0001808377

false

2023

Q2

--12-31

0001808377

2023-01-01

2023-06-30

0001808377

LUCY:CommonStock0.00001ParValueMember

2023-01-01

2023-06-30

0001808377

LUCY:WarrantsToPurchaseCommonStockMember

2023-01-01

2023-06-30

0001808377

2023-08-08

0001808377

2023-06-30

0001808377

2022-12-31

0001808377

2023-04-01

2023-06-30

0001808377

2022-04-01

2022-06-30

0001808377

2022-01-01

2022-06-30

0001808377

us-gaap:CommonStockMember

2022-12-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001808377

LUCY:StockSubscriptionReceivableMember

2022-12-31

0001808377

us-gaap:RetainedEarningsMember

2022-12-31

0001808377

us-gaap:CommonStockMember

2023-03-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001808377

LUCY:StockSubscriptionReceivableMember

2023-03-31

0001808377

us-gaap:RetainedEarningsMember

2023-03-31

0001808377

2023-03-31

0001808377

us-gaap:CommonStockMember

2021-12-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001808377

LUCY:StockSubscriptionReceivableMember

2021-12-31

0001808377

us-gaap:RetainedEarningsMember

2021-12-31

0001808377

2021-12-31

0001808377

us-gaap:CommonStockMember

2022-03-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001808377

LUCY:StockSubscriptionReceivableMember

2022-03-31

0001808377

us-gaap:RetainedEarningsMember

2022-03-31

0001808377

2022-03-31

0001808377

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001808377

LUCY:StockSubscriptionReceivableMember

2023-01-01

2023-03-31

0001808377

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001808377

2023-01-01

2023-03-31

0001808377

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001808377

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001808377

LUCY:StockSubscriptionReceivableMember

2023-04-01

2023-06-30

0001808377

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001808377

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001808377

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001808377

LUCY:StockSubscriptionReceivableMember

2022-01-01

2022-03-31

0001808377

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001808377

2022-01-01

2022-03-31

0001808377

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001808377

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001808377

LUCY:StockSubscriptionReceivableMember

2022-04-01

2022-06-30

0001808377

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001808377

us-gaap:CommonStockMember

2023-06-30

0001808377

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001808377

LUCY:StockSubscriptionReceivableMember

2023-06-30

0001808377

us-gaap:RetainedEarningsMember

2023-06-30

0001808377

us-gaap:CommonStockMember

2022-06-30

0001808377

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001808377

LUCY:StockSubscriptionReceivableMember

2022-06-30

0001808377

us-gaap:RetainedEarningsMember

2022-06-30

0001808377

2022-06-30

0001808377

us-gaap:PatentsMember

2023-06-30

0001808377

us-gaap:PatentsMember

2022-12-31

0001808377

2023-01-01

2023-01-31

0001808377

LUCY:TekcapitalEuropeLtdMember

2023-04-01

2023-06-30

0001808377

LUCY:TekcapitalEuropeLtdMember

2022-04-01

2022-06-30

0001808377

LUCY:TekcapitalEuropeLtdMember

2023-01-01

2023-06-30

0001808377

LUCY:TekcapitalEuropeLtdMember

2022-01-01

2022-06-30

0001808377

LUCY:OfficersAndManagementMember

2023-01-01

2023-06-30

0001808377

LUCY:NonManagementDirectorsMember

2023-01-01

2023-06-30

0001808377

LUCY:EmployeesAndConsultantsMember

2023-01-01

2023-06-30

0001808377

LUCY:EmployeeMember

2023-01-01

2023-06-30

0001808377

LUCY:AConsultantMember

2023-01-01

2023-06-30

0001808377

2023-05-30

2023-06-01

0001808377

us-gaap:IPOMember

2023-06-02

2023-06-26

0001808377

us-gaap:CommonStockMember

2023-06-02

2023-06-26

0001808377

us-gaap:IPOMember

2023-06-26

0001808377

us-gaap:WarrantMember

2023-06-02

2023-06-26

0001808377

us-gaap:WarrantMember

2023-06-26

0001808377

us-gaap:IPOMember

2022-08-01

2022-08-17

0001808377

us-gaap:CommonStockMember

2022-08-01

2022-08-17

0001808377

us-gaap:IPOMember

LUCY:MaximMember

2022-08-01

2022-08-17

0001808377

us-gaap:IPOMember

LUCY:MaximMember

2022-08-17

0001808377

2023-02-01

2023-02-28

0001808377

2023-02-28

0001808377

us-gaap:WarrantMember

2023-04-01

2023-04-16

0001808377

us-gaap:WarrantMember

2023-04-16

0001808377

LUCY:InducementLetterMember

2023-04-01

2023-04-17

0001808377

LUCY:InducementLetterMember

2023-04-17

0001808377

LUCY:InducementLetterMember

LUCY:NewWarrantsMember

2023-04-01

2023-04-17

0001808377

LUCY:InducementLetterMember

LUCY:NewWarrantsMember

2023-04-17

0001808377

LUCY:ListedWarrantsMember

2023-06-30

0001808377

LUCY:CommonWarrantsMember

2023-06-30

0001808377

LUCY:PrivateWarrantsMember

2023-06-30

0001808377

LUCY:UnderwriterWarrantsMember

2023-06-30

0001808377

LUCY:PlacemenAgentWarrantsMember

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-Q

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to __________

Commission

file number 001-41392

INNOVATIVE EYEWEAR, INC.

|

| (Exact

name of registrant as specified in its charter) |

| Florida |

|

84-2794274 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| 11900 Biscayne Blvd., Suite 630, North Miami, Florida 33181 |

| (Address

of Principal Executive Offices, including zip code) |

| (786)

785-5178 |

| (Registrant’s

telephone number, including area code) |

| Not

Applicable |

| (Former

name, former address and former fiscal year, if changed since last report) |

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

Registrant was required to submit such files.) Yes ☒ No ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

Accelerated Filer |

☐ |

Accelerated

Filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller

Reporting Company |

☒ |

| Emerging

growth company |

☒ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.00001 par value |

|

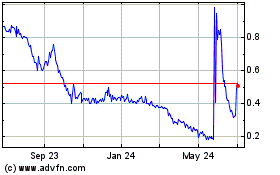

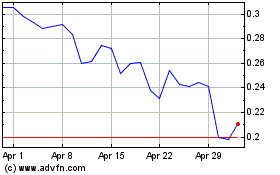

LUCY |

|

The

Nasdaq Capital Market LLC |

| Warrants

to purchase Common Stock |

|

LUCYW |

|

The

Nasdaq Capital Market LLC |

As

of August 8, 2023, there were 12,917,239 shares of the Company’s common stock issued and outstanding.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

discussions in this Quarterly Report on Form 10-Q contain forward-looking statements reflecting our current expectations that involve

risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning any potential future

impact of the coronavirus disease (“COVID-19”) pandemic on our business, supply chain constraints, our strategy, competition,

future operations and production capacity, future financial position, future revenues, projected costs, profitability, expected cost

reductions, capital adequacy, expectations regarding demand and acceptance for our technologies, growth opportunities and trends in the

market in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,”

“will,” “would” and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed

in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events

could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking

statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking

statements, including, without limitation, the risks set forth in Part II, Item 1A, “Risk Factors” in this Quarterly

Report on Form 10-Q and in our other filings with the Securities and Exchange Commission (the “SEC”). We do not assume

any obligation to update any forward-looking statements.

Innovative

Eyewear, Inc.

Table

of Contents

Unless

specifically set forth to the contrary, when used in this report the terms “Innovative Eyewear,” the “Company,”

“we,” “our,” “us,” and similar terms refer to Innovative Eyewear, Inc. The information which appears

on our website lucyd.co is not part of this report.

PART

I - FINANCIAL INFORMATION

Item 1.

Financial Statements

INNOVATIVE

EYEWEAR, INC.

CONDENSED

BALANCE SHEETS

June 30,

2023 (Unaudited) and December 31, 2022

| |

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

| TOTAL

ASSETS |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

| Cash

and cash equivalents |

|

$ |

5,356,445 |

|

|

$ |

3,591,109 |

|

| Investments

in debt securities, at amortized cost (fair value of $1,950,220) |

|

|

1,949,204 |

|

|

|

- |

|

| Accounts

receivable, net of allowances of $98,318 and $92,646, respectively |

|

|

130,655 |

|

|

|

110,258 |

|

| Prepaid

expenses |

|

|

271,276 |

|

|

|

210,673 |

|

| Inventory

prepayment |

|

|

366,626 |

|

|

|

197,750 |

|

| Inventory |

|

|

659,867 |

|

|

|

94,701 |

|

| Other

current assets |

|

|

36,240 |

|

|

|

36,240 |

|

| Total

Current Assets |

|

|

8,770,313 |

|

|

|

4,240,731 |

|

| |

|

|

|

|

|

|

|

|

| Non-Current

Assets |

|

|

|

|

|

|

|

|

| Patent

costs, net |

|

|

251,363 |

|

|

|

137,557 |

|

| Capitalized

software costs |

|

|

110,073 |

|

|

|

110,073 |

|

| Property

and equipment, net |

|

|

125,200 |

|

|

|

119,744 |

|

| Other

non-current assets |

|

|

82,719 |

|

|

|

81,779 |

|

| TOTAL

ASSETS |

|

$ |

9,339,668 |

|

|

$ |

4,689,884 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

148,982 |

|

|

$ |

275,660 |

|

| Deferred

revenue |

|

|

30,000 |

|

|

|

30,000 |

|

| Due

to Parent and Affiliates |

|

|

151,612 |

|

|

|

232,989 |

|

| Related

party convertible debt |

|

|

- |

|

|

|

61,356 |

|

| Total

Current Liabilities |

|

|

330,594 |

|

|

|

600,005 |

|

| |

|

|

|

|

|

|

|

|

| Non-Current

Liabilities |

|

|

|

|

|

|

|

|

| Deferred

revenue |

|

|

57,950 |

|

|

|

65,450 |

|

| TOTAL

LIABILITIES |

|

|

388,544 |

|

|

|

665,455 |

|

| |

|

|

|

|

|

|

|

|

| Commitments

and contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Common

stock (par value $0.00001, 50,000,000 shares authorized, and 12,917,239 and 7,307,157 shares issued and outstanding as of June 30,

2023 and December 31, 2022, respectively) |

|

|

129 |

|

|

|

73 |

|

| Additional

paid-in capital |

|

|

21,975,594 |

|

|

|

14,330,343 |

|

| Accumulated

deficit |

|

|

(13,024,599 |

) |

|

|

(10,305,987 |

) |

| TOTAL

STOCKHOLDERS’ EQUITY |

|

|

8,951,124 |

|

|

|

4,024,429 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

9,339,668 |

|

|

$ |

4,689,884 |

|

See

accompanying Notes to the Financial Statements.

INNOVATIVE

EYEWEAR, INC.

CONDENSED

STATEMENTS OF OPERATIONS

For

the three and six months ended June 30, 2023 and 2022

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three

Months Ended

June 30, |

|

|

Six

Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues,

net |

|

$ |

169,929 |

|

|

$ |

204,741 |

|

|

$ |

314,850 |

|

|

$ |

440,763 |

|

| Less:

Cost of Goods Sold |

|

|

(199,745 |

) |

|

|

(161,494 |

) |

|

|

(334,375 |

) |

|

|

(323,126 |

) |

| Gross

(Deficit) Profit |

|

|

(29,816 |

) |

|

|

43,247 |

|

|

|

(19,525 |

) |

|

|

117,637 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General

and administrative |

|

|

(968,354 |

) |

|

|

(710,135 |

) |

|

|

(1,962,126 |

) |

|

|

(1,317,108 |

) |

| Sales

and marketing |

|

|

(103,643 |

) |

|

|

(391,919 |

) |

|

|

(362,940 |

) |

|

|

(976,714 |

) |

| Research

and development |

|

|

(197,478 |

) |

|

|

(52,560 |

) |

|

|

(348,647 |

) |

|

|

(88,367 |

) |

| Related

party management fee |

|

|

(35,000 |

) |

|

|

(35,000 |

) |

|

|

(70,000 |

) |

|

|

(70,000 |

) |

| Total

Operating Expenses |

|

|

(1,304,475 |

) |

|

|

(1,189,614 |

) |

|

|

(2,743,713 |

) |

|

|

(2,452,189 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

Income (Expense) |

|

|

47,586 |

|

|

|

(2,059 |

) |

|

|

47,662 |

|

|

|

(2,558 |

) |

| Interest

Expense |

|

|

(1,097 |

) |

|

|

(45,386 |

) |

|

|

(3,036 |

) |

|

|

(63,261 |

) |

| Total

Other Income (Expense) |

|

|

46,489 |

|

|

|

(47,445 |

) |

|

|

44,626 |

|

|

|

(65,819 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Loss |

|

$ |

(1,287,802 |

) |

|

$ |

(1,193,812 |

) |

|

$ |

(2,718,612 |

) |

|

$ |

(2,400,371 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares outstanding |

|

|

8,570,035 |

|

|

|

6,060,187 |

|

|

|

8,072,340 |

|

|

|

6,060,187 |

|

| Loss

per share, basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.40 |

) |

See

accompanying Notes to the Financial Statements.

INNOVATIVE

EYEWEAR, INC.

CONDENSED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

For

the three and six months ended June 30, 2023 and 2022

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Common

Stock |

|

|

Additional

Paid In |

|

|

Stock

Subscription |

|

|

Accumulated |

|

|

Total

Stockholders’

Equity |

|

| |

|

#

Shares |

|

|

Amount |

|

|

Capital |

|

|

Receivable |

|

|

Deficit |

|

|

(Deficit) |

|

| Balances,

January 1, 2023 |

|

|

7,307,157 |

|

|

$ |

73 |

|

|

$ |

14,330,343 |

|

|

$ |

- |

|

|

$ |

(10,305,987 |

) |

|

$ |

4,024,429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock

based compensation |

|

|

- |

|

|

|

- |

|

|

|

424,431 |

|

|

|

- |

|

|

|

- |

|

|

|

424,431 |

|

| Exercises

of warrants by stockholders (see Note 9) |

|

|

|

|

|

4 |

|

|

|

1,532,246 |

|

|

|

- |

|

|

|

- |

|

|

|

1,532,250 |

|

| Net

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,430,810 |

) |

|

|

(1,430,810 |

) |

| Balances,

March 31, 2023 |

|

|

7,715,757 |

|

|

$ |

77 |

|

|

$ |

16,287,020 |

|

|

$ |

- |

|

|

$ |

(11,736,797 |

) |

|

$ |

4,550,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock

based compensation |

|

|

- |

|

|

|

- |

|

|

|

(40,180 |

) |

|

|

- |

|

|

|

- |

|

|

|

(40,180 |

) |

| Exercises

of stock options |

|

|

230,362 |

|

|

|

2 |

|

|

|

17,648 |

|

|

|

- |

|

|

|

- |

|

|

|

17,650 |

|

| Exercises

of warrants by stockholders (see Note 9) |

|

|

|

|

|

3 |

|

|

|

1,204,197 |

|

|

|

- |

|

|

|

- |

|

|

|

1,204,200 |

|

| Second

public offering (see Note 9) |

|

|

4,500,000 |

|

|

|

45 |

|

|

|

4,115,643 |

|

|

|

- |

|

|

|

- |

|

|

|

4,115,688 |

|

| Net

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,287,802 |

) |

|

|

(1,287,802 |

) |

| Balances,

June 30, 2023 |

|

|

12,917,239 |

|

|

$ |

129 |

|

|

$ |

21,975,594 |

|

|

$ |

- |

|

|

$ |

(13,024,599 |

) |

|

$ |

8,951,124 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances,

January 1, 2022 |

|

|

6,060,187 |

|

|

$ |

60 |

|

|

$ |

4,842,836 |

|

|

$ |

(11,226 |

) |

|

$ |

(4,624,154 |

) |

|

$ |

207,516 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock

based compensation |

|

|

- |

|

|

|

- |

|

|

|

416,951 |

|

|

|

- |

|

|

|

- |

|

|

|

416,951 |

|

| Net

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,206,559 |

) |

|

|

(1,206,559 |

) |

| Balances,

March 31, 2022 |

|

|

6,060,187 |

|

|

$ |

60 |

|

|

$ |

5,259,787 |

|

|

$ |

(11,226 |

) |

|

$ |

(5,830,713 |

) |

|

$ |

(582,092 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock

based compensation |

|

|

- |

|

|

|

- |

|

|

|

416,951 |

|

|

|

- |

|

|

|

- |

|

|

|

416,951 |

|

| Collection

of stock subscription receivable |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,684 |

|

|

|

|

|

|

|

6,684 |

|

| Net

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,193,812 |

) |

|

|

(1,193,812 |

) |

| Balances,

June 30, 2022 |

|

|

6,060,187 |

|

|

$ |

60 |

|

|

$ |

5,676,738 |

|

|

$ |

(4,542 |

) |

|

$ |

(7,024,525 |

) |

|

$ |

(1,352,269 |

) |

See

accompanying Notes to the Financial Statements.

INNOVATIVE

EYEWEAR, INC.

CONDENSED

STATEMENTS OF CASH FLOWS

For

the six months ended June 30, 2023 and 2022

(Unaudited)

| |

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

| Operating

Activities |

|

|

|

|

|

|

|

|

| Net

Loss |

|

$ |

(2,718,612 |

) |

|

$ |

(2,400,371 |

) |

| Adjustments

to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Amortization |

|

|

17,816 |

|

|

|

4,181 |

|

| Depreciation |

|

|

28,979 |

|

|

|

7,899 |

|

| Non

cash interest expense |

|

|

3,036 |

|

|

|

64,512 |

|

| Stock

based compensation expense |

|

|

384,251 |

|

|

|

833,902 |

|

| Expenses

paid by parent and affiliates |

|

|

151,467 |

|

|

|

474,047 |

|

| Provision

for doubtful accounts |

|

|

5,814 |

|

|

|

- |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

(26,211 |

) |

|

|

(143,487 |

) |

| Accounts

payable and accrued expenses |

|

|

(129,714 |

) |

|

|

53,042 |

|

| Prepaid

expenses |

|

|

(60,603 |

) |

|

|

14,770 |

|

| Inventory |

|

|

(734,042 |

) |

|

|

(44,607 |

) |

| Other

current assets |

|

|

(10,000 |

) |

|

|

- |

|

| Other

current liabilities |

|

|

(184,701 |

) |

|

|

- |

|

| Contract

assets and liabilities |

|

|

1,560 |

|

|

|

- |

|

| Net

cash flows from operating activities |

|

|

(3,270,960 |

) |

|

|

(1,136,112 |

) |

| |

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

|

| Purchases

of financial investments (debt securities) |

|

|

(1,949,204 |

) |

|

|

- |

|

| Patent

costs |

|

|

(131,622 |

) |

|

|

(38,512 |

) |

| Purchases

of property and equipment |

|

|

(34,435 |

) |

|

|

(40,394 |

) |

| Capitalized

software expenditures |

|

|

- |

|

|

|

(18,848 |

) |

| Net

cash flows from investing activities |

|

|

(2,115,261 |

) |

|

|

(97,754 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

|

| Proceeds

from second public offering (see Note 9) |

|

|

4,115,688 |

|

|

|

- |

|

| Proceeds

from exercises of warrants related to private placement transaction (see Note 9) |

|

|

391,268 |

|

|

|

- |

|

| Proceeds

from exercise of warrants by stockholders (see Note 9) |

|

|

2,736,450 |

|

|

|

- |

|

| Proceeds

from exercise of stock options |

|

|

17,650 |

|

|

|

- |

|

| Collection

of stock subscription receivable |

|

|

- |

|

|

|

6,684 |

|

| Payment

of deferred offering costs |

|

|

- |

|

|

|

(62,667 |

) |

| Proceeds

from related party convertible debt |

|

|

- |

|

|

|

1,245,000 |

|

| Repayment

of related party convertible debt |

|

|

(109,499 |

) |

|

|

- |

|

| Net

cash flows from financing activities |

|

|

7,151,557 |

|

|

|

1,189,017 |

|

| |

|

|

|

|

|

|

|

|

| Net

Change In Cash |

|

|

1,765,336 |

|

|

|

(44,849 |

) |

| Cash

at Beginning of Period |

|

$ |

3,591,109 |

|

|

$ |

79,727 |

|

| Cash

at End of Period |

|

$ |

5,356,445 |

|

|

$ |

34,878 |

|

| |

|

|

|

|

|

|

|

|

| Significant

Non-Cash Transactions |

|

|

|

|

|

|

|

|

| Expenses

paid for by Parent reported as increase in Due to Parent and Affiliates and related party convertible debt |

|

|

151,467 |

|

|

|

474,047 |

|

See

accompanying Notes to the Financial Statements.

INNOVATIVE

EYEWEAR, INC.

NOTES

TO THE FINANCIAL STATEMENTS

June 30,

2023 and 2022

(Unaudited)

NOTE

1 – GENERAL INFORMATION

Innovative

Eyewear, Inc. (the “Company,” “us,” “we,” or “our”) is a corporation organized under

the laws of the State of Florida that develops and sells cutting-edge eyeglasses and sunglasses, which are designed to allow our customers

to remain connected to their digital lives, while also offering prescription eyewear and sun protection. The Company was founded by Lucyd

Ltd. (the “Parent” or “Lucyd”), a portfolio company of Tekcapital Plc through Tekcapital Europe, Ltd. (collectively,

the “Parent and Affiliates”), which owned approximately 40% of our issued and outstanding shares of common stock as of June 30,

2023. Innovative Eyewear has licensed the exclusive rights to the Lucyd® brand from Lucyd Ltd., which includes the exclusive use

of all of Lucyd’s intellectual property, including our main product, Lucyd Lyte® glasses.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation

The

accompanying condensed balance sheet as of December 31, 2022 (which has been derived from audited financial statements) and the

unaudited interim condensed financial statements have been prepared in accordance with accounting principles generally accepted in the

United States (“GAAP”) for interim financial information and pursuant to the instructions to Form 10-Q and Article 8

of Regulation S-X promulgated by the United States Securities and Exchange Commission (“SEC”). Certain information or footnote

disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted, pursuant to the

rules and regulations of the SEC for interim financial reporting. Accordingly, they do not include all the information and footnotes

necessary for a comprehensive presentation of financial position, results of operations, or cash flows.

In

the opinion of management, all adjustments considered necessary for the fair presentation of the financial statements for the periods

presented have been included. The results of operations for the three and six months ended June 30, 2023 are not necessarily indicative

of the results to be expected for future periods or the full year.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates, particularly

given the significant economic disruptions and uncertainties associated with the ongoing economic environment, including potential supply

chain constraints.

Cash

Equivalents

All

highly liquid investments with original maturities of three months or less, including money market funds, certificates of deposit, and

US Treasury bills purchased three months or less from maturity, are considered cash equivalents.

Investments

As

of June 30, 2023, the Company held an investment in U.S. Treasury bills, which matures in December 2023. This investment is

classified as “held-to-maturity” and is recorded at amortized cost of $1,949,204 in the accompanying condensed balance sheet.

The fair value of this investment, based on quoted prices (unadjusted) in active markets for identical assets, is $1,950,220 as of June 30,

2023, which includes an unrealized gain of $1,016.

Receivables

and Credit Policy

Trade

receivables from customers are uncollateralized customer obligations due under normal trade terms. For direct-to-consumer sales, payment

is required before product is shipped. Trade receivables are stated at the amount billed to the customer. Payments of trade receivables

are allocated to the specific invoices identified on the customer’s remittance advice or, if unspecified, are applied to the earliest

unpaid invoice. The Company, by policy, routinely assesses the financial strength of its customers. To comply with industry standards,

we offer “net 30” payments on wholesale orders of $1,500 or more. For wholesale orders, to acquire an order on net 30 terms,

the customer is provided a credit check application as well as a credit card authorization form. The authorization form explicitly states

when and for much we will bill the customer via credit card.

Accounts

receivable are reported net of the allowance for doubtful accounts. The allowance for doubtful accounts is based on the Company’s

evaluation of each customer’s payment history, account aging, and financial position. The Company recognized bad debt expense of

$5,672 and $5,814 for the three and six months ended June 30, 2023, respectively, and had an allowance for doubtful accounts of

$98,318 as of June 30, 2023. There was no bad debt expense recognized for the three and six months ended June 30, 2022.

Inventory

The

Company’s inventory includes purchased eyewear and is stated at the lower of cost or net realizable value, with cost determined

on a specific identification method of inventory costing which attaches the actual cost to an identifiable unit of product. Provisions

for excess, obsolete, or slow-moving inventory are recorded after periodic evaluation of historical sales, current economic trends, forecasted

sales, estimated product life cycles, and estimated inventory levels. No provisions were determined as needed as of June 30, 2023

and as of December 31, 2022.

As

of June 30, 2023 and December 31, 2022, the Company recorded an inventory prepayment in the amount of $366,626 and $197,750,

respectively, related to down payment for eyewear purchased from the manufacturer, prior to shipment of the product that occurred after

June 30, 2023 and December 31, 2022, respectively.

Intangible

Assets

Intangible

assets relate to patent costs received in conjunction with the initial capitalization of the Company and internally developed utility

and design patents. The Company amortizes these assets over the estimated useful life of the patents. The Company reviews its intangibles

assets for impairment whenever changes in circumstances indicate that the carrying amount of the assets may not be recoverable.

Capitalized

Software

The

Company incurred software development costs related to development of the Vyrb app. The Company capitalized these costs in accordance

with ASC 985-20, “Software – Costs of Software to be Sold, Leased, or Marketed,” considering it is the Company’s

intention to market and sell the software externally. Planning, designing, coding, and testing occurred necessary to meet Vyrb’s

design specifications. As such, all coding, development, and testing costs incurred subsequent to establishing technical feasibility

were capitalized. The Company launched a beta version of the Vyrb application in December 2021 that demonstrates the functionality

of the software. Management is planning the commercial launch of Vyrb in the fourth quarter of 2023, and expects an estimated useful

life of five years for this product.

Property

and Equipment

Property

and equipment assets are depreciated using the straight-line method over their estimated useful lives or lease terms if shorter. Depreciation

expense for the three months ended June 30, 2023 and 2022 was $10,307 and $3,916, respectively. Depreciation expense for the six

months ended June 30, 2023 and 2022 was $28,979 and $7,899, respectively. For income tax purposes, accelerated depreciation methods

are generally used. Repair and maintenance costs are expensed as incurred.

Income

Taxes

The

Company accounts for income taxes under an asset and liability approach that recognizes deferred tax assets and liabilities based on

the difference between the financial statement carrying amounts and the tax bases of assets and liabilities using enacted tax rates in

effect in the years in which the differences are expected to reverse.

The

Company follows a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected

to be taken, in a tax return. Any interest and penalties accrued related to uncertain tax positions are recorded in tax expense.

The

Company periodically assesses the realizability of its net deferred tax assets. If, after considering all relevant positive and negative

evidence, it is more likely than not that some portion or all of the net deferred tax assets will not be realized, the Company will reduce

the net deferred tax assets by a valuation allowance. The realization of net deferred tax assets is dependent on several factors, including

the generation of sufficient taxable income prior to the expiration of net operating loss carryforwards.

Stock-Based

Compensation

The

Company accounts for stock-based compensation to employees and directors in accordance with ASC Topic 718, which requires that compensation

expense be recognized in the financial statements for stock-based awards based on the grant date fair value. For stock option awards,

the Black-Scholes-Merton option pricing model is used to estimate the fair value of share-based awards. The Black-Scholes-Merton option

pricing model incorporates various and highly subjective assumptions, including expected term and share price volatility.

The

expected term of the stock options is estimated based on the simplified method as allowed by Staff Accounting Bulletin 107 (SAB 107).

The share price volatility at the grant date is estimated using historical stock prices of comparably profiled public companies based

upon the expected term of the award being valued. The risk-free interest rate assumption is determined using the rates for U.S. Treasury

zero-coupon bonds with maturities similar to those of the expected term of the award being valued.

Revenue

Recognition

Our

revenue is generated from the sales of prescription and non-prescription optical glasses, sunglasses, and shipping charges, which are

charged to the customer, associated with these purchases. We sell products through our retail store resellers, distributors, on our own

website Lucyd.co, and on Amazon.

To

determine revenue recognition, we perform the following steps: (i) identify the contract(s) with a customer, (ii) identify the performance

obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations

in the contract, and (v) recognize revenue when (or as) we satisfy a performance obligation. At contract inception, we assess the goods

or services promised within each contract and determine those that are performance obligations, and also assess whether each promised

good or service is distinct. We then recognize as revenue the amount of the transaction price that is allocated to the respective performance

obligation when (or as) the performance obligation is satisfied. In instances where the collectability of contractual consideration is

not probable at the time of sale, the revenue is deferred on our balance sheet as a contract liability, and the associated cost of goods

sold is deferred on our balance sheet as a contract asset; subsequently, we recognize such revenue and cost of goods sold as payments

are received.

All

revenue, including sales processed online and through our retail store resellers and distributors, is reported net of sales taxes collected

from customers on behalf of taxing authorities, returns, and discounts.

For

sales generated through our e-commerce channels, we identify the contract with a customer upon online purchase of our eyewear and transaction

price at the manufacturer suggested retail price (“MSRP”) for non-prescription, polarized sunglass and blue light blocking

glasses across all of our online channels. Our e-commerce revenue is recognized upon meeting the performance obligation when the eyewear

is shipped to end customers. Only U.S. consumers enjoy free USPS first class postage, with faster delivery options available for extra

cost, for sales processed through our website and on Amazon. For Amazon sales, shipping is free for U.S consumers while international

customers pay shipping charges on top of MSRP. Any costs associated with fees charged by the online platforms (Shopify for Lucyd.co website

and Amazon) are not recharged to customers and are recorded as a component of cost of goods sold as incurred. The Company charges applicable

state sales taxes in addition to the MSRP for both online channels and all other marketplaces on which the company sells products.

For

sales to our retail store partners, we identify the contract with a customer upon receipt of an order of our eyewear through our Shopify

wholesale portal or direct purchase order. Revenue is recognized upon meeting the performance obligation, which is delivery of the Company’s

eyewear products to the retail store and is also recorded net of returns and discounts. Our wholesale pricing for eyewear sold to the

retail store partners includes volume discounts, due to the nature of large quantity orders. The pricing includes shipping charges, while

excluding any state sales tax charges applicable. Due to the nature of wholesale retail orders, no e-commerce fees are applicable.

For

sales to distributors, we identify the contract with a customer upon receipt of an order of our eyewear through a direct purchase order.

Revenue is recognized upon meeting the performance obligation, which is delivery of our eyewear products to the distributor and is also

recorded net of returns and discounts. Our wholesale pricing for eyewear sold to distributors includes volume discounts, due to the nature

of large quantity orders. The pricing includes shipping charges, while excluding any state sales tax charges applicable. Due to the nature

of wholesale orders, no e-commerce fees are applicable.

The

Company’s sales do not contain any variable consideration.

We

allow our customers to return our products, subject to our refund policy, which allows any customer to return our products for any reason

within the first:

|

● |

7 days for sales made through

our website (Lucyd.co) |

| |

● |

30

days for sales made through Amazon |

| |

● |

30

days for sales to most wholesale retailers and distributors (although certain sales to independent distributors are ineligible for

returns) |

For

all of our sales, at the time of sale, we establish a reserve for returns, based on historical experience and expected future returns,

which is recorded as a reduction of sales. Additionally, we reviewed all individual returns received in July 2023 pertaining to

orders processed prior to June 30, 2023. As a result, the Company determined that an allowance for sales returns was necessary.

The Company recorded an allowance for sales returns of $4,441 and $24,897 as of June 30, 2023 and December 31, 2022, respectively.

Shipping

and Handling

Costs

incurred for shipping and handling are included in cost of revenue at the time the related revenue is recognized. Amounts billed to a

customer for shipping and handling are reported as revenues.

NOTE

3 – GOING CONCERN

The

Company has a limited operating history. The Company’s business and operations are sensitive to general business and economic conditions

in the United States. A host of factors beyond the Company’s control could cause fluctuations in these conditions. Adverse conditions

may include recession, downturn, or otherwise, changes in regulations or restrictions in imports, competition, or changes in consumer

taste. These adverse conditions could affect the Company’s financial condition and the results of its operations.

The Company

meets its day-to-day working capital requirements using monies raised through sales of eyewear and issuances of equity, including our

initial public offering completed in August 2022, a secondary public offering completed in June 2023, and exercises of warrants by stockholders

(see Note 9 for additional details). The Company also previously issued a convertible note held by its parent company, which was repaid

in full during the six months ended June 30, 2023. The Company’s forecasts and projections indicate that the Company expects to

have sufficient cash reserves and future income to operate within the level of its current facilities. The Company anticipates that its

available liquidity will be sufficient to fund operations through at least the end of August 2024.

NOTE

4 – INCOME TAX PROVISION

At

the end of each interim reporting period, the Company estimates its effective tax rate expected to be applied for the full year. This

estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

The Company has not recorded a tax provision for the three and six months ended June 30, 2023 and 2022 as it maintains a full valuation

allowance against its net deferred tax assets.

NOTE

5 – INTANGIBLE ASSETS

| Schedule of intangible assets |

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| Finite-lived

intangible assets |

|

2023 |

|

|

2022 |

|

| Patent

Costs |

|

$ |

287,818 |

|

|

$ |

156,196 |

|

| Intangible

assets, gross |

|

|

287,818 |

|

|

|

156,196 |

|

| |

|

|

|

|

|

|

|

|

| Less:

Accumulated amortization |

|

|

(36,455 |

) |

|

|

(18,639 |

) |

| Intangible

assets, net |

|

$ |

251,363 |

|

|

$ |

137,557 |

|

Amortization

expense totalled $11,860 and $17,816 for the three and six months ended June 30, 2023, respectively.

Amortization

expense totalled $2,442 and $4,181 for the three and six months ended June 30, 2022, respectively.

NOTE

6 – RELATED PARTY ADVANCES AND OTHER INTERCOMPANY AGREEMENTS

Convertible

Note and Due to Parent and Affiliates

During

the six months ended June 30, 2023 and during 2022, the Company had the availability of, but not the contractual right to, intercompany

financing from the Parent and Affiliates in the form of either cash advances or borrowings under a convertible note (as discussed below).

The

convertible notes balances were $61,356 at December 31, 2022. In January 2023, the Company borrowed an additional $48,143 under

such convertible notes, and subsequently repaid the outstanding balances of the convertible notes in full in February 2023, such

that there were no amounts outstanding under convertible notes as of June 30, 2023.

Management

Service Agreement

In

2020, the Company entered into a management services agreement with Tekcapital Europe Ltd. (a related party, related through common ownership),

for which the Company was billed $25,000 quarterly. Effective February 1, 2022, the original management services agreement was amended

to have the Company billed at $35,000 quarterly. While the agreement does not stipulate a specific maturity date, it can be terminated

with 30 calendar days written notice by any party.

The

related party currently provides the following services:

| |

● |

Support

and advice to the Company in accordance with their area of expertise; |

| |

● |

Research,

technical review, legal review, recruitment, software development, marketing, public relations, and advertisement; and |

| |

● |

Advice,

assistance, and consultation services to support the Company or in relation to any other related matter. |

During

the three months ended June 30, 2023 and 2022, the Company incurred $35,000 in each respective period under the management services

agreement. During the six months ended June 30, 2023 and 2022, the Company incurred $70,000 in each respective period under the

management services agreement.

Rent

of Office Space

Prior

to the February 1, 2022 amendment of the aforementioned management services agreement, the Company was provided with rent-free office

space by the Parent and Affiliates. Effective February 1, 2022, Tekcapital began to bill the Company for an allocation of rent paid

by Tekcapital on the Company’s behalf. The Company recognized $22,992 and $45,760 of expense related to this month-to-month arrangement

for the three and six months ended June 30, 2023, respectively.

NOTE

7 – COMMITMENTS AND CONTINGENCIES

Legal

Matters

We

are not the subject of any material pending legal proceedings; however, we may from time to time become a party to various legal proceedings

arising in the ordinary course of business.

Leases

Our

executive offices are located at 11900 Biscayne Blvd., Suite 630 Miami, Florida 33181. Our executive offices are provided to us by the

parent of Tekcapital (see Note 6). We consider our current office space adequate for our current operations.

License

Agreements

In

2022 and 2023, we entered into various multi-year license agreements which grant us the right to sell certain branded smart eyewear,

including the Nautica, Eddie Bauer, and Reebok brands. These agreements require us to pay royalties based on a percentage of net retail

and wholesale sales during the period of the license, and also require guaranteed minimum royalty payments. The aggregate future minimum

payments due under these license agreements are as follows:

| Schedule of future minimum

payments due |

|

|

|

|

| 2023 |

|

$ |

- |

|

| 2024 |

|

|

161,210 |

|

| 2025 |

|

|

436,000 |

|

| 2026 |

|

|

834,000 |

|

| 2027 |

|

|

1,290,000 |

|

| Thereafter

(through 2033) |

|

|

10,550,000 |

|

| Total |

|

$ |

13,271,210 |

|

Other

Commitments

See

related party management services agreement discussed in Note 6.

NOTE

8 – STOCK-BASED COMPENSATION

During

the six months ended June 30, 2023, we granted the following option awards, all of which had an exercise price of $1.275 per share

and expire on January 13, 2028:

|

● |

Options

to purchase an aggregate of 330,000 shares of common stock were issued to the Company’s officers and management, of which 1/3

vested immediately, 1/3 shall vest on January 13, 2024, and the remaining 1/3 shall vest on January 13, 2025. |

|

● |

Options

to purchase an aggregate of 75,000 shares of common stock were issued to non-management directors, which vest evenly over three years,

whereby 1/3 shall vest on each of January 13, 2024, January 13, 2025, and January 13, 2026. |

|

● |

Options

to purchase an aggregate of 162,000 shares of common stock were issued to certain employees and consultants, which vest evenly over

three years, whereby 1/3 shall vest on each of January 13, 2024, January 13, 2025, and January 13, 2026. |

|

● |

Options

to purchase an aggregate of 75,000 shares of common stock were issued an employee, which vest evenly over three years, whereby 1/6

of the options shall vest every six months. |

|

● |

Options

to purchase an aggregate of 6,000 shares of common stock were issued to a consultant, which vested immediately. |

Additionally,

on June 1, 2023, we modified the terms of certain options awarded in 2021 to purchase an aggregate of 140,000 shares of common stock,

in order to extend their expiration dates from July 21, 2023 to July 21, 2024. There were no changes to the exercise price

or other terms of these stock options, and these options were already fully vested prior to the modification. As a result of this modification,

we recognized incremental stock option expense of $9,188 for the three and six months ended June 30, 2023.

Details

of the number of stock options and the weighted average exercise price outstanding as of and during the six months ended June 30,

2023 are as follows:

| Schedule of number of share options and the weighted average exercise price outstanding |

|

|

|

|

|

|

|

|

| |

|

Average

Exercise

price per share

$ |

|

|

Options

(Number) |

|

| As at January 1, 2023 |

|

|

2.61 |

|

|

|

2,332,500 |

|

| Granted |

|

|

1.28 |

|

|

|

648,000 |

|

| Exercised |

|

|

1.01 |

|

|

|

(316,000 |

) |

| Forfeited / Expired |

|

|

3.56 |

|

|

|

(200,000 |

) |

| As

at June 30, 2023 |

|

|

2.39 |

|

|

|

2,464,500 |

|

| Exercisable

as at June 30, 2023 |

|

|

2.65 |

|

|

|

1,485,231 |

|

As

of June 30, 2023, the weighted average remaining contractual life of options was 2.22 years for outstanding options, and 1.58 years

for exercisable options.

As

of June 30, 2023, unrecognized stock option expense of $1,193,562 remains to be recognized over next 1.39 years.

NOTE

9 – STOCKHOLDERS’ EQUITY

Second

Public Offering

On

June 26, 2023, the Company closed on a public offering of 4,500,000 units consisting of 4,500,000 shares of its common stock and

4,500,000 warrants to purchase 4,500,000 shares of common stock (the “Common Warrants”) at a combined offering price of $1.05

per unit in exchange for gross proceeds of approximately $4.73 million, before deducting underwriting discounts and offering expenses.

Each share of common stock was sold together with one warrant. Each Common Warrant is exercisable to purchase one share of common stock

at an initial exercise price of $1.05 per share, subject to certain adjustments as set forth in the warrant agreement. In addition, pursuant

to the terms of the placement agency agreement for the offering, the Company issued to the placement agent certain other warrants to

purchase up to 180,000 shares of the Company’s common stock at an exercise price of $1.31 per share. The net proceeds received

by the Company from this offering amounted to $4,115,688.

Warrants

On

August 17, 2022, as part of the Company’s initial public offering, the Company issued a total of 2,254,000 warrants to purchase

2,254,000 shares of common stock, which began trading and are currently trading on the Nasdaq Capital Market, under the symbol “LUCYW”

(which we refer to as the “Listed Warrants”). Additionally, pursuant to the terms of the related underwriting agreement for

the initial public offering, the Company issued to the underwriter certain other warrants to purchase up to 58,800 shares of the Company’s

common stock , which have an exercise price of $8.228 per share.

In

February 2023, holders of the Company’s Listed Warrants exercised such warrants to purchase an aggregate of 408,600 shares

of the Company’s common stock, at an adjusted exercise price of $3.75 per share, resulting in cash proceeds to the Company of $1,532,250.

Between

April 1, 2023 and April 16, 2023, holders of the Company’s Listed Warrants exercised such warrants to purchase an aggregate

of 321,120 shares of the Company’s common stock, at an adjusted exercise price of $3.75 per share, resulting in cash proceeds to

the Company of $1,204,200.

On

April 17, 2023, the Company entered into a warrant exercise inducement letter agreement (“Inducement Letter”) with certain

accredited investors that were existing holders of the Company’s Listed Warrants to purchase an aggregate of 150,000 shares of

the Company’s common stock for cash, wherein the investors agreed to exercise all of their existing Listed Warrants at an exercise

price of $3.75 per share. The gross proceeds to the Company from this transaction, before deducting estimated expenses and fees, was

$562,000. In consideration for the immediate exercise of the existing Listed Warrants for cash, the exercising holders received new warrants

to purchase up to an aggregate of 300,000 shares of common stock (the “Private Warrants”) in a private placement pursuant

to Section 4(a)(2) of the Securities Act of 1933, as amended. The Private Warrants are immediately exercisable upon issuance at

an exercise price of $3.75 per common share and will expire on April 19, 2028. The Private Warrants were offered in a private placement

pursuant to an applicable exemption from the registration requirements of the Securities Act and, along with the shares of common stock

issuable upon their exercise, have not been registered under the Securities Act of 1933, and may not be offered or sold in the United

States absent registration with the SEC or an applicable exemption from such registration requirements. The securities were offered only

to accredited investors. The net proceeds received by the Company from this transaction amounted to $391,268.

None

of the aforementioned other warrants issued to underwriters and placement agents have been exercised.

As

of June 30, 2023, the Company’s remaining outstanding warrants are as follows:

| Schedule of stockholders' equity note, warrants or rights |

|

|

|

|

|

|

|

|

|

|

|

| Warrant

Type |

|

Warrants

Outstanding |

|

|

Exercise

Price |

|

|

Expiration

Date |

|

| Listed

Warrants |

|

|

1,374,280 |

|

|

$ |

3.75 |

|

|

8/17/27 |

|

| Common

Warrants |

|

|

4,500,000 |

|

|

$ |

1.05 |

|

|

6/26/28 |

|

| Private

Warrants |

|

|

300,000 |

|

|

$ |

3.75 |

|

|

4/19/28 |

|

| Underwriter

warrants |

|

|

58,800 |

|

|

$ |

8.23 |

|

|

8/12/27 |

|

| Placement

agent warrants |

|

|

180,000 |

|

|

$ |

1.05 |

|

|

6/26/28 |

|

| Total |

|

|

6,413,080 |

|

|

|

|

|

|

|

|

NOTE

10 – EARNINGS PER SHARE

The

Company calculates earnings/(loss) per share data by calculating the quotient of earnings/(loss) divided by the weighted average number

of common shares outstanding during the respective period as required by ASC 260-10-50. Due to the net losses for the three and six months

ended June 30, 2023 and 2022, all shares underlying the related party convertible debt, common stock warrants, and common stock

options were excluded from the earnings per share calculation due to their anti-dilutive effect.

Calculation

of net earnings per common share — basic and diluted:

| Schedule of calculation of net earnings per common share - basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For

the

three months ended |

|

|

For

the

six months ended |

|

| |

|

June 30,

2023 |

|

|

June 30,

2022 |

|

|

June 30,

2023 |

|

|

June 30,

2022 |

|

| Basic

and diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(1,287,802 |

) |

|

$ |

(1,193,812 |

) |

|

$ |

(2,718,612 |

) |

|

$ |

(2,400,371 |

) |

| Weighted-average

number of common shares |

|

|

8,570,035 |

|

|

|

6,060,187 |

|

|

|

8,072,340 |

|

|

|

6,060,187 |

|

| Basic

and diluted net loss per common share |

|

$ |

(0.15 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.40 |

) |

Item 2.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion and analysis of our financial condition and results of operations should be read together with our financial statements

and the related notes and the other financial information included elsewhere in this Quarterly Report. This discussion contains forward-looking

statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking

statements as a result of various factors, including those discussed below and elsewhere in this Quarterly Report.

Overview

The

mission of our company is to upgrade the world’s eyewear, by adding useful tech features to comfortable and stylish sunglasses

and eyeglasses. Our products enable seamless Bluetooth connection to your digital life and prescription vision correction in one affordable

and convenient package. Our flagship brand of smart eyewear is called Lucyd, and Lucyd eyewear is enjoyed by thousands of people around

the world who want the convenience and utility of wireless headphones and glasses in one. Furthermore, we are revolutionizing the concept

of eyewear overall, by enabling connection to the powerful ChatGPT AI assistant right on our glasses, using a novel and ergonomic voice

interface. The Company believes the advent of this powerful feature to our eyewear will significantly enhance user adoption of Lucyd

frames, and provide a new revenue stream for the business in the form of in-app purchases.

In

January 2021, we officially launched our first commercial product, Lucyd Lyte® (“Lucyd Lyte”). This initial product

offering embodied our goal of creating smart eyewear for all day wear that looks like and is priced similarly to designer eyewear, but

is also light weight and comfortable, and enables the wearer to remain connected to their digital lives. The product was initially launched

with six styles, and in September 2021, an additional six styles were added.

We

recently launched version 2.0 of our Lucyd Lyte eyewear, and our current product offering consists of 15 version 2.0 models, which offers

a similar amount of style variety as many traditional eyewear collections. All styles are each available with 80+ different lens types,

resulting in hundreds of variations of products currently available.

The

new Lucyd Lyte version 2.0 collection features several key breakthroughs for the smart eyewear product category:

|

1. |

Music

playback and call time were extended to 12 hours, a 50% increase over the version 1.0 and making Lyte one of the longest-lasting

true wireless audio devices on the market. |

|

2. |

A

four-speaker array was introduced, improving audio fidelity significantly compared to the version 1.0 model and many other smart

eyewear products. |

|

3. |

Styling

of the frames deployed the Company’s new expert design team, producing smart eyewear that follows trending styles in 2023 in

the traditional eyeglasses and sunglasses markets. The collection features many style firsts for a smart eyewear collection designed

in the United States, that have proven commercially successful in traditional eyewear, such as titanium rose gold and champagne crystal

styles for women, and gunmetal gray and acetate aviator styles for men. |

|

4. |

The

upgrade to a Bluetooth 5.2 chip improves connection stability, especially for older devices. |

|

5. |

Responsiveness

of touch controls improved with an audible tone added to alert the wearer when they have used a command successfully. |

|

6. |

The

transition of the LED status indicators to the interior of the temples, a change based on consumer feedback, makes the product more

discreet. |

Since

the launch of Lucyd Lyte, we witnessed interest and demand from customers throughout the United States and have sold thousands of our

smart glasses. Within six months of the launch of Lucyd Lyte, several optical stores in the United States and Canada have on- boarded

the product and we have had discussions with several other large eyewear chains (by number of locations) regarding onboarding our product.

We believe smart eyewear is a product category whose time has come, and we believe we are well positioned to capitalize on and help develop

this exciting new sector–where eyewear meets electronics in a user-friendly, mass market format, priced similarly to designer eyewear.

In

first quarter of 2022 we introduced a virtual try-on kiosk for select retail stores. This device introduces our products to prospective

retail customers and enables them to digitally try on our line of smart glasses in a touch-free manner.

We

anticipate introducing eight styles of Nautica smart eyewear, six to twelve additional styles of Lucyd Lyte glasses, and our first Bluetooth

safety glasses in 2023. In addition, we anticipate the following upgrades to accessory products in 2023:

|

● |

The

patent-pending Lucyd charging dock will be upgraded to feature a charging status LED and USB data capability, enabling it to be used

as a USB multi-device hub for computers in addition to a charging hub. |

|

● |

We

will complete a total overhaul of our retail fixtures in the third quarter of this year, offering our new enhanced video and audio

demo displays to all current and prospective retail partners. Our new modular display system, of which the first units shipped in

the late second quarter, incorporates two different center stations focused on audio and video experiences, along with side pieces

for stores with additional counter space to exhibit any number of our frames. Over the course of the third quarter of this year,

we plan to upgrade the store fixtures of most of our retail partners to the new display systems, which we believe will enhance sell-through

of our products. Initial retailer feedback on the new display system has been positive, as it eliminates key issues with the Company’s

previous displays, by providing enough consumer information to make an educated buying decision, by allowing the customer to interact

with and listen to music on live products, and by the addition of a security tether to make it suitable for all retail environments. |

In the fourth quarter of 2022, we introduced

key features in the Vyrb app, including live broadcasts for up to 100 users in one digital “room”, and the ability to upload

external audio content into Vyrb, enabling longstanding content creators to import their existing libraries swiftly into the platform.

This new feature allows content creators to share content they made outside of Vyrb on the Vyrb network, and in the future we plan to

allow users to monetize this content as well as the content they generate originally on the platform. For example, we plan to enable

podcasters to import their existing podcast library into Vyrb, and set a paywall for other users to access the content. Also in the fourth

quarter of 2022, we completed development of core audio eyewear product improvements, such as upgrading all frames to quadraphonic sound,

which have been rolled out across all new eyewear models as of January 2023.

In

April 2023, we introduced a major software upgrade for our glasses with the launch of the Lucyd app for iOS/Android. This free application

enables the user to converse with the extremely popular ChatGPT AI language model on the glasses, to instantly gain the benefit of one

of the world’s most powerful AI assistants in a hands-free ergonomic interface. The app deploys a powerful and unique Siri and

Google Voice integration with the Open AI API for ChatGPT, developed internally by the company and now pending patent. This development

instantly makes all Lucyd eyewear perhaps the smartest smartglasses available today, and represents a significant marketing opportunity

for the company’s core smartglasses product, and a potential in-app purchase revenue stream for the Company.

We