UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of

August 2023

Commission File Number 001-38072

___________________

NexGen Energy Ltd.

(Translation of registrant's

name into English)

Suite 3150, 1021 - West

Hastings Street

Vancouver, B.C., Canada V6E 0C3

(Address of principal

executive offices)

___________________

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ☐

Form 40-F ☑

INCORPORATION BY

REFERENCE

Exhibits 99.1 to this Report on

Form 6-K are hereby incorporated by reference as Exhibits to the Registration Statement on Form F-10 of NexGen Energy Ltd. (File No.

333-253512).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized,

on August 31, 2023.

| |

NEXGEN

ENERGY LTD. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/

Benjamin Salter |

|

| |

Name: |

Benjamin Salter |

|

| |

Title: |

Vice-President, Finance and Acting Chief Financial Officer |

|

Exhibit 99.1

NexGen Announces US$110 Million Convertible Debenture Financing and

Strategic Purchase of Common Shares

Vancouver, BC, August 31, 2023 - NexGen

Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE) (ASX:

NXG) is pleased to announce that it has entered into binding term sheets with Queen’s Road Capital Investment Ltd. (“QRC”)

and Washington H Soul Pattinson and Company Limited (“WHSP”) for a private placement (the “Offering”) of

US$110 million aggregate principal amount of unsecured convertible debentures (the “Debentures”).

The Debentures will be convertible at the holder’s

option into approximately 16.27 million common shares of NexGen (the “Common Shares”).

In addition, WHSP has agreed to purchase 8.7 million

outstanding common shares of NexGen from QRC (the “Pre-Arranged Trade”), enabling QRC to partially fund its purchase

of Debentures.

Leigh Curyer, Chief Executive Officer, commented: "Today’s

US$110M financing from two highly respected investors, our long-standing investor in QRC and, the addition of WHSP in Australia, optimally

places NexGen to deliver on its stated objectives in the development of the Rook I Project. It is an incredibly exciting time for NexGen

as we recently received confirmation of the completion of the Provincial Environmental Assessment Technical Review and submission of the

Final Provincial Environmental Impact Statement to the Saskatchewan Ministry of Environment. Further, permitted pre-construction site

works are well advanced with the team and all of its stakeholders focused on the responsible delivery of Rook I for the world’s

energy transition.”

Terms of the Debentures

The Debentures will carry a 9.0% coupon (the “Interest”)

over a 5-year term. The Debentures will be convertible at the holder’s option into Common Shares, at a conversion price (the “Conversion

Price”) per Common Share of US$6.76 (C$9.15 per Common Share equivalent incorporating today’s exchange rate) representing

a 30% premium to the volume-weighted average trading price (the “VWAP”) per Common Share on the Toronto Stock Exchange (the

“TSX”) for the 5-days ending on the day prior to the date of this announcement.

Two-thirds of the Interest (equal to 6% per annum)

is payable in cash. One-third of the Interest (equal to 3% per annum) is payable in Common Shares issuable at a price equal to the 20-day

VWAP on either the Toronto Stock Exchange or New York Stock Exchange (whichever has the greatest trading volume of Common Shares) ending

on, and including, the third trading day prior to the date such interest payment is due.

The Company will be entitled, on or after the third

anniversary of the date of the issuance of the Debentures, at any time that the 20-day VWAP on the TSX exceeds 130% of the Conversion

Price, to redeem the Debentures at par plus accrued and unpaid Interest.

This is a Designated News Release

Strategic Alignment Provisions

In connection with the Offering, the Company will enter

into an investor rights agreement with both QRC and WHSP, containing the same voting alignment, standstill, and transfer restriction covenants

as the existing investor rights agreement with QRC dated May 27, 2020. However, these provisions will be revised to apply regardless of

the number of Common Shares held, and the restrictions allowing for a sale of Common Shares every thirty days will be limited to 0.5%

of the number of Common Shares held.

Use

of Proceeds

Proceeds from the Offering will be used to fund the

continuing development and further exploration of the Company’s mineral properties, and for general corporate purposes.

Conditions

Closing of the Offering is conditional upon completion

of the Pre-Arranged Trade and the satisfaction of customary closing conditions, including stock exchange approvals, the completion of

definitive documentation, there being no material adverse change in the business of the Company, or a major event of national or international

consequence that disrupts the financial markets or the business, operations or affairs of the Company.

Advisors and Legal Counsel

Aitken Mount Capital Partners were advisors to the

transaction. Farris LLP, Vancouver provided legal.

About NexGen

NexGen Energy is a Canadian company focused on delivering

clean energy fuel for the future. The Company’s flagship Rook I Project is being optimally developed into the largest

low cost producing uranium mine globally, incorporating the most elite standards in environmental and social governance. The

Rook I Project is supported by a NI 43-101 compliant Feasibility Study which outlines the elite environmental

performance and industry leading economics. NexGen is led by a team of experienced uranium and mining industry professionals with

expertise across the entire mining life cycle, including exploration, financing, project engineering and construction, operations

and closure. NexGen is leveraging its proven experience to deliver a Project that leads the entire mining industry socially, technically

and environmentally. The Project and prospective portfolio in northern Saskatchewan will provide generational long-term economic,

environmental, and social benefits for Saskatchewan, Canada, and the world.

NexGen is listed on the Toronto

Stock Exchange, the New York Stock Exchange under the ticker symbol “NXE” and on the Australian Securities Exchange under

the ticker symbol “NXG” providing access to global investors to participate in NexGen’s mission of solving three major

global challenges in decarbonization, energy security and access to power. The Company is headquartered in Vancouver, British Columbia,

with its primary operations office in Saskatoon, Saskatchewan.

Contact Information

Leigh Curyer

Chief Executive Officer

NexGen Energy Ltd.

+1 604 428 4112

lcuryer@nxe-energy.ca

Travis McPherson

Chief Commercial Officer

NexGen Energy Ltd.

+1 604 428 4112

tmcpherson@nxe-energy.ca

Monica Kras

Vice President, Corporate Development

+44 (0) 7307 191933

mkras@nxe-energy.ca

Technical Disclosure

All technical information in this news

release has been reviewed and approved by Kevin Small, NexGen's Senior Vice President, Engineering and Operations, a qualified person

under National Instrument 43-101.

A technical report in respect of the

FS is filed on SEDAR ( www.sedar.com ) and EDGAR (www.sec.gov/edgar.shtml ) and is available for review on NexGen Energy's

website (www.nexgenenergy.ca ).

Cautionary Note to U.S. Investors

This news release includes Mineral Reserves

and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral

Resources estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These

standards differ from the requirements of the Securities and Exchange Commission ("SEC") set by the SEC's rules that are applicable

to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information

included in this news release is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies

subject to the reporting and disclosure requirements of the SEC Accordingly, information concerning mineral deposits set forth herein

may not be comparable with information made public by companies that report in accordance with U.S. standards.

Forward-Looking Information

The information contained herein contains

"forward-looking statements" within the meaning of applicable United States securities laws and regulations and "forward-looking

information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes,

but is not limited to, statements with respect to mineral reserve and mineral resource estimates, the 2021 Arrow Deposit, Rook I Project

and estimates of uranium production, grade and long-term average uranium prices, anticipated effects of completed drill results on the

Rook I Project, planned work programs, completion of further site investigations and engineering work to support basic engineering of

the project and expected outcomes. Generally, but not always, forward-looking information and statements can be identified by the use

of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations

of such words and phrases or state that certain actions, events or results "may", "could", "would", "might"

or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Statements relating

to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment that, based on certain

estimates and assumptions, the mineral resources described can be profitably produced in the future.

Forward-looking information and statements

are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen's business and the industry and

markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions, including among others,

that the mineral reserve and resources estimates and the key assumptions and parameters on which such estimates are based are as set out

in this news release and the technical report for the property , the results of planned exploration activities are as anticipated, the

price and market supply of uranium, the cost of planned exploration activities, that financing will be available if and when needed and

on reasonable terms, that third party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen's

planned exploration activities will be available on reasonable terms and in a timely manner and that general business and economic conditions

will not change in a material adverse manner. Although the assumptions made by the Company in providing forward looking information or

making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions

will prove to be accurate in the future.

Forward-looking information and statements

also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements

of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward-looking

information or statements, including, among others, the existence of negative operating cash flow and dependence on third party financing,

uncertainty of the availability of additional financing, the risk that pending assay results will not confirm previously announced preliminary

results, conclusions of economic valuations, the risk that actual results of exploration activities will be different than anticipated,

the cost of labour, equipment or materials will increase more than expected, that the future price of uranium will decline or otherwise

not rise to an economic level, the appeal of alternate sources of energy to uranium-produced energy, that the Canadian dollar will strengthen

against the U.S. dollar, that mineral resources and reserves are not as estimated, that actual costs or actual results of reclamation

activities are greater than expected, that changes in project parameters and plans continue to be refined and may result in increased

costs, of unexpected variations in mineral resources and reserves, grade or recovery rates or other risks generally associated with mining,

unanticipated delays in obtaining governmental, regulatory or First Nations approvals, risks related to First Nations title and consultation,

reliance upon key management and other personnel, deficiencies in the Company's title to its properties, uninsurable risks, failure to

manage conflicts of interest, failure to obtain or maintain required permits and licences, risks related to changes in laws, regulations,

policy and public perception, as well as those factors or other risks as more fully described in NexGen's Annual Information Form dated

February 24, 2023 filed with the securities commissions of all of the provinces of Canada except Quebec and in NexGen's

40-F filed with the United States Securities and Exchange Commission, which are available on SEDAR at www.sedar.com and Edgar

at www.sec.gov .

Although the Company has attempted to

identify important factors that could cause actual results to differ materially from those contained in the forward-looking information

or statements or implied by forward-looking information or statements, there may be other factors that cause results not to be as anticipated,

estimated or intended. Readers are cautioned not to place undue reliance on forward-looking information or statements due

to the inherent uncertainty thereof.

There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated,

estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company

undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required

by applicable securities laws.

Exhibit 99.2

Form

51-102F3 MATERIAL CHANGE REPORT

| Item 1 | Name and Address of Company |

NexGen Energy Ltd. (the “Corporation”

or “NexGen”)

Suite 3150, 1021 West Hastings Street

Vancouver, BC V6E 0C3

| Item 2 | Date of Material Change |

August 31, 2023

On August 31, 2023, the Corporation

issued a news release reporting the material change through CNW (Canada NewsWire).

| Item 4 | Summary of Material Change |

On August 31, 2023, the Corporation

announced that it had entered into binding term sheets with Queen’s Road Capital Investment Ltd. (“QRC”) and

Washington H Soul Pattinson and Company Limited (“WHSP”) for a private placement (the “Offering”)

of US$110 million aggregate principal amount of 9.0% unsecured convertible debentures (the “Debentures”).

| Item 5 | Full Description of Material Change |

5.1 Full Description

of Material Change

The Debentures will be convertible

at the holder’s option into approximately 16.27 million common shares of NexGen (the “Common Shares”).

The Debentures will carry a 9.0%

coupon (the “Interest”) over a 5-year term. The Debentures will be convertible at the holder’s option into Common

Shares, at a conversion price (the “Conversion Price”) per Common Share of US$6.76 (C$9.15 per Common Share based on

current exchange rates), representing a 30% premium to the volume-weighted average trading price (the “VWAP”) per Common

Share on the Toronto Stock Exchange (the “TSX”) for the five days ending on the day prior to the date of the news release.

Two-thirds of the Interest (equal

to 6% per annum) is payable in cash. One-third of the Interest (equal to 3% per annum) is payable in Common Shares issuable at a price

equal to the 20-day VWAP on either the Toronto Stock Exchange or New York Stock Exchange (whichever has the greatest trading volume of

Common Shares) ending on, and including, the third trading day prior to the date such interest payment is due.

The Corporation will be entitled,

on or after the third anniversary of the date of the issuance of the Debentures, at any time that the 20-day VWAP on the TSX exceeds 130%

of the Conversion Price, to redeem the Debentures at par plus accrued and unpaid Interest.

WHSP has agreed to purchase 8.7 million

outstanding common shares of NexGen from QRC (the “Pre-Arranged Trade”), enabling QRC to partially fund its purchase

of Debentures.

Strategic Alignment Provisions

In connection with the Offering,

the Corporation will enter into an investor rights agreement with both QRC and WHSP containing the same voting alignment, standstill,

and transfer restriction covenants as the existing investor rights agreement with QRC dated May 27, 2020. However, these provisions will

be revised to apply regardless of the number of Common Shares held, and the restrictions allowing for a sale of Common Shares every thirty

days will be limited to 0.5% of the number of Common Shares held.

Use of Proceeds

Proceeds from the Offering will

be used to fund the continuing development and further exploration of the Corporation’s mineral properties, and for general corporate

purposes.

Conditions

Closing of the Offering is conditional

upon completion of the Pre-Arranged Trade and the satisfaction of customary closing conditions, including stock exchange approvals, the

completion of definitive documentation, there being no material adverse change in the business of the Corporation, or a major event of

national or international consequence that disrupts the financial markets or the business, operations or affairs of the Corporation.

| Item 6 | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7 | Omitted Information |

No significant facts otherwise required

to be disclosed in this report have been omitted.

The following executive officer of

the Corporation is knowledgeable about the material change and may be contacted respecting the change:

Leigh Curyer

Chief Executive Officer

Phone: (604) 428-4112

Email: lcuryer@nxe-energy.ca

August 31, 2023

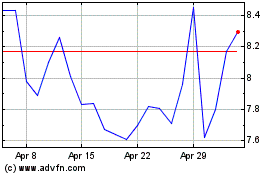

NexGen Energy (NYSE:NXE)

Historical Stock Chart

From Mar 2024 to Apr 2024

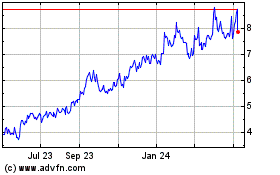

NexGen Energy (NYSE:NXE)

Historical Stock Chart

From Apr 2023 to Apr 2024