UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10/A

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

Mike the Pike Productions, Inc.

(Exact name of registrant as specified in its charter)

|

Wyoming

|

47-2131970

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.)

|

|

20860 N. Tatum Blvd. Suite 300, Phoenix, AZ

|

85050

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (310) 986-2734

Copies to:

Mark Newbauer

20860 N. Tatum Blvd. Suite 300

Phoenix AZ 85050

hey@mikethepike.com

Securities to be registered pursuant to Section 12(b) of the Act:

|

None

|

None

|

|

(Title of class)

|

Name of each exchange on which each class is to be registered

|

Securities to be registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.0001

|

|

|

(Title of class)

|

Name of each exchange on which each class is to be registered

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definition of “large accelerated filed,” “accelerated filed,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller Reporting Company ☒

|

|

|

|

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark (if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The Company qualifies as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act.

We are filing this General Form for Registration of Securities on Form 10 to register our common stock, par value $0.0001 per share (the “Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

This Form 10 becomes effective by operation of law sixty (60) days after the date of the initial filing of the Form 10. Upon effectiveness, the Company became subject to the requirements of Regulation 13A under the Exchange Act, which will require us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Unless otherwise noted, references in this registration statement to “Mike the Pike,” the “Company,” “we,” “our” or “us” means Mike the Pike Productions, Inc.

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

TABLE OF CONTENTS

Item 1. Description of Business

(a) Business Development

Mike The Pike Productions Inc. has one wholly owned subsidiary, Arowana Media Holdings, Inc. a pre-revenue stage IP acquisition and development company with a focus in entertainment properties which can be adapted for film, television, VR/AR, Gaming, and Metaverse opportunities.

Mike The Pike Productions Inc. originated as a company called Reflexor, Inc. This was a corporation, located in New York, New York and was formed on Oct 16, 1997. Reflexor, Inc.’s operations consisted of managing and distributing prepaid card products, specifically development of prepaid phone cards. On August 15th, 2001, John Riddle resigned and Michael Paloma was appointed President & CEO. Paloma announced as Director in the Articles of Incorporation that the Company would be renamed Advanced Bodymetrics Corporation. Advanced Bodymetrics Corporation(TM) was a high technology company dedicated to developing products for monitoring vital functions of the human body and displaying such data via a wristwatch or simple arm monitor. Advanced Bodymetrics Corporation’s research and development employed advanced, proprietary sensor technologies for health and fitness use. On January 24, 2002 Advanced Bodymetrics Corporation acquired ICM Telecommunications, Inc. Douglas Hamby was named President & CEO of ICM Telecommunications Inc. ICM Telecommunications was a rapidly growing supplier of prepaid, stored value debit cards on a national and international basis through its partnership with Secure Financial Solutions. ICM Telecommunications underwent a name change and was called eHoldings Technology Inc. The name change reflects an expansion of the company’s business plan to include global monitoring systems, in addition to its focus on debit cards and telecommunications applications. On December 26th 2007 Douglas Hamby resigned and Kevin May was appointed as President and CEO of the Company which then changed its name to Pine Ridge Holdings, Inc. Pine Ridge Holdings was a property management/real estate development and technology development holding company. Pine Ridge Holdings had four operating businesses in its portfolio and was evaluating other management and/or acquisition opportunities in Indiana, Ohio, Michigan, Arizona, and North Carolina.

On April 24th 2009 Kevin May resigned and concurrently appointed Mark B. Newbauer as CEO of the Company. May also transferred ownership of the Company’s controlling shares to Mark B. Newbauer. On August 5th, 2009, the name was changed from Pine Ridge Holdings, Inc. to Mike The Pike Productions, Inc. On October 5, 2010 a merger was formed with Mike The Pike Merger Sub, a business corporation organized under the laws of the State of Wyoming, to redomicile the company in Nevada and Mike The Pike Productions, Inc. survived the merger as a Wyoming Company.

(b) Business of Issuer

The Company operates as a media holdings company with an active focus in the entertainment industry, including motion picture/entertainment content development, production & distribution, graphic novels, and literary assets.

There is something truly magical about storytelling that has been with us since humans first populated the planet.

Written form dates back tens of thousands of years ago, with works like Aesop’s Fables and The Epic of Gilgamesh, carved on stone pillars; and works of literature have been adapted for film since the dawn of the industry, like the work of Georges Méliès in 1899, who released two adaptations of established IP —Cinderella, based on the Brothers Grimm and King John, the first known film to be based on the works of Shakespeare.

Today, IP is in higher demand than ever before with streamers and studios willing to pay top dollar for compelling storytelling, source material, & other IP on which to base content with built-in audience potential.

A fan-held company helps ensure we bring audiences around the world the kind of content that truly resonates with our human experience no matter who we are, or where we are from: transcendent storytelling across a wide range of genres, brought to life in ways like never before!

Arowana Media Holdings is an entertainment company with a passion for timeless and transcendent storytelling across film, television, digital media, and other entertainment mediums.

We do this in our flagship subsidiary, Mike the Pike Entertainment LLC, where we secure rights to undervalued and/or legacy IP and develop, package and produce these materials for feature film, television series and more, in partnership with studios and production companies.

The Company’s assets are primarily in the form of Intellectual Property rights and currently include rights in the exclusive motion picture, television, DVD, Internet (i.e., a program, web series or movie derived from the Work), and all subsidiary, allied, and ancillary rights to the Ella Clah series of novels by Aimee and David Thurlo, which books in the Series are entitled “Blackening Song”, “Death Walker”, “Bad Medicine”, “Enemy Way”, “Shooting Chant”, “Red Mesa”, “Changing Woman”, Plant Them Deep”, “Tracking Bear”, “Wind Spirit”, “White Thunder”, Mourning Dove”, Turquoise Girl”, “Coyote’s Wife”, “Earthway”, “Neverending Snake”, “Black Thunder”, and “Ghost Medicine”. Rights under Option for Purchase include all right, title and interest of every kind or nature whatsoever in and to the Work including all rights under copyright, and Producer shall have the right to develop, make, sell, produce, distribute, exhibit, broadcast (including without limitation, free broadcast, pay television, cable, subscription, pay-per- view, video-on-demand, DVD and Internet), advertise, publicize, license, record and otherwise exploit the Work and all other publications, productions and other derivative works based upon the Work in any and all languages, formats, manners and media, whether now known or hereafter devised, throughout the universe in perpetuity, subject only to the Reserved Rights, which consist of print publication and stage rights.

Ella Clah is currently in development; however due to the Writers Guild of America strike which, as of the date of this document, is ongoing, we are unable to move forward in working with a WGA writer, which is the Company’s intent.

The Company has, however, secured interest from a writer to formulate a pitch for studios prior to the strike and plans to resume working with the writer once the strike comes to a resolution, or otherwise, if at all. A Presentation Deck based on the IP has been created by the Company and we have secured an Emmy award winning Executive Producer to collaborate with us on developing the project and shopping to studios.

As well, we hold rights to the comic book series and certain characters in the Vampirella universe including the characters below:

1. Vampirella

2. Pendragon

3. Adam Van Helsing

4. Conrad Van Helsing

5. Lilith

6. Mad God Chaos

7. Blood Red Queen Of Hearts

8. Mistress Nyx

9. Hemmorhage

10. Von Kreist

11. Trixie Fattoni

12. Pixie Fattoni

13. Don Fattoni

14. Draculina

15. Passion

16. Monsignor Pesaro

17. Skaar

18. Passion

19. Tyler Westron

20. Anuberis

21. Tristan

22. The Scarlett Legion (Team)

23. The Sisterhood (Team)

24. Chelsea Cantrell

25. Ethan Shroud

26. The Unseelie Congress (collective of supernatural creatures)

27. Vampirella Army

28. Madek & Magdelene

29. The Kabal

30. Lorelei

31. Botis

32. Bazrys

33. Delilah William

34. Goodman William

35. Sophia

36. Le Fanu

37. Schuld

38. Cestus Dei

39. Yag-Ath Vermellus

40. Ikari: Sister of Rage from The Karasu Shimai

41. Zetsobou: Sister of Despair from The Karasu Shimai

42. Kanki: Sister of Delight from The Karasu Shimai

43. Gregory

44. Bazrys

45. Pantha

with rights included to develop, make, sell, produce, distribute, exhibit, broadcast (including without limitation, free broadcast, pay television, cable, subscription, pay-per-view, video-on- demand, DVD and Internet), advertise, publicize, license, record and otherwise exploit an audiovisual production based on the Work and derivative audiovisual works based upon the Work (collectively, “Derivative Works”) in any and all languages, formats, manners and media, whether now known or hereafter devised, throughout the universe in perpetuity, subject only to the Reserved Rights, which include Print Publication Rights, Live Stage Reading Rights, Live Stage Rights, and Radio Recital Rights Though there was a feature film based on the character Vampirella in 1996 as part of the ‘Roger Corman Presents’ series, the rights have since reverted to the publisher prior to the rights purchase agreement secured by the Company.

We are currently partnered with Dynamite Comics (the publisher) and a notable animation studio in Vancouver, Canada (with award winning animated series on Amazon (Kirkman’s ‘The Invincibles’) , and whose principle has produced a number of award-winning feature films (including Angry Birds, Star Wars: The Clone Wars, Escape from Planet Earth) which have enjoyed worldwide distribution and revenue and/or critical success. We have agreed to produce an animated series based on the Vampirella universe as an inaugural project toward further exploitation of the rights for screen and otherwise. Though the information is currently confidential, we are happy to share copies of correspondence and agreements confidentially to support. We intend to monetize the project within the next 24 months.

We also have rights in Wish by Barbara O’Connor to include all motion picture, all television rights (pay, free, cable, and otherwise) all home video rights. and all allied, ancillary, and subsidiary rights in the Property, whether now known or hereafter devised (including without limitation prequel, sequel, and remake rights, music and music publishing rights, soundtrack recording, comic book rights, and graphic novel right; video game and interactive gaming rights, podcast rights and other exploitation rights, commercial tie-in and merchandising rights (including without limitation the exploitation and/or licensing of characters and other elements of the Property for all types of goods and services, theme parks, and other types of attractions), and all promotional publishing rights with the exception of novel publication rights. including print and nondramatic audio rights (i.e. so-called books-on-tape or e-books; rights) subject to 7,500 word (but no more than 10% of the text) promotional publication rights; the right to publish the text of the Property electronically; the right to broadcast the text of the Property, whether in installments or otherwise, by television or radio in single-voice, non-dramatic readings {subject to Purchaser's right at all limes to exercise its television and radio rights for purposes of advertising, promoting, publicizing, and/or otherwise exploiting any production based on the Property; live stage rights; and all rights in all Owner- written and Owner-authorized sequels (provided that Purchaser shall have a rolling right of first negotiation and last refusal to option any such sequels).

We are currently partnered with Imprint Family Entertainment (Groove Tails) and its principals, including Michael Becker (https://deadline.com/2021/07/maryann-garger-michael-becker-launch- imprint-family-entertainment-1234797003/ ) with a finished screenplay by Nicholl fellow Joey Clarke Jr. (https://deadline.com/2021/08/wish-joey-clarke-jr-to-adapt-barbara-oconnor-book-for-the-screen-1234813761/ ) to produce as a feature film. We are currently out to directors and financiers to prepare for principle photography which we anticipate to be on or about Spring 2024.

Also, the Company has a shopping agreement to produce ‘Silverwing’ based on the Kenneth Oppel book series with the founder of Bardel Entertainment (the original producer of the Canadian series produced in 2003). The founder retained the rights to Silverwing and is in collaboration with Company to adapt the series to screen seeking worldwide distribution alongside the development and production process. To date, a lookbook/deck has been completed for the project including 45% participation for Mike The Pike once, and if, a project is produced. Parties have agreed in good faith and intends to

formalize the agreement by late June 2023.

The Company also has an 11.3% stake in net profits to the film “Beyond White Space”, which is anticipated to breakeven this year. The Company was a financier on the film, and its principal, Mark Newbauer, a producer on the film which enjoyed a theatrical release in December 2018 and is now streaming on various platforms. It is distributed by Vertical Entertainment and the trailer can be viewed here: https://www.youtube.com/watch?v=_RihSzdaCtc.

OUR CURRENT PROPERTIES/PROJECTS

SILVERWING

A small bat’s curiosity leads to an adventure filled odyssey in the acclaimed Silverwing from award-winning author, Kenneth Oppel, which has sold over a million copies worldwide.

ELLA CLAH

Ella Clah – a Native American FBI agent must return to the reservation to solve her father’s murder, setting in motion a struggle between traditionalist and modernist forces in this critically acclaimed mystery series by Aimée and David Thurlo.

VAMPIRELLA UNIVERSE

One of our featured projects is the iconic Vampirella universe. It tells the story of a vengeful angel of death who comes to Earth, and soon decides to change her way of thinking, vowing never to take a life without a good reason. Vampirella has become the longest-running English-language vampire comic book of all time.

WISH

Wish, written by award-winning author Barbara O’Connor, comes a middle-grade novel about a girl who with the help of a true-blue friend, a big hearted aunt and uncle, and the dog of her dreams, unexpectedly learns the true meaning of family in the least likely of places.

Our Board of Directors have designated a single Series of Preferred Stock designated as Series A Preferred Shares (“Preferred Shares”) are convertible to common stock at the rate of one share of preferred to 1,000 shares of common after notice to the Company by the holder, only when there is both sufficient common stock available for conversion and a sufficient number of common stock shares are authorized by the Company. Preferred Shares enjoy voting rights in the rate of one thousand votes for each share of the Preferred Shares with common stock and shall be entitled to vote when the holders of common stock shall have the right to vote. There are 2,415,142 of preferred shares outstanding. Mr. Newbauer, our CEO, holds 2,014,286. Thus, he will control the Company as a result of his holding of Preferred Shares, including with respect to the election of directors.

Emerging Growth Company

We are an emerging growth company under the JOBS Act. We shall continue to be deemed an emerging growth company until the earliest of:

| |

●

|

(a) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,070,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

|

| |

|

|

| |

●

|

(b) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective IPO registration statement;

|

| |

|

|

| |

●

|

(c) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

|

| |

|

|

| |

●

|

(d) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.’.

|

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are also exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Item 1A. Risk Factors.

Failure to Comply with Reporting Requirements of the Securities Act of 1934, as amended.

Our failure to file all required Reports on a timely basis will not allow for the use of Rule 144 in connection with the resale of unregistered securities; could cause various defaults under other agreements to which the Company is a party; could cause the SEC to include adverse comments in its Comments Letter(s) in response to various other SEC filings; disallow third parties the use of current financial statements for review and other valid purposes, etc. At the time this Form 10 was filed, the financial statements included therein (“Filed Financials Statements”) were current; however, at the time the Form 10 became effective on June 9, 2023, the filed Financials Statements were late. The Amendment No. 2 to Form 10 included current financial statements

Risks of ownership of “Penny Stocks” under SEC regulations

Penny stocks have less visibility and transparency than higher priced securities. Companies that are quoted as penny stocks have risks that are inherently greater than securities that are higher priced due to such factors as less disclosure, lower investor interest and uncertain financial conditions of the issuer. The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and other quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statement showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure and suitability requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our stock.

If the Company’s Common Stock is Listed Only on Expert Market – Eligible for Unsolicited Quotes Only.

The Expert Market which provides for the lowest level of disclosure in comparison to other OTC Market trades, trading is limited to quotation on an unsolicited (customer order) basis. This means that trades of securities subject to unsolicited quotations in the Expert Market are only available to broker-dealers, institutions and other sophisticated investors, and not the average investor. We have earlier been designated as a No Information security which means that broker dealers are only persons to give full quotes on the Expert Markets for our securities.

We were now in compliance with SEC public company reporting requirements. We have filed a Form 10-Q for the quarter ended March 31, 2023 and for the six months ended June 30, 2023. We intend to continue to file Reports with the SEC on a timely basis. We are currently quoted on the OTC Pink Market under the symbol MIKP and are current with our filings.

We have never paid dividends on our common stock.

We have never paid dividends on our Common Stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for payment of dividends will be re-invested into the Company to further its business strategy.

The Company may be subject to certain tax consequences in our business, which may increase our cost of doing business.

We may not be able to structure our acquisition to result in tax-free treatment for the companies or their stockholders, which could deter third parties from entering into certain business combinations with us or result in being taxed on consideration received in a transaction. Currently, a transaction may be structured so as to result in tax-free treatment to both companies, as prescribed by various federal and state tax provisions. We intend to structure any business combination so as to minimize the federal and state tax consequences to both us and the target entity; however, we cannot guarantee that the business combination will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the intended tax-free treatment upon a transfer of stock or assets. A non-qualifying reorganization could result in the imposition of both federal and state taxes that may have an adverse effect on both parties to the transaction.

Our business will have minimal revenues until further growth.

We are a development stage company and have had minimal revenues from operations. We may not realize larger revenues unless and until we successfully expand.

Industry-wide Strikes may affect the Company

On April 18, 2023, 97.85% of members of the Writers Guild of America (WGA) voted to go on strike if they failed to reach a satisfactory agreement with the Alliance of Motion Picture and Television Producers (AMPTP), which represents the major film and television studios in Hollywood, by May 1, 2023.

The AMPTP engaged in lengthy negotiations with the WGA on behalf of Amazon Studios (as well as MGM Holdings), Apple Studios, Lionsgate, NBCUniversal, Netflix, Paramount Global, Sony Pictures, the Walt Disney Company, and Warner Bros. Discovery (WBD), but failed to reach a deal before the mandated deadline. As a result, the leadership of the Writers Guild of America, West (WGAW) and Writers Guild of America, East (WGAE) unanimously approved a strike on the eve of May 2, the first of its kind since the 2007–2008 strike fifteen years prior.

This affects our Company and its operations currently to a certain degree in that we currently have limited capacity to engage writers on projects until and unless the strike is resolved. Many films, television programs, and podcasts have been affected by the strike; some have been forced to continue production without writers, while others have been completely shut down.

The Company has exercised its rights as they pertain to its standard Force Majeure clause in each of the project agreements and has been duly noted by each authorized party accordingly

Consolidation in the industry.

Through mergers and acquisitions fewer individuals and organizations are control increasing shares of the film and tv industry. Thus, there may be fewer outlets for our products, and the concentration of media could effect the price at which we sell our content.

Going Concerns

The Company’s auditor has expressed doing concern language in his audit as this stage of its life, the company is operating and has achieved only intellectual assets and no revenue.

Difficult economic and market conditions could negatively impact our businesses in unanticipated ways.

Our business may be materially affected by conditions in the global economic conditions or events throughout the world that are outside of our control, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation and regulations on the entertainment industry), pandemics or other severe public health events, , national and international political circumstances (including government shutdowns, wars, terrorist acts or security operations) and the effects of climate change. Recently, markets have been affected by the COVID-19 pandemic, U.S. interest rates, the imposition of trade barriers and changes in U.S. tax regulations. The COVID-19 pandemic caused severe disruptions in the U.S. and global economies and may negatively impact the Company’s results of operations, financial condition and cash flow. These conditions, events and factors are outside our control and may negatively affect the Company

Our Certificate of Incorporation authorizes the issuance of preferred stock.

Our Certificate of Incorporation authorizes the issuance of up to 50,000,000 shares of preferred stock with designations, rights and preferences determined from time to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. Although we have no present intention to issue any shares of its authorized preferred stock, there can be no assurance that the Company will not do so in the future.

Our Board of Directors have designated a single Series of Preferred Stock designated as Series A Preferred. Series A Preferred Shares are convertible to common stock at the rate of one Share of preferred to 1,000 shares of common after notice to the Corporation by the holder, only when there is both sufficient common stock available for conversion and a sufficient number of common stock shares are authorized by the Corporation. Preferred shares enjoy voting rights at the rate of 1/1000 (one to one thousand) with common stock and shall be entitled to vote when the holders of common stock shall have the right to vote. There are 2,415,142 of preferred shares outstanding. Mr. Newbauer, our CEO, holds 2,014,286. Thus, he will control the company as a result of his holding of preferred shares, including with respect to the election of directors.

Investors may have difficulty in reselling their shares due to the lack of market.

Our common stock is not currently traded on any exchange. It is listed on the Expert Market under the trading symbol “MIKP.” There is a limited trading market for our common stock and no public quote. There is no guarantee that any significant market for our securities will ever develop. Further, state securities laws may make it difficult or impossible to resell our shares in certain states. Accordingly, our securities should be considered highly illiquid.

Item 2. Financial Information.

Results of Operations

The net loss for the period ended December 31, 2021 was ($33,350) compared to ($131,331) for 2022. Total Assets as of December 31, 2021 was $169,283 compared to $10,211 for December 31, 2022. Total Liabilities as of December 31, 2021 were $532,666 compared to $145,324 for 2022.

Quantitative and Qualitative Disclosures About Market Risk.

We have not utilized any derivative financial instruments such as futures contracts, options and swaps, forward foreign exchange contracts or interest rate swaps and futures. We believe that adequate controls are in place to monitor any hedging activities. We do not have any borrowings and, consequently, we are not affected by changes in market interest rates. We do not currently have any sales or own assets and operate facilities in countries outside the United States and, consequently, we are not affected by foreign currency fluctuations or exchange rate changes. Overall, we believe that our exposure to interest rate risk and foreign currency exchange rate changes is not material to our financial condition or results of operations.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

Item 3. Properties.

The Company leases property at 20860 N. Tatum Blvd Suite 300 Phoenix AZ 85050.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

Security ownership of certain beneficial owners.

The following tables set forth the ownership of our common stock by each person known by us to be the beneficial owner of more than 5% of our outstanding common stock, our director, and our executive officer and directors as a group as of July 31, 2018. The persons named have sole voting and investment power with respect to such shares. There are not any pending arrangements that may cause a change in control. However, it is anticipated that there will be one or more change of control, including adding members of management, possibly involving the private sale or redemption of our principal shareholder’s securities or our issuance of additional securities, at or prior to the closing of a business combination.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner.

|

Name and Address(1)

|

|

Amount and

Nature of

Beneficial

Ownership

Common

|

|

|

Percentage of

Class Common

|

|

|

Amount of

Preferred

|

|

|

Percentage of

Preferred

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Mewbauer

|

|

|

54,316,653 |

|

|

|

2.4 |

%

|

|

|

2,014,286 |

|

|

|

83.4 |

%

|

|

James DiPrima

|

|

|

0 |

|

|

|

0 |

|

|

|

161,143 |

|

|

|

6.7 |

%

|

|

All Officers and Directors as a group (2 persons)

|

|

|

54,316,653 |

|

|

|

2.4 |

%

|

|

|

2,175,429 |

|

|

|

90.1 |

%

|

(1) The address for the persons named in the table above is c/o the Company.

This table is based upon information derived from our stock records. We believe that each of the shareholders named in this table has sole or shared voting and investment power with respect to the shares indicated as beneficially owned; except as set forth above, applicable percentages are based upon 2,242,000,000 shares of common stock issued and outstanding and 2,415,142 shares of Series A Preferred Stock issued and outstanding.

Item 5. Directors and Executive Officers.

(a) Identification of Directors and Executive Officers.

Our officers and directors and additional information concerning them are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Mark B. Newbauer

|

|

49

|

|

President, Chief Executive Officer, and Member of Board of Directors Secretary

|

Mark B. Newbauer

Mark B. Newbauer, age 49, has served as CEO and member of Board of Directors of Mike The Pike Productions, Inc. since April 24th, 2009. Mark graduated from Columbia College Chicago where he studied filmmaking, screenwriting, producing and entertainment business. As part of his duties and experience, Newbauer successfully identifies, negotiates, and acquires rights to prominent intellectual property with titles such as Vampirella (Dynamite Comics), Wish, Ella Clah, and others, and then spearheads development and production objectives for each project, often times in partnership with other production company heads. Newbauer also produced the sci-fi/horror thriller ‘Beyond White Space’, starring Holt McCallany(Mindhunter, Wrath of Man). During the preceding five year Mark Newbauer's principal occupation has been the CEO of the Company and he also holds his Life & Health Insurance license, He is an Agency Director with Symmetry Financial Group/Quility with over 100 agents throughout the country in his master agency and has cultivated an infrastructure to hire, train, mentor, and assist agents toward building a successful agency of their own. The agency has no affiliation or association otherwise with Mike the Pike Productions, Inc. or any of its subsidiaries and/or assigns.

The term of office of each director expires at our annual meeting of stockholders or until their successors are duly elected and qualified.

(b) Significant Employees. None.

(c) Family Relationships. None.

(d) Involvement in Certain Legal Proceedings.

No officer, director, or persons nominated for such positions, promoter or significant employee has been involved in the last ten years in any of the following:

| |

●

|

Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

| |

|

|

| |

●

|

Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

| |

|

|

| |

●

|

Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; and

|

| |

|

|

| |

●

|

Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

|

(e) The Board of Directors acts as the Audit Committee and the Board has no separate committees. The Company has no qualified financial expert at this time because it has not been able to hire a qualified candidate. Further, the Company believes that it has inadequate financial resources at this time to hire such an expert. The Company intends to continue to search for a qualified individual for hire.

(f) Code of Ethics. We do not currently have a code of ethics.

Item 6. Executive Compensation.

No officer or director has received any compensation from the Company since the inception of the Company. Until the Company acquires additional capital, it is not anticipated that any officer or director will receive compensation from the Company other than reimbursement for out-of-pocket expenses incurred on behalf of the Company.

The Company has no stock option, retirement, pension, or profit sharing programs for the benefit of directors, officers or other employees, but our sole officer and director may recommend adoption of one or more such programs in the future.

There are no understandings or agreements regarding compensation our management will receive after a business combination that is required to be disclosed.

The Company does not have a standing compensation committee or a committee performing similar functions, since the Board of Directors has determined not to compensate the officer and director until such time that the Company completes a reverse merger or business combination.

Item 7. Certain Relationships and Related Transactions, and Director Independence.

|

SUMMARY COMPENSATION TABLE

|

|

Name

and

principal

position

|

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Stock

Awards

($)

|

|

Option

Awards

($)

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

All Other

Compensation

($)

|

|

Total ($)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2019

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

| |

|

2020

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2021

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

| |

|

2022

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

|

n/a

|

During the twelve months end December 31, 2022 and 2021, the Company’s CEO, Mark Newbauer, had advanced the Company $17,500 and $0 respectively of personal funds. As of December 31, 2022 and 2021 the Company owed him $135,903 and $118,403 respectively there have been no other related party transactions, or any other transactions or relationships required to be disclosed pursuant to Item 404 and Item 407(a) of Regulation S-K.

Corporate Governance and Director Independence.

The Company has not:

| |

●

|

established its own definition for determining whether its directors and nominees for directors are “independent” nor has it adopted any other standard of independence employed by any national securities exchange or inter-dealer quotation system, though our current director would not be deemed to be “independent” under any applicable definition given that he is an officer of the Company; nor

|

| |

|

|

| |

●

|

established any committees of the board of directors.

|

Given the nature of the Company’s business, its limited stockholder base and the current composition of management, the board of directors does not believe that the Company requires any corporate governance committees at this time. The board of directors takes the position that management of a target business will establish committees that will be suitable for its operations after the Company consummates a business combination.

As of the date hereof, the entire board serves as the Company’s audit committee.

During the Three months end March 31, 2023 and 2022, the Company’s CEO had advanced $5,209 and $0 respectively of personal funds. As of March 31, 2023 and December 31, 2022 the Company owed the CEO $141,112 and $135,903, respectively.

Item 8. Legal Proceedings.

There are presently no material pending legal proceedings to which the Company is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

Item 9. Market Price of and Dividends on the Company’s Common Equity and Related Stockholder Matters.

(a) Market Information.

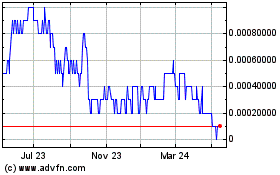

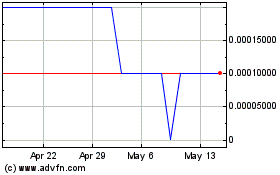

The Company’s common stock trades on the expert market but intends on applying to trade on the pink sheets. The high trade has been for $0.00095 and the low $0.00001 during the last two years.

The Company is not obligated by contract or otherwise to issue any securities and there are no outstanding securities which are convertible into or exchangeable for shares of our common stock, furthermore, there are currently no outstanding warrants on any of our securities. All outstanding shares of our common stock are “restricted securities,” as that term is defined under Rule 144 promulgated under the Securities Act of 1933, because they were issued in a private transaction not involving a public offering. Accordingly, none of the outstanding shares of our common stock may be resold, transferred, pledged as collateral or otherwise disposed of unless such transaction is registered under the Securities Act of 1933 or an exemption from registration is available. In connection with any transfer of shares of our common stock other than pursuant to an effective registration statement under the Securities Act of 1933, the Company may require the holder to provide to the Company an opinion of counsel to the effect that such transfer does not require registration of such transferred shares under the Securities Act of 1933.

Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, shell companies, like us, unless the following conditions are met:

| |

●

|

the issuer of the securities that was formerly a shell company has ceased to be a shell company;

|

| |

|

|

| |

●

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934;

|

| |

|

|

| |

●

|

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and

|

| |

|

|

| |

●

|

at least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company.

|

Neither the Company nor its officer and director has any present plan, proposal, arrangement, understanding or intention of selling any unissued or outstanding shares of common stock in the public market subsequent to a business combination. Nevertheless, in the event that a substantial number of shares of our common stock were to be sold in any public market that may develop for our securities subsequent to a business combination, such sales may adversely affect the price for the sale of the Company’s common stock securities in any such trading market. We cannot predict what effect, if any, market sales of currently restricted shares of common stock or the availability of such shares for sale will have on the market prices prevailing from time to time, if any.

The Company has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Company’s business.

Item 10. Recent Sales of Unregistered Securities.

The Company has no sales of unregistered securities within the prior two years. However, its subisidary Arowana did sell unregistered securities through the funding portal Netcapital, and raised $10,000 in March 2023 in reliance on the exemption found in the Securities Act section 4(a)(6)

Item 11. Description of Registrant’s Securities to be Registered.

Authorized Capital Stock

2,249,000,000 common authorized and 100,000,000 preferred authorized.

Common Stock

Holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the stockholders. Holders of common stock do not have cumulative voting rights. Holders of common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the Board of Directors in its discretion from funds legally available. In the event of a liquidation, dissolution or winding up of the company, the holders of common stock are entitled to share pro rata all assets remaining after payment in full of all liabilities. All of the outstanding shares of common stock are fully paid and non-assessable.

Holders of common stock have no preemptive rights to purchase the Company’s common stock. There are no conversion or redemption rights or sinking fund provisions with respect to the common stock.

Preferred stock

Our authorized capital preferred stock is 100,000,000 shares of $0.001 par value preferred stock. Pursuant to our Articles of Incorporation, our board has the authority, without further stockholder approval, to provide for the issuance of up to 100,000,000 shares of our preferred stock in one or more series and to determine the dividend rights, conversion rights, voting rights, rights in terms of redemption, liquidation preferences, the number of shares constituting any such series and the designation of such series. Our board has the power to afford preferences, powers and rights (including voting rights) to the holders of any preferred stock preferences, such rights and preferences being senior to the rights of holders of common stock.

Our Board of Directors have designated a single Series of Preferred Stock designated as Series A Preferred. Series A Preferred Shares are convertible to common stock at the rate of one Share of preferred to 1,000 shares of common after notice to the Corporation by the holder, only when there is both sufficient common stock available for conversion and a sufficient number of common stock shares are authorized by the Corporation. Preferred shares enjoy voting rights at the rate of 1/1000 (one to one thousand) with common stock and shall be entitled to vote when the holders of common stock shall have the right to vote.

In November 2022 press release by Sack Lunch Productions, Inc. that they had entered into a letter of intent to acquire a 45% minority interest in our wholly owned subsidiary Arowana Media Holdings, Inc.

This transaction has not been completed.

Dividends

We have not paid any dividends on our common stock and do not presently intend to pay cash dividends prior to the consummation of a business combination. The payment of cash dividends in the future, if any, will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent to consummation of a business combination, if any. The payment of any dividends subsequent to a business combination, if any, will be within the discretion of our then existing board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, the board of directors does not anticipate paying any cash dividends in the foreseeable future.

Trading of Securities in Secondary Market

In order to qualify for listing on the Nasdaq Small Cap Market, a company must have at least (i) net tangible assets of $4,000,000 or market capitalization of $50,000,000 or net income for two of the last three years of $750,000; (ii) public float of 1,000,000 shares with a market value of $5,000,000; (iii) a bid price of $4.00; (iv) three market makers; (v) 300 shareholders and (vi) an operating history of one year or, if less than one year, $50,000,000 in market capitalization. For continued listing on the Nasdaq Small Cap Market, a company must have at least (i) net tangible assets of $2,000,000 or market capitalization of $35,000,000 or net income for two of the last three years of $500,000; (ii) a public float of 500,000 shares with a market value of $1,000,000; (iii) a bid price of $1.00; (iv) two market makers; and (v) 300 shareholders.

Rules 504, 505 and 506 of Regulation D

The Commission is of the opinion that Rule 504 of Regulation D regarding exemption for limited offerings and sales of securities not exceeding $1,000,000 is not available to blank check companies. However, Rules 505 and 506 of Regulation D are available.

We have considered the possible need and intend to issue shares prior to any business combination relying on the exemption provided under Regulation D of The Securities Act of 1933 as the need arises to complete a business combination, to retain a consultant, finder or other professional to locate and investigate a potential target company or for any other requirement we deem necessary and in the interest of our shareholders. We do not intend to conduct a registered offering of our securities at this time. We have taken no action in furtherance of any offering of any securities at this time as our only activities since inception have been limited to organizational efforts, obtaining initial financing, and preparing a registration statement on Form 10 to file with the Securities and Exchange Commission.

Transfer

Madison Stock Transfer, Inc. is currently the company’s transfer agent. Madison Stock Transfer, Inc. is registered with the SEC.

(b) Debt Securities. None.

(c) Other Securities to be Registered. None.

Item 12. Indemnification of Directors and Officers.

The Wyoming General Corporation provides that a corporation may indemnify directors and officers as well as other employees and individuals against expenses including attorneys’ fees, judgments, fines and amounts paid in settlement in connection with various actions, suits or proceedings, whether civil, criminal, administrative or investigative other than an action by or in the right of the corporation, a derivative action, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, if they had no reasonable cause to believe their conduct was unlawful. A similar standard is applicable in the case of derivative actions, except that indemnification only extends to expenses including attorneys’ fees incurred in connection with the defense or settlement of such actions and the statute requires court approval before there can be any indemnification where the person seeking indemnification has been found liable to the corporation. The statute provides that it is not exclusive of other indemnification that may be granted by a corporation’s certificate of incorporation, bylaws, agreement, and a vote of stockholders or disinterested directors or otherwise.

Our Certificate of Incorporation provides that it will indemnify and hold harmless, to the fullest extent permitted by Section 145 of the Wyoming General Corporation Law, as amended from time to time, each person that such section grants us the power to indemnify.

The Wyoming General Corporation Law permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability for:

| |

● |

any breach of the director’s duty of loyalty to the corporation or its stockholders;

|

| |

|

|

| |

● |

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

| |

|

|

| |

● |

payments of unlawful dividends or unlawful stock repurchases or redemptions; or

|

| |

|

|

| |

● |

any transaction from which the director derived an improper personal benefit.

|

Our Certificate of Incorporation provides that, to the fullest extent permitted by applicable law, none of our directors will be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director. Any repeal or modification of this provision will be prospective only and will not adversely affect any limitation, right or protection of a director of our company existing at the time of such repeal or modification.

Item 13. Financial Statements and Supplementary Data.

Item 14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

There are not and have not been any disagreements between the Company and its accountants on any matter of accounting principles, practices or financial statement disclosure.

Item 15. Financial Statements and Exhibits.

(a) Financial Statements.

The financial statements and related notes are included as part of this Form 10 registration statement as indexed in the appendix on page F-1 through F-21.

MIKE THE PIKE PRODUCTIONS, INC.

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2022 and 2021

Certified Public Accountants and Advisors

A PCAOB Registered Firm

713-489-5635 bartoncpafirm.com Cypress, Texas

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

Mike The Pike Productions, Inc.

20860 N. Tatum Blvd, Suite 300

Phoenix AZ 85050

Opinion on the Financial Statement

We have audited the accompanying balance sheets of Mike The Pike Productions, Inc., (the “Company”). as of December 31, 2022 and 2021, and the related statements of operations, stockholders’ equity, and cash flows for the year then ended, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of Mike The Pike Productions, Inc. as of December 31, 2022 and 2021, and the results of its operations and its cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to Mike The Pike Productions, Inc. in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Mike The Pike Productions, Inc. is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provide a reasonable basis for our opinion.

Critical Audit Matters

The are no critical audit matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments.

We have served as Mike The Pike Productions, Inc.’s auditor since 2023.

BARTON CPA

Cypress, Texas

April 27, 2023

MIKE THE PIKE PRODUCTIONS, INC.

CONSOLIDATED BALANCE SHEETS

AT DECEMBER 31, 2022 & 2021

| |

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Intangible Assets net of amortization (Note 4)

|

|

|

10,211 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

10,211 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

|

9,421 |

|

|

|

8,879 |

|

| |

|

|

|

|

|

|

|

|

|

Due to Stockholder (Note 9)

|

|

|

135,903 |

|

|

|

118,403 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

145,324 |

|

|

|

127,282 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

145,324 |

|

|

|

127,282 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ (DEFICIT)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Preferred A Stock $.001 par value, 100,000,000 authorized, 2,415,142 issued and outstanding at December 31, 2022 and December 31, 2021, respectively

|

|

|

2,415 |

|

|

|

2,415 |

|

| |

|

|

|

|

|

|

|

|

|

Common Stock, $.001 par value, 2,249,000,000 authorized, 2,227,000,000 issued and outstanding at December 31, 2022 and December 31, 2021, respectively

|

|

|

2, 227,000 |

|

|

|

2,227,000 |

|

| |

|

|

|

|

|

|

|

|

|

Additional paid-in-capital

|

|

|

1,251,537 |

|

|

|

1,251,537 |

|

| |

|

|

|

|

|

|

|

|

|

Subscription receivable

|

|

|

(2,229,415 |

)

|

|

|

(2,229,415 |

)

|

| |

|

|

|

|

|

|

|

|

|

Retained earnings

|

|

|

(1,386,650 |

)

|

|

|

(1,378,819 |

)

|

| |

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ ACCUMULATED (DEFICIT)

|

|

|

(135,113 |

)

|

|

|

(127,282 |

)

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

|

|

|

10,211 |

|

|

|

— |

|

The accompanying notes are an integral part of the financial statements.

MIKE THE PIKE PRODUCTIONS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| |

|

2022

|

|

|

2021

|

|

|

REVENUES:

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

TOTAL REVENUE

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

COST OF SALES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Administrative expenses

|

|

|

542 |

|

|

|

650 |

|

| |

|

|

|

|

|

|

|

|

|

Amortization (Note 10)

|

|

|

7,289 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Transfer Agent Fees

|

|

|

— |

|

|

|

1,500 |

|

| |

|

|

|

|

|

|

|

|

|

Total Operating expenses

|

|

|

7,831 |

|

|

|

2,150 |

|

| |

|

|

|

|

|

|

|

|

|

NET OPERATING LOSS

|

|

|

(7,831 |

)

|

|

|

(2,150 |

)

|

| |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Gain on accrued debt interest write off (Note 6)

|

|

|

— |

|

|

|

59,049 |

|

| |

|

|

|

|

|

|

|

|

|

Impairment expense (Note 10)

|

|

|

— |

|

|

|

(45,783 |

)

|

| |

|

|

|

|

|

|

|

|

|

Gain on debt write off (Note 6)

|

|

|

— |

|

|

|

115,000 |

|

| |

|

|

|

|

|

|

|

|

|

Gain on write of accrued salary (Note 5)

|

|

|

— |

|

|

|

133,500 |

|

| |

|

|

|

|

|

|

|

|

|

Gain (loss) on change in fair value of derivative liabilities

|

|

|

— |

|

|

|

66,635 |

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS)

|

|

$ |

(7,831 |

)

|

|

$ |

326,251 |

|

| |

|

|

|

|

|

|

|

|

|

Basic and Diluted Income (Loss) per Common Share

|

|

$ |

(0.00 |

)

|

|

|

(0.00 |

)

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding

|

|

|

2,227,000,000 |

|

|

|

2,227,000,000 |

|

The accompanying notes are an integral part of the financial statements.

MIKE THE PIKE PRODUCTIONS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDER’S DEFICIT

FOR THEYEARSENDED DECEMBER 31 2022 AND 2021

| |

|

PREFERRED

|

|

|

COMMON STOCK

|

|

|

ADDITIONAL

PAID- IN

|

|

|

SUBSCRIPTION

|

|

|

ACCUMULATED

|

|

|

TOTAL SHAREHOLDERS

|

|

| |

|

SHARES

|

|

|

VALUE

|

|

|

SHARES

|

|

|

VALUE

|

|

|

CAPITAL

|

|

|

RECEIVABLE

|

|

|

(DEFICIT)

|

|

|

(DEFICIT)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(34,367 |

)

|

|

|

(34,367 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE DECEMBER 31, 2020 (UNAUDITED)

|

|

|

2,415,142 |

|

|

$ |

2,415 |

|

|

|

2,227,000,000 |

|

|

$ |

2,227,000 |

|

|

$ |

1,251,537 |

|

|

|

(2,229,415 |

)

|

|

$ |

(1,705,070 |

)

|

|

$ |

(453,533 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME DECEMBER 31, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

326,251 |

|

|

|

326,251 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE DECEMBER 31, 2021

|

|

|

2,415,142 |

|

|

$ |

2,415 |

|

|

|

2,227,000,000 |

|

|

$ |

2,227,000 |

|

|

$ |

1,251,537 |

|

|

|

(2,229415 |

)

|

|

$ |

(1,378,819 |

)

|

|

$ |

(127,282 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS DECEMBER 31,2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,831 |

)

|

|

|

(7,831 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE DECEMBER 31, 2022

|

|

|

2,415,142 |

|

|

$ |

2,415 |

|

|

|

2,227,000,000 |

|

|

$ |

2,227,000 |

|

|

$ |

1,251,537 |

|

|

|

(2,229,415 |

)

|

|

$ |

(1,386,650 |

)

|

|

$ |

(135,113 |

)

|

The accompanying notes are an integral part of the financial statements.

MIKE THE PIKE PRODUCTIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|