false0001497253DEF 14A000149725312022-04-012023-03-310001497253onvo:ChangeInFairValueAtVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedDuringTheYearFromPriorYearEndMemberecd:NonPeoNeoMember2022-04-012023-03-310001497253ecd:PeoMemberonvo:GrantDateFairValueOfEquityAwardsAsReportedInSummaryCompensationTableMember2022-04-012023-03-310001497253ecd:PeoMemberonvo:ChangeInFairValueAtVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedDuringTheYearFromPriorYearEndMember2021-04-012022-03-310001497253ecd:NonPeoNeoMemberonvo:FairValueAtYearEndOfAwardsGrantedDuringTheYearThatAreOutstandingAndUnvestedMember2022-04-012023-03-310001497253ecd:PeoMemberonvo:ChangeInFairValueAtYearEndOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedFromPriorYearEndMember2021-04-012022-03-310001497253ecd:PeoMemberonvo:ChangeInFairValueAtYearEndOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedFromPriorYearEndMember2022-04-012023-03-310001497253onvo:FairValueAtVestingDateOfEquityAwardsGrantedDuringTheYearThatVestedDuringTheYearMemberecd:NonPeoNeoMember2022-04-012023-03-310001497253ecd:PeoMemberonvo:FairValueAtYearEndOfAwardsGrantedDuringTheYearThatAreOutstandingAndUnvestedMember2021-04-012022-03-310001497253ecd:NonPeoNeoMemberonvo:ChangeInFairValueAtYearEndOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedFromPriorYearEndMember2021-04-012022-03-310001497253onvo:FairValueAtVestingDateOfEquityAwardsGrantedDuringTheYearThatVestedDuringTheYearMemberecd:NonPeoNeoMember2021-04-012022-03-3100014972532022-04-012023-03-310001497253ecd:PeoMemberonvo:GrantDateFairValueOfEquityAwardsAsReportedInSummaryCompensationTableMember2021-04-012022-03-310001497253onvo:GrantDateFairValueOfEquityAwardsAsReportedInSummaryCompensationTableMemberecd:NonPeoNeoMember2021-04-012022-03-310001497253onvo:FairValueAtVestingDateOfEquityAwardsGrantedDuringTheYearThatVestedDuringTheYearMemberecd:PeoMember2021-04-012022-03-310001497253ecd:PeoMemberonvo:ChangeInFairValueAtVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedDuringTheYearFromPriorYearEndMember2022-04-012023-03-3100014972532021-04-012022-03-310001497253ecd:NonPeoNeoMemberonvo:FairValueAtYearEndOfAwardsGrantedDuringTheYearThatAreOutstandingAndUnvestedMember2021-04-012022-03-310001497253onvo:ChangeInFairValueAtVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedDuringTheYearFromPriorYearEndMemberecd:NonPeoNeoMember2021-04-012022-03-310001497253onvo:FairValueAtVestingDateOfEquityAwardsGrantedDuringTheYearThatVestedDuringTheYearMemberecd:PeoMember2022-04-012023-03-310001497253ecd:NonPeoNeoMemberonvo:ChangeInFairValueAtYearEndOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedFromPriorYearEndMember2022-04-012023-03-310001497253onvo:GrantDateFairValueOfEquityAwardsAsReportedInSummaryCompensationTableMemberecd:NonPeoNeoMember2022-04-012023-03-310001497253ecd:PeoMemberonvo:FairValueAtYearEndOfAwardsGrantedDuringTheYearThatAreOutstandingAndUnvestedMember2022-04-012023-03-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. _)

______________________

|

|

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

Organovo Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Organovo Holdings, Inc.

11555 Sorrento Valley Rd., Suite 100

San Diego, CA 92121

September 13, 2023

Dear Stockholder:

You are cordially invited to attend this year’s Annual Meeting of Stockholders of Organovo Holdings, Inc. on Tuesday, October 31, 2023 at 9:00 a.m. (Pacific Daylight Time). The Annual Meeting will be completely virtual. You may attend the virtual meeting, submit questions and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/ONVO2023.

On or about September 13, 2023, we will mail our proxy materials to our stockholders, comprised of the enclosed Annual Report, the Notice of Annual Meeting of Stockholders, the Proxy Statement, and proxy card.

The matters to be acted upon are described in the Notice of 2023 Annual Meeting of Stockholders and Proxy Statement. Following the formal business of the meeting, we will respond to questions from stockholders.

Whether or not you plan to virtually attend the meeting, your vote is very important and we encourage you to vote promptly. You may vote by proxy over the internet or by telephone, or you can also vote by mail by following the instructions on your proxy card. If you virtually attend the meeting, you will have the right to revoke your proxy and vote electronically during the meeting via the live webcast. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares.

On behalf of your Board of Directors, thank you for your continued support and interest.

Sincerely yours,

Keith Murphy

Executive Chairman and Corporate Secretary

i

ORGANOVO HOLDINGS, INC. NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 31, 2023

To Our Stockholders:

The 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Organovo Holdings, Inc. (“we,” “us,” “our,” “Organovo” or the “Company”) will be held on Tuesday, October 31, 2023, at 9:00 a.m. (Pacific Daylight Time). The Annual Meeting will be completely virtual. You may attend the meeting, submit questions and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/ONVO2023. At the Annual Meeting, our stockholders will be asked:

1.To elect each of Keith Murphy and Adam Stern as a Class III director to hold office until the 2026 Annual Meeting of Stockholders and until his respective successor is elected and qualified;

2.To ratify the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending March 31, 2024

3.To approve, on an advisory basis, the compensation of our named executive officers;

4.To approve the Organovo Holdings, Inc. 2023 Employee Stock Purchase Plan;

5.To approve an amendment to our Certificate of Incorporation, as amended, to reflect new Delaware law provisions regarding officer exculpation; and

6.To transact such other business as may properly be brought before the Annual Meeting or any adjournments or postponements thereof.

Our Board of Directors recommends a vote FOR each of the director nominees, and FOR proposals 2, 3, and 4 listed above. Stockholders of record at the close of business on September 5, 2023 are entitled to notice of, and to vote on, all matters at the Annual Meeting and any reconvened meeting following any adjournments or postponements thereof. For 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose relating to the Annual Meeting, during ordinary business hours at our corporate offices located at 11555 Sorrento Valley Rd., Suite 100, San Diego, CA 92121.

All stockholders are invited to attend the virtual Annual Meeting. Whether or not you expect to attend the Annual Meeting, you are urged to vote or submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Telephone and internet voting are available. For specific instructions on voting, please refer to the proxy card. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting: This Notice of 2023 Annual Meeting of Stockholders, Proxy Statement and Annual Report are available at www.proxyvote.com.

By Order of the Board of Directors

Keith Murphy

Executive Chairman and Corporate Secretary

September 13, 2023

ii

2023 Proxy Statement Summary

To assist you in reviewing the Proxy Statement for the Organovo Holdings, Inc. (“we,” “us,” “our,” “Organovo” or the “Company”) 2023 Annual Meeting of Stockholders (the “Annual Meeting”), we call your attention to the following summary information about the Annual Meeting, the proposals to be considered at the Annual Meeting and our corporate governance and compensation frameworks. For more complete information, please review our Proxy Statement. Regardless of the number of shares you own, your VOTE is very important. Even if you presently plan to virtually attend the Annual Meeting, please vote or submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Telephone and internet voting are available. For specific instructions on voting, please refer to the proxy card. If you do virtually attend the Annual Meeting and wish to vote electronically, you may withdraw your proxy at that time.

Annual Meeting of Stockholders

|

|

Date and Time: |

October 31, 2023 at 9:00 a.m. (Pacific Daylight Time) |

Place: |

www.virtualshareholdermeeting.com/ONVO2023 |

Record Date: |

September 5, 2023 |

Voting: |

If you were a “stockholder of record” or beneficial owner of shares held in “street name” as of the Record Date, you may vote your shares. You may vote in person at the Annual Meeting or by the internet, telephone or mail. See the “General Information – Voting Instructions” in the Proxy Statement for more detail regarding how you may vote your shares. |

Virtual Meeting: |

The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live webcast. We believe that hosting a virtual meeting will enable greater stockholder attendance and participation from any location, improved communication and cost savings to our stockholders. You can virtually attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/ONVO2023, where you will be able to vote your shares and submit your questions during the meeting via the internet. There will not be a physical meeting location and you will not be able to attend in person. The Annual Meeting starts at 9:00 a.m. (Pacific Daylight Time). We encourage you to access the meeting website prior to the start time to allow time for check-in. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual shareholder meeting login page. You do not need to register to virtually attend the Annual Meeting webcast. Follow the instructions on your proxy card to access the Annual Meeting. |

iii

Proposals and Voting Recommendations

|

|

|

|

Board Vote Recommendation |

Page References (for more detail) |

Proposals: |

|

|

(1) Election of two Class III directors each to hold office until the 2026 Annual Meeting of Stockholders and until his respective successor is elected and qualified. |

FOR EACH

NOMINEE |

7 – 8 |

(2) Ratification of the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending March 31, 2024. |

FOR |

9 – 10 |

(3) To approve, on an advisory and non-binding basis, the compensation of our named executive officers. |

FOR |

11 |

(4) To approve the Organovo Holdings, Inc. 2023 Employee Stock Purchase Plan. |

FOR |

12 – 18 |

(5) To approve an amendment to our Certificate of Incorporation, as amended, to reflect new Delaware law provisions regarding officer exculpation. |

FOR |

19 |

Current Corporate Governance Summary Facts

We seek to maintain high standards of business conduct and corporate governance, which we believe are fundamental to the overall success of our business, serve our stockholders well and maintain our integrity in the marketplace. The following table summarizes some of the key elements of our current corporate governance framework:

|

|

Size of Board |

6 |

Number of Independent Directors |

4 |

Lead Independent Director |

Yes |

Review Board and Board Committee Independence and Qualifications |

Annual |

Board Self-Evaluation |

Periodic |

Hold Executive Sessions |

Yes |

Diverse Board (as to background, experience and skills) |

Yes |

Board has Adopted Corporate Governance Guidelines |

Yes |

Board has Not Amended Charters or Taken Actions to Reduce Stockholder Rights |

True |

Director Meeting Attendance Above 75% |

Yes |

Stock Ownership Guidelines |

Yes |

No Family Relationships Among Officers and Directors |

True |

All Committee Chairs and Other Committee Members Qualify as Independent Directors |

Yes |

Plurality Plus Standard in Director Elections |

Yes |

Summary of Compensation Best Practices

Our Board of Directors (the “Board of Directors” or the “Board”) established a Compensation Committee of the Board (the “Compensation Committee”) comprised of three independent directors in accordance with the rules and regulations established by the Securities and Exchange Commission (the “SEC”) and the Nasdaq Capital Market. Our Board has delegated to the Compensation Committee the authority to establish the Company’s executive compensation program and to approve all compensation received by the Company’s executive officers and the other members of its management team. Since October 1, 2020, the Compensation Committee has retained, on an annual basis, Anderson Pay Advisors LLC (“Anderson”) as its independent compensation consultants, to assist it in evaluating the Company’s executive compensation program and selecting an appropriate peer group of comparable companies for purposes of setting executive compensation.

iv

The Compensation Committee periodically reviews best practices in governance and executive compensation. The following is a high-level summary of certain executive compensation practices that the Compensation Committee believes drive Company performance and serve our stockholders’ long-term interests:

|

|

Compensation Committee Comprised of At Least Three Independent Directors |

Yes |

Independent Compensation Consultant Retained |

Yes |

Compensation Committee Members all qualify as “outside directors” and “non-employee directors” |

True |

Compensation Based on Comparison to Peer Group Data |

Yes |

All Directors and Officers Subject to Stock Ownership Guidelines |

Yes |

Compensation Committee Performs Compensation Risk Assessment |

Annual |

Prohibitions Against all Directors, Officers and Employees Hedging or Pledging Stock |

Yes |

Incentive Plans Based on Performance Metrics |

Yes |

Company Does Not Offer Tax Gross Ups for Severance or Change of Control |

Yes |

Reasonable and Double Trigger Accelerated Vesting Provisions Adopted |

Yes |

No Multi-Year Guaranteed Bonuses |

Yes |

Stock Option Plan Prohibits Option Repricing and Share Recycling |

Yes |

Company Has Not Repriced Options in Last Three Years |

Yes |

No Executive Employment Agreements with Guaranteed Terms |

Yes |

Offer Limited Perquisites to Executives |

Yes |

Consider Prior Year’s Advisory Vote regarding Named Executive Officer Compensation |

Yes |

Terms of Severance Plan Described to Stockholders |

Yes |

Equity Incentive Plans Do Not Contain an “Evergreen” Feature |

Yes |

v

TABLE OF CONTENTS

vii

ORGANOVO HOLDINGS, INC.

11555 Sorrento Valley Rd., Suite 100,

San Diego, CA 92121

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD OCTOBER 31, 2023

This Proxy Statement, along with a proxy card, is being mailed and made available to our stockholders on or about September 13, 2023

GENERAL INFORMATION

We have made these proxy materials available to you in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of Organovo Holdings, Inc. of proxies to be voted at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on Tuesday, October 31, 2023 at 9:00 a.m. (Pacific Daylight Time) via live webcast by visiting www.virtualshareholdermeeting.com/ONVO2023. References in this Proxy Statement to the “Company,” “Organovo,” “we,” “our” and “us” are to Organovo Holdings, Inc. and its subsidiaries.

Record Date

Holders of shares of our common stock, our only class of issued and outstanding voting securities, at the close of business on September 5, 2023 (the “Record Date”) are entitled to vote on the proposals presented at the Annual Meeting. As of September 5, 2023, we had 8,718,203 issued and outstanding shares of common stock.

Quorum

The presence, in person or by proxy, of the holders of at least 2,906,068 shares of common stock, representing one-third of the outstanding shares of common stock entitled to vote at the virtual Annual Meeting, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum.

The Annual Meeting may be adjourned or postponed from time to time and at any reconvened meeting, action with respect to the matters specified in this Proxy Statement may be taken without further notice to stockholders except as required by applicable law and our charter documents.

Virtual Annual Meeting

The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live webcast. We believe that hosting a virtual meeting will enable greater stockholder attendance and participation from any location, improved communication and cost savings to our stockholders. You can virtually attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/ONVO2023, where you will be able to vote your shares and submit your questions during the meeting via the internet. There will not be a physical meeting location and you will not be able to attend in person.

We invite you to virtually attend the Annual Meeting and request that you vote on the proposals described in this proxy statement. However, you do not need to attend the virtual meeting to vote your shares. Instead, you may vote by internet, by telephone or, if you requested and received paper copies of the proxy materials by mail, you may also vote by completing and mailing your proxy card.

The Annual Meeting starts at 9:00 a.m. (Pacific Daylight Time) on Tuesday, October 31. We encourage you to access the meeting website prior to the start time to allow time for check-in. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual shareholder meeting login page.

1

You do not need to register to virtually attend the Annual Meeting webcast. Follow the instructions on your proxy card to access the Annual Meeting.

If you wish to submit a question the day of the Annual Meeting, you may log in to the virtual meeting platform at www.virtualshareholdermeeting.com/ONVO2023, type your question into the “Ask a Question” field and click “Submit.” Questions pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters, including those related to employment, are not pertinent to annual meeting matters and, therefore, will not be answered.

Stockholders of Record

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, Continental Stock Transfer and Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. All shares represented by a proxy will be voted at the Annual Meeting, and where a stockholder specifies choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If a stockholder does not indicate a choice on the proxy card, the shares will be voted in favor of the election of each of the nominees for director contained in this Proxy Statement and in favor of Proposals 2, 3, 4 and 5.

Shares Held in Street Name

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization. If this is the case, you will receive a separate voting instruction form with this Proxy Statement from such organization. As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee how to vote your shares, and you are also invited to attend the Annual Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, bank, trustee or nominee, your shares will not be voted on any proposals on which such party does not have discretionary authority to vote (a “broker non-vote”), as further described below under the heading “Broker Non-Votes.”

Please note that if your shares are held of record by a broker, bank, trustee or nominee and you wish to vote at the virtual Annual Meeting, you will not be permitted to vote at the virtual meeting unless you first obtain a proxy issued in your name from the record holder.

Broker Non-Votes

Broker non-votes are shares held by brokers, banks or other nominees who are present in person or represented by proxy, but which are not voted on a particular matter because the brokers, banks or nominees do not have discretionary authority with respect to that proposal and they have not received voting instructions from the beneficial owner. Under the rules that govern brokers, brokers have the discretion to vote on routine matters, but not on non-routine matters. The only routine matter to be considered at the Annual Meeting is the ratification of the appointment of the Company’s independent registered public accounting firm. The remaining proposals are considered to be non-routine matters. As a result, if you do not provide your brokers or nominees with voting instructions on these non-routine matters, your shares will not be voted on these proposals.

Voting Matters

Stockholders are entitled to cast one vote per share of common stock on each matter presented for consideration by the stockholders. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for a proper purpose during normal business hours at the executive offices of the Company for a period of at least 10 days preceding the day of the Annual Meeting.

There are five proposals scheduled to be voted on at the Annual Meeting:

1.To elect each of Keith Murphy and Adam Stern as a Class III director to hold office until the 2026 Annual Meeting of Stockholders and until his respective successor is elected and qualified;

2

2.To ratify the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending March 31, 2024;

3.To approve, on a non-binding advisory basis, the compensation of our named executive officers;

4.To approve the Organovo Holdings, Inc. 2023 Employee Stock Purchase Plan (the “ESPP”); and

5.To approve an amendment to our Certificate of Incorporation, as amended (“Certificate of Incorporation”), to reflect new Delaware law provisions regarding officer exculpation.

Our Board of Directors recommends a vote FOR each of the director nominees and FOR proposals 2, 3, 4 and 5 listed above.

We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration and you have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

Votes Required

Proposal 1 – Election of Directors

Under our Certificate of Incorporation, and our amended and restated bylaws (the “Bylaws”), the Class II directors will be elected by a plurality of the votes cast in person or by proxy at the Annual Meeting assuming a quorum is present. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your broker will not have authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will not have any effect on the outcome of the proposal.

Because this is an uncontested election of directors (an election in which the number of persons properly nominated to serve as director does not exceed the number of directors to be elected), each of Mr. Murphy and Mr. Stern will be elected to the Board under the plurality voting standard if he receives any vote “FOR” his election. However, pursuant to the Company’s corporate governance guidelines, in an uncontested election, if a nominee receives a greater number of votes “withheld” than votes “for” such nominee’s election, then such nominee must tender such nominee’s resignation to the Board. The Nominating and Corporate Governance Committee will then determine whether the Board should accept or reject such director nominee’s resignation and will submit a recommendation to the Board for prompt consideration by the Board. The Board then will review the Nominating and Corporate Governance Committee’s recommendation and accept or reject the director nominee’s resignation within 100 days following certification of the stockholder vote for the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR AND SOLICITS PROXIES IN FAVOR OF THE ELECTION OF KEITH MURPHY AND ADAM STERN AS CLASS III DIRECTORS.

Proposal 2 – Ratification of Appointment of Independent Registered Public Accounting Firm

If a quorum is present, the affirmative vote of a majority of the votes cast at the Annual Meeting is required for ratification of the appointment of our independent registered public accounting firm. Abstentions will each be counted as present for purposes of determining the presence of a quorum but will not be considered as votes cast for or against the proposal and will therefore have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF ROSENBERG RICH BAKER BERMAN P.A. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING MARCH 31, 2024.

3

Proposal 3 – Advisory Vote to Approve Compensation of Named Executive Officers

If a quorum is present, the proposal to approve, on an advisory basis, the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be considered as votes cast for or against the proposal and will therefore have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

Proposal 4 – Approval of the ESPP

If a quorum is present, the proposal to approve the ESPP requires the affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be considered as votes cast for or against the proposal and will therefore have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL OF THE ESPP.

Proposal 5 – Approval of the Amendment to our Certificate of Incorporation to Reflect New Delaware Law Provisions Regarding Officer Exculpation

If a quorum is present, the proposal to approve the amendment to our Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation requires the affirmative vote of a majority of the outstanding shares of our common stock. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will be considered as votes cast against the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL OF THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO REFLECT NEW DELAWARE LAW PROVISIONS REGARDING OFFICER EXCULPATION.

Voting Instructions

If you are a stockholder of record, you can vote in the following ways:

•By Internet: by following the internet voting instructions included on the proxy card at any time up until 11:59 p.m., Eastern Time, on October 30, 2023.

•By Telephone: by following the telephone voting instructions included on the proxy card at any time up until 11:59 p.m., Eastern Time, on October 30, 2023.

•By Mail: you may vote by mail by marking, dating and signing your proxy card in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials. The proxy card must be received prior to the Annual Meeting.

You may also vote your shares during the virtual Annual Meeting. Even if you plan to attend the virtual Annual Meeting, we encourage you to vote in advance by internet, telephone or mail so that your vote will be counted in the event you later decide not to attend the virtual Annual Meeting.

If you hold shares through a bank or broker, please refer to your proxy card, Notice or other information forwarded by your bank or broker to see which voting options are available to you.

4

Proxies

Proxies are solicited by and on behalf of our Board and we will bear the entire cost of soliciting proxies, including the costs of preparing, assembling, printing and mailing this proxy statement, the proxy card and any additional soliciting materials furnished to stockholders.

All shares represented by a proxy will be voted, and where a stockholder specifies a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If a stockholder does not indicate a choice on the proxy card, the shares will be voted: (i) in favor of the election of the two director nominees contained in this Proxy Statement, (ii) in favor of ratifying the appointment of Rosenberg Rich Baker Berman P.A. as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2024, (iii) in favor of the non-binding advisory vote on the compensation of our named executive officers, (iv) in favor of approving the ESPP, and (v) in favor of approving the amendment to our Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation; and in the discretion of the proxy holders on any other matter that comes before the meeting.

If your shares are held by a broker, bank or other stockholder of record, in nominee name or otherwise, exercising fiduciary powers (typically referred to as being held in “street name”), you may receive a separate voting instruction form with this Proxy Statement. Your broker may vote your shares on Proposal 2 to ratify the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm, but will not be permitted to vote your shares with respect to Proposal 1, the election of the Class III directors, Proposal 3, the non-binding advisory vote on the compensation of our named executive officers, Proposal 4, the approval of the ESPP or Proposal 5, the approval of an amendment to our Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation, unless you provide instructions as to how to vote your shares. Please note that if your shares are held of record by a broker, bank or nominee and you wish to vote at the meeting, you will not be permitted to vote at the virtual meeting unless you first receive materials necessary to access the Annual Meeting from the record holder.

Proxy Revocation Procedure

If you are a stockholder of record, you may revoke your proxy: (i) by written notice of revocation mailed to and received by the Secretary of the Company prior to the date of the Annual Meeting, (ii) by voting again via the internet or by telephone at a later time before the closing of those voting facilities at 11:59 p.m. (Eastern Time) on October 30, 2023, (iii) by executing and delivering to the Secretary a proxy dated as of a later date than a previously executed and delivered proxy (provided, however, that such action must be taken prior to 11:59 p.m. (Eastern Time) on October 30, 2023), or (iv) by virtually attending the Annual Meeting and voting electronically by going to www.virtualshareholdermeeting.com/ONVO2023 and using your unique control number that was included in the Proxy Materials that you received in the mail. Attendance at the virtual Annual Meeting will not in and of itself revoke a proxy.

If your shares are held by a bank, broker or other agent, you may change your vote by submitting new voting instructions to your bank, broker or other agent, or by referring to your proxy card or other information forwarded by your bank or broker.

Voting Results

We will announce preliminary voting results at the Annual Meeting. We will report final results in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Interests of Officers and Directors in Any Matters to be Acted Upon at the Annual Meeting

Each of Mr. Murphy and Mr. Stern has an interest in Proposal 1, the election of Mr. Murphy and Mr. Stern as Class III directors, as each of them is currently a member of the Board that is up for reelection. Members of the Board and our executive officers do not have any interest in Proposal 2, the ratification of the appointment of Rosenberg Rich

5

Baker Berman P.A. as our independent registered public accounting firm. Our named executive officers have an interest in Proposal 3, as the compensation for our named executive officers is subject to this vote. Members of the Board who are employees of ours and our executive officers will be eligible to receive awards under the ESPP, and they therefore have an interest in Proposal 4. Our executive officers have an interest in Proposal 5, as the proposed changes to our Certificate of Incorporation would exculpate our executive officers from liability in specific circumstances.

6

PROPOSAL 1: ELECTION OF DIRECTORS

General

Our Certificate of Incorporation and Bylaws provide for a classified Board consisting of three classes of directors with staggered three-year terms. The Board currently consists of six directors, having terms expiring at the respective annual meetings of stockholders listed below:

|

|

|

2023 Annual Meeting |

2024 Annual Meeting |

2025 Annual Meeting |

Keith Murphy |

Alison Tjosvold Milhous |

Douglas Jay Cohen |

Adam Stern |

Vaidehi Joshi |

David Gobel |

Proposal to Elect Two Directors to Hold Office for Three Years until the 2026 Annual Meeting

The Board is recommending, and has nominated for election at the Annual Meeting, the following slate of two nominees, each to hold office for three years until the 2026 Annual Meeting of Stockholders and until his respective successor is duly elected and qualified.

|

|

|

|

|

|

|

Name |

Age |

Director Since |

Principal Occupation |

Experience/

Qualifications |

Current Committee Membership |

Independent? |

Keith Murphy |

51 |

2020 |

Executive Chairman of Organovo and Chief Executive Officer and Chairman of Viscient Biosciences, Inc. |

Industry, Strategy |

- Science and Technology Committee |

No |

Adam Stern |

59 |

2020 |

Chief Executive Officer of SternAegis Ventures |

Industry, Corporate Finance |

- Audit Committee

- Compensation Committee |

Yes |

Each of the nominees is currently serving as a director and has indicated his willingness to serve if elected, but if either nominee should be unable or unwilling to stand for election, the shares represented by proxies may be voted for a substitute as the Board of Directors may designate, unless a contrary instruction is indicated in the proxy.

Additional Information

For additional information about each nominee and each of the other directors serving on our Board, please see pages 20-23 in this Proxy Statement.

Vote Required

Under our Certificate of Incorporation and Bylaws, the Class III directors will be elected by a plurality of the votes cast in person or by proxy at the Annual Meeting assuming a quorum is present. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your broker will not have authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will not have any effect on the outcome of the proposal.

Because this is an uncontested election of directors (an election in which the number of persons properly nominated to serve as director does not exceed the number of directors to be elected), each of Mr. Murphy and Mr. Stern will be elected to the Board under the plurality voting standard if he receives any votes “FOR” their re-election. However, pursuant to the Company’s corporate governance guidelines, in an uncontested election, if a nominee receives a greater number of votes “withheld” than votes “for” such nominee’s election, then such nominee must tender such nominee’s resignation to the Board. The Nominating and Corporate Governance Committee will then determine whether the Board should accept or reject such director nominee’s resignation and will submit a recommendation to the Board for prompt consideration by the Board. The Board will then review the Nominating and Corporate Governance Committee’s recommendation and accept or reject the director nominee’s resignation within 100 days following certification of the stockholder vote for the Annual Meeting.

7

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR AND SOLICITS PROXIES IN FAVOR OF THE ELECTION OF EACH OF KEITH MURPHY AND ADAM STERN.

Unless otherwise instructed, it is the intention of the persons named as proxy holders in the proxy card to vote shares represented by properly executed proxy cards for the election of each of Keith Murphy and Adam Stern.

8

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At the Annual Meeting, our stockholders will be asked to ratify the appointment of Rosenberg Rich Baker Berman P.A. (“RRBB P.A.”) as our independent registered public accounting firm for the fiscal year ending March 31, 2024. Representatives of RRBB P.A. are expected to be present at the virtual Annual Meeting and will have the opportunity to make statements if they desire to do so and to respond to appropriate questions. RRBB P.A. has served as our independent registered public accounting firm since August 31, 2023.

In the event our stockholders fail to ratify the appointment of RRBB P.A., the Audit Committee of the Board (the “Audit Committee”) will reconsider its appointment. In addition, even if our stockholders ratify the appointment, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it believes that a change would be in the best interests of the Company and its stockholders.

Changes in Certifying Accountant

On July 18, 2023, Mayer Hoffman McCann P.C. (“MHM”) informed us and the Audit Committee that it would not stand for re-election as our registered public accounting firm for the audit of our financial statements for the fiscal year ending March 31, 2024. MHM ceased to serve as the Company’s independent registered public accounting firm as of August 10, 2023.

The audit reports of MHM on our financial statements for the fiscal years ended March 31, 2023 and 2022 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles, except for an explanatory paragraph regarding the existence of substantial doubt about our ability to continue as a going concern in the report for the fiscal year ended March 31, 2023.

During our two most recent fiscal years ended March 31, 2023 and 2022 and the subsequent interim period through July 18, 2023, there were no (a) disagreements, within the meaning of Item 304(a)(1)(iv) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (“Regulation S-K”), and the related instructions thereto, with MHM on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of MHM, would have caused it to make reference to the subject matter of the disagreements in connection with its reports, or (b) reportable events within the meaning of Item 304(a)(1)(v) of Regulation S-K and the related instructions thereto.

MHM has served as our independent registered public accounting firm since February 8, 2011, the date we completed our reverse merger transaction and became a public reporting company.

Audit and Non-Audit Fees

Our Audit Committee is responsible for, and has approved, the engagement of RRBB P.A. as our independent registered public accounting firm for the fiscal year ending March 31, 2024.

The Audit Committee intends to meet with RRBB P.A. on a quarterly or more frequent basis. At such times, the Audit Committee will continue to review the services performed by RRBB P.A., as well as the fees charged for such services.

During Fiscal 2023, the Audit Committee met with MHM on a quarterly or more frequent basis. At such times, the Audit Committee reviewed the services performed by MHM, as well as the fees charged for such services. Substantially all MHM’s personnel, who work under the control of MHM shareholders, are employees of wholly-owned subsidiaries of CBIZ, Inc., which provides personnel and various services to MHM in an alternative practice structure.

The following table sets forth the fees for services provided and billed by MHM and its associated entity CBIZ MHM, LLC, relating to Fiscal 2023 and Fiscal 2022.

9

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year 2023 |

|

|

Fiscal Year 2022 |

|

Audit fees |

|

$ |

567,930 |

|

|

$ |

310,120 |

|

Audit-related fees |

|

|

— |

|

|

|

— |

|

Tax fees |

|

|

26,670 |

|

|

|

24,764 |

|

All other fees |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

594,600 |

|

|

$ |

334,884 |

|

Audit Fees: For the fiscal years ended March 31, 2023 and 2022, the aggregate audit fees billed by MHM were for professional services rendered for audits and quarterly reviews of our consolidated financial statements, and assistance with reviews of registration statements and documents filed with the SEC.

Audit-Related Fees: For the fiscal years ended March 31, 2023 and 2022, there were no audit-related fees billed by MHM, other than the fees described above.

Tax Fees: For the fiscal years ended March 31, 2023 and 2022, the tax-related fees billed by an associated entity of MHM pertained to services related to tax return preparation and tax planning services.

All Other Fees: For the fiscal years ended March 31, 2023 and 2022, there were no fees billed by MHM for other services, other than the fees described above.

Policy on Audit Committee Pre-Approval of Audit and Permitted Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee has determined that all services provided by RRBB P.A. to date are compatible with, and all services provided previously by MHM were compatible with, maintaining the independence of such respective audit firm. The charter of the Audit Committee requires advance approval of all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by our independent registered public accounting firm, subject to any exception permitted by law or regulation. The Audit Committee has delegated to the Chair of the Audit Committee authority to approve permitted services, provided that the Chair reports any decisions to the Audit Committee at its next scheduled meeting.

Vote Required

If a quorum is present, the affirmative vote of a majority of the votes cast at the Annual Meeting is required for ratification of the appointment of our independent registered public accounting firm. Abstentions will be counted as present for purposes of determining the presence of a quorum but will not be considered as votes cast for or against the proposal and will therefore have no effect on the outcome of the vote.

Although ratification is not required by our Bylaws or otherwise, the Board is submitting this proposal as a matter of good corporate governance. If stockholders do not ratify the appointment of RRBB P.A., the Audit Committee and the Board would consider what, if any, action to take. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the fiscal year if it is determined that such a change would be in the best interests of Organovo and its stockholders.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF ROSENBERG RICH BAKER BERMAN P.A. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING MARCH 31, 2024.

10

PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Board is providing stockholders with the opportunity to cast an advisory vote on the compensation of our named executive officers. This proposal, commonly known as a “Say-on-Pay” proposal, gives you, as a stockholder, the opportunity to endorse or not endorse our executive compensation program and the compensation paid to our named executive officers as reported in this Proxy Statement.

The “Say-on-Pay” vote is advisory, and therefore not binding on the Compensation Committee or the Board. Although the vote is non-binding, the Compensation Committee and the Board will review the voting results, seek to determine the cause or causes of any significant negative voting, and take them into consideration when making future decisions regarding executive compensation.

The Compensation Committee and the Board have designed our executive compensation program to attract and retain talented executives, to motivate them to achieve our key financial, operational, and strategic goals, and to reward them for superior performance. They also designed our compensation program to align our executive officers’ interests with those of our stockholders by rewarding their achievement of the specific corporate and individual goals approved by our Compensation Committee. The performance goals set by the Compensation Committee are focused on achieving our commercialization objectives, increasing long-term stockholder value, and advancing our product development and technology platform. Stockholders are encouraged to read the “Executive Compensation” section of this Proxy Statement for a more detailed discussion of how our compensation program reflects the Company’s core objectives and aligns our executive officers’ interests with those of our stockholders.

Vote Required

The Board believes the Company’s executive compensation program uses appropriate structures and sound pay practices that are effective in achieving our core compensation objectives. Accordingly, the Board recommends that you vote in favor of the following resolution:

“RESOLVED, that the stockholders of Organovo Holdings, Inc. approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s 2023 Proxy Statement pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Executive Compensation section.”

If a quorum is present, the proposal to approve, on an advisory basis, the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be considered as votes cast for or against the proposal and will therefore have no effect on the outcome of the vote.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

11

PROPOSAL 4: APPROVAL OF THE ORGANOVO HOLDINGS, INC. 2023 EMPLOYEE STOCK PURCHASE PLAN

We are asking our stockholders to approve the Organovo Holdings, Inc. 2023 Employee Stock Purchase Plan (the “ESPP”) at the Annual Meeting.

Overview

The following is a summary description of the ESPP as adopted by our Board subject to the approval by our stockholders. The summary is not a complete statement of the ESPP and is qualified in its entirety by reference to the complete text of the ESPP, a copy of which is attached hereto as Annex A. Please refer to the ESPP for more complete and detailed information about the terms and conditions of the ESPP. In the event of a conflict between the information in this description and the terms of the ESPP, the ESPP shall control.

Background of the ESPP

On July 12, 2023, our Board adopted, subject to the approval by our stockholders, the ESPP. The ESPP will become effective on the date on which the ESPP is approved by our stockholders. If the ESPP is not approved by our stockholders, the ESPP will not become effective. We believe our ability to recruit and retain top talent will be adversely affected if the ESPP is not approved.

Summary of the ESPP

Purpose

The purpose of the ESPP is to secure the services of new employees, to retain the services of existing employees, and to provide incentives for such individuals to exert maximum efforts toward our success and that of our related corporations. The ESPP will include two components. One component is designed to allow eligible U.S. employees to purchase our common stock in a manner that may qualify for favorable tax treatment under Section 423 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), and accordingly, it will be construed in a manner that is consistent with the requirements of Section 423 of the Code (the “423 Component”). We intend (but make no undertaking or representation to maintain) the 423 Component to qualify as an employee stock purchase plan, as that term is defined in Section 423(b) of the Code. The other component will permit the grant of purchase rights that do not qualify for such favorable tax treatment (the “Non-423 Component”) in order to allow deviations necessary to permit participation by eligible employees who are foreign nationals or employed outside of the U.S. while complying with applicable foreign laws, and except as otherwise provided in the ESPP or determined by our Board, it will operate and be administered in the same manner as the 423 Component.

Share Reserve

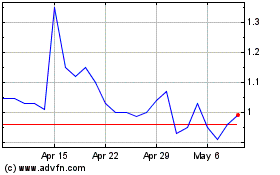

Initially, the maximum number of shares of our common stock that may be issued under the ESPP will not exceed 45,000 shares of our common stock. For the avoidance of doubt, up to the maximum number of shares of our common stock reserved may be used to satisfy purchases of our common stock under the 423 Component and any remaining portion of such maximum number of shares may be used to satisfy the purchases of our common stock under the Non-423 Component. The closing price of a share of our common stock on September 5, 2023 was $1.13 per share.

If any purchase right granted under the ESPP terminates without having been exercised in full, the shares of our common stock not purchased under such purchase right will again become available for issuance under the ESPP.

The common stock purchasable under the ESPP will be shares of authorized but unissued or reacquired common stock, including shares repurchased by us on the open market.

Administration

Our Board will administer the ESPP. Our Board may delegate some or all of the administration of the ESPP to a committee or committees of our Board. All references to our Board in this proposal shall include a duly authorized

12

committee of our Board except where the context dictates otherwise. Further, to the extent not prohibited by applicable law, our Board may, from time to time, delegate some or all of its authority under the ESPP to one or more of our officers or other persons or groups of persons as it deems necessary, appropriate or advisable under conditions or limitations that it may set at or after the time of the delegation. Our Board will have the authority to determine how and when purchase rights are granted and the provisions of each offering; to designate, from time to time, which of our related corporations will be eligible to participate in the 423 Component or the Non-423 Component, or which related corporations will be eligible to participate in each separate offering; to construe and interpret the ESPP and purchase rights thereunder, and to establish, amend and revoke rules and regulations for the ESPP’s administration; to settle all controversies regarding the ESPP and purchase rights granted thereunder; to amend, suspend or terminate the ESPP; to exercise such powers and to perform such acts as it deems necessary or expedient to promote the best interests of us and our related corporations and to carry out the intent of the ESPP to be treated as an employee stock purchase plan with respect to the 423 Component; and to adopt such rules, procedures and sub-plans as are necessary or appropriate to permit or facilitate participation in the ESPP by employees who are foreign nationals or employed or located outside the United States.

All determinations, interpretations and constructions made by our Board in good faith will not be subject to review by any person and will be final, binding and conclusive on all persons.

Offerings

Our Board may grant or provide for the grant of purchase rights to eligible employees under an offering (consisting of one or more purchase periods) on an offering date or offering dates selected by our Board. Each offering will be in the form and will contain those terms and conditions as our Board deems appropriate, and, with respect to the 423 Component, will comply with the requirements of Section 423(b)(5) of the Code. The provisions of separate offerings do not need to be identical, but each offering will include the period during which the offering will be effective, which period will not exceed 27 months beginning with the offering date, and the substance of the applicable provisions contained in the ESPP.

If a participant has more than one purchase right outstanding under the ESPP, unless he or she otherwise indicates in forms delivered to us or a third party designee of ours: (i) each form will apply to all of his or her purchase rights under the ESPP, and (ii) a purchase right with a lower exercise price (or an earlier-granted purchase right, if different purchase rights have identical exercise prices) will be exercised to the fullest possible extent before a purchase right with a higher exercise price (or a later-granted purchase right if different purchase rights have identical exercise prices) will be exercised.

Our Board will have the discretion to structure an offering so that if the fair market value of a share of our common stock on the first trading day of a new purchase period within that offering is less than or equal to the fair market value of a share of our common stock on the first day of that offering, then (i) that offering will terminate immediately as of that first trading day, and (ii) the participants in such terminated offering will be automatically enrolled in a new offering beginning on the first trading day of such new purchase period.

Eligibility

Generally, purchase rights may only be granted to employees, including executive officers, employed by us (or by any of our affiliates or related corporations as designated by our Board) on the first day of an offering if such employee has been employed by us or by one of our designated affiliates or related corporations for such continuous period preceding such date as our Board may require, but in no event will the required period of continuous employment be equal to or greater than two years. Our Board may (unless prohibited by applicable law) require that employees have to satisfy one or both of the following service requirements with respect to the 423 Component: (i) being customarily employed by us, or any of our related corporations or affiliates, for more than 20 hours per week and more than five months per calendar year; or (ii) such other criteria as our Board may determine consistent with Section 423 of the Code with respect to the 423 Component. Our Board may provide that each person who, during the course of an offering, first becomes an eligible employee will, on the date or dates specified in the offering which coincides with the day on which the person becomes an eligible employee or which occurs thereafter, receive a purchase right under that offering, and the purchase right will thereafter be deemed to be part of the offering with substantially identical characteristics. No employee will be eligible for the grant of any purchase rights under the

13

ESPP if immediately after such rights are granted, such employee owns stock possessing five percent or more of the total combined voting power or value of all classes of our outstanding capital stock (or the stock of any related corporation) determined in accordance with the rules of Section 424(d) of the Code. As specified by Section 423(b)(8) of the Code, an employee may be granted purchase rights only if such purchase rights, together with any other rights granted under all employee stock purchase plans of ours or any of our related corporations, do not permit such employee’s rights to purchase our stock or the stock of any of our related corporations to accrue at a rate which, when aggregated, exceeds $25,000 (based on the fair market value per share of such common stock on the date that the purchase right is granted) for each calendar year such purchase rights are outstanding at any time. Our Board may also exclude from participation in the ESPP or any offering employees of ours, or of any of our related corporation, who are highly compensated employees, as within the meaning of Section 423(b)(4)(D) of the Code, or a subset of such highly compensated employees. As of September 5, 2023, there were approximately 19 employees who would have been eligible to participate in the ESPP (non-employee directors and consultants are not eligible to participate in the ESPP).

Notwithstanding anything in the foregoing paragraph to the contrary, in the case of an offering under the Non-423 Component, an employee (or a group of employees) may be excluded from participation in the ESPP or an offering if our Board has determined, in its sole discretion, that participation of such employee is not advisable or practical for any reason.

Purchase Rights; Purchase Price

On the first day of each offering, each eligible employee, pursuant to an offering made under the ESPP, will be granted a purchase right to purchase up to that number of shares purchasable either with a percentage or with a maximum dollar amount, as designated by our Board, which will not exceed 15% of such employee’s earnings (as defined by our Board) during each period that begins on the first day of the offering (or such later date as our Board determines for a particular offering) and ends on the date stated in the offering, which date will be no later than the end of the offering. Our Board will establish one or more purchase dates during an offering on which purchase rights granted for that offering will be exercised and shares of common stock will be purchased in accordance with such offering. Each eligible employee may purchase of up to 500 shares of our common stock in an offering (or such lesser number of shares determined by our Board prior to the start of the offering). Our Board may also specify (i) a maximum number of shares that may be purchased by any participant on any purchase date during an offering, (ii) a maximum aggregate number of shares that may be purchased by all participants in an offering and/or (iii) a maximum aggregate number of shares that may be purchased by all participants on any purchase date under an offering. If the aggregate number of shares issuable upon exercise of purchase rights granted under the offering would exceed any such maximum aggregate number, then, in the absence of any action by our Board otherwise, a pro rata allocation of the shares (rounded down to the nearest whole share) available, based on each participant’s accumulated contributions, will be made in as nearly a uniform manner as will be practicable and equitable.

The purchase price of shares acquired pursuant to purchase rights will not be less than the lesser of (i) 85% of the fair market value of a share of our common stock on the first day of an offering; or (ii) 85% of the fair market value of a share of our common stock on the date of purchase.

Participation; Withdrawal; Termination

An eligible employee may elect to participate in an offering and authorize payroll deductions as the means of making contributions by completing and delivering to us or our designee, within the time specified in the offering, an enrollment form provided by us or our designee. The enrollment form will specify the amount of contributions the maximum amount specified by our Board, but in any event not to exceed 15% of the eligible employee’s base wages. Each participant’s contributions will be credited to a bookkeeping account for the participant under the ESPP and will be deposited with our general funds except where applicable law requires that contributions be deposited with a third party. If permitted in the offering, a participant may begin such contributions with the first payroll occurring on or after the first day of the applicable offering (or, in the case of a payroll date that occurs after the end of the prior offering but before the first day of the next new offering, contributions from such payroll will be included in the new offering). If permitted in the offering, a participant may thereafter reduce (including to zero) or increase his or her contributions. If required under applicable law or if specifically provided in the offering, in addition to or instead of making contributions by payroll deductions, a participant may make contributions through payment by cash, check or wire transfer prior to a purchase date.

14

During an offering, a participant may cease making contributions and withdraw from the offering by delivering to us or our designee a withdrawal form provided by us. We may impose a deadline before a purchase date for withdrawing. Upon such withdrawal, such participant’s purchase right in that offering will immediately terminate and we will distribute as soon as practicable to such participant all of his or her accumulated but unused contributions and such participant’s purchase right in that offering shall then terminate. A participant’s withdrawal from that offering will have no effect upon his or her eligibility to participate in any other offerings under the ESPP, but such participant will be required to deliver a new enrollment form to participate in subsequent offerings.

Unless otherwise required by applicable law, purchase rights granted pursuant to any offering under the ESPP will terminate immediately if the participant either (i) is no longer an employee for any reason or for no reason (subject to any post-employment participation period required by applicable law) or (ii) is otherwise no longer eligible to participate. We will distribute the individual’s accumulated but unused contributions as soon as practicable to such individual.

Unless otherwise determined by our Board, a participant whose employment transfers or whose employment terminates with an immediate rehire (with no break in service) by or between us and one of our designated companies designated to participate in an offering (or between such designated companies) will not be treated as having terminated employment for purposes of participating in the ESPP or an offering. However, if a participant transfers from an offering under the 423 Component to an offering under the Non-423 Component, the exercise of the participant’s purchase right will be qualified under the 423 Component only to the extent such exercise complies with Section 423 of the Code. If a participant transfers from an offering under the Non-423 Component to an Offering under the 423 Component, the exercise of the purchase right will remain non-qualified under the Non-423 Component. Our Board may establish different and additional rules governing transfers between separate offerings within the 423 Component and between offerings under the 423 Component and offerings under the Non-423 Component. Unless otherwise specified in the offering or as required by applicable law, we will have no obligation to pay interest on contributions.

Purchase of Shares

On each purchase date, each participant’s accumulated contributions will be applied to the purchase of shares, up to the maximum number of shares permitted by the ESPP and the applicable offering, at the purchase price specified in the offering. Unless otherwise provided in the offering, if any amount of accumulated contributions remains in a participant’s account after the purchase of shares on the final purchase date of an offering, then such remaining amount will not roll over to the next offering and will instead be distributed in full to such participant after the final purchase date of such offering without interest (unless otherwise required by applicable law). No purchase rights may be exercised to any extent unless the shares of our common stock to be issued upon such exercise under the ESPP are covered by an effective registration statement pursuant to the Securities Act of 1933, as amended (the “Securities Act”), and the ESPP is in material compliance with all applicable U.S. federal and state, foreign and other securities, exchange control and other laws applicable to the ESPP. If on a purchase date the shares of our common stock are not so registered or the ESPP is not in such compliance, no purchase rights will be exercised on such purchase date, and the purchase date will be delayed until the shares of our common stock are subject to such an effective registration statement and the ESPP is in material compliance, except that the purchase date will in no event be more than 27 months from the first day of an offering. If, on the purchase date, as delayed to the maximum extent permissible, the shares of our common stock are not registered and the ESPP is not in material compliance with all applicable laws, as determined by us in our sole discretion, no purchase rights will be exercised and all accumulated but unused contributions will be distributed to the ESPP participants without interest (unless the payment of interest is otherwise required by applicable law).

A participant will not be deemed to be the holder of, or to have any of the rights of a holder with respect to, shares of our common stock subject to purchase rights unless and until the participant’s shares of our common stock acquired upon exercise of purchase rights are recorded in our books (or the books of our transfer agent, Continental Stock Transfer and Trust Company).

Changes to Capital Structure

15

The ESPP provides that in the event of a change in our capital structure through actions such as a stock split, merger, consolidation, reorganization, recapitalization, reincorporation, stock dividend, dividend in property other than cash, large nonrecurring cash dividend, liquidating dividend, combination of shares, exchange of shares, change in corporate structure, or similar transaction, our Board will appropriately and proportionately adjust: (i) the class(es) and maximum number of shares subject to the ESPP; (ii) the class(es) and number of shares subject to, and purchase price applicable to, outstanding offerings and purchase rights; and (iii) the class(es) and number of shares that are subject to purchase limits under each ongoing offering. Our Board will make these adjustments, and its determination will be final, binding and conclusive.

Corporate Transactions

The ESPP provides that in the event of a corporate transaction (as defined below), any then-outstanding rights to purchase our common stock under the ESPP may be assumed, continued, or substituted for by any surviving or acquiring corporation (or its parent company). If the surviving or acquiring corporation (or its parent company) elects not to assume, continue, or substitute for such purchase rights, then (i) the participants’ accumulated payroll contributions will be used to purchase shares of our common stock (rounded down to the nearest whole share) within 10 business days (or such other period specified by our Board) before such corporate transaction under the outstanding purchase rights, and such purchase rights will terminate immediately after such purchase, or (ii) our Board, in its discretion, may terminate outstanding offerings, cancel the outstanding purchase rights and refund the participants’ accumulated contributions.

Under the ESPP, a “corporate transaction” is generally the consummation, in a single transaction or in a series of related transactions, of: (i) a sale or other disposition of all or substantially all, as determined by our Board, of the consolidated assets of us and our subsidiaries; (ii) a sale or other disposition of at least 50% of our outstanding securities; (iii) a merger, consolidation or similar transaction following which we are not the surviving corporation; or (iv) a merger, consolidation or similar transaction following which we are the surviving corporation but the shares of our common stock outstanding immediately prior to such transaction are converted or exchanged into other property by virtue of the transaction.

Transferability

During a participant’s lifetime, purchase rights will be exercisable only by a participant. Purchase rights are not transferable by a participant, except by will, by the laws of descent and distribution, or, if permitted by us, by a beneficiary designation.

Tax Withholding

Each participant must make arrangements, satisfactory to us and any applicable related corporation, to enable us or our related corporation to fulfill any withholding obligation for taxes arising out of or in relation to a participant’s participation in the ESPP. In our sole discretion and subject to applicable law, such withholding obligation may be satisfied in whole or in part by (i) withholding from the participant’s salary or any other cash payment due to the participant from us or any related corporation; (ii) withholding from the proceeds of the sale of shares of our common stock acquired under the ESPP, either through a voluntary sale or a mandatory sale arranged by us; or (iii) any other method deemed acceptable by our Board. We will not be required to issue any shares of our common stock under the ESPP until such obligations are satisfied.

Amendment, Suspension or Termination

Our Board will have the authority to amend, suspend or terminate the ESPP. Any benefits, privileges, entitlements and obligations under any outstanding purchase right granted before an amendment, suspension or termination of the ESPP will not be materially impaired by any such amendment, suspension or termination except (i) with the consent of the person to whom such purchase rights were granted, (ii) as necessary to facilitate compliance with any laws, listing requirements, or governmental regulations (including, without limitation, the provisions of Section 423 of the Code), or (iii) as necessary to obtain or maintain favorable tax, listing, or regulatory treatment. Except with respect to certain changes in our capital structure, stockholder approval is required for any amendment to the ESPP if such

16

approval is required by applicable law or listing requirements. No purchase rights may be granted under the ESPP while it is suspended or after it is terminated.

Certain U.S. Federal Income Tax Aspects of the ESPP

The following is a general summary under current law of the material federal income tax consequences to participants in the ESPP under U.S. law. This summary deals with the general tax principles that apply and is provided only for general information. Certain types of taxes, such as state and local income taxes, are not discussed. Tax laws are complex and subject to change and may vary depending on individual circumstances and from locality to locality. The summary does not discuss all aspects of income taxation that may be relevant to a participant in light of his or her personal investment circumstances. This summarized tax information is not tax advice.

The ESPP is intended to be an employee stock purchase plan within the meaning of Section 423 of the Code. The ESPP also authorizes the grant of rights to purchase shares that do not qualify under Section 423 pursuant to the non-423 component.

423 Component Offerings

Under an employee stock purchase plan that qualifies under Section 423 of the Code, no taxable income will be recognized by a participant, and no deductions will be allowable to us, upon either the grant or the exercise of the purchase rights. Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the ESPP or in the event that the participant should die while still owning the purchased shares.

If the participant sells or otherwise disposes of the purchased shares (a) within two years after the start date of the offering in which the shares were acquired or (b) within one year after the purchase of the shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeded the purchase price paid for those shares, and we will be entitled to an income tax deduction (subject to applicable limits under the Code), for the taxable year in which such disposition occurs equal in amount to such excess. The amount of this ordinary income will be added to the participant’s basis in the shares, and any resulting gain or loss recognized upon the sale or disposition will be a capital gain or loss. If the shares have been held for more than one year since the date of purchase, the gain or loss will be long-term.

If the participant sells or disposes of the purchased shares more than two years after the start date of the offering in which the shares were acquired and more than one year after the purchase of the shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the lesser of (a) the amount by which the fair market value of the shares on the sale or disposition date exceeded the purchase price paid for the shares, or (b) 15% of the fair market value of the shares on the start date of that offering. Any additional gain upon the disposition will be taxed as a long-term capital gain. Alternatively, if the fair market value of the shares on the date of the sale or disposition is less than the purchase price, there will be no ordinary income and any loss recognized will be a long-term capital loss. We will not be entitled to an income tax deduction with respect to such disposition.

Non-423 Component Offerings