false

0001621672

0001621672

2023-09-11

2023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 11, 2023

Super League Enterprise, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38819

|

47-1990734

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

2912 Colorado Avenue, Suite 203

Santa Monica, California 90404

|

|

(Address of principal executive offices)

|

(213) 421-1920

(Registrant’s telephone number, including area code)

Super League Gaming, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SLGG

|

Nasdaq Capital Market

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

See Item 8.01.

Item 8.01 Other Events.

As previously disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on August 24, 2023, Super League Enterprise, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”) on August 21, 2023, relating to the Company’s public offering (the “Offering”) of 15,573,077 shares (the “Shares”) of its Common Stock, par value $0.001 per share (“Common Stock”), and pre-funded warrants to purchase 1,350,000 shares of Common Stock in lieu of Common Stock (the “Pre-Funded Warrants”, and collectively with the Shares, the “Firm Securities”) to certain investors. Pursuant to the Underwriting Agreement, the Company also granted the Underwriters a 45-day option (the “Over-Allotment Option”) to purchase an additional 2,538,461 shares of Common Stock and/or Pre-Funded Warrants (the “Over-Allotment Securities”), or approximately 126,924 shares of Common Stock and/or Pre-Funded Warrants after giving effect to the Company’s reverse stock split that was effective September 11, 2023.

On September 12, 2023, the Underwriter partially exercised its Over-Allotment Option and purchased an additional 32,616 shares of Common Stock at a price of $2.60 per share. The issuance by the Company of the Over-Allotment Securities resulted in total gross proceeds of approximately $84,800, before deducting underwriting discounts, commissions, and other offering expenses payable by the Company.

A copy of the Press Release announcing the exercise of the Option is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Super League Gaming, Inc.

|

| |

|

|

|

Date: September 13, 2023

|

By:

|

/s/ Clayton Haynes

|

| |

|

Clayton Haynes

Chief Financial Officer

|

Exhibit 99.1

Super League Enterprise (formerly known as Super League Gaming) Announces the Partial Exercise of Underwriter’s Over-Allotment Option

SANTA MONICA, Calif., Sept. 11, 2023 -- Super League Enterprises, Inc. (NASDAQ: SLE) ("Super League" or the "Company"), today announced that the underwriter of its previously announced underwritten public offering (the “Offering”), Aegis Capital Corp., has partially exercised its option (“Over-Allotment Option”) to purchase an additional 32,616 shares of common stock at a price of $2.60 per share. Total gross proceeds to the Company from the underwriter’s partial exercise of the Over-Allotment Option, are $84,801.60, before deducting underwriting discounts, commissions, and other offering expenses payable by the Company. The exercise of the Over-Allotment Option is expected to close on September 12, 2023, subject to customary closing conditions.

Aegis Capital Corp. acted as the sole book-running manager for the Offering.

The Offering was made pursuant to an effective shelf registration statement on Form S-3 (No. 333-259347), declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on November 16, 2021. A final prospectus supplement and accompanying shelf prospectus describing the terms of the Offering have been filed with the SEC and are available on the SEC's website located at http://www.sec.gov. Electronic copies of the final prospectus supplement and the accompanying shelf prospectus may be obtained by contacting Aegis Capital Corp., Attention: Syndicate Department, 1345 Avenue of the Americas, 27th floor, New York, NY 10105, by email at syndicate@aegiscap.com, or by telephone at (212) 813-1010. Before investing in the Offering, interested parties should read in their entirety the prospectus supplement and the accompanying prospectus and the other documents that the Company has filed with the SEC and that are incorporated by reference in such prospectus supplement and the accompanying prospectus, which provide more information about the Company and such offering.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities described hereunder in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Super League

Super League Enterprise, Inc. (Nasdaq: SLE), formerly Super League Gaming, Inc. is a leading strategically-integrated publisher and creator of games and experiences across the world’s largest immersive digital platforms. From metaverse gaming powerhouses such as Roblox, Minecraft and Fortnite, to the most popular Web3 environments such as Sandbox and Decentraland, to bespoke worlds built using the most advanced 3D creation tools, Super League’s innovative solutions provide incomparable access to massive audiences who gather in immersive digital spaces to socialize, play, explore, collaborate, shop, learn and create. As a true end-to-end activation partner for dozens of global brands, Super League offers a complete range of development, distribution, monetization and optimization capabilities designed to engage users through dynamic, energized programs. As an originator of new experiences fueled by a network of top developers, a comprehensive set of proprietary creator tools and a future-forward team of creative professionals, Super League accelerates IP and audience success within the fastest growing sector of the media industry. For more, go to superleague.com.

Forward-Looking Statements

This press release contains forward-looking statements which involve substantial risks and uncertainties. Forward-looking statements are often identifiable by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although the Company believes that it has a reasonable basis for making each forward-looking statement contained in this press release, the Company cautions that these statements are based on a combination of facts and factors currently known by the Company and its expectations of the future, about which the Company cannot be certain. Forward-looking statements are subject to considerable risks and uncertainties, as well as other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

These risks and uncertainties include, without limitation, risks and uncertainties related to the satisfaction of customary closing conditions related to the public offering; the Company’s ability to maintain adequate liquidity and financing sources; various risks related to the Company’s business operations; and the impact of general economic, industry or political conditions in the United States or internationally. There can be no assurance that the Company will be able to complete the proposed offering of additional shares on the anticipated terms, or at all. You should not place undue reliance on these forward-looking statements. Additional risks and uncertainties relating to the Offering, the Company, and its business can be found under the caption entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, subsequent Quarterly Reports on Form 10-Q, the Company’s final prospectus supplement and accompanying shelf prospectus, and any other filings that the Company may make with the SEC in the future. Any forward-looking statements contained in this press release speak only as of the date hereof, and the Company expressly disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

Shannon Devine/ Mark Schwalenberg

MZ North America

SLGG@mzgroup.us

CONTACT

For Super League

Gillian Sheldon

gillian.sheldon@superleague.com

Source: Super League Enterprise

v3.23.2

Document And Entity Information

|

Sep. 11, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Super League Enterprise, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 11, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38819

|

| Entity, Tax Identification Number |

47-1990734

|

| Entity, Address, Address Line One |

2912 Colorado Avenue, Suite 203

|

| Entity, Address, City or Town |

Santa Monica

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

90404

|

| City Area Code |

213

|

| Local Phone Number |

421-1920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SLGG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001621672

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Super League Gaming (NASDAQ:SLGG)

Historical Stock Chart

From Apr 2024 to May 2024

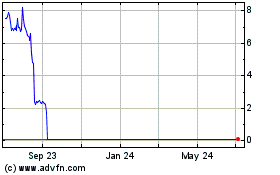

Super League Gaming (NASDAQ:SLGG)

Historical Stock Chart

From May 2023 to May 2024