0001469443false00014694432023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 10, 2023 |

Arcadia Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37383 |

81-0571538 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5950 Sherry Lane Suite 215 |

|

Dallas, Texas |

|

75225 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 214 974-8921 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common |

|

RKDA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 10, 2023, Arcadia Biosciences, Inc. (the “Company”) issued a press release announcing financial results for the second quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1, and the Company's financial information tables for the second quarter ended June 30, 2023 are furnished as Exhibit 99.2, to this Current Report on Form 8-K and are incorporated herein by reference.

The information furnished in this Form 8-K, the press release attached as Exhibit 99.1, and the financial information attached as Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02, in the press release attached as Exhibit 99.1, and in the financial information attached as Exhibit 99.2, shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ARCADIA BIOSCIENCES, INC. |

|

|

|

|

Date: |

August 10, 2023 |

By: |

/s/ THOMAS J. SCHAEFER |

|

|

|

Thomas J. Schaefer, Chief Financial Officer |

Exhibit 99.1

Arcadia Biosciences (RKDA) Announces Second-Quarter and First-Half 2023 Financial Results and Business Highlights

•GoodWheatTMexpands into breakfast category with the launch of better-for-you pancake and waffle mixes

•Exiting Body Care to reduce OpEx, focus on Food & Beverage

•Exploring strategic opportunities to drive shareholder value

DAVIS, Calif. (August 10, 2023) – Arcadia Biosciences, Inc.® (Nasdaq: RKDA), a producer and marketer of innovative, plant-based health and wellness products, today released its financial and business results for the second quarter and first half of 2023.

“Arcadia continues to make progress executing Project Greenfield, our three-year strategic plan to unlock the company’s potential and provide a path to profitability,” said Stan Jacot, president and CEO. “Both GoodWheatTM pasta and Zola®coconut water added hundreds of stores of distribution in Q2, and we are aggressively managing costs, as evidenced by our lowest quarterly operating expense since Q4 of 2020.

“We’ve also embarked on several initiatives to scale more quickly, while simultaneously reducing expenses and complexity, and together, these plans have the potential to accelerate Project Greenfield milestones.”

•GoodWheat Expands Into $850M Baking Mixes Category with Better-for-You Pancake and Waffle Mixes and Single-Serve QuikcakesTM. Launching just in time for back-to-school, Arcadia’s new pancake mixes are made with simple ingredients and its proprietary GoodWheat flour, delivering the same delicious taste and texture of regular pancakes with 8X-11X the fiber and 5-7g of protein per serving. GoodWheat Quikcakes are available nationwide on Amazon, and both Quikcakes and Multi-Serve Pancake & Waffle Mixes began shipping to retailers in August.

•Zola Coconut Water Distribution Grows in Q2, Innovations to Launch in Early 2024. Zola reversed its downward distribution trend in Q2 and grew velocity through adding rack displays in the Produce category. Innovation will ramp up on the brand for the first time in years, with new flavor launches planned in Q1 2024, continuing to accelerate growth in the category.

•Arcadia Streamlines Operations, Exits Body Care Brands ProVaultTM and SoulSpringTM. As part of its strategy to focus resources on high-opportunity, scalable businesses, Arcadia decided to wind-down its two remaining Body Care brands in order to concentrate on the more promising GoodWheat and Zola brands.

1

Streamlined operations and organizational changes are expected to result in operating expense savings of $2 million in the remainder of 2023 and $3 million to $4 million annually.

•Arcadia Engages Lake Street Capital Markets to Explore Strategic Opportunities. Arcadia recently initiated a strategic review process to explore a range of potential transactions and opportunities focused on maximizing the GoodWheat value proposition and driving long-term shareholder value. As part of this process, the company will explore strategic options that may include potential acquisition, company sale, merger, business combination, asset sale, joint venture, licensing arrangement, capital raise or other strategic transaction.

Arcadia Biosciences, Inc.

Financial Snapshot

(Unaudited)

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

2022 |

Favorable /

(Unfavorable) |

|

2023 |

2022 |

Favorable /

(Unfavorable) |

|

|

|

$ |

% |

|

|

|

$ |

% |

Total revenues |

1,389 |

3,858 |

(2,469) |

(64%) |

|

2,899 |

7,078 |

(4,179) |

(59%) |

Total operating expenses |

5,180 |

7,641 |

2,461 |

32% |

|

10,739 |

15,484 |

4,745 |

31% |

Loss from operations |

(3,791) |

(3,783) |

(8) |

(0%) |

|

(7,840) |

(8,406) |

566 |

7% |

Net income (loss) attributable to common stockholders |

823 |

(3,777) |

4,600 |

122% |

|

(8,561) |

(8,265) |

(296) |

(4%) |

More detailed financial statements are included in the Form 8-K filed today, available in the Investors section of the company’s website under SEC Filings.

Revenues

Revenues decreased $2.5 million and $4.2 million during the second quarter and first half of 2023, respectively, compared to the same periods in 2022. Revenues during the second quarter and first half of 2022 included sales of GoodWheat grain and body care products that are no longer part of the Arcadia product portfolio in 2023, as well as one-time license revenue recognized in the second quarter of 2022 related to the sale of Verdeca.

Arcadia achieved a $2 million milestone from Bioceres in the second quarter of 2022 as a result of the HB4® soybean approval in China. Based on accounting guidance, $862,000 was recognized as license revenue and the remaining $1.1 million was recognized as a gain on the 2020 sale to Bioceres of Arcadia’s interest in the Verdeca joint venture.

Operating Expenses

Operating expenses decreased $2.5 million and $4.7 million during the second quarter and first half of 2023, respectively, compared to the same periods in 2022.

2

Cost of product revenues decreased $2.5 million and $5.1 million during the second quarter and first half of 2023, respectively, compared to the same periods in 2022. Cost of revenues in the second quarter and first half of 2022 included grain sold at cost, low-margin body care product sales and higher inventory write-downs.

General and administrative (SG&A) expenses decreased $837,000 and $791,000 during the second quarter and first half of 2023, respectively, compared to the same periods in 2022, primarily driven by lower employee compensation, insurance and research expenses in 2023.

Net Income (Loss) Attributable to Common Stockholders

Net income attributable to common stockholders for the second quarter of 2023 was $823,000, or $0.61 per share, a $4.6 million improvement from the $3.8 million, or $6.81 per share, net loss for the second quarter of 2022. The change in the fair value of the common stock warrant and option liabilities during the second quarter of 2023 resulted in a non-cash gain of $4.4 million. No such gain was recorded in the second quarter of 2022.

Net loss attributable to common stockholders for the first half of 2023 was $8.6 million, or $7.70 per share, a $296,000 increase from the $8.3 million, or $14.90 per share, net loss for the first half of 2022. The net loss attributable to common stockholders during the first half of 2023 included a $6.1 million valuation loss from the March 2023 financing.

Conference Call and Webcast

The company has scheduled a conference call for 4:30 p.m. Eastern time (1:30 p.m. Pacific time) today, August 10, to discuss second-quarter results and key strategic achievements. Interested participants can join the conference call using the following options:

•An audio-only webcast of the conference call will be available in the Investors section of Arcadia’s website.

•To join the live call, please register here, and a dial-in number and unique PIN will be provided.

Following completion of the call, a recorded replay will be available on the company’s investor website.

About Arcadia Biosciences, Inc.

Since 2002, Arcadia Biosciences (Nasdaq: RKDA) has been innovating crops to provide high-value, healthy ingredients to meet consumer demands for healthier choices. With its roots in agricultural innovation, Arcadia cultivates next-generation wellness products that make every body feel good, inside and out. The company’s food and beverage products include GoodWheat™ pasta and pancake mixes and Zola®coconut water. For more information, visit www.arcadiabio.com.

3

Safe Harbor Statement

“Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This press release and the accompanying conference call contain forward-looking statements about the company and its products, including statements relating to the company’s growth, reduction in operating expenses, retail expansion, financial performance and commercialization of products. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the company’s ability to reduce operating expenses; the company’s and its partners’ and affiliates’ ability to successfully develop and sell commercial products incorporating its traits and to complete the regulatory review process for such products; the company’s compliance with laws and regulations that impact the company’s business; the growth of the global wheat market; our ability to continue to make acquisitions and execute on divestitures in accordance with our business strategy or effectively manage the growth from acquisitions; and the company’s future capital requirements and ability to satisfy its capital needs. Further information regarding these and other factors that could affect the company’s financial results and prospects is included in filings the company makes with the Securities and Exchange Commission from time to time, including the section entitled “Risk Factors” and additional information set forth in its Form 10-K for the year ended December 31, 2022, and other filings. These forward-looking statements speak only as of the date hereof, and Arcadia Biosciences, Inc. undertakes no duty to update this information.

Arcadia Biosciences Contact:

T.J. Schaefer

ir@arcadiabio.com

# # #

4

Exhibit 99.2

Arcadia Biosciences, Inc.

Consolidated Balance Sheets

(Unaudited)

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,484 |

|

|

$ |

20,644 |

|

Short-term investments |

|

|

5,023 |

|

|

|

— |

|

Accounts receivable and other receivables, net of allowance for doubtful accounts of

$1 and $3 as of June 30, 2023 and December 31, 2022, respectively |

|

|

630 |

|

|

|

1,287 |

|

Inventories, net — current |

|

|

3,164 |

|

|

|

2,571 |

|

Assets held for sale |

|

|

87 |

|

|

|

87 |

|

Prepaid expenses and other current assets |

|

|

951 |

|

|

|

809 |

|

Total current assets |

|

|

23,339 |

|

|

|

25,398 |

|

Property and equipment, net |

|

|

560 |

|

|

|

704 |

|

Right of use asset |

|

|

1,384 |

|

|

|

1,848 |

|

Inventories, net — noncurrent |

|

|

1,297 |

|

|

|

767 |

|

Intangible assets, net |

|

|

40 |

|

|

|

40 |

|

Other noncurrent assets |

|

|

178 |

|

|

|

165 |

|

Total assets |

|

$ |

26,798 |

|

|

$ |

28,922 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

2,783 |

|

|

$ |

2,881 |

|

Amounts due to related parties |

|

|

33 |

|

|

|

48 |

|

Operating lease liability — current |

|

|

993 |

|

|

|

1,010 |

|

Other current liabilities |

|

|

282 |

|

|

|

270 |

|

Total current liabilities |

|

|

4,091 |

|

|

|

4,209 |

|

Operating lease liability — noncurrent |

|

|

532 |

|

|

|

1,007 |

|

Common stock warrant and option liabilities |

|

|

2,445 |

|

|

|

806 |

|

Other noncurrent liabilities |

|

|

2,000 |

|

|

|

2,000 |

|

Total liabilities |

|

|

9,068 |

|

|

|

8,022 |

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.001 par value—150,000,000 shares authorized as

of June 30, 2023 and December 31, 2022; 1,108,432 and 616,079 shares issued

and outstanding as of June 30, 2023 and December 31, 2022, respectively |

|

|

65 |

|

|

|

65 |

|

Additional paid-in capital |

|

|

284,202 |

|

|

|

278,827 |

|

Accumulated other comprehensive income |

|

|

21 |

|

|

|

— |

|

Accumulated deficit |

|

|

(266,420 |

) |

|

|

(257,859 |

) |

Total stockholders’ equity |

|

|

17,868 |

|

|

|

21,033 |

|

Non-controlling interest |

|

|

(138 |

) |

|

|

(133 |

) |

Total stockholders' equity |

|

|

17,730 |

|

|

|

20,900 |

|

Total liabilities and stockholders’ equity |

|

$ |

26,798 |

|

|

$ |

28,922 |

|

1

Arcadia Biosciences, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

$ |

1,379 |

|

|

$ |

2,946 |

|

|

$ |

2,889 |

|

|

$ |

6,116 |

|

Royalty |

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

100 |

|

License |

|

|

10 |

|

|

|

862 |

|

|

|

10 |

|

|

|

862 |

|

Total revenues |

|

|

1,389 |

|

|

|

3,858 |

|

|

|

2,899 |

|

|

|

7,078 |

|

Operating expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

981 |

|

|

|

3,447 |

|

|

|

1,806 |

|

|

|

6,906 |

|

Research and development |

|

|

391 |

|

|

|

359 |

|

|

|

750 |

|

|

|

754 |

|

Gain on sale of Verdeca |

|

|

— |

|

|

|

(1,138 |

) |

|

|

— |

|

|

|

(1,138 |

) |

Impairment of intangible assets |

|

|

— |

|

|

|

72 |

|

|

|

— |

|

|

|

72 |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(39 |

) |

|

|

— |

|

|

|

(70 |

) |

Impairment of property and equipment |

|

|

— |

|

|

|

346 |

|

|

|

— |

|

|

|

346 |

|

Gain on sale of property and equipment |

|

|

(7 |

) |

|

|

(58 |

) |

|

|

(26 |

) |

|

|

(386 |

) |

Selling, general and administrative |

|

|

3,815 |

|

|

|

4,652 |

|

|

|

8,209 |

|

|

|

9,000 |

|

Total operating expenses |

|

|

5,180 |

|

|

|

7,641 |

|

|

|

10,739 |

|

|

|

15,484 |

|

Loss from operations |

|

|

(3,791 |

) |

|

|

(3,783 |

) |

|

|

(7,840 |

) |

|

|

(8,406 |

) |

Interest income |

|

|

207 |

|

|

|

30 |

|

|

|

405 |

|

|

|

29 |

|

Other (loss) income, net |

|

|

(13 |

) |

|

|

(44 |

) |

|

|

19 |

|

|

|

(3 |

) |

Valuation loss on March 2023 PIPE |

|

|

— |

|

|

|

— |

|

|

|

(6,076 |

) |

|

|

— |

|

Change in fair value of common stock warrant and option liabilities |

|

|

4,416 |

|

|

|

— |

|

|

|

5,357 |

|

|

|

— |

|

Issuance and offering costs allocated to liability classified options |

|

|

— |

|

|

|

— |

|

|

|

(430 |

) |

|

|

(27 |

) |

Net income (loss) before income taxes |

|

|

819 |

|

|

|

(3,797 |

) |

|

|

(8,565 |

) |

|

|

(8,407 |

) |

Income tax provision |

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

Net income (loss) |

|

|

818 |

|

|

|

(3,797 |

) |

|

|

(8,566 |

) |

|

|

(8,407 |

) |

Net loss attributable to non-controlling interest |

|

|

(5 |

) |

|

|

(20 |

) |

|

|

(5 |

) |

|

|

(142 |

) |

Net income (loss) attributable to common stockholders |

|

$ |

823 |

|

|

$ |

(3,777 |

) |

|

$ |

(8,561 |

) |

|

$ |

(8,265 |

) |

Net income (loss) per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.61 |

|

|

$ |

(6.81 |

) |

|

$ |

(7.70 |

) |

|

$ |

(14.90 |

) |

Weighted-average number of shares used in per share

calculations: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

1,358,395 |

|

|

|

554,723 |

|

|

|

1,111,915 |

|

|

|

554,700 |

|

Other comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains on available-for-sale securities |

|

$ |

21 |

|

|

$ |

— |

|

|

$ |

21 |

|

|

$ |

— |

|

Other comprehensive income |

|

|

21 |

|

|

|

— |

|

|

|

21 |

|

|

|

— |

|

Comprehensive income (loss) attributable to common stockholders |

|

$ |

844 |

|

|

$ |

(3,777 |

) |

|

$ |

(8,540 |

) |

|

$ |

(8,265 |

) |

2

Arcadia Biosciences, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

|

$ |

(8,566 |

) |

|

$ |

(8,407 |

) |

Adjustments to reconcile net loss to cash used in operating activities: |

|

|

|

|

|

|

Change in fair value of common stock warrant and option liabilities |

|

|

(5,357 |

) |

|

|

— |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(70 |

) |

Issuance and offering costs allocated to liability classified options |

|

|

430 |

|

|

|

— |

|

Valuation loss on March 2023 PIPE |

|

|

6,076 |

|

|

|

— |

|

Depreciation |

|

|

138 |

|

|

|

277 |

|

Amortization of intangible assets |

|

|

— |

|

|

|

26 |

|

Lease amortization |

|

|

357 |

|

|

|

420 |

|

Impairment of intangible assets |

|

|

— |

|

|

|

72 |

|

Gain on disposal of property and equipment |

|

|

(26 |

) |

|

|

(386 |

) |

Stock-based compensation |

|

|

411 |

|

|

|

583 |

|

Bad debt expense |

|

|

— |

|

|

|

37 |

|

Gain on sale of Verdeca |

|

|

— |

|

|

|

(1,138 |

) |

Write-down of inventories |

|

|

192 |

|

|

|

1,515 |

|

Impairment of property and equipment |

|

|

— |

|

|

|

346 |

|

Changes in operating assets and liabilities: |

|

|

— |

|

|

|

— |

|

Accounts receivable and other receivables |

|

|

87 |

|

|

|

(1,333 |

) |

Inventories |

|

|

(1,316 |

) |

|

|

1,001 |

|

Prepaid expenses and other current assets |

|

|

(142 |

) |

|

|

(541 |

) |

Other noncurrent assets |

|

|

(13 |

) |

|

|

15 |

|

Accounts payable and accrued expenses |

|

|

(149 |

) |

|

|

(247 |

) |

Amounts due to related parties |

|

|

(16 |

) |

|

|

19 |

|

Other current liabilities |

|

|

12 |

|

|

|

8 |

|

Other noncurrent liabilities |

|

|

— |

|

|

|

(1 |

) |

Operating lease liabilities |

|

|

(382 |

) |

|

|

(446 |

) |

Net cash used in operating activities |

|

|

(8,264 |

) |

|

|

(8,250 |

) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

37 |

|

|

|

841 |

|

Proceeds from sale of Verdeca — earn-out received |

|

|

569 |

|

|

|

— |

|

Purchases of property and equipment |

|

|

(5 |

) |

|

|

(46 |

) |

Purchases of investments |

|

|

(5,002 |

) |

|

|

— |

|

Net cash used by investing activities |

|

|

(4,401 |

) |

|

|

795 |

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of common stock, pre-funded warrants and

preferred investment options from March 2023 PIPE |

|

|

5,997 |

|

|

|

— |

|

Payments of offering costs relating to March 2023 PIPE |

|

|

(497 |

) |

|

|

— |

|

Proceeds from ESPP purchases |

|

|

5 |

|

|

|

4 |

|

Net cash provided by financing activities |

|

|

5,505 |

|

|

|

4 |

|

Net decrease in cash and cash equivalents |

|

|

(7,160 |

) |

|

|

(7,451 |

) |

Cash and cash equivalents — beginning of period |

|

|

20,644 |

|

|

|

28,685 |

|

Cash and cash equivalents — end of period |

|

$ |

13,484 |

|

|

$ |

21,234 |

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

— |

|

|

$ |

1 |

|

NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

Common stock warrant liabilities reclassified to equity

upon adoption of ASU 2020-06 |

|

$ |

— |

|

|

$ |

3,392 |

|

Common stock options issued to placement agent and included in offering

costs related to March 2023 PIPE |

|

$ |

212 |

|

|

$ |

— |

|

Warrant and option modifications included in Valuation loss on March

2023 PIPE |

|

$ |

404 |

|

|

$ |

— |

|

Proceeds from sale of property and equipment in accounts receivable and other receivables |

|

$ |

2 |

|

|

$ |

51 |

|

# # #

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

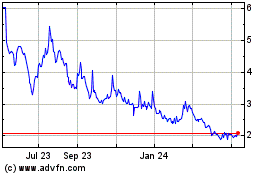

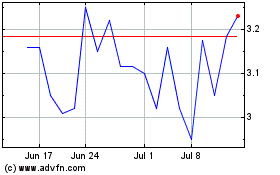

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Apr 2023 to Apr 2024