0001859795faise--12-31June, 30. 20230001859795nvx:AccumulatedLossesMember2023-06-300001859795ifrs-full:IssuedCapitalMember2021-12-310001859795ifrs-full:OtherEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2022-12-310001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMemberifrs-full:MajorOrdinaryShareTransactionsMembersrt:ChiefExecutiveOfficerMember2023-04-052023-04-050001859795ifrs-full:IssuedCapitalMember2022-12-310001859795ifrs-full:DerivativesMember2023-06-300001859795ifrs-full:GrossCarryingAmountMembernvx:PlantAndEquipmentMember2022-12-310001859795nvx:SecuritiesPurchaseAgreementMembernvx:KorePowerMember2022-01-312022-01-3100018597952023-01-0100018597952023-06-212023-06-210001859795us-gaap:LeaseholdImprovementsMember2023-06-300001859795ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2022-12-3100018597952023-06-300001859795nvx:ExerciseOfOptionsOneMember2023-03-150001859795nvx:NonKeyManagementPersonnelEmployeesFourMembernvx:PerformanceRightsMember2023-01-012023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:HardwareSalesMembernvx:BatteryTechnologyMember2022-01-012022-06-300001859795ifrs-full:IndividualAssetsOrCashgeneratingUnitsMember2022-12-310001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:ShareBasedCompensationArrangementByShareBasedPaymentAwardAwardGrantDateOneMembernvx:PerformanceRightsMembernvx:RashdaButtarMember2023-01-012023-06-300001859795nvx:PlantAndEquipmentMember2023-01-012023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:ConsultingSalesMembernvx:BatteryTechnologyMember2022-01-012022-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMembernvx:PlantAndEquipmentMember2022-12-310001859795ifrs-full:BuildingsMember2023-01-012023-06-300001859795ifrs-full:TechnologybasedIntangibleAssetsMember2023-01-012023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:ShareBasedCompensationArrangementByShareBasedPaymentAwardAwardGrantDateOneMembernvx:PerformanceRightsMembernvx:NickLiverisMember2023-01-012023-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2023-06-300001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2022-01-012022-06-300001859795nvx:NonKeyManagementPersonnelEmployeesTwoMembernvx:PerformanceRightsMember2023-01-012023-06-300001859795ifrs-full:ReserveOfSharebasedPaymentsMember2022-01-012022-06-300001859795nvx:ExerciseOfOptionsOneMember2023-03-152023-03-150001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2023-06-300001859795nvx:ExerciseOfPerformanceRightsMember2023-04-122023-04-120001859795nvx:AccumulatedLossesMember2023-01-012023-06-300001859795ifrs-full:UnallocatedAmountsMember2022-01-012022-06-300001859795ifrs-full:OperatingSegmentsMembernvx:HardwareSalesMembernvx:BatteryTechnologyMember2023-01-012023-06-300001859795nvx:ExerciseOfOptionsOneMember2023-01-012023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:BatteryMaterialsMember2023-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2022-12-310001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembersrt:ChiefExecutiveOfficerMember2023-01-012023-06-300001859795ifrs-full:ReserveOfEquityComponentOfConvertibleInstrumentsMember2022-12-310001859795ifrs-full:OperatingSegmentsMembernvx:BatteryMaterialsMember2022-12-310001859795ifrs-full:LongtermBorrowingsMember2023-01-012023-06-3000018597952021-12-310001859795nvx:PerformanceRightsMember2023-01-012023-06-300001859795ifrs-full:ReserveOfEquityComponentOfConvertibleInstrumentsMember2021-12-310001859795nvx:LgEnergySolutionMember2023-01-012023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembernvx:RashdaButtarMember2023-01-012023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMemberifrs-full:MajorOrdinaryShareTransactionsMembersrt:ChiefFinancialOfficerMember2023-04-052023-04-050001859795ifrs-full:TechnologybasedIntangibleAssetsMember2023-06-300001859795nvx:HardwareSalesMember2023-01-012023-06-300001859795nvx:AccumulatedLossesMember2022-12-310001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2021-12-310001859795ifrs-full:UnallocatedAmountsMember2023-01-012023-06-300001859795ifrs-full:OtherEquitySecuritiesMember2022-12-310001859795ifrs-full:OperatingSegmentsMembernvx:BatteryMaterialsMember2022-01-012022-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMemberus-gaap:LeaseholdImprovementsMember2022-12-310001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:ShareBasedCompensationArrangementByShareBasedPaymentAwardAwardGrantDateOneMembernvx:PerformanceRightsMembernvx:ChrisBurnsMember2023-01-012023-06-300001859795ifrs-full:GrossCarryingAmountMembernvx:PlantAndEquipmentMember2023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembernvx:RashdaButtarMember2023-04-052023-04-050001859795nvx:ExerciseOfOptionsTwoMember2023-03-152023-03-150001859795nvx:PlantAndEquipmentMember2023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembersrt:ChiefFinancialOfficerMember2023-01-012023-06-300001859795nvx:NonKeyManagementPersonnelEmployeesThreeMembernvx:PerformanceRightsMember2023-01-012023-06-3000018597952022-11-300001859795us-gaap:LandMember2022-12-310001859795nvx:NonKeyManagementPersonnelEmployeesFiveMembernvx:PerformanceRightsMember2023-01-012023-06-300001859795nvx:SecuritiesPurchaseAgreementMembernvx:KorePowerMember2022-01-310001859795ifrs-full:OperatingSegmentsMembernvx:BatteryTechnologyMember2023-01-012023-06-300001859795nvx:SecuritiesPurchaseAgreementMembernvx:KorePowerMember2023-01-012023-06-3000018597952023-06-210001859795ifrs-full:BuildingsMember2022-12-310001859795nvx:ExerciseOfPerformanceRightsMember2023-05-012023-05-010001859795us-gaap:LeaseholdImprovementsMemberifrs-full:GrossCarryingAmountMember2023-06-300001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2023-01-012023-06-300001859795ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:BatteryTechnologyMember2022-12-310001859795ifrs-full:ReserveOfSharebasedPaymentsMember2021-12-310001859795ifrs-full:GrossCarryingAmountMemberus-gaap:LandMember2022-12-310001859795nvx:ConsultingSalesMember2023-01-012023-06-300001859795ifrs-full:BuildingsMember2023-06-300001859795nvx:AccumulatedLossesMember2022-01-012022-06-300001859795ifrs-full:IssuedCapitalMember2022-06-300001859795ifrs-full:ReserveOfSharebasedPaymentsMember2023-06-300001859795nvx:ExerciseOfPerformanceRightsMember2023-03-152023-03-150001859795ifrs-full:UnallocatedAmountsMember2022-12-310001859795ifrs-full:OperatingSegmentsMembernvx:BatteryTechnologyMember2022-01-012022-06-300001859795ifrs-full:DerivativesMember2023-01-012023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:GraphiteExplorationMember2022-12-310001859795us-gaap:LandMember2023-01-012023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:GraphiteExplorationMember2023-06-3000018597952022-12-3100018597952023-01-012023-06-300001859795ifrs-full:ConstructionInProgressMember2023-01-012023-06-300001859795ifrs-full:IndividualAssetsOrCashgeneratingUnitsMember2023-06-300001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2022-06-300001859795ifrs-full:IssuedCapitalMember2022-01-012022-06-300001859795nvx:AccumulatedLossesMember2021-12-310001859795nvx:ConsultingSalesMember2022-01-012022-06-300001859795ifrs-full:ReserveOfSharebasedPaymentsMember2022-12-310001859795ifrs-full:IssuedCapitalMember2023-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMembernvx:PlantAndEquipmentMember2023-06-300001859795ifrs-full:IssuedCapitalMember2023-01-012023-06-300001859795ifrs-full:ConstructionInProgressMember2023-06-300001859795nvx:HardwareSalesMember2022-01-012022-06-300001859795nvx:ExerciseOfPerformanceRightsMember2023-06-292023-06-290001859795ifrs-full:ReserveOfSharebasedPaymentsMember2022-06-300001859795ifrs-full:ReserveOfSharebasedPaymentsMember2023-01-012023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembernvx:RashdaButtarMemberifrs-full:MajorOrdinaryShareTransactionsMember2023-04-052023-04-050001859795nvx:AccumulatedLossesMember2022-06-300001859795ifrs-full:OtherEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2023-06-300001859795ifrs-full:GrossCarryingAmountMemberus-gaap:LandMember2023-06-300001859795ifrs-full:OtherEquitySecuritiesMember2023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:BatteryMaterialsMember2023-01-012023-06-300001859795ifrs-full:UnallocatedAmountsMember2023-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembernvx:ZhannaGolodrygaMember2023-01-012023-06-300001859795ifrs-full:ReserveOfEquityComponentOfConvertibleInstrumentsMember2022-06-300001859795ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2023-06-300001859795nvx:NonKeyManagementPersonnelEmployeesOneMembernvx:PerformanceRightsMemberifrs-full:OrdinarySharesMembernvx:EventsAfterReportingPeriodMember2023-08-250001859795us-gaap:LeaseholdImprovementsMemberifrs-full:GrossCarryingAmountMember2022-12-310001859795nvx:NonKeyManagementPersonnelEmployeesOneMembernvx:PerformanceRightsMember2023-01-012023-06-3000018597952022-01-012022-12-310001859795us-gaap:LeaseholdImprovementsMember2022-12-310001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembersrt:ChiefFinancialOfficerMember2023-04-052023-04-050001859795ifrs-full:LongtermBorrowingsMember2023-06-300001859795ifrs-full:OperatingSegmentsMembernvx:ConsultingSalesMembernvx:BatteryTechnologyMember2023-01-012023-06-300001859795nvx:PerformanceRightsMembernvx:EventsAfterReportingPeriodMember2023-07-012023-08-250001859795ifrs-full:TechnologybasedIntangibleAssetsMember2022-12-3100018597952022-06-300001859795ifrs-full:KeyManagementPersonnelOfEntityOrParentMembernvx:PerformanceRightsMembersrt:ChiefExecutiveOfficerMember2023-04-052023-04-050001859795nvx:PlantAndEquipmentMember2022-12-310001859795ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2022-12-310001859795nvx:ExerciseOfOptionsTwoMember2023-01-012023-06-300001859795us-gaap:LandMember2023-06-300001859795ifrs-full:AccumulatedDepreciationAndAmortisationMemberus-gaap:LeaseholdImprovementsMember2023-06-300001859795ifrs-full:ConstructionInProgressMember2022-12-310001859795ifrs-full:OperatingSegmentsMembernvx:BatteryTechnologyMember2023-06-300001859795nvx:ExerciseOfPerformanceRightsMember2023-01-012023-06-300001859795ifrs-full:OtherEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2023-01-012023-06-300001859795nvx:ExerciseOfOptionsTwoMember2023-03-150001859795us-gaap:LeaseholdImprovementsMember2023-01-012023-06-300001859795nvx:SecuritiesPurchaseAgreementMembernvx:KorePowerMember2022-11-012022-11-3000018597952022-01-012022-06-300001859795ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2022-12-310001859795ifrs-full:ReserveOfEquityComponentOfConvertibleInstrumentsMember2023-06-30iso4217:AUDnvx:Tonnesxbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023

|

|

|

|

001-41208 |

|

|

(Commission File Number) |

|

NOVONIX LIMITED

(Translation of registrant’s name into English)

Level 38

71 Eagle Street

Brisbane, QLD 4000 Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

NOVONIX LIMITED |

|

|

|

|

|

|

By: |

|

/s/ Dr. John Christopher Burns |

|

|

Dr. John Christopher Burns |

|

|

Chief Executive Officer |

Date: August 28, 2023

NOVONIX Limited has changed its financial year end to December 31 (previously June 30)

|

|

|

Providing revolutionary solutions to the battery industry |

NOVONIX LIMITED

ABN 54 157 690 830

INTERIM FINANCIAL REPORT FOR THE HALF-YEAR ENDED

JUNE 30, 2023

HALF-YEAR REPORT - JUNE 30, 2023

|

|

Directors |

Admiral R J Natter, US Navy (Ret.) D Akerson BS (Eng), MSc (Economics) A Bellas B. Econ, DipEd, MBA, FAICD, FCPA, FGS R Edmonds CPA, BBA (Acct) Z Golodryga MEng (Mech) Andrew N. Liveris AO, BE (Hons) Doctor of Science (honoris causa) J Oelwang BS (Hons) |

|

|

Secretary |

S M Yeates CA, B.Bus |

|

|

Registered office in Australia |

McCullough Robertson Level 11, Central Plaza Two 66 Eagle Street Brisbane QLD 4000 |

|

|

Principal place of business |

Level 38, 71 Eagle Street Brisbane QLD 4000 |

|

|

Share register |

Link Market Services Limited Level 21, 10 Eagle Street Brisbane QLD 4000 www.linkmarketservices.com.au |

|

|

Auditor |

PricewaterhouseCoopers 480 Queen Street Brisbane QLD 4000 www.pwc.com.au |

|

|

Solicitors |

Allens Linklaters Level 26 480 Queen Street Brisbane QLD 4000 |

|

|

Bankers |

Commonwealth Bank of Australia |

|

|

Stock exchange listing |

NOVONIX Limited shares are listed on the Australian Securities Exchange ("ASX") and American Depositary Receipts ("ADR’s") are listed on the Nasdaq Stock Market. |

|

|

Website address |

www.novonixgroup.com |

HALF-YEAR REPORT - JUNE 30, 2023

con

|

|

REVIEW OF OPERATIONS AND ACTIVITIES |

|

|

NOVONIX Limited ("the Group") is a leading battery technology company revolutionising the global lithium-ion battery industry with innovative, sustainable technologies, high-performance materials, and more efficient production methods. The Group manufactures industry-leading battery cell testing equipment, is growing its high-performance synthetic graphite anode material manufacturing operations, and has developed an all-dry zero-waste cathode synthesis process. Through advanced R&D capabilities, proprietary technology, and strategic partnerships, NOVONIX has gained a prominent position in the electric vehicle and energy storage systems battery industry and is powering a cleaner energy future.

Our vision is to provide revolutionary clean energy solutions to the battery industry. Therefore, we are focused on the development of materials and technologies that support key ESG criteria in the field of battery materials and technologies, including: longer life batteries, higher energy efficiency, reduced chemical usage, reduced waste generation, and cleaner power inputs. This effort is rooted in our fundamental Group values of curiosity, collaboration, and commitment that support social impact and embody NOVONIX’s approach to corporate responsibility.

NOVONIX’s Battery Technology Solutions division (“BTS”) focuses on innovative battery research and development, along with providing advanced battery testing equipment and services on a global scale. BTS provides unique visibility across the battery value chain and allows the Group to continue to be an industry leader, delivering materials and technologies to support high-performance and cost-effective battery development. NOVONIX's Anode Materials division (“NAM”) manufactures high-performance synthetic graphite anode materials used to make lithium-ion batteries that power electric vehicles, personal electronics, medical devices, and energy storage units.

Half-Year Results

During the half-year ended June 30, 2023, NOVONIX had an after-tax loss of $28.1 million compared to a $31.0 million loss in the same period in 2022. Cash on the consolidated balance sheet was $99.1 million at June 30, 2023, compared to $99.0 million at December 31, 2022. Net assets over the same period declined $24.1 million to $202.0 million as of June 30, 2023. Total revenue increased 23% to $3.9 million compared to the same 2022 period driven by BTS hardware and service sales. All figures are in U.S. Dollars, unless otherwise noted.

KEY HIGHLIGHTS

For the six months ended June 30, 2023, NOVONIX executed against its long-term strategic initiatives, announced key strategic partnerships, progressed operational knowledge through furnace operations and explored additional avenues to create long-term shareholder value.

|

|

March 2023 |

|

|

NOVONIX has agreed to incorporate a joint venture (“JV”) with TAQAT Development Company (“TAQAT”) to produce battery materials in the Middle East & North Africa (“MENA”) region. |

HALF-YEAR REPORT - JUNE 30, 2023

|

|

April 2023 |

|

|

|

NOVONIX announced the launch of a pilot production facility in Halifax, Nova Scotia, leveraging its patent-pending all-dry zero-waste cathode synthesis technology. |

|

|

May 2023 |

|

|

|

NOVONIX participated in several investor and industry events including Citi’s 2023 Energy & Climate Technology Conference, Evercore ISI Electrification Metals and Enabling Technologies Conference, Rho Motion Q2 EV & Battery Seminar Series Live, and B. Riley Securities 23rd Annual Institutional Investor Conference. |

|

|

June 2023 |

|

|

|

NOVONIX entered into a joint development agreement (“JDA”) with LG Energy Solution ("LGES") to research and develop artificial graphite anode material for lithium-ion batteries. |

|

|

|

NOVONIX issued unsecured convertible loan notes to LGES for proceeds of $30 million. |

|

|

|

NOVONIX joined Accelerate, Canada’s Zero-Emission Vehicle ("ZEV") Supply Chain Alliance, in an effort to strengthen Canada’s battery ecosystem and onshore the supply chain at a pivotal moment for the industry. |

|

|

|

NOVONIX participated in several investor and industry events including Benchmark Minerals Battery Gigafactory USA 2023 Conference, Shaw and Partners, ASX Graphite Virtual Conference, and Jefferies Sales Desk Briefing Video Conference. |

NOVONIX OUTLOOK

As an industry leader, NOVONIX is at the forefront of onshoring the battery supply chain through its product innovation and intellectual property development in battery materials and technology. The global demand for high-performance battery materials and technology continues to increase significantly as the world grapples with increasing energy supply and demand imbalances, as demonstrated by the growing desire for a domestic localised battery supply chain. NOVONIX is opportunistically positioned to benefit from potential U.S. government funding opportunities offered through the Bipartisan Infrastructure Law, Defense Production Act, and Department of Energy Loan Programs Office, all of which aim to advance domestic processing of critical materials.

The Group has built a team of top talent with the experience to drive innovation company-wide and believes it has the next generation technology needed to support the rapidly growing electric vehicle ("EV") and energy storage systems (“ESS”) markets in North America. NOVONIX is focused on scaling its production capacity of synthetic graphite to meet the growing demands of its customers, through increasing production capabilities at its facility in Chattanooga, Tennessee by investing in future expansions. The Group has already recognised significant technological milestones on its proprietary graphitization process and remains on track to commence commercial production in 2024 to support its supply agreement with KORE Power, Inc. ("KORE Power").

HALF-YEAR REPORT - JUNE 30, 2023

In August 2022, the Inflation Reduction Act of 2022 (the “IRA”) was signed into law. The IRA includes an estimated $369 billion in investments related to "climate change and energy security,” including tax and other incentives to promote U.S. production of EVs, renewable energy technologies, and critical minerals. NOVONIX is evaluating several provisions that are aimed at bolstering domestic and regional production of critical materials. These include: (1) a $7,500 federal consumer tax credit, starting in 2023 based on the origin of battery materials and localisation of manufacturing; (2) new "advanced manufacturing" and production tax credits; (3) $500 million appropriation for enhanced use of the Defense Production Act as economic support under the banner of national security; and (4) a $40 billion increase in lending authority under Title XVII of the Energy Policy Act of 2005. The impact of the IRA and other government programs and incentives is unclear. As a result, NOVONIX is currently unable to predict whether other proposed changes will occur, if they will be effective and what the ultimate impact will be on the business.

The Group's strong balance sheet provides a multi-year pathway to fund operating expenses and obtain additional capital to scale its operations to meet the material needs of the growing battery sector in North America. Additionally, NOVONIX remains focused on developing improved and sustainable technologies, pursuing strategic partnerships with leading international companies, and enhancing its intellectual property pipeline that will position the Group at the forefront of next-generation battery technology. NOVONIX's technology, products and processes have been well-received and are being tested by current and potential battery sector customers. The Group is in regular dialogue with tier one cell manufacturers and automotive manufacturers to supply their critical materials for their proposed battery factories. To date, NOVONIX has executed a supply agreement with KORE Power to supply graphite anode material for their gigafactory which is under construction in Arizona. In June 2023, NOVONIX entered into a joint development agreement ("JDA") with LG Energy Solution ("LGES"), and also issued $30 million of unsecured convertible loan notes to LGES. The JDA is intended to lead to the option for LGES to purchase up to 50,000 tonnes of the anode material from NOVONIX over a 10-year period from the start of mass production.

Growth Strategies

NOVONIX’s leadership is focused on the successful execution of its operational strategic road map with the objective of maximising shareholder value through the generation of strong cash flow and the pursuit of profitable, high-growth opportunities. The Group’s key strategies include:

▪Maintain technology leadership throughout the EV battery and energy storage supply chain. NOVONIX is committed to leveraging its competitive advantages to expand offerings and technological know-how into other advanced areas including lithium-metal and beyond lithium-ion technology with a focus on localisation of key elements of the supply chain.

▪Execute on the development of synthetic graphite production capacity with plan to expand to 150,000 tonnes per annum by 2030. The Group plans to reach synthetic graphite production capacity of 10,000 tonnes per annum (“tpa”) at its current Riverside facility, beginning deliveries to KORE Power in 2024 at an initial 3,000 tpa rate, and plans to add an incremental 30,000 tpa production capacity by 2025 and reach 150,000 tpa of total production capacity in North America by 2030.

▪Commercialise our proprietary pipeline of advanced battery technologies. We are currently expanding opportunities to work with partners globally to commercialise our proprietary and patent pending cathode production process. Our broader battery technology pipeline contains a number of innovative materials and processes in advanced anodes, cathodes and electrolytes,

HALF-YEAR REPORT - JUNE 30, 2023

as well as advanced capabilities and solutions for energy storage applications that we continue to develop and believe will be critical to the growth of the clean energy economy. The Group has made significant progress towards commercialising its all-dry zero-waste cathode synthesis technology with its pilot line that will be used to demonstrate large scale production to potential partners and customers.

▪Invest in talent. NOVONIX continues to invest in its personnel through recruitment, training, and development to ensure it attracts and retains the best talent in the industry, which is critical to the growth of our business.

NOVONIX Enterprise Overview

The Group manufactures industry-leading battery cell testing equipment in Canada and is growing its high-performance synthetic graphite anode material manufacturing operations in the United States. Through advanced R&D capabilities, proprietary technology, and strategic partnerships, NOVONIX has gained a prominent position in battery materials for the electric vehicle and energy storage solutions battery industry and is powering a cleaner energy future.

OPERATIONAL STRUCTURE AT A GLANCE

NOVONIX’s synergistic business groups, as depicted below, are integral to the Group’s operating structure, business development, and future strategy.

NOVONIX invests in intellectual property for key materials technologies, including anode and cathode materials, that we believe will enhance the performance of long-life EV and ESS applications. NAM, our anode materials division located in Chattanooga, Tennessee, USA, manufactures high-performance synthetic graphite anode materials used to make lithium-ion batteries that power electric vehicles, personal electronics, medical devices, and energy storage units. BTS, based in Halifax, Nova Scotia, Canada, has a full cell pilot line and extensive cell testing capabilities, and works with tier one customers across the battery value chain. BTS has established an all-dry-zero-waste cathode synthesis pilot line aligned with NOVONIX's mission to develop innovative, sustainable technologies and high-performance materials and provide revolutionary clean energy solutions to the battery industry.

HALF-YEAR REPORT - JUNE 30, 2023

As led by Chief Scientific Advisor Jeff Dahn, and as part of the investment in intellectual property, NOVONIX continues to collaborate with the group led by Dr. Mark Obrovac, a leading battery materials innovator, at Dalhousie University. Pursuant to the terms of the collaborative research agreement with Dalhousie University, NOVONIX exclusively owns all intellectual property developed within Dr. Obrovac's research group without any ongoing obligations to Dalhousie University.

NOVONIX BATTERY TECHNOLOGY SOLUTIONS (BTS)

NOVONIX Battery Technology Solutions provides battery R&D services and manufactures what we believe to be the most accurate lithium-ion battery cell testing equipment in the world. This equipment is now used by leading battery makers, researchers, and equipment manufacturers including Panasonic, LG, Samsung SDI, and SK Innovation, and numerous consumer electronics and automotive Original Equipment Manufacturers (“OEMs”). The BTS division significantly expanded R&D capabilities through direct investment in and through a long-term partnership agreement with Dalhousie University.

In the six months ended June 30, 2023, BTS continued to build a strong pipeline with distributors to actively support total revenue growth with hardware sales and continued to add and expand key strategic accounts for R&D service offerings.

|

|

|

|

Six Months Ended |

June 30, 2023* |

June 30, 2022* |

December 31, 2022** |

Total Revenue |

$3.92M |

$3.18M |

$2.70M |

*Unaudited.

** Audited.

Other notable highlights from the half-year at BTS include:

▪NOVONIX joined Accelerate Coalition to promote the growing battery ecosystem in Canada.

▪New cell testing and analytics software service available on the cloud and onboarded internal research team in the first half of the year.

▪Expanded UHPC battery testing equipment distribution agreement with AVL Test Systems, Inc in North America.

Cathode Pilot Line

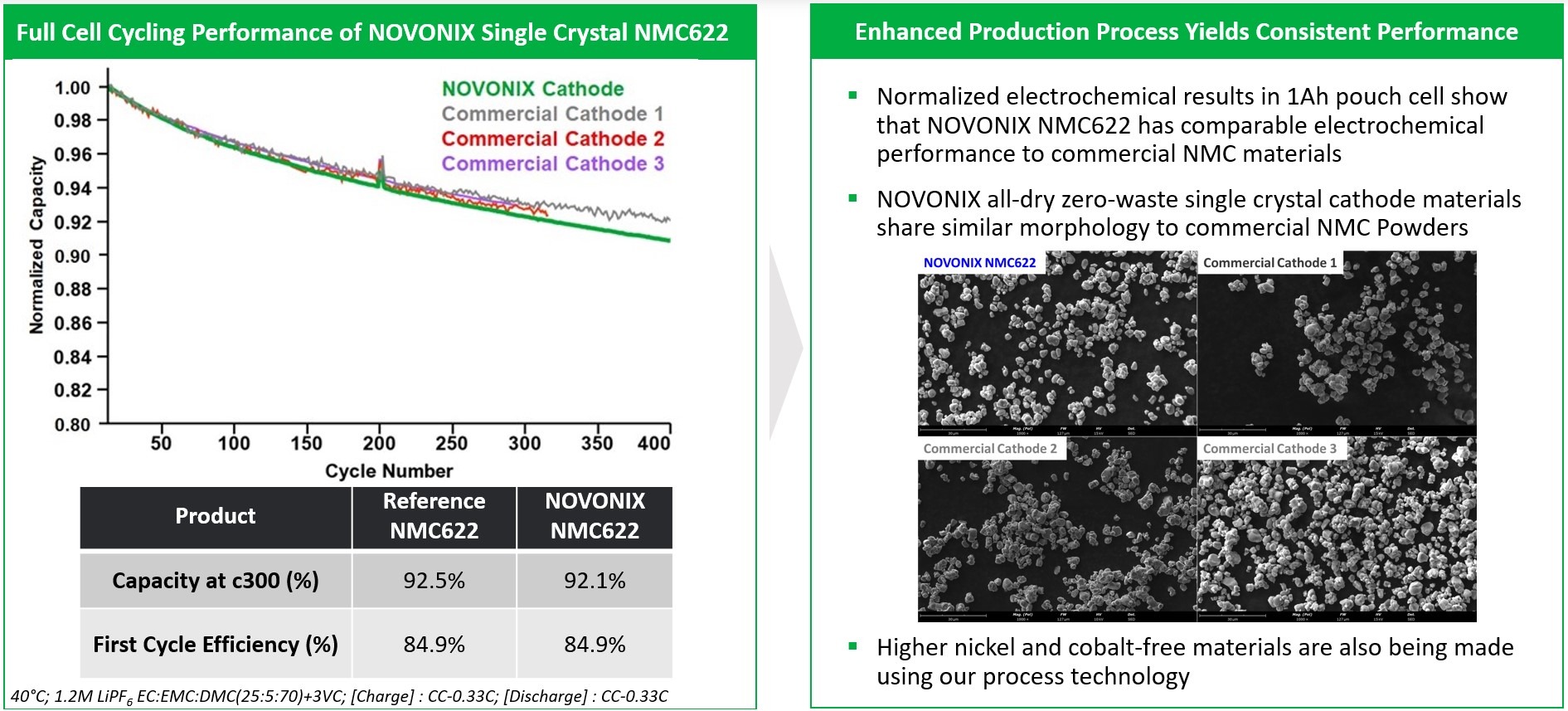

NOVONIX has increased its investment in the intellectual property developed around all-dry zero-waste cathode synthesis technology, which the Group believes could enable a substantial reduction in the cost of producing high energy density (high nickel-based) cathode materials including cobalt-free materials. The Group announced it successfully completed the commissioning of its 10 tpa cathode pilot line in July 2023. The cathode pilot line’s first product, a mid-nickel grade of single-crystal cathode material (“NMC622"), produced using NOVONIX’s patent-pending, all-dry zero-waste synthesis technology, matches the performance of leading cathode materials from existing suppliers in full-cell testing. NOVONIX will use the pilot line to further demonstrate the manufacturability of the Group’s long-life cathode materials and technology, including high-nickel (e.g., NMC811) and cobalt-free materials, along with their performance in industrial format lithium-ion cells.

HALF-YEAR REPORT - JUNE 30, 2023

The patent-pending process – and the innovations resulting from it – are transformational for the battery industry, decreasing processing complexity which should result in a substantial reduction in costs and waste (e.g., elimination of sodium sulfate) in the cathode manufacturing process.

This progress and the positive performance results seen below enable the Group to advance plans to scale to larger test samples and accelerate commercial discussions with potential partners and customers. BTS’s cathode team has started commercial discussions with precursor and cathode suppliers regarding the Group’s technology and current state of demonstration capability in terms of synthesising capability and performance.

Cathode Cycle Performance Similar to Commercial Material

In the second quarter of 2023, BTS also engaged with multiple established and potential lithium suppliers in material evaluation programs, which build on the Group’s initiatives in cathode precursor as well as final cathode synthesis technology.

Other Technologies

In addition to NOVONIX's investment in cathode materials technology, the Group continues to focus on developing other materials and technologies to support longer-life and lower-cost batteries that can power us towards a cleaner energy future.

NOVONIX has developed a new proprietary cell testing and analytics software service for battery R&D efforts that aims to improve time-to-market and reduce battery costs. Based on NOVONIX’s expertise in material evaluation and degradation analysis, our advanced analytics software platform, which is cloud-based, helps researchers more accurately predict cell performance and reliability. The new analytics software is currently used internally and BTS has finalised its beta version in the second quarter of 2023.

With carbon-neutral policies emerging in across major economies around the world, NOVONIX continues to opportunistically invest in the energy storage system market, which has experienced an increase in demand driven primarily by a significant increase in renewable energy adoption. NOVONIX first announced its partnership with Emera Technologies to develop innovative battery storage technology in early 2021.

HALF-YEAR REPORT - JUNE 30, 2023

More recently, NOVONIX developed a first-of-its-kind microgrid battery prototype to support Emera Technologies’ residential microgrid system, which is operating in a residential pilot project in Florida. This partnership highlights the strategic value BTS provides through working with various companies and industries to identify growth opportunities across the battery value chain.

NOVONIX ANODE MATERIALS DIVISION

NOVONIX Anode Materials division (“NAM”) manufactures high-performance synthetic graphite anode materials used to make lithium-ion batteries that power electric vehicles, personal electronics, medical devices, and energy storage units. The Group plans to reach minimum synthetic graphite production capacity of 10,000 tpa at its current Riverside facility, beginning deliveries to KORE Power in 2024 at an initial 3,000 tpa rate and plans to add an incremental 30,000 tpa production capacity by 2025 and reach 150,000 tpa of total production capacity in North America by 2030.

In the six months ended June 30, 2023, NAM made significant progress towards validating the performance of its Generation 3 furnace systems both in reaching operational production targets for the equipment as well as the product produced meeting its target specifications. NOVONIX installed and began commissioning additional production equipment in its 400,000+ square-foot Riverside facility in Chattanooga, Tennessee, the planned site for expansion to at least 10,000 tpa of production capacity. Additionally, NAM has progressed further expansion plans beyond Riverside. The team continues to progress plant design and engineering for the 30,000 tpa greenfield plan, including its site selection, plant layout, and engineering design. Other highlights of the half-year include:

▪NOVONIX entered into a JDA with LGES to research and develop artificial graphite anode material for lithium-ion batteries.

▪NOVONIX has agreed to incorporate a joint venture agreement with TAQAT to produce battery materials in the MENA region.

▪Continued installation and operation of equipment at Riverside as NOVONIX’s proprietary Generation 3 graphitization furnaces are being optimised ahead of the start of production in 2024 to support KORE Power’s required volume and other potential customers.

▪EV grade of synthetic graphite produced from Generation 3 production furnaces met its full specification targets in the first quarter and production output expectations in the second quarter.

▪Progressed engagements with tier one cell and automotive manufacturers through additional material sampling and qualification.

▪Continued expansion of equipment at NOVONIX’s anode pilot plant facility to support ongoing customer engagement.

▪Continued negotiation with the Department of Energy ("DOE") Office of Manufacturing and Energy Supply Chains ("MESC") on terms and conditions related to the previously announced $150 million grant.

▪Continued discussions with DOE Loan Programs Office ("LPO") and invited to progress to next stage (Stage 3- Due Diligence) of the loan approval process.

▪Awarded four college scholarships across four high schools in the local Chattanooga area.

▪NOVONIX's Director of Anode Technology nominated for the General Robert Neyland Young Engineer of the Year Award.

HALF-YEAR REPORT - JUNE 30, 2023

NOVONIX-LGES Joint Development Agreement & $30 Million Investment

NOVONIX and LG Energy Solution, a global battery manufacturer, announced the signing of a joint research and development agreement (JDA) for artificial graphite anode material for lithium-ion batteries. Also, pursuant to a separate agreement, NOVONIX issued an aggregate principal amount of $30 million unsecured convertible loan notes to LGES.

Upon successful completion of certain development work under the JDA, LGES and NOVONIX will enter into a separate purchase agreement pursuant to which LGES will have the option to purchase up to 50,000 tonnes of artificial graphite anode material over a 10-year period from the start of mass production. LGES is a leading global battery manufacturer with two stand-alone and five joint venture plants currently operating or being constructed in the U.S. LGES plans to maximise the benefits from the Inflation Reduction Act (IRA) by expanding local battery production, as well as establish a local supply chain for battery components. In order to solidify its market leadership in North America, LGES further aims to expedite the localisation of manufacturing and assembly of battery components, including electrodes, cells, and modules.

Development Progress

Following the passage of the IRA in August 2022, battery development capacity plans have accelerated with increased domestic production forecasts and robust electric vehicle demand. These recent trends underpin the significance of NOVONIX’s agreement with Phillips 66 in January 2022 for the joint development of new feedstocks and synthetic graphite with reduced carbon-intensive processing. This partnership positions NOVONIX at the forefront of revolutionary solutions that seek to advance the adoption of clean energy. Aligned with its strategic partnership and investment in KORE Power, NOVONIX will be KORE Power’s exclusive supplier of graphite anode material in North America. In June 2023, KORE Power received a conditional commitment of $850 million from the DOE LPO for the construction of its KOREPlex facility in Phoenix, Arizona, which will begin commercial production in the fourth quarter of 2024.

NAM currently produces anode materials to support the progression in customer qualification programs at both its anode materials pilot plant and at Riverside which can produce synthetic graphite at mass production quantities of greater than one tonne. This is an integral step in qualifying battery materials for long term supply contracts with potential customers. NOVONIX believes its ability to provide consistent mass-produced samples for qualifications, as evidenced by its contract with KORE Power and recent JDA with LGES, is a unique competitive advantage within the market. The Group continues to work with other tier one battery manufacturers (including Samsung SDI and Panasonic Energy (formerly Sanyo, a subsidiary of Panasonic)) as well as several automotive manufacturers. NOVONIX Anode Materials strives to produce the highest performance synthetic graphite for powering the battery materials industry's growth with lower carbon emissions.

In June 2022, NOVONIX released the results of a Life Cycle Assessment (“LCA”), conducted by Minviro Ltd., a London-based, globally recognised sustainability and life cycle assessment consultancy. The LCA showed an approximate 60% decrease in global warming potential compared to commercially manufactured anode grade synthetic graphite produced in China, and an approximate 30% decrease in global warming potential compared to anode grade natural graphite also produced in China.

HALF-YEAR REPORT - JUNE 30, 2023

NOVONIX is expanding production capacity at its Riverside facility to a target minimum of 10,000 tpa output at full operation. Production will begin at a rate of approximately 3,000 tpa in 2024 and increases will align with KORE Power’s contracted volumes or any additional contracts that may be entered into with other customers. Through operational growth and by executing on strategic partnerships, NOVONIX has developed proprietary technology that delivers increased energy efficiency, negligible facility emissions, and anode materials that outperform industry standards.

U.S. Department of Energy Funding Opportunities

The Biden Administration’s Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) have provided many potential incentives for companies to build out a robust supply chain in the United States. The DOE Loan Programs Office has $15.1 billion in loan authority to support the manufacture of eligible light-duty vehicles and qualifying components under the Advanced Technology Vehicles Manufacturing Loan Program (ATVM), authorised by the Energy Independence and Security Act of 2007, providing debt capital at U.S. Treasury rates. These government programs provide a significant potential opportunity to support NOVONIX’s financing needs.

NOVONIX was selected to receive a $150 million grant for a greenfield project to produce an initial 30,000 tpa of capacity with additional installed facility and infrastructure to support expansion and supply the EV battery supply chain. NOVONIX remains in active discussions with the DOE Office of Manufacturing and Energy Supply Chains (MESC) regarding the scope and use of this grant funding. In October 2022, NOVONIX formally submitted its application for a loan under the ATVM program. The loan, if received, could contribute a large component of the funding needed for the Group’s current expansion plans for NAM’s growth. In May 2023, NOVONIX was invited by DOE LPO to enter due diligence (Stage 3) and the Group is working with DOE LPO to begin the formal due diligence process. NOVONIX is working with both MESC and LPO to understand how the different sources of financing support can best be used to support the Group's growth plans.

NOVONIX-TAQAT Development JV

NOVONIX has agreed to incorporate a JV with TAQAT to develop and produce anode materials for electric vehicle and energy storage system batteries in the MENA region.

The JV is intended to utilise NOVONIX’s battery technology and capability to develop a graphite anode materials facility with capacity of 30,000 tonnes per annum. The project is to be located in Saudi Arabia and is expected to secure ready access to precursor material as feedstock for critical battery materials and access to developing end-use markets for the manufacture and sale of EVs and ESS applications. Trends in government support and incentives for electrification and the localisation of the supply chain are prominent in the United States due to the Inflation Reduction Act but are strong in other jurisdictions as well. Saudi Arabia has set ambitious targets around electrification within its Vision 2030 goal and has opportunities to offer strong financial support to key strategic projects that are being built within Saudi Arabia.

To address growing industry demand, NAM remains on track to be a leading supplier of synthetic graphite in North America and the MENA region for anode battery materials. Discussions are continuing with tier one OEM EV companies and cell manufacturers to qualify and negotiate off-take agreements from both its Riverside and proposed greenfield anode materials facilities. Companies are seeking partnerships with dependable and qualified suppliers who can accelerate execution and scale production of high-performance anode materials quickly within their domestic markets. The NOVONIX Anode Materials

HALF-YEAR REPORT - JUNE 30, 2023

division is well-positioned to capitalise on international collaboration opportunities, having shown industry excellence in material production and a demonstrated track record of scalability.

MOUNT DROMEDARY

The Mount Dromedary Graphite Project is a world-class, high-grade (18%+) natural graphite deposit located in Northern Queensland, Australia.

Despite the favourable characteristics of this natural graphite deposit, exploration was put on hold given the substantially more favourable investment opportunities for the Group through the manufacturing of advanced battery anode materials and the development of new battery technologies. During the year ended June 30, 2022, management initiated a strategic review of the graphite deposit asset, and management continues to assess opportunities and holds the project in good standing while monitoring the market.

TENEMENT LIST

|

|

|

|

|

Tenement |

Permit Holder |

Grant date |

NVX Rights |

Expiry date |

EPM 26025 |

Exco Resources Limited |

12/14/2015 |

100% (Sub-Blocks Normanton 3123 D, J, N, O and S) |

12/13/2025 |

EPM 17323 |

MD South Tenements Pty Ltd

(Subsidiary of NOVONIX Limited) |

10/20/2010 |

100% |

10/19/2024 |

EPM 17246 |

MD South Tenements Pty Ltd |

10/26/2010 |

100% |

10/25/2024 |

END OF REVIEW OF OPERATIONS AND ACTIVITIES

HALF-YEAR REPORT - JUNE 30, 2023

DIRECTORS’ REPORT

FOR THE HALF-YEAR ENDED JUNE 30, 2023

The Directors present their report, together with the interim consolidated financial statements, on the consolidated entity (referred to hereafter as the 'Group', or 'Novonix') consisting of Novonix Limited and the entities it controlled at the end of, or during, the half-year ended June 30, 2023.

DIRECTORS

The following persons were directors of NOVONIX Limited during the whole of the half-year and up to the date of this report, unless otherwise stated:

Admiral Robert Natter - Chairman, Non-Executive Director

Dan Akerson - Non-Executive Director

Tony Bellas - Deputy Chairman, Non-executive director

Robert Cooper - Non-Executive Director (ceased April 5, 2023)

Ron Edmonds - Non-Executive Director

Zhanna Golodryga - Non-Executive Director

Andrew Liveris - Non-Executive Director

Jean Oelwang - Non-Executive Director

PRINCIPAL ACTIVITIES

During the six-month period, the principal activities of the Group included investment in scalability efforts to increase production capacity of anode materials, commercialisation of the Group's cathode technology and expansion of cell assembly and testing capabilities.

REVIEW OF OPERATIONS

The loss for the Group for the half-year ended June 30, 2023 after providing for income tax amounted to $28,498,657 (June 2022: $31,047,824).

Information on the operations and financial position of the Group and its business strategies and prospects are set out in the review of operations and activities on pages 2-11 of this interim report.

SUBSEQUENT EVENTS OCCURRING AFTER THE BALANCE SHEET DATE

Since the end of the half-year period, the Group have issued 401,984 performance rights and issued 324,590 ordinary shares on the vesting of performance rights to non-KMP employees

No other matters or circumstances have arisen since June 30, 2023 that have significantly affected, or may significantly affect, the operations of the Group, the results of those operations or the state of affairs of the Group in future financial years.

SIGNIFICANT CHANGES IN THE STATE OF AFFAIRS

There were no significant changes in the state of affairs of the Group during the financial half-year.

HALF-YEAR REPORT - JUNE 30, 2023

AUDITOR’S INDEPENDENCE DECLARATION

A copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out on the following page.

This report is made in accordance with a resolution of directors, pursuant to section 306(3)(a) of the Corporations Act 2001.

Robert Natter

Chairman

August 28, 2023

Brisbane

Auditor’s Independence Declaration

As lead auditor for the review of Novonix Limited for the half-year ended 30 June 2023, I declare that to the best of my knowledge and belief, there have been:

(a)no contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the review; and

(b)no contraventions of any applicable code of professional conduct in relation to the review.

This declaration is in respect of Novonix Limited and the entities it controlled during the period.

|

|

|

|

Michael Crowe |

Brisbane |

Partner |

28 August 2023 |

PricewaterhouseCoopers |

|

PricewaterhouseCoopers, ABN 52 780 433 757

480 Queen Street, BRISBANE QLD 4000, GPO Box 150, BRISBANE QLD 4001

T: +61 7 3257 5000, F: +61 7 3257 5999, www.pwc.com.au

Liability limited by a scheme approved under Professional Standards Legislation.

CONTENTS

NOVONIX LIMITED

ABN 54 157 690 830

Half-year financial report

General information

The financial statements are consolidated financial statements for the Group consisting of NOVONIX Limited and its subsidiaries.

The financial statements are presented in US dollars.

NOVONIX Limited is a Group limited by shares, incorporated and domiciled in Australia.

All press releases, financial reports and other information are available at our website: www.novonixgroup.com.

|

|

Registered office |

Principal place of business |

|

|

c/- McCullough Robertson |

Level 38, 71 Eagle Street |

Central Plaza Two |

Brisbane QLD 4000 |

Level 11, 66 Eagle Street |

|

Brisbane QLD 4000 |

|

A description of the nature of the Group's operations and its principal activities are included in the directors' report, which is not part of the financial statements.

The financial statements were authorised for issue, in accordance with a resolution of directors, on August 28, 2023.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE HALF-YEAR ENDED JUNE 30, 2023

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Half-year |

|

|

|

|

2023 |

|

|

2022 |

|

|

Notes |

|

US$ |

|

|

US$ |

|

|

|

|

|

|

|

|

Revenue from contracts with customers |

|

2 |

|

3,919,895 |

|

|

3,178,925 |

|

|

|

|

|

|

|

|

Product manufacturing and operating costs (exclusive of depreciation presented separately) |

|

|

|

(2,765,896) |

|

|

(2,718,918) |

Administrative and other expenses |

|

|

|

(9,803,730) |

|

|

(9,527,146) |

Borrowing costs |

|

|

|

(981,100) |

|

|

(881,568) |

Depreciation and amortisation expenses |

|

|

|

(2,331,394) |

|

|

(2,423,450) |

Loss on equity investment securities at fair value through profit or loss |

|

|

|

- |

|

|

(8,113,657) |

Research and development costs |

|

|

|

(2,278,806) |

|

|

(2,459,073) |

Nasdaq listing related expenses |

|

|

|

(168,507) |

|

|

(927,876) |

Share based compensation |

|

14 |

|

(6,818,045) |

|

|

(5,929,068) |

Employee benefits expense |

|

|

|

(8,909,635) |

|

|

(7,162,384) |

Foreign currency (loss)/gain |

|

|

|

1,134,485 |

|

|

5,109,657 |

Gain on fair value of derivative financial instruments |

|

|

|

263,257 |

|

|

- |

Other income |

|

2 |

|

640,729 |

|

|

806,734 |

|

|

|

|

|

|

|

|

Loss before income tax expense |

|

|

|

(28,098,747) |

|

|

(31,047,824) |

Income tax expense |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

Loss for the period |

|

|

|

(28,098,747) |

|

|

(31,047,824) |

Other comprehensive (loss)/income for the period, net of tax |

|

|

|

|

|

|

|

Foreign exchange differences on translation of foreign operations |

|

|

|

(2,827,882) |

|

|

(8,328,385) |

|

|

|

|

|

|

|

|

Total comprehensive loss for the period |

|

|

|

(30,926,629) |

|

|

(39,376,209) |

|

|

|

|

|

|

|

|

|

|

|

|

Cents |

|

|

Cents |

Earnings per share for loss attributable to the ordinary equity holders of the Group: |

|

|

|

|

|

|

|

Basic earnings per share |

|

12 |

|

(0.06) |

|

|

(0.06) |

Diluted earnings per share |

|

12 |

|

(0.06) |

|

|

(0.06) |

The above consolidated statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes.

CONSOLIDATED BALANCE SHEET

AS AT JUNE 30, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

|

Notes |

|

US$ |

|

|

US$ |

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

99,075,082 |

|

|

99,039,172 |

Trade and other receivables |

|

|

|

2,325,063 |

|

|

2,847,229 |

Inventory |

|

|

|

2,565,368 |

|

|

3,165,932 |

Prepayments |

|

|

|

3,183,795 |

|

|

1,958,269 |

Escrow reserves |

|

3 |

|

1,427,298 |

|

|

9,137,605 |

Total current assets |

|

|

|

108,576,606 |

|

|

116,148,207 |

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Property, plant and equipment |

|

4 |

|

136,303,064 |

|

|

125,316,748 |

Investment securities at fair value through profit or loss |

|

5 |

|

16,022,682 |

|

|

16,490,271 |

Right-of-use assets |

|

|

|

4,699,778 |

|

|

4,915,035 |

Exploration and evaluation assets |

|

6 |

|

2,149,952 |

|

|

2,212,013 |

Intangible assets |

|

7 |

|

12,082,009 |

|

|

12,173,710 |

Other assets |

|

|

|

1,059,542 |

|

|

168,574 |

Total non-current assets |

|

|

|

172,317,027 |

|

|

161,276,351 |

|

|

|

|

|

|

|

|

Total assets |

|

|

|

280,893,633 |

|

|

277,424,558 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Trade and other payables |

|

|

|

4,373,744 |

|

|

6,954,464 |

Contract liabilities |

|

10 |

|

254,174 |

|

|

71,985 |

Lease liabilities |

|

|

|

368,855 |

|

|

353,378 |

Borrowings |

|

8 |

|

1,223,991 |

|

|

1,085,314 |

Total current liabilities |

|

|

|

6,220,764 |

|

|

8,465,141 |

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

Contract liabilities |

|

10 |

|

3,000,000 |

|

|

3,000,000 |

Lease liabilities |

|

|

|

4,639,186 |

|

|

4,825,560 |

Derivative financial instruments |

|

9 |

|

2,093,741 |

|

|

- |

Borrowings |

|

8 |

|

62,983,850 |

|

|

35,077,588 |

Total non-current liabilities |

|

|

|

72,716,777 |

|

|

42,903,148 |

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

78,937,541 |

|

|

51,368,289 |

|

|

|

|

|

|

|

|

Net assets |

|

|

|

201,956,092 |

|

|

226,056,269 |

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

Contributed equity |

|

11 |

|

338,155,349 |

|

|

338,108,198 |

Reserves |

|

|

|

30,499,068 |

|

|

26,547,649 |

Accumulated losses |

|

|

|

(166,698,325) |

|

|

(138,599,578) |

|

|

|

|

|

|

|

|

Total equity |

|

|

|

201,956,092 |

|

|

226,056,269 |

The above consolidated balance sheet should be read in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED JUNE 30, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserves |

|

|

Consolidated Group

(All in US$) |

|

Contributed

equity |

|

Accumulated

losses |

|

Share based

payments

reserve |

|

Foreign

currency

translation

reserve |

|

Convertible

loan note

reserve |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2022 |

|

325,760,184 |

|

(79,687,740) |

|

25,788,204 |

|

(4,363,021) |

|

4,523,095 |

|

272,020,722 |

Loss for the period |

|

- |

|

(31,047,824) |

|

- |

|

- |

|

- |

|

(31,047,824) |

Other comprehensive loss |

|

- |

|

- |

|

- |

|

(8,328,385) |

|

- |

|

(8,328,385) |

Total comprehensive loss |

|

- |

|

|

|

- |

|

(8,328,385) |

|

- |

|

(39,376,209) |

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Contributions of equity, net of transaction costs |

|

12,251,658 |

|

- |

|

- |

|

- |

|

- |

|

12,251,658 |

Share-based payment transactions |

|

- |

|

- |

|

6,237,307 |

|

- |

|

- |

|

6,237,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2022 |

|

338,011,842 |

|

(110,735,564) |

|

32,025,511 |

|

(12,691,406) |

|

4,523,095 |

|

251,133,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2023 |

|

338,108,198 |

|

(138,599,578) |

|

37,161,498 |

|

(15,136,944) |

|

4,523,095 |

|

226,056,269 |

Loss for the period |

|

- |

|

(28,098,747) |

|

- |

|

- |

|

- |

|

(28,098,747) |

Other comprehensive loss |

|

- |

|

- |

|

- |

|

(2,827,882) |

|

- |

|

(2,827,882) |

Total comprehensive loss |

|

- |

|

(28,098,747) |

|

- |

|

(2,827,882) |

|

- |

|

(30,926,629) |

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Contributions of equity, net of transaction costs |

|

47,151 |

|

- |

|

- |

|

- |

|

- |

|

47,151 |

Share-based payment transactions (note 14) |

|

- |

|

- |

|

6,779,301 |

|

- |

|

- |

|

6,779,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2023 |

|

338,155,349 |

|

(166,698,325) |

|

43,940,799 |

|

(17,964,826) |

|

4,523,095 |

|

201,956,092 |

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF-YEAR ENDED JUNE 30, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Half-year |

|

|

|

|

2023 |

|

|

2022 |

|

|

Notes |

|

US$ |

|

|

US$ |

Cash flows from operating activities |

|

|

|

|

|

|

|

Receipts from customers (inclusive of consumption tax) |

|

|

|

4,714,808 |

|

|

3,339,529 |

Payments to suppliers and employees (inclusive of consumption tax) |

|

|

|

(25,554,506) |

|

|

(20,685,056) |

Interest received |

|

|

|

244,514 |

|

|

6,477 |

Borrowing costs paid |

|

|

|

(943,574) |

|

|

(843,590) |

Government grants received |

|

|

|

396,734 |

|

|

416,992 |

|

|

|

|

|

|

|

|

Net cash outflow from operating activities |

|

|

|

(21,142,024) |

|

|

(17,765,648) |

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

Payments for property, plant and equipment |

|

|

|

(13,200,358) |

|

|

(14,972,534) |

Payments for investments |

|

|

|

- |

|

|

(12,767,817) |

Payment of escrow funds |

|

|

|

(755,403) |

|

|

- |

Proceeds from release of escrow funds |

|

|

|

8,465,710 |

|

|

3,085,744 |

Payments for security deposits |

|

|

|

(888,381) |

|

|

- |

Payments for exploration and evaluation assets |

|

|

|

(5,071) |

|

|

(30,744) |

|

|

|

|

|

|

|

|

Net cash outflow from investing activities |

|

|

|

(6,383,503) |

|

|

(24,685,351) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

Proceeds from share issues |

|

|

|

- |

|

|

983,120 |

Payment of share issue expenses |

|

|

|

(4,201) |

|

|

(23,815) |

Proceeds from convertible loan note issues |

|

9 |

|

30,000,000 |

|

|

- |

Payment of convertible notes issue expenses |

|

|

|

(47,338) |

|

|

- |

Proceeds from the exercise of options |

|

|

|

51,537 |

|

|

- |

Payment of withholding tax - Performance rights |

|

|

|

(49,499) |

|

|

(2,501,992) |

Proceeds from borrowings |

|

|

|

753,768 |

|

|

1,453,704 |

Principal elements of lease payments |

|

|

|

(170,896) |

|

|

(156,044) |

Repayment of borrowings |

|

|

|

(518,025) |

|

|

(272,952) |

|

|

|

|

|

|

|

|

Net cash inflow / (outflow) from financing activities |

|

|

|

30,015,346 |

|

|

(517,979) |

|

|

|

|

|

|

|

|

Net increase / (decrease) in cash and cash equivalents |

|

|

|

2,489,819 |

|

|

(42,968,978) |

|

|

|

|

|

|

|

|

Effects of foreign currency |

|

|

|

(2,453,909) |

|

|

(2,763,448) |

Cash and cash equivalents at the beginning of the year |

|

|

|

99,039,172 |

|

|

188,469,787 |

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the half-year |

|

|

|

99,075,082 |

|

|

142,737,361 |

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED JUNE 30, 2023

Note 1 Basis of preparation

This condensed consolidated interim financial report for the half-year reporting period ended June 30, 2023 has been prepared in accordance with Australian Accounting Standard 134 Interim Financial Reporting and the Corporations Act 2001. These financial statements also comply with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), as applicable to interim financial reporting.

This condensed consolidated interim financial report does not include all the notes normally included in an annual financial report. Accordingly, this report is to be read in conjunction with the Annual Report for the period ended December 31, 2022 and any public announcements made by the Group during the interim reporting period in accordance with the continuous disclosure requirements of the Corporations Act 2001.

The principal accounting policies adopted in the preparation of the financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

The interim consolidated financial statements of the consolidated entity (referred to hereafter as the “Group”, or “Novonix”) consists of Novonix Limited and the entities it controlled at the end of, or during, the half-year ended June 30, 2023.

The financial report has been prepared on a going concern basis, which contemplates continuity of normal business activities and the realisation of assets and settlement of liabilities in the normal course of business.

The Group incurred a net loss of $28,098,747 (June 30, 2022: $31,047,824) and net operating cash outflows of $21,142,024 (June 30, 2022: $17,765,648) for the half-year ended June 30, 2023. As at June 30, 2023 the Group has a cash balance of $99,075,082 (December 31, 2022: $99,039,172) and net current assets of $102,355,842 (December 31, 2022: $107,683,066).

The Group is continuing to execute on its expansion plans of reaching production capacity of 150,000 tonnes per year by 2030 and in order to fund these expansionary activities, which will primarily involve significant capital expenditure, additional funding beyond the existing cash balance at June 30, 2023, and forecast inflows from customers, will be required.

These conditions give rise to a material uncertainty which may cast significant doubt (or substantial doubt as contemplated by Public Company Accounting Oversight Board (“PCAOB”) standards) over the Group’s ability to continue as a going concern.

The ability of the Group to continue as a going concern is principally dependent upon one or more of the following:

•the ability of the Group to raise funds as and when necessary from either customers, governments and/or investors in the form of debt, equity and/or grant funding;

•the successful and profitable growth of the battery materials, battery consulting and battery technology businesses; and

•the ability of the Group to meet its cash flow forecasts.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED JUNE 30, 2023

Note 1 Basis of preparation (continued)

The directors believe that the going concern basis of preparation is appropriate as the Group has a strong history of being able to raise capital from debt and equity sources, most recently through the issue of US$30 million of unsecured convertible loan notes to LG Energy Solution (LGES) during the period (note 9).

In November 2022, the Group was selected to enter negotiations with the US Department of Energy (DOE) to receive up to US$150 million of grant funding. These negotiations are still ongoing. The Group has also had a formal application submitted and was invited into Stage 3 of the DOE Loan Program Office (LPO) with the potential funds to be used to develop a new greenfield production facility.

Should the Group be unable to continue as a going concern, it may be unable to realise its assets and discharge its liabilities in the normal course of business, and at amounts stated in the financial report.

This financial report does not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts or classification of liabilities and appropriate disclosures that may be necessary should the Group be unable to continue as a going concern.

b)Historical cost convention

The financial statements have been prepared under the historical cost convention, except for, where applicable, the revaluation of available-for-sale financial assets, financial assets and liabilities at fair value through profit or loss, certain classes of property, plant and equipment and derivative financial instruments.

c)Classification of expenses

During the period ended June 30, 2023, management reassessed the classification of certain expenses and has reclassed $2,296,138 from Employee Benefits Expense to Product Manufacturing and Operating Costs. The comparative period has been prepared on a like for like basis. An amount of $2,525,462 has been reclassified from Employee Benefits Expense to Product Manufacturing and Operating Costs in the comparative period.

The reclassification of Employee Benefits Expense to Product Manufacturing and Operating Costs has been made as the business has transitioned to a standard costing approach which incorporates labour costs.

Borrowings are initially recognised at fair value, net of transaction costs incurred. Borrowings are subsequently measured at amortised cost. Any difference between the proceeds (net of transaction costs) and the redemption amount is recognised in profit or loss over the period of the borrowings using the effective interest method.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED JUNE 30, 2023

Note 1 Basis of preparation (continued)

The fair value of the liability (borrowings) portion of a convertible bond is determined using a market interest rate for an equivalent non-convertible bond. This amount is recorded as a liability on an amortised cost basis until extinguished on conversion or maturity of the bonds. The remainder of the proceeds is allocated to the conversion option. Alternatively, the fair value of the conversion option is determined using Monte Carlo Simulation methodology, with the remainder of the proceeds allocated to the liability (borrowings) portion.

•New and amended standards adopted by the Group

The Group has adopted all of the new, revised or amending accounting standards and interpretations issued by the International Accounting Standards Board that are mandatory for the current reporting period. None of the new and amended standards have had any material impact on the financial statements.

Amendments to IAS 12 – Deferred Tax related to Assets and Liabilities arising from a Single Transaction:

In May 2021, the IASB issued Deferred Tax related to Assets and Liabilities arising from a Single Transaction, which amended IAS 12, Income Taxes. The amendments clarify that companies are required to recognise deferred taxes on transactions where both assets and liabilities are recognised, such as with leases and asset retirement (decommissioning) obligations. The amendments are effective for annual reporting periods beginning on or after January 1, 2023, with earlier application permitted. The adoption of the amendment did not have a material impact on the consolidated financial statements.

Any new, revised or amending Accounting Standards or Interpretations that are not yet mandatory have not been early adopted.

e)Critical accounting estimates

The preparation of the financial statements requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements were set out in the Annual Report for the period ended December 31, 2022. Set out below are any changes during the period.

Valuation of unsecured convertible notes and embedded derivatives

The fair value of the conversion feature is determined using a Monte Carlo Simulation, taking into account the terms and conditions upon which the convertible loan notes were issued. The key assumptions include:

•The probability of the timing of when the parties will enter into a purchase order for material, which will lead to the mandatory conversion of all loan notes into ordinary shares;

•The volatility of the NOVONIX share price.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED JUNE 30, 2023

Note 2 Segment reporting

The Group has identified its operating segments based on the internal reports that are reviewed and used by the Executive Key Management Personnel (Chief Operating Decision Makers or “CODMs”) in assessing performance and determining the allocation of resources. The Group is managed primarily on an operational basis. Operating segments are determined on the basis of financial information reported to the Board.

The CODMs have identified three operating segments being Battery Materials, Battery Technology, and Graphite Exploration. The Battery Materials segment develops and manufactures battery anode materials, and the Battery Technology segment develops battery cell testing equipment, performs consulting services and carries out research and development in battery development (inclusive of cathode technology). The Graphite Exploration segment involves exploration and evaluation activity, as well as maintenance and potential future development of the Mt Dromedary natural graphite deposit.

Basis of accounting for purposes of reporting by operating segments

a.Accounting policies adopted

Unless stated otherwise, all amounts reported to the CODMs, are determined in accordance with accounting policies that are consistent with those adopted in the annual financial statements of the Group.

Where an asset is used across multiple segments, the asset is allocated to the segment that receives the majority of the economic value from the asset. In most instances, segment assets are clearly identifiable on the basis of their nature and physical location.

Liabilities are allocated to segments where there is a direct nexus between the incurrence of the liability and the operations of the segment.

The following items for revenue, expenses, assets, and liabilities are not allocated to operating segments as they are not considered part of the core operations of any segment:

-Corporate administrative and other expenses

-Corporate share-based payment expenses

-Corporate marketing and project development expenses

-Corporate cash and cash equivalents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED JUNE 30, 2023

Note 2 Segment reporting (continued)

-Corporate trade and other payables

-Corporate trade and other receivables

Segment performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(All in US$) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Half-year ended June 30, 2023 |

|

|

Battery

Materials |

|

|

Battery

Technology |

|

|

Graphite

Exploration |

|

|

Unallocated |

|

|

Total |

Segment revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hardware sales |

|

|

- |

|

|

1,411,867 |

|

|

- |

|

|

- |

|

|

1,411,867 |

Consulting sales |

|

|

- |

|

|

2,508,028 |

|

|

- |

|

|

- |

|

|

2,508,028 |

Other income |

|

|

19,305 |