As filed with the U.S. Securities and Exchange Commission on September

5, 2023

Registration No. 333-274076

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Yoshitsu Boueki

Kabushiki Kaisha

(Exact name of Registrant as specified in its

charter)

Yoshitsu Co.,

Ltd

(Translation of Registrant’s name into

English)

| Japan |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Harumi Building, 2-5-9 Kotobashi,

Sumida-ku, Tokyo, 130-0022

Japan

+81356250668

(Address and telephone number of Registrant’s

principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, and telephone number of agent

for service)

With a Copy to:

Ying Li, Esq.

Guillaume de Sampigny, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of the registration statement.

If only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ☐

†The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act, or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Yoshitsu Co., Ltd is filing this Amendment No.

2 (this “Amendment No. 2”) to the Registration Statement on Form F-3 (Registration No. 333-274076), originally filed on August

18, 2023 (the “Registration Statement”), as an exhibit-only filing solely to file an updated opinion of City-Yuwa Partners

as Exhibit 5.1. Accordingly, this Amendment No. 2 consists only of the facing page, this explanatory note, Part II of the Registration

Statement, the signature pages to the Registration Statement, and the exhibit being filed, and is not intended to amend or delete any

part of the Registration Statement except as specifically noted herein.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification of Directors, etc.

Article 330 of the

Companies Act of Japan, makes the provisions of Articles 643 through 656 of the Civil Code of Japan applicable to the

relationship between us and our directors, corporate auditors, and accounting auditor. Such provisions, among other things, provide in

effect that:

| (1) | any

director, corporate auditor, or accounting auditor of a company may demand advance payment

of expenses which are considered necessary for the management of affairs of such company

entrusted to him or her; |

| (2) | if

a director, a corporate auditor, or an accounting auditor of a company has defrayed any expenses

which are considered necessary for the management of the affairs of such company entrusted

to him or her, he or she may demand reimbursement therefor from the company; |

| (3) | if

a director, a corporate auditor, or an accounting auditor has assumed an obligation necessary

for the management of the affairs entrusted to him or her, he or she may require the company

to perform it in his or her place or, if it is not due, to furnish adequate security; and |

| |

(4) |

if

a director, a corporate auditor, or an accounting auditor, without any fault on his or her part, sustains damage through the management

of the affairs entrusted to him or her, he or she may demand compensation therefor from the company. |

Our directors, corporate

auditors, and accounting auditor are, to a limited extent, insured under an insurance policy against damages resulting from their conduct.

Under the Companies Act and our articles of incorporation, we may exempt our non-executive directors from liabilities to us arising in

connection with their failure to execute their duties, within the limits stipulated by applicable laws and regulations. Pursuant to such

authority, we have entered into a liability limitation agreement with each non-executive director which limits the maximum amount of

their liability to us arising in connection with a failure to execute their duties to the greater of either ¥10 million or the minimum

liability amount prescribed in applicable laws.

Item 9. Exhibits

| Exhibit No. |

|

Description |

| 1.1* |

|

Form of Underwriting Agreement |

| 4.1 |

|

Registrant’s

Specimen Certificate for Ordinary Shares (incorporated by reference to Exhibit 4.1 of our Registration Statement on Form F-1 (File

No. 333-259129), as amended, initially filed with the SEC on August 27, 2021) |

| 4.2 |

|

Form

of Deposit Agreement among the Registrant, The Bank of New York Mellon, as depositary, and the holders and beneficial owners of ADSs

issued thereunder (incorporated by reference to Exhibit 4.3 of our Registration Statement on Form F-1 (File No. 333-259129), as amended,

initially filed with the SEC on August 27, 2021) |

| 4.3 |

|

Form of

American Depositary Receipt (included in Exhibit 4.2) |

| 4.4* |

|

Form of Debt Security |

| 4.5* |

|

Form of Warrant Agreement and Warrant Certificate |

| 4.6* |

|

Form of Unit Agreement and Unit Certificate |

| 4.7* |

|

Form of indenture with respect to senior debt securities, to be

entered into between registrant and a trustee acceptable to the registrant, if any |

| 4.8* |

|

Form of indenture with respect to subordinated debt securities,

to be entered into between registrant and a trustee acceptable to the registrant, if any |

| 5.1** |

|

Opinion of City-Yuwa Partners |

| 23.1*** |

|

Consent

of Marcum Asia CPAs LLP |

| 23.2*** |

|

Consent

of Friedman LLP |

| 23.3** |

|

Consent of City-Yuwa Partners (included in Exhibit 5.1) |

| 24.1*** |

|

Powers

of Attorney |

| 25.1**** |

|

Form T-1 Statement of Eligibility under the Trust Indenture Act

of 1939 of the Trustee under the Senior Debt Securities Indenture |

| 25.2**** |

|

Form T-1 Statement of Eligibility under the Trust Indenture Act

of 1939 of the Trustee under the Subordinated Debt Securities Indenture |

| 107*** |

|

Filing Fee Table |

| * |

To be filed, if applicable, by amendment or as an exhibit to a report

filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and incorporated herein

by reference. |

| **** |

To be filed, if necessary, on electronic Form 305b2 pursuant to

Section 305(b)(2) of the Trust Indenture Act of 1939. |

Item 10 Undertakings

| |

(a) |

The undersigned registrant hereby undertakes: |

| |

(1) |

To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement: |

| |

(i) |

To include any prospectus required by Section 10(a)(3) of

the Securities Act of 1933; |

| |

(ii) |

To reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of

prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement. |

| |

(iii) |

To include any material information with respect to the plan of

distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement. |

provided, however, that paragraphs

(a)(1)(i), (a)(1)(ii), and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b).

| |

(2) |

That, for the purpose of determining any liability under the Securities

Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering. |

| |

(4) |

To file a post-effective amendment to the registration statement

to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a

continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act

of 1933 need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective amendment,

financial statements required pursuant to this paragraph (4) and other information necessary to ensure that all other information

in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, a post-effective

amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities

Act of 1933 or Rule 3-19 of Regulation S-K if such financial statements and information are contained in periodic reports filed

with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange

Act of 1934 that are incorporated by reference in this registration statement. |

| |

(5) |

That, for the purpose of determining liability under the Securities

Act of 1933 to any purchaser: |

| |

(i) |

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall

be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and |

| |

(ii) |

Each prospectus required to be filed pursuant to Rule 424(b)(2),

(b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to

Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the

Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such

form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described

in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is

part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective

date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date. |

| |

(6) |

That, for the purpose of determining liability of the registrant

under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes

that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the

underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means

of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer

or sell such securities to such purchaser: |

| |

(i) |

Any preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule 424; |

| |

(ii) |

Any free writing prospectus relating to the offering prepared by

or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| |

(iii) |

The portion of any other free writing prospectus relating to the

offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned

registrant; and |

| |

(iv) |

Any other communication that is an offer in the offering made by

the undersigned registrant to the purchaser. |

| |

(b) |

That, for purposes of determining any liability under the Securities

Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities

Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of

the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| |

(c) |

Insofar as indemnification for liabilities arising under the Securities

Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions,

or otherwise, the registrant has been advised that in the opinion of the U.S. Securities and Exchange Commission such indemnification

is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has

been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by

it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Tokyo, Japan, on September 5, 2023.

| |

Yoshitsu Co., Ltd |

| |

|

| |

By: |

/s/

Mei Kanayama |

| |

|

Mei Kanayama |

| |

|

Representative Director

and Director |

| |

|

(Principal Executive Officer) |

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Mei Kanayama |

|

Representative Director and Director |

|

September 5, 2023 |

| Name: Mei Kanayama |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Youichiro Haga |

|

Director and Corporate Officer |

|

September 5, 2023 |

| Name: Youichiro Haga |

|

(Principal Accounting and Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Yoji Takenaka |

|

Director |

|

September 5, 2023 |

| Name: Yoji Takenaka |

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN

THE UNITED STATES

Pursuant to the Securities Act of 1933, as amended,

the undersigned, the duly authorized representative in the United States of America of Yoshitsu Co., Ltd, has signed this registration

statement or amendment thereto in New York, NY on September 5, 2023.

| |

Cogency Global Inc. |

| |

Authorized U.S. Representative |

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

|

Name: |

Colleen A. De Vries |

| |

|

Title: |

Senior Vice President on behalf of Cogency Global Inc. |

II-5

Exhibit 5.1

Yoshitsu Co., Ltd

Harumi Building, 2-5-9 Kotobashi,

Sumida-ku, Tokyo 130-0022

Japan

September 5, 2023

Yoshitsu Co., Ltd (the “Company”)

– Exhibit 5.1

We have acted as Japanese legal counsel to the

Company in connection with the Company’s registration statement on Form F-3, including all amendments or supplements thereto (the “Registration

Statement”), filed by the Company with the United States Securities and Exchange Commission (the “Commission”) under

the United States Securities Act of 1933, as amended (the “Act”) to date relating to the registration of up to US$100,000,000

of its securities to be issued by the Company from time to time listed below (together, the “Securities”):

| (a) | ordinary shares of the Company (the “Ordinary Shares”), including Ordinary Shares represented

by American depositary shares (the “ADSs”), each representing one Ordinary Share; |

| (b) | debt securities (the “Debt Securities”) to be issued pursuant to the applicable indenture,

purchase agreement or similar agreement to be entered into by the Company (the “Debt Document”); |

| (c) | warrants to purchase Ordinary Shares or any combination thereof (the “Warrants”) issuable

pursuant to the terms of a warrant agreement to be entered into between the Company and a warrant agent for such Warrants thereunder,

if any (the “Warrant Document”); and/or |

| (d) | units in three types of combination, namely (i) convertible debt securities, (ii) debt securities with

warrants, and (iii) simultaneous issuance of warrants and debt securities (collectively, the “Units”) to be issued under a

unit agreement, purchase agreement or similar agreement between the Company and a unit agent to be specified therein, if any (the “Unit

Document”). |

City-Yuwa Partners

2-2-2 Marunouchi, Chiyoda-ku

Tokyo 100-0005, Japan

TEL: +81-3-6212-5500

FAX: +81-3-6212-5700

city-yuwa.com

A list of Partners may be inspected on our website.

The Debt Document, Warrant Document, and Unit

Document are referred to herein collectively as “Governing Documents.”

The Debt Securities, the Warrants, and the Units

are collectively referred to herein as “Non-Equity Securities.”

No opinion is expressed herein as to any matter

pertaining to the contents of the Registration Statement other than as expressly stated herein with respect to the issue of the Securities.

Unless a contrary intention appears, all capitalized

terms used in this opinion have the respective meanings set forth in the Documents. A reference to a Schedule is a reference to a schedule

to this opinion and the headings herein are for convenience only and do not affect the construction of this opinion.

For the purposes of giving this opinion, we have

examined originals, copies or drafts of the following documents (the “Documents”):

| (a) | an official certificate of all matters recorded in the commercial register of the Company dated August

28, 2023; |

| (b) | the Articles of Incorporation of the Company effective as of October 19, 2021 (the “Articles”);

and |

| (c) | the Registration Statement. |

In giving this opinion we have relied upon the

assumptions set forth in Schedule 1 without having carried out any independent investigation or verification in respect of those assumptions.

On the basis of the examinations and assumptions

referred to above and subject to the limitations and qualifications set forth below, we are of the opinion that:

Corporate status

| (a) | The Company has been duly incorporated as a stock company and is validly existing and in good standing. |

Issuance of Shares

| (b) | With respect to the Ordinary Shares, when: |

| (i) | the board of directors of the Company (the “Board”) has taken all necessary corporate actions

to approve the issuance and allotment of the Ordinary Shares, the terms of the offering of the Ordinary Shares and any other related matters; |

| (ii) | notices or public notice of the terms of the offering of the Ordinary Shares has been given to the shareholders

of the Company at least two weeks prior to the payment date or the first day of the payment period; and |

| (iii) | either (A) the provisions of the applicable definitive purchase, underwriting or similar agreement approved

by the Board have been satisfied and payment of the consideration specified therein (being not less than the par value of the Ordinary

Shares) has been made, or (B) if such Ordinary Shares are issuable upon conversion, exchange, redemption, repurchase or exercise of any

other security, the terms of such security, the Articles or the instrument governing such security providing for such conversion, exchange,

redemption, repurchase or exercise for Ordinary Shares, as approved by the Board, have been satisfied and the consideration approved by

the Board (being not less than the par value of the Ordinary Shares) received, the Ordinary Shares will be recognized

as having been duly authorized and validly issued, fully paid and non-assessable. |

Issuance of Debt Securities

| (c) | With respect to the Debt Securities to be issued, when: |

| (i) | the Board has taken all necessary corporate actions to authorize and approve the creation and terms of

the Debt Securities and to approve the issue thereof, the terms of the offering thereof and related matters; |

| (ii) | a manager of the Debt Securities has been appointed, when legally required; |

| (iii) | notices or public notice of the terms of the offering of the Debt Securities has been given to the shareholders

of the Company at least two weeks prior to the allotment date; |

| (iv) | a Debt Document relating to the Debt Securities shall have been duly authorized and validly executed and

unconditionally delivered by and on behalf of the Company and all the relevant parties thereunder; and |

| (v) | the Debt Securities issued thereunder have been duly executed and delivered on behalf of the Company

in the manner set forth in the applicable Debt Document relating to such issue of Debt Securities and delivered against due payment

therefor pursuant to, and in accordance with, the terms of the Registration Statement and any relevant prospectus supplement, the Debt Securities will be duly issued

and delivered. |

Issuance of Warrants

| (d) | With respect to the Warrants to be issued, when: |

| (i) | the Board has taken all necessary corporate actions to authorize and approve the creation and terms of

the Warrants and to approve the issue thereof, the terms of the offering thereof and related matters; |

| (ii) | notices or public notice of the terms of the offering of the Warrants has been given to the shareholders

of the Company at least two weeks prior to the allotment date; |

| (iii) | a Warrant Document relating to the Warrants shall have been duly authorized and validly executed and unconditionally

delivered by the Company and the warrant agent thereunder, the Warrants will be duly authorized

and validly issued and will constitute legal, valid and binding obligations of the Company. |

Issuance of Units

| (e) | With respect to each issue of Units, when: |

| (i) | the Board has taken all necessary corporate actions to authorize and approve the creation and terms of

the Units and to approve the issue of the Securities which are components thereof, the terms of the offering thereof and related matters; |

| (ii) | a manager of the Units has been appointed, when legally required; |

| (iii) | notices or public notice of the terms of the offering of the Units has been given to the shareholders

of the Company at least two weeks prior to the allotment date; |

| (iv) | a Unit Document relating to the Units shall have been duly authorized and validly executed and unconditionally

delivered by the Company and the financial institution designated as unit agent thereunder; |

| (v) | in respect of any Debt Securities which are components of the Units, the Debt Securities shall have been

duly authorized and validly executed and unconditionally delivered by the Company and all relevant parties thereunder; |

| (vi) | in respect of any Warrants which are components of the Units, a Warrant Document shall have been duly

authorized and validly executed and unconditionally delivered by the Company and the warrant agent thereunder, if any, in respect of any

Warrants which are components of the Units; and |

| (vii) | the Units and any Securities which are components of the Units shall have been duly executed,

countersigned, authenticated, issued, registered and delivered (in each case, as and when applicable), in accordance with the

provisions of (A) the applicable Unit Document relating to the Units, (B) the applicable Debt Document relating to any Debt

Securities which are components of the Units, (C) the applicable Warrant Document relating to any Warrants which are components of

the Units, and (D) the applicable definitive purchase, underwriting or similar agreement approved by the Board, and upon payment of

the consideration therefor provided therein, the Units will be duly authorized and

validly issued and will constitute legal, valid and binding obligations of the Company. |

| 4 | Limitations and Qualifications |

| (a) | as to any laws other than the laws of Japan, and we have not, for the purposes of this opinion, made any

investigation of the laws of any other jurisdiction, and we express no opinion as to the meaning, validity, or effect of references in

the Registration Statement and the Governing Documents to statutes, rules, regulations, codes or judicial authority of any jurisdiction

other than Japan; |

| (b) | except to the extent that this opinion expressly provides otherwise, as to the commercial terms of, or

the validity, enforceability or effect of the Registration Statement or any of the Governing Documents, the accuracy of representations,

the fulfilment of warranties or conditions, the occurrence of events of default or terminating events or the existence of any conflicts

or inconsistencies among the Registration Statement, the Governing Documents and any other agreements into which the Company may have

entered or any other documents; or |

| (c) | as to whether the acceptance, execution or performance of the Company’s obligations under the Governing

Documents will result in the breach of or infringe any other agreement, deed or document (other than the Articles) entered into by or

binding on the Company. |

| 4.2 | In good standing means only that as of the date of this opinion the Company is up-to-date with the registration

at the Registrar of Companies. We have made no enquiries into the Company’s good standing with respect to any registration that it may

be required to make under the laws of Japan other than the Companies Act of Japan. |

| 4.3 | In this opinion the phrase “non-assessable” means, with respect to the Ordinary Shares, that

a shareholder of the Company shall not, by virtue of its status as a shareholder of the Company, be liable for additional assessments

or calls on the Ordinary Shares by the Company or its creditors (except in exceptional circumstances, such as involving fraud, the establishment

of an agency relationship or an illegal or improper use or other circumstance in which a court may be prepared to pierce or lift the corporate

veil). |

| 4.4 | We reserve our opinion as to the extent to which the courts of Japan would, in the event of any relevant

illegality or invalidity, sever the relevant provisions of the Governing Documents and the Non-Equity Securities and enforce the remainder

of the Governing Documents and the Non-Equity Securities or the transaction of which such provisions form a part, notwithstanding any

express provisions in the Indenture in this regard. |

| 5 | Governing law of this opinion |

| (a) | governed by, and shall be construed in accordance with, the

laws of Japan; |

| (b) | limited to the matters expressly stated in it; and |

| (c) | confined to, and given on the basis of, the laws and practice

in Japan at the date of this opinion. |

| 5.2 | Unless otherwise indicated, a reference to any specific Japan legislation is a reference to that legislation

as amended to, and as in force at, the date of this opinion. |

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to the reference to our firm under the headings “Enforceability of Civil Liabilities”

and “Legal Matters” of the Registration Statement. In giving such consent, we do not hereby admit that we are experts within

the meaning of Section 11 of the Act or that we are in the category of persons whose consent is required under Section 7 of the Act or

the Rules and Regulations of the Commission promulgated thereunder.

This opinion may be used only in connection with

the offer and sale of the Securities while the Registration Statement is effective.

Yours faithfully

| /s/ Yusuke Tani |

|

| Attorney at Law, City-Yuwa Partners |

|

SCHEDULE 1

Assumptions

| 1 | All original documents examined by us are authentic and complete. |

| 2 | All copy documents examined by us (whether in facsimile, electronic or other form) conform to the originals

and those originals are authentic and complete. |

| 3 | All signatures, seals, dates, stamps and markings (whether on original or copy documents) are genuine. |

| 4 | Each of the Documents is accurate and complete as at the date of this opinion. |

| 5 | Each of the parties to the Governing Documents other than the Company is duly incorporated, formed or

organized (as applicable), validly existing and in good standing under all relevant laws. Any individuals who are parties to the Governing

Documents, or who sign or have signed documents or give information on which we rely, have the legal capacity under all relevant laws

(including the laws of Japan) to enter into and perform their obligations under such Governing Document, sign such documents and give

such information. |

| 6 | Each Governing Document and the Non-Equity Securities have been, or will be, authorized and duly executed

and unconditionally delivered by or on behalf of all relevant parties in accordance with all relevant laws and, in respect of the Company,

in the manner authorized by the Board. |

| 7 | The applicable Governing Documents will be governed by and construed in accordance with the laws of New

York and will be legal, valid, binding and enforceable against all relevant parties in accordance with its terms under the laws of New

York and all other relevant laws. If an obligation is to be performed in a jurisdiction outside Japan, its performance will not be contrary

to an official directive, impossible or illegal under the laws of that jurisdiction. |

| 8 | The choice of the laws of the State of New York as the governing law of the Governing Documents has, or

will have, been made in good faith and would be regarded as a valid and binding selection which will be upheld by the courts of the State

of New York and any other relevant jurisdiction (other than Japan) as a matter of the laws of the State of New York and all other relevant

laws (other than the laws of Japan). |

| 9 | No monies paid to or for the account of any party in respect of the Securities under the Governing Documents

represent, or will represent, proceeds of crime (as defined in the Act on Punishment of Organized Crimes and Control of Proceeds of Crime)

and none of the parties to the Governing Documents is acting or will act in relation to the transactions contemplated by the Governing

Documents, in a manner inconsistent with sanctions imposed by Japanese authorities. |

| 10 | The Non-Equity Securities will respectively be issued and authenticated as required in accordance with

the provisions of a duly authorized, executed and delivered applicable Governing Document and the Non-Equity Securities will be legal,

valid, binding and enforceable against all relevant parties in accordance with their terms under the laws of the State of New York and

all other relevant laws (other than, with respect to the Company, the laws of Japan). |

| 11 | The form and terms of any and all Securities, the issuance and sale thereof by the Company, and the Company’s

incurrence and performance of its obligations thereunder or in respect thereof (including, without limitation, its obligations under any

related agreement, indenture or supplement thereto) in accordance with the terms thereof will not violate the Articles then in effect

nor any applicable law, regulation, order or decree in Japan. |

| 12 | None of the opinions expressed herein will be adversely affected by the laws or public policies of any

jurisdiction other than Japan. In particular, but without limitation to the previous sentence: |

| (a) | the laws or public policies of any jurisdiction other than

Japan will not adversely affect the capacity or authority of the Company; and |

| (b) | neither the execution or delivery of the Governing Documents

nor the exercise by any party to the Governing Documents of its rights or the performance of its obligations under them contravene those

laws or public policies. |

| 13 | There are no agreements, documents or arrangements (other than the documents expressly referred to in

this opinion as having been examined by us) that materially affect or modify the Governing Documents or the transactions contemplated

by Governing Documents or restrict the powers and authority of the Company in any way from entering into and performing its obligations

under a duly authorized, executed and delivered Governing Documents. |

| 14 | The Company has obtained, or will obtain prior to execution, all consents, licenses, approvals and authorizations

of any governmental or regulatory authority or agency or of any other person that it is required to obtain pursuant to the laws of all

relevant jurisdictions (other than those of Japan) to ensure the legality, validity, enforceability, proper performance and admissibility

in evidence of the Governing Documents. Any conditions to which such consents, licenses, approvals and authorizations are subject have

been, and will continue to be, satisfied or waived by the parties entitled to the benefit of them. |

| 15 | All necessary corporate action will be taken to authorize and approve any issuance of Securities and the

terms of the offering of such Securities thereof and other related matters and that the applicable definitive purchase, underwriting or

similar agreement will be duly approved, executed and delivered by or on behalf of the Company and all other parties thereto. |

8

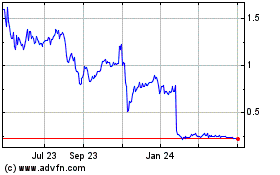

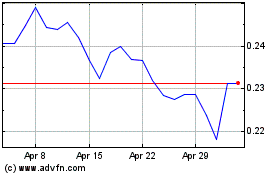

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From Apr 2023 to Apr 2024