Amazon dives into the Play-to-Earn universe with exclusive NFTs

Amazon (NASDAQ:AMZN) is offering its 170 million top subscribers

the chance to claim unique non-fungible tokens (NFTs) in popular

blockchain games such as Mojo Melee and Blankos Block

Party. Starting August 9th, Amazon Prime members will receive

a variety of NFTs that offer unique benefits in games like BBP and

Mojo Melee. These NFTs can be traded for profit, driving a

Play-to-Earn economy. The collaboration between Amazon Prime

Gaming and Mystic Moose has launched Mojo Melee, promising monthly

in-game items and tradable digital collectibles. This

expansion reflects Amazon’s commitment to blockchain technology and

underscores the potential of NFTs in virtual worlds.

BIS joins forces with Ripple to boost cross-border payments

The Bank for International Settlements (BIS) formed a task force

for international payments including Ripple. Announced on Aug.

9, the group, part of the BIS Payments and Market Infrastructure

Committee, aims to improve cross-border payments. Ripple will

collaborate with entities such as Mastercard (NYSE:MA) and SWIFT to

enhance interoperability. Global cooperation is essential for

these improvements, BIS highlighted. Separately, SEC is

seeking to review a decision in its case against Ripple Labs.

SoFi: A look at the delicate dance between banks and

cryptocurrencies

San Francisco-based SoFi Technologies (NASDAQ:SOFI) has $170

million in cryptocurrencies, with $82 million in BTC (COIN:BTCUSD),

$55 million in ETH (COIN:ETHUSD), plus Litecoin (COIN:LTCUSD),

Cardano (COIN:ADAUSD), Solana (COIN:SOLUSD), Dogecoin

(COIN:DOGEUSD) and Ethereum Classic (COIN:ETCUSD). While it

started offering crypto services in 2019, it didn’t get a banking

license until 2022. Facing questions from the US Senate and the

Federal Reserve over compliance, SoFi’s relationship with crypto is

closely monitored, reflecting broader concerns about traditional

banks that embrace crypto.

PancakeSwap seeks advanced efficiency in Arbitrum One

PancakeSwap, the second largest decentralized exchange, has

expanded to Arbitrum One, an Ethereum Layer 2 scaling, seeking

lower fees and accelerated transactions. Initially, it will

offer swaps and liquidity provisioning, followed by farming and

IFO. This expansion makes DEX more capital efficient, with up

to 4,000x greater efficiency thanks to the v3.

Coinbase Base starts quiet, but plans big

On the first day after its launch, Coinbase’s (NASDAQ:COIN) new

blockchain, Base, saw flows below expectations, with just $10

million transferred. Data from Dune Analytics shows an

enrollment of 15,000 new users and a 40% drop in transactions

compared to the previous day. Most transfers were between $500

and $1,000 in Ether. A possible explanation for this slow

start is that many investors had already transferred funds to Base

before its official launch. Coinbase, meanwhile, is actively

promoting its new network to attract more users.

Binance backs post-hack Curve with strategic investment

Binance Labs will invest $5 million in the Curve DAO Token

(COIN:CRVUSD) from the Curve decentralized exchange on

Ethereum. In response to a recent $70 million hack, Binance is

fully supporting Curve. After the announcement, the value of

the CRV increased by 4.8%, but then dropped slightly.

Alex Mashinsky had his bail changed

Former Celsius CEO Alex Mashinsky had his bail modified by a

federal judge to include electronic monitoring and restrictions on

withdrawing funds. Mashinsky faces allegations of multiple

fraud. After his arrest in July, he pleaded not

guilty. Celsius declared bankruptcy in 2022 and was fined $4.7

billion for misleading users. Roni Cohen-Pavon, former

director of the platform, also faces similar accusations.

Gemini vs DCG: Duel of giants over fraud allegations

The Digital Currency Group (DCG) has refuted accusations by

cryptocurrency exchange Gemini, which claimed fraud on the part of

DCG subsidiary Genesis and its founder, Barry Silbert. Gemini

alleges Genesis’ financial misrepresentation, linked to the

collapse of Three Arrows Capital in 2022. DCG alleges that Gemini’s

actions are a public relations campaign, spearheaded by the

Winklevoss, to divert attention from its own poor management.

FTX rejects UCC proposal, targets FTX 2.0 launch

FTX leaders, including CEO John J. Ray III, disapproved of the

Official Committee of Unsecured Creditors’ (UCC) proposal to

control assets and invest $2.6 billion in Treasuries. After

criticism of FTX for spending during the bankruptcy, the company

recovered $7 billion of the $8.7 billion owed. FTX plans to

launch FTX 2.0, albeit facing skepticism, and has denied

cryptocurrency services through FTX Dubai.

Num Finance and TruBit promote Argentine stablecoin in Latin

America

Num Finance, an Argentine stablecoin issuer, has partnered with

TruBit exchange to promote the adoption of nARS in Latin

America. The collaboration will enable the integration of the

nARS stablecoin into the TruBit Pro Exchange platform. The

strategy aims to expand the access and usefulness of nARS, mainly

benefiting Latin American users. The partnership aims to

connect traditional finance with cryptocurrencies and tackle

monetary challenges in the region.

MakerDAO’s ambition: Spark and the future of lending governance

Rune Christensen of MakerDAO (COIN:DAOUSD) has proposed a new

governance token for the Spark Lending Protocol, planning to

distribute 2 billion Spark tokens over ten years to encourage

continued use. Spark, which accepts assets like Ether

(COIN:ETHUSD) and Dai (COIN:DAIUSD) as collateral, can become a

subDAO within MakerDAO, an autonomous entity with its own

governance. The plan seeks to strengthen the SparkDAO

community and encourage adoption of the protocol by adjusting the

yield rate on Dai deposits.

Nigeria bets on blockchain to certify its youth

The Nigerian government plans to adopt blockchain technology to

issue and verify NYSC certificates. This decision aims to

combat counterfeiting problems that have affected the authenticity

of certificates. With the support of the Central Bank and

NITDA, the measure also brings Nigeria in line with modern

digitization trends and provides greater transparency to

processes. The growing use of blockchain reflects the

country’s openness to technological innovations, including

recognizing digital assets in its tax legislation.

Bank of England seeks brilliant minds to unlock the CBDC world

The Bank of England (BoE) has created the CBDC Academic Advisory

Group (AAG) to advise on central bank digital currency

(CBDC). The group will work closely with Her Majesty’s

Treasury (HM) and invite academics to join and provide

cross-disciplinary insights. The aim is to deepen the

understanding of CBDCs, considering various disciplines, and to

promote discussions on their implementation. In February, a

public consultation was launched on the digital libra, pointing to

future collaborations and research-based assessments by the

AAG.

France sets sail for the MiCA era in crypto regulations

In 2024, France will adapt its cryptographic regulations to the

pan-European MiCA standard. The Autorité des Marchés

Financiers detailed new rules for digital asset service providers,

including managing conflicts of interest and protecting customer

assets. Platforms registered before 2024 will have lighter

guidelines. MiCA, approved in 2023, has raised concerns in the

crypto community, such as limits on stablecoins.

India flirts with Web3 with secure browsing and digital signature

The Indian Ministry of Electronics and Technology intends to

enable the digital signing of documents with cryptographic tokens

in a new national web browser. Even without clear legislation

on Web3 or cryptocurrency in India, the IWBDC project was launched,

seeking a browser with support for Web3 and high standards of

security and privacy. The prize pool is US$400,000 and the

deadline for entries is July 2024.

Riot hits $76.7M in revenue, overcoming crypto market hurdles

Bitcoin (COIN:BTCUSD) mining company Riot Platforms

(NASDAQ:RIOT) reported revenue of $76.7 million for the quarter

ending June 30, 2023. Riot reduced mining costs and produced 460

Bitcoins in June, offsetting lower revenue from energy

sales. Partnerships, like the one with Midas Immersion,

position Riot as a leader in mining. Even facing challenges

such as storms and declining hosting revenue, the company has shown

resilience and innovation in the unpredictable cryptocurrency

market.

Xverse raises millions to expand Bitcoin DeFi universe

Bitcoin wallet Xverse raised $5 million in a round led by Jump

Crypto, aiming to improve DeFi capabilities and Bitcoin scaling

solutions. Based in Hong Kong, Xverse supports Ordinals, a

technique for creating NFTs on Bitcoin.

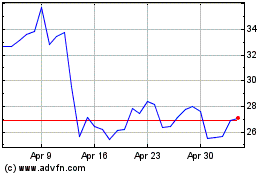

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024