0000910267

false

0000910267

2023-09-01

2023-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report: September 1, 2023

(Date

of earliest event reported)

TITAN PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-13341 |

|

94-3171940 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

400 Oyster Point Blvd., Suite 505, South San Francisco, CA 94080

(Address

of principal executive offices, including zip code)

650-244-4990

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

TTNP |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

Asset

Purchase Agreement

On

September 1, 2023 (the “Closing Date”), Titan Pharmaceuticals, Inc. (the “Titan” or the “Company”)

closed on the previously announced sale of certain ProNeura assets including Titan’s portfolio

of drug addiction products, in addition to other early development programs based on the ProNeura drug delivery technology (the “ProNeura

Assets”). As previously reported by the Company, on July 26, 2023, the Company entered into an asset purchase agreement

(the “Asset Purchase Agreement”) with Fedson, Inc., a Delaware corporation (“Fedson”) for

the sale of the ProNeura Assets. The Company’s addiction portfolio consists of the Probuphine and Nalmefene implant programs.

The ProNeura Assets constituted only a portion of Titan’s assets. On August 25, 2023, the Company entered into an Amendment

and Extension Agreement (the “Amendment”) to the Asset Purchase Agreement, pursuant to which Fedson

agreed to purchase the ProNeura Assets from the Company for a purchase price of $2 million, consisting of (i) $500,000 in readily available

funds, to be paid in full on the Closing Date (the “Closing Cash”), (ii) $500,000 in the form of a promissory note due and

payable on October 1, 2023 (the “Cash Note”) and (iii) $1,000,000 in the form of a promissory note due and payable on

January 1, 2024 (the “Escrow Note”). On the Closing Date, Fedson delivered to the Company a written guaranty by a principal

of Fedson of all of Fedson’s obligations under both the Cash Note and Escrow Note.

The

foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by the terms and

conditions of the Asset Purchase Agreement, which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on

July 28, 2023. The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Amendment, which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on August 30,

2023.

Item

2.01. Completion of Acquisition or Disposition of Assets

The

information set forth above under Item 1.01 of this Current Report on Form 8-K is hereby incorporated into this Item 2.01 by reference.

Item

9.01. Financial Statements and Exhibits.

(b)

Pro Forma Financial Information.

The

following unaudited pro forma condensed financial statements of the Company are attached hereto as Exhibit 99.1 and incorporated herein

by reference:

| ● | Unaudited

pro forma condensed balance sheet as of June 30, 2023; |

| | | |

| ● | Unaudited

pro forma condensed statements of operations for the six months ended June 30, 2023 and the

year ended December 31, 2022; and |

| | | |

| ● | Notes

to the unaudited pro forma condensed financial information. |

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

TITAN

PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/

Katherine Beebe DeVarney, Ph.D. |

| |

|

Katherine Beebe DeVarney, Ph.D.

President and Chief Operating Officer |

Exhibit 99.1

TITAN

PHARMACEUTICALS, INC.

UNAUDITED

PRO FORMA CONDENSED FINANCIAL INFORMATION

On

September 1, 2023, Titan Pharmaceuticals, Inc. (“Titan” or the “Company”) completed the sale of certain ProNeura

Assets, for approximately $2.0 million, comprised of approximately $0.5 million of cash proceeds, the Cash Note for $0.5 million and

the Escrow Note for $1.0 million.

The

sale constitutes a significant disposition for the purposes of Item 2.01 of Current Report on Form 8-K. The unaudited pro forma condensed

balance sheet as of June 30, 2023 gives effect to the transaction as if it had occurred on June 30, 2023. The transaction accounting

adjustments for the disposition consist of those necessary to account for the disposition. In addition, we have included unaudited

pro forma condensed statements of operations for the six months ended June 30, 2023 and the year ended December 31, 2022.

The

unaudited pro forma condensed balance sheet has been derived from the historical consolidated balance sheet prepared in accordance with

U.S. generally accepted accounting principles (“US GAAP”) and is presented based on information currently available. The

unaudited pro forma condensed balance sheet is intended for informational purposes only and is not intended to represent the Company’s

financial position had the disposition and related events occurred on the date indicated. Our actual financial condition may differ significantly

from the pro forma amounts reflected herein due to a variety of factors.

TITAN

PHARMACEUTICALS, INC.

PRO

FORMA CONDENSED BALANCE SHEETS

(unaudited)

(in

thousands, except share and per share data)

| | |

June 30,

2023 | | |

Transfer

Accounting | | |

June 30,

2023 | |

| | |

| Historical | | |

| Adjustments | | |

| Pro forma | |

| Assets | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 105 | | |

$ | 500 | | |

$ | 605 | |

| Restricted cash | |

| 17 | | |

| - | | |

| 17 | |

| Receivables | |

| 9 | | |

| - | | |

| 9 | |

| Inventory | |

| - | | |

| - | | |

| - | |

| Prepaid expenses and other current assets | |

| 229 | | |

| - | | |

| 229 | |

| Discontinued operations - current assets | |

| 32 | | |

| - | | |

| 32 | |

| Notes receivable, current | |

| - | | |

| 1,500 | | |

| 1,500 | |

| Current assets held for sale | |

| 106 | | |

| (106 | ) | |

| - | |

| Total current assets | |

| 498 | | |

| 1,894 | | |

| 2,392 | |

| Property and equipment, net | |

| 9 | | |

| - | | |

| 9 | |

| Other assets | |

| 48 | | |

| - | | |

| 48 | |

| Operating lease right-of-use assets, net | |

| 124 | | |

| - | | |

| 124 | |

| Noncurrent assets held for sale | |

| 133 | | |

| (133 | ) | |

| - | |

| Total assets | |

$ | 812 | | |

$ | 1,761 | | |

$ | 2,573 | |

| | |

| | | |

| | | |

| | |

| Liabilities and Stockholders’ Equity (Deficit) | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 597 | | |

$ | - | | |

$ | 597 | |

| Accrued clinical trials expenses | |

| 3 | | |

| - | | |

| 3 | |

| Other accrued liabilities | |

| 676 | | |

| 74 | | |

| 750 | |

| Operating lease liability, current | |

| 128 | | |

| - | | |

| 128 | |

| Deferred grant revenue | |

| 16 | | |

| - | | |

| 16 | |

| Discontinued operations – current liabilities | |

| 190 | | |

| - | | |

| 190 | |

| Current liabilities held for sale | |

| 236 | | |

| (236 | ) | |

| - | |

| Total current liabilities | |

| 1,846 | | |

| (162 | ) | |

| 1,684 | |

| Operating lease liability, noncurrent | |

| - | | |

| - | | |

| - | |

| Total liabilities | |

| 1,846 | | |

| (162 | ) | |

| 1,684 | |

| Commitments and contingencies (Note 6) | |

| | | |

| | | |

| | |

| Stockholders’ equity (deficit): | |

| | | |

| | | |

| | |

| Common stock, at amounts paid-in, $0.001 par value per share; 225,000,000 shares authorized, 15,016,295 shares issued and outstanding at June 30, 2023 and December 31, 2022. | |

| 15 | | |

| - | | |

| 15 | |

| Additional paid-in capital | |

| 388,473 | | |

| - | | |

| 388,473 | |

| Accumulated deficit | |

| (389,522 | ) | |

| 1,923 | | |

| (387,599 | ) |

| Total stockholders’ equity (deficit) | |

| (1,034 | ) | |

| 1,923 | | |

| 889 | |

| Total liabilities and stockholders’ equity (deficit) | |

$ | 812 | | |

$ | 1,761 | | |

$ | 2,573 | |

TITAN

PHARMACEUTICALS, INC.

PRO

FORMA CONDENSED STATEMENTS OF OPERATIONS

(in

thousands, except per share amount)

(unaudited)

| | |

Six Months Ended | | |

| | |

Six Months Ended | |

| | |

June 30,

2023 | | |

Transaction

Accounting | | |

June 30,

2023 | |

| | |

Historical | | |

Adjustments | | |

Pro forma | |

| Revenues: | |

| | | |

| | | |

| | |

| License revenue | |

$ | 1 | | |

$ | - | | |

$ | 1 | |

| Grant revenue | |

| 180 | | |

| - | | |

| 180 | |

| Total revenues | |

| 181 | | |

| - | | |

| 181 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development | |

| 1,003 | | |

| - | | |

| 1,003 | |

| General and administrative | |

| 2,463 | | |

| - | | |

| 2,463 | |

| Total operating expenses | |

| 3,466 | | |

| - | | |

| 3,466 | |

| Loss from operations | |

| (3,285 | ) | |

| - | | |

| (3,285 | ) |

| Other income (expense): | |

| | | |

| | | |

| | |

| Interest income | |

| 29 | | |

| - | | |

| 29 | |

| Other expense, net | |

| (5 | ) | |

| - | | |

| (5 | ) |

| Gain on sale of assets | |

| - | | |

| 1,923 | | |

| 1,923 | |

| Other income (expense), net | |

| 24 | | |

| 1,923 | | |

| 1,947 | |

| Net loss | |

$ | (3,261 | ) | |

$ | 1,923 | | |

$ | (1,338 | ) |

| Basic and diluted net loss per common share | |

$ | (0.22 | ) | |

$ | 0.13 | | |

$ | (0.09 | ) |

| Weighted average shares used in computing basic and diluted net loss per common share | |

| 15,016 | | |

| 15,016 | | |

| 15,016 | |

TITAN

PHARMACEUTICALS, INC.

PRO

FORMA CONDENSED STATEMENTS OF OPERATIONS

(in

thousands, except per share amount)

(unaudited)

| | |

Year Ended | | |

| | |

Year Ended | |

| | |

December 31,

2022 | | |

Transaction

Accounting | | |

December 31,

2022 | |

| | |

Historical | | |

Adjustments | | |

Pro forma | |

| Revenues: | |

| | | |

| | | |

| | |

| License revenue | |

$ | 60 | | |

$ | - | | |

$ | 60 | |

| Grant revenue | |

| 497 | | |

| - | | |

| 497 | |

| Total revenues | |

| 557 | | |

| - | | |

| 557 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development | |

| 4,758 | | |

| - | | |

| 4,758 | |

| General and administrative | |

| 6,034 | | |

| - | | |

| 6,034 | |

| Total operating expenses | |

| 10,792 | | |

| - | | |

| 10,792 | |

| Loss from operations | |

| (10,235 | ) | |

| - | | |

| (10,235 | ) |

| Other income (expense): | |

| | | |

| | | |

| | |

| Interest income | |

| 53 | | |

| - | | |

| 53 | |

| Other expense, net | |

| (24 | ) | |

| - | | |

| (24 | ) |

| Gain on sale of assets | |

| - | | |

| 1,865 | | |

| 1,865 | |

| Other income (expense), net | |

| 29 | | |

| 1,865 | | |

| 1,894 | |

| Net loss | |

$ | (10,206 | ) | |

$ | 1,865 | | |

$ | (8,341 | ) |

| Basic and diluted net loss per common share | |

$ | (0.76 | ) | |

$ | 0.14 | | |

$ | (0.62 | ) |

| Weighted average shares used in computing basic and diluted net loss per common share | |

| 13,434 | | |

| 13,434 | | |

| 13,434 | |

TITAN

PHARMACEUTICALS, INC.

NOTES

TO PRO FORMA CONDENSED FINANCIAL STATEMENTS

(unaudited)

Note

1. Basis of Presentation

The

Company's historical consolidated balance sheet has been adjusted in the preparation of the unaudited pro forma condensed balance sheet

to reflect only the transaction accounting adjustments related to the sale of the ProNeura Assets. The pro forma balance sheet as of June

30, 2023 gives effect to the disposition as if it were completed on June 30, 2023.

Note

2. Pro forma Adjustments

The

following adjustments have been reflected in the unaudited pro forma condensed combined financial statements:

(a)

Pro forma adjustment represents a total purchase price of approximately $2.0 million comprised of approximately $0.5 million estimated

cash proceeds from the sale at the closing of the transaction, the $0.5 million Cash Note due on October 1, 2023 and the $1.0 million

Escrow Note due on January 1, 2024.

(b)

Pro forma adjustment reflects closing transaction costs of approximately $74,000.

(c)

Pro forma adjustments reflect the elimination of assets and liabilities attributable to the ProNeura Assets included in the sale as if

it had occurred on June 30, 2023.

(d)

Pro forma adjustment reflects an additional portion related to the estimated pre-tax gain on the sale of approximately $1.9 million,

which was calculated as follows:

| | |

(in thousands) | |

| Estimated consideration of the disposition, net of transaction costs (1) | |

$ | 1,926 | |

| Assets of the businesses | |

| (239 | ) |

| Liabilities of the businesses | |

| 236 | |

| Pre-tax gain on the disposition | |

$ | 1,923 | |

(1) Reflects the estimated net cash consideration

received, inclusive of items identified in (a) and other customary adjustments identified in (b), as if the transaction had closed on June

30, 2023.

v3.23.2

Cover

|

Sep. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 01, 2023

|

| Entity File Number |

001-13341

|

| Entity Registrant Name |

TITAN PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0000910267

|

| Entity Tax Identification Number |

94-3171940

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Oyster Point Blvd.

|

| Entity Address, Address Line Two |

Suite 505

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

244-4990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

TTNP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

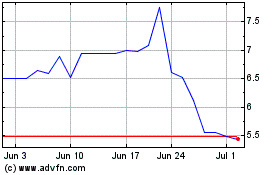

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Apr 2023 to Apr 2024