0001715611false00017156112023-09-052023-09-05iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 5, 2023

Date of Report (Date of earliest event reported)

BODY AND MIND INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-55940 | | 98-1319227 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

750 – 1095 West Pender Street Vancouver, British Columbia, Canada | | V6E 2M6 |

(Address of principal executive offices) | | (Zip Code) |

(800) 361-6312

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

On September 5, 2023, Body and Mind Inc.’s (the “Company”) wholly-owned subsidiary, DEP Nevada, Inc. (“DEP”), which currently holds one hundred percent (100%) of the issued and outstanding membership interests (the “Interests”) in NMG OH P1, LLC, an Ohio limited liability company (“NMG OH P1”), entered into a membership interest purchase agreement (the “Purchase Agreement”) with LMTB LLC, an Ohio limited liability company (the “Purchaser”), pursuant to which DEP will sell the Interests to the Purchaser for the purchase price (the “Purchase Price”) of Two Million and 00/100 U.S. Dollars (US$2,000,000.00), subject to adjustment in the event that NMG OH P1’s Working Capital (as defined in the Purchase Agreement) on the Closing Date (as hereinafter defined) varies from the Target Working Capital (as defined in the Purchase Agreement and thereby fixed at zero (0) dollars). An amount equal to the Deposit (as defined in the Purchase Agreement), being One Million and 00/100 U.S. Dollars (US$1,000,000), shall be held in escrow by Murphy Schiller & Wilkes LLP as escrow agent (the “Escrow Agent”) pursuant to the terms and conditions of an escrow agreement entered into among DEP, NMG OH P1 and the Purchaser contemporaneously with the Purchase Agreement.

Closing of the Purchase Agreement (“Closing”) is subject to certain Closing Conditions (as defined in the Purchase Agreement), including but not limited to: (i) the approval of the State of Ohio Department of Commerce (the “Regulator”) to change the ownership of the License (as defined in the Purchase Agreement) from DEP to the Purchaser pursuant to Ohio Admin. Code 3796:3-1-08; (ii) receipt of any other third-party consents required to effect such change of ownership of the License; (iii) renewal of the Lease (as defined in the Purchase Agreement) on terms acceptable to the Purchaser; and (iv) receipt from the landlord under the Lease and/or any lender to the landlord of all approvals required to permit the Purchaser to operate under the Lease. The Closing shall occur on the later of: (i) the first (1st) calendar day of the month following the satisfaction or waiver, if applicable, of all Closing Conditions, including the receipt of all approvals for the transfer of the License by the Regulator, or such earlier time as the parties agree; or (ii) seven (7) days following the satisfaction or waiver, if applicable, of all Closing Conditions (the “Closing Date”).

The Purchaser, DEP and NMG OH P1 entered into a side letter agreement contemporaneously with the Purchase Agreement (the “Side Agreement”) to set forth the terms of their mutual understanding relating to operations and certain business decisions of NMG OH P1 during the period starting at the signing of the Purchase Agreement and up to and including the Closing Date of the Purchase Agreement (the “Pre-Takeover Period”). Pursuant to the Side Agreement, the Purchaser will provide to NMG OH P1 certain administrative, finance and accounting, operational and compliance support during the Pre-Takeover Period.

The Company along with its subsidiaries, DEP and the other guarantors, Nevada Medical Group, LLC, NMG OH 1, LLC, NMG OH P1, NMG Long Beach, LLC, NMG MI C1, Inc., NMG MI P1, Inc., NMG MI 1, Inc., NMG CA C1, LLC, NMG CA P1, LLC, NMG CA 1, LLC and NMG Cathedral City, LLC (each, a “Guarantor” and collectively, the “Guarantors”) previously entered into a loan agreement (the “Loan Agreement”) with FG Agency Lending, LLC (the “Agent”) and Bomind Holdings LLC (together with its successors and assigns, the “Lender”), dated July 19, 2021, as amended on November 30, 2021, on June 14, 2022, on December 12, 2022 and on December 16, 2022.

The Company, DEP, NMG OH P1, the Agent and the Lender entered into a consent agreement (the “Consent Agreement”) on September 11, 2023. Pursuant to the Consent Agreement, the Agent and the Lender consented to the transaction contemplated in the Purchase Agreement, including the sales of the Interests, and has agreed to the provision or authorization of a UCC-3 Termination Statement and any applicable releases of all liens in favor of the Agent on the assets and equity of NMG OH P1 pursuant to the Loan Agreement, provided that certain conditions precedent and conditions subsequent are satisfied. The consent provided pursuant to the Consent Agreement is conditioned on the following conditions subsequent: (i) subject to the Exit Fee (as defined in the Loan Agreement) and applied Premium Rate (as defined in the Loan Agreement) of 105% upon any date the Purchase Price or any funds are owed or paid to DEP or any other Loan Party pursuant to the Purchase Agreement, the Loan Parties shall cause the Agent to directly receive a repayment in the amount of such proceeds paid directly by the Purchaser (inclusive of the Deposit) to be paid by the Purchaser or the Escrow Agent, as applicable, in each case applied as a mandatory repayment of the Principal Balance (as defined in the Loan Agreement), and (ii) the Closing Date shall occur on or before September 1, 2024; provided that this consent shall be rescindable by the Agent in entirety if any Default (as defined in the Loan Agreement) occurs or is continuing after December 31, 2023.

The foregoing descriptions of the Purchase Agreement, the Side Agreement and the Consent Agreement do not purport to be complete and are qualified in their entirety by the Purchase Agreement, the Side Agreement and the Consent Agreement, which are filed as Exhibits 10.1, 10.2 and 10.3 hereto, respectively, and are incorporated by reference herein.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit | | Description |

| | |

10.1 | | Membership Interest Purchase Agreement by and among DEP Nevada, Inc., NMG OH P1, LLC and LMTB LLC, dated September 5, 2023 |

| | |

10.2 | | Agreement by and between DEP Nevada, Inc., NMG OH P1, LLC and LMTB LLC, dated September 5, 2023 |

| | |

10.3 | | Consent Agreement by and among Body and Mind Inc., DEP Nevada, Inc., NMG OH P1, LLC, FG Agency Lending, LLC and Bomind Holdings LLC, dated September 11, 2023 |

| | |

104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BODY AND MIND INC. | |

| | |

DATE: September 11, 2023 | By: | /s/ Michael Mills | |

| | Michael Mills President, CEO and Director | |

nullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

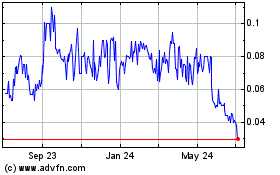

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

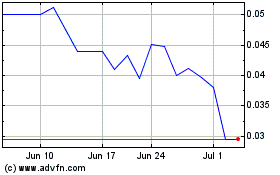

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024