Crypto This Tuesday: Grayscale Win Boosts Crypto, Argo Blockchain Cuts Losses, and More

August 29 2023 - 2:19PM

IH Market News

Court decision boosts Bitcoin and brings US closer to spot crypto

ETF

After a US appeals court instructed the SEC to review its denial

of the Grayscale Bitcoin Trust to become an ETF, Bitcoin

(COIN:BTCUSD) rallied 6.65% to hit $27,843.53. The market

reacted positively, with Grayscale Bitcoin Trust rising 17% and

other crypto assets posting gains. The win was called a

“monumental step” by Grayscale and could have significant

implications for institutional cryptocurrency adoption.

Preliminary agreement between Digital Currency Group and Genesis

creditors to settle debts of billions

The Digital Currency Group (DCG) has reached a tentative

agreement to repay 70-90% of debts owed to Genesis’ unsecured

lenders, its lending arm. The deal comes after Genesis

declared bankruptcy in January 2023, owing more than $3

billion. The repayment involves long-term payments totaling

about $1.1 billion. This settlement comes amid a fraud lawsuit

filed by Gemini against the DCG and its leadership.

SEC requests secrecy in lawsuit against Binance, fueling

speculation about sanctions violations and money laundering

SEC is seeking permission to file sensitive documents in its

lawsuit against Binance, fueling speculation about an ongoing

criminal investigation. This legal move could be linked to the

US Department of Justice investigation into possible violations by

Binance, including money laundering and sanctions issues with

Russian entities. The move comes after Binance restricted the

use of non-Russian fiat currencies for Russian

residents. Additionally, Binance has removed Banco de

Venezuela from its payment options on its peer-to-peer (P2P)

trading service. While Venezuelan private banks remain on the

list, Banco de Venezuela’s removal comes following a Wall Street

Journal report on Binance’s involvement in sanctions evasion.

Iris Energy invests $10 Million in Nvidia GPUs for expanding AI and

cloud computing

Bitcoin mining company Iris Energy has acquired 248 Nvidia

(NASDAQ:NVDA) H100 GPUs for $10 million to expand its operations in

generative artificial intelligence and cloud computing. With a

focus on sustainability, the company plans to use its existing data

centers, powered by renewable sources, to meet the growing demand

for sustainable computing in various sectors. Hardware

delivery is scheduled for the next few months.

Argo Blockchain reduces losses, restructures debt in challenging

crypto market

Argo Blockchain (NASDAQ:ARBK), a digital asset mining company,

cut its net losses to $18.8 million in the first half of 2023, down

50% compared to the same period a year earlier. Revenue also

dropped by 21%, influenced by the drop in Bitcoin prices. The

company was able to cut its debt from $143 million to $75 million

and raise $7.5 million through a stock offering. These

measures are part of a broader restructuring plan to keep the

company viable in a challenging market environment.

Circle and Mercado Pago introduce stablecoin USDC in Chile to fight

inflation

Amid economic uncertainty and high inflation in Chile, Circle

(COIN:USDCUSD) is teaming up with Latin American payments giant

Mercado Pago (NASDAQ:MELI) to offer the stablecoin USDC to Chilean

customers. The objective is to provide a stable and reliable

dollar alternative for more than two million Mercado Pago users,

allowing almost instantaneous transactions. The move is part

of a broader plan to expand the use of USDC in other

jurisdictions.

Mastercard conducts first blockchain innovation sprint with focus

on Multi-Token Network

Mastercard (NYSE:MA) conducted its first blockchain innovation

sprint in London, developing its Multi-Token Network (MTN) with

participation from startups such as Polytrade. MTN aims to

facilitate secure and efficient transactions using digital assets

and serve as a “multi-chain layer 2” for existing

blockchains. The aim is to address the compliance, governance

and interoperability challenges that have limited broader

blockchain adoption. The network also intends to integrate

with Web3 and traditional financial systems.

Polygon launches development kit to power zero-knowledge proof

blockchains

Ethereum scaling company Polygon (COIN:MATICUSD) has

released a Chain Development Kit (CDK) to spur the development of

blockchains powered by zero-knowledge (ZK) proofs. This open

source kit will allow developers to create their own interoperable

Layer 2 chains using Polygon’s ZK technology. The initiative

comes in response to the growing trend of using ‘rollups’ and ZK in

Ethereum scaling. Polygon aims to make sending and receiving

value as simple as exchanging information online.

MoonPay Ventures invests in Web3, gaming and fintech startups

MoonPay, a $3.4 billion cryptocurrency payment infrastructure

company, has launched MoonPay Ventures to invest in early-stage

startups focused on Web3, gaming and fintech. The investment

arm intends to allocate between US$100,000 and US$1 million in

initial and Series A rounds. With more than 25 investments already

made, MoonPay Ventures seeks to accelerate the adoption of these

startups, with a focus on commercial ROI and the development of

efficient operations.

Tradeteq launches US treasury tokens on XDC blockchain network

Tradeteq, a UK firm specializing in the private debt market, has

launched an offering of US Treasury Yield (USTY) tokens on the

layer 1 blockchain of the XDC Network. The tokens are

affordable for professional investors and managed by

Securitize. The offering comes at a time of growing interest

in tokenizing real-world assets, with demand for tokenized

Treasuries rising significantly to $622 million this year.

CoinSwitch reduces staff by 8% due to bearish cryptocurrency market

in India

Indian cryptocurrency exchange CoinSwitch has laid off 44

members of its customer support team, representing around 8% of its

total workforce. The company justified the decision by

pointing to the “prolonged winter of cryptocurrencies” and a drop

in customer queries. The staff cut comes a week after CoinDCX,

another major Indian exchange, also cut its staff by 12%. Both

layoffs are seen in the context of tax challenges and taxes

recently imposed on cryptocurrency exchanges in India.

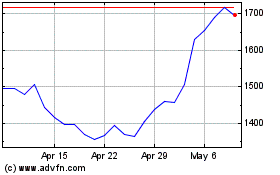

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

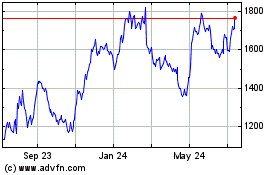

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Apr 2023 to Apr 2024