New Alibaba Group CEO Lays Out Strategic Priorities For Staff

September 12 2023 - 7:11AM

IH Market News

Alibaba’s New CEO, Eddie Wu, Reveals Key Strategic Focus on

“User First” and AI-Driven Initiatives

Eddie Wu, the newly appointed CEO of Alibaba Group (NYSE:BABA),

has outlined the tech giant’s primary strategic priorities in an

internal letter reviewed by Reuters. Wu, who sent the communication

on his third day as CEO, emphasized two core focuses: “user first”

and an “AI-driven” approach.

In his letter, Wu also stressed Alibaba’s commitment to

nurturing young talent, particularly those born after 1985, to

shape the core of its future business management teams within the

next four years. This initiative aims to instill and maintain a

“start-up mindset” within the company, preventing it from becoming

entrenched in outdated practices.

As one of Alibaba Group’s founders and a long-time collaborator

of former chief Jack Ma, Wu’s strategic direction comes at a

pivotal moment for Alibaba. The company is undergoing its most

significant organizational restructuring in its 24-year

history.

In a surprising move, Alibaba announced that Wu would

concurrently serve as CEO of its cloud computing unit, a role

previously held by Daniel Zhang. Zhang had previously expressed his

intention to step away as CEO of Alibaba Group to focus on the

cloud division, which is targeting an IPO by May 2024. The Cloud

Intelligence Group, valued at $41 billion to $60 billion this year,

is one of five units that Alibaba is spinning off as part of its

restructuring. It is also home to the group’s generative artificial

intelligence model, Tongyi Qianwen.

Eddie Wu underlined the transformative potential of AI in the

coming decade, stating that “the most significant change agent will

be the disruptions brought about by AI across all sectors.” He

cautioned that failure to keep pace with the changes of the AI era

could lead to displacement.

While Alibaba exceeded analyst expectations in its first-quarter

earnings report last month, it faces challenges stemming from a

two-year regulatory crackdown, intensifying competition, and a

slowing Chinese economy. Economic pressures have driven domestic

e-commerce consumers toward budget-friendly platforms like PDD

Holdings’ Pinduoduo (NASDAQ:PDD) and ByteDance’s Douyin (the

Chinese version of TikTok). In response, Alibaba’s domestic

e-commerce division is shifting its focus toward value-for-money

segments.

Despite reporting revenue growth of only 4% for the quarter, the

cloud unit is estimated by analysts to be China’s largest cloud

provider, boasting a 34% market share ahead of competitors like

Huawei Technologies, Tencent Holdings (USOTC:TCEHY), and Baidu

(NASDAQ:BIDU).

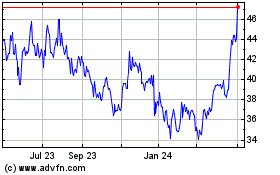

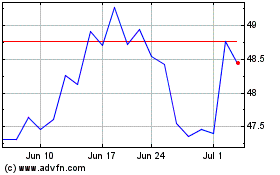

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024