0001360442false--12-31Q220230.001500000077765400.0014556636350048273117300004000124829861906190675054556660.050.081565463405000000013604422023-01-012023-06-300001360442cbds:PrestoCorpMembercbds:NewYorkOfficeFacilitiesMember2022-01-012022-06-300001360442cbds:PrestoCorpMembercbds:NewYorkOfficeFacilitiesMember2023-04-012023-06-300001360442cbds:PrestoCorpMembercbds:NewYorkOfficeFacilitiesMember2022-04-012022-06-300001360442cbds:PrestoCorpMembercbds:NewYorkOfficeFacilitiesMember2023-01-012023-06-300001360442cbds:WarrantsMember2023-06-300001360442cbds:WarrantsMember2022-12-310001360442cbds:N2020StockPlanMember2023-06-300001360442cbds:TwoThousandTwentyOneStockPlanMember2023-01-012023-06-300001360442cbds:NonRelatedPartyMember2023-06-300001360442cbds:NonRelatedPartyMember2023-01-012023-06-300001360442cbds:BoardOfDirectorsMember2023-06-300001360442cbds:CommonStockSharesMember2022-12-310001360442cbds:CommonStockSharesMember2023-06-300001360442cbds:PreferredStockSharesMember2022-12-310001360442cbds:PreferredStockSharesMember2023-06-300001360442cbds:CommonStockSharesMembercbds:BoardOfDirectorsMember2023-06-300001360442cbds:PreferredStockSharesMembercbds:BoardOfDirectorsMember2023-06-300001360442cbds:CarolynMerrillMember2023-01-012023-06-300001360442cbds:DiagonalLendingLlcMember2022-12-310001360442cbds:DiagonalLendingLlcMember2023-06-300001360442cbds:DiagonalLendingLlcMember2023-01-012023-06-300001360442cbds:CarolynMerrillMember2023-01-012023-01-020001360442cbds:CarolynMerrillMember2023-01-010001360442cbds:DiagonalLendingLlcMember2022-11-070001360442cbds:DiagonalLendingLlcMember2022-08-250001360442cbds:CBDGMember2023-04-012023-06-300001360442cbds:CBDGMember2022-04-012022-06-300001360442cbds:CBDGMember2022-01-012022-06-300001360442cbds:CBDGMember2023-01-012023-06-300001360442cbds:CBDGMember2022-01-012022-12-310001360442cbds:REFGMember2023-01-012023-06-300001360442cbds:CBDGMember2023-06-300001360442cbds:REFGMember2022-12-310001360442cbds:REFGMember2023-06-300001360442cbds:CBDGMember2022-12-310001360442cbds:CBDGMembercbds:CommonStockOneMember2021-01-012021-12-310001360442cbds:CBDGMembercbds:PreferredStockOneMember2021-01-012021-12-310001360442cbds:ConsultantMember2022-01-012022-06-300001360442cbds:ConsultantMember2022-04-012022-06-300001360442cbds:ConsultantMember2023-04-012023-06-300001360442cbds:ConsultantMember2023-01-012023-06-300001360442cbds:DavidTobiasDirectorMember2023-01-012023-06-300001360442cbds:DavidTobiasDirectorMember2022-12-310001360442cbds:DavidTobiasDirectorMember2023-06-300001360442cbds:CathyCarrollDirectorMember2023-01-012023-06-3000013604422021-01-012021-12-3100013604422022-01-012022-12-310001360442cbds:DirectorsAndContractOfficersMember2022-01-012022-12-310001360442cbds:DirectorsAndContractOfficersMember2023-01-012023-06-300001360442srt:MaximumMember2023-06-300001360442srt:MinimumMember2023-06-300001360442cbds:NewCompendiumAffiliateMember2022-12-310001360442cbds:OtherAffiliateMember2022-12-310001360442cbds:CathyCarrollDirectorMember2022-12-310001360442cbds:DavidTobiasCEOAndDirectorMember2022-12-310001360442cbds:OtherAffiliateMember2023-06-300001360442cbds:CathyCarrollDirectorMember2023-06-300001360442cbds:NewCompendiumAffiliateMember2023-06-300001360442cbds:DavidTobiasCEOAndDirectorMember2023-06-300001360442cbds:PrestoCorpMembercbds:AugustMember2023-03-310001360442cbds:PrestoCorpMembercbds:AugustMember2022-12-310001360442cbds:PrestoCorpMembercbds:AugustMember2023-01-012023-06-300001360442srt:MaximumMember2023-01-012023-06-300001360442srt:MinimumMember2023-01-012023-06-300001360442cbds:KPALMembercbds:PatentsAndTrademarksMember2022-12-310001360442cbds:KPALMembercbds:PatentsAndTrademarksMember2023-06-300001360442cbds:PrestoCorpMemberus-gaap:IntellectualPropertyMember2022-12-310001360442cbds:PrestoCorpMemberus-gaap:IntellectualPropertyMember2023-06-300001360442cbds:CannabisSativaMemberus-gaap:InternetDomainNamesMember2022-12-310001360442cbds:ConvertibleSeriesAPreferredStockMember2022-01-012022-06-300001360442cbds:ConvertibleSeriesAPreferredStockMember2023-01-012023-06-300001360442cbds:WarrentsMember2022-01-012022-06-300001360442cbds:WarrentsMember2023-01-012023-06-300001360442cbds:PreferredStocksMember2023-06-300001360442cbds:CannabisSativaMemberus-gaap:InternetDomainNamesMember2023-06-300001360442cbds:NonControllingInterestPrestocorpMember2023-06-300001360442us-gaap:RetainedEarningsMember2023-06-300001360442us-gaap:AdditionalPaidInCapitalMember2023-06-300001360442us-gaap:CommonStockMember2023-06-300001360442us-gaap:PreferredStockMember2023-06-300001360442cbds:NonControllingInterestPrestocorpMember2023-04-012023-06-300001360442us-gaap:RetainedEarningsMember2023-04-012023-06-300001360442us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001360442us-gaap:CommonStockMember2023-04-012023-06-300001360442us-gaap:PreferredStockMember2023-04-012023-06-3000013604422023-03-310001360442cbds:NonControllingInterestPrestocorpMember2023-03-310001360442us-gaap:RetainedEarningsMember2023-03-310001360442us-gaap:AdditionalPaidInCapitalMember2023-03-310001360442us-gaap:CommonStockMember2023-03-310001360442us-gaap:PreferredStockMember2023-03-3100013604422023-01-012023-03-310001360442cbds:NonControllingInterestPrestocorpMember2023-01-012023-03-310001360442us-gaap:RetainedEarningsMember2023-01-012023-03-310001360442us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001360442us-gaap:CommonStockMember2023-01-012023-03-310001360442us-gaap:PreferredStockMember2023-01-012023-03-310001360442cbds:NonControllingInterestPrestocorpMember2022-12-310001360442us-gaap:RetainedEarningsMember2022-12-310001360442us-gaap:AdditionalPaidInCapitalMember2022-12-310001360442us-gaap:CommonStockMember2022-12-310001360442us-gaap:PreferredStockMember2022-12-3100013604422022-06-300001360442cbds:NonControllingInterestPrestocorpMember2022-06-300001360442us-gaap:RetainedEarningsMember2022-06-300001360442us-gaap:AdditionalPaidInCapitalMember2022-06-300001360442us-gaap:CommonStockMember2022-06-300001360442us-gaap:PreferredStockMember2022-06-300001360442cbds:NonControllingInterestPrestocorpMember2022-04-012022-06-300001360442us-gaap:RetainedEarningsMember2022-04-012022-06-300001360442us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001360442us-gaap:CommonStockMember2022-04-012022-06-300001360442us-gaap:PreferredStockMember2022-04-012022-06-3000013604422022-03-310001360442cbds:NonControllingInterestPrestocorpMember2022-03-310001360442us-gaap:RetainedEarningsMember2022-03-310001360442us-gaap:AdditionalPaidInCapitalMember2022-03-310001360442us-gaap:CommonStockMember2022-03-310001360442us-gaap:PreferredStockMember2022-03-3100013604422022-01-012022-03-310001360442cbds:NonControllingInterestPrestocorpMember2022-01-012022-03-310001360442us-gaap:RetainedEarningsMember2022-01-012022-03-310001360442us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001360442us-gaap:CommonStockMember2022-01-012022-03-310001360442us-gaap:PreferredStockMember2022-01-012022-03-3100013604422021-12-310001360442cbds:NonControllingInterestPrestocorpMember2021-12-310001360442us-gaap:RetainedEarningsMember2021-12-310001360442us-gaap:AdditionalPaidInCapitalMember2021-12-310001360442us-gaap:CommonStockMember2021-12-310001360442us-gaap:PreferredStockMember2021-12-3100013604422022-01-012022-06-3000013604422022-04-012022-06-3000013604422023-04-012023-06-3000013604422022-12-3100013604422023-06-3000013604422023-08-18iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 10-Q

___________________

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the quarterly period ended: June 30, 2023 |

|

or |

| | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | |

| For the transition period from: _____________ to _____________ |

Commission File Number: 000-53571

Cannabis Sativa, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 20-1898270 |

(State or Other Jurisdiction | | (I.R.S. Employer |

of Incorporation) | | Identification No.) |

450 Hillside Dr. #A224, Mesquite, Nevada 89027

(Address of Principal Executive Office) (Zip Code)

(702) 762-3123

(Registrant’s telephone number, including area code)

N/A

(Former name, former address, and former fiscal year, if changed since last report)

———————

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered. |

None | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☒ |

Emerging growth company | ☒ | | |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

The number of shares of the issuer’s Common Stock outstanding as of August 18, 2023, is 50,048,273

.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Attached after signature page.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Certain statements in this Report constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Factors that might cause such a difference include, among others, uncertainties relating to general economic and business conditions; industry trends; changes in demand for our products and services; uncertainties relating to customer plans and commitments and the timing of orders received from customers; announcements or changes in our pricing policies or that of our competitors; unanticipated delays in the development, market acceptance or installation of our products and services; changes in government regulations; availability of management and other key personnel; availability, terms, and deployment of capital; relationships with third-party equipment suppliers; and worldwide political stability and economic growth. The words “believe,” “expect,” “anticipate,” “intend” and “plan” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.

Results of Operations

Three Months Ended June 30, 2023, compared with the Three Months Ended June 30, 2022

| | Three Months Ended | |

| | A | | | B | | | A-B | |

| | June 30, 2023 | | | June 30, 2022 | | | Change | | | Change % | |

REVENUE | | $ | 323,197 | | | $ | 456,088 | | | $ | (132,891 | ) | | | (29 | )% |

Cost of revenues | | | 120,608 | | | | 170,541 | | | | (49,933 | ) | | | (29 | )% |

Cost of sales % of total sales | | | 37 | % | | | 37 | % | | | | | | (-0-) | % |

Gross profit | | | 202,589 | | | | 285,547 | | | | (82,958 | ) | | | (29 | )% |

Gross profit % of sales | | | 63 | % | | | 63 | % | | | | | | (-0-) | % |

EXPENSES | | | | | | | | | | | | | | | | |

Professional fees | | | 108,757 | | | | 89,502 | | | | 19,255 | | | | 22 | % |

Depreciation and amortization | | | 37,990 | | | | 42,354 | | | | (4,364 | ) | | | (10 | )% |

Wages and salaries | | | 209,690 | | | | 184,150 | | | | 25,540 | | | | 14 | % |

Advertising | | | 4,630 | | | | 15,308 | | | | (10,678 | ) | | | (70 | )% |

General and administrative | | | 146,339 | | | | 128,762 | | | | 17,577 | | | | 14 | % |

Total expenses | | | 507,406 | | | | 460,076 | | | | 47,330 | | | | 10 | % |

NET LOSS FROM CONTINUING OPERATIONS | | | (304,817 | ) | | | (174,529 | ) | | | (130,288 | ) | | | (75 | )% |

Revenue for the three months ended June 30, 2023, decreased 29% compared to the three months ended June 30, 2022. Cost of revenues as a percentage of sales decreased 29% between the periods. The decrease in revenues is primarily a result of the lessening impact COVID-19 as we progressed into 2022. In 2021, COVID-19 and the associated concerns with in-person visits to doctors’ offices caused a surge in the use of telemedicine in general and the Company benefitted from this with an increase in customers seeking medical marijuana cards through telemedicine. The first quarter of 2022 continued to benefit somewhat from this surge but as the public grew more accustomed to the pandemic, and as vaccinations and booster shots became widely available, the demand for remote visits with physicians for medical marijuana cards decreased. This softening in the demand for our service continued during the second quarter of 2023.

Total operating expenses increased 10% in the three months ended June 30, 2023 compared with the three months ended June 30, 2022. Professional fees, wages and salaries and general and administrated fees increased. Wages and salaries decreased as a result of the death of our CFO in the fourth quarter of 2022 and our CEO assuming those duties without an increase in salary, however $88,200 was paid out in bonuses. Professional fees and general and administrative expenses also increased as audit expenses and other general expenses went up for additional time and rate increases.

Six Months Ended June 30, 2023, compared with the Six Months Ended June 30, 2022

| | Six Months Ended | |

| | A | | | B | | | A-B | |

| | June 30, 2023 | | | June 30, 2022 | | | Change | | | Change % | |

REVENUE | | $ | 668,565 | | | $ | 879,789 | | | $ | (211,224 | ) | | | (24 | )% |

Cost of revenues | | | 226,009 | | | | 329,230 | | | | (103,221 | ) | | | (31 | )% |

Cost of sales % of total sales | | | 34 | % | | | 37 | % | | | | | | | (3 | )% |

Gross profit | | | 442,556 | | | | 550,559 | | | | (108,003 | ) | | | (20 | )% |

Gross profit % of sales | | | 66 | % | | | 63 | % | | | | | | | 3 | % |

EXPENSES | | | | | | | | | | | | | | | | |

Professional fees | | | 161,898 | | | | 211,408 | | | | (49,510 | ) | | | (23 | )% |

Depreciation and amortization | | | 75,979 | | | | 84,707 | | | | (8,728 | ) | | | (10 | )% |

Wages and salaries | | | 324,793 | | | | 370,911 | | | | (46,118 | ) | | | (12 | )% |

Advertising | | | 7,476 | | | | 31,529 | | | | (24,053 | ) | | | (76 | )% |

General and administrative | | | 289,588 | | | | 356,364 | | | | (66,776 | ) | | | (19 | )% |

Total expenses | | | 859,734 | | | | 1,054,919 | | | | (195,185 | ) | | | (19 | )% |

NET LOSS FROM CONTINUING OPERATIONS | | | (417,178 | ) | | | (504,360 | ) | | | 87,182 | | | | 17 | % |

Revenue for the six months ended June 30, 2023, decreased 24% compared to the six months ended June 30, 2022. Cost of revenues as a percentage of sales decreased 31% between the periods. The decrease in revenues is primarily a result of the lessening impact COVID-19 as we progressed into 2022. In 2021, COVID-19 and the associated concerns with in-person visits to doctors’ offices caused a surge in the use of telemedicine in general and the Company benefitted from this with an increase in customers seeking medical marijuana cards through telemedicine. The first quarter of 2022 continued to benefit somewhat from this surge but as the public grew more accustomed to the pandemic, and as vaccinations and booster shots became widely available, the demand for remote visits with physicians for medical marijuana cards decreased. This softening in the demand for our service continued during the second quarter of 2023.

Total operating expenses decreased 19% in the six months ended June 30, 2023 compared with the six months ended June 30, 2022. Professional fees, wages and salaries and general and administrated fees decreased. Wages and salaries decreased as a result of the death of our CFO in the fourth quarter of 2022 and our CEO assuming those duties without an increase in salary, however $88,200 was paid out in bonuses.

Liquidity and Capital Resources

Cash used in operating activities was $51,857 and $40,886 in the six months period ended June 30, 2023 and 2022, respectively. In the six months period ended June 30, 2023, financing activities provided $22,884, consisting of net proceeds from related party notes. We ended the second quarter of 2023 with $58,124 in cash on hand.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. We incurred net losses of $816,437 and $418,889, respectively, for the six months ended June 30, 2023, and 2022 and had an accumulated deficit of $81,458,477 as of June 30, 2023. The Company may seek to raise money for working capital purposes through a public offering of its equity capital or through a private placement of equity capital or convertible debt. It will be important for the Company to be successful in its efforts to raise capital in this manner if it is going to be able to further its business plan in an aggressive manner. Raising capital in this manner will cause dilution to current shareholders.

The amount of cash on hand the Company has does not provide sufficient liquidity to meet the immediate needs of our current operations.

Off Balance Sheet Arrangements

None

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Not required.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

Conclusions of Management Regarding Effectiveness of Disclosure Controls and Procedures

At the end of the period covered by this Quarterly Report on Form 10-Q, an evaluation was carried out under the supervision and with the participation of the Company’s management, including the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operations of the Company’s disclosure controls and procedures (as defined in Rule 13a – 15(e) and Rule 15d – 15(e) under the Exchange Act). Based on that evaluation, the CEO and the CFO have concluded that as of the end of the period covered by this report, the Company’s disclosure controls and procedures were not effective as it was determined that there were material weaknesses affecting our disclosure controls and procedures.

Management of the Company believes that these material weaknesses are due to the small size of the company’s accounting staff. The small size of the Company’s accounting staff may prevent adequate controls in the future, such as segregation of duties, due to the cost/benefit of remediation. To mitigate the current limited resources and limited employees, we rely heavily on direct management oversight of transactions, along with the use of external legal and accounting professionals. As the Company grows, management expects to increase the number of employees, which will enable us to implement adequate segregation of duties within the internal control framework.

Changes in Internal Control over Financial Reporting

There was no change in our internal control over financial reporting during the quarter ended June 30, 2023, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings.

We are not a party to any material legal proceedings, and, to the best of our knowledge, no such legal proceedings have been threatened against us.

Item 1A. Risk Factors

Not required.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the fiscal quarter ended June 30, 2023, 2,031,910 shares of common stock were issued to convert $54,000 of a note payable to a non-related party. Also, during the quarter, the Company issued a convertible note to a contract services provider in the principal amount of $72,262. The note bears interest at 8% and is due December 31, 2023.

The securities issued were exempt from registration pursuant to Section 4(2) of the Securities Act of 1933.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

None.

Item 6. Exhibits.

The following documents are included as exhibits to this report:

(a) Exhibits

(1) Incorporated by reference to Exhibits 3.01 and 3.02 of the Company’s Registration Statement on Form 10 filed January 28, 2009.

(2) XBRL information is furnished and not filed for purposes of Sections 11 and 12 of the Securities Act of 1933 and Section 18 of the Securities Exchange Act of 1934, and is not subject to liability under those sections, is not part of any registration statement or prospectus to which it relates and is not incorporated or deemed to be incorporated by reference into any registration statement, prospectus or other document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Cannabis Sativa, Inc.

Date: August 18, 2023

By: | /s/ David Tobias | |

| David Tobias Principal Executive Officer Principal Financial Officer | |

CANNABIS SATIVA, INC. |

|

Contents |

CANNABIS SATIVA, INC. | | | |

| | | |

CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED | | |

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

ASSETS | | | | | | |

Current Assets | | | | | | |

Cash | | $ | 58,124 | | | $ | 97,445 | |

Investment in equity securities, at fair value | | | 1,200 | | | | 379,858 | |

Right of use asset | | | 24,958 | | | | — | |

| | | | | | | | |

Total Current Assets | | | 84,282 | | | | 477,303 | |

| | | | | | | | |

Advances to related party | | | 75,054 | | | | 55,666 | |

Right of use asset | | | — | | | | 38,968 | |

Property and equipment, net | | | 2,572 | | | | 2,709 | |

Intangible assets, net | | | 83,101 | | | | 158,943 | |

Goodwill | | | 1,837,202 | | | | 1,837,202 | |

| | | | | | | | |

Total Assets | | $ | 2,082,211 | | | $ | 2,570,791 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | |

Current Liabilities | | | | | | | | |

Accounts payable and accrued expenses | | $ | 133,093 | | | $ | 164,411 | |

Operating lease liability, current | | | 24,958 | | | | 28,736 | |

Accrued interest - related parties | | | 16,474 | | | | 16,374 | |

Convertible notes payable | | | 211,762 | | | | 168,500 | |

Notes payable to related parties | | | 144,421 | | | | 91,700 | |

| | | | | | | | |

Total Current Liabilities | | | 530,708 | | | | 469,721 | |

| | | | | | | | |

Long-term liabilities | | | | | | | | |

Operating lease liability, long term | | | — | | | | 10,232 | |

Stock payable | | | 542,421 | | | | 418,156 | |

| | | | | | | | |

Total Liabilities | | | 1,073,129 | | | | 898,109 | |

| | | | | | | | |

Commitments and contingencies (Notes 6 and 8) | | | | | | | | |

| | | | | | | | |

Stockholders’ Equity: | | | | | | | | |

| | | | | | | | |

Preferred stock $0.001 par value; 5,000,000 shares authorized; -0- and 777,654 issued and outstanding, respectively | | | — | | | | — | |

Common stock $0.001 par value; 495,000,000 shares authorized; 50,048,273 and 45,566,363 shares issued and outstanding, respectively | | | 50,049 | | | | 45,567 | |

Additional paid-in capital | | | 81,087,973 | | | | 80,939,618 | |

Accumulated deficit | | | (81,458,477 | ) | | | (80,603,069 | ) |

| | | | | | | | |

Total Cannabis Sativa, Inc. Stockholders’ Equity (Deficit) | | | (320,455 | ) | | | 382,116 | |

| | | | | | | | |

Non-Controlling Interest | | | 1,329,537 | | | | 1,290,566 | |

| | | | | | | | |

Total Stockholders’ Equity | | | 1,009,082 | | | | 1,672,682 | |

| | | | | | | | |

Total Liabilities and Stockholders’ Equity | | $ | 2,082,211 | | | $ | 2,570,791 | |

| | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

CANNABIS SATIVA, INC. | | | | | | | | | |

| | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED | | | | |

| | Three Months Ended | | | Six Months Ended | |

| | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Revenues | | $ | 323,197 | | | $ | 456,088 | | | $ | 668,565 | | | $ | 879,789 | |

| | | | | | | | | | | | | | | | |

Cost of Revenues | | | 120,608 | | | | 170,541 | | | | 226,009 | | | | 329,230 | |

| | | | | | | | | | | | | | | | |

Gross Profit | | | 202,589 | | | | 285,547 | | | | 442,556 | | | | 550,559 | |

| | | | | | | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | | | | | | |

Professional fees | | | 108,757 | | | | 89,502 | | | | 161,898 | | | | 211,408 | |

Depreciation and amortization | | | 37,990 | | | | 42,354 | | | | 75,979 | | | | 84,707 | |

Wages and salaries | | | 209,690 | | | | 184,150 | | | | 324,793 | | | | 370,911 | |

Advertising | | | 4,630 | | | | 15,308 | | | | 7,476 | | | | 31,529 | |

General and administrative | | | 146,339 | | | | 128,762 | | | | 289,588 | | | | 356,364 | |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 507,406 | | | | 460,076 | | | | 859,734 | | | | 1,054,919 | |

| | | | | | | | | | | | | | | | |

Loss from Operations | | | (304,817 | ) | | | (174,529 | ) | | | (417,178 | ) | | | (504,360 | ) |

| | | | | | | | | | | | | | | | |

Other (Income) and Expenses | | | | | | | | | | | | | | | | |

Unrealized (gain) loss on investment | | | 2,400 | | | | 142,012 | | | | 213,883 | | | | (104,642 | ) |

Loss on debt settlement | | | (114 | ) | | | — | | | | 10,527 | | | | — | |

Loss on sale of investment securities | | | — | | | | — | | | | 155,735 | | | | — | |

Interest expense | | | 9,233 | | | | 1,995 | | | | 19,114 | | | | 19,171 | |

| | | | | | | | | | | | | | | | |

Total Other (Income) Expenses, Net | | | 11,519 | | | | 144,007 | | | | 399,259 | | | | (85,471 | ) |

| | | | | | | | | | | | | | | | |

Loss Before Income Taxes | | | (316,336 | ) | | | (318,536 | ) | | | (816,437 | ) | | | (418,889 | ) |

| | | | | | | | | | | | | | | | |

Income Taxes | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net Loss for the Period | | | (316,336 | ) | | | (318,536 | ) | | | (816,437 | ) | | | (418,889 | ) |

| | | | | | | | | | | | | | | | |

Income attributable to non-controlling interest - PrestoCorp | | | 16,150 | | | | 32,029 | | | | 38,971 | | | | 22,567 | |

| | | | | | | | | | | | | | | | |

Net Loss for the Period Attributable To Cannabis Sativa, Inc. | | $ | (332,486 | ) | | $ | (350,565 | ) | | $ | (855,408 | ) | | $ | (441,456 | ) |

| | | | | | | | | | | | | | | | |

Net Loss for the Period per Common Share: Basic & Diluted | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | | | | | | |

Weighted Average Common Shares Outstanding: | | | | | | | | | | | | | | | | |

Basic & Diluted | | | 48,169,783 | | | | 31,394,764 | | | | 46,926,618 | | | | 31,370,814 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

CANNABIS SATIVA, INC. | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022 - UNAUDITED |

| | | | | | | | | | | | | | Additional | | | | | | Non-controlling | | | | |

| | Preferred Stock | | | Common Stock | | | Paid-In | | | Accumulated | | | Interest - | | | | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Prestocorp | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance - January 1, 2022 | | | 777,654 | | | $ | 778 | | | | 30,746,865 | | | $ | 30,748 | | | $ | 79,151,240 | | | $ | (79,475,968 | ) | | $ | 1,338,102 | | | $ | 1,044,900 | |

Net loss for period | | | — | | | | — | | | | — | | | | — | | | | — | | | | (90,891 | ) | | | (9,462 | ) | | | (100,353 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance - March 31, 2022 | | | 777,654 | | | | 778 | | | | 30,746,865 | | | | 30,748 | | | | 79,151,240 | | | | (79,566,859 | ) | | | 1,328,640 | | | | 944,547 | |

Conversion of preferred to common (1:1) | | | (131,880 | ) | | | (132 | ) | | | 131,880 | | | | 132 | | | | — | | | | — | | | | — | | | | — | |

Conversion of preferred to common (19:1) | | | (288,223 | ) | | | (288 | ) | | | 5,476,237 | | | | 5,476 | | | | (5,188 | ) | | | — | | | | — | | | | — | |

Shares issued for services | | | 458,333 | | | | 458 | | | | 1,306,242 | | | | 1,306 | | | | 348,743 | | | | — | | | | — | | | | 350,507 | |

Shares issued in consideration of notes and interest payable - related parties | | | — | | | | — | | | | 7,089,255 | | | | 7,089 | | | | 1,410,762 | | | | — | | | | — | | | | 1,417,851 | |

Net income (loss) for period | | | — | | | | — | | | | — | | | | — | | | | — | | | | (350,565 | ) | | | 32,029 | | | | (318,536 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance - June 30, 2022 | | | 815,884 | | | $ | 816 | | | | 44,750,479 | | | $ | 44,751 | | | $ | 80,905,557 | | | $ | (79,917,424 | ) | | $ | 1,360,669 | | | $ | 2,394,369 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance - January 1, 2023 | | | — | | | $ | — | | | | 45,566,363 | | | $ | 45,567 | | | $ | 80,939,618 | | | $ | (80,603,069 | ) | | $ | 1,290,566 | | | $ | 1,672,682 | |

Common Stock Issued - Note Payable Conversion | | | — | | | | — | | | | 320,513 | | | | 321 | | | | 25,316 | | | | — | | | | — | | | | 25,637 | |

Net income (loss) for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | (522,922 | ) | | | 22,821 | | | | (500,101 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance - March 31, 2023 | | | — | | | | — | | | | 45,886,876 | | | | 45,888 | | | | 80,964,934 | | | | (81,125,991 | ) | | | 1,313,387 | | | | 1,198,218 | |

Common Stock Issued - Note Payable Conversion | | | — | | | | — | | | | 1,711,397 | | | | 1,711 | | | | 37,289 | | | | — | | | | — | | | | 39,000 | |

Shares issued for services | | | — | | | | — | | | | 2,450,000 | | | | 2,450 | | | | 85,750 | | | | — | | | | — | | | | 88,200 | |

Net income (loss) for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | (332,486 | ) | | | 16,150 | | | | (316,336 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance - June 30, 2023 | | | — | | | $ | — | | | | 50,048,273 | | | $ | 50,049 | | | $ | 81,087,973 | | | $ | (81,458,477 | ) | | $ | 1,329,537 | | | $ | 1,009,082 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

CANNABIS SATIVA, INC. | | | | | |

| | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED | | | |

For the six months ended June 30, | | 2023 | | | 2022 | |

| | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

Net loss for the period | | $ | (816,437 | ) | | $ | (418,889 | ) |

Adjustments to reconcile net loss for the period to net cash used in operating activities: | | | | | | | | |

Unrealized loss (gain) on investments | | | 213,883 | | | | (104,642 | ) |

Depreciation and amortization | | | 75,979 | | | | 84,707 | |

Loss on debt settlement | | | 10,527 | | | | — | |

Loss on sale of investment securities | | | 155,735 | | | | — | |

Stock issued for services | | | 88,200 | | | | 350,507 | |

Stock payable for services | | | 196,527 | | | | — | |

Note payable issued for services | | | 55,000 | | | | 30,000 | |

Write off of abandoned equipment | | | — | | | | 583 | |

Changes in Assets and Liabilities: | | | | | | | | |

Accounts payable and accrued expenses | | | (31,321 | ) | | | 1,424 | |

Accrued interest - related parties | | | 50 | | | | 15,424 | |

Net Cash Provided by (Used in) Operating Activities | | | (51,857 | ) | | | (40,886 | ) |

| | | | | | | | |

Cash Flows from Investing Activities: | | | | | | | | |

Proceeds from sale of stock held for investment | | | 9,040 | | | | — | |

Advances to related party | | | (19,388 | ) | | | — | |

Net Cash Used in Investing Activities | | | (10,348 | ) | | | — | |

| | | | | | | | |

Cash Flows from Financing Activities: | | | | | | | | |

Proceeds from related parties notes payable, net | | | 22,884 | | | | 41,340 | |

Net Cash Provided by Financing Activities | | | 22,884 | | | | 41,340 | |

| | | | | | | | |

NET CHANGE IN CASH | | | (39,321 | ) | | | 454 | |

| | | | | | | | |

CASH AT BEGINNING OF PERIOD | | | 97,445 | | | | 194,060 | |

| | | | | | | | |

CASH AT END OF PERIOD | | $ | 58,124 | | | $ | 194,514 | |

| | | | | | | | |

Supplemental Disclosures of Non Cash Activities: | | | | | | | | |

Noncash investing and financing activities | | | | | | | | |

Shares issued in consideration of notes and interest payable - related parties | | $ | 30,000 | | | $ | 1,417,851 | |

Shares issued in consideration of convertible notes payable | | $ | 39,000 | | | | | |

Recognition of operating lease liability and right of use asset | | $ | — | | | $ | 56,595 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

1. Organization and Summary of Significant Accounting Policies

Nature of Business:

Cannabis Sativa, Inc. (the “Company,” “us”, “we” or “our”) was incorporated as Ultra Sun Corp. under the laws of Nevada in November 2004. On November 13, 2013, we changed our name to Cannabis Sativa, Inc. We operate through several subsidiaries including:

| · | PrestoCorp, Inc. (“PrestoCorp”) |

| · | Wild Earth Naturals, Inc. (“Wild Earth”) |

| · | Kubby Patent and Licenses Limited Liability Company (“KPAL”) |

| · | Hi Brands, International, Inc. (“Hi Brands”) |

| · | Eden Holdings LLC (“Eden”). |

PrestoCorp is a 51% owned subsidiary and until April 22, 2021, GKMP and iBud were 51% and 50.1% owned subsidiaries. Wild Earth, KPAL, Hi Brands, and Eden are wholly owned subsidiaries. At December 31, 2022 and 2021, PrestoCorp is the sole operating subsidiary. Until sale of the Company’s interest in April 2021, GKMP and iBud tender were operating subsidiaries although iBud was not generating any revenue.

Our primary operations for the years ended December 31, 2022 through June 30, 2023 were through PrestoCorp, which provides telemedicine online referral services for customers desiring medical marijuana cards in states where medical marijuana has been legalized. The Company is actively seeking new business opportunities for acquisition and is continually reviewing opportunities for product and brand development through our Wild Earth, Hi Brands, and KPAL subsidiaries.

Basis of Presentation

Operating results for the three and six months ended June 30, 2023 may not be indicative of the results expected for the full year ending December 31, 2023. For further information, refer to the financial statements and notes thereto in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

The interim financial statements should be read in conjunction with audited financial statements and related footnotes set forth in our annual report filed on Form 10-K for the year ended December 31, 2022, as filed with the United States Securities and Exchange Commission on April 20, 2023.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of the Company’s financial position as of June 30, 2023, and its results of operations, cash flows, and changes in stockholders’ equity for the three and six months ended June 30, 2023. The financial statements do not include all of the information and notes required by accounting principles generally accepted in the United States (‘GAAP”) for complete financial statements.

Principles of Consolidation:

The consolidated financial statements include the accounts of Cannabis Sativa, Inc. (the “Company” or “CBDS”), and its wholly-owned subsidiaries and PrestoCorp, a 51% owned subsidiary. All significant inter-company balances have been eliminated in consolidation.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

Going Concern:

The Company has an accumulated deficit of $81,458,477 at June 30, 2023, which, among other factors, raises substantial doubt about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to generate profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they are due.

Use of Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Significant estimates and assumptions by management affect the allowance for doubtful accounts, the carrying value of long-lived assets (including goodwill and intangible assets), the provision for income taxes and related deferred tax accounts, certain accrued liabilities, revenue recognition, contingencies, and the value attributed to stock-based awards.

Net Loss per Share:

Basic net loss per share is computed by dividing net loss available to common shareholders by the weighted average number of common shares outstanding for the period and contains no dilutive securities. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of the Company. Potentially dilutive shares are excluded from the calculation of diluted net loss per share because the effect is anti-dilutive. For the six months ended June 30, 2023 and 2022, the Company had 50,000 and 175,000 outstanding warrants, respectively, and -0- and 777,654 shares of convertible preferred stock, respectively, that would be dilutive to future periods net income if converted. The number of shares that can be converted per the convertible note agreement can be converted after December 31, 2022 thus are dilutive as of June 30, 2023.

Recent Accounting Pronouncement:

Accounting Standards Updates Adopted

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2019-12 Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. The update is to address issues identified as a result of the complexity associated with applying generally accepted accounting principles for certain financial instruments with characteristics of liabilities and equity. The update is effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years and with early adoption permitted. Early adoption of this update had no impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the financial statements upon adoption.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

2. Intangibles and Goodwill

The Company considers all intangibles to be definite-lived assets with lives of 5 to 10 years. Intangibles consisted of the following at June 30, 2023 and December 31, 2022:

| | June 30, 2023 | | | December 31, 2022 | |

CBDS.com website (Cannabis Sativa) | | $ | 13,999 | | | $ | 13,999 | |

Intellectual Property Rights (PrestoCorp) | | | 240,000 | | | | 240,000 | |

Patents and Trademarks (KPAL) | | | 1,281,411 | | | | 1,281,411 | |

Total Intangibles | | | 1,535,410 | | | | 1,535,410 | |

Less: Accumulated Amortization | | | (1,452,309 | ) | | | (1,376,467 | ) |

Net Intangible Assets | | $ | 83,101 | | | $ | 158,943 | |

Amortization expense for the three and six months ended June 30, 2023 and 2022 was $37,921 (2022: $42,285) and $75,842 (2022: $84,570), respectively.

Amortization of intangibles through 2027 is:

July 1, 2023 to June 30, 2024 | | $ | 78,432 | |

July 1, 2024 to June 30, 2025 | | | 932 | |

July 1, 2025 to June 30, 2026 | | | 932 | |

July 1, 2026 to June 30, 2027 | | | 932 | |

July 1, 2027 to June 30, 2028 | | | 932 | |

July 1, 2028 to June 30, 2029 | | | 941 | |

Goodwill in the amount of $3,010,202 was recorded as part of the acquisition of PrestoCorp that occurred on August 1, 2017. Cumulative impairment of the PrestoCorp goodwill totals $1,173,000 as of June 30, 2023 and December 31, 2022. The balance of goodwill at June 30, 2023 and December 31, 2022 was $1,837,202.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

3. Related Party Transactions

In addition to items disclosed in Note 6, the Company had additional related party transactions during the six months ended June 30, 2023 and 2022.

Historically, the Company has received funds from borrowings on notes payable and advances from related parties and officers of the Company to cover operating expenses. Related parties include the officers and directors of the Company and a significant shareholder holding in excess of 10% of the Company’s outstanding shares.

During the six months ended June 30, 2023, David Tobias, the Company’s chief executive officer and director, loaned $22,721 to the Company for notes payable bearing interest at the rate of 5% per annum due on December 31, 2023.

During the six months ended June 30, 2023, the Company and Cathy Carroll, director, entered into a note payable for $30,000 for compensation due her for services. Ms. Carroll’s note bears interest at 8% per annum and is due December 31, 2024. The note payable totaled $55,000 at December 31, 2022.

During the years ended December 31, 2022 and 2021, the Company recorded interest expense related to notes payable to related parties at the rates between 5% and 8% per annum in the amounts of $16,374 and $66,872, respectively.

The following tables reflect the related party note payable balances.

| | Related party notes | | | Accrued interest | | | Total | |

| | June 30, 2023 | |

David Tobias, CEO & Director | | $ | 55,421 | | | $ | 12,482 | | | $ | 67,903 | |

New Compendium, greater than 10% Shareholder | | | - | | | | 1,906 | | | | 1,906 | |

Cathy Carroll, Director | | | 85,000 | | | | 986 | | | | 85,986 | |

Other Affiliates | | | 4,000 | | | | 1,100 | | | | 5,100 | |

Totals | | $ | 144,421 | | | $ | 16,474 | | | $ | 160,895 | |

| | Related party notes | | | Accrued interest | | | Total | |

| | December 31, 2022 | |

David Tobias, CEO & Director | | $ | 32,700 | | | $ | 12,482 | | | $ | 45,182 | |

New Compendium, greater than 10% Shareholder | | –– | | | | 1,906 | | | | 1,906 | |

Cathy Carroll, Director | | | 55,000 | | | | 986 | | | | 55,986 | |

Other Affiliates | | | 4,000 | | | | 1,000 | | | | 5,000 | |

Totals | | $ | 91,700 | | | $ | 16,374 | | | $ | 108,074 | |

During the three and six months ended June 30, 2023 and 2022, the Company incurred approximately $-0- (2022: $12,500) and $-0- (2022: $26,389), respectively, for consulting services from a nephew of the Company’s president. The services were accrued at June 30, 2022 and paid in common stock. These amounts are included in the statements of operations in general and administrative expenses.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

At June 30, 2023 and December 31, 2022, the Company has a balance due from MJ Harvest, Inc., with whom the Company plans to merge, of $75,054 and $55,666 (see Note 8). The amount is included in advances to related party on the condensed consolidated balance sheets. The funds were advanced to MJ Harvest, Inc. to cover operating expenses.

At June 30, 2023 and December 31, 2022 the Company had stock payable in the amount $542,421 and $345,893 due to related parties; directors and contract officers.

4. Investments

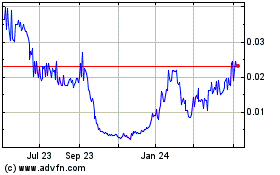

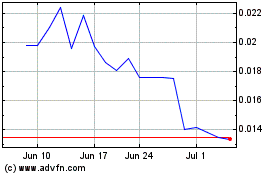

At June 30, 2023 and December 31, 2022, the Company owns -0- and 8,238,769 shares respectively, of common stock of Medical Cannabis Payment Solutions (ticker: REFG). At June 30, 2023 and December 31, 2022, the fair value of the investment in REFG was $-0- and $12,358, respectively. The Company sold all of its position in REFG during the six months ended June 30, 2023 and recognized a loss on the sale of investment securities in the amount of $155,735.

In 2021, the Company received 1,500,000 shares of common stock and 1,500,000 shares of preferred stock of THC Pharmaceuticals Inc. (ticker: CBDG). The CBDG shares were received as consideration for the sale of the Company’s majority interest in iBud and GKMP in the year ended December 31, 2021. On the date of sale, the shares were valued at fair value which was $0.20 per share or $600,000 in the aggregate. The Company’s Chief Executive Officer and Chairman of the Board, David Tobias is a Director of CBDG.

The Company’s investment in CBDG represents 15% of CBDG’s voting shares on a fully diluted basis which, coupled with Mr. Tobias’ position as a director and his individual investment in CBDG, results in the Company having significant influence over CBDG. The Company elected to account for its investment in CBDG at fair value because the Company does not intend to hold the investment for a long period of time and the shares are readily marketable. The fair value of the Company’s investment at June 30, 2023 and December 31, 2022 was $1,200 and $367,500 resulting in a gain (loss) of ($2,400) (2022: $114,000) and ($366,300) (2022: ($117,000)) for the change in fair value during the three and six months ended June 30, 2023 and 2022, respectively.

5. Convertible Notes Payable

On August 25, 2022 and November 7, 2022, the Company entered into an agreement with 1800 Diagonal Lending, LLC (“Diagonal”) whereby the Company issued convertible notes to Diagonal with principal amounts of $104,250 and $64,250, respectively. The notes bear interest at 10% and have terms of one year when payment of principal and interest is due. After 180 days, the notes are convertible into shares of the Company’s common stock the number of which determined by dividing the principal balance outstanding by 65% of the lowest trading price of the Company’s stock during the five previous trading days before the date of the conversion. During the six months ended June 30, 2023, Diagonal converted $54,000 of their note payable from August into 2,031,910 shares of common stock. As of June 30, 2023 amounts due to Diagonal total $50,250 and $64,250, respectively.

On January 1, 2023, the Company entered into an agreement with Carolyn Merrill (“Carolyn”) whereby the Company issued a convertible note to Carolyn with a principal amount of $72,262. As stated in the January 1, 2023 agreement Ms. Merrill’s contract compensation will also be added to the note for her services through June 30, 2023 in the amount of $25,000. Total note payable at June 30, 2023 is $97,262. The note bears interest at 8% and has a term of one year when payment of principal and interest is due. If payment by S-8 shares the amount paid will be with a 10% discount, if by agreement and paid with restricted stock will be with a 20% discount. Both methods are calculated using the lowest 3 closing prices during the 15 trading days preceding the first day of the next calendar quarter.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

At June 30, 2023 and December 31, 2022, accrued interest payable and interest expense on these notes was $16,362 and $4,546. Accrued interest payable is included in accounts payable and accrued expenses on the consolidated balance sheet.

6. Stockholders’ Equity

Change in Authorized Shares

The Company increased the number of authorized common shares the Company is authorized to issue to 495,000,000 on August 8, 2022. This change in capital structure was approved without a meeting by the consent of the shareholders holding a majority of the common stock outstanding and Articles of Amendment were filed with the State of Nevada.

Securities Issuances

During the six months ended June 30, 2023, 2,031,910 shares of common stock were issued to convert $54,000 of a note payable to a non-related party. See Note 5.

During the six months ended June 30, 2023, 2,450,000 shares of common stock were issued to pay bonuses in the amount of $88,200.

Stock payable at June 30, 2023 consists of 1,219,513 preferred shares and 838,415 common shares owed to members of the board of directors for directors’ fees and contract services. These shares were valued at $84,375 based on the fair value of the Company’s common stock at the date of board authorization. Subsequent to year end, no issuances of the shares have been made.

Stock payable at June 30, 2023 and December 31, 2022 consists of 5,025,814 and 1,306,302 preferred shares and 1,934,530 and 1,469,590 common shares, respectively, owed to members of the board of directors for directors’ fees and contract services. These shares were valued at $325,000 and $212,500, respectively, based on the fair value of the Company’s common stock at the date of board authorization. An additional 5,874,988 and 2,393,873 common shares were owed to various non-related vendors at June 30, 2023 and December 31, 2022 valued at $217,421 and $205,656, respectively, based on the fair value of the Company’s common stock at the date of board authorization. Subsequent to year end, no issuances of the shares have been made.

Stock Compensation Plans

2020 Stock Plan

On September 25, 2020, the Company adopted the Cannabis Sativa 2020 Stock Plan which authorized the Company to utilize common stock to compensate employees, officers, directors, and independent contractors for services provided to the Company. By resolution dated September 25, 2020, the Company authorized up to 1,000,000 shares of common stock to be issued pursuant to the 2020 Stock Plan. This amount was subsequently increased to 2,000,000 shares on January 27, 2021. At June 30, 2023, 44,425 shares were available for future issuance.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

Warrants

At June 30, 2023 and December 31, 2022, the Company has outstanding warrants to purchase 50,000 shares of the Company’s common stock. As of June 30, 2023, the warrants have an exercise price of $2.00 and expire in July and August 2023. During the six months ended June 30, 2023 and 2022, warrants activity consisted of the following: warrants issued – none (2022: none), warrants exercised – none (2022: none), warrants expired – none (2022: none).

7. Commitments and Contingencies

Leases.

PrestoCorp leased office space through WeWork in New York on a month-to-month basis which ended in April 2022. On April 12, 2022, PrestoCorp signed a new lease in New York with Spaces for a two-year term at $2,590 per month expiring in April 2024. Upon signing the lease with Spaces, the Company recognized a lease liability and a right of use asset of $56,595 using a discount rate of 10%. The future lease payments under the new lease are as follows:

From July 1, 2023 to June 30, 2024 | | $ | 25,900 | |

Less imputed interest | | | (942 | ) |

Net lease liability | | | 24,958 | |

Current Portion | | | (24,958 | ) |

Long-term portion | | $ | -0- | |

Rent expense for the three and six months ended June 30, 2023 and 2022 was $9,163 (2022: $2,602) and $17,579 (2022: $21,325), respectively.

Litigation.

In the ordinary course of business, we may face various claims brought by third parties and we may, from time to time, make claims or take legal actions to assert our rights, including intellectual property disputes, contractual disputes and other commercial disputes. Any of these claims could subject us to litigation. As of June 30, 2023, no claims are outstanding.

CANNABIS SATIVA, INC. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For the Six Months Ended June 30, 2023 and 2022 |

8. Proposed Merger with MJ Harvest, Inc.

On August 8, 2022, the Company entered into a Merger Agreement (the “Merger Agreement”) with MJ Harvest, Inc. (“MJHI”). Pursuant to the Merger Agreement, MJHI will merge with and into the Company and the Company will be the surviving corporation in the Merger. The Merger is expected to be consummated once the shareholders of the Company and the shareholders of MJHI approve the Merger which management expects will be completed early in the second quarter of calendar year 2023. The terms of the Merger Agreement are summarized below:

| · | The name of the surviving company in the Merger will be Cannabis Sativa, Inc. |

| · | Each share of MJHI common stock outstanding on the effective date of the Merger will be converted into 2.7 shares of CBDS Common Stock. |

| · | The Merger is subject to majority approval of the shareholders of both MJHI and CBDS. |

| · | The shareholders of MJHI and CBDS will have rights to dissent from the Merger, and, if the notice of dissent is properly given, the dissenting shareholders may be paid fair value for such dissented shares. |

| · | The Board of Directors of the surviving company following the Merger is intended to consist of Patrick Bilton, Randy Lanier, Clinton Pyatt, and David Tobias. |

| · | The Executive Officers of the Company following the Merger are intended to include Patrick Bilton - Chief Executive Officer, Clinton Pyatt - Chief Operating Officer. |

| · | The Merger Agreement includes representations and warranties, covenants, and conditions for MJHI and CBDS as are customary for transactions of this nature. |

| · | No brokerage fees are payable in connection with the Merger. |

| · | If majority shareholder approval of the merger is not obtained, the Merger will not occur, and the Merger Agreement will be terminated. |

| · | All costs and expenses in connection with the Merger transactions will be borne by CBDS, except that MJHI will be responsible for expenses of its own legal counsel and auditing costs. |

9. Subsequent Event

In accordance with ASC 855-10, Company management reviewed all material events through the date of this report and determined that there are no additional material subsequent events to report.

nullnullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.2

CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($)

|

Jun. 30, 2023 |

Dec. 31, 2022 |

| Current Assets |

|

|

| Cash |

$ 58,124

|

$ 97,445

|

| Investment in equity securities, at fair value |

1,200

|

379,858

|

| Right of use asset |

24,958

|

0

|

| Total Current Assets |

84,282

|

477,303

|

| Advances to related party |

75,054

|

55,666

|

| Right of use asset |

0

|

38,968

|

| Property and equipment, net |

2,572

|

2,709

|

| Intangible assets, net |

83,101

|

158,943

|

| Goodwill |

1,837,202

|

1,837,202

|

| Total Assets |

2,082,211

|

2,570,791

|

| Current Liabilities |

|

|

| Accounts payable and accrued expenses |

133,093

|

164,411

|

| Operating lease liability, current |

24,958

|

28,736

|

| Accrued interest - related parties |

16,474

|

16,374

|

| Convertible notes payable |

211,762

|

168,500

|

| Notes payable to related parties |

144,421

|

91,700

|

| Total Current Liabilities |

530,708

|

469,721

|

| Long-term liabilities |

|

|

| Operating lease liability, long term |

0

|

10,232

|

| Stock payable |

542,421

|

418,156

|

| Total Liabilities |

1,073,129

|

898,109

|

| Stockholders' Equity: |

|

|

| Preferred stock $0.001 par value; 5,000,000 shares authorized; -0- and 777,654 issued and outstanding, respectively |

0

|

0

|

| Common stock $0.001 par value; 495,000,000 shares authorized; 50,048,273 and 45,566,363 shares issued and outstanding, respectively |

50,049

|

45,567

|

| Additional paid-in capital |

81,087,973

|

80,939,618

|

| Accumulated deficit |

(81,458,477)

|

(80,603,069)

|

| Total Cannabis Sativa, Inc. Stockholders' Equity (Deficit) |

(320,455)

|

382,116

|

| Non-Controlling Interest |

1,329,537

|

1,290,566

|

| Total Stockholders' Equity |

1,009,082

|

1,672,682

|

| Total Liabilities and Stockholders' Equity |

$ 2,082,211

|

$ 2,570,791

|

| X |

- References

+ Details

| Name: |

cbds_StockPayables |

| Namespace Prefix: |

cbds_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying values as of the balance sheet date of obligations incurred through that date and due within one year (or the operating cycle, if longer), including liabilities incurred (and for which invoices have typically been received) and payable to vendors for goods and services received, taxes, interest, rent and utilities, accrued salaries and bonuses, payroll taxes and fringe benefits. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19,20)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccountsPayableAndAccruedLiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of excess of issue price over par or stated value of stock and from other transaction involving stock or stockholder. Includes, but is not limited to, additional paid-in capital (APIC) for common and preferred stock. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionLong-Term advances receivable from a party that is affiliated with the reporting entity by means of direct or indirect ownership. This does not include advances to clients. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 850

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 2

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483326/850-10-50-2

| Name: |

us-gaap_AdvancesToAffiliate |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are recognized. Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-12

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(12))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 10: http://www.xbrl.org/2003/role/disclosureRef