Coinbase gets approval for cryptocurrency futures, boosts its

shares

Coinbase Global (NASDAQ:COIN) gained approval from the National

Futures Association to offer cryptocurrency futures contracts to

U.S. retail customers, leading to a 5% increase in its stock ahead

of the market open. This approval comes as Coinbase is in

litigation with the SEC, which alleges that the company operates as

an unregistered exchange. The central debate is whether crypto

assets are considered securities or commodities. Coinbase has

already seen a 123% increase in its shares this year and previously

acquired FairX, a regulated futures exchange. The company

plans to expand its cryptocurrency derivatives services in the

coming months.

Binance shuts down Binance Connect

A Binance spokesperson confirmed that Binance Connect will be

shut down on August 16. This decision follows the announcement

by Biswap, a decentralized exchange, about the deactivation of the

Binance Connect card payments service. This move is part of

Binance’s strategy to focus on its core activities. The

company says it constantly revises its services to align with

market trends. Launched in 2022, Bifinity (now Binance

Connect) was a fiat-to-crypto payment platform.

Ledger announces integration with PayPal for direct purchases of

cryptocurrencies

On August 16, Ledger, a manufacturer of hardware wallets,

announced the integration of its Ledger Live software with PayPal

(NASDAQ:PYPL). This partnership allows Americans with verified

PayPal accounts to purchase cryptocurrencies such as Bitcoin

(COIN:BTCUSD), Ether (COIN:ETHUSD), Bitcoin Cash (COIN:BCHUSD) and

Litecoin (COIN:LTCUSD) directly via Ledger Live. What’s new is

that when buying crypto through PayPal, the funds immediately go to

the Ledger wallet, with no additional steps. Ledger CEO Pascal

Gauthier highlighted that this combination aims to simplify

cryptographic transactions while maintaining security.

PayPal suspends buying cryptocurrencies in the UK due to regulation

To comply with financial regulations in the UK, PayPal

(NASDAQ:PYPL), is temporarily pausing the purchase of

cryptocurrencies by its British users. The interruption stems

from new Financial Conduct Authority (FCA)

guidelines. Existing customers can still hold and sell their

cryptocurrencies. This suspension is expected to last until

early 2024. Recently, the FCA gave notice that crypto companies

need to align their marketing strategies with the UK financial

promotional regime by October 2023.

Vitalik Buterin reviews X’s “Community Notes” feature

Vitalik Buterin, founder of Ethereum, analyzed the “Community

Notes” feature of platform X (formerly Twitter) from a

cryptographic perspective. Launched in 2021 as “Birdwatch”,

this feature allows users to add context and fact checks to

tweets. The algorithm scores the notes based on peer reviews,

favoring those that are non-partisan. Buterin suggests that,

although susceptible to manipulation, the feature represents an

advance towards decentralized governance. He also sees

potential for decentralized moderation in future platforms,

highlighting the importance of transparent, consensus-driven

algorithms.

Donald Trump is an Ethereum Whale

Recent documents reveal that former US President Donald Trump

owns $2.8 million worth of Ethereum (COIN:ETHUSD), demonstrating a

departure from his former critical view on

cryptocurrencies. In addition, Trump earned $4.86 million from

non-fungible tokens (NFTs) through a licensing agreement between

his company, CIC Digital LLC, and NFT INT LLC. While his

related NFT collections have attracted attention, they are not

linked to political campaigns and are not directly managed by Trump

or his companies.

Shiba Inu announces release of Shibarium for tomorrow

Shiba Inu (COIN:SHIBUSD), with its philosophy based on

decentralization and community development, is on the Ethereum

blockchain, boasting a massive supply of 1 quadrillion

tokens. Besides being a meme currency, it has a robust

ecosystem with protocols like ShibaSwap and exploits in the NFT

world and metaverse. The project announced Shibarium, a Layer

2 solution, seeking to solve scalability issues and high fees in

Ethereum. The launch is scheduled for August 17th. This

innovation promises faster and cheaper transactions, boosting

blockchain adoption and bolstering Shiba Inu’s position in the DeFi

landscape.

ConsenSys introduces Ethereum Linea sizing rollup with broad

support

ConsenSys launched the Linea Ethereum scaling rollup,

integrating over 150 partners and mobilizing over $26 million in

Ether (COIN:ETHUSD). Launched in July 2023, Linea allows the

migration of decentralized applications (DApps) to its platform,

offering lower costs and better performance. Declan Fox,

senior product manager at Linea, emphasized Ethereum co-founder

Vitalik Buterin’s support for zero-knowledge accumulation

technologies. He highlighted that Linea is ideal for DeFi

protocols and offers integration with the MetaMask wallet,

expanding the reach to millions of users.

Stellar Development Foundation buys stake in MoneyGram

The Stellar Development Foundation (SDF) acquired a minority

stake in MoneyGram. Denelle Dixon, CEO of SDF, unveiled the

investment on Aug. 15, using reserved funds from the foundation

instead of Stellar’s Enterprise Fund. While financial terms

were not disclosed, the SDF now has a seat on MoneyGram’s

board. Dixon hopes the investment will help MoneyGram advance

digital business and blockchain technology. SDF and MoneyGram

have been collaborating since 2019 and made their partnership

official in 2021. Recently, MoneyGram has launched new digital and

blockchain services. The value of Stellar (COIN:XLMUSD) is

down more than 2% at press time.

Nova Labs launches $5 phone plan focused on Miami

Startup Nova Labs launched a phone plan for $5 a month,

initially available only to Miami residents or guests. Founded

in 2013 with a focus on the “Internet of Things”, the company

shifted its focus to cryptocurrency in 2018. Formerly called

Helium, it faced criticism and raised $250 million. The new

plan will use individual and corporate 5G hotspots. The

company cites dissatisfaction with traditional carriers, while

noting market competition such as T-Mobile (NASDAQ:TMUS). Nova

Labs has partnered with T-Mobile for a smooth transition between

networks. CEO Haleem recognizes the importance of this

partnership, admitting limitations in Nova Labs’ current

network.

Bittrex Global repositions after SEC settlement

Following a settlement with the US Securities and Exchange

Commission (SEC) over allegations of unregistered trading, Bittrex

Global seeks to win over investors concerned about regulatory

uncertainty in the US. Bittrex CEO Oliver Linch has assured

support for anyone wishing to trade without US regulatory

ties. Surprisingly, Bittrex Global will not pay for the

deal. While the US segment of Bittrex will pay $24 million in

the deal, it faces bankruptcy and holds between $500 million and $1

billion in assets and liabilities. SEC charged Bittrex and its

co-founder with regulatory violations and tampering with token

communications. Bittrex’s market presence in the US has

dropped significantly since 2018.

WhiteBIT and Justin Sun under scrutiny for high-yield offer

Justin Sun-linked exchange WhiteBIT raised eyebrows by

announcing a 24.8% Annual Percentage Yield (APY) for Tether

(COIN:USDTUSD) deposits for one year. This rate is unusually

high compared to market averages. Sun, well known in the

crypto industry, has a history of promoting high returns on

questionable stablecoins. WhiteBIT’s “lending” platform and

its connection to Sun raise the alarm. WhiteBIT offers over

150 cryptocurrency pairs and access to fiat currencies from Ukraine

and Kazakhstan, but has challenges with licenses and banking

relationships, making its legitimacy suspect.

Three Arrows Capital founders fined for breaches in Dubai

Three Arrows Capital founders Kyle Davies and Su Zhu have been

fined by the Dubai Virtual Assets Regulatory Authority (VARA) for

violations at OPNX exchange. On Aug. 16, VARA fined the

exchange approximately $2.7 million and OPNX leaders around $54,000

for flouting Dubai’s advertising laws. The leaders have

already paid their fines, but the exchange’s fine remains

pending. The VARA may impose further penalties or refer the

case to legal enforcement.

RocketSwap committed to 471 ETH loss and suspicious coin creation

RocketSwap, a Base Layer 2 decentralized exchange, was

compromised, resulting in the loss of 471 ETH

($870,000). According to PeckShield, the flaw arose from

multiple errors, including offline signatures and improper storage

of private keys. While some accuse the RocketSwap team of

internal manipulation, they blame an external

hacker. Subsequently, the hacker transferred the funds to

Ethereum, creating and profiting from a new coin, LoveRCKT, whose

value skyrocketed and then crashed.

SwirlLend accused of Rug Pull

The SwirlLend project, active on Ethereum Layer 2, is accused of

performing a rug pull resulting in the loss of $460,000 in

deposits. Cybersecurity firm PeckShield has reported

suspicious withdrawals from the Base and Linea

networks. SwirlLend’s deposits have dropped dramatically and

their social media accounts have been wiped. This term, “rug

pull,” refers to developers running off with user funds. It’s

yet another notable incident on the Base network, a reminder of the

risks of the decentralized financial (DeFi) ecosystem and the need

for caution.

Sora Summit gathers blockchain experts in Taipei

Sora Ventures will hold its Sora Summit in Taipei on December

16, concluding Taipei Blockchain Week. This event, which

started in Macau in 2018, will have more than 100 experts,

including co-founders of Paxos and leaders of CryptoSlate, debating

Web3 topics for an estimated audience of 1000

people. Discussions will focus on Bitcoin, DeSci, NFTs, DeFi

and more. Sora, a VC company focused on Web3 innovations,

chose Taipei for the event, in line with its headquarters and the

city’s strategic position in connecting blockchain communities.

El Salvador sees rise in bonds after bitcoin adoption

After adopting Bitcoin as legal tender in 2021, El Salvador saw

a 70% increase in its bonds in 2023, attracting giants such as JP

Morgan (NYSE:JPM) and UBS Group (NYSE:UBS). President Nayib

Bukele celebrated, saying, “I told you so.” Contrary to

initial criticisms of BTC adoption, El Salvador paid off its $800

million debt on time, boosting investor confidence. The

country has also introduced crypto legislation and plans for

Bitcoin-backed securities (COIN:BTCUSD), demonstrating resilience

and attracting institutional interest.

Chinese court judges mining company for pyramid scheme

A court in Pingnan, Guangxi, China, tries Filecoin mining

company Shenzhen Shikongyun Technology, accused of creating an

$83.2 million pyramid scheme. Four company executives are

under scrutiny for allegedly misleading clients with promises of

high mining profits. They encouraged customers to recruit more

people and invest in storage servers, disrupting the economic

order.

Between March and May, FBI confiscated around $1.7 million worth of

cryptocurrencies

Between March and May, FBI confiscated around $1.7 million worth

of cryptocurrencies, including Bitcoin (COIN:BTCUSD) and Ether

(COIN:ETHUSD). The largest seizure was 428.5 ETH in the

Eastern District of Virginia. The FBI indicated that these

arrests were due to violations of federal law. In addition to

cryptocurrencies, items such as luxury cars and handbags were also

seized. The agency warned the community about scams in the NFT

space and fake cryptocurrency job advertisements.

Digital Power Council created to represent cryptocurrency miners in

the US

The Digital Energy Council was created on Aug. 15 to represent

cryptocurrency miners to alleviate concerns about the

sustainability of mining and promote its growth in the

US. This movement aims to modify the negative view of recent

legislation against the industry. Thomas Mapes, the group’s

founder and former head of the US energy industry, sees mining

companies as “the energy companies of the future”. Despite

global criticism, especially after the Chinese ban, Mapes ensures

that his group includes important cryptocurrency companies.

ZetaChain raises $27 million

ZetaChain, a Tier 1 network, has raised $27 million to underpin

its autonomous chain platform, with notable investors such as

Blockchain.com and Jane Street Capital. Created in 2021, the

protocol facilitates the interaction between blockchains and the

decentralized financial ecosystem, allowing smart contracts to be

used in networks without this technology, such as Bitcoin

(COIN:BTCUSD). The platform already has more than 27,000 DApp

contracts for various applications. Industry notables such as

Ankur Nandwani have joined the team, who highlight the

effectiveness of their interconnected smart contracts.

BitGo raises $100 million

Despite the turmoil in the US crypto market, BitGo, a

cryptocurrency custody company, is expected to reveal that it has

raised $100 million, valued at $1.75 billion, according to

Bloomberg. BitGo, which protects cryptocurrency private keys,

acts as a custodian for several clients, including bankrupt

FTX. CEO Mike Belshe attributes the company’s success to its

focus on regulation. The California-based company secured the

new investment from global sponsors, and plans to use some of the

funds for strategic acquisitions. The round had investors from

the US and Asia, some outside the crypto business. In 2023,

BitGo saw a 60% increase in customers and 40x in staked

assets. After failed acquisition attempts in previous years,

BitGo now focuses on meeting the global demand for custody

solutions.

Linera raised $6 million in funding round led by Borderless Capital

Linera, a tier one blockchain focused on solving scalability

challenges through “microchains,” has raised $6 million in a

funding round led by Borderless Capital. Founded by former

Meta Novi engineer Mathieu Baudet, the company has raised a total

of $12 million. The new funding will be used to expand the

team, launch development and test networks, and strengthen its

presence in the APAC region. Linera innovates by using

microchains to tackle bottlenecks in traditional blockchains,

allowing users to interact with Web3 applications directly from

their wallets. Investors in this round include Laser Digital

Ventures, Flow Traders and Eterna Capital.

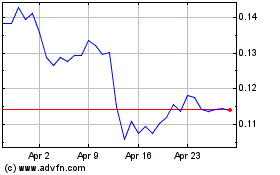

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024