As filed with the Securities and Exchange Commission on August 25, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FLORA GROWTH CORP.

(Exact Name of Registrant as Specified in Its Charter)

| Province of Ontario |

|

Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

3406 SW 26th Terrace, Suite C-1

Fort Lauderdale, Florida 33132

Tel: (954) 842-4989

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Dany Vaiman

Chief Financial Officer

3406 SW 26th Terrace, Suite C-1

Fort Lauderdale, Florida 33312

Tel: (954) 842-4989

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies of communications to:

Richard Raymer

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place 161 Bay Street, Suite 4310

Toronto, ON M5J 2S1, Canada

(416) 367-7370

Approximate Date of Commencement of Proposed Sale to the Public: From time to time after this Registration Statement is declared effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 25, 2023

PROSPECTUS

$10,000,000

FLORA GROWTH CORP.

Common Shares

Warrants

Units

We may from time to time sell our common shares, warrants and units described in this prospectus in one or more offerings. The aggregate initial offering price of the securities that we may offer and sell under this prospectus will not exceed $10,000,000.

We refer to the common shares, warrants and units collectively as "securities" in this prospectus.

This prospectus provides a general description of these securities, which we may offer and sell in amounts, at prices and on terms to be determined at the time of sale and set forth in a supplement to this prospectus. Each time we sell the securities described in this prospectus, we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in any of our securities. This prospectus may not be used to consummate a sale of our securities unless accompanied by an applicable prospectus supplement.

We may offer the securities from time through public or private transactions, and in the case of our common shares, on or off the Nasdaq Capital Market, at prevailing market prices or at privately negotiated prices. These securities may be offered and sold in the same offering or in separate offerings, to or through underwriters, dealers and agents, or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities registered hereunder and any applicable fees, commissions or discounts will be described in the applicable prospectus supplement. Our net proceeds from the sale of securities will also be set forth in the applicable prospectus supplement.

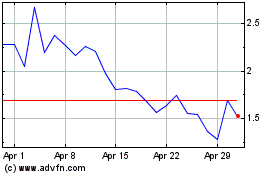

Our common shares are traded on the Nasdaq Capital Market under the symbol “FLGC.” As of July 7, 2023, the aggregate market value of our outstanding common shares held by non-affiliates was $16,564,176 based on 6,859,120 outstanding common shares, of which approximately 5,791,670 common shares were held by non-affiliates. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the registration statement of which this prospectus is a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. We have not offered any of our common shares pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

Investing in our securities involves risks. See "Risk Factors" beginning on page 4 for information you should consider before investing in our securities. See also "Risk Factors" in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 25, 2023

_______________

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a "shelf" registration statement on Form S-3 that we filed with the United States Securities and Exchange Commission, or the SEC. Under this shelf registration statement, we may sell any one or more or a combination of the securities described in this prospectus in one or more offerings, up to a total dollar amount of $10,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we use this prospectus to offer securities, we will provide a prospectus supplement that contains specific information about any offering by us with respect to the securities registered hereunder. The prospectus supplement may also add, update or change the information contained in this prospectus. You should read carefully both this prospectus, any prospectus supplement and any free writing prospectus related to the applicable offering that is prepared by us or on our behalf or that is otherwise authorized by us, together with additional information described under the heading "Where You Can Find More Information" located on page 16.

You should rely only on the information contained or incorporated by reference in this prospectus, any prospectus supplement and any free writing prospectus related to the applicable offering of securities that is prepared by us or on our behalf or that is otherwise authorized by us. We have not authorized any other person to provide you with different information. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus, any accompanying prospectus supplement or any free writing prospectus that is prepared by us or on our behalf or that is otherwise authorized by us. This prospectus and any accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and any accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of this prospectus and such accompanying prospectus supplement or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement are delivered, or securities sold, on a later date.

References in this prospectus to the "Registrant," the "Company," "Flora," "we," "us" and "our" refer to Flora Growth Corp., a company incorporated in the Province of Ontario, and its consolidated subsidiaries, unless the context requires otherwise.

Table of Contents

RISK FACTORS

Investing in our securities involves risks. Before deciding whether to purchase our securities, you should carefully consider the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2022 (the "2022 Annual Report") filed with the SEC on March 31, 2023, as amended on April 28, 2023, under the heading "Item 1A. Risk Factors", any updates to those risk factors contained in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K and the other information contained in this prospectus or any applicable prospectus supplement, as updated by those subsequent filings with the SEC under the Exchange Act that are incorporated herein by reference. These risks could materially affect our business, results of operations and financial condition and could cause the value of our securities to decline in value, in which case you may lose all or part of your investment. For more information, see "Where You Can Find More Information" and "Incorporation of Certain Documents by Reference."

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward- looking statements by terms such as "may", "will", "should", "believe", "expect", "could", "intend", "plan", "anticipate", "estimate", "continue", "predict", "project", "potential", "target," "goal" or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed under the heading "Item 1A. Risk Factors" in our 2022 Annual Report, which is incorporated by reference in this prospectus, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this prospectus. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

- Our limited operating history and net losses;

- changes in cannabis laws, regulations and guidelines;

- decrease in demand for cannabis and derivative products due to certain research findings, proceedings, or negative media attention;

- damage to our reputation as a result of negative publicity;

- exposure to product liability claims, actions and litigation;

- risks associated with product recalls;

- product viability;

- continuing research and development efforts to respond to technological and regulatory changes;

- shelf life of inventory;

- our ability to successfully integrate businesses that we acquire;

- maintenance of effective quality control systems;

- changes to energy prices and supply;

- risks associated with expansion into new jurisdictions;

- regulatory compliance risks;

- opposition to the cannabinoid industry;

- unpredictable events, such as the COVID-19 outbreak, and associated business disruptions;

- risks related to our operations in Colombia, including the closing of the sale thereof; and

- potential delisting resulting in reduced liquidity of our common shares.

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this prospectus. The forward-looking statements contained in this prospectus are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward- looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this prospectus, they may not be predictive of results or developments in future periods. Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

Table of Contents

OUR COMPANY

We are a prominent lifestyle brand in the United States and a player in international pharmaceutical distribution focused on therapeutics, starting with medical cannabis. Our approach has enabled us to develop distribution networks, build customer bases, establish operations as the regulatory framework evolves and allow for expanded access to cannabis and its derivatives.

JustCBD is Flora's leading consumer packaged goods brand. JustCBD was launched in 2017 with a mission to bring high-quality, trustworthy, and budget-friendly CBD products to market. The JustCBD offering currently consists of over 350 products across 15 categories, including CBD gummies, topicals, tinctures, and vape products and ships to over 11,500 independent retailers worldwide. JustCBD also sells direct to consumers with a customer base of approximately 350,000 people. JustCBD products are available for purchase in smoke and vape shops, clinics, spas and pet stores, as well as other independent non-traditional retail channels. JustCBD's products are both internally and third-party lab-tested to ensure quality.

Vessel is Flora's cannabis accessory and technology brand currently servicing the United States and Canada through direct-to-consumer and retail sales. Vessel's products include cannabis consumption accessories, personal storage, and travel accessories for the vape and dry herb categories, which are sold to consumers, dispensaries, smoke shops and cannabis brands. Vessel has been fully integrated into JustCBD and now benefits from operational, logistical and sales synergies with JustCBD.

Based in Germany, Phatebo is a wholesale pharmaceutical distribution company with import and export capabilities of a wide range of pharmaceutical goods and medical cannabis products to treat a variety of health indications, including drugs related to cancer therapies, ADHD, multiple sclerosis and anti-depressants, among others. Phatebo holds a license for the Trade in Narcotic Drugs (including the cannabis sales license amendment) and a wholesale trading license, both of which are issued by BfArM (the largest drug approval authority in Europe). Phatebo is focused on distributing pharmaceutical products within 28 countries globally, primarily in Europe, but also with sales to Asia, Latin America, and North America. In November 2018, Phatebo also received a medical cannabis import and distribution license. Additionally, the Phatebo warehouse provides a logistics outpost for Flora's growing product portfolio and distribution network within the European Union.

Table of Contents

Corporate Information

We were originally incorporated on March 13, 2019, under the laws of the Province of Ontario. We are an early-stage company with our registered office located at 365 Bay Street, Suite 800, Toronto, Ontario, M5H 2V1. Our principal place of business in the United States is located at 3406 SW 26th Terrace, Suite C-1, Fort Lauderdale, Florida 33312, and our phone number is (954) 842-4989. Our website address is www.floragrowth.com. The information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference herein.

Table of Contents

USE OF PROCEEDS

Unless we specify otherwise in the applicable prospectus supplement, we expect to use the net proceeds from the sale of the securities offered hereby for capital expenditures, operating capacity, working capital and general corporate purposes.

Any specific allocation of the net proceeds of an offering of securities to a specific purpose will be determined at the time of such offering and will be described in the related supplement to this prospectus.

Table of Contents

DESCRIPTION OF COMMON SHARES

General

This prospectus describes the general terms of our common shares, which description is qualified in its entirety by reference to applicable Canadian law and the terms and provisions contained in our articles of incorporation (as amended, the "articles") and our bylaws currently in effect (the "bylaws"). When we offer to sell common shares, we will describe the specific terms of such offering in a supplement to this prospectus. Accordingly, for a description of the terms of a particular offering of our common shares, you must refer to both this prospectus and the applicable prospectus supplement. To the extent the information contained in the prospectus supplement differs from this summary description, you should rely on the information contained in the prospectus supplement.

Under our articles, our authorized capital consists of an unlimited number of common shares, with no par value per share, which do not have any special rights or restrictions. As of August 25, 2023, there were 6,859,120 common shares outstanding.

Rights, Preferences, Restrictions Attaching to Our Common Shares

The Business Corporations Act (Ontario) provides the following rights, privileges, restrictions and conditions attaching to our common shares:

- to vote at meetings of shareholders, except meetings at which only holders of a specified class of shares are entitled to vote;

- subject to the rights, privileges, restrictions and conditions attaching to any other class of shares of our Company, to share equally in the remaining property of our Company on liquidation, dissolution or winding-up of our Company; and

- the Common Shares are entitled to receive dividends if, as, and when declared by the board of directors of the Company (the "Board of Directors").

Shareholder Meetings

The Business Corporations Act (Ontario) provides that: (i) a general meeting of shareholders shall be held at such place in or outside Ontario as the directors determine or, in the absence of such a determination, at the place where the registered office of our Company is located; (ii) directors must call an annual meeting of shareholders no later than 15 months after the last preceding annual meeting; (iii) for the purpose of determining shareholders entitled to receive notice of or vote at meetings of shareholders, the directors may fix in advance a date as the record date for that determination, provided that such date shall not precede by more than 50 days or by less than 21 days, if we are an "offering corporation" under the rules of the Business Corporations Act (Ontario), otherwise not less than 10 days, the date on which the meeting is to be held; (iv) the holders of not less than 5% of the issued shares entitled to vote at a meeting may requisition the directors to call a meeting of shareholders for the purposes stated in the requisition; (v) only shareholders entitled to vote at the meeting, our directors and our auditor are entitled to be present at a meeting of shareholders (along with such other persons as may be invited by the chairperson or with the consent of the meeting); and (vi) upon the application of a director or shareholder entitled to vote at the meeting, the Ontario Superior Court of Justice may order a meeting to be called, held and conducted in a manner that the Court directs.

The Company's bylaws provide that a quorum is met when holders of not less than 35% of the shares entitled to vote at the meeting of shareholders are present in person or represented by proxy. The holders of our common shares are entitled to attend and vote at all meetings of the shareholders of the Company.

Table of Contents

Fully Paid and Non-assessable

All outstanding common shares are duly authorized, validly issued, fully paid and non-assessable.

Limitations on Liability and Indemnification of Officers and Directors

In accordance with the Business Corporations Act (Ontario) and pursuant to the bylaws of the Company, subject to certain conditions, the Company shall, to the maximum extent permitted by law, indemnify a director or officer, a former director or officer, or another individual who acts or acted at the Company's request as a director or officer, or an individual acting in a similar capacity, of another entity, against all costs, charges and expenses, including any amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved because of that association with the Company or other entity. We may advance monies to a director, officer or other individual for costs, charges and expenses reasonably incurred in connection with such a proceeding, provided that such individual shall repay the moneys if the individual does not fulfill the conditions described below. Indemnification is prohibited unless the individual:

- Acted honestly and in good faith with a view to our best interests;

- In the case of a criminal or administration action or proceeding enforced by a monetary penalty, had reasonable grounds to believe the conduct was lawful; and

- Was not judged by a court or other competent authority to have committed any fault or omitted to do anything that the individual ought to have done.

Transfer Agent and Registrar

The transfer agent and registrar for our common shares is Continental Stock Transfer & Trust Company.

Listing

Our common shares are listed on the Nasdaq Capital Market under the symbol "FLGC."

Table of Contents

DESCRIPTION OF WARRANTS

General

We may issue warrants to purchase our common shares. The warrants may be issued independently or together with common shares offered by this prospectus and may be attached to or separate from those common shares.

While the terms we have summarized below will apply generally to any warrants we may offer under this prospectus, we will describe the particular terms of any warrants that we may offer in more detail in the applicable prospectus supplement. The terms of any warrants we offer under a prospectus supplement may differ from the terms we describe below, and you should refer to the applicable prospectus supplement for the specific terms of any warrants that we offer.

We may issue the warrants under a warrant agreement, which we will enter into with a warrant agent to be selected by us. Each warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action its right to exercise, and receive the common shares purchasable upon exercise of, its warrants.

We may issue warrants in such numerous distinct series as we determine.

We will incorporate by reference into the registration statement of which this prospectus forms a part the form of warrant agreement, including a form of warrant certificate, that describes the terms of the series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement applicable to a particular series of warrants. We urge you to read the applicable prospectus supplements related to the warrants that we sell under this prospectus, as well as the complete warrant agreements that contain the terms of the warrants.

We will set forth in the applicable prospectus supplement the terms of the warrants in respect of which this prospectus is being delivered, including, when applicable, the following:

- the title of the warrants;

- the aggregate number of the warrants;

- the price or prices at which the warrants will be issued;

- the designation, number, and terms of common shares purchasable upon exercise of the warrants;

- the date, if any, on and after which the warrants and the related common shares will be separately transferable;

- the price at which each common share purchasable upon exercise of the warrants may be purchased;

- the date on which the right to exercise the warrants will commence and the date on which such right will expire;

- the minimum or maximum amount of the warrants that may be exercised at any one time;

- any information with respect to book-entry procedures;

- the effect of any merger, consolidation, sale, or other disposition of our business on the warrant agreement and the warrants;

- any other terms of the warrants, including terms, procedures, and limitations relating to the transferability, exchange, and exercise of such warrants;

- the terms of any rights to redeem or call, or accelerate the expiration of, the warrants;

- the date on which the right to exercise the warrants begins and the date on which that right expires;

- the material U.S. federal income tax consequences of holding or exercising the warrants; and

- any other specific terms, preferences, rights, or limitations of, or restrictions on, the warrants.

Table of Contents

Unless specified in an applicable prospectus supplement, warrants will be in registered form only.

A holder of warrant certificates may exchange them for new certificates of different denominations, present them for registration of transfer, and exercise them at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement. Until any warrants are exercised, holders of the warrants will not have any rights of holders of the underlying common shares, including any rights to receive dividends or to exercise any voting rights, except to the extent set forth under the heading "Warrant Adjustments" below.

Exercise of Warrants

Each warrant will entitle the holder to purchase for cash common shares at the applicable exercise price set forth in, or determined as described in, the applicable prospectus supplement. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or a part of the exercise price for the warrants. Warrants may be exercised at any time up to the close of business on the expiration date of the warrants, as set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Warrants may be exercised by delivering to the corporation trust office of the warrant agent or any other officer indicated in the applicable prospectus supplement (a) the warrant certificate properly completed and duly executed and (b) payment of the amount due upon exercise. As soon as practicable following exercise, we will issue the underlying common shares subject to such exercise to the applicable warrant holder. If less than all of the warrants represented by a warrant certificate are exercised, a new warrant certificate will be issued for the remaining warrants.

Amendments and Supplements to the Warrant Agreements

We may amend or supplement a warrant agreement without the consent of the holders of the applicable warrants to cure ambiguities in the warrant agreement, to cure or correct a defective provision in the warrant agreement, or to provide for other matters under the warrant agreement that we and the warrant agent deem necessary or desirable, so long as, in each case, such amendments or supplements do not materially and adversely affect the interests of the holders of the warrants.

Warrant Adjustments

Unless the applicable prospectus supplement states otherwise, the exercise price of, and the number of common shares covered by, a warrant will be adjusted proportionately if we subdivide or combine our common shares. In addition, unless the prospectus supplement states otherwise, if we, without payment:

- issue capital stock or other securities convertible into or exchangeable for common shares, or any rights to subscribe for, purchase, or otherwise acquire common shares, as a dividend or distribution to holders of our common shares;

- pay any cash to holders of our common shares other than a cash dividend paid out of our current or retained earnings;

- issue any evidence of our indebtedness or rights to subscribe for or purchase our indebtedness to holders of our common shares; or

- issue common shares or additional stock or other securities or property to holders of our common shares by way of spinoff, split-up, reclassification, combination of shares, or similar corporate rearrangement,

then the holders of warrants will be entitled to receive upon exercise of the warrants, in addition to the common shares otherwise receivable upon exercise of the warrants and without paying any additional consideration, the amount of stock and other securities and property such holders would have been entitled to receive had they held the common shares issuable under the warrants on the dates on which holders of those securities received or became entitled to receive such additional stock and other securities and property.

Except as stated above, the exercise price and number of securities covered by a warrant, and the amounts of other securities or property to be received, if any, upon exercise of those warrants, will not be adjusted or provided for if we issue those securities or any securities convertible into or exchangeable for those securities, or securities carrying the right to purchase those securities or securities convertible into or exchangeable for those securities.

Table of Contents

Holders of warrants may have additional rights under the following circumstances:

- certain reclassifications, capital reorganizations, or changes of the common shares;

- certain share exchanges, mergers, or similar transactions involving us and which result in changes of the common shares; or

- certain sales or dispositions to another entity of all or substantially all of our property and assets.

If one of the above transactions occurs and holders of our common shares are entitled to receive stock, securities, or other property with respect to or in exchange for their common shares, the holders of the warrants then outstanding, as applicable, will be entitled to receive upon exercise of their warrants the kind and amount of shares of stock and other securities or property that they would have received upon the applicable transaction if they had exercised their warrants immediately before the transaction.

Table of Contents

DESCRIPTION OF UNITS

The following description, together with the additional information we include in any applicable prospectus supplement, summarizes the material terms and provisions of the units that we may offer under this prospectus. Units may be offered independently or together with common shares and warrants offered by any prospectus supplement, and may be attached to or separate from those securities. While the terms we have summarized below will generally apply to any units that we may offer under this prospectus, we will describe the particular terms of any series of units that we may offer in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement may differ from the terms described below, and you should refer to the applicable prospectus supplement for the specific terms of any units that we offer.

We will incorporate by reference into the registration statement of which this prospectus forms a part the form of unit agreement, including a form of unit certificate, if any, that describes the terms of the series of units we are offering before the issuance of the related series of units. The following summaries of material provisions of the units and the unit agreements are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement applicable to a particular series of units. We urge you to read the applicable prospectus supplements related to the units that we sell under this prospectus, as well as the complete unit agreements that contain the terms of the units.

General

We may issue units consisting of common shares and warrants. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each security included in the unit. The unit agreement under which a unit is issued may provide that the securities included in the unit are immediately separable or otherwise may not be held or transferred separately, at any time, or at any time before a specified date.

We will describe in the applicable prospectus supplement the terms of the series of units, including the following:

- the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

- any provisions of the governing unit agreement that differ from those described below; and

- any provisions for the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units.

The provisions described in this section, as well as those described under "Description of Common Shares" and "Description of Warrants," will apply to each unit and to any common share or warrant included in each unit, respectively.

Issuance in Series

We may issue units in such amounts and in such numerous distinct series as we determine.

Enforceability of Rights by Holders of Units

Each unit agent, if any, will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship of agency or trust with any holder of any unit. A single bank or trust company may act as unit agent for more than one series of units. A unit agent will have no duty or responsibility in case of any default by us under the applicable unit agreement or unit, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a unit, without the consent of the related unit agent or the holder of any other unit, may enforce by appropriate legal action its rights as holder under any security included in the unit.

Title

We, the unit agent, and any of their agents may treat the registered holder of any unit certificate as an absolute owner of the units evidenced by that certificate for any purposes and as the person entitled to exercise the rights attaching to the units so requested, despite any notice to the contrary.

Table of Contents

PLAN OF DISTRIBUTION

We may sell the securities offered hereby from time to time pursuant to underwritten public offerings, negotiated transactions, block trades or a combination of these methods. We may sell the securities (1) through underwriters or dealers, (2) through agents and/or (3) directly to one or more purchasers. We may distribute the securities from time to time in one or more transactions:

- at a fixed price or prices, which may be changed;

- at market prices prevailing at the time of sale;

- at prices related to such prevailing market prices; or

- at negotiated prices.

We may directly solicit offers to purchase the securities being offered by this prospectus. We may also designate agents to solicit offers to purchase the securities from time to time. We will name in a prospectus supplement any agent involved in the offer or sale of our securities.

If we utilize a dealer in the sale of the securities being offered by this prospectus, we will sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

If we utilize an underwriter in the sale of the securities being offered by this prospectus, we will execute an underwriting agreement with the underwriter at the time of sale and provide the name of any underwriter in the prospectus supplement that the underwriter will use to make resales of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities for whom the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter may sell the securities to or through dealers, and the underwriter may compensate those dealers in the form of discounts, concessions or commissions.

We will provide in the applicable prospectus supplement any compensation we pay to underwriters, dealers or agents in connection with the offering of the securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers. Underwriters, dealers and agents participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities, including liabilities under the Securities Act, or to contribute to payments they may be required to make in respect thereof.

An underwriter may engage in over-allotment, stabilizing transactions, short covering transactions and penalty bids in accordance with applicable securities laws. Over-allotment involves sales in excess of the offering size, which creates a short position. Stabilizing transactions permit bidders to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short positions. Those activities may cause the prices of the securities to be higher than they would otherwise be. The underwriters may engage in these activities on any exchange or other market in which the securities may be traded. If commenced, the underwriters may discontinue these activities at any time. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business.

Table of Contents

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Wildeboer Dellelce LLP.

EXPERTS

The Company's consolidated financial statements as of and for the fiscal year ended December 31, 2022 included in this prospectus have been audited by Davidson & Company LLP ("Davidson"), an independent registered public accounting firm, as set forth in their report thereon. Such financial statements have been so included in reliance upon the report of such firm given upon their authority as experts in accounting and auditing. Davidson is independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the SEC and the PCAOB on auditor independence. Davidson's headquarters are located at Suite 1200-609 Granville Street, Vancouver, BC V7Y 1G6 Canada.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation organized under the laws of the Province of Ontario. As a result, it may not be possible for investors to effect service of process within the United States upon these persons or us, or to enforce against them or us judgments obtained in U.S. courts, whether or not predicated upon the civil liability provisions of the federal securities laws of the United States or of the securities laws of any state of the United States. There is doubt as to the enforceability in Canada, either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated solely on the federal securities laws of the United States or the securities laws of any state of the United States.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Exchange Act. Accordingly, we are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the SEC's website is www.sec.gov.

We make available free of charge on or through our website, www.floragrowth.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the SEC.

We have filed with the SEC a registration statement under the Securities Act relating to the securities offered under this prospectus. The registration statement, including the attached exhibits, contains additional relevant information about us and the securities. If a document has been filed as an exhibit to the registration statement, we refer you to the copy of the document that has been filed. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects by the filed exhibit. This prospectus does not contain all of the information set forth in the registration statement. You can obtain a copy of the registration statement for free at www.sec.gov. The registration statement and the documents referred to below under "Incorporation of Certain Documents by Reference" are also available on our website, www.floragrowth.com.

Information contained on or accessible through our website is not incorporated by reference in this prospectus and does not constitute a part hereof.

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to "incorporate by reference" the information we have filed with it, which means that we can disclose important information to you by referring you to the documents containing such information. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future documents (excluding information furnished pursuant to Items 2.02, 7.01 and 9.01 of Form 8-K or any other information that is identified as "furnished" rather than filed) we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this prospectus and prior to the termination of this offering:

- our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023, as amended by our Form 10-K/A Amendment No. 1 filed with the SEC on April 28, 2023;

- our Quarterly Report on Form 10-Q for the three months ended March 31, 2023, filed with the SEC on May 15, 2023;

- our Quarterly Report on Form 10-Q for the three months ended June 30, 2023, filed with the SEC on August 10, 2023;

- our Current Reports on Form 8-K (not including any information furnished under Item 2.02, 7.01 or 9.01 of such Form 8-K or any other information that is identified as "furnished" rather than filed, which information is not incorporated by reference herein), filed with the SEC on January 6, 2023, April 18, 2023, May 18, 2023, June 6, 2023, June 7, 2023, June 27, 2023, July 11, 2023, July 25, 2023 and August 10, 2023;

- the Company's Registration Statement on Form 8-A filed with the SEC on May 10, 2021, in which there is described the terms, rights and provisions applicable to the shares of the Company's common shares, including any amendment or report filed for the purpose of updating such description, including the description of common shares filed as Exhibit 2.1 to the Company's Form 20-F for the year ended December 31, 2021.

All filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to the effectiveness of such registration statement (excluding information furnished pursuant to Items 2.02, 7.01 and 9.01 of Form 8-K or any other information that is identified as "furnished" rather than filed) shall also be deemed to be incorporated by reference into this prospectus.

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide you with different information. Any statement contained in a document incorporated by reference into this prospectus will be deemed to be modified or superseded for the purposes of this prospectus to the extent that a later statement contained in this prospectus or in any other document incorporated by reference into this prospectus modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You should not assume that the information in this prospectus is accurate as of any date other than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

We will provide without charge to each person to whom a copy of this prospectus is delivered, upon written or oral request, a copy of any or all of the reports or documents that have been incorporated by reference in this prospectus but not delivered with this prospectus (other than an exhibit to these filings, unless we have specifically incorporated that exhibit by reference in this prospectus). Any such request should be addressed to us at: 3406 SW 26th Terrace, Suite C-1, Fort Lauderdale, Florida 33312, Attention: Dany Vaiman, Chief Financial Officer or made by phone at +(954) 842-4989. You may also access the documents incorporated by reference in this prospectus through our website at www.floragrowth.com. Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms a part.

Table of Contents

FLORA GROWTH CORP.

Common Shares

Warrants

Units

PROSPECTUS

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the expenses (other than underwriting discounts and commissions or agency fees and other items constituting underwriters' or agents' compensation, if any) expected to be incurred by us in connection with a possible offering of securities registered under this registration statement.

| SEC Registration Fee* |

$ |

0 |

|

| Legal Fees and Expenses |

|

** |

|

| Accounting Fees and Expenses |

|

** |

|

| Printing Expenses |

|

** |

|

| Blue Sky Fees |

|

** |

|

| Transfer Agent Fees and Expenses |

|

** |

|

| Miscellaneous |

|

** |

|

| Total |

|

** |

|

*Pursuant to Rule 415(a)(6) under the Securities Act, the securities registered pursuant to this registration statement include unsold securities previously registered on the Company's Registration Statement on Form F-3 (No. 333-267585) filed on September 23, 2022, and declared effective on October 5, 2022 (the "Prior Registration Statement"). The filing fees previously paid in connection with such unsold securities in the aggregate value of $10,000,000 and the Prior Registration Statement will continue to be applied to such unsold securities in connection with the filing of this Registration Statement on Form S-3.

** To be provided by a prospectus supplement or a Current Report on Form 8-K that is incorporated by reference into this prospectus.

Item 15. Indemnification of Directors and Officers

In accordance with the Business Corporations Act(Ontario)and pursuant to the bylaws of the Company, subject to certain conditions, the Company shall, to the maximum extent permitted by law, indemnify a director or officer, a former director or officer, or another individual who acts or acted at the Company's request as a director or officer, or an individual acting in a similar capacity, of another entity, against all costs, charges and expenses, including any amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved because of that association with the Company or other entity. We may advance monies to a director, officer or other individual for costs, charges and expenses reasonably incurred in connection with such a proceeding, provided that such individual shall repay the moneys if the individual does not fulfill the conditions described below. Indemnification is prohibited unless the individual:

- Acted honestly and in good faith with a view to our best interests;

- In the case of a criminal or administration action or proceeding enforced by a monetary penalty, had reasonable grounds to believe the conduct was lawful; and

- Was not judged by a court or other competent authority to have committed any fault or omitted to do anything that the individual ought to have done.

Table of Contents

Item 16. Exhibits

__________________

* To be filed by amendment or as an exhibit to a document incorporated by reference herein in connection with an offering of the offered securities.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Table of Contents

Provided, however, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

Table of Contents

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Fort Lauderdale, Florida, on August 25, 2023.

| |

Flora Growth Corp. |

| |

|

|

| |

By: |

/s/ Clifford Starke |

| |

|

Clifford Starke |

| |

|

Chief Executive Officer

(Principal Executive Officer) |

| |

|

|

| |

By: |

/s/ Dany Vaiman |

| |

|

Dany Vaiman |

| |

|

Chief Financial Officer

(Principal Financial and Accounting Officer) |

Table of Contents

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Clifford Starke and Dany Vaiman and each of them such person's true and lawful attorney-in-fact and agent, for such person and in such person's name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this registration statement or any registration statement relating to this offering to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or such person's substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Clifford Starke |

|

Chief Executive Officer |

|

August 25, 2023 |

| Clifford Starke |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Dany Vaiman |

|

Chief Financial Officer |

|

August 25, 2023 |

| Dany Vaiman |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Kevin Taylor |

|

Chairman of the Board of Directors |

|

August 25, 2023 |

| Kevin Taylor |

|

|

|

|

| |

|

|

|

|

| /s/ Juan Carlos Gomez Roa |

|

Director |

|

August 25, 2023 |

| Juan Carlos Gomez Roa |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas Solomon |

|

Director |

|

August 25, 2023 |

| Thomas Solomon |

|

|

|

|

| |

|

|

|

|

| /s/ Hussein Rakine |

|

Director |

|

August 25, 2023 |

| Hussein Rakine |

|

|

|

|

| |

|

|

|

|

| /s/ Edward Woo |

|

Director |

|

August 25, 2023 |

| Edward Woo |

|

|

|

|

EXHIBIT 5.1

August 25, 2023

Flora Growth Corp.

3406 SW 26th Terrace, Suite C-1

Fort Lauderdale, Florida

33312

Re: Flora Growth Corp.

Dear Sirs/Mesdames:

We have acted as Canadian counsel to Flora Growth Corp., an Ontario corporation (the "Corporation"), in connection with the preparation of a Shelf Registration Statement on Form S-3, including the prospectus constituting a part thereof (the "Registration Statement"), being filed by the Corporation with the Securities and Exchange Commission (the "Commission") under the Securities Act of 1933, as amended (the "Securities Act"), relating to the Corporation's offering of up to an aggregate of US$10,000,000 of any combination of: (i) common shares in the capital of the Corporation ("Common Shares"); (ii) warrants to purchase Common Shares ("Warrants"); (iii) purchase units consisting of Common Shares and Warrants ("Units"); and (iv) the Common Shares that may be issued upon the exercise of the Warrants ("Warrant Shares") or in connection with the Units, as applicable. The Common Shares, Warrants and Units are referred to herein collectively as the "Securities". We understand that the Securities may be issued and sold or delivered from time to time as set forth in the Registration Statement, any amendment thereto, the prospectus contained therein (the "Prospectus") and supplements to the prospectus (the "Prospectus Supplements") and pursuant to Rule 415 under the Securities Act.

Documents Reviewed

For the purposes of this opinion, we have examined and relied on, among other things, the following:

| (a) |

the Registration Statement; |

| |

|

| (b) |

a certificate of even date herewith of the Chief Financial Officer of the Corporation with respect to certain factual matters and enclosing certified copies of, inter alia, the constating documents and by-laws of the Corporation and resolutions passed by the directors of the Corporation that relate to the Registration Statement and the actions to be taken in connection therewith (the "Officer's Certificate"); and |

| |

|

| (c) |

a certificate of status dated August 24, 2023 issued by the Ministry of Government and Consumer Services (Ontario) in respect of the Corporation (the "Certificate of Status"). |

In preparation for the delivery of this opinion, we have examined the above-mentioned documents and we have examined all such other documents and made such other investigations as we consider relevant and necessary in order to give this opinion. In particular, we have not reviewed, and express no opinion on, any document that is referred to or incorporated by reference into the documents reviewed by us. As to various questions of fact material to this opinion which we have not independently established, we have examined and relied upon, without independent verification, certificates of public officials and officers of the Corporation including, without limitation, the Officer's Certificate and the Certificate of Status.

For purposes of the opinion set forth below, we have assumed:

| (a) |

the legal capacity of all individuals; |

| |

|

| (b) |

the genuineness of all signatures on, and the authenticity and completeness of all documents submitted to us as originals and the conformity to authentic or original documents of all documents submitted to us as certified, conformed, telecopied, photostatic, electronically transmitted copies (including commercial reproductions); |

| |

|

| (c) |

the identity and capacity of any person acting or purporting to act as a corporate or public official; |

| |

|

| (d) |

the accuracy and completeness of all information provided to us by public officials or offices of public record; |

| |

|

| (e) |

the accuracy and completeness of all representations and statements of fact contained in all documents, instruments and certificates (including the Officer's Certificate); |

| |

|

| (f) |

the accuracy and completeness of the minute books and all other corporate records of the Corporation reviewed by us; |

| |

|

| (g) |

the Securities will be offered, issued and sold in compliance with applicable United States federal and state securities laws, and in the manner stated in the Registration Statement and the applicable Prospectus Supplement; |

| |

|

| (h) |

that at the time of the execution and delivery of any definitive purchase, underwriting, agency or similar agreement between the Corporation and any third party pursuant to which any of the Securities may be issued (a "Securities Agreement") and at the time of the issuance and sale of any of the Securities, the Securities Agreement will have been duly authorized, executed and delivered by the Corporation and the other parties thereto, such agreement will be the valid and legally binding obligation of the Corporation and the other parties thereto, enforceable against such parties in accordance with its terms, and the performance by the Corporation of its obligations thereunder will have been duly and validly approved; |

| |

|

| (i) |

the taking by the Corporation of all necessary corporate action to authorize and approve the issuance of any Securities, the terms of the offering thereof and related matters (the "Authorizing Resolutions") prior to or as at the time the Securities are offered or issued as contemplated by the Registration Statement; |

| |

|

| (j) |

the effectiveness of the Registration Statement (including any post-effective amendments) under the Securities Act, that such effectiveness shall not have been terminated or rescinded, that no stop orders will have been issued by the Commission with respect to the Registration Statement and that the Registration Statement will comply with all applicable laws, each as at the time the Securities are offered or issued as contemplated by the Registration Statement; |

| (k) |

an appropriate Prospectus Supplement, free writing prospectus or term sheet relating to the Securities offered thereby will have been prepared and filed with the Commission in compliance with the Securities Act and will comply with all applicable laws at the time the Securities are offered or issued as contemplated by the Registration Statement; |

| |

|

| (l) |

that at the time of the issuance and sale of any of the Securities, the terms of the Securities, and their issuance and sale, will have been established so as not to violate any applicable law or result in a default under or breach of any agreement or instrument binding upon the Corporation and so as to comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Corporation; |

| |

|

| (m) |

the facts stated in the Certificate of Status continue to be true and correct as of the date hereof; and |

| |

|

| (n) |

the facts stated in the Certificate of Status and the Officer's Certificate shall continue to be true and correct as at the date of completion of any offering of Securities. |

We have not undertaken any independent investigation to verify the accuracy of any of the foregoing assumptions.

When our opinion refers to Common Shares or Warrant Shares to be issued as being "fully paid and non-assessable", such opinion indicates that the holder of such Common Shares or Warrant Shares cannot be required to contribute any further amounts to the Corporation by virtue of his, her or its status as holder of such Common Shares or Warrant Shares, either in order to complete payment for the Common Shares or Warrant Shares, to satisfy claims of creditors or otherwise. No opinion is expressed as to the adequacy of any consideration received for such Common Shares or Warrant Shares.

We are qualified to practise law only in the Province of Ontario. Our opinion below is limited to the existing laws of the Province of Ontario and the federal laws of Canada applicable therein as of the date of this opinion and should not be relied upon, nor are they given, in respect of the laws of any other jurisdiction. In particular, we express no opinion as to United States federal or state securities laws or any other laws, rule or regulation, federal or state, applicable to the Corporation.

In rendering our opinion in paragraph 1 below as to the valid existence of the Corporation, we have relied solely on the Certificate of Status.

Based and relying upon and subject to the foregoing and the qualifications expressed below, we are of the opinion that:

| 1. |

The Corporation is a corporation existing under the Business Corporations Act (Ontario) and has not been dissolved. |

| |

|

| 2. |

The Common Shares (including any Common Shares partially comprising Units) will be duly authorized by all necessary corporate action on the part of the Corporation and, upon payment and delivery in accordance with the applicable Securities Agreement and Prospectus Supplement, will be validly issued, fully paid and non-assessable. |

| |

|

| 3. |

The Warrants (including any Warrants partially comprising Units) will be duly authorized and, when issued and sold in accordance with and in the manner described in the applicable Securities Agreement and Prospectus Supplement, will be authorized, created and validly issued by the Corporation. |

| |

|

| 4. |

The Warrant Shares to be issued pursuant to the exercise of the Warrants (including any Warrants partially comprising Units) will be set aside and reserved for issuance and conditionally allotted for issuance to holders of such Warrants and such Warrant Shares will, when issued in accordance with the terms of the Warrants and in the manner described in the applicable Securities Agreement and Prospectus Supplement against payment of the exercise price therefor, be validly issued as fully paid and non-assessable shares in the capital of the Corporation. |

We understand that the Corporation intends to issue the Securities from time to time on a delayed or continuous basis and that prior to issuing any Securities the Corporation will afford us an opportunity to review the Authorizing Resolutions and operative documents pursuant to which such Securities are to be issued (including an appropriate Prospectus Supplement), and we will file such supplement or amendment to this opinion (if any) as we may reasonably consider necessary or appropriate by reason of the terms of such Securities.

We hereby consent to the reference to our firm's name under the caption "Legal Matters" in the Prospectus included in the Registration Statement and the filing of this opinion with the Commission as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the SEC promulgated thereunder.

This opinion letter is furnished to you at your request in accordance with the requirements of Item 601 of Regulation S-K in connection with the filing of the Registration Statement, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose. No opinion is expressed as to the contents of the Registration Statement, other than the opinions expressly set forth herein. This opinion is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking or obligation to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable laws.

Yours truly,

(signed) "Wildeboer Dellelce LLP"

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statement on Form S-3 of Flora Growth Corp. of our report dated March 31, 2023, relating to the consolidated financial statements of Flora Growth Corp., filed with the Securities and Exchange Commission on August 25, 2023. We also consent to the reference to our firm under the wording "Experts" in such Registration Statement.

/s/ DAVIDSON & COMPANY LLP

Davidson & Company LLP

Chartered Professional Accountants

Vancouver, Canada

August 25, 2023

EXHIBIT 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Flora Growth Corp.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| |

Security

Type |

Security