SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF A FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

August 17, 2023

Commission File Number 0-28800

______________________

DRDGOLD Limited

Constantia Office Park

Cnr 14th Avenue and Hendrik Potgieter Road

Cycad House, Building 17, Ground Floor

Weltevreden Park 1709

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Exhibit

99.1 Release dated August 17, 2023 “VOLUNTARY TRADING STATEMENT AND TRADING UPDATE FOR THE YEAR ENDED 30 JUNE 2023”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

DRDGOLD LIMITED

Date: August 17, 2023 By: /s/ Riaan Davel

Name: Riaan Davel

Title: Chief Financial Officer

Exhibit 99.1

DRDGOLD LIMITED

(Incorporated in the Republic of South Africa)

(Registration number: 1895/000926/06)

ISIN: ZAE000058723

JSE share code: DRD

NYSE trading symbol: DRD

(“DRDGOLD” or the “Company” or the “Group”)

| | |

VOLUNTARY TRADING STATEMENT AND TRADING UPDATE FOR THE YEAR ENDED 30 JUNE 2023 |

DRDGOLD is in the process of finalising its results for the year ended 30 June 2023 (“Current Reporting Period”) and shareholders are accordingly advised that the Company has reasonable certainty that for the Current Reporting Period it will report:

•earnings per share (“EPS”) of between 142.5 cents and 155.7 cents per share compared to EPS of 131.2 cents per share for the year ended 30 June 2022 (“Previous Corresponding Period”), being an increase of between 9% and 19%; and

•headline earnings per share (“HEPS”) of between 141.7 cents and 154.7 cents per share compared to HEPS of 130.7 cents per share for the Previous Corresponding Period, being an increase of between 8% and 18%.

The expected increases in EPS and HEPS, respectively, for the Current Reporting Period compared to the Previous Corresponding Period, are mainly due to movements in, inter alia, the following items:

1.Revenue

Revenue increased by R377.8 million, or 7%, to R5,496.3 million (2022: R5,118.5 million).

Ergo Mining Proprietary Limited’s (“Ergo”) revenue increased by R403.7 million to R4,108.6 million (2022: R3,704.9 million), mainly due to a 16% increase in the Rand gold price received as well as a 21% increase in yield to 0.227g/t from 0.188g/t in 2022 to make up for the 5% decrease in gold sold to 3,936kg (2022: 4,139kg). Gold production decreased as a result of a decrease in throughput tonnages, caused by significant load shedding at the beginning of the financial year affecting particularly the City Deep line, the depletion of high-volume reclamation sites at City Deep and Ergo and the late commissioning of two major new reclamation sites.

Far West Gold Recoveries Proprietary Limited's (“FWGR”) revenue decreased by R25.9 million to R1,387.7 million (2022: R1,413.6 million). The 15% decrease in gold sold to 1,337kg (2022: 1,575kg) was offset by the 16% increase in the Rand gold price received. The decrease in the amount of gold sold was as a result of a decrease in throughput tonnages due to Driefontein 5 nearing the end of its life of mine and entering final clean up. Yield decreased by 8% to 0.237g/t from 0.257g/t in 2022, in part attributable to the material being processed from the lower grade areas of the newly commissioned Driefontein 3 and the almost depleted Driefontein 5, as well as reduced milling with mills needing to be switched off during periods of load shedding.

2.Cash operating costs

The impact of the increase in revenue on earnings and headline earnings was moderated by an increase in cash operating costs of R224.3 million, or 6%, to R3,688.1 million (2022: R3,463.8 million).

At Ergo, cash operating costs increased by R173.4 million, or 6%, to R3,183.2 million (2022: R3,009.8 million), and, at FWGR, cash operating costs increased by R50.9 million, or 11%, to R504.9 million (2022: R454.0 million). At both Ergo and FWGR, costs relating to reagents, diesel, electricity and security

experienced above inflationary increases. Additionally, there was a significant increase in machine hire costs to mechanically lift and reclaim material from late phase clean-up sites at both Ergo and FWGR.

3.Liquidity

As at 30 June 2023, DRDGOLD held R2,471.4 million in cash and cash equivalents compared to R2,525.6 million on 30 June 2022. During the Current Reporting Period, DRDGOLD generated free cash flow (cash inflow from operating activities less cash outflow from investing activities) of R468.9 million (2022: R871.6 million) after a R546.1 million increase to R1,172.3 million in investing activities (2022: R626.2 million) and paying cash dividends of R515.3 million (2022: R513.3 million). The Group remains free of any bank debt as at 30 June 2023 (2022: Rnil).

The financial information contained in this announcement is the responsibility of the directors of DRDGOLD, and such information has not been reviewed or reported on by the Company’s auditors.

The condensed consolidated financial statements for the year ended 30 June 2023 are expected to be published on SENS on or about 23 August 2023.

Johannesburg

17 August 2023

Sponsor

One Capital

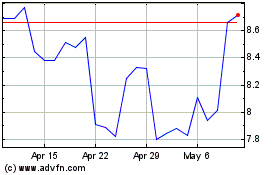

DRDGold (NYSE:DRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

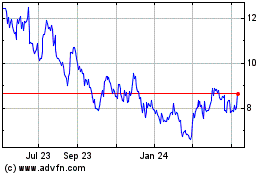

DRDGold (NYSE:DRD)

Historical Stock Chart

From Apr 2023 to Apr 2024