our common stock pursuant to a Tier II Regulation A Offering we seek to conduct in the near future. At present, the

Offering Statement pursuant to the Tier II Regulation Offering remains in review by the Securities and Exchange Commission. It is

not yet qualified. The Offering Circular and related documentation was filed on July 5, 2023. At this time, we cannot accurately

forecast when the Offering may be qualified and or subsequently conducted.

The number of computers that we may purchase or lease for mining

bitcoin will depend on how quickly we are able to raise funds through the aforementioned Offering and the amounts that we are ultimately

able to raise. We expect the proceeds from the Offering will be sufficient for us to implement our business plan and that no additional

funding will be needed to implement our business plan, however there is no guarantee that this may be the case. We may be unsuccessful

in raising any capital from the Offering, and thus we may need to seek out alternate sources of financing. The scalability of our business

plan also depends entirely on our ability to secure funds for future operations and the amount of funds at our disposal. At this time

we do not have the needed funding to implement our business plan in any capacity.

Net

Loss

Our

net income/loss for the year ended June 30, 2023 was $(18,507) and was attributed to general and administrative expenses.

Our

net income/loss for the year ended June 30, 2022 was $(8,407) and was attributed to general and administrative expenses.

Liquidity

We

have no known demands or commitments and are not aware of any events or uncertainties as of June 30, 2023 and June 30, 2022 that will result in or that are reasonably likely to materially increase or decrease our current liquidity.

Capital

Resources.

We

had no material commitments for capital expenditures as of June 30, 2023 and June 30, 2022.

Off

Balance Sheet Arrangements.

We

do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

that is material to investors.

Item 7A. Quantitative and Qualitative Disclosures

about Market Risk.

We qualify as a smaller reporting company, as defined

by Item 10 of Regulation S-K and, thus, are not required to provide the information required by this Item.

- 5 -

Table of Contents

Item 8. Financial Statements and Supplementary

Data.

C2 Blockchain, Inc.

FINANCIAL STATEMENTS

INDEX TO FINANCIAL

STATEMENTS

| |

|

Pages |

| |

|

|

| Report of Independent Registered Public Accounting Firm (PCAOB FIRM ID 5041) |

|

F2 |

| |

|

|

| Balance Sheets |

|

F3 |

| |

|

|

| Statements of Operations |

|

F4 |

| |

|

|

| Statements of Changes in Stockholders’ Deficit |

|

F5 |

| |

|

|

| Statements of Cash Flows |

|

F6 |

| |

|

|

| Notes to Financial Statements |

|

F7-F9 |

- F1 -

Table of Contents

Report of Independent Registered Public

Accounting Firm

To the stockholders and the board of directors

of C2 Blockchain, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance

sheets of C2 Blockchain, Inc. as of June 30, 2023 and June 30, 2022, the related consolidated statements of operations, stockholders'

equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements").

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30,

2023 and June 30, 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles

generally accepted in the United States.

Substantial Doubt about the Company’s

Ability to Continue as a Going Concern

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company

has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience

negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern.

Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We

are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are

required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with

the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures

to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that

respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial

statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as

evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/S/ BF Borgers CPA PC

BF Borgers CPA PC (PCAOB ID 5041)

We have served as the Company's auditor since 2021

Lakewood, CO

September 18, 2023

- F2 -

Table of Contents

C2 Blockchain, Inc.

Balance Sheet

| |

|

|

June 30,

2023 |

|

June 30,

2022 |

| TOTAL ASSETS |

|

$ |

- |

$ |

- |

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

| Loan to Company - related party |

|

$ |

31,164 |

$ |

12,657 |

| TOTAL LIABILITIES |

|

$ |

31,164 |

$ |

12,657 |

| |

|

|

|

|

|

| Stockholders’ Equity (Deficit) |

|

|

|

|

|

| Preferred stock ($.001 par value, 20,000,000 shares authorized; 0 issued and outstanding as of June 30, 2023 and June 30, 2022) |

|

|

- |

|

- |

| |

|

|

|

|

|

| Common stock ($.001 par value, 500,000,000 shares authorized, 253,936,005 shares issued and outstanding as of June 30, 2023 and June 30, 2022) |

|

|

253,936 |

|

253,936 |

| Additional paid-in capital |

|

|

(252,601) |

|

(252,601) |

| Accumulated deficit |

|

|

(32,499) |

|

(13,992) |

| Total Stockholders’ Equity (Deficit) |

|

|

(31,164) |

|

(12,657) |

| |

|

|

|

|

|

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) |

|

$ |

- |

$ |

- |

The

accompanying notes are an integral part of these audited financial statements.

- F3 -

Table of Contents

C2 Blockchain, Inc.

Statement of Operations

| |

|

For the Year Ended

June 30, 2023 |

|

For the Year Ended

June 30, 2022 |

| |

|

|

|

|

| Operating expenses |

|

|

|

|

| |

|

|

|

|

| General and administrative expenses |

$ |

18,507 |

$ |

8,407 |

| Total operating expenses |

|

18,507 |

|

8,407 |

| |

|

|

|

|

| Net loss |

$ |

(18,507) |

$ |

(8,407) |

| |

|

|

|

|

| Basic and Diluted net loss per common share |

$ |

(0.00) |

$ |

(0.00) |

| |

|

|

|

|

| Weighted

average number of common shares outstanding - Basic and Diluted |

|

253,936,005 |

|

63,310,072 |

The

accompanying notes are an integral part of these audited financial statements.

- F4 -

Table of Contents

C2 Blockchain, Inc.

Statement of Changes is

Stockholder (Deficit)

For the years ended June

30, 2023 and June 30, 2022

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Common Shares |

|

Par Value Common Shares |

|

|

Additional Paid-in Capital |

|

Accumulated Deficit |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances, June 30, 2021 |

|

|

- |

$ |

- |

|

$ |

1,335 |

$ |

(5,585) |

$ |

(4,250) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares issued after reorganization |

|

|

253,936,005 |

|

253,936 |

|

|

(253,936) |

|

- |

|

- |

|

| Net loss |

|

|

- |

|

- |

|

|

|

|

(8,407) |

|

(8,407) |

|

| Balances, June 30, 2022 |

|

|

253,936,005 |

$ |

253,936 |

|

$ |

(252,601) |

$ |

(13,992) |

$ |

(12,657) |

|

| Net loss |

|

|

- |

|

- |

|

|

- |

|

(18,507) |

|

(18,507) |

|

| Balances, June 30, 2023 |

|

|

253,936,005 |

$ |

253,936 |

$ |

|

(252,601) |

$ |

(32,499) |

$ |

(31,164) |

|

The

accompanying notes are an integral part of these audited financial statements.

- F5 -

Table of Contents

C2

Blockchain, Inc.

Statement

of Cash Flows

| |

|

For the Year Ended June 30, 2023 |

|

|

For the Year Ended June 30,

2022

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

| Net loss |

$ |

(18,507) |

|

$ |

(8,407) |

| Adjustment to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

| Changes in current assets and liabilities: |

|

|

|

|

|

| Accrued expenses |

|

- |

|

|

(4,250) |

| Net cash used in operating activities |

|

(18,507) |

|

|

(12,657) |

| |

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

| Loan to company - related party |

$ |

18,507 |

|

$ |

12,657 |

| Net cash provided by financing activities |

|

18,507 |

|

|

12,657 |

| |

|

|

|

|

|

| Net change in cash |

$ |

- |

|

$ |

- |

| Beginning cash balance |

|

- |

|

|

- |

| Ending cash balance |

$ |

- |

|

$ |

- |

| |

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

| Interest paid |

$ |

- |

|

$ |

- |

| Income taxes paid |

$ |

- |

|

$ |

- |

The accompanying notes

are an integral part of these audited financial statements.

- F6 -

Table of Contents

C2

Blockchain, Inc.

Notes

to the Audited Financial Statements

Note 1 - Organization and Description

of Business

C2 Blockchain, Inc. was incorporated on June 30, 2021 in the State of Nevada.

On June 30, 2021, Levi Jacobson was appointed Chief Executive Officer, Chief Financial Officer, and Director of C2 Blockchain, Inc.

On

March 31, 2022, the Company entered into a “Agreement and Plan of Merger”, whereas it agreed to, and subsequently participated

in, a Nevada holding company reorganization pursuant to NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250 (“Reorganization”).

The constituent corporations in the Reorganization were American Estate Management Company (“AEMC” or “Predecessor”),

C2 Blockchain, Inc. (“Successor” or “CBLO”), and AEMC Merger Sub, Inc. (“Merger Sub”). Our director

is, and was, the sole director/officer of each constituent corporation in the Reorganization.

C2

Blockchain, Inc. issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of its common stock

to C2 Blockchain, Inc. immediately prior to the Reorganization. As such, immediately prior to the merger, C2 Blockchain, Inc. became a

wholly owned direct subsidiary of American Estate Management Company and Merger Sub became a wholly owned and direct subsidiary of C2

Blockchain, Inc.

On

March 31, 2022, Merger Sub filed Articles of Merger with the Nevada Secretary of State. The merger became

effective on April 1, 2022 at 4:00 PM PST (“Effective Time”). At the Effective Time, Predecessor was merged with and into

Merger Sub (the “Merger), and Predecessor became the surviving corporation. Each share of Predecessor common stock issued and outstanding

immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of C2 Blockchain, Inc.’s (“Successors”) common stock.

On

May 23, 2022, C2 Blockchain, Inc., as successor issuer to American Estate Management Company began a quoted market in its common

stock which was the market effective date for our corporate action.

On

April 1, 2022, after the completion of the Holding Company Reorganization, we cancelled all of the stock we held in AEMC resulting in

AEMC as a stand-alone company. Pursuant to the holding company merger agreement and effects of merger, all of the assets and liabilities,

if any, remain with AEMC after the Reorganization. Levi Jacobson, the Director of AEMC, did not discover any assets of AEMC from the time

he was appointed Director until the completion of the Reorganization and subsequent separation of AEMC as a stand-alone company.

Given

that the former business plan and objectives of AEMC and the present day business plan and objectives of CBLO substantially differ from

one another, we conducted the corporate separation with AEMC immediately after the effective time of the Reorganization in order to avoid

any shareholder confusion. The former business plan of AEMC under the leadership of its former directors, does not, in any way, represent

the current day business plan of CBLO. The result of corporate separation ameliorated shareholder confusion about our identity

and/or corporate objectives. Furthermore, we wanted to continue trading in the OTC MarketPlace.

On April 1, 2022, the Company transmuted its business plan from that of

a blank check shell company to a business combination related shell company with a holding company formation pursuant to a reorganization

with American Estate Management Company.

FINRA

completed its review of our corporate action pursuant to our Reorganization. On April 26, 2022, CBLO was given a CUSIP number by CUSIP

Global Services of 12675R 109. The announcement of our Predecessor’s corporate action was posted on the FINRA daily list on May

20, 2022. The Market Effective date was May 23, 2022.

Our

Common Stock is currently quoted on the OTC Markets Group Inc’s Pink® Open Market under the symbol “CBLO”.

After completion of the Holding Company Reorganization and separation

of AEMC as a wholly owned subsidiary, the Company reverted back to a blank check shell company.

Currently, we no longer believe we are deemed to be a blank check

shell company, but rather a shell company as we have a bona fide business plan at this time. The Company’s business plan is to

concentrate on cryptocurrency related investments and development opportunities including but not limited to cryptocurrency mining, primarily

for Bitcoin, for our own account, investments in private and/or public entities, joint ventures and acquisitions of blockchain related

companies. We have not commenced our planned principal operations.

Currently,

Mendel Holdings, LLC, a Delaware Limited Liability Company, owned and controlled by Levi Jacobson, our sole director is our controlling

shareholder, owning 200,000,000 shares of our common stock representing approximately 78.76 % voting control.

As of June 30, 2023, the Company

had not yet commenced any operations.

The Company has elected June 30th

as its year end.

- F7 -

Table of Contents

Note 2 - Summary of Significant

Accounting Policies

Basis of Presentation

This summary of significant accounting

policies is presented to assist in understanding the Company's financial statements. These accounting policies conform to accounting principles,

generally accepted in the United States of America, and have been consistently applied in the preparation of the financial statements.

Use of Estimates

The preparation of financial statements

in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order

to make the financial statements not misleading have been included. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly

liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents

at June 30, 2023 and June 30, 2022 were $0.

Income

Taxes

The Company accounts for income taxes

under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities

are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing

assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates

expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A

valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets

through future operations. No deferred tax assets or liabilities were recognized at June 30, 2023 and June 30, 2022.

Basic Earnings (Loss) Per

Share

The Company computes basic and diluted

earnings (loss) per share in accordance with ASC Topic 260, Earnings per Share. Basic earnings (loss) per share is computed

by dividing net income (loss) by the weighted average number of common shares outstanding during the reporting period. Diluted earnings

(loss) per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised

or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company.

The Company does not have any potentially

dilutive instruments as of June 30, 2023 and, thus, anti-dilution issues are not applicable.

Fair Value of Financial

Instruments

The Company’s

balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their

fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

ASC 820, Fair Value Measurements

and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an

exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants

on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions

developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about

market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair

value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical

assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy

are described below:

- Level 1 - Unadjusted quoted prices

in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

- Level 2 - Inputs other than quoted

prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices

for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are

not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are

derived principally from or corroborated by observable market data by correlation or other means.

- Level 3 - Inputs that are both

significant to the fair value measurement and unobservable.

Fair value estimates discussed herein

are based upon certain market assumptions and pertinent information available to management as of June 30, 2023. The respective carrying

value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature of these instruments.

These financial instruments include accrued expenses.

- F8 -

Table of Contents

Related Parties

The Company follows ASC 850, Related

Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Share-Based Compensation

ASC 718, “Compensation –

Stock Compensation”, prescribes accounting and reporting standards for all share-based payment transactions in which employee

services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments

such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee

stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized

over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period

(usually the vesting period).

The Company accounts for stock-based

compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based Payments

to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair value

of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value

of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

The Company had no

stock-based compensation plans as of June 30, 2023 and June 30, 2022.

The Company’s stock-based compensation

for the periods ended June 30, 2023 and June 30, 2022 was $0 for both periods.

Recently Issued Accounting

Pronouncements

In

February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). ASU 2016-02 is amended by ASU 2018-01, ASU2018-10, ASU

2018-11, ASU 2018-20 and ASU 2019-01, which FASB issued in January 2018, July 2018, July 2018, December 2018 and March 2019, respectively

(collectively, the amended ASU 2016-02). The amended ASU 2016-02 requires lessees to recognize on the balance sheet a right-of-use asset,

representing its right to use the underlying asset for the lease term, and a lease liability for all leases with terms greater than 12

months. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly

changed from current GAAP. The amended ASU 2016-02 retains a distinction between finance leases (i.e. capital leases under current GAAP)

and operating leases. The classification criteria for distinguishing between finance leases and operating leases will be substantially

similar to the classification criteria for distinguishing between capital leases and operating leases under current GAAP. The amended

ASU 2016-02 also requires qualitative and quantitative disclosures designed to assess the amount, timing, and uncertainty of cash flows

arising from leases. A modified retrospective transition approach is permitted to be used when an entity adopts the amended ASU 2016-02,

which includes a number of optional practical expedients that entities may elect to apply.

We

have no assets and or leases and do not believe we will be impacted in the foreseeable future by the newly adopted accounting standard(s)

mentioned above.

The Company has implemented all new

accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other

new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Note 3 - Going Concern

The Company’s financial statements

are prepared in accordance with generally accepted accounting principles applicable to a going concern that contemplates the realization

of assets and liquidation of liabilities in the normal course of business.

The Company demonstrates adverse

conditions that raise substantial doubt about the Company's ability to continue as a going concern for one year following the issuance

of these financial statements. These adverse conditions are negative financial trends, specifically operating loss, working capital deficiency,

and other adverse key financial ratios.

The Company has not established any

source of revenue to cover its operating costs. Management plans to fund operating expenses with related party contributions to capital.

There is no assurance that management's plan will be successful. The financial statements do not include any adjustments relating to the

recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the

event that the Company cannot continue as a going concern.

Note 4 - Income Taxes

Potential benefits of income tax

losses are not recognized in the accounts until realization is more likely than not. In assessing

the realization of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred

tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income

during the periods in which those temporary differences become deductible. The Company has incurred a net operating loss carryforward

of $32,499 which begins expiring in 2041. The Company has adopted ASC 740, “Accounting for Income Taxes”, as of its inception.

Pursuant to ASC 740 the Company is required to compute tax asset benefits for non-capital losses carried forward. The potential benefit

of the net operating loss has not been recognized in these financial statements because the Company cannot be assured it is more likely

than not it will utilize the loss carried forward in future years.

Significant components of the Company’s

deferred tax assets are as follows:

| |

|

June 30, |

|

| |

|

|

|

| |

|

2023 |

|

2022 |

|

| Deferred tax asset, generated from net operating loss |

|

$ |

6,825 |

|

$ |

2,938 |

|

| Valuation allowance |

|

|

(6,825) |

|

|

(2,938) |

|

| |

|

$ |

— |

|

$ |

— |

|

The reconciliation of the

effective income tax rate to the federal statutory rate is as follows:

| Federal income tax rate 21.0% |

|

|

21.0 |

% |

| Increase in valuation allowance (21.0%) |

|

|

(21.0 |

%) |

| Effective income tax rate 0.0% |

|

|

0.0 |

% |

On December 22, 2017,

the Tax Cuts and Jobs Act of 2017 was signed into law. This legislation reduced the federal corporate tax rate from the previous 35% to

21%.

Due to the change

in ownership provisions of the Tax Reform Act of 1986, net operating loss carryforwards for Federal income tax reporting purposes are

subject to annual limitations. Should a change in ownership occur, net operating loss carryforwards may be limited as to use in future

years.

Note 5 - Commitments

and Contingencies

The Company follows

ASC 450-20, Loss Contingencies, to report accounting for contingencies. Liabilities for loss contingencies

arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability

has been incurred and the amount of the assessment can be reasonably estimated. There were no commitments or contingencies as of June

30, 2023 and June 30, 2022.

Note 6 - Shareholder Equity

Preferred Stock

The authorized preferred stock of

the Company consists of 20,000,000 shares with a par value of $0.001. There were no shares issued and outstanding as of June 30, 2023

and June 30, 2022.

Common Stock

The authorized common stock of the

Company consists of 500,000,000 shares with a par value of $0.001. There were 253,936,005 shares of common stock issued and outstanding

as of June 30, 2023 and June 30, 2022 (See Note 1).

Note 7 - Related-Party

Transactions

Loan

The Company’s sole officer

and director, Levi Jacobson, paid expenses on behalf of the company totaling $18,507 during the period ended June 30, 2023. These

payments are considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand. As of June 30, 2023, the

related party loan to the Company totaled $31,164.

The Company’s sole officer

and director, Levi Jacobson, paid expenses on behalf of the company totaling $12,657 during the period ended June 30, 2022. These

payments are considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand.

Office Space

We utilize the home office space

and equipment of our management at no cost.

Note 8 - Subsequent Events

Management has reviewed financial transactions for the Company

subsequent to the period ended June 30, 2023 and has found that there was nothing material to disclose.

- F9 -

Table of Contents

Item 9. Changes in and Disagreements with Accountants on Accounting

and Financial Disclosure.

None.

Item 9A Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,”

as such term is defined in Rule 13a-15e and Rule 15d-15(e) under the Exchange Act that are designed to ensure that information required

to be disclosed in our reports filed under the Exchange Act is recorded, processed, summarized and reported within the time periods specified

in the SEC's rules and forms, and that such information is accumulated and communicated to our management, which at this time consists

solely of our officer and director, Levi Jacobson.

As of June 30, 2023, the end of the year covered

by this Report, we carried out an evaluation, under the supervision of Mr. Jacobson, our Chief Executive Officer and Chief Financial Officer,

of the effectiveness of the design and the operation of our disclosure controls and procedures. Mr. Jacobson concluded that the disclosure

controls and procedures were not effective as of the end of the year covered by this Report due to material weaknesses identified below.

Management’s Annual Report on Internal Control Over Financial

Reporting

Our management is responsible for establishing and

maintaining adequate internal control over our financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). Internal control

over financial reporting is a process, including policies and procedures, designed to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external reporting purposes in accordance with U.S. generally accepted

accounting principles. Our management assessed our internal control over financial reporting using the criteria in Internal Control –

Integrated Framework (2013), issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). A system

of internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Because

of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements.

Based on our evaluation under the framework in COSO,

our management concluded that our internal control over financial reporting was ineffective as of June 30, 2023 based on such criteria.

Deficiencies existed in the design or operation of our internal control over financial reporting that adversely affect our internal controls

and that may be considered material weaknesses. A material weakness is a significant deficiency, or combination of deficiencies, in internal

control over financial reporting that results in more than a remote likelihood that a material misstatement of the annual or interim financial

statements will not be prevented or detected. As a result of the determination that there was a lack of resources to provide segregation

of duties consistent with control objectives, the lack of a formal audit committee, and the lack of a formal review process that includes

multiple levels of review over financial disclosure and reporting processes, management has determined that material weaknesses existed

as of June 30, 2023.

The weaknesses and the related risks are not uncommon

in a company of our size because of the limitations in the size and number of our staff. To address these material weaknesses, and subject

to the receipt of additional financing or cash flows, we intend to undertake remediation measures to address the material weaknesses described

in this Report, including implementing procedures pursuant to which we can ensure segregation of duties and hire additional resources

to ensure appropriate review and oversight.

A control system, no matter how well conceived and

operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met under all potential conditions,

regardless of how remote, and may not prevent or detect all errors and all fraud. Because of the inherent limitations in all control systems,

no evaluation of controls can provide absolute assurance that all control issues, if any, within the Company have been detected. These

inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of a

simple error or mistake. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting

principles.

Auditor’s Report on Internal Control Over Financial Reporting

This Report does not include an attestation report

of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was

not subject to attestation by our independent registered public accounting firm pursuant to the rules of the SEC that permit us to provide

only management’s report in this Report.

Changes in Internal Control Over Financial Reporting

There have been no changes in our internal control

over financial reporting (as that term is defined in Rules 13(a)-15(f) and 15(d)-15(f) of the Exchange Act) that have occurred during

the fourth quarter ended June 30, 2023 that have materially affected, or are reasonably likely to materially affect, our internal control

over financial reporting.

Item 9B. Other Information.

None.

- 6 -

Table of Contents

PART III

Item 10. Directors, Executive Officers and Corporate

Governance.

Each of our directors holds office until the next

annual meeting of our stockholders or until his successor has been elected and qualified, or until his death, resignation, or removal.

Our executive officers are appointed by our board of directors and hold office until their death, resignation, or removal from office.

Our current executive officers and directors and

additional information concerning them are as follows:

| Name |

|

Age |

|

Position(s) |

| |

|

|

|

|

| Levi Jacobson |

|

29 |

|

Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, and Director |

Levi

Jacobson - Chief Executive Officer, Chief Financial Officer, Chief Operations Officer, Chief Accounting Officer, President,

Secretary and sole Director.

Mr.

Jacobson studied business and economics at Touro College, which he graduated from in 2014. From February 2015 to August 2015, Mr. Jacobson

worked for Blue Car Enterprise as a Manager/Director specializing in sales and ad management. Mr. Jacobson was appointed Chief Executive

Officer, Chief Financial Officer, President, Secretary, Treasurer and Director of the Company on June 30, 2021. Mr. Jacobson served as

director of Elektros, Inc. from December 1, 2020 until July 1, 2021. Mr. Jacobson is the CEO and sole director of Hemp Naturals, Inc.

and has served in such positions since November 13, 2015. He is also the CEO and sole director of China Xuefeng Environmental Engineering

Group, since November 19, 2020 and American Estate Management Company since July 7, 2021. From 2016 through 2019, Mr. Jacobson was working

at Bluejay Management LLC, a real estate developer in Hewlett, NY assisting management in all aspects of real estate including property

management, collection of rents and remodeling.

- 7 -

Table of Contents

Committees of the Board

We currently do not have nominating, compensation, or

audit committees, or committees performing similar functions, nor do we have a written nominating, compensation, or audit committee charter.

Our board of director(s) believes that it is not necessary to have such committees given our current size and the limited scope of our

business. Currently, our board of director(s) is performing the functions of such committees.

In lieu of an Audit Committee, our board of director(s)

is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results, and

effectiveness of the annual audit of our financial statements and other services provided by our independent registered public accounting

firm. Our board of director(s), our Chief Executive Officer, and our Chief Financial Officer, all of whom are Levi Jacobson, review our

internal accounting controls, practices, and policies.

Audit Committee Financial Expert

Our board of director(s) has determined that we do

not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation

S-K . We believe that given our current size and the limited scope of our business, retaining an independent director who would qualify

as an audit committee financial expert would be overly costly and burdensome. We will consider establishing an Audit Committee, and identifying

an individual to serve as an independent director and as the audit committee financial expert when so required.

Involvement in Certain Legal Proceedings

None of our executive officers and directors, of which

we have one, have been involved in or a party to any of the following events or actions during the past ten years:

| 1. |

Any petition under the federal bankruptcy laws or any state insolvency laws filed by or against, or an appointment of a receiver, fiscal agent, or similar officer by a court for the business or property of such person, a partnership in which such person was a general partner at or within two years before the time of such filing, or any corporation or business association of which such person was an executive officer either at or within two years prior to the time of such filing; |

| 2. |

Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. |

Being subject to any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, such person from, or otherwise limiting, the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director, or employee of any investment company, bank, savings and loan association, or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; or (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws; |

| 4. |