EuroDry Ltd. Announces Agreement to Acquire Three Eco Ultramax Bulkers

September 12 2023 - 8:00AM

EuroDry Ltd. (NASDAQ: EDRY, the “Company” or “EuroDry”), an owner

and operator of drybulk vessels and provider of seaborne

transportation for drybulk cargoes, announced today that it has

agreed to acquire three Ultramax bulkers, M/V Giants Causeway, a

63,197 dwt drybulk vessel built in 2015, M/V Sadlers Wells, a

63,153 dwt drybulk vessel built in 2015 and M/V Gallileo, a 63,177

dwt drybulk vessel built in 2014, for a total price of about $65

million. The vessels are expected to be delivered to the Company

during October and November 2023. The acquisitions will be financed

by the Company’s own funds and bank debt.

Aristides Pittas, Chairman and CEO of

EuroDry, commented: “We are pleased to

announce the acquisition of three Eco Ultramax drybulk vessels, all

built during 2014 and 2015. The vessels are sisterships of our own

M/V Alexandros P which was built at the same shipyard in 2017. This

acquisition further expands our modern fleet cluster at a time when

we believe that the market fundamentals, especially the low

orderbook, are very supportive of a healthy market over the next

two to three years. While demand side -geopolitical and economic-

uncertainties remain, we believe that the risks are tilted to the

upside and the present level of the market presents a great

opportunity to expand our fleet with high quality units of known

design. We expect these vessels to make significant contributions

to our EBITDA.”

Fleet Profile:

Assuming the delivery of the three Eco Ultramax drybulk vessels

described above, the EuroDry Ltd. fleet profile would be as

follows:

|

Name |

Type |

Dwt |

YearBuilt |

Employment(*) |

TCE Rate ($/day) |

|

Dry Bulk Vessels |

|

|

|

|

|

|

EKATERINI |

Kamsarmax |

82,000 |

2018 |

TC until Mar-25 |

Hire 105.5% of theAverage BalticKamsarmaxP5TC(**) index |

|

XENIA |

Kamsarmax |

82,000 |

2016 |

TC until Mar-24 |

Hire 105.5% of theAverage BalticKamsarmax P5TC(**) index |

|

ALEXANDROS P. |

Ultramax |

63,500 |

2017 |

TC until Oct-23 |

$19,500 |

|

CHRISTOS K (ex - GIANTS CAUSEWAY) |

Ultramax |

63,197 |

2015 |

To be arranged |

|

|

YANNIS PITTAS (ex - GALLILEO) |

Ultramax |

63,177 |

2014 |

TC until Dec-23 |

$12,500 |

|

MARIA (ex - SADLERS WELLS) |

Ultramax |

63,153 |

2015 |

To be arranged |

|

|

GOOD HEART |

Ultramax |

62,996 |

2014 |

TC until Nov-23 |

$11,900 |

|

MOLYVOS LUCK |

Supramax |

57,924 |

2014 |

TC until Oct-23 |

$8,000 |

|

EIRINI P |

Panamax |

76,466 |

2004 |

TC until Oct-23 |

$15,750 |

|

SANTA CRUZ |

Panamax |

76,440 |

2005 |

In ballast |

|

|

STARLIGHT |

Panamax |

75,845 |

2004 |

TC until Sep-23 |

$9,000 |

|

TASOS |

Panamax |

75,100 |

2000 |

TC until Dec-23 |

$8,000 |

|

BLESSED LUCK |

Panamax |

76,704 |

2004 |

TC until Jan-24 |

$15,800 |

|

Total Dry Bulk Vessels |

13 |

918,502 |

|

|

|

| |

|

|

|

|

|

Note:(*) Represents the earliest redelivery date(**) The average

Baltic Kamsarmax P5TC Index is an index based on five Panamax time

charter routes.

About EuroDry Ltd.EuroDry Ltd.

was formed on January 8, 2018 under the laws of the Republic of the

Marshall Islands to consolidate the drybulk fleet of Euroseas Ltd.

into a separate listed public company. EuroDry was spun-off from

Euroseas Ltd on May 30, 2018; it trades on the NASDAQ Capital

Market under the ticker EDRY.

EuroDry operates in the dry cargo, drybulk

shipping market. EuroDry’s operations are managed by Eurobulk Ltd.,

an ISO 9001:2008 and ISO 14001:2004 certified affiliated ship

management company and Eurobulk (Far East) Ltd. Inc., which are

responsible for the day-to-day commercial and technical management

and operations of the vessels. EuroDry employs its vessels on spot

and period charters and under pool agreements.

After the delivery of the three vessels, the

Company would have a fleet of 13 vessels, including 2 Kamsarmax

drybulk, 5 Panamax drybulk carriers, 5 Ultramax drybulk carriers,

and 1 Supramax drybulk carrier. EuroDry’s 13 drybulk carriers have

a total cargo capacity of 918,502 dwt.

Forward Looking StatementThis

press release contains forward-looking statements (as defined in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended) concerning

future events and the Company's growth strategy and measures to

implement such strategy; including expected vessel acquisitions and

entering into further time charters. Words such as "expects,"

"intends," "plans," "believes," "anticipates," "hopes,"

"estimates," and variations of such words and similar expressions

are intended to identify forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to changes in the demand

for dry bulk vessels, competitive factors in the market in which

the Company operates; risks associated with operations outside the

United States; and other factors listed from time to time in the

Company's filings with the Securities and Exchange Commission. The

Company expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is

based.

Visit our website www.eurodry.gr

|

Company Contact |

Investor Relations / Financial Media |

| Tasos

AslidisChief Financial OfficerEuroDry Ltd.11 Canterbury

Lane,Watchung, NJ07069Tel. (908) 301-9091E-mail:

aha@eurodry.gr |

Nicolas

BornozisMarkella KaraCapital Link, Inc.230 Park Avenue, Suite

1540New York, NY10169Tel. (212) 661-7566E-mail:

eurodry@capitallink.com |

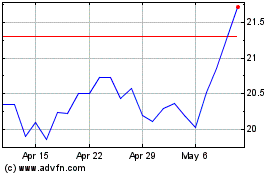

EuroDry (NASDAQ:EDRY)

Historical Stock Chart

From Apr 2024 to May 2024

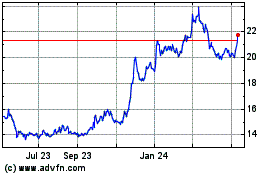

EuroDry (NASDAQ:EDRY)

Historical Stock Chart

From May 2023 to May 2024