UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT of 1934

August 16, 2023

Pan American

Silver Corp.

(Exact name of registrant as specified in its charter)

1500-625 HOWE STREET

VANCOUVER BC CANADA V6C 2T6

(Address of principal executive offices)

001-41683

(Commission File Number)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT LIST

Cautionary Note to U.S.

Investors Concerning Estimates of

Measured, Indicated and Inferred Resources

The Technical Report for the El Peñon Gold-Silver

Mine, Antofagasta Region, Chile, with an effective date of December 31, 2020, included as Exhibit 99.1 hereto (the “Technical

Report”), has been prepared and disclosed in accordance with Canadian National Instrument 43-101 — Standards of Disclosure

for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification system.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer

makes of scientific and technical information concerning mineral projects.

Canadian public disclosure standards, including

NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”),

and mineral reserve and mineral resource information included in the Technical Report may not be comparable to similar information disclosed

by U.S. companies. In particular, and without limiting the generality of the foregoing, the Technical Report uses the terms “measured

mineral resources,” “indicated mineral resources” and “inferred mineral resources” as defined under Canadian

regulations. The requirements of NI 43-101 for the identification of “mineral reserves” are also not the same as those of

the SEC, and reserves reported by the Registrant in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

While the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers

whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, including amendments to certain

definitions to be substantially similar to the corresponding standards under NI 43-101, there are still differences in these standards

and definitions. U.S. investors are cautioned not to assume that any part of a “measured mineral resource” or “indicated

mineral resource” will ever be converted into a “mineral reserve”. U.S. investors should also understand that “inferred

mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot

be assumed that all or any part of “inferred mineral resources” exist, are economically or legally mineable or will ever be

upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility

or pre-feasibility studies except in rare cases. In addition, disclosure of “contained ounces” in a mineral resource is permitted

disclosure under Canadian regulations. However, the SEC normally only permits issuers to report mineralization that does not constitute

“reserves” by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning

mineral deposits set forth in the Technical Report may not be comparable with information made public by companies that report in accordance

with U.S. standards.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Pan American Silver Corp. |

| |

(Registrant) |

| |

|

|

| Date: August 16, 2023 |

By: |

/s/ “Delaney Fisher” |

| |

|

Delaney Fisher |

| |

|

SVP Associate General Counsel & Corporate Secretary |

Exhibit 99.1

| |

|

| |

NI

43-101 TECHNICAL REPORT

El

Peñón gold-silver MINE

Antofagasta

Region, Chile

|

|

| |

Qualified Persons:

Sergio Castro, Registered

Member CMC

Marco Velásquez Corrales, Registered

Member CMC

Henry Marsden, P.Geo.

Carlos Iturralde, P.Eng.

|

|

Royal Bank Plaza, North Tower

200 Bay Street, Suite 2200

Toronto, Ontario M5J 2J3

|

Effective Date: December

31, 2020

Signature Date: March 25,

2021

|

|

|

|

|

Yamana Gold Inc.

Royal Bank Plaza, North Tower

200 Bay Street, Suite 2200

Toronto, ON, Canada

M5J 2J3 |

NI

43-101 TECHNICAL REPORT

El

Peñón gold-silver MINE

Antofagasta

Region, Chile

|

|

| |

|

|

|

|

| Effective Date: |

December 31, 2020 |

|

|

|

| Signature Date: |

March 25, 2021 |

|

|

|

| |

|

|

|

|

| Authors: |

[Signature] |

|

[Signature] |

| |

Sergio Castro

Registered Member CMC

Technical Services Manager, El Peñón

Yamana Gold Inc. |

|

Marco Velásquez Corrales,

Registered Member CMC

Chief Resource Geologist, El Peñón

Yamana Gold Inc. |

| |

|

|

|

| |

[Signature] |

|

[Signature] |

|

Henry Marsden, P.Geo.

Senior Vice President, Exploration

Yamana Gold Inc. |

|

Carlos Iturralde, P.Eng.

Director, Tailings, Health, Safety & Sustainable Development

Yamana Gold Inc. |

| |

|

|

|

| Reviewer |

[Signature] |

|

|

| |

Sébastien Bernier, P.Geo.

Senior Director, Geology & Mineral Resources,

Yamana Gold Inc. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Technical

Report El Peñón Mine, Chile

TABLE OF CONTENTS

| |

|

|

|

|

|

|

| Signature

Page |

|

I |

| |

|

|

| TABLE OF CONTENTS |

|

II |

| |

|

|

| Cautionary

Note Regarding Forward-Looking Statements |

|

VIII |

| |

|

|

| List

of Abbreviations |

|

X |

| |

|

|

| 1 |

|

Summary |

|

1 |

| |

|

|

|

|

| |

1.1 |

|

Property

Description |

|

1 |

| |

1.2 |

|

Geology

and Mineralization |

|

2 |

| |

1.3 |

|

Exploration

Status |

|

2 |

| |

1.4 |

|

Mineral

Resource and Mineral Reserve Estimates |

|

3 |

| |

1.5 |

|

Mining

and Processing Methods |

|

6 |

| |

1.6 |

|

Environmental

Studies, Permitting, and Social or Community Impact |

|

7 |

| |

1.7 |

|

Conclusions

and Recommendations |

|

8 |

| |

|

|

|

|

|

| 2 |

|

Introduction |

|

11 |

| |

|

|

|

|

| |

2.1 |

|

Sources

of Information |

|

12 |

| |

|

|

|

|

|

| 3 |

|

Reliance

on Other Experts |

|

13 |

| |

|

|

|

|

| 4 |

|

Property

Description and Location |

|

14 |

| |

|

|

|

|

| |

4.1 |

|

Mineral

and Surface Tenure |

|

15 |

| |

4.2 |

|

Underlying

Agreements |

|

23 |

| |

4.3 |

|

Permits

and Authorizations |

|

23 |

| |

4.4 |

|

Environmental

Considerations |

|

23 |

| |

|

|

|

|

|

| 5 |

|

Accessibility,

Climate, Local Resources, Infrastructure, and Physiography |

|

24 |

| |

|

|

|

|

| |

5.1 |

|

Accessibility |

|

24 |

| |

5.2 |

|

Climate |

|

24 |

| |

5.3 |

|

Local

Resources |

|

24 |

| |

5.4 |

|

Infrastructure |

|

24 |

| |

5.5 |

|

Physiography |

|

25 |

| |

|

|

|

|

|

| 6 |

|

History |

|

26 |

| |

|

|

|

|

| |

6.1 |

|

Historical

Mineral Resource and Mineral Reserve Estimates |

|

26 |

| |

6.2 |

|

Past Production |

|

27 |

| |

|

|

|

|

|

| 7 |

|

Geological

Setting and Mineralization |

|

28 |

| |

|

|

|

|

| |

7.1 |

|

Regional

Geology |

|

28 |

| |

7.2 |

|

Local

Geology |

|

29 |

| |

7.3 |

|

Property

Geology |

|

32 |

| Signature Date: March 25, 2021 |

ii |

Technical

Report El Peñón Mine, Chile

| |

|

7.3.1 |

|

Structure |

|

32 |

| |

7.4 |

|

Mineralization |

34 |

| |

|

|

|

| 8 |

|

Deposit

Types |

|

36 |

| |

|

|

|

|

| 9 |

|

Exploration |

|

37 |

| |

|

|

|

|

| |

9.1 |

|

Exploration

Potential |

|

37 |

| |

|

|

|

|

|

| 10 |

|

Drilling |

|

39 |

| |

|

|

|

|

| 11 |

|

Sample

Preparation, Analyses, and Security |

|

43 |

| |

|

|

|

|

| |

11.1 |

|

Sample

Preparation and Analysis |

|

43 |

| |

|

11.1.1 |

|

Sampling of Drill Core |

|

43 |

| |

|

11.1.2 |

|

Underground Channel Sampling |

|

44 |

| |

|

11.1.3 |

|

Preparation and Analytical Procedures |

|

45 |

| |

11.2 |

|

Quality

Assurance/ Quality Control |

|

48 |

| |

|

11.2.1 |

|

Certified Reference Materials |

|

50 |

| |

|

11.2.2 |

|

Blank Samples |

|

51 |

| |

|

11.2.3 |

|

Umpire Laboratory Check Assays |

|

54 |

| |

11.3 |

|

Sample

Security |

|

55 |

| |

|

|

|

|

|

| 12 |

|

Data

Verification |

|

57 |

| |

|

|

|

|

| 13 |

|

Mineral

Processing and Metallurgical Testing |

|

58 |

| |

|

|

|

|

| |

13.1 |

|

Processing

Plant |

|

58 |

| |

13.2 |

|

Metallurgical

Testing |

|

58 |

| |

|

|

|

|

|

| 14 |

|

Mineral

Resource Estimates |

|

61 |

| |

|

|

|

|

| |

14.1 |

|

Mineral

Resource Summary |

|

61 |

| |

14.2 |

|

Resource

Database and Validation |

63 |

| |

14.3 |

|

Definition

and Interpretation of Estimation Domains |

|

63 |

| |

14.4 |

|

Compositing

Methods |

|

65 |

| |

14.5 |

|

Basic

Statistics |

|

65 |

| |

14.6 |

|

Specific

Gravity |

|

67 |

| |

14.7 |

|

Variography |

|

67 |

| |

14.8 |

|

Block

Models |

|

70 |

| |

14.9 |

|

Block

Model Validation |

|

72 |

| |

14.10 |

|

Resource

Classification |

|

76 |

| |

14.11 |

|

Resource

Estimation of Stockpiles and Tailings |

|

76 |

| |

14.12 |

|

Mineral

Resource Estimate |

|

76 |

| |

|

|

|

|

|

| 15 |

|

Mineral

Reserve Estimates |

|

80 |

| |

|

|

|

|

| |

15.1 |

|

Mineral

Reserve Summary |

|

80 |

| |

15.2 |

|

Conversion

Methodology |

|

81 |

| |

15.3 |

|

NSR Cut-Off

Value |

|

81 |

| |

15.4 |

|

Design,

Dilution, and Mining Recovery Parameters |

|

82 |

| Signature Date: March 25, 2021 |

iii |

Technical

Report El Peñón Mine, Chile

| |

15.5 |

|

Reconciliation |

|

83 |

| |

15.6 |

|

Mineral Reserve Estimate |

|

83 |

| |

|

|

|

|

|

| 16 |

|

Mining Methods |

|

86 |

| |

|

|

|

|

| |

16.1 |

|

Underground Mining Methods |

|

86 |

| |

16.2 |

|

Underground Mine Design |

|

87 |

| |

16.3 |

|

Mining Sequence |

|

88 |

| |

16.4 |

|

Geomechanics and Ground Support |

|

89 |

| |

16.5 |

|

Mine Equipment |

|

90 |

| |

16.6 |

|

Mine Services |

|

91 |

| |

|

16.6.1 |

|

Dewatering |

|

91 |

| |

|

16.6.2 |

|

Ventilation |

|

92 |

| |

|

16.6.3 |

|

Electrical |

|

93 |

| |

|

16.6.4 |

|

Compressed Air |

|

93 |

| |

|

16.6.5 |

|

Communications |

|

94 |

| |

16.7 |

|

Life of Mine Plan |

|

94 |

| |

|

|

|

|

|

| 17 |

|

Recovery Methods |

|

96 |

| |

|

|

|

|

| |

17.1 |

|

Primary Crushing |

|

96 |

| |

17.2 |

|

Grinding and Pre-Leach Thickening |

|

98 |

| |

17.3 |

|

Clarification |

|

98 |

| |

17.4 |

|

Leaching |

|

98 |

| |

17.5 |

|

CCD Concentrate Solution Recovery |

|

99 |

| |

17.6 |

|

Pregnant Solution Precipitation |

|

99 |

| |

17.7 |

|

Refining |

|

100 |

| |

17.8 |

|

Tailings Filtering and Disposal |

|

100 |

| |

17.9 |

|

Metallurgical Reporting |

|

101 |

| |

17.10 |

|

Plant Consumption |

|

101 |

| |

17.11 |

|

Optimization Opportunities |

|

102 |

| |

|

|

|

|

|

| 18 |

|

Project Infrastructure |

|

103 |

| |

|

|

|

|

| |

18.1 |

|

Filtered Tailings Stack Design and Construction |

|

105 |

| |

|

|

|

|

|

| 19 |

|

MARKET STUDIES AND CONTRACTS |

|

107 |

| |

|

|

|

|

|

| |

19.1 |

|

Market Studies |

|

107 |

| |

19.2 |

|

Contracts |

|

107 |

| |

|

|

|

|

|

| 20 |

|

Environmental Studies, Permitting, and Social or Community Impact |

|

108 |

| |

|

|

|

|

| |

20.1 |

|

Project Permitting and Authorizations |

|

108 |

| |

20.2 |

|

Environmental Management |

|

110 |

| |

|

20.2.1 |

|

Environmental Management System |

|

110 |

| |

|

20.2.2 |

|

Tailings Management |

|

111 |

| |

|

20.2.3 |

|

Water Management |

|

112 |

| |

20.3 |

|

Community Relations |

|

114 |

| Signature Date: March 25, 2021 |

iv |

Technical

Report El Peñón Mine, Chile

| |

|

20.3.1 |

|

General Social Context |

|

114 |

| |

|

20.3.2 |

|

Social and Environmental Assessment and Management Systems |

|

114 |

| |

|

20.3.3 |

|

Workplace Health and Safety |

|

115 |

| |

|

20.3.4 |

|

Support for Community Priorities |

|

116 |

| |

|

20.3.5 |

|

Cultural Heritage |

|

117 |

| |

20.4 |

|

Mine Closure |

|

117 |

| |

|

|

|

|

|

| 21 |

|

Capital and Operating Costs |

|

119 |

| |

|

|

|

|

| |

21.1 |

|

Capital Costs |

|

119 |

| |

21.2 |

|

Operating Costs |

|

120 |

| |

|

|

|

|

|

| 22 |

|

Economic Analysis |

|

121 |

| |

|

|

|

|

| 23 |

|

Adjacent Properties |

|

122 |

| |

|

|

|

|

| 24 |

|

Other Relevant Data and Information |

|

123 |

| |

|

|

|

|

| 25 |

|

Interpretation and Conclusions |

|

124 |

| |

|

|

|

|

| 26 |

|

Recommendations |

|

126 |

| |

|

|

|

|

| 27 |

|

References |

|

127 |

| |

|

|

|

|

| 28 |

|

Certificates of Qualified Persons |

|

130 |

| |

|

|

|

|

|

|

| Signature Date: March 25, 2021 |

v |

Technical

Report El Peñón Mine, Chile

LIST

OF FIGURES

| Figure

4-1: General location map |

14 |

| Figure

4-2: Map of mineral tenure |

16 |

| Figure

4-3: Detailed map of mineral tenure |

22 |

| Figure

5-1: Infrastructure and typical landscape |

25 |

| Figure

7-1: Regional geological setting |

29 |

| Figure

7-2: Local and property geology |

31 |

| Figure

7-3: Schematic geological plan and cross-sections of the El Peñón deposit |

33 |

| Figure

7-4: Photographs of mineralization in underground exposures and in drill core |

35 |

| Figure

8-1: Generalized gold deposit types and environments |

36 |

| Figure

10-1: Plan view of drill holes in El Peñón core mine area |

40 |

| Figure

11-1: Time-series plots: gold assays of select CRMs by laboratory (2018–2020) |

51 |

| Figure

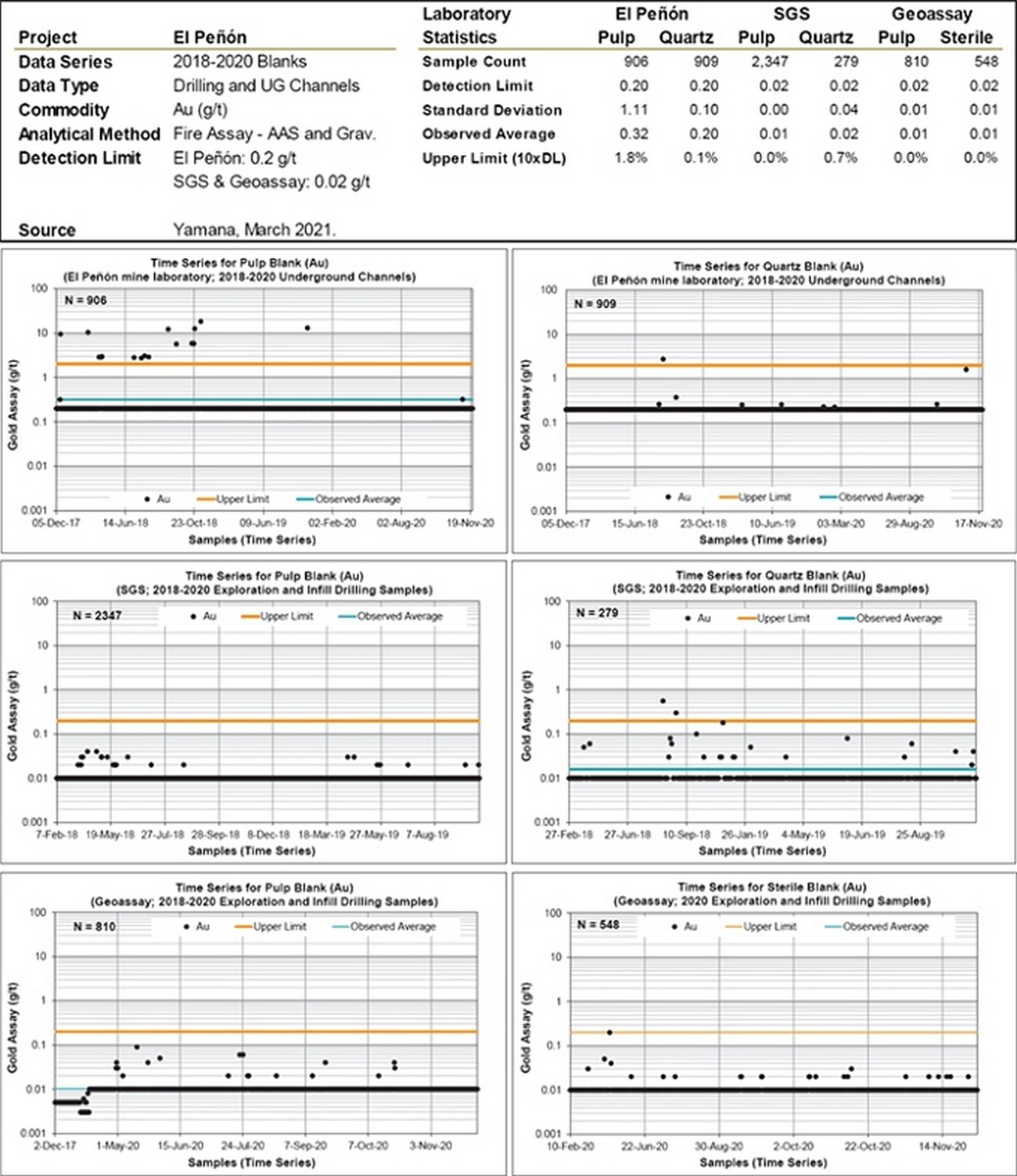

11-2: Time-series plots: gold assays of select blanks by type and laboratory (2018–2020) |

53 |

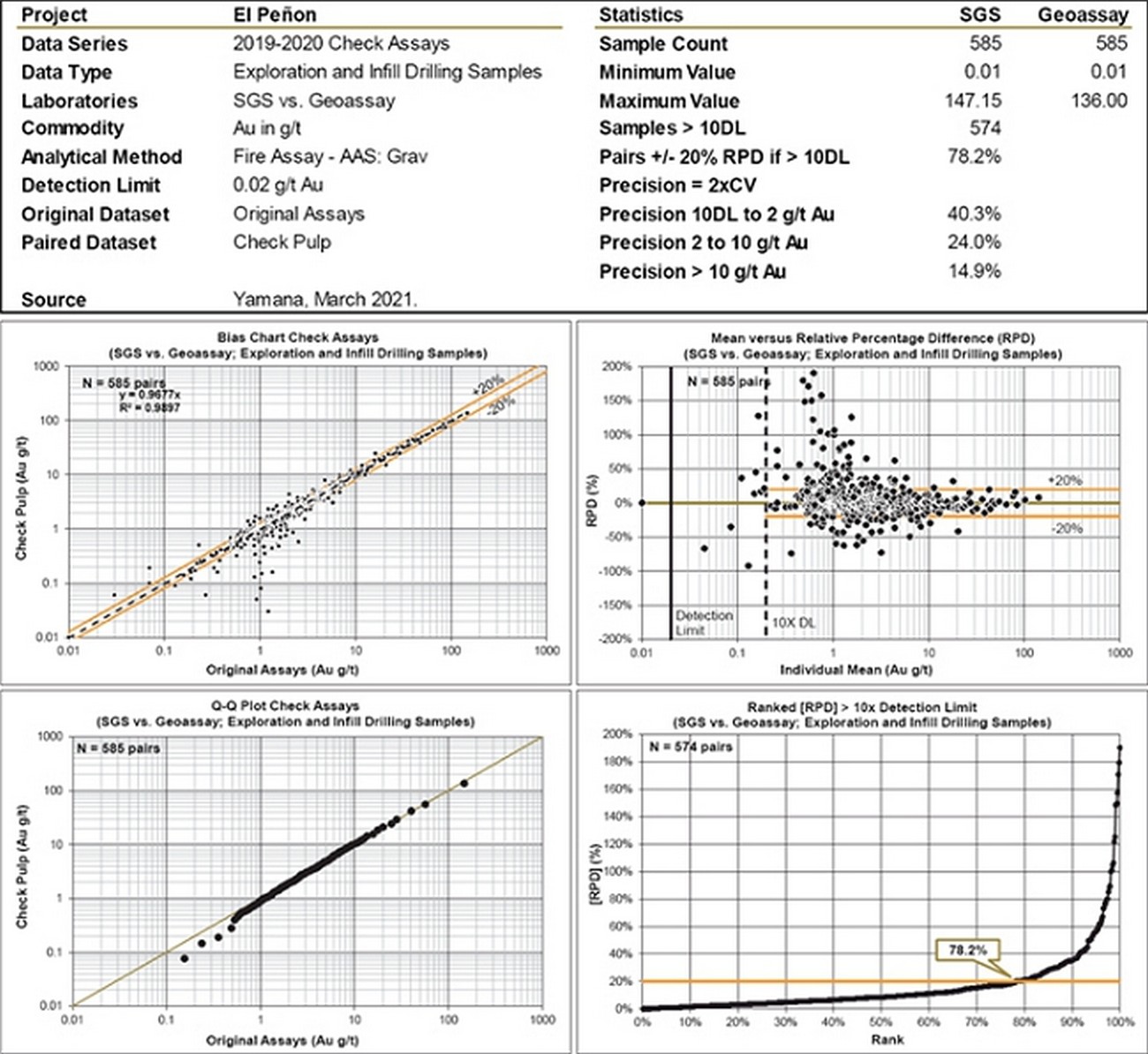

| Figure

11-3: Comparison between SGS and Geoassay umpire gold assays (2019-2020) |

55 |

| Figure

14-1: Plan view of estimation domains in El Peñón core mine area |

64 |

| Figure

14-2: Experimental gold and silver correlograms and fitted correlograms models for the 505 and Magenta veins |

69 |

| Figure

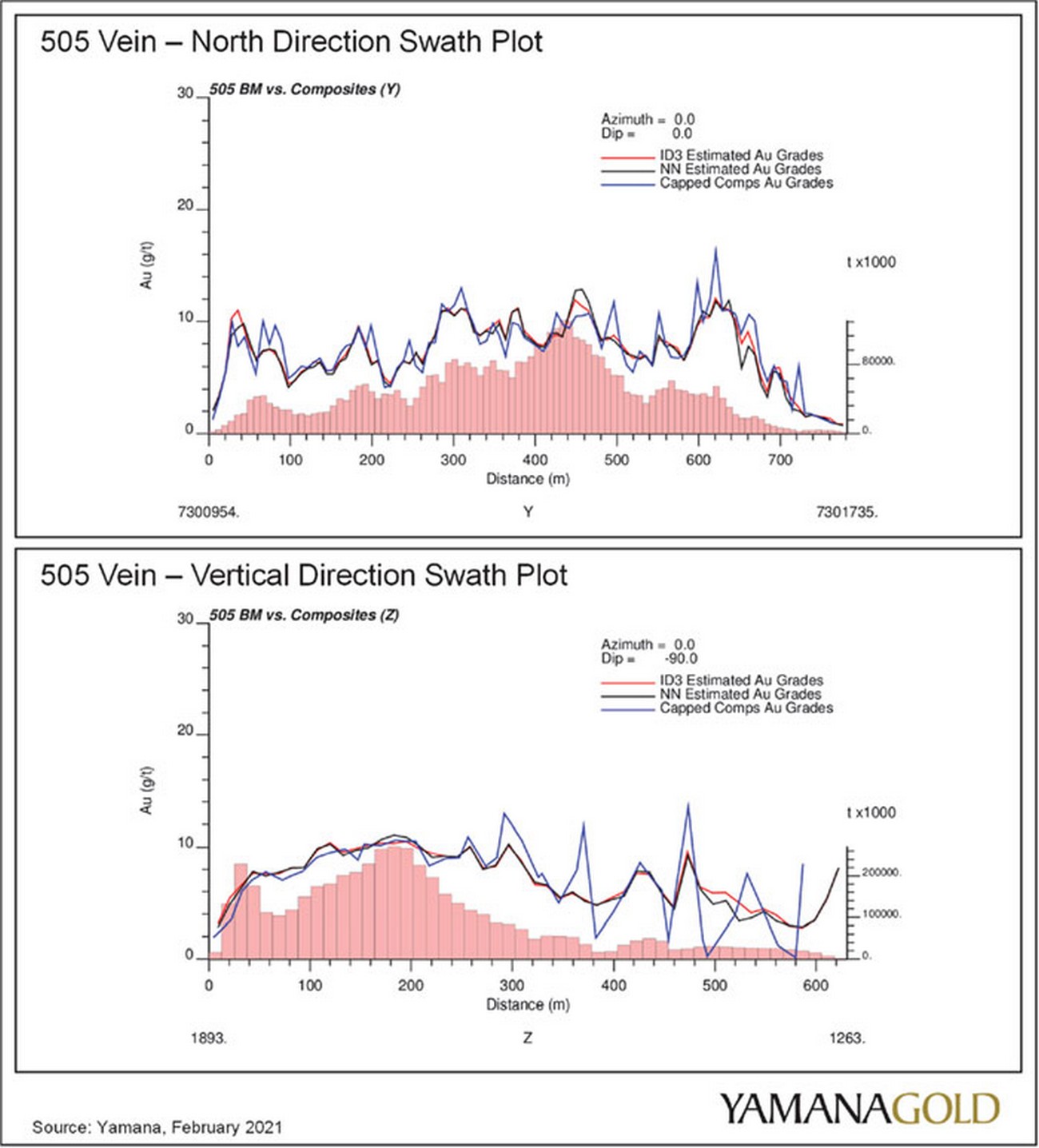

14-3: Gold swath plots for 505 Vein |

74 |

| Figure

14-4: Gold swath plots for Magenta Vein |

75 |

| Figure

16-1: Schematic cross-section of drift and vein showing extent of split-blasting technique |

87 |

| Figure

16-2: Schematic example of bench-and-fill mining method |

88 |

| Figure

16-3: Ventilation circuit of the Pampa Augusta Victoria underground mine |

93 |

| Figure

17-1: Mineral processing flowsheet |

97 |

| Figure

18-1: Plan map of main infrastructure at El Peñón |

104 |

| Figure

18-2: Schematic cross-section of western face of filtered tailings stack |

105 |

| Signature Date: March 25, 2021 |

vi |

Technical

Report El Peñón Mine, Chile

LIST

OF TABLES

| Table

1-1: El Peñón Mineral Resource Statement as of December 31, 2020 |

3 |

| Table

1-2: El Peñón Mineral Reserve Statement as of December 31, 2020 |

5 |

| Table

4-1: Mineral tenure list |

17 |

| Table

6-1: Commercial production at El Peñón, January 2000 to December 31, 2020 |

27 |

| Table

7-1: Description of main lithologies |

30 |

| Table

10-1: Exploration and infill drilling by year and type, 1993 to December 31, 2020 |

39 |

| Table

11-1: Sample preparation and analytical standard operating procedures |

43 |

| Table

11-2: Summary of analytical quality control data produced between 2018 and 2020 |

49 |

| Table

11-3: Lower detection limits and acceptance limits for blanks |

52 |

| Table

13-1: Gold recovery by zone, ore type, and grade category |

59 |

| Table

13-2: Silver recovery by zone, ore type, and grade category |

59 |

| Table

13-3: Processing plant production for 2019 |

60 |

| Table

13-4: Processing plant production for 2020 |

60 |

| Table

14-1: El Peñón Mineral Resource Statement as of December 31, 2020 |

62 |

| Table

14-2: Summary of gold and silver capping values by zone |

65 |

| Table

14-3: Specific gravity density values assigned to each zone |

67 |

| Table

14-4: Typical calculation parameters for experimental correlograms |

68 |

| Table

14-5: Correlogram model parameters for 505 and Magenta veins |

68 |

| Table

14-6: Generalized block model variables |

70 |

| Table

14-7: Block models per veins and per mining zones |

71 |

| Table

14-8: Summary of the typical estimation search parameters |

72 |

| Table

14-9: Statistical validation of the estimated block model – 505 Vein |

73 |

| Table

14-10: Statistical validation of the estimated block model – Magenta Vein |

73 |

| Table

14-11: Resource NSR cut-off value calculation parameters |

77 |

| Table

14-12: Summary of El Peñón mineral resources by zone, as of December 31, 2020 |

78 |

| Table

15-1: El Peñón Mineral Reserve Statement as of December 31, 2020 |

80 |

| Table

15-2: NSR cut-off value calculation parameters for mineral reserves |

82 |

| Table

15-3: Stope SMU design parameters by zone |

82 |

| Table

15-4: Drift (split blasting) SMU design parameters |

82 |

| Table

15-5: Reconciliation |

83 |

| Table

15-6: Summary of El Peñón mineral reserves by zone, as of December 31, 2020 |

84 |

| Table

16-1: Underground mobile equipment for development & production |

90 |

| Table

16-2: Support mobile equipment |

91 |

| Table

16-3: Life of mine plan (LOM) |

95 |

| Table

17-1: Consumption of reagents for 2020 |

101 |

| Table

17-2: Consumption of processing supplies for 2020 |

102 |

| Table

20-1: Summary of environmental resolutions since 1998 |

109 |

| Table

20-2: Social risk management element of Yamana’s HSEC Framework (2016) |

114 |

| Table

20-3: Health and safety management elements of Yamana’s HSEC Framework (2016) |

115 |

| Table

20-4: Mine closure costs |

118 |

| Table

21-1: Life of mine capital costs |

119 |

| Table

21-2: LOM average unit operating costs |

120 |

| Signature Date: March 25, 2021 |

vii |

Technical

Report El Peñón Mine, Chile

Cautionary Note Regarding

Forward-Looking Statements

This report contains or incorporates by reference

“forward-looking statements” and “forward-looking information” under applicable Canadian securities legislation

within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking information includes,

but is not limited to: cash flow forecasts, projected capital, operating and exploration expenditures, targeted cost reductions,

mine life and production rates, grades, infrastructure, capital, operating and sustaining costs, the future price of gold, potential

mineralization and metal or mineral recoveries, estimates of mineral resources and mineral reserves and the realization of such

mineral resources and mineral reserves, information pertaining to potential improvements to financial and operating performance

and mine life at El Peñón (as defined herein) that may result from expansion projects or other initiatives, maintenance

and renewal of permits or mineral tenure, estimates of mine closure obligations, leverage ratios and information with respect

to the Company’s (as defined herein) strategy, plans or future financial or operating performance. Forward-looking statements

are characterized by words such as “plan,” “expect”, “budget”, “target”, “project”,

“intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements

that certain events or conditions “may” or “will” occur, including the negative connotations of such terms.

Forward-looking statements are statements that are not historical facts and are based on the opinions, assumptions and estimates

of Qualified Persons (as defined herein) considered reasonable at the date the statements are made, and are inherently subject

to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements. These factors include, but are not limited to: the impact of

general domestic and foreign business; economic and political conditions; global liquidity and credit availability on the timing

of cash flows and the values of assets and liabilities based on projected future conditions; fluctuating metal and commodity prices

(such as gold, silver, diesel fuel, natural gas and electricity); currency exchange rates (such as the Chilean Peso and the Canadian

dollar versus the United States dollar); changes in interest rates; possible variations in ore grade or recovery rates; the speculative

nature of mineral exploration and development; changes in mineral production performance, exploitation and exploration successes;

diminishing quantities or grades of reserves; increased costs, delays, suspensions, and technical challenges associated with the

construction of capital projects; operating or technical difficulties in connection with mining or development activities, including

disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to the Company’s

or El Peñón’s reputation due to the actual or perceived occurrence of any number of events, including negative

publicity with respect to the handling of environmental matters or dealings with community groups, whether true or not; risk of

loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with infectious diseases, including COVID-19;

risks associated with nature and climatic conditions; uncertainty regarding whether El Peñón will meet the Company’s

capital allocation objectives; the impact of global liquidity and credit availability on the timing of cash flows and the values

of assets and liabilities based on projected future cash flows; the impact of inflation; fluctuations in the currency markets;

changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of

laws, policies and practices, expropriation or nationalization of property and political or economic developments in Chile; failure

to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary

permits and approvals; changes in project parameters as plans continue to be refined; changes in project development, construction,

production and commissioning time frames; contests over title to properties or over access to water, power, and other required

infrastructure; increased costs and physical risks including extreme weather events and resource shortages related to climate

change; availability and increased costs associated with mining inputs and labor; the possibility of project cost overruns or

unanticipated costs and expenses, potential impairment charges, higher prices for fuel, steel, power, labour, and other consumables

contributing to higher costs; unexpected changes in mine life; final pricing for concentrate sales; unanticipated results of future

studies; seasonality and unanticipated weather changes; costs and timing of the development of new deposits; success of exploration

activities; risks related to relying on local advisors and consultants in foreign jurisdictions; unanticipated reclamation expenses;

limitations on insurance coverage; timing and possible outcome of pending and outstanding litigation and labour disputes; risks

related to enforcing legal rights in foreign jurisdictions, vulnerability of information systems and risks related to global financial

conditions. In addition, there are risks and hazards associated with the business of mineral exploration, development, and mining,

including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding, failure

of plant, equipment, or processes to operate as anticipated (and the risk of inadequate insurance, or inability to obtain insurance,

to cover these risks), as well as those risk factors discussed or referred to herein and in the Company's Annual Information Form

filed with the securities regulatory authorities in all of the provinces and territories of Canada and available under the Company’s

profile at www.sedar.com, and the Company’s Annual Report on Form 40-F filed with the United States Securities and Exchange

Commission at www.edgar.com. Although the Company has attempted to identify important factors that could cause actual actions,

events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause

actions, events, or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions,

or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking

statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding

the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented

in the Company’s plans and objectives and may not be appropriate for other purposes.

| Signature Date: March 25, 2021 |

viii |

Technical

Report El Peñón Mine, Chile

Cautionary Note to United States Investors Concerning

Estimates of Mineral Reserves and Mineral Resources

This report has been prepared in accordance with

the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements

promulgated by the Securities and Exchange Commission (SEC). For example, the terms “Mineral Reserve”, “Proven

Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”,

“Indicated Mineral Resource” and “Inferred Mineral Resource” are Canadian mining terms as defined in accordance

with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects and the Canadian Institute of Mining, Metallurgy

and Petroleum (CIM) Definition Standards on Mineral Resources and Mineral Reserves (May 2014), adopted by the CIM Council, as amended.

These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained

in this report may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure

requirements.

Non-GAAP Measures

The

Company has included certain non-GAAP financial measures and additional line items or subtotals, which the Company believes that,

together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying

performance of the Company. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS, and therefore

they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information

and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The

non-GAAP financial measures included in this report include: free cash flow, cash costs per gold-equivalent ounce sold, and all-in

sustaining costs per gold-equivalent ounce sold. Please refer to section 11 of the Company’s current annual Management’s

Discussion and Analysis, which is filed under the Company’s profile on SEDAR at www.sedar.com and which includes

a detailed discussion of the usefulness of the non-GAAP measures. The Company believes that in addition to conventional measures

prepared in accordance with IFRS, the Company and certain investors and analysts use this information to evaluate the Company’s

performance. In particular, management uses these measures for internal valuation for the period and to assist with planning and

forecasting of future operations.

| Signature Date: March 25, 2021 |

ix |

Technical

Report El Peñón Mine, Chile

List

of Abbreviations

Units of measurement used in this report conform to the metric

system. All currency in this report is listed in US dollars (US$) unless noted otherwise

| ° |

degrees |

|

HDPE |

high-density polyethylene |

|

NSR |

net smelter return |

| > |

greater than |

|

hp |

horsepower |

|

NPV |

net present value |

| < |

less than |

|

HSEC |

Health, Safety, Environment, and Community |

|

NTU |

nephelometric turbidity units |

| % |

percent |

|

ID3 |

inverse distance cubed |

|

oz |

troy ounce (31.1035 g) |

| a |

annum |

|

k |

kilo (thousand) |

|

PFS |

pre-feasibility study |

| A |

ampere or amp |

|

kg |

kilogram |

|

ppm |

parts per million |

| AAS |

atomic absorption spectrometry |

|

km |

kilometre |

|

QA/QC |

quality assurance/quality control |

| Ag |

silver |

|

km2 |

square kilometre |

|

RAR |

return air raise |

| ARD |

acid rock drainage |

|

kV |

kilovolt |

|

RC |

reverse circulation |

| Au |

gold |

|

kVA |

kilovolt-amperes |

|

RCA |

Environmental Qualification Resolutions |

| C&F |

cut and fill mining method |

|

kW |

kilowatt |

|

RMR89 |

rock mass rating |

| °C |

degree Celsius |

|

kWh |

kilowatt-hour |

|

s |

second |

| CRM |

certified reference material |

|

L |

litre |

|

SD |

Standard deviation |

| cm |

centimetre |

|

LHD |

load-haul-dump truck |

|

SMU |

selective mining units |

| cm2 |

square centimetre |

|

LOM |

life of mine |

|

SOP |

standard operating procedures |

| cog |

cut-off grade |

|

L/s |

litres per second |

|

t |

metric tonne |

| d |

day |

|

m |

metre |

|

tpa |

metric tonnes per year |

| DL |

detection limit |

|

M |

Mega, million |

|

tpd |

metric tonnes per day |

| DIA |

Declaration of Environmental Impacts |

|

m2 |

square metre |

|

tph |

metric tonnes per hour |

| dmt |

dry metric tonne |

|

m3 |

cubic metre |

|

tpm |

metric tonnes per month |

| EDA |

exploratory data analysis |

|

masl |

metres above sea level |

|

US$ |

United States dollar |

| EIA |

environmental impact assessment |

|

μg |

microgram |

|

TFS |

tailings storage facility |

| Fm |

formation |

|

m3/h |

cubic metres per hour |

|

V |

volt |

| g |

gram |

|

min |

minute |

|

VFD |

variable frequency drive |

| g |

peak ground acceleration |

|

ML |

metal leaching |

|

VSO |

Vulcan Stope Optimizer |

| G |

giga (billion) |

|

mm |

micrometre, micron |

|

W |

watt |

| GDMS |

geological data management system |

|

mm |

millimetre |

|

wt % |

weight percent |

| g/L |

grams per litre |

|

Mtpa |

million tonnes per year |

|

|

|

| g/t |

grams per metric tonne |

|

MVA |

megavolt-amperes |

|

|

|

| ha |

hectare |

|

MW |

megawatt |

|

|

|

| |

|

|

MWh |

megawatt-hour |

|

|

|

| |

|

|

NN |

nearest neighbour |

|

|

|

| Signature Date: March 25, 2021 |

x |

Technical

Report El Peñón Mine, Chile

This report documents the El Peñón

mine (El Peñón), an underground and open-pit gold-silver mine located in northern Chile in the Atacama Desert. Yamana

Gold Inc. (Yamana) holds a 100% interest in El Peñón through its subsidiary, Minera Meridian Limitada (Minera Meridian).

Yamana is a Canadian-based precious metals producer

with significant gold and silver production- and development-stage properties, exploration properties, and land positions throughout

the Americas, including Canada, Brazil, Chile, and Argentina. Yamana plans to continue to build on this base through expansion

and optimization initiatives at existing operating mines, development of new mines, advancement of its exploration properties and,

at times, by targeting other consolidation opportunities, with a primary focus on the Americas.

This technical report prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) documents the current mining operation

as well as the mineral resource and mineral reserve estimate of El Peñón as of December 31, 2020.

El Peñón is located approximately

165 km southeast of the city of Antofagasta. The mine site, situated approximately midway between the Pacific Coast and the border

with Argentina, is in the Atacama Desert, a desert plateau with one of the driest climates on earth. The mine has been in operation

since 1999 and it operates on a year-round basis.

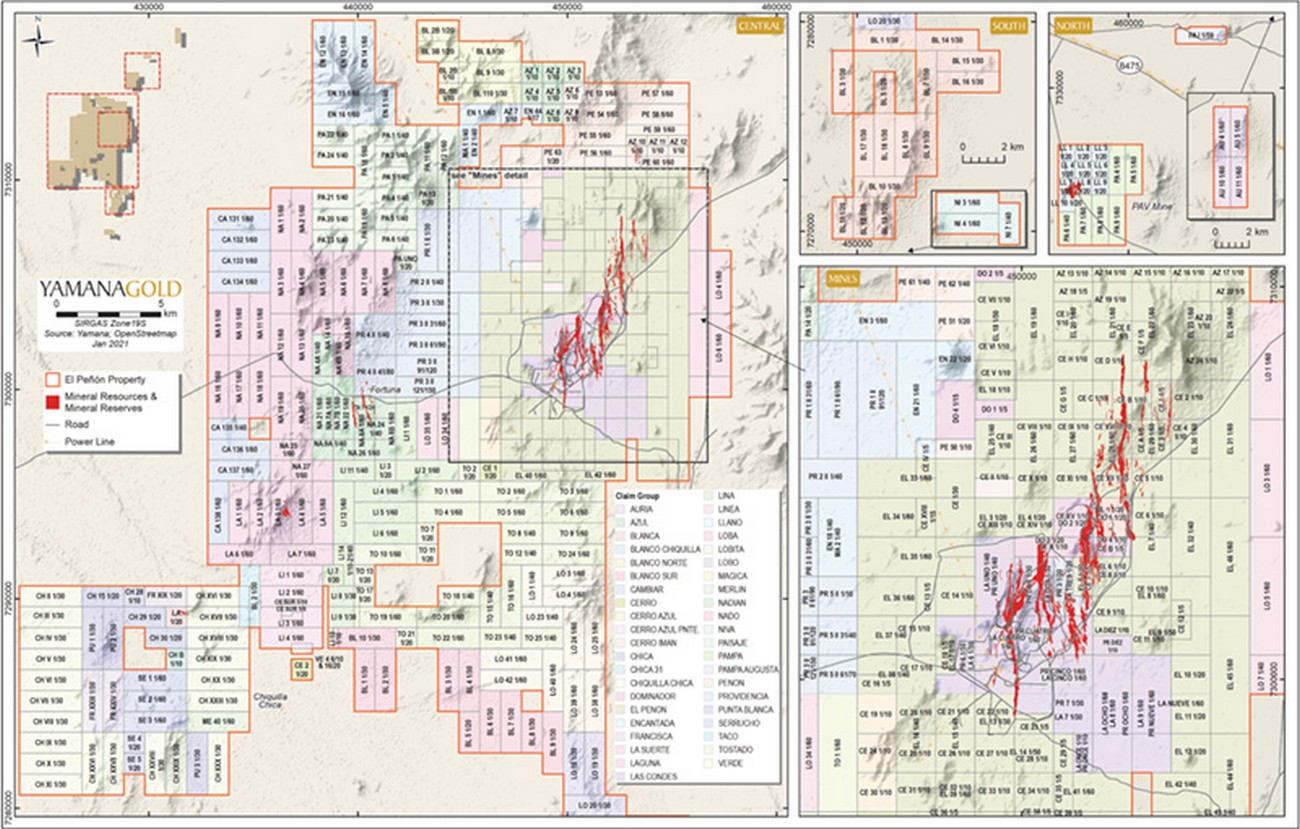

Yamana acquired the property in late 2007 with the

purchase of Meridian Gold Inc. (Meridian Gold). The mineral rights consist of 443 individual mining exploitation claims that comprise

an area measuring 92,387 ha. It covers the El Peñón core mine area, the Fortuna area, the Laguna area, the Pampa

Augusta Vitoria (PAV) area, and the surrounding exploration lands.

Minera Meridian is subject to a royalty tax between

5% and 14% based on the mining gross profit margin and currently pays approximately a 5% to 7% royalty tax on taxable mining income.

In addition, El Peñón is also subject to First Category Tax (income tax) in Chile at a rate of 27%.

Minera Meridian has all required permits to continue

carrying out mining and processing operations on the El Peñón property.

A 2% Net Smelter Return (NSR) royalty is payable

to Maverix Metals Inc. as agreed as part of the purchase of the Nado claims covering the Fortuna area and a further 2% NSR is payable

to Soquimich Comercial SA for claims Providencia 1, 2, 3, 4, and 5 and claims Dominador 1, 2, and 4. These claims are also located

in the Fortuna area.

| 1 –Summary |

1 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1.2 | Geology

and Mineralization |

The discovery of the El Peñón gold-silver

deposit was the result of successful grassroots exploration throughout the early 1990s. El Peñón is classified as

a low- to intermediate-sulphidation epithermal gold-silver deposit associated with steeply dipping fault-controlled veins emplaced

following rhyolite dome emplacement.

The gold-silver mineralization is hosted in near-horizontal

to gently dipping Paleocene to Eocene basaltic to rhyolitic volcanic rocks. The deposit comprises many individual tabular and steeply

dipping zones that are amenable to mining by both underground and surface methods. Vein thickness range from decimetre-scale to

more than 20 metres. The strike length of individual mineralized zones ranges from less than 1 km to 4 km and the down-dip extent

reaches up to 350 m.

Yamana has been successful in expanding the footprint

of mineralization through geological mapping, geochemical characterization, geophysics, and abundant surface and underground drilling

within the northeast trend, first starting at the El Peñón area, with Quebrada Orito in the southwest and ending

at Angosta in the northeast.

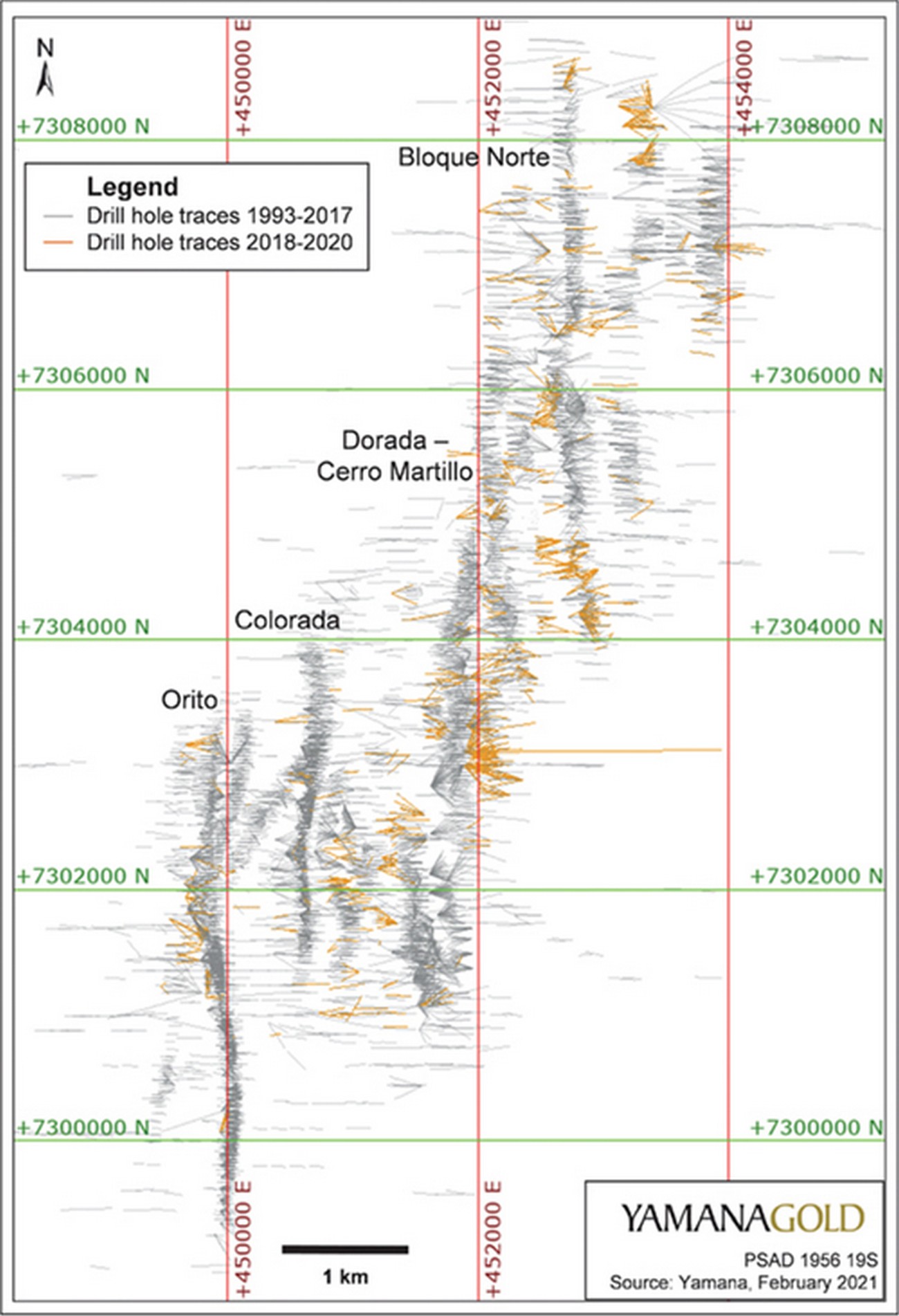

The significant exploration results were obtained

by surface and underground core drilling. As of the end of December 2020, over three million metres have been drilled at El Peñón.

Yamana continually conducts exploration work to develop drill targets to replenish mineral reserves. Drilling is carried out on

a 60 × 60 m grid with infill drill holes on a 30 × 30 m grid pattern.

Drilling activities have been successful in defining

and expanding known mineralized zones and have led to the discovery of new mineralized zones. Based on these exploration successes

and the production history of El Peñón, good potential exists for the discovery of new mineralized zones in the proximity

of the current mine infrastructure and in the strike and dip extents of known mineralized horizons.

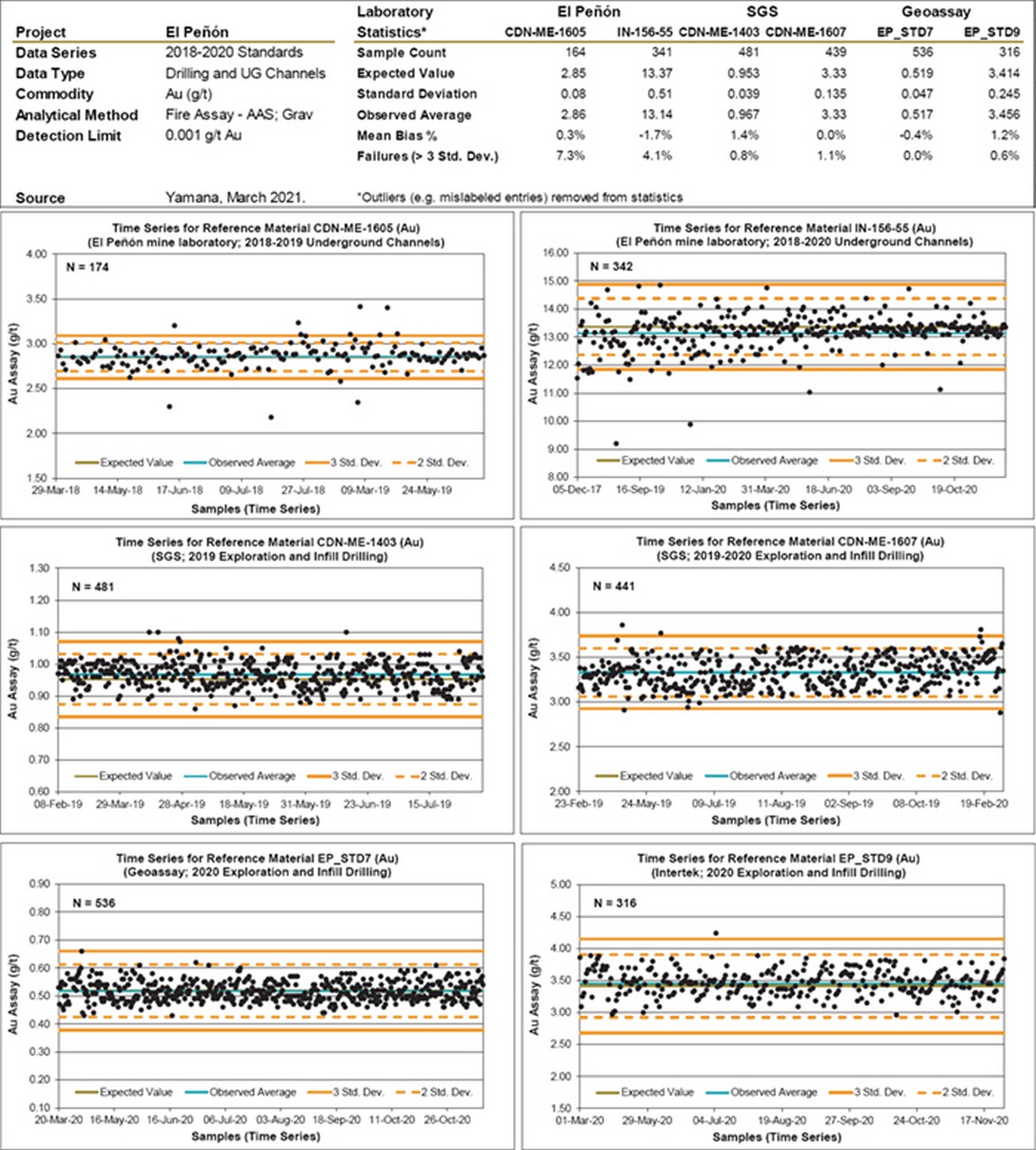

Analytical samples include both drill core and channel

samples. The drill core samples are generated from exploration and infill drilling programs that are conducted on surface and underground;

analytical results are used for target generation and estimation of mineral resources and reserves. The sample preparation, sample

security, and analytical procedures at El Peñón are adequate and consistent with industry standards. The verification

of the sampling data by Yamana and external consultants, including the analytical quality control data produced by Yamana for samples

submitted to various laboratories, suggests that the analytical results delivered by the laboratories are sufficiently reliable

for the purpose of mineral resource and mineral reserve estimation.

| 1 –Summary |

2 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1.4 | Mineral

Resource and Mineral Reserve Estimates |

Interpreted geological wireframes were constructed

based on a three-dimensional and sectional interpretation of geological continuity, assay results, lithological information and

structural data. Assays were composited to one-metre lengths, then interpolated using capping and a high-yield restriction for

anomalously high grades. Gold and silver grades were interpolated into a sub-blocked model with minimum block size of 0.5 ×

0.5 × 0.5 m and a parent block size of 20 × 20 × 20 m. Estimated grades were interpolated into blocks using Inverse

Distance Cubed (ID3) and checked using Nearest Neighbor (NN) methods. Block estimates were validated using industry standard validation

techniques. Classification of blocks was completed following distance-based criteria.

El Peñón mineral resources have been

estimated in conformity with generally accepted standards set out in Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Mineral Resource and Mineral Reserves Estimation Best Practices Guidelines (November 2019) and were classified according

to CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM (2014) Standards). Mineral resources

are not mineral reserves and have not demonstrated economic viability. Underground mineral resources are estimated within conceptual

underground mining shapes at a cut-off value of US$95.31/t, which corresponds to 75% of the break-even cut-off value used to estimate

the mineral reserves. A minimum mining width of 0.60 m as well as 0.30 m of hanging-wall and 0.30 m of footwall overbreak dilution

are used to construct the conceptual mining shapes. Mineral resources are reported fully diluted.

Table 1-1: El Peñón Mineral Resource Statement

as of December 31, 2020

| Mineral Resources |

|

Category |

|

Tonnage |

|

Grade |

|

Contained Metal |

| |

|

(kt) |

|

Au (g/t) |

|

Ag (g/t) |

|

Au (koz) |

|

Ag (koz) |

| Underground |

|

Measured |

|

667 |

|

4.81 |

|

143.0 |

|

103 |

|

3,063 |

| |

Indicated |

|

6,355 |

|

3.06 |

|

105.4 |

|

625 |

|

21,535 |

| |

Total Measured + Indicated |

|

7,022 |

|

3.22 |

|

109.0 |

|

728 |

|

24,599 |

| |

Inferred |

|

5,208 |

|

3.61 |

|

118.0 |

|

605 |

|

19,758 |

| Tailings |

|

Measured |

|

– |

|

– |

|

– |

|

– |

|

– |

| |

Indicated |

|

– |

|

– |

|

– |

|

– |

|

– |

| |

Total Measured + Indicated |

|

– |

|

– |

|

– |

|

– |

|

– |

| |

Inferred |

|

13,767 |

|

0.55 |

|

18.9 |

|

245 |

|

8,380 |

| Stockpiles |

|

Measured |

|

– |

|

– |

|

– |

|

– |

|

– |

| |

Indicated |

|

1,019 |

|

1.13 |

|

28.8 |

|

37 |

|

942 |

| |

Total Measured + Indicated |

|

1,019 |

|

1.13 |

|

28.8 |

|

37 |

|

942 |

| |

Inferred |

|

– |

|

– |

|

– |

|

– |

|

– |

| Combined |

|

Measured |

|

667 |

|

4.81 |

|

143.0 |

|

103 |

|

3,063 |

| |

Indicated |

|

7,374 |

|

2.79 |

|

94.8 |

|

662 |

|

22,478 |

| |

Total Measured + Indicated |

|

8,041 |

|

2.96 |

|

98.8 |

|

765 |

|

25,541 |

| |

Inferred |

|

18,975 |

|

1.39 |

|

46.1 |

|

850 |

|

28,138 |

| 1 –Summary |

3 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1. | Mineral resources have been estimated by the El Peñón resource geology team under

the supervision of Marco Velásquez Corrales, Registered Member of the Chilean Mining Commission, a full-time employee of

Minera Meridian Limitada, and a qualified person as defined by NI 43-101. The estimate conforms to the CIM (2014) Standards. Mineral

resources are reported exclusive of mineral reserves. Mineral resources were evaluated using an inverse distance weighting algorithm

informed by capped composites and constrained by three-dimensional mineralization wireframes. Mineral resources are not mineral

reserves and have not demonstrated economic viability. Metal price assumptions of US$1,250/oz for gold and US$18.00/oz for silver

were used. |

| 2. | Underground mineral resources are estimated at a cut-off NSR of US$95.31/t, which corresponds

to 75% of the mineral reserves cut-off value. Processing recoveries assumptions range from 84.13% to 97.38% for gold and from 56.47%

to 92.33% for silver. The estimation considered the following cost assumptions: mine operating cost of US$80.10/t; processing cost

of US$29.42/t; sustaining capital cost of US$4.10/t; and G&A costs of US$13.46/t. A royalty of 2% was also considered for mineral

resources contained in the Fortuna zone. Mineral resources are reported fully diluted; they consider a minimum mining width of

0.60 m and hanging wall and footwall overbreak dilutions of 0.30 m each to determine reasonable prospects of economic extraction.

Bulk densities ranging from 2.36 g/cm3 to 2.57 g/cm3 were used to convert volume to tonnage. |

| 3. | Mineral resources contained in tailings are reported at a cut-off grade of 0.50 g/t gold-equivalent,

using recoveries of 60% for gold and 30% for silver, operating cost of US$2.39/t, and processing cost of US$29.42/t. A bulk density

value of 1.75 g/cm3 was used to convert tailings volume to tonnage. |

| 4. | Mineral resources contained in stockpiles are reported at a cut-off grade of 0.79 g/t gold-equivalent,

using recoveries of 88.0% for gold and 80.8% for silver, operating cost of US$2.39/t, and processing cost of US$29.42/t. A bulk

density value of 1.60 g/cm3 was used to convert the stockpile volume to tonnage. |

| 5. | Mineral resources are reported as of December 31, 2020. |

| 6. | All figures are rounded to reflect the relative accuracy of the estimate. |

| 7. | Numbers may not add up due to rounding. |

The methodology used at El Peñón to

convert mineral resources to mineral reserves is summarized as follows:

| • | Drift and bench (stope) selective mining units (SMUs) are designed using Vulcan Stope Optimiser; design parameters calibrated

with actual operational results. |

| • | Long-term metal price assumptions for gold and silver of US$1,250/oz and US$18/oz, respectively, as well as processing recoveries

and average operating costs obtained respectively from geometallurgical tests and last year’s life of mine (LOM) plan are

used to determine an economic score for each SMU. Only measured and indicated mineral resources are considered for conversion to

mineral reserves |

| • | SMUs with positive scores are analyzed for inclusion into the mineral reserve inventory. This is done by analyzing development

costs, considering the capital and auxiliary development required to enable mining of the designed SMUs. |

| 1 –Summary |

4 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| • | Before including SMUs with positive scores in the mineral reserves inventory, geomechanical considerations are revised. Design

is adjusted where required. |

| • | SMUs containing a majority portion of measured or indicated blocks are converted to proven or probable mineral reserves, respectively. |

Table 1-2: El Peñón Mineral Reserve

Statement as of December 31, 2020

| Mineral Reserves |

|

Category |

|

Tonnage |

|

Grade |

|

Contained Metal |

| |

|

(kt) |

|

Au (g/t) |

|

Ag (g/t) |

|

Au (koz) |

|

Ag (koz) |

| Open Pit |

|

Proven |

|

– |

|

– |

|

– |

|

– |

|

– |

| |

Probable |

|

53 |

|

0.34 |

|

316.2 |

|

1 |

|

543 |

| |

Total Open Pit |

|

53 |

|

0.34 |

|

316.2 |

|

1 |

|

543 |

| Underground |

|

Proven |

|

368 |

|

5.73 |

|

213.4 |

|

68 |

|

2,526 |

| |

Probable |

|

5,068 |

|

5.07 |

|

158.6 |

|

826 |

|

25,835 |

| |

Total Underground |

|

5,436 |

|

5.12 |

|

162.3 |

|

894 |

|

28,361 |

| Stockpile |

|

Proven |

|

9 |

|

1.40 |

|

54.1 |

|

0 |

|

16 |

| |

Probable |

|

651 |

|

1.26 |

|

14.1 |

|

26 |

|

294 |

| |

Total Stockpile |

|

660 |

|

1.26 |

|

14.6 |

|

27 |

|

310 |

| Combined |

|

Proven |

|

377 |

|

5.63 |

|

209.5 |

|

68 |

|

2,542 |

| |

Probable |

|

5,772 |

|

4.60 |

|

143.7 |

|

853 |

|

26,672 |

| |

Grand Total |

|

6,149 |

|

4.66 |

|

147.8 |

|

921 |

|

29,214 |

| 1. | Mineral reserves have been estimated by the El Peñón long-term mine planning team

under the supervision of Sergio Castro, Registered Member of the Chilean Mining Commission, a full-time employee of Minera Meridian

Limitada, and a qualified person as defined by NI 43-101. The estimate conforms to the CIM (2014) Standards. Mineral reserves are

stated at a mill feed reference point and allow for dilution and mining losses. Metal price assumptions of US$1,250/oz for gold

and US$18.00/oz for silver were used. |

| 2. | Open-pit mineral reserves are reported at a cut-off NSR of US$ 49.14/t. Processing recoveries

assumptions range from 84.13% to 89.22% for gold and from 79.71% to 81.67% for silver. Mine operating (including transport), processing,

and G&A costs assumptions of US$6.27/t and US$29.42/t and US$13.46/t were considered, respectively. |

| 3. | Underground mineral reserves are reported at an NSR cut-off of US$127.08/t. Processing recoveries

assumptions range from 84.13% to 97.38% for gold and from 56.47% to 92.33% for silver. The following cost assumptions were considered:

mine operating cost: US$80.10/t; processing cost: US$29.42/t; sustaining capital cost: US$4.10/t, and G&A cost: US$13.46/t.

A royalty of 2% was considered for reserves planned to be mined in the Fortuna zone. |

| 4. | Mineral reserves contained in low-grade stockpiles are reported at a cut-off grade of 0.90 g/t

gold-equivalent. Processing recoveries assumptions of 95.2% for gold and 83.0% for silver were used. Operating and processing costs

assumptions of US$2.02/t and US$29.42/t, respectively, were considered. |

| 5. | Mineral reserves are reported as of December 31, 2020. |

| 6. | All figures are rounded to reflect the relative accuracy of the estimate. |

| 7. | Numbers may not add up due to rounding |

| 1 –Summary |

5 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1.5 | Mining

and Processing Methods |

Ore from underground mines have recently been—and

will continue to be—the main source of feed for the El Peñón mill.

The various underground mining zones are accessed

by ramps; this type of access is suitable for this mine in light of its shallow depth. The underground workings of the core mine

extend approximately ten kilometers along strike and span a vertical extent of approximately 500 m, measured from the highest portal

collar elevation to the bottom-most mine workings. The ramps provide flexibility for rapid adjustments for changes in direction

and elevation and allow access to the veins at appropriate elevations.

Mining at El Peñón utilizes mainly

the bench-and-fill mining method, which is a narrow longhole-stoping method that uses a combination of rockfill and cemented rockfill;

a small percentage of cut-and-fill mining is also applied where required, depending on the characteristics of vein geometry and

ground conditions. Due to the narrow vein widths, a “split-blasting” technique is used in many areas of the mine to

reduce dilution in secondary development in ore zones.

The major assets and facilities associated with

El Peñón are: the mining and processing infrastructure, which include office buildings, shops, and equipment; a processing

plant which produces gold doré by crushing, grinding, leaching, counter-current decantation (CCD) concentrate solution recovery,

zinc precipitation and refining; concrete and cemented backfill plants, and a filtered tailings stack storage facility.

El Peñón is connected to the National

Electric Grid through a 66 kV transmission line connected to the Palestina substation.

The tailings produced at the El Peñón

mill are stored in a filtered tailings stack storage facility, located 1.5 km southeast of the mineral processing plant. The current filter stack stores 25.4 Mt of tailings. The final design

considers an additional storage capacity of 24.5 Mt.

The El Peñón mineral processing plant

and associated facilities process run-of-mine as well as stockpiled ore. Comminution comprises a single stage of crushing followed

by wet grinding in a SAG mill operating in series with a ball mill; these feed a battery of hydrocyclones. Leaching starts at the

SAG mill, where sodium cyanide is added as a leaching agent. The hydrocyclones overflow is subsequently clarified and leached in

reactors with mechanical agitators. The leached pulp is finally transported by gravity to a CCD thickener circuit to wash the pulp

and recover the pregnant solution for gold and silver by zinc precipitation and refining to doré.

| 1 –Summary |

6 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1.6 | Environmental

Studies, Permitting, and Social or Community Impact |

The El Peñón operation submitted its

first Environmental Impact Assessment (EIA) in 1997 to the Chilean Environmental Impact Assessment System (SEIA). The Environmental

Commission of the Region of Antofagasta (Comision Regional de Medio Ambiente de Antofagasta) approved the application with Exempt

Resolution Nr. 043 in 1998.

The El Peñón operation has undergone

a series of modifications since its original EIA submission. Required Environmental Qualification Resolutions (RCAs) were granted

through a series of Declaration of Environmental Impacts (DIAs). A DIA was approved in 2019. Based on the increase in mineral reserves

over the past three years, a new DIA was submitted in February 2021 for a life of mine plan extension; approval is expected in

2021.

El Peñón consists of historical open

pits, underground mining operations, a process plant, and other support infrastructure, including waste dumps and a filtered tailings

facility with a total storage capacity of 49.8 Mt. The approved plant capacity is 4,800 tpd.

Yamana has implemented an integrated management

system covering health, safety, environment, and community through internationally accredited systems that include the ISO 14001

Environment Management System and the OSHAS 18001 Occupational Health and Safety Management System. A risk assessment matrix has

been developed for the El Peñón mine operation that integrates risk matrices for ISO 14001:2015 and OHSAS 18001:2007.

Beginning in 2020, El Peñón also began the

implementation of the Mining Association of Canada’s Towards Sustainable Mining framework, as well as the World Gold Council’s

Responsible Gold Mining Principles, each of which included internal assessments and will require external audits within a 3-year

timeframe.

Water conservation is a primary focus at El

Peñón. The water management system at El Peñón has been designed as a closed circuit. Process water from

the mill is recovered in the tailings filter plant and recirculated back to the processing plant.

Even though no communities are located near El Peñón,

Yamana has made a number of commitments to the well-being, health, and safety of the communities in the area. As such, the social

and community activities conducted by Yamana are concentrated in the Taltal District and are of philanthropic orientation.

El Peñón has developed a closure plan

covering all current and approved facilities; this plan is in accordance with applicable legal requirements. The closure plan addresses

progressive and final closure actions, post-closure inspections, and monitoring.

| 1 –Summary |

7 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 1.7 | Conclusions

and Recommendations |

More than 5.3 Moz of gold and 134 Moz of silver

have been produced from El Peñón since commercial production commenced in 2000. The mine’s current production

rate, the result of the rightsizing of the operation initiated in late 2016, increased free cash flow generation and reduced capital

expenditures while ensuring the long-term sustainability of the mine, matching production rate with replacement of mineral reserves

and mineral resources.

Exploration results at El Peñón continue

to highlight the expansion potential of the mine and Yamana’s ability to replenish mineral reserves and mineral resources

so as to extend the life of mine past its current mineral reserve base. Drilling is effective at adding mineral resources and mineral

reserves at El Peñón. Similar to drilling results from the previous two years, the 2020 drilling successfully replenished

the 2020 depletion of gold mineral reserves. Based on this successful track record, a drilling program totalling 384,000 m is planned

from 2021 to 2023.

El Peñón mineral resources and mineral

reserves have been estimated in conformity with generally accepted CIM Estimation of Mineral Resources and Mineral Reserves Best

Practice Guidelines (November 2019) and were classified in accordance with CIM (2014) Standards.

The total proven and probable mineral reserve at

El Peñón as of December 31, 2020, is 6.1 Mt averaging 4.66 g/t gold and 147.8 g/t silver, for approximately 0.921

Moz of contained gold and 29.21 Moz of silver. In addition, measured and indicated mineral resources are estimated at 8.0 Mt grading

2.96 g/t gold (0.765 Moz gold) and 98.8 g/t silver (25.5 Moz silver), and inferred mineral resources are estimated at 18.98 Mt

grading 1.39 g/t gold (0.850 Moz gold) and 46.1 g/t silver (28.1 Moz silver).

The mineral reserves supporting the life of mine

(LOM) plan consists of an integrated operation, mining mainly underground ore and small amounts of ore from the Chiquilla Chica

open pit. The ore produced by the mining operations and reclaimed from stockpiles is fed to the mill to sustain a six-year mine

life. LOM production is estimated at 866 koz gold and 25,591 koz silver.

Yamana is confident that, based on required infill

drilling, the future conversion of mineral resources to mineral reserves will continue to show positive results. In recent years,

mineral resources converted to mineral reserves have more than offset the depletion of mineral reserves; this indicates the significant

potential of extending the mine life beyond the current LOM and sustaining a strategic mine life of 10 years or more.

The capital and operating cost estimates are based

on mine budget data and operating experience, and are appropriate for the known mining methods and production schedule. Under the

assumptions in this technical report, El Peñón has positive project economics until the end of mine life, which supports

the mineral reserve estimate. Capital costs over the LOM period are estimated at US$167M, consisting mainly of sustaining underground

mine development (83%) and capital required for equipment replacement (14%). An additional budget of US$37M is estimated for mine

closure purposes.

| 1 –Summary |

8 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

No environmental or social issues were identified

that could materially impact the ability to extract the mineral resources and mineral reserves. El Peñón has all

the operational licences required for operation according to the national legislation. The approved licences address the authority’s

requirements for mining extraction and operation activities. The results of this technical report are subject to variations in

operational conditions including, but not limited to the following:

| • | Assumptions related to commodity and foreign exchange (in particular, the relative movement

of gold and the Chilean peso/US dollar exchange rate) |

| • | Unanticipated inflation of capital or operating costs |

| • | Significant changes in equipment productivities |

| • | Geological continuity of the mineralized structures |

| • | Geotechnical assumptions in pit and underground designs |

| • | Throughput and recovery rate assumptions |

| • | Changes in political and regulatory requirements that may affect the operation or future closure

plans |

| • | Changes in closure plan costs |

| • | Availability of financing and changes in modelled taxes |

In the opinion of the qualified persons, there are

no reasonably foreseen inputs from risks and uncertainties identified in the technical report that could affect the project’s

continued economic viability.

Over the past 20 years, El Peñón has

established an exploration strategy to continually replace depletion of mineral reserves and extend mine life. The strategy involves

maintaining a pipeline of mineral resources and exploration potential to maintain a rolling mine life visibility of at least 10

years. To continue this trend, drilling programs should continue to be carried out with the following objectives:

| • | Infill drilling to replace production by upgrading and extending known mineral resources. |

| • | Expansion exploration drilling to upgrade inferred mineral resources to measured or indicated categories, or to transform zones

of geological potential into inferred mineral resources. |

| • | District exploration to test the extension of little-known areas of mineralization or to discover new primary structures by

testing targets identified in mapping, geochemistry, geophysics, or machine learning programs. |

| 1 –Summary |

9 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

Ongoing exploration success could also unlock the

opportunity to leverage the available processing capacity which could increase annual gold and silver production and reduce unit

costs.

Yamana instituted an Operational Excellence program

to improve productivity and control costs. An assessment of the processing plant performed in the first quarter of 2021 has identified

several opportunities to improve gold and silver recoveries and/or reduce operating costs. Opportunities include leach solution

management, additional filblast in the leaching circuit, optimized automated reagent dosing, thickener Advanced Process Control,

and Viper filtration technology. These opportunities could be quickly implemented with minimal capital investment. The El Peñón

team should continue to evaluate and prioritize these opportunities and develop an action plan for their implementation.

In the underground mine, El Peñón

should continue the implementation of Operational Excellence initiatives with an objective to increase productivity minimize dilution,

and control operating costs. Mining initiatives include testing of smaller drift profiles for specific sectors, optimized stoping

and development face drill patterns, and opportunities to reduce specific consumption of consumables.

In 2021, El Peñón should initiate

the process of certification for ISO 45001 (replacing OSHAS 18001) and recertification of the ISO 14001 Environment Management

System; it should also continue the implementation of the Mining Association of Canada’s Towards Sustainable Mining

framework as well as the World Gold Council’s Responsible Gold Mining Principles.

| 1 –Summary |

10 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

The El Peñón mine (El Peñón)

is an underground and open-pit gold-silver mine located in the Atacama Region of Chile, approximately 165 km southeast of the city

of Antofagasta. Yamana Gold Inc. (Yamana) holds a 100% interest in El Peñón through its subsidiary, Minera Meridian

Limitada (Minera Meridian).

Yamana is a Canadian-based precious metals producer

with significant gold and silver production- and development-stage properties, exploration properties, and land positions throughout

the Americas, including Canada, Brazil, Chile, and Argentina. Yamana plans to continue to build on this base through the expansion

and optimization initiatives at existing operating mines, the development of new mines, advancement of its exploration properties

and, at times, by targeting other consolidation opportunities, with a primary focus on the Americas.

Yamana acquired El Peñón when it completed

the purchase of Meridian Gold Inc. (Meridian Gold) in 2007.

Yamana’s other operations include:

| • | 100% ownership of the Jacobina underground gold mine located in the state of Bahia in eastern

Brazil |

| • | 50% ownership in the Canadian Malartic open-pit gold mine located in Malartic, Québec,

Canada |

| • | 100% ownership of the Minera Florida underground gold-silver mine located southwest of Santiago,

Chile |

| • | 100% ownership in the Cerro Moro underground and open-pit gold-silver mine located in Santa

Cruz province, Argentina |

This technical report, prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) and Form 43-101F1, documents

the mineral resource estimate for El Peñón as of December 31, 2020, the mineral reserve estimate for El Peñón

as of December 31, 2020, and also summarizes the current mining operation at El Peñón as of December 31, 2020.

The mineral resource and mineral reserve estimates

reported herein were prepared in conformity with generally accepted standards set out in the Canadian Institute of Mining, Metallurgy

and Petroleum (CIM) Mineral Resource and Mineral Reserves Estimation Best Practices Guidelines (November 2019) and were

classified according to CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM (2014) Standards).

| 2–Introduction |

11 |

| |

|

| Signature Date: March 25, 2021 |

|

Technical

Report El Peñón Mine, Chile

| 2.1 | Sources

of Information |

The qualified persons for this technical report

are Sergio Castro, Registered Member of the Chilean Mining Commission; Marco Velásquez Corrales, Registered Member of the

Chilean Mining Commission; Henry Marsden, P.Geo.; and Carlos Iturralde, P.Eng.; all are full-time employees of Yamana.

Mr. Castro is the Technical Services Manager of

El Peñón for Yamana. Mr. Velásquez is Chief Resource Geologist at El Peñón for Yamana. Mr. Castro

and Mr. Velásquez are both local employees and work full time at the mine. Mr. Marsden, Senior Vice President, Exploration

for Yamana visited the project on many occasions since January 2016 and most recently between March 11 and 13, 2020. Mr. Iturralde,

Director, Tailings, Health, Safety & Sustainable Development at Yamana, has not visited the project due to travel restrictions

related to the global COVID-19 pandemic.

Sergio Castro is responsible for Sections 13, 15

to 19 (excluding sub-section 18.1), 21 to 22, and 24; he also shares responsibility for related disclosure in Sections 1, 25, 26,

and 27 of the technical report. Marco Velásquez Corrales is responsible for Section 11, 12, and 14, and shares responsibility

for related disclosure in Sections 1, 25, 26, and 27 of the technical report. Henry Marsden is responsible for Sections 2 to 10,

23, and shares responsibility for related disclosure in Sections 1, 25, 26, and 27 of the technical report. Carlos Iturralde is

responsible for Sections 18.1 and 20, and shares responsibility for related disclosure in Sections 1, 25, 26, and 27 of the technical

report.

In preparation of this technical report, the qualified

persons reviewed technical documents and reports on El Peñón supplied by on-site personnel. The documentation reviewed

and other sources of information are listed at the end of this technical report in Section 27 - References.

The prior technical report on El Peñón

was compiled by RPA Inc. (RPA) with an effective date and signature date of March 2, 2018 (RPA, 2018). The RPA report served as