0001743745FALSE00017437452023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023

GREENLANE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38875 | | 83-0806637 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 1095 Broken Sound Parkway | Suite 100 | | |

| Boca Raton | FL | | 33487 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (877) 292-7660

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | | GNLN | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☑

Item 2.02. Results of Operations and Financial Condition.

On August 14, 2023, Greenlane Holdings, Inc. (the “Company”) issued a press release announcing its financial position as of June 30, 2023, results of operations for the three and six months ended June 30, 2023 and other related information. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company intends to make certain supplemental information available on its website www.gnln.com under the section “Investors — Company Information — Presentations” prior to the Company’s conference call with investors on Monday, August 14, 2023 at 4:30 p.m. (Eastern Time).

In accordance with General Instruction B.2 of Form 8-K, the information included in this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | |

| | | |

| 104 | | Cover Page Interactive Data File | |

* Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GREENLANE HOLDINGS, INC. |

| | | |

| Dated: August 14, 2023 | By: | /s/ Lana Reeve |

| | | Lana Reeve |

| | | Chief Financial and Legal Officer |

Exhibit 99.1

GREENLANE REPORTS Q2 2023 FISCAL RESULTS

BOCA RATON, FL / August 14, 2023 / Greenlane Holdings, Inc. ("Greenlane" or the "Company") (NASDAQ:GNLN), a premier global seller of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, today reported financial results for the second quarter ended June 30th, 2023.

Recent Highlights

•Revenue for Q2 2023 decreased to $19.6 million, compared to $24.0 million in Q1 2023.

•Operating expenses in Q2 2023 were reduced $0.9 million or 6.2% compared with Q1 2023.

•Net loss attributed to Greenlane Holdings, Inc. for Q2 2023 was $10.5 million, compared to $10.2 million in Q1 2023. Basic and diluted net loss of $6.56 per share compared to a loss of $6.40 per share for the prior quarter.

•Adjusted EBITDA loss for Q2 2023 was $5.8 million compared to a loss of $6.8 million for Q1 2023.

•The Company has launched 21 new products this year: The ORAFLEX line with the Rig, full line of Groove products, including the new line of Groove glass, the Groove Micro Rigs and a Limited-Edition Spoon Pipe. From DaVinci we brought a new color way to market in the MIQRO-C line along with the new ARTIQ, the newest DaVinci premium portable vaporizer which is quickly garnering critical acclaim.

Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | % | | % |

| ($ in thousands) | Q2'23 | | Q1'23 | | Q4'22 | | Change Q2 vs. Q1 | | Change Q1 vs. Q4 |

| Net Sales | $ | 19,625 | | | $ | 23,959 | | | $ | 21,986 | | | (18.1)% | | 9.0% |

| Greenlane Brands Sales | 5,135 | | | 3,207 | | | 3,180 | | | 60.1% | | 0.8% |

| % of Net Sales | 26.2 | % | | 13.4 | % | | 14.5 | % | | | | |

| Cost of Sales | 15,051 | | | 18,440 | | | 16,108 | | | (18.4)% | | 14.5% |

| Gross Profit | 4,574 | | | 5,519 | | | 5,878 | | | (17.1)% | | (6.1)% |

| Gross Margin | 23.3 | % | | 23.0 | % | | 26.7 | % | | 1.3% | | (13.9)% |

| Salaries, Benefits & Payroll Taxes | 5,157 | | | 5,370 | | | 5,413 | | | (4.0)% | | (0.8)% |

| General and Administrative | 6,968 | | | 7,677 | | | 9,954 | | | (9.2)% | | (22.9)% |

| Depreciation and Amortization | 1,978 | | | 1,992 | | | 2,190 | | | (0.7)% | | (9.0)% |

| Goodwill and Intangible Asset Impairment | — | | | — | | | 4,600 | | | —% | | (100.0)% |

| Interest Expense | (918) | | | 815 | | | 851 | | | (212.6)% | | (4.2)% |

| Other Income (Expense), Net | (85) | | | 88 | | | 3,656 | | | (196.6)% | | (97.6)% |

| Provision for (benefit from) income taxes | (7) | | | 1 | | | — | | | (800.0)% | | |

| Net Loss | (10,525) | | | (10,248) | | | (13,475) | | | 2.7% | | (23.9)% |

| Less: Net income (loss) attributable to non-controlling interest | 8 | | | (54) | | | (218) | | | (114.8)% | | (75.2)% |

| Net loss attributable to Greenlane Holdings, Inc. | $ | (10,533) | | | $ | (10,194) | | | $ | (13,257) | | | 3.3% | | (23.1)% |

| Adjusted EBITDA | $ | (5,769) | | | $ | (6,818) | | | $ | (7,564) | | | (15.4)% | | (9.9)% |

| Cash (includes restricted cash) | $ | 4,651 | | | $ | 5,872 | | | $ | 12,176 | | | (20.8)% | | (51.8)% |

Net sales for the three months ended June 30, 2023 were $19.6 million, a decrease of $4.3 million or 18% over the prior quarter.

Gross margin was 23.3% during the quarter versus 23.0% during the first quarter of 2023.

Operating expenses in Q2 2023 were down $0.9 million or 6.2% compared to Q1 2023.

Net loss attributable to Greenlane Holdings, Inc. was $10.5 million during the quarter, or $6.56 per share, compared with a loss of $10.2 million, or $6.40 per share, in the first quarter of 2023.

Adjusted EBITDA loss was $5.8 million compared to a loss of $6.8 million, in the first quarter of 2023.

Path to Profitability

At Greenlane, we are hyper focused on getting our business profitable and well-capitalized for long-term sustainability. We have been working hard to right-size our business, focus on core areas, and reduce our overall cost structure while improving our margins in an effort to be profitable in Q4 2023.

In addition, we are emphasizing our higher-margin proprietary Greenlane brands, including Eyce, DaVinci, Groove, Marley Natural, Keith Haring, and Higher Standards. We believe this forms a central part of our growth strategy and will enhance our overall gross margin profile and accelerate our path to profitability.

On a year over year basis for the six months ended June 30th we have experienced a significant improvement in loss from operation of 39.8%. We reduced our total operating expenses from $15.0 million in Q1 2023 to 14.1 million in Q2 2023, a reduction of over $0.9 million or 6.2%. We reduced our labor-related expenses by 4.0%, and have reduced general and administrative expenses by 9.2% for the

same comparable periods. Loss from operations remained relatively flat at a loss of 9.5 million in Q2 versus a loss of 9.5 million in Q1.

Management Commentary

“We are continuing our transformative strategy by focusing on our path to profitability, enhancing and growing our leading position as a product innovator and disruptor in our segment, and eliminating our preexisting debt of $15 million,” commented Craig Snyder, Greenlane CEO.

“In the second quarter we continued to make substantial progress in reducing our operating expenses, We completed consolidation of eight of our facilities including our former third-party logistics partner, Verst into our Moreno Valley warehouse location, which is anticipated to save the company more than $4 million annually, and we believe, through our own management, give customers a better experience with Greenlane. We have similar initiatives being executed in Technology and Professional Services and expect to continue to realize those savings over the next 2 quarters.

Labor is another area where the business has become more efficient, and we expect continued reductions in both headcount and overall cost of labor. In Q2 we had charges related to severance of two former senior executives which clouded the gains we have made in overall cost of labor. These two agreements represented more than 12% of the overall labor number in Q2 and are one time in nature. We expect overall cost of labor to continue to decline and are focused on a labor structure that brings the business to profitability.

This quarter we launched five new products from our house brands. An addition to the Eyce ORAFLEX line with the Rig, a new line of Groove glass, the Groove Micro Rigs and a Limited-Edition Spoon Pipe. From DaVinci we brought a new color way to market in the MIQRO-C line along with the ARTIQ, the newest premium portable vaporizer. Offering DaVinci’s clean technology in the convenience of a 510 oil-compatible vaporizer, the ARTIQ has garnered a lot of popularity and critical acclaim in a short period of time.

In a return to our roots, we also announced our expansion of products to include disposable nicotine offerings. This is part of our strategic vision as a leader in the market to diversify our product portfolio. With a total addressable U.S. market exceeding $6 billion annually and expected to grow at a compound annual rate exceeding 11%, disposable nicotine products have a significant impact on our customer revenues. We identified industry leading partners, manufacturers, and brands to capitalize on our expansion into the nicotine industry including Fume, Death Row Vapes, Packspod, and Tyson 2.0.

Finally, in order to make the business scalable and durable, we recently announced payoff of our previously existing facility with Whitehawk Capital. The business was able to pay off this $15mm facility prior to the first anniversary date and we believe by doing so allows us a much more authority over our future.

Conference Call Information

Greenlane management will host a scheduled conference call and webcast later today, Monday, August 14 at 4:30 p.m. Eastern time to discuss the results for its second quarter ended June 30, 2023, followed by a question-and-answer session. The call will be webcast with an accompanying slide deck, which will be accessible by visiting the Financial Results page of Greenlane’s investor relations website.

All interested parties are invited to listen to the live conference call and presentation by dialing the number below or by clicking the webcast link available on the Financial Results page of the Company’s investor relations website.

| | | | | |

| DATE: | Monday, August 14, 2023 |

| TIME: | 4:30 p.m. Eastern Time |

| WEBCAST: | https://www.webcaster4.com/Webcast/Page/2603/48874 |

| DIAL-IN NUMBER: | 877-545-0320 (Toll-Free) 973-528-0002 (International) |

| CONFERENCE ID: | 139234 |

| REPLAY: | 877-481-4010 or 919-882-2331 Replay Passcode: 48874 Available until August 28, 2023 |

If you have any difficulty connecting with the conference call or webcast, please contact Greenlane’s investor relations at ir@greenlane.com.

To be added to the Company's distribution list, please email ir@greenlane.com with "Greenlane" in the subject line.

About Greenlane Holdings, Inc.

Founded in 2005, Greenlane is a premier global platform for the development and distribution of premium smoking accessories, vape devices, and lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers. We operate as a powerful family of brands, third-party brand accelerator, and an omnichannel distribution platform.

We proudly offer our own diverse brand portfolio including DaVinci Vaporizers, Higher Standards, Groove, and Eyce, and our exclusively licensed Marley Natural and K. Haring branded products. We also offer a carefully curated set of third-party products such as Storz & Bickel (Canopy-owned), PAX, VIBES, and CCELL through our direct sales channels and our proprietary, owned and operated e-commerce platforms which include Vapor.com, Vaposhop.com, DaVinciVaporizer.com, PuffItUp.com, EyceMolds.com, HigherStandards.com, and MarleyNaturalShop.com.

For additional information, please visit: https://gnln.com/.

Investor Contact

ir@greenlane.com

Use of Non-GAAP Financial Measures

Adjusted EBITDA

Greenlane discloses Adjusted EBITDA, which is a non-GAAP performance measure because management believes this measure assists investors and analysts in assessing our overall operating performance and evaluating how well we are executing our business strategies. You should not consider Adjusted EBITDA as alternatives to net loss, as determined in accordance with U.S. GAAP, as indicators of our operating performance. Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are:

•Adjusted EBITDA does not include interest expense, which has been a necessary element of our costs, and income tax payments we may be required to make;

•Adjusted EBITDA does not reflect equity-based compensation;

•Adjusted EBITDA does not reflect other one-time expenses and income, including consulting costs related to the implementation of our ERP system and the reversal of an allowance against indemnification receivables associated with the EU VAT liability;

•Adjusted EBITDA does not reflect goodwill and intangible asset impairment;

•Other companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because Adjusted Net Loss and Adjusted EBITDA do not account for these items, these measures have material limitations as indicators of operating performance. Accordingly, management does not view Adjusted Net Loss or Adjusted EBITDA in isolation or as substitutes for measures calculated in accordance with U.S. GAAP.

Adjusted SG&A

Adjusted SG&A is a supplemental non-GAAP financial measure, which the Company calculates as total selling, general and administrative expenses less depreciation and amortization expense, and goodwill and intangible asset impairment. The Company believes this measure is helpful to investors because it gives investors information about cash operating expenses.

Cautionary Statement Regarding Forward-Looking Statements

Certain matters within this press release are discussed using forward-looking language as specified in the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and other factors that may cause the actual results or performance to differ from those projected in the forward-looking statements. These forward-looking statements include, among others: comments relating to the current and future performance of the Company's business, including the achievement of profitability and the Company's proprietary house brands, distribution and strategic partnerships in emerging and international markets, and relationships with partner brands; the Company's product lineup and anticipated product launches in 2023; the ongoing implementation of initiatives intended to increase sales and the efficiency and scalability of the Company's business; and the Company's financial outlook and expectations. For a description of factors that may cause the Company's actual results or performance to differ from its forward-looking statements, please review the information under the heading "Risk Factors" included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and the Company's other filings with the SEC, which are accessible on the SEC's website at www.sec.gov. Additional information is also set forth in Greenlane's Quarterly Report on Form 10-Q for the three months ended June 30, 2023. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to Greenlane on the date hereof. Greenlane undertakes no duty to update this information unless required by law.

| | | | | | | | | | | | | | |

| Three Months Ended |

| (in millions) | June 30, 2023 | March 31, 2023 | | December 31, 2022 |

| Net loss | $ | (10,525) | | $ | (10,248) | | | $ | (13,475) | |

| Other expense (income), net [1] | 85 | | (88) | | | (3,656) | |

| Provision for (benefit from) income taxes | (7) | | — | | | — | |

| Interest expense | 918 | | 815 | | | 851 | |

| Restructuring expenses [2] | 837 | | 124 | | | 897 | |

| Equity-based compensation expense | 54 | | 206 | | | 277 | |

| Depreciation and amortization | 1,978 | | 1,992 | | | 2,190 | |

| Eyce earn-out related to employee compensation | — | | 220 | | | 225 | |

| Non-recurring litigation and consulting fees | 180 | | — | | | 61 | |

| One-time early termination fee on operating lease in connection with moving to a centralized distribution center model | — | | — | | | — | |

| Obsolete inventory charges related to management's strategic initiative | — | | — | | | — | |

| Patent settlement related to E-bottles | 564 | | | | |

| Loss (gain) on sale of assets | — | | — | | | 466 | |

| Goodwill and intangible assets impairment charge [3] | — | | — | | | 4,600 | |

| Adjustment related to sublease | 147 | | 161 | | | — | |

| Adjusted EBITDA | $ | (5,769) | | $ | (6,818) | | | $ | (7,564) | |

(1)Includes rental and interest income and other miscellaneous income.

(2)Includes severance payments for employees terminated as part of transformation plans and post-merger restructuring expenses

(3)Impairment charges on goodwill and intangible assets

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in millions) | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Salaries, benefits and payroll taxes | $ | 5,157 | | | $ | 5,370 | | | $ | 5,413 | |

| General and administrative [1] | 6,968 | | | 7,677 | | | 9,954 | |

| Adjusted SG&A | $ | 12,125 | | | $ | 13,047 | | | $ | 15,367 | |

| Goodwill and intangible asset impairment charge [2] | — | | | — | | | 4,600 | |

| Depreciation and amortization | 1,978 | | | 1,992 | | | 2,190 | |

| Total operating expenses | $ | 14,103 | | | $ | 15,039 | | | $ | 22,157 | |

(1)General and administrative expenses include a net loss on the sale of assets of $0.5 million in Q4 2022

(2)Impairment charges on goodwill and intangible assets

v3.23.2

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38875

|

| Entity Tax Identification Number |

83-0806637

|

| Entity Registrant Name |

GREENLANE HOLDINGS, INC.

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

877

|

| Local Phone Number |

292-7660

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

GNLN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001743745

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

1095 Broken Sound Parkway

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

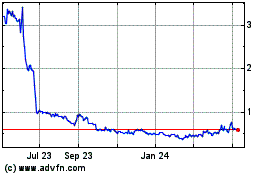

Greenlane (NASDAQ:GNLN)

Historical Stock Chart

From Apr 2024 to May 2024

Greenlane (NASDAQ:GNLN)

Historical Stock Chart

From May 2023 to May 2024