As filed with the Securities and Exchange Commission

on August 28, 2023

Registration No. 333-270355

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ReTo Eco-Solutions, Inc.

(Exact name of registrant as specified in its charter)

| British Virgin Islands |

|

Not Applicable |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(IRS Employer

Identification No.) |

|

c/o Beijing REIT Technology Development Co.,

Ltd.

X-702, Tower A, 60 Anli Road, Chaoyang District

Beijing,

People’s Republic of China |

|

100101 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| ReTo Eco-Solutions, Inc. 2022 Share Incentive Plan |

| (Full Title of the Plan) |

Vcorp Agent Services, Inc.

25 Robert Pitt Dr., Suite 204

Monsey, New York 10952

(Name and address of agent for service)

Tel: (888) 528-2677

(Telephone number, including area code, of agent

for service)

With copies to:

|

Wei Wang, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 11th Floor

New York, NY 10105

Phone: (212) 370-1300

Fax: (212) 370-7889 |

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”).

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Post-Effective Amendment

No. 1 to Form S-8 is being filed to amend the Registration Statement on Form S-8 (File No. 333-270355) filed by ReTo Eco-Solutions, Inc.,

a British Virgin Islands business company, registered in the British Virgin Islands with company number 1885527 (the “Company”,

“we”, “us”, “our” or similar terminology), with the Securities and Exchange Commission (the “SEC”)

on April 27, 2022 (the “Registration Statement”) to include in Part I of the Registration Statement as amended hereby a “Reoffer

Prospectus” for the securities issuable under the ReTo Eco-Solutions, Inc. 2022 Share Incentive Plan (the “2022 Plan”)

prepared in accordance with the requirements of Part I of Form S-3 under the Securities Act of 1933, as amended (the “Securities

Act”). As a filing fee was paid in connection with the registration of these “control securities” by the Company under

the original Registration Statement, no additional registration fee is required to add these securities pursuant to Rule 457(b)(3) under

the Securities Act.

The Registration Statement

includes, pursuant to General Instruction E to Form S-8, the Reoffer Prospectus in Part I. The Reoffer Prospectus may be utilized for

reofferings and resales by certain executive officers and directors listed in the Reoffer Prospectus who may be deemed “affiliates”

of the Company on a continuous or a delayed basis in the future of up to 74,500 common shares, par value $0.01 per share (the “Common

Shares”) issued under the 2022 Plan. These shares constitute “control securities” or “restricted securities”

which have been issued prior to the filing of this Registration Statement. The Reoffer Prospectus does not contain all of the information

included in the Registration Statement, certain items of which are contained in schedules and exhibits to the Registration Statement,

as permitted by the rules and regulations of the SEC. Statements contained in the Reoffer Prospectus as to the contents of any agreement,

instrument or other document referred to are not necessarily complete. With respect to each such agreement, instrument or other document

filed as an exhibit to the Registration Statement, we refer you to the exhibit for a more complete description of the matter involved,

and each such statement shall be deemed qualified in its entirety by this reference.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. |

Plan Information.* |

| Item 2. |

Registrant Information and Employee Plan Annual Information.* |

| * |

The document(s) containing the information specified in this Part I of

Form S-8 will be sent or given to participants in the ReTo Eco-Solutions, Inc. 2022 Share Incentive Plan as specified by Rule 428(b)(1)

under the Securities Act. Such documents need not be filed with the SEC either as part of this Registration Statement or as a prospectus

or prospectus supplements pursuant to Rule 424. The documents and the documents incorporated by reference in this Registration Statement

pursuant to Item 3 of Part II of this Form S-8, when taken together, constitute a prospectus that meets the requirements of Section 10(a)

of the Securities Act. |

REOFFER PROSPECTUS

ReTo Eco-Solutions, Inc.

UP TO 74,500 COMMON SHARES

ISSUED UNDER THE 2022 SHARE INCENTIVE PLAN

This reoffer prospectus (“prospectus”)

relates to the resale, from time to time, of up to an aggregate of 74,500 common shares, par value $0.01 per share (the “Common

Shares”) of ReTo Eco-Solutions, Inc. (“ReTo”, collectively with its consolidated subsidiaries, the “Company,”

“we,” “us”, “our” or similar terminology), by certain security holders (the “Selling Shareholders”)

identified herein in the section entitled “Selling Shareholders” for such Selling Shareholders’ own account, subject

to the requirements of ReTo’s memorandum and articles of association (the “M&A”) and the BVI Business Companies

Act, 2004 (as amended) (the “Act”). Common Shares have been acquired in connection with awards granted under the ReTo Eco-Solutions,

Inc. 2022 Share Incentive Plan (the “2022 Plan”). The 2022 Plan is intended to provide incentives which will attract, retain

and motivate highly compensate persons such as officers, employees, directors, and consultants to our Company by providing them opportunities

to acquire our Common Shares. Additionally, the 2022 Plan is intended to assist in further aligning the interests of our officers, employees,

directors, and consultants to those of the Company’s other shareholders.

The

persons who are issued Common Shares under the 2022 Plan may include our directors, officers, employees and consultants, certain of whom

may be considered our “affiliates”. Such persons may, but are not required to, sell the Common Shares they acquire pursuant

to this prospectus, subject to the requirements of ReTo’s M&A and the Act. If any additional awards are issued to or shares

are purchased by affiliates under the 2022 Plan, we will file with the Securities and Exchange Commission (the “SEC”) an update

to this prospectus naming such person as a selling shareholder and indicating the number of shares such person is offering pursuant to

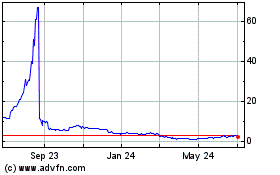

the prospectus. See “Selling Shareholders” on page 21 of this prospectus. Our Common Shares are listed on the Nasdaq

Capital Market under the symbol “RETO.” On August 25, 2023, the closing price of the Common Shares on Nasdaq Capital Market

was $1.09 per share.

We will not receive any proceeds

from any sale of Common Shares offered pursuant to this prospectus. The Common Shares may be offered from time to time by any or all of

the Selling Shareholders through ordinary brokerage transactions, in negotiated transactions or in other transactions, at such prices

as such Selling Shareholder may determine, which may relate to market prices prevailing at the time of sale or be a negotiated price.

See “Plan of Distribution.” Sales may be made through brokers or to dealers, who are expected to receive customary

commissions or discounts. We are paying all expenses of registration incurred in connection with this offering but the Selling Shareholders

will pay all brokerage commissions and other selling expenses.

The

Selling Shareholders and participating brokers and dealers may be deemed to be “underwriters” within the meaning of the Securities

Act of 1933, as amended (the “Securities Act”), in which event any profit on the sale of shares of those Selling Shareholders

and any commissions or discounts received by those brokers or dealers may be deemed to be underwriting compensation under the Securities

Act.

ReTo is a business company

incorporated in the British Virgin Islands (“BVI”). As a holding company with no material operations of its own, ReTo conducts

substantially all of its operations through its subsidiaries established in the People’s Republic of China (the “PRC”

or “China”). Investors in the Common Shares should be aware that they may never directly hold equity interests in the Chinese

operating entities, but rather purchasing equity solely in ReTo, our BVI holding company, which does not directly own substantially all

of our business in China conducted by our subsidiaries. Common Shares offered in this offering are shares of our BVI holding company instead

of shares of our subsidiaries in China. When used herein, the references to laws and regulations of “China” or the “PRC”

are only to such laws and regulations of mainland China, excluding, for the purpose of this prospectus only, Taiwan, Hong Kong and Macau.

As we conduct

substantially all of our operations in China, we are subject to legal and operational risks associated with having substantially all

of our operations in China, which risks could result in a material change in our operations and/or the value of the securities we

are registering for sale or could significantly limit or completely hinder our ability to offer or continue to offer our securities

to investors and cause the value of our securities to significantly decline or be worthless. Recently, the PRC government initiated

a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little

advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in

anti-monopoly enforcement. We have relied on the opinion of our PRC counsel, Yuan Tai Law Offices, that as of the date of this

prospectus, we are not directly subject to these regulatory actions or statements, as we have not implemented any monopolistic

behavior and our business does not involve large-scale collection of user data, implicate cybersecurity, or involve any other type

of restricted industry. None of our PRC subsidiaries currently operates in an industry that prohibits or limits foreign investment.

As a result, as advised by our PRC counsel, Yuan Tai Law Offices, other than those requisite for a domestic company in mainland

China to engage in the businesses similar to those of our PRC subsidiaries, none of our PRC subsidiaries is required to obtain any

permission from Chinese authorities, including the China Securities Regulatory Commission (the “CSRC”), the Cyberspace

Administration of China (the “CAC”), or any other governmental agency that is required to approve its current

operations. On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by

Domestic Companies (the “Trial Measures”), effective on March 31, 2023, which requires the filing with the CSRC of the

overseas offering and listing plans and the follow-on offering plans by PRC domestic companies under certain conditions, and the

filing with the CSRC by their underwriters associated with such companies’ overseas securities offering and listing. In

addition, any actions by the PRC government to exert more oversight and control over offerings that are conducted overseas and

foreign investment in China-based issuers or any failure of us to fully comply with new regulatory requirements may significantly

limit or completely hinder our ability to offer or continue to offer our securities, cause significant disruption to our business

operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of

operations and cause our securities to significantly decline in value or become worthless. Since these statements and regulatory

actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is

highly uncertain what potential impact such modified or new laws and regulations will have on our daily business operations, or

ability to accept foreign investments and list on a U.S. or other foreign exchange. The Standing Committee of the National

People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations

or implementing rules that require our company or any of our subsidiaries to obtain regulatory approval from Chinese authorities

before offering securities in the U.S. Any future Chinese, U.S., British Virgin Islands or other laws, rules and regulations that

place restrictions on capital raising or other activities by companies with extensive operations in China could adversely affect our

business and results of operations. See “Risk Factors — Risks Related to Doing Business in China”

beginning on page 16 for a detailed description of various risks related to doing business in China and other information that

should be considered before making a decision to purchase any of our securities.

Furthermore, as more

stringent criteria have been imposed by the SEC and the Public Company Accounting Oversight Board (the “PCAOB”) recently,

our securities may be prohibited from trading if our auditor cannot be fully inspected. On December 16, 2021, the PCAOB issued its determination

that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China

and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB included in the report of its determination

a list of the accounting firms that are headquartered in mainland China or Hong Kong. This list does not include our auditor, YCM CPA,

Inc. Our auditor is based in the U.S., registered with PCAOB and subject to laws in the United States pursuant to which the PCAOB conducts

regular inspections to assess its compliance with the applicable professional standards. On August 26, 2022, the CSRC, the Ministry of

Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), taking the first

step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China

and Hong Kong. However, uncertainties exist with respect to the implementation of this framework and there is no assurance that the PCAOB

will be able to execute, in a timely manner, its future inspections and investigations in a manner that satisfies the Protocol if it

is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits

of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections

of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control

procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate, then such lack

of inspection could cause our securities to be delisted from the stock exchange.

As a holding company, ReTo

relies on dividends and other distributions on equity paid by its operating subsidiaries for cash and financing requirements, including

the funds necessary to pay dividends and other cash distributions to its shareholders or to service any expenses it may incur. Our PRC

subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC

subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, as determined in accordance

with mainland China accounting standards and regulations. In addition, under PRC law, each of our PRC subsidiaries is required to set

aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach

50% of its registered capital. These reserves are not distributable as cash dividends. If any of our PRC subsidiaries incurs debt on its

own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to ReTo. To date, there have not

been any such dividends or other distributions from our PRC subsidiaries to our subsidiary located outside of China, ReTo or its shareholders

outside of China. Furthermore, as of the date of this prospectus, neither ReTo nor any of its subsidiaries have ever paid dividends or

made distributions to U.S. investors. ReTo is permitted under PRC laws and regulations as an offshore holding company to provide funding

to its PRC subsidiaries in China through shareholder loans or capital contributions, subject to satisfaction of applicable government

registration, approval and filing requirements. According to the relevant PRC regulations on foreign-invested enterprises in China, there

are no quantity limits on ReTo’s ability to make capital contributions to its PRC subsidiaries. However, our PRC subsidiaries may

not procure loans which exceed the higher of (i) difference between their total investment amount as recorded in the Foreign Investment

Comprehensive Management Information System and their respective registered capital and (ii) 2.5 times of their net worth. In the future,

cash proceeds raised from overseas financing activities may continue to be transferred by ReTo to the PRC subsidiaries via capital contribution

or shareholder loans, as the case may be. We intend to retain most, if not all, of our available funds and any future earnings for the

development and growth of our business in China. We do not expect to pay dividends or distribute earnings in the foreseeable future.

To date, fund transfers

have occurred between ReTo and its subsidiaries. The sources of funds of ReTo to its subsidiaries primarily consisted of proceeds from

equity and debt financings.

We maintain bank accounts

in China, including cash in Renminbi in the amount of approximately RMB 1.5 million and cash in USD in the amount of approximately US$212,000

as of July 31, 2023. Funds are transferred between ReTo and its subsidiaries for their daily operation purposes. The transfer of funds

between our PRC subsidiaries are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application

of Law in the Trial of Private Lending Cases (2020 Second Revision, the “Provisions on Private Lending Cases”), which was

implemented on January 1, 2021, to regulate the financing activities between natural persons, legal persons and unincorporated organizations.

The Provisions on Private Lending Cases set forth that private lending contracts will be upheld as invalid under the circumstance that

(i) the lender swindles loans from financial institutions for relending; (ii) the lender relends the funds obtained by means of a loan

from another profit-making legal person, raising funds from its employees, illegally taking deposits from the public; (iii) the lender

who has not obtained the lending qualification according to the law lends money to any unspecified object of the society for the purpose

of making profits; (iv) the lender lends funds to a borrower when the lender knows or should have known that the borrower intended to

use the borrowed funds for illegal or criminal purposes; (v) the lending is in violation of public orders or good morals; or (vi) the

lending is in violation of mandatory provisions of laws or administrative regulations. We have relied on the opinion of our PRC counsel,

Yuan Tai Law Offices, that the Provisions on Private Lending Cases does not prohibit using cash generated from one subsidiary to fund

another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC subsidiaries’

ability to transfer cash between subsidiaries. As of the date of this prospectus, we have no cash management policies that dictate how

funds are transferred between ReTo and its subsidiaries.

Most of our cash is in

Renminbi, and the PRC government could prevent the cash maintained in mainland China or Hong Kong from leaving, could restrict deployment

of the cash into the business of our subsidiaries and restrict the ability to pay dividends.

Investing in our Commons

Shares involves substantial risk. See “Risk Factors” beginning on page 19 of this prospectus for a discussion of certain

risks and other factors that you should consider before purchasing our Common Shares.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is August 28, 2023.

TABLE OF CONTENTS

Please read this prospectus

and the documents incorporated by reference herein carefully. These documents describe our business, our financial condition and our results

of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on the information contained or incorporated by reference in this prospectus. We and the Selling Shareholders have

not authorized anyone to provide you with any information or to make any representations about us, the securities being offered pursuant

to this prospectus or any other matter discussed or incorporated by reference in this prospectus, other than the information and representations

contained or incorporated by reference in this prospectus. If any other information or representation is given or made, such information

or representation may not be relied upon as having been authorized by us or the Selling Shareholders.

The information contained

or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery

of this prospectus or of any sale of our Common Shares. Neither the delivery of this prospectus nor any distribution of securities in

accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this

prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities laws.

We are responsible for the

disclosure in this prospectus. However, this prospectus (including the documents incorporated by reference herein) includes industry data

that we obtained from internal surveys, market research, publicly available information and industry publications. The market research,

publicly available information and industry publications that we use generally state that the information contained therein has been obtained

from sources believed to be reliable. Such information contained or incorporated by reference herein represents the most recently available

data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with

any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications

and additional uncertainties regarding the other forward-looking statements in this prospectus.

Unless otherwise indicated

or the context implies otherwise:

| |

● |

“Act” refers to The BVI Business Companies Act, 2004 (as amended); |

| |

● |

“Beijing REIT” refers to Beijing REIT Technology Development Co., Ltd., a PRC limited liability company; |

| |

● |

“Beijing REIT Ecological” refers to Beijing REIT Ecological Engineering Technology Co., Ltd., a PRC limited liability company; |

| |

● |

“BVI” refers to the British Virgin Islands; |

| |

● |

“China” or the “PRC” refers to the People’s Republic of China and the term “Chinese” has a correlative meaning for the purpose of this prospectus; |

| |

● |

“Common Shares” refers to common shares of par value $0.01 per share issued in ReTo; |

| |

● |

“CSRC” refers to the China Securities Regulatory Commission; |

| |

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| |

● |

“FINRA” refers to the Financial Industry Regulatory Authority, Inc.; |

| |

● |

“Hainan Coconut” refers to Hainan Coconut Network Freight Co., Ltd., a limited liability company incorporated in mainland China and subsidiary of Yangpu Fangyuyuan; |

| |

● |

“Hainan Kunneng” refers to Hainan Kunneng Direct Supply Chain Management Co., Ltd., a limited liability company incorporated in mainland China and subsidiary of Yangpu Fangyuyuan; |

| |

● |

“Hainan Yile IoT” refers to Hainan Yile IoT Technology Co., Ltd, a PRC limited liability company and subsidiary of REIT Mingde; |

| |

● |

“Hong Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| |

● |

“IoV Technology Research” refers to Hainan Yile IoV Technology Research Institute Co., Ltd., a limited liability company incorporated in mainland China and subsidiary of Hainan Yile IoT; |

| |

● |

“JOBS Act” refers to the Jumpstart Our Business Startups Act, enacted in April 2012; |

| |

● |

“M&A” refers to the amended and restated memorandum and articles of association of ReTo, currently in effect and as amended from time to time; |

| |

● |

“Macau” refers to the Macao Special Administrative Region of the PRC; |

| |

● |

“mainland China” refers to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan, Hong Kong and Macau; |

| |

● |

“MOFCOM” refers to China’s Ministry of Commerce; |

| |

● |

“PCAOB” refers to the Public Company Accounting Oversight Board of the United States; |

| |

● |

“PRC subsidiaries” refers to the Company’s subsidiaries that were incorporated in mainland China; |

| |

● |

“REIT Changjiang” refers to REIT MingSheng Environment Protection Construction Materials (Changjiang) Co., Ltd., a PRC limited liability company, which was disposed in December 2021; |

| |

● |

“REIT Construction” refers to Hainan REIT Construction Engineering Co., Ltd., a PRC limited liability company, which was dissolved on February 9, 2023; |

| |

● |

“REIT Holdings” refers to REIT Holdings (China) Limited, a Hong Kong limited company and a wholly owned subsidiary of ReTo; |

| |

● |

“REIT Mingde” refers to Hainan REIT Mingde Investment Holding Co., Ltd., a PRC limited liability company and a wholly owned subsidiary of REIT Technology Development Co., Ltd.; |

| |

● |

“REIT Ordos” Refers to REIT Ecological Technology Co., Ltd., a limited liability company incorporated in mainland China and a wholly owned subsidiary of REIT Holdings; |

| |

● |

“REIT Technology” refers to REIT Technology Development Co., Ltd., a PRC limited liability company and subsidiary of REIT Holdings; |

| |

● |

“Renminbi” or “RMB” refers to the legal currency of the People’s Republic of China; |

| |

● |

“ReTo” refers to ReTo Eco-Solutions, Inc., a BVI business company (registered in the BVI with company number 1885527); |

| |

● |

“SAFE” refers to China’s State Administration of Foreign Exchange; |

| |

● |

“SEC” refers to the U.S. Securities and Exchange Commission; |

| |

● |

“Securities Act” refers to the Securities Act of 1933, as amended; |

| |

● |

“Xinyi REIT” refers to REIT New Materials Xinyi Co., Ltd, a joint venture established by Beijing REIT; |

| |

● |

“Yangpu Fangyuyuan” refers to Yangpu Fangyuyuan United Logistics Co., Ltd., a limited liability company incorporated in mainland China and a subsidiary of REIT Mingde; |

| |

● |

“U.S. dollars”, “US$” and “$” refer to the legal currency of the United States; and |

| |

● |

“We”, “us”, “our”, or the “Company” refers to ReTo Eco-Solutions, Inc. and its subsidiaries, unless the context requires otherwise. |

Our reporting and functional

currency is the Renminbi. Solely for the convenience of the reader, this prospectus contains translations of some RMB amounts into U.S.

dollars, at specified rates. Except as otherwise stated in this prospectus, all translations from RMB to U.S. dollars are made at RMB6.8972

to US$1.00, the rate published by the Federal Reserve Board on December 31, 2022. No representation is made that the RMB amounts referred

to in this prospectus could have been or could be converted into U.S. dollars at such rate.

Our fiscal year end is December

31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year.

We own or have rights to trademarks

or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In

addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products.

This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective

owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended

to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights,

trade names and trademarks referred to in this prospectus or the documents incorporated by reference herein are listed without their ©,

® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and

trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference herein contains forward-looking statements that reflect our current expectations and views of future events.

Readers are cautioned that known and unknown risks, uncertainties and other factors, including those over which we may have no control

and others listed in the “Risk Factors” section of this prospectus, may cause our actual results, performance or achievements

to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these

forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,”

“potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on

our current expectations and projections about future events that we believe may affect our financial condition, results of operations,

business strategy and financial needs. These forward-looking statements include statements relating to:

| |

● |

the potential impact on our business of the economic, political and social conditions of the PRC; |

| |

● |

any changes in the laws of the PRC or local province that may affect our operations; |

| |

● |

the impact of COVID-19 on our operations; |

| |

|

|

| |

● |

our ability to operate as a going concern; |

| |

● |

the liquidity of our securities; |

| |

|

|

| |

● |

inflation and fluctuations in foreign currency

exchange rates; |

| |

|

|

| |

● |

the ability to realize benefits of the acquisition

of REIT Mingde and integrate and expand its businesses into our existing business and grow and manage growth profitably; |

| |

|

|

| |

● |

our projections for our return on investment in client projects; |

| |

● |

the ability to navigate geographic market risks of our eco-friendly construction materials; |

| |

● |

the ability to maintain a reserve for warranty or defective products and installation claims; |

| |

|

|

| |

● |

our on-going ability to obtain all mandatory

and voluntary government and other industry certifications, approvals, and/or licenses to conduct our business; |

| |

|

|

| |

● |

our ability to maintain effective supply chain of raw materials and our products; |

| |

● |

slowdown or contraction in industries in China in which we operate; |

| |

● |

our ability to maintain or increase our market share in the competitive markets in which we do business; |

| |

● |

our ability to diversify our product and service offerings and capture new market opportunities; |

| |

● |

our estimates of expenses, capital requirements and needs for additional financing and our ability to fund our current and future operations; |

| |

● |

the costs we may incur in the future from complying with current and future laws and regulations and the impact of any changes in the regulations on our operations; and |

| |

|

|

| |

● |

the loss of key members of our senior management. |

These forward-looking statements

involve numerous risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are

reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other matters that

we anticipate could be materially different from our expectations. Important risks and factors that could cause our actual results to

be materially different from our expectations are generally set forth in “Risk Factors” and other sections included

or incorporated by reference in this prospectus. You should thoroughly read this prospectus and the documents incorporated herein by reference

with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of

our forward-looking statements by these cautionary statements.

The forward-looking statements

made in this prospectus relate only to events or information as of the date on which the statements are made in or incorporated by reference

in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events. You should read this prospectus, the documents incorporated by reference into this prospectus and

the documents we have filed as exhibits to the registration statement, of which this prospectus forms a part, completely and with the

understanding that our actual future results may be materially different from what we expect.

PROSPECTUS SUMMARY

Investors in our securities

are not purchasing an equity interest in our operating entities in mainland China but instead are purchasing an equity interest in a British

Virgin Islands holding company.

This summary highlights

selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain

all of the information that may be important to you and your investment decision. Before investing in the securities that we are offering,

you should carefully read this entire prospectus, including the matters set forth under the section of this prospectus captioned “Risk

Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including,

but not limited to, our annual report for the year ended December 31, 2022 (the “2022 Annual Report”) and our other SEC reports.

Overview

We, through our operating

subsidiaries in China, are engaged in the manufacture and distribution of eco-friendly construction materials (aggregates, bricks, pavers

and tiles), made from mining waste (iron tailings), as well as equipment used for the production of these eco-friendly construction materials.

In addition, we provide consultation, design, project implementation and construction of urban ecological protection projects through

our operating subsidiaries in China. We also provide parts, engineering support, consulting, technical advice and service, and other project-related

solutions for our manufacturing equipment and environmental protection projects. As more fully described below under the heading “Our

Products and Services,” through the newly acquired subsidiaries, we have expanded our product and service offerings to include roadside

assistance services, and software development services and solutions utilizing Internet of Things (“IoT”) technologies.

We currently provide a full

spectrum of products and services related to recycling and reuse of solid wastes, from producing eco-friendly construction materials and

manufacturing equipment used to produce construction materials, to project installation. We differentiate us from our competitors through

strong research and development capabilities and advanced technologies and systems.

Our products are eco-friendly,

as they contain approximately 70% of reclaimed iron tailings in place of traditional cement. The use of reclaimed iron tailings assists

in the protection of the environment by saving space in landfills used for the disposal of these materials, and assisting in the remediation

and reclamation of abandoned or closed mining sites. In addition, we believe less energy is consumed when manufacturing our eco-friendly

construction materials as compared with other traditional building materials. We believe our eco-friendly construction materials, with

superior water permeability and competitive prices, are in greater demand than traditional materials as governments and others increase

their focus on reducing the environmental impact of their activities.

Due to China’s recent

emphasis on environmental protection, we believe there is a unique opportunity to grow our company, which we expect will be driven by

demand for our eco-friendly construction materials and equipment used to produce these materials as well as our project construction expertise.

We believe our technological know-how, production capacity, reputation and offerings of products and services will enable us to seize

this opportunity.

Our clients are located throughout

mainland China, and internationally in Middle East, Southeastern Asia, Africa, Europe and North America. We are actively pursuing additional

clients for our products, equipment and projects, internationally in Bangladesh, North America and in additional provinces of China. We

seek to establish long-term relationships with our clients by producing and delivering high-quality products and equipment and by providing

technical support and consulting services after equipment is delivered and projects are completed.

Holding Company Structure

ReTo is a holding company

and a business company incorporated in the British Virgin Islands (“BVI”) with no material operations of its own. We conduct

substantially all of our operations through our subsidiaries established in mainland China. Our equity structure is a direct holding structure,

that is, ReTo, the BVI entity listed in the U.S., controls Beijing REIT and other PRC operating entities through REIT Holdings. See “Prospectus

Summary - History and Development of the Company.”

We face various risks and

uncertainties relating to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex

and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly

regulatory actions, and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain businesses, accept

foreign investments, or list and conduct offerings on a United States or other foreign exchange. These risks could result in a material

adverse change in our operations and the value of our Common Shares, significantly limit or completely hinder our ability to continue

to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risks

relating to doing business in China, see “Risk Factors—Risks Related to Doing Business in China.”

The PRC government’s

significant discretion and authority in regulating our operations and its oversight and control over offerings conducted overseas by,

and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors. Implementation of industry-wide regulations in this nature may cause the value of our securities to significantly

decline or become worthless. For more details, see “Risk Factors—Risks Relating to Doing Business in China— The PRC

government’s significant oversight and discretion over the conduct of our business and may intervene or influence our operations

at any time which could result in a material adverse change in our operation and/or the value of our Common Shares.”

Risks and uncertainties arising

from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations

in China, could result in a material adverse change in our operations and cause our Common Shares to decrease in value or become worthless.

For more details, see “Risk Factors—Risks Relating to Doing Business in China— There are uncertainties regarding

the interpretation and enforcement of PRC laws, rules and regulations. The rules and regulations in China can change quickly with little

advance notice and uncertainties in the interpretation and enforcement of PRC laws, rules and regulations could limit the legal protections

available to you and us.”

Cash and Other Assets Transfers between

the Holding Company and Its Subsidiaries

Upon

the closing of ReTo’s initial public offering (“IPO”) in November 2017, ReTo received net proceeds of approximately

$14.3 million. In March 2021, ReTo issued a convertible debenture to an institutional investor in the principal amount of $2,300,000 and

received net proceeds of $1,476,915. In July 2021, ReTo issued a convertible debenture to an institutional investor in the principal amount

of $2,500,000 and received net proceeds of $2,189,256. In March 2022, ReTo issued the Note (as defined below) in the principal amount

of $3,415,500 and received net proceeds of $3,000,000. On May 25, 2022, ReTo issued 5,970,000 Common Shares to Hainan Tashanshi Digital

Information Co. Ltd. (“Hainan Tashanshi”) at $0.60 per share for aggregate gross proceeds of $3,582,000 (the “Private

Placement”), RMB19.6 million (approximately $2.9 million) of which was transferred to Beijing REIT as a shareholder loan and approximately

RMB4.4 million (approximately $0.6 million) of which was transferred to Beijing REIT Ecological as a shareholder loan. In May 2023, ReTo

closed its registered direct public offering of an aggregate of 2,000,000 Common Shares for a total $6,600,000 in gross proceeds (the

“Registered Direct Offering”). As of the date of this prospectus, with respect to the net proceeds from the IPO, the convertible

debentures, the Note, the Private Placement and the Registered Direct Offering, ReTo had transferred an aggregate of approximately $21.4

million to Beijing REIT through REIT Holdings via shareholder loans and capital contribution and approximately $0.6 million to Beijing

REIT Ecological via shareholder loans.

Other

than the IPO, the convertible debentures, the Note, the Private Placement and the Registered Direct Offering, ReTo has not raised funds

from investors as of the date of this prospectus, nor has it transferred any other funds to its subsidiaries. To date, there have not

been any dividends or other distributions from our PRC subsidiaries to REIT Holdings and ReTo, both of which are located outside of mainland

China. ReTo, as a BVI holding company, may rely on dividends and other distributions on equity paid by its PRC subsidiaries for its cash

and financing requirements, including the funds necessary to pay dividends and other cash distributions to its shareholders, subject to

ReTo’s M&A and the Act or to service any expenses and other obligations it may incur.

Within

our direct holding structure, the cross-border transfer of funds from ReTo to its PRC subsidiaries is permitted under laws and regulations

of the PRC currently in effect. Specifically, ReTo is permitted to provide funding to its PRC subsidiaries in the form of shareholder

loans or capital contributions, subject to satisfaction of applicable government registration, approval and filing requirements in China.

There are no quantity limits on ReTo’s ability to make capital contributions to its PRC subsidiaries under the PRC law and regulations.

However, the PRC subsidiaries may only procure shareholder loans from REIT Holding in an amount equal to the difference between their

respective registered capital and total investment amount as recorded in the Chinese Foreign Investment Comprehensive Management Information

System or 2.5 times of its net assets, at the discretion of such PRC subsidiary. For additional information, see “Risk Factors—Risks

Related to Doing Business in China — PRC regulation on loans to, and direct investment in, PRC entities by offshore holding companies

and governmental control in currency conversion may delay or prevent us from using the proceeds of our offerings to make loans to or make

additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to

fund and expand our business.”

Subject

to the passive foreign investment company rules, the requirements of ReTo’s M&A and the Act, the gross amount of any distribution

that we make to investors with respect to our securities (including any amounts withheld to reflect PRC withholding taxes) will be taxable

as a dividend, to the extent paid out of our current or accumulated earnings and profits, as determined under United States federal income

tax principles. Any proposed dividend would be subject to ReTo’s M&A and the Act; specifically, ReTo may only pay a dividend

if ReTo’s directors are satisfied, on reasonable grounds, that, immediately after the dividend is paid, the value of its assets

will exceed its liabilities and it will be able to pay its debts as they fall due.

The

PRC Enterprise Income Tax Law (the “EIT Law”) and its implementation rules provide that a withholding tax at a rate of 10%

will be applicable to dividends payable by PRC companies to non-PRC-resident enterprises unless reduced under treaties or arrangements

between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident.

Pursuant to the tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect

to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if

the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment,

the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced

5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will

reduce the amount of dividends we may receive from our PRC subsidiaries.

We

maintain bank accounts in China, including cash in Renminbi in the amount of RMB 1,646,240.89 and cash in USD in the amount of US$227,027

as of June 30, 2023. Funds are transferred between ReTo and its subsidiaries for their daily operation purposes. The transfer of funds

between our PRC subsidiaries are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application

of Law in the Trial of Private Lending Cases (2020 Second Revision, the “Provisions on Private Lending Cases”), which was

implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated organizations.

The Provisions on Private Lending Cases set forth that private lending contracts will be upheld as invalid under the circumstance that

(i) the lender swindles loans from financial institutions for relending; (ii) the lender relends the funds obtained by means of a loan

from another profit-making legal person, raising funds from its employees, illegally taking deposits from the public; (iii) the lender

who has not obtained the lending qualification according to the law lends money to any unspecified object of the society for the purpose

of making profits; (iv) the lender lends funds to a borrower when the lender knows or should have known that the borrower intended to

use the borrowed funds for illegal or criminal purposes; (v) the lending is in violation of public orders or good morals; or (vi) the

lending is in violation of mandatory provisions of laws or administrative regulations. We have relied on the opinion of our PRC counsel,

Yuan Tai Law Offices, that the Provisions on Private Lending Cases does not prohibit using cash generated from one subsidiary to fund

another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC subsidiaries’

ability to transfer cash between subsidiaries. As of the date of this prospectus, we have not adopted any cash management policies that

dictate how funds are transferred between our holding company and our subsidiaries.

There

is no assurance that the PRC government will not intervene or impose restrictions on the ability of us or our subsidiaries to transfer

cash. Most of our cash is in Renminbi, and the PRC government could prevent the cash maintained in our bank accounts in mainland China

from leaving mainland China, could restrict deployment of the cash into the business of our subsidiaries and restrict the ability to pay

dividends. For details regarding the restrictions on our ability to transfer cash between us, and our subsidiaries, see “Risk

Factors — Risks Related to Doing Business in China — The PRC government could prevent the cash maintained in our bank accounts

in mainland China from leaving mainland China, restrict deployment of the cash into the business of its subsidiaries and restrict the

ability to pay dividends to U.S. investors, which could materially adversely affect our operations.” We currently do not have

cash management policies that dictate how funds are transferred between our BVI holding company and our subsidiaries.

Restrictions on Our Ability to Transfer Cash

Out of China and to U.S. Investors

Our PRC subsidiaries’

ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay

dividends to their respective shareholders only out of their accumulated profits, if any, as determined in accordance with PRC accounting

standards and regulations. In addition, under PRC law, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax

profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital. These

reserves are not distributable as cash dividends. If any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments

governing such debt may restrict its ability to pay dividends to ReTo.

To address persistent capital

outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and

the State Administration of Foreign Exchange, or SAFE, implemented a series of capital control measures in the subsequent months, including

stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder

loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other

distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into

foreign currencies and the remittance of currencies out of mainland China. Therefore, we may experience difficulties in completing the

administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any.

Effect of Holding Foreign Companies Accountable

Act

The Holding Foreign Companies

Accountable Act (the “HFCAA”), which was signed into law on December 18, 2020, requires a foreign company to submit that it

is not owned or manipulated by a foreign government or disclose the ownership of governmental entities and certain additional information,

if the PCAOB is unable to inspect completely a foreign auditor that signs the company’s financial statements. If the PCAOB is unable

to inspect the Company’s auditors for three consecutive years, the Company’s securities will be prohibited from trading on

a national exchange. The Accelerating Holding Foreign Companies Accountable Act, which was enacted on December 29, 2022, has decreased

the number of non-inspection years from three years to two, thus reducing the time period before our Common Shares may be prohibited from

trading or delisted.

On December 16, 2021, the

PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms

headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB

included in the report of its determination a list of the accounting firms that are headquartered in mainland China or Hong Kong. This

list did not include YCM CPA Inc., our current auditor. Our auditor, as an auditor of companies that are traded publicly in the United

States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections

to assess its compliance with the applicable professional standards. On August 26, 2022, the PCAOB signed a Statement of Protocol with

the CSRC and MOF, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong without any limitations on scope. However, uncertainties exist with respect to the implementation

of this framework and there is no assurance that the PCAOB will be able to execute, in a timely manner, its future inspections and investigations

in a manner that satisfies the Statement of Protocol. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete

access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate

its previous determinations to the contrary.

These developments could add

uncertainties to the trading of our securities, including the possibility that the SEC may prohibit trading in our securities if the PCAOB

cannot fully inspect or investigate our auditor and we fail to appoint a new auditor that is accessible to the PCAOB and that Nasdaq can

delist our Common Shares.

If it is later determined

that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection.

Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken

in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result

in a lack of assurance that our financial statements and disclosures are adequate and accurate, then such lack of inspection could cause

our securities to be delisted from the stock exchange.

On December 2, 2021, the SEC

adopted final amendments to its rules implementing the HFCAA. Such final rules establish procedures that the SEC will follow in (i) determining

whether a registrant is a “Commission-Identified Issuer” (a registrant identified by the SEC as having filed an annual report

with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable

to inspect or investigate completely because of a position taken by an authority in that jurisdiction) and (ii) prohibiting the trading

of an issuer that is a Commission-Identified Issuer for three consecutive years under the HFCAA. The SEC began identifying Commission-Identified

Issuers for the fiscal years beginning after December 18, 2020. A Commission-Identified Issuer is required to comply with the submission

and disclosure requirements in the annual report for each year in which it was identified. If a registrant is identified as a Commission-Identified

Issuer based on its annual report for the fiscal year ended, for example, September 30, 2021, the registrant will be required to comply

with the submission or disclosure requirements in its annual report filing covering the fiscal year ended September 30, 2022.

For details on the effects

of HFCAA on us, see “Risk Factors — Risks Related to Doing Business in China — Our Common Shares may be delisted

under the HFCAA if the PCAOB is unable to inspect our auditors. The delisting of our Common Shares, or the threat of their being delisted,

may materially and adversely affect the value of your investment. Furthermore, on December 29, 2022, the Accelerating Holding Foreign

Companies Accountable Act was enacted, which amends the HFCAA and requires the SEC to prohibit an issuer’s securities from trading

on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.”

Regulatory Permissions and Developments

We have been advised by our

PRC Counsel, Yuan Tai Law Offices, that pursuant to the relevant laws and regulations in China, none of our PRC subsidiaries’

currently engaged business is stipulated on the Special Administrative Measures for the Access of Foreign Investment (Negative List) (2021

Version) (the “2021 Negative List”) promulgated by the Ministry of Commerce (the “MOFCOM”) and the National Development

and Reform Commission of the People’s Republic of China (the “NDRC”) which entered into force on January 1, 2022. Therefore,

our PRC subsidiaries are able to conduct their business without being subject to restrictions imposed by the foreign investment laws and

regulations of the PRC. Certain of the business scope of our PRC subsidiaries are listed on the 2021 Negative List, such as value-added

telecommunication business, which the ratio of investment by foreign investors in a foreign-invested telecommunication enterprise that

engages in the operation of a value-added telecommunication business (except e-commerce, domestic multi-party communication, storage and

forwarding class and call center) shall not exceed 50%. Based on the confirmation of the PRC subsidiaries, these subsidiaries have not

been actually engaged in such business activities.

Certain of the business stated

on the business license of our PRC subsidiaries are subject to additional licenses and permits, such as value-added telecommunication

certification and construction enterprise qualifications. Based on the confirmation of the PRC subsidiaries, these subsidiaries have not

been actually engaged in business activities those require special licenses or permits and they will only carry out business activities

after obtaining corresponding licenses or permits. Currently, none of our PRC subsidiaries is required to obtain additional licenses or

permits beyond a regular business license for their operations currently being conducted. Each of our PRC subsidiaries is required to

obtain a regular business license from the local branch of the State Administration for Market Regulation (“SAMR”). Each of

our PRC subsidiaries has obtained a valid business license for its respective business scope, and no application for any such license

has been denied.

As of the date of this prospectus,

ReTo and its PRC subsidiaries are not subject to permission requirements from the CSRC, the CAC or any other entity that is required to

approve of its PRC subsidiaries’ operations. Recently, the PRC government initiated a series of regulatory actions and made a number

of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal

activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend

the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

Among other things, the Regulations

on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”) and Anti-Monopoly Law of the

People’s Republic of China promulgated by the SCNPC which became effective in 2008 and amended and put into effect as from August

1, 2022 (the “Anti-Monopoly Law”), established additional procedures and requirements that could make merger and acquisition

activities by foreign investors more time-consuming and complex. Such regulation requires, among other things, that the MOFCOM be notified

in advance of any change-of-control transaction in which a foreign investor acquires control of a PRC domestic enterprise or a foreign

company with substantial PRC operations, if certain thresholds under the Provisions of the State Council on the Standard for Declaration

of Concentration of Business Operators, issued by the State Council in 2008 and amended on September 19, 2018, are triggered. Moreover,

the Anti-Monopoly Law requires that transactions which involve the national security, the examination on the national security shall also

be conducted according to the relevant provisions of the State Council. In addition, the PRC Measures for the Security Review of Foreign

Investment which became effective in January 2021 require acquisitions by foreign investors of PRC companies engaged in military-related

or certain other industries that are crucial to national security be subject to security review before consummation of any such acquisition.

On July 6, 2021, the relevant

PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law.

These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas

listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems

to deal with the risks and incidents faced by China-based overseas-listed companies. As these opinions are recently issued, official guidance

and related implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage. Given

the current PRC regulatory environment, it is uncertain when and whether ReTo, REIT Holdings or any of our PRC subsidiaries will be required

to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission is obtained, whether

it will be denied or rescinded.

On July 10, 2021, the CAC

published the Measures for Cybersecurity Review (Revised Draft for Comments), or the Measures, for public comments, which propose to authorize

the relevant government authorities to conduct cybersecurity review on a range of activities that affect or may affect national security,

including listings in foreign countries by companies that possess the personal data of more than one million users. On December 28, 2021,

the Measures for Cybersecurity Review (2021 Version) was promulgated and became effective on February 15, 2022, which iterates that any

“online platform operators” controlling personal information of more than one million users which seeks to list in a foreign

stock exchange should also be subject to cybersecurity review. The Measures for Cybersecurity Review (2021 Version), further elaborates

the factors to be considered when assessing the national security risks of the relevant activities, including, among others, (i) the risk

of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited the

country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information

being affected, controlled, or maliciously used by foreign governments after listing abroad. We have relied on the opinion of our PRC

counsel, Yuan Tai Law Offices, that as a result of: (i) we do not hold personal information on more than one million users in our business

operations; and (ii) data processed in our business does not have a bearing on national security and thus may not be classified as core

or important data by the authorities, we are not required to apply for a cybersecurity review under the Measures for Cybersecurity Review

(2021 Version).

As advised by our PRC legal

counsel, Yuan Tai Law Offices, the PRC governmental authorities may have wide discretion in the interpretation and enforcement of these

laws, including the interpretation of the scope of “critical information infrastructure operators”. In anticipation of the

strengthened implementation of cybersecurity laws and regulations and the continued expansion of our business, we may face challenges

in addressing its requirements and make necessary changes to our internal policies and practices in data processing. As of the date of

this prospectus, we have not been involved in any investigations on cybersecurity review made by the CAC on such basis, and we have not

received any inquiry, notice, warning, or sanctions in such respect.

On August 20, 2021, the SCNPC

promulgated the Personal Information Protection Law, which integrates the scattered rules with respect to personal information rights

and privacy protection and took effect on November 1, 2021. Personal information refers to information related to identified or identifiable

natural persons which is recorded by electronic or other means and excluding anonymized information. The Personal Information Protection

Law provides that a personal information processor could process personal information only under prescribed circumstances such as with

the consent of the individual concerned and where it is necessary for the conclusion or performance of a contract to which such individual

is a party to the contract. If a personal information processor shall provide personal information to overseas parties, various conditions

shall be met, which includes security evaluation by the national network department and personal information protection certification

by professional institutions. The Personal Information Protection Law raises the protection requirements for processing personal information,

and many specific requirements of the Personal Information Protection Law remain to be clarified by the CAC, other regulatory authorities,

and courts in practice. We may be required to make further adjustments to our business practices to comply with the personal information

protection laws and regulations.

None of our PRC subsidiaries

currently operates in an industry that prohibits or limits foreign investment. As a result, as advised by our PRC counsel, Yuan Tai Law

Offices, other than those requisite for a domestic company in mainland China to engage in the businesses similar to those of our PRC subsidiaries,

none of our PRC subsidiaries is required to obtain any permission from Chinese authorities, including the CSRC, the CAC, or any other

governmental agency that is required to approve its current operations. However, if our PRC subsidiaries do not receive or maintain the

approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change

such that our PRC subsidiaries are required to obtain approval in the future, we may be subject to investigations by competent regulators,

fines or penalties, ordered to suspend our PRC subsidiaries’ relevant operations and rectify any non-compliance, prohibited from

engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our PRC subsidiaries’

operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such

securities to significantly decline in value or become worthless. As of the date of this prospectus, we and our PRC subsidiaries have

received from PRC authorities all requisite licenses, permissions, or approvals needed to engage in the businesses currently conducted

in China, and no permission or approval has been denied.

CSRC released the Trial Measures

on February 17, 2023, which became effective on March 31, 2023. The Trial Measures lay out the filing regulation arrangement for both

direct and indirect overseas listing by PRC domestic companies, and clarify the determination criteria for indirect overseas listing in

overseas markets. Any future securities offerings and listings outside of mainland China by our Company, including but not limited to,

follow-on offerings, secondary listings and going private transactions, will be subject to the filing requirements with the CSRC under

the Trial Measures, and we cannot assure you that we will be able to comply with such filing requirements in a timely manner, or at all. Meanwhile,

CSRC released a notice which provides transitional arrangements for domestic companies which have completed the direct and indirect overseas

listing before the effectiveness of the Trial Measures. Under the Trial Measures and the transitional arrangements, we may be required

to submit (1) a filing report and associated undertaking and (2) PRC legal opinions to the CSRC within three working days after this offering

is completed. According to the guidance on the application of the Trial Measures, issuance of securities for the implementation of equity

incentives is not subject to filing requirements.

As of the date of this prospectus,

we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC or any other PRC governmental authorities

with respect to our listing on Nasdaq. As the Trial Measures were newly published and there is uncertainty with respect to the filing

requirements and their implementation, if we are required to submit to the CSRC and complete the filing procedure, we cannot be sure that

we will be able to complete such filings in a timely manner, or at all. Any failure or perceived failure of us to fully comply with such

new regulatory requirements could significantly limit or completely hinder our ability to offer or continue to offer securities to investors,

cause significant disruption to our business operations, and severely damage our reputation, which could materially and adversely affect

our financial condition and results of operations and could cause the value of our securities to significantly decline or be worthless.

Except as disclosed above,

in connection with our issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules, as of the

date of this prospectus, we and our PRC subsidiaries, (i) are not required to obtain permissions from the PRC authorities, including the

CSRC or the CAC, and (ii) have not received or were denied such permissions by any PRC authority. We are subject to the risks of uncertainty

of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that the permission or approvals

discussed here are not required, that applicable laws, regulations or interpretations change such that we and our PRC subsidiaries are

required to obtain approvals in the future.

Our Products and Services

Eco-Friendly Construction Materials

We manufacture eco-friendly

construction materials (aggregates, bricks, pavers and tiles) through our subsidiary, Xinyi REIT, which operates our plant in Xinyi, Jiangsu

Province. We refer to our construction materials as eco-friendly because we produce them from reclaimed iron mine tailings. Tailings are

the materials left over after the process of separating the valuable fraction from the worthless fraction of an ore. Iron ore tailings

generally consist of hard rock and sand. Waste rock and tailings constitute the largest (by volume) industrial solid waste generated in

the mining process. Xinyi REIT has utilized construction and demolition waste (which is the disposed bricks and/or concrete after the

old building is dismantled) as the raw materials to produce the products. By recycling iron tailings and utilizing the construction and

demolition waste, we believe that our construction materials manufacturing process is a viable and environmentally friendly solution to

disposal problems associated with these materials.

Traditional bricks in China

consist primarily of clay, which is mixed with water and silt, pressed into a mold for shaping, then fired in a kiln, or furnace. We use

reclaimed iron tailings or construction and demolition waste primarily as a substitute for rocks. Through vibration technology, with these

raw materials inputted, the finished products can come out with different shape and types. Since the whole production is cured without

fire, this process has the benefits of less space required for production and less pollution generated to the environment. We believe

iron tailings or construction and demolition waste reduce both the density and heat conductivity of our construction materials without

sacrificing their durability and strength. Our construction materials’ density and strength meet or exceed China national standards.

In addition, because we use iron tailings or construction and demolition waste in the manufacturing process, we believe our construction

materials are consistent with China’s recent environmental protection policies, such as energy conservation included in the 2016

China’s 14th Five-Year Plan (2021-2025).

In addition to iron tailings

and construction and demolition waste, our construction materials contain river sand and granite. Our eco-friendly construction materials

are produced on a fully automatic production line primarily based upon our proprietary technology.

Our eco-friendly construction

materials include, without limitation, the following:

| |

● |