UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 5)1

Gyrodyne, LLC

(Name of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

403829104

(CUSIP Number)

JEFFREY E. EBERWEIN

STAR EQUITY FUND, LP

53 Forest Avenue, Suite 101

Old Greenwich, Connecticut 06870

(203) 489-9504

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 5, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note. Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

1 The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY FUND, LP |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

PN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY FUND GP, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR INVESTMENT MANAGEMENT, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

CONNECTICUT |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY HOLDINGS, INC. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF, OO |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

CO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

JEFFREY E. EBERWEIN |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF, PF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR VALUE, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

99,464 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

99,464 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,464 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.71% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

HANNAH M. BIBLE |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

MATTHEW R. SULLIVAN |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

The following constitutes Amendment No. 5 ("Amendment No. 5) to the Schedule 13D filed by the undersigned on August 1, 2022 (as previously amended, the “Schedule 13D”). This Amendment No. 5 amends the Schedule 13D as specifically set forth herein.

Item 3. Source and Amount of Funds or Other Consideration.

The Shares purchased by Star Equity Fund were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open market purchases, except as otherwise noted, as set forth in Schedule A, which is incorporated by reference herein. The aggregate purchase price of the 99,464 Shares beneficially owned by Star Equity Fund is approximately $1,181,180, excluding brokerage commissions, of which 200 shares are held directly by Star Equity Fund.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to add the following:

On September 5, 2023, Star Equity Fund entered into a letter agreement (the “Settlement Agreement”) with the Issuer, pursuant to which the Issuer, in order to better align the Issuer’s board of directors (“Board”) with shareholder interests, has agreed to submit for shareholder approval at the Issuer’s 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”), a new stock incentive plan which replaces the cash retention bonus plan in place for directors (“New Plan”). Additionally, the Company agreed not to increase director fees.

Star Equity Fund agreed to vote with the recommendation of the Board at the 2023 Annual Meeting and thereafter at any special meeting of shareholders occurring before the date that is thirty days prior to the opening of the window for submission of shareholder nominations for the Company’s 2024 annual meeting of shareholders (the “Termination Date”), except that Star Equity may vote (i) in its discretion on any proposal regarding certain extraordinary transactions, and (ii) in accordance with the recommendation of Institutional Shareholder Services Inc. (“ISS”) to the extent the recommendation of ISS differs from the Board’s recommendation on any matter presented to shareholders In connection with entering into the Settlement Agreement, Star Equity Fund has withdrawn its nomination of two candidates to the Board, and its proposal regarding director and management compensation matters.

If shareholders approve the New Plan, current director participants in the bonus plan will exchange their benefits under the New Plan, which they agreed to reduce by $579,328, for an equivalent value of shares (“Restricted Shares”), under the New Plan, with the Restricted Shares vesting over a three-year period. The Restricted Shares will not be transferable unless and until a liquidating distribution is made to all shareholders.

In addition, Star Equity Fund has agreed, until the Termination Date, to customary standstill provisions.

The foregoing summary of the Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement, which is attached as Exhibit 99.10 and incorporated herein by reference.

On September 5, 2023, Star Equity Fund withdrew its nomination of Mr. Sullivan and Ms. Bible for election to the Board at the Annual Meeting.

Item 5. Interest in Securities of the Issuer.

Items 5(a)-(c) are hereby amended and restated to read as follows:

The aggregate percentage of the Shares reported owned by each person named herein is based upon 1,482,680 Shares outstanding as of August 9, 2023, which is the total number of Shares reported outstanding in the Issuer’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on August 9, 2023.

A. Star Equity Holdings

(a) Star Equity Holdings, as the parent of Star Value, sole member of Star Management, and limited partner of Star Equity Fund may be deemed the beneficial owner of the 99,464 Shares beneficially owned by Star Equity Fund.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Star Equity Holdings has not entered into any transactions in the Shares in the last 60 days. The transactions in the Shares on behalf of Star Equity Fund in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

B. Star Equity Fund

(a) As of the close of business on September 7, 2023, Star Equity Fund beneficially owned 99,464 Shares.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Star Equity Fund's transactions in the Shares in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

C. Star Equity GP

(a) Star Equity GP, as the general partner of Star Equity Fund, may be deemed the beneficial owner of the 99,464 Shares owned by Star Equity Fund.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Star Equity GP has not entered into any transactions in the Shares in the last 60 days. The transactions in the Shares on behalf of Star Equity Fund in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

D. Star Investment Management

(a) Star Investment Management, as the investment manager of Star Equity Fund, may be deemed the beneficial owner of the 99,464 Shares owned by Star Equity Fund.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Star Investment Management has not entered into any transactions in the Shares in the last 60 days. The transactions in the Shares on behalf of Star Equity Fund in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

E. Mr. Eberwein

(a) Mr. Eberwein, as the manager of Star Equity GP and Star Equity Management, may be deemed the beneficial owner of the 99,464 Shares owned by Star Equity Fund.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Mr. Eberwein has not entered into any transactions in the Shares in the last 60 day. The transactions in the Shares on behalf of Star Equity Fund in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

F. Star Value

(a) Star Value, as the sole member of Star Equity GP and wholly owned subsidiary of Star Equity Holdings may be deemed the beneficial owner of the Shares of common stock owned by Star Equity Fund.

Percentage: Approximately 6.71%

(b) 1. Sole power to vote or direct vote: 99,464

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 99,464

4. Shared power to dispose or direct the disposition: 0

(c) Star Value has not entered into any transactions in the Shares in the last 60 days. The transactions in the Shares on behalf of Star Equity Fund in the last 60 days are set forth in Schedule A and are incorporated herein by reference.

G. Ms. Bible

(a) As of the close of business on September 7, 2023, Ms. Bible beneficially owned 0 Shares.

Percentage: 0%

(b) 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0

(c) Ms. Bible has not entered into any transactions in the Shares in the last 60 days.

H. Mr. Sullivan

(a) As of the close of business on September 7, 2023, Mr. Sullivan beneficially owned 0 Shares.

Percentage: 0%

(b) 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0

(c) Mr. Sullivan has not entered into any transactions in the Shares in the last 60 days.

Each Reporting Person, may be deemed to be a member of a “group” with the other Reporting Persons for the purposes of Section 13(d)(3) of the Exchange Act, and such group may be deemed to beneficially own the Shares beneficially owned in aggregate by all of the Reporting Persons.

Each Reporting Person disclaims beneficial ownership of the Shares that he, she, or it does not directly own.

| | | | | |

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended to add the following:

On September 5, 2023, Star Equity Fund entered into a Settlement Agreement with the Issuer, wherein Star Equity Fund withdrew its slate of directors for nomination to the Board at the Annual Meeting, and its compensation proposal applicable to the Board and management. Star Equity Fund also agreed to vote in accordance with the Board's recommendations at the 2023 Annual Meeting and thereafter with certain exceptions at any special meetings of shareholders occurring before the Termination Date, and agreed to other customary standstill provisions. In exchange, the Board agreed to submit for shareholder approval at the 2023 Annual Meeting the New Plan, keep director fees at status quo, and pay a portion of fees incurred by Star Equity Fund in connection with the 2023 Annual Meeting.

On September 5, 2023, the Reporting Persons entered into a Joint Filing Agreement in which the Reporting Persons who will remain Reporting Persons subsequent to this Amendment No. 5 agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Issuer to the extent required by applicable law. The Joint Filing Agreement is attached hereto as Exhibit 99.11 and is incorporated herein by reference

| | | | | |

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended to add the following exhibits:

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: September 7, 2023

| | | | | | | | | | | |

| Star Equity Fund, LP |

| | |

| By: | Star Equity Fund GP, LLC

General Partner |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Equity Holdings, Inc. |

| | |

| By: | /s/ Richard K. Coleman Jr. |

| | Name: | Richard K. Coleman, Jr. |

| | Title: | Chief Executive Officer |

| | | | | | | | | | | |

| Star Equity Fund GP, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Investment Management, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Value, LLC |

| | |

| By: | Star Equity Holdings, Inc. |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Executive Chairman |

| | | | | |

| /s/ Jeffrey E. Eberwein |

| Jeffrey E. Eberwein |

| Individually and as attorney-in-fact for Hannah M. Bible and Matthew R. Sullivan |

SCHEDULE A

Transactions in the Securities of the Issuer Since the Filing of Amendment No. 4 to the Schedule 13D

| | | | | | | | |

Shares of Common Stock Purchased/(Sold) | Price Per Share ($)1 | Date of Purchase / Sale |

STAR EQUITY FUND, LP

| | | | | | | | |

| 101 | $9.51 | 7/10/2023 |

| 3 | $9.51 | 7/11/2023 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

1 The prices reported in this column are weighted average prices. Star Equity Fund, LP undertakes to provide the Issuer and any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares purchased (or sold) at each separate price such shares were purchased.

September 5, 2023

Star Equity Fund, LP

c/o Jeffrey E. Eberwein

53 Forest Avenue, Suite 101

Old Greenwich, Connecticut 06870

Re: Gyrodyne, LLC

Dear Mr. Eberwein:

This letter agreement is intended to memorialize the understandings and agreements that have been reached between Gyrodyne, LLC (the “Company” or “we”) and Star Equity Fund, LP (collectively with its Affiliates (as defined below), “Star Equity”) relating to, among other things, Star Equity’s (i) notice to the Company (the “Nomination Notice”) of its intent to nominate two candidates for election to the Company’s board of directors (the “Board”) at the Company’s 2023 annual meeting of shareholders (the “Annual Meeting”) and (ii) shareholder proposal submitted to the Company pursuant to Rule 14a-8 (the “Shareholder Proposal”) of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder, (the “Exchange Act”).

In consideration of the promises, representations and mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Star Equity have successfully reached the following agreements:

1.Effective upon execution of this letter agreement, Star Equity shall irrevocably withdraw each of the Nomination Notice and the Shareholder Proposal (with this letter agreement deemed to evidence each such withdrawal), and shall cease any and all solicitation and other activity in connection with the Annual Meeting.

2.Until the Termination Date (as defined below), Star Equity shall not directly or indirectly (a) nominate, recommend for nomination or give notice of an intent to nominate or recommend for nomination a person for election at any meeting of shareholders of the Company at which directors are to be elected; (b) initiate, encourage or participate in any solicitation of proxies in respect of any election contest or removal contest with respect to directors of the Company; (c) submit, initiate, make or be a proponent of any shareholder proposal for consideration at, or bring any other business before, any meeting of shareholders of the Company or shareholder actions by written consent in lieu of a meeting of shareholders; (d) initiate, encourage or participate in any solicitation of proxies in respect of any shareholder proposal for consideration at, or other business brought before, any meeting of shareholders of the Company or shareholder actions by written consent in lieu of a meeting of shareholders; (e) initiate, encourage or participate in any “withhold” or similar campaign with respect to any meeting of shareholders of the Company or shareholder actions by written consent in lieu of a meeting of shareholders; (f) make any public or private proposal (other than to the Board), public statement or otherwise seek to encourage, advise or assist any person in, (i) any change in the number or term of directors serving on the Board or the filling of any vacancies on the Board, (ii) any change in the Company’s business, operations, strategy, management, governance, corporate structure or other affairs or policies, (iii) causing a class of securities of the Company to be delisted from, or cease to be authorized or quoted on, any securities exchange or (iv) causing a class of equity securities of the Company to become eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (g) enter into any discussions, negotiations, agreements or understandings with any person with respect to any action Star Equity is prohibited from taking pursuant to subclauses (a) through (f) above, or advise, assist, encourage or persuade any person to take any such action.

3.The Company shall adopt, and submit for shareholder approval at the Annual Meeting a proposal to approve, a new stock incentive plan (the “Stock Plan”) for directors who currently participate in the Company’s retention bonus plan (the “Bonus Plan”), pursuant to which such director participants will exchange their cash benefits under the Bonus Plan for an equivalent value of shares under the Stock Plan, but in no event shall the number of shares granted exceed 91,628 shares or represent more than ten percent (10%) of the shares outstanding, with one-third (1/3) of the shares of each award granted vesting on each annual anniversary of the grant for a three year period. The Stock Plan shall be in substantially the same form as set forth in Exhibit A.

4.The Company agrees not to increase Board fees.

5.For the avoidance of doubt, Star Equity shall not, directly or indirectly, cause or influence any of its Affiliates or Associates (as defined in Rule 12b-2 of the Exchange Act) (respectively, “Affiliates” and “Associates”) to take any action that, if taken by Star Equity, would constitute a violation or breach of any term or condition of this letter agreement.

6.The Company shall issue a press release (the “Press Release”) in a form prepared by the Company and approved by Star Equity (such approval not to be unreasonably withheld), announcing entry into this letter agreement. Prior to the issuance of the Press Release, neither party shall make any public announcement regarding this letter agreement without the prior written consent of the other party, except to the extent required by applicable law or the applicable securities exchange.

7.No later than four business days following the execution of this letter agreement, the Company shall file with the U.S. Securities and Exchange Commission (the “SEC”) a Current Report on Form 8-K reporting its entry into this letter agreement and appending this letter agreement as an exhibit thereto. No later than two business days following the execution of this letter agreement, Star Equity shall file with the SEC an amendment to its Schedule 13D reporting its entry into this letter agreement and appending this letter agreement as an exhibit thereto. Each party shall provide the other party with a reasonable opportunity to review and comment on its applicable SEC filing prior to such respective report or schedule being filed and consider in good faith any comments of the other party.

8.The term of this letter agreement will commence on the date hereof and will terminate on the date that is thirty days prior to the opening of the window for submission of shareholder nominations for the Company’s 2024 annual meeting of shareholders (the date of such termination, the “Termination Date”); provided, however, that any party (the “Non-Breaching Party”) may earlier terminate this letter agreement if the other party commits a material breach of this letter agreement (the “Breaching Party”) that is not cured within fifteen days after the Breaching Party’s receipt of written notice from the Non-Breaching Party or, if impossible to cure within fifteen days, which the Breaching Party has not taken any substantive action to cure within such fifteen-day period.

9.Until the Termination Date, Star Equity shall vote, or cause to be voted (including, without limitation, any action by written consent), all of its common shares of limited liability company interests beneficially owned, at all meetings of the Company’s shareholders in accordance with the Board’s recommendation in connection with any and all proposals, including, without limitation, those related to the election, removal or replacement of any director; provided, however, that (i) Star Equity shall be permitted to vote in its sole discretion on any proposal of the Company in respect of any equity tender offer, equity exchange offer, merger, acquisition, joint venture, business combination, financing, recapitalization, reorganization, restructuring, disposition, distribution, or other transaction with a third party that, in each case, would result in a change of control of the Company,

liquidation, dissolution or other extraordinary transaction involving a majority of its equity securities or a majority of its assets (determined on a consolidated basis), and, for the avoidance of doubt, including, without limitation, any such transaction with a third party that is submitted for a vote of the Company’s shareholders, and (ii) as to any special meeting occurring after the Annual Meeting, Star Equity shall be permitted to vote in accordance with the recommendation of Institutional Shareholder Services Inc. (“ISS) where the recommendation of ISS differs from the Board’s recommendation on any matter.

10.The Company shall promptly reimburse Star Equity for its reasonable and documented out-of-pocket fees and expenses incurred by Star Equity in connection with the Annual Meeting and the subject matter of this letter agreement, including, without limitation, the negotiation and execution of this letter agreement and the transactions contemplated hereby, provided, that such reimbursement shall not exceed $75,000 in the aggregate.

11.Until the Termination Date, except for such truthful statements as may be required by applicable law or the rules of any self-regulatory organization, Star Equity will not make, or permit any of its Representatives (as defined below) to make, or cause a third party to make, any public statement that disparages, or is otherwise negative or critical of the Company, its Affiliates or any of the Company’s past or current directors or officers, and the Company will not make, or permit any of its Representatives (as defined below) to make, or cause a third party to make, any public statement that disparages, or is otherwise negative or critical of Star Equity, its Affiliates, or their directors or officers. “Representatives” means (a) a person’s Affiliates and Associates and (b) its and their respective directors, officers, employees, partners, members, managers, consultants, legal or other advisors, agents and other representatives acting in a capacity on behalf of, in concert with or at the direction of such person or its Affiliates or Associates; provided, that when used with respect to the Company, “Representatives” shall not include any non-executive employees.

12.Each party acknowledges and agrees that irreparable harm to the other party may occur in the event any of the provisions of this letter agreement are not performed in accordance with their specific terms or are otherwise breached and that such injury would not be adequately compensable by the remedies available at law (including, without limitation, the payment of money damages). Accordingly, each party will be entitled to specifically enforce the covenants and other agreements of the other party contained in this letter agreement and to obtain injunctive relief restraining the other party from breaching or threatening to breach this letter agreement, and the other party will not take action, directly or indirectly, in opposition to the party seeking such relief on the grounds that any other remedy or relief is available at law or in equity. The parties further agree to waive any requirement for the security or posting of any bond in connection with any such relief. The prevailing party that obtains a final, non-appealable order shall be entitled to recover its fees and expenses incurred with respect to any action from the non-prevailing party. The remedies available pursuant to this Section 10 shall not be deemed to be the exclusive remedies for a breach of this letter agreement but shall be in addition to all other remedies available at law or equity.

13.Each party represents and warrants that it is duly authorized and has legal capacity to execute and deliver this letter agreement. Each party represents and warrants to the other parties that the execution and delivery of this letter agreement and the performance of such party’s obligations hereunder have been duly authorized and that this letter agreement is a valid and legal agreement binding on such party and enforceable in accordance with its terms.

14.Any notices required or permitted to be given under this letter agreement shall be in writing and shall be delivered by certified mail, overnight courier or electronic mail with confirmation of receipt to the addresses specified on the signature page of this letter agreement.

15.This letter agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement. Signatures to this letter agreement transmitted by electronic mail shall have the same effect as physical delivery of the paper document bearing the original signature. No modifications of this letter agreement can be made except in writing signed by each of the parties. Unless required to be disclosed by federal or state securities or other laws, the parties agree to keep this letter agreement confidential.

16.If any provision of this letter agreement is held invalid or unenforceable by any court of competent jurisdiction, the other provisions shall remain in full force and effect and shall in no way be affected, impaired or invalidated. Any provision held invalid or unenforceable only in part or degree shall remain in full force and effect to the extent not held invalid or unenforceable. The parties further agree to replace such invalid or unenforceable provision with a valid and enforceable provision that will achieve, to the extent possible, the purposes of such invalid or unenforceable provision.

17.This letter agreement and all disputes or controversies out of or related to this letter agreement shall be deemed to be made under the laws of the State of New York and for all purposes shall be governed by, and construed in accordance with, the laws of such State applicable to contracts to be made and performed entirely within such State, without reference to conflicts of laws principles.

* * *

If the foregoing accurately sets forth our agreements, please sign this letter agreement where indicated below.

Sincerely,

GYRODYNE, LLC

By: /s/ Paul L Lamb Esq.

Name: Paul L. Lamb Esq.

Title: Chairman of the Board of Directors

Address for Notices for the Company:

Gyrodyne, LLC

Attn: Gary Fitlin

1 Flowerfield, Suite 24

St. James, New York 11780

Email: gfitlin@gyrodyne.com

ACKNOWLEDGED AND AGREED:

STAR EQUITY FUND, LP

| | | | | | | | | | | |

| | |

| By: | STAR EQUITY FUND GP, LLC

General Partner |

| By: | /s/ Jefferey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

Address for Notices for Star Equity:

Star Equity Fund, LP

c/o Jeffrey E. Eberwein

53 Forest Avenue, Suite 101

Old Greenwich, Connecticut 06870

Email: jeff.eberwein@starequity.com

AMENDED AND RESTATED JOINT FILING AND SOLICITATION AGREEMENT

In accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of a Statement on Schedule 13D (including additional amendments thereto) with respect to the shares of Common Stock, par value $1.00 per share, of Gyrodyne, LLC. This Joint Filing Agreement shall be filed as an Exhibit to such Statement.

| | | | | | | | | | | |

| Star Equity Holdings, Inc. |

| | |

| By: | /s/ Richard K. Coleman, Jr. |

| | Name: | Richard K. Coleman, Jr. |

| | Title: | Chief Executive Officer |

| | | | | | | | | | | |

| Star Equity Fund, LP |

| | |

| By: | Star Equity Fund GP, LLC

General Partner |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Equity Fund GP, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Investment Management, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Value, LLC |

| | |

| By: | Star Equity Holdings, Inc. |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Executive Chairman |

| | | | | |

| /s/ Jeffrey E. Eberwein |

| Jeffrey E. Eberwein |

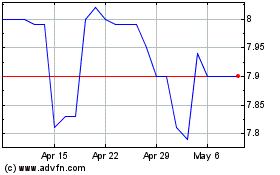

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024