0001817760

false

0001817760

2023-08-25

2023-08-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 25, 2023

SmartKem, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-56181 |

85-1083654 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

Manchester Technology Center, Hexagon Tower

Delaunays Road, Blackley

Manchester, M9 8GQ U.K.

(Address of principal executive offices, including

zip code)

011-44-161-721-1514

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On

August 25, 2023, SmartKem, Inc. (the “Company”) held its 2023 annual meeting of stockholders (the “Annual Meeting”).

At the Annual Meeting, the Company’s stockholders approved an amendment (the “2021 Plan Amendment”) to the Company’s

2021 Equity Incentive Plan (the “2021 Plan”), increasing the number of the shares of common stock, par value $0.0001 per share

(“Common Stock”), reserved for issuance under the 2021 Plan from 4,376,571 shares to 26,008,708 shares. The Company’s

Board of Directors (the “Board”) had previously approved the 2021 Plan Amendment, subject to stockholder approval.

The foregoing description

of the 2021 Plan Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the 2021

Plan Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 5.07 Submission of Matters to

a Vote of Security Holders.

On

August 25, 2023, at the Annual Meeting, the Company’s stockholders voted on the five proposals listed below. The proposals are described

in detail in the Company’s definitive proxy statement for the Annual Meeting filed with the Securities and Exchange Commission on

July 24, 2023 (the “Proxy Statement”). The final results for the votes regarding each proposal are set forth below.

| 1. |

The holders of the Common Stock elected each of Klaas de Boer and Sri Peruvemba as Class II directors of the Company to serve three-year terms expiring at the 2026 annual meeting and until their respective successors have been duly elected and qualified, or, if sooner, until their death, resignation or removal. The votes were cast with respect to this matter as follows: |

| Nominee |

|

FOR |

|

WITHHELD |

|

BROKER

NON-VOTES |

| Klaas de Boer |

|

18,636,815 |

|

1,215,100 |

|

1,946,509 |

| Sri Peruvemba |

|

18,636,815 |

|

1,215,100 |

|

1,946,509 |

| 2. |

The proposal to ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2023 was approved by the holders of Common Stock based upon the following votes: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER

NON-VOTES |

| 21,438,324 |

|

359,900 |

|

200 |

|

N/A |

| 3. |

The proposal to adopt and approve an amendment to the Charter to effect a reverse stock split of the Common Stock, at a specific ratio, ranging from one-for-thirty (1:30) to one-for-sixty (1:60), at any time prior to the one-year anniversary date of the Annual Meeting, with the exact ratio to be determined by the Board without further approval or authorization of the stockholders was approved by the holders of Common Stock and the holders of the Company’s Series A-1 Convertible Preferred Stock based upon the following votes: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER

NON-VOTES |

| 60,446,102 |

|

718,100 |

|

497,000 |

|

N/A |

| 4. |

The proposal to approve an amendment to the 2021 Equity Incentive Plan to increase the number of shares of Common Stock authorized for issuance thereunder from 4,376,571 to 26,008,708 was approved by the holders of Common Stock based upon the following votes: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER

NON-VOTES |

| 18,540,751 |

|

1,279,100 |

|

32,064 |

|

1,946,509 |

| 5. |

The proposal to adopt and approve an amendment to the Charter to declassify the Board on the date on which shares of Common Stock begin trading on the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New York Stock Exchange and provide for the annual election of all directors was not approved by the holders of Common Stock based upon the following votes: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER

NON-VOTES |

| 19,493,715 |

|

338,200 |

|

20,000 |

|

1,946,509 |

Item 9.01. Financial Statements and Exhibits.

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SMARTKEM, INC. |

| |

|

|

| Dated: August 28, 2023 |

By: |

/s/ Barbra C. Keck |

| |

|

Barbra C. Keck |

| |

|

Chief Financial Officer |

Exhibit 10.1

AMENDMENT TO THE

SMARTKEM, INC.

2021 EQUITY INCENTIVE PLAN

Dated: July 13, 2023

WHEREAS, the Board of

Directors (the “Board”) of SmartKem, Inc., a Delaware corporation (the “Company”) heretofore established the SmartKem,

Inc. 2021 Equity Inventive Plan (the “Plan”); and

WHEREAS, after giving

effect to increases in accordance with the “evergreen” provisions of the Plan, the maximum number of shares of common stock

of the Company (“Common Stock”) currently available for grants of “Awards” (as defined under the Plan)

(not counting shares of Common Stock that have previously been issued pursuant to the Plan or that are the subject of outstanding Awards

under the Plan), is 4,376,571 all of which are available as grants as Incentive Stock Options (“ISOs”), within the meaning

of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”); and

WHEREAS, after taking

into account Awards granted under the Plan to date, there are currently 1,610,842 shares of Common Stock remaining available for additional

Awards under the Plan; and

WHEREAS, in order to

ensure that a sufficient number of shares of Common Stock are available under the Plan in order to properly incentivize those eligible

to participate in the Plan, including future eligible participants, the Board believes it to be in the best interests of the Company and

its shareholders to increase the maximum number of shares of Common Stock available for grants of Awards thereunder by 21,632,137 additional

shares of Common Stock (the “Additional Reserved Shares”) (from 4,376,571 to 26,008,708 shares), not counting shares of Common

Stock that have previously been issued pursuant to the Plan or that are the subject of outstanding Awards under the Plan; and

WHEREAS, the Board further

believes it to be in the best interests of the Company and its shareholders that all such Additional Reserved Shares be available for

grants of ISOs under the Plan, to the extent allowable under Section 422 of the Code and the Treasury Regulations promulgated thereunder,

any shares of Common Stock that become available for issuance under the Plan pursuant to Sections 3(b) and 3(c) thereof; and

WHEREAS, Section 19

of the Plan authorizes the Board to amend the Plan, subject to stockholder approval to the extent that such approval is required by applicable

law.

NOW, THEREFORE, subject

to approval of the Company’s stockholders, effective the date hereof, the Plan is hereby amended as follows:

Section 3(a) of the Plan is hereby amended

in its entirety, to read as follows:

“(a) Stock

Subject to the Plan. Subject to the provisions of Section 14 of the Plan and the automatic increase set forth in

Section 3(b), the maximum aggregate number of Shares that may be issued under the Plan is 26,008,708 Shares. In addition, Shares

may become available for issuance under the Plan pursuant to Sections 3(b) and 3(c). The Shares may be authorized, but unissued,

or reacquired Common Stock.”

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned has executed

this Amendment as evidence of its adoption by the Board of Directors of the Company on the date set forth above.

| |

SMARTKEM, INC.

By: /s/ Ian Jenks

Name: Ian Jenks

Title: Chief Executive Officer

Date: July 13, 2023 |

v3.23.2

Cover

|

Aug. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 25, 2023

|

| Entity File Number |

000-56181

|

| Entity Registrant Name |

SmartKem, Inc.

|

| Entity Central Index Key |

0001817760

|

| Entity Tax Identification Number |

85-1083654

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Manchester Technology Center, Hexagon Tower

|

| Entity Address, Address Line Two |

Delaunays Road

|

| Entity Address, Address Line Three |

Blackley

|

| Entity Address, City or Town |

Manchester

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

M9 8GQ

|

| City Area Code |

011-44-161

|

| Local Phone Number |

721-1514

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

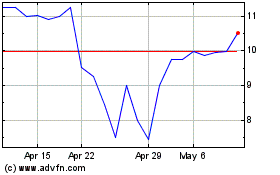

SmartKem (QB) (USOTC:SMTK)

Historical Stock Chart

From Apr 2024 to May 2024

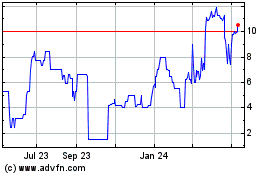

SmartKem (QB) (USOTC:SMTK)

Historical Stock Chart

From May 2023 to May 2024