0001546296

false

0001546296

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

| PROFESSIONAL

DIVERSITY NETWORK, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-35824 |

|

80-0900177 |

| (State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

55

E. Monroe Street, Suite 2120, Chicago, Illinois 60603

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (312) 614-0950

| N/A |

| (Former name or former address,

if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $.01 par value |

|

IPDN |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition

On

August 14, 2023, the Company issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by

reference.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Professional

Diversity Network, Inc. |

| |

|

| Date: August 14, 2023 |

/s/

Adam He |

| |

Adam He, Chief Executive Officer |

Exhibit

99.1

Professional

Diversity Network, Inc. Announces Financial Results for the Quarter Ended June 30, 2023

Chicago,

IL, August 14, 2023 (GLOBE NEWSWIRE) — Professional Diversity Network, Inc. (NASDAQ:IPDN), (“IPDN” or the “Company”),

a global developer and operator of online and in-person networks that provides access to networking, training, educational and employment

opportunities for diverse individuals, today announced its financial results for the quarter ended June 30, 2023.

“Our

industry has seen the continued slowing through the second quarter of 2023. We have seen some hiring come back as seasonal industries

begin to ramp up and we are poised to take advantage of this. We have created an internal marketing department which is focused on strategic

targeting of industries and we have seen some of our new efforts paying off already.” said Adam He, CEO of Professional Diversity

Network. “Through the completion of our equity line of credit transaction with Tumim Stone Capital LLC, we are in a solid cash

position for the remainder of this year and the foreseeable future, where we are looking to take advantage of our position as one of

the leaders in diversity recruiting.”

Second

Quarter Financial Highlights:

| |

● |

Total consolidated revenues

for the three months ended June 30, 2023 decreased $0.4 million, or 16 percent, as compared to the same period in the prior year.

PDN Network segment revenues decreased $0.3 million or 21 percent compared to revenues during the same period in the prior year.

Revenues for the three months ended June 30, 2023 from the NAPW segment decreased approximately $25,000 as compared to the same period

in the prior year. Revenues for the three months ended June 30, 2023 from the RemoteMore segment decreased $44,000 in revenues as

compared to the same period in the prior year. |

| |

|

|

| |

● |

Basic and diluted net loss

per share decreased to $0.14 during the three months ended June 30, 2023 as compared to $0.01 during the three months ended June

30, 2022. |

| |

|

|

| |

● |

On

June 30, 2023, cash balances were approximately $2.2 million as compared to $1.2 million

on December 31, 2022. Working capital deficit from continuing operations on June 30, 2023,

was approximately $0.2 million as compared to $0.2 million on December 31, 2022.

|

| |

● |

In June 2023, the Company entered into a committed

equity facility with Tumim Stone Capital LLC (the “Investor”) under which the Company has

the right, but not the obligation, to sell up to $12,775,000 of its newly issued shares to the Investor. Upon execution of the stock

purchase agreement, the Company issued and sold an initial 469,925 shares to the Investor for aggregate gross proceeds to the Company

of $2,000,000. As consideration for the Investor’s commitment to purchase shares of common stock at the Company’s direction

from time to time, the Company also issued 176,222 shares of common stock to the Investor, valued at $750,000 based on the five-day average

closing price at the time the purchase agreement was signed.

|

Financial

Results for the Three Months Ended June 30, 2023

Revenues

Total revenues for the three months ended June

30, 2023 decreased approximately $354,000, or 16.1 percent, to approximately $1,841,000 from approximately $2,195,000

during the same period in the prior year. The decrease was predominately attributable to a reduction in recruitment services revenues

of approximately $265,000. Partially offsetting the decrease were approximately $65,000 of event revenue from the recently acquired Expo

Experts for which there was no comparable revenue in the same period of the prior year.

During the three months ended June 30, 2023, our

PDN Network generated approximately $1,101,000 in revenues compared to approximately $1,386,000 in revenues during the three months ended

June 30, 2022, a decrease of approximately $285,000 or 20.5 percent. The decrease in revenues was primarily driven by the continued softening

in client hiring due to the macroeconomic environment change stemming from the latter half of 2022 and continuing in the second quarter

of 2023. Offsetting the decrease was an increase in event revenues of $65,000 related to Expo Experts operations for which there was

no comparable activity in the same period of the prior year.

During the three months ended June 30, 2023, NAPW

Network revenues were approximately $136,000, compared to revenues of approximately $161,000 during the same period in the prior year,

a decrease of approximately $25,000 or 15.5 percent.

During the three months ended June 30, 2023, RemoteMore

revenue was approximately $604,000, compared to revenues of approximately $648,000 during the same period in the prior year, a decrease

of approximately $44,000, or 6.8 percent.

Costs

and Expenses

Cost of revenues during the three months ended

June 30, 2023 was approximately $766,000, a decrease of approximately $166,000, or 17.8 percent, from approximately $932,000 during the

same period of the prior year.

Sales and marketing expense during the three months

ended June 30, 2023 was approximately $1,116,000, an increase of approximately $416,000, or 59.4 percent, from $700,000 during the same

period in the prior year. The increase was predominately attributed to increased marketing spend, the aforementioned creation of our

new marketing department and onboarding of Expo Experts, for which there were no comparable charges in the same period of the prior year.

General and administrative

expenses increased by approximately $885,000, or 246.5 percent, to approximately $1,244,000 during the three months ended June 30, 2023,

as compared to approximately $357,000 the same period in the prior year. The increase was predominately due to the settlement of litigation

resulting in a one-time, non-cash gain of approximately $909,000 in the prior year for which there was no comparable transaction in the

current year. Also contributing to the increase, as compared to the same period in the prior year, were approximately $139,000 of financing

expenses and approximately $92,000 of legal expenses primarily related to the aforementioned equity transaction. Offsetting the increase

were decreases in discretionary share-based compensation of approximately $251,000 and other purchased services of approximately $137,000,

as compared to the same period in the prior year.

Net

Loss from Continuing Operations

As

the result of the factors discussed above, during the three months ended June 30, 2023, we incurred a net loss from continuing operations

of approximately $1,432,000, an increase in the net loss of approximately $1,380,000, compared to a net loss of approximately $52,000

during the three months ended June 30, 2022.

Financial

Results for the Six Months Ended June 30, 2023

Revenues

Total revenues for the six months ended June 30,

2023 decreased approximately $452,000, or 10.6 percent, to approximately $3,796,000 from approximately $4,248,000

during the same period in the prior year. The decrease was predominately attributable to a reduction in recruitment services revenues

of approximately $495,000 and an approximate $92,000 decrease in membership fees and related services revenues, as compared to the same

period in the prior year. Partially offsetting the decrease were increases of approximately $177,000 of contracted software development

related to RemoteMore, as compared to the same period in the prior year, and approximately $147,000 of event revenue from the recently

acquired Expo Experts for which there was no comparable revenue in the same period of the prior year.

During the six months ended June 30, 2023, our

PDN Network generated approximately $2,229,000 in revenues compared to approximately $2,766,000 in revenues during the six months ended

June 30, 2022, a decrease of approximately $537,000 or 19.4 percent. The decrease in revenues was primarily driven by the continuing

softening in client hiring due to the macroeconomic environment change stemming from the latter half of 2022, and continued in the second

quarter of 2023. Offsetting the decrease was an increase in event revenues of $147,000 related to Expo Experts operations for which there

was no comparable activity in the same period of the prior year

During the six months ended June 30, 2023, NAPW

Network revenues were approximately $265,000, compared to revenues of approximately $357,000 during the same period in the prior year,

a decrease of approximately $92,000 or 25.8 percent.

During the six months ended June 30, 2023, RemoteMore

revenue was approximately $1,302,000, compared to revenues of approximately $1,125,000 during the same period in the prior year, an increase

of approximately $177,000, or 15.7 percent.

Costs

and Expenses

Cost of revenues during the six months ended June

30, 2023 was approximately $1,840,000, an increase of approximately $46,000, or 2.6 percent, from approximately $1,794,000 during the

same period of the prior year.

Sales and marketing expense during the six months

ended June 30, 2023 was approximately $1,937,000, an increase of approximately $518,000, or 36.6 percent, from $1,419,000 during the

same period in the prior year. The increase was predominately attributed to increased marketing spend, the aforementioned creation of

our new marketing department and onboarding of Expo Experts, for which there were no comparable charges in the same period of the prior

year.

General and administrative expenses increased

by approximately $831,000, or 56.7 percent, to approximately $2,297,000 during the six months ended June 30, 2023, as compared to approximately

$1,466,000 the same period in the prior year. The increase was predominately due to the settlement of litigation resulting in a one-time,

non-cash gain of approximately $909,000 in the prior year for which there was no comparable transaction in the current year. Also contributing

to the increase, as compared to the same period in the prior year, were approximately $139,000 of financing expenses and approximately

$92,000 of legal expenses primarily related to the aforementioned equity transaction. Offsetting the increase were decreases in discretionary

share-based compensation of approximately $342,000 as compared to the same period in the prior year.

Net

Loss from Continuing Operations

During

the six months ended June 30, 2023, we incurred a net loss of approximately $2,541,000 from continuing operations, an increase in the

net loss of approximately $1,598,000, compared to a net loss of approximately $943,000 during the

same period in the prior year.

Summary

of the Quarter’s Financial Information

Amounts

in following tables are in thousands except for per share amounts and outstanding shares.

Summary

of Financial Position

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,207 | | |

$ | 1,237 | |

| Other current assets | |

| 1,708 | | |

| 2,020 | |

| Total current assets | |

$ | 3,915 | | |

$ | 3,257 | |

| Long-term assets | |

| 4,534 | | |

| 3,579 | |

| Total Assets | |

$ | 8,449 | | |

$ | 6,836 | |

| | |

| | | |

| | |

| Total current liabilities | |

$ | 4,634 | | |

$ | 3,943 | |

| Total long-term liabilities | |

| 454 | | |

| 584 | |

| Total liabilities | |

$ | 5,088 | | |

$ | 4,527 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 3,676 | | |

| 2,546 | |

| Total stockholders’ equity – noncontrolling interests | |

| (315 | ) | |

| (237 | ) |

| Total liabilities and stockholders’ equity | |

$ | 8,449 | | |

$ | 6,836 | |

Summary

of Financial Operations

| | |

Six Months Ended June 30, | | |

Change | | |

Change | |

| | |

2023 | | |

2022 | | |

(Dollars) | | |

(Percent) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Membership fees and related services | |

$ | 265 | | |

$ | 357 | | |

$ | (92 | ) | |

| (25.8 | )% |

| Recruitment services | |

| 2,179 | | |

| 2,674 | | |

| (495 | ) | |

| (18.5 | )% |

| Contracted software development | |

| 1,302 | | |

| 1,125 | | |

| 177 | | |

| 15.7 | % |

| Consumer advertising and marketing solutions | |

| 50 | | |

| 92 | | |

| (42 | ) | |

| (45.7 | )% |

| Total revenues | |

$ | 3,796 | | |

$ | 4,248 | | |

$ | (452 | ) | |

| (10.6 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Cost and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

$ | 1,840 | | |

$ | 1,794 | | |

$ | 46 | | |

| 2.6 | % |

| Sales and marketing | |

| 1,937 | | |

| 1,419 | | |

| 518 | | |

| 36.6 | % |

| General and administrative | |

| 2,297 | | |

| 1,466 | | |

| 831 | | |

| 56.7 | % |

| Depreciation and amortization | |

| 280 | | |

| 513 | | |

| (233 | ) | |

| (45.4 | )% |

| Total pre-tax cost and expenses: | |

$ | 6,354 | | |

$ | 5,192 | | |

$ | 1,162 | | |

| 22.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Consolidated net loss from continuing operations, net of tax | |

$ | (2,541 | ) | |

$ | (943 | ) | |

$ | (1,598 | ) | |

| (169.5 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share: | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | (0.25 | ) | |

$ | (0.12 | ) | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average outstanding shares used in computing net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 10,149,410 | | |

| 8,103,557 | | |

| | | |

| | |

| | |

Three Months Ended June 30, | | |

Change | | |

Change | |

| | |

2023 | | |

2022 | | |

(Dollars) | | |

(Percent) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Membership fees and related services | |

$ | 136 | | |

$ | 161 | | |

$ | (25 | ) | |

| (15.5 | )% |

| Recruitment services | |

| 1,076 | | |

| 1,341 | | |

| (265 | ) | |

| (19.8 | )% |

| Products sales and other | |

| 604 | | |

| 648 | | |

| (44 | ) | |

| (6.8 | )% |

| Consumer advertising and marketing solutions | |

| 25 | | |

| 45 | | |

| (20 | ) | |

| (44.4 | )% |

| Total revenues | |

$ | 1,841 | | |

$ | 2,195 | | |

$ | (354 | ) | |

| (16.1 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Cost and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

$ | 765 | | |

$ | 932 | | |

$ | (167 | ) | |

| (17.8 | )% |

| Sales and marketing | |

| 1,116 | | |

| 700 | | |

| 416 | | |

| 59.4 | % |

| General and administrative | |

| 1,244 | | |

| 359 | | |

| 885 | | |

| 246.5 | % |

| Depreciation and amortization | |

| 147 | | |

| 232 | | |

| (85 | ) | |

| (36.6 | )% |

| Total pre-tax cost and expenses: | |

$ | 3,272 | | |

$ | 2,223 | | |

$ | 1,049 | | |

| 47.2 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Consolidated net loss from continuing operations, net of tax | |

$ | (1,432 | ) | |

$ | (52 | ) | |

$ | (1,380 | ) | |

| (2554.8 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share: | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | (0.14 | ) | |

$ | (0.01 | ) | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average outstanding shares used in computing net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 10,387,359 | | |

| 8,202,793 | | |

| | | |

| | |

Summary

of Cash Flows from Continuing Operations

| | |

Six Months Ended June 30, | |

| Cash (used in) provided by continuing operations | |

2023 | | |

2022 | |

| Operating activities | |

$ | (878 | ) | |

$ | (570 | ) |

| Investing activities | |

| (822 | ) | |

| (7 | ) |

| Financing activities | |

| 2,700 | | |

| (387 | ) |

| Net increase in cash and cash equivalents from continuing operations | |

$ | 1,000 | | |

$ | (964 | ) |

Professional

Diversity Network, Inc. and Subsidiaries

Non-GAAP

(Adjusted) Financial Measures

We

believe Adjusted EBITDA provides a meaningful representation of our operating performance that provides useful information to investors

regarding our financial condition and results of operations. Adjusted EBITDA is commonly used by financial analysts and others to measure

operating performance. Furthermore, management believes that this non-GAAP financial measure may provide investors with additional meaningful

comparisons between current results and results of prior periods as they are expected to be reflective of our core ongoing business.

However, while we consider Adjusted EBITDA to be an important measure of operating performance, Adjusted EBITDA and other non-GAAP financial

measures have limitations, and investors should not consider them in isolation or as a substitute for analysis of our results as reported

under GAAP. Further, Adjusted EBITDA, as we define it, may not be comparable to EBITDA, or similarly titled measures, as defined by other

companies.

The

following non-GAAP financial information in the tables that follow are reconciled to comparable information presented using GAAP, derived

by adjusting amounts determined in accordance with GAAP for certain items presented in the accompanying selected operating statement

data.

The adjustments for the

three and six months ended June 30, 2023 relate to stock-based compensation, loss attributable to noncontrolling interest, depreciation

and amortization, interest and other income and income tax expense (benefit).

The

adjustments for the three and six months ended June 30, 2022 relate to stock-based compensation, litigation settlement reserves, loss

attributable to noncontrolling interest, depreciation and amortization, interest and other income and income tax expense (benefit).

| | |

Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

(in thousands) | |

| Loss from Continuing Operations | |

$ | (1,432 | ) | |

$ | (53 | ) |

| Stock-based compensation | |

| 30 | | |

| 281 | |

| Litigation settlement reserve | |

| - | | |

| (925 | ) |

| Loss attributable to noncontrolling interest | |

| 25 | | |

| 155 | |

| Depreciation and amortization | |

| 147 | | |

| 232 | |

| Interest and other income | |

| - | | |

| (1 | ) |

| Income tax expense (benefit) | |

| 1 | | |

| 16 | |

| Adjusted EBITDA | |

$ | (1,229 | ) | |

$ | (295 | ) |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

(in thousands) | |

| Loss from Continuing Operations | |

$ | (2,541 | ) | |

$ | (943 | ) |

| Stock-based compensation | |

| 63 | | |

| 405 | |

| Litigation settlement reserve | |

| - | | |

| (909 | ) |

| Loss attributable to noncontrolling interest | |

| 77 | | |

| 359 | |

| Depreciation and amortization | |

| 280 | | |

| 513 | |

| Interest and other income | |

| (7 | ) | |

| (4 | ) |

| Income tax benefit | |

| (10 | ) | |

| (10 | ) |

| Adjusted EBITDA | |

$ | (2,138 | ) | |

$ | (589 | ) |

About

Professional Diversity Network

Professional

Diversity Network, Inc. (NASDAQ: IPDN) is a global developer and operator of online and in-person networks that provides access to networking,

training, educational and employment opportunities for diverse professionals. We operate subsidiaries in the United States including

National Association of professional Women (NAPW) and its brand, International Association of Women (IAW), which is one of the largest,

most recognized networking organizations of professional women in the country, spanning more than 200 industries and professions. Through

an online platform and our relationship recruitment affinity groups, we provide our employer clients a means to identify and acquire

diverse talent and assist them with their efforts to comply with the Equal Employment Opportunity Office of Federal Contract Compliance

Program. Our mission is to utilize the collective strength of our affiliate companies, members, partners and unique proprietary platform

to be the standard in business diversity recruiting, networking and professional development for women, minorities, veterans, LGBTQ and

disabled persons globally.

Forward-Looking

Statements

This

press release contains certain forward-looking statements based on our current expectations, forecasts and assumptions that involve risks

and uncertainties. This release does not constitute an offer to sell or a solicitation of offers to buy any securities of any entity.

Forward-looking statements in this release are based on information available to us as of the date hereof. Our actual results may differ

materially from those stated or implied in such forward-looking statements, due to risks and uncertainties associated with our business,

which include the risk factors disclosed in our most recently filed Annual Report on Form 10-K and in our subsequent filings with the

Securities and Exchange Commission. Forward-looking statements include statements regarding our expectations, beliefs, intentions or

strategies regarding the future and can be identified by forward-looking words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,”

and “would” or similar words. We assume no obligation to update the information included in this press release, whether as

a result of new information, future events or otherwise. Our most recently filed Annual Report on Form 10-K, together with this press

release and the financial information contained herein, are available on our website, www.prodivnet.com. Please click on “Investor

Relations.”

Investor

Inquiries:

investors@ipdnusa.com

+1

(312) 614-0950

Source:

Professional Diversity Network, Inc.

Released

August 14, 2023

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-35824

|

| Entity Registrant Name |

PROFESSIONAL

DIVERSITY NETWORK, INC.

|

| Entity Central Index Key |

0001546296

|

| Entity Tax Identification Number |

80-0900177

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

55

E. Monroe Street

|

| Entity Address, Address Line Two |

Suite 2120

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60603

|

| City Area Code |

(312)

|

| Local Phone Number |

614-0950

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $.01 par value

|

| Trading Symbol |

IPDN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

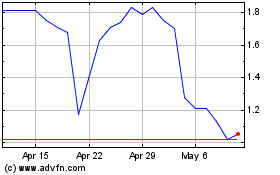

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Apr 2023 to Apr 2024