0001355839

false

0001355839

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023

| PALTALK, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-38717 |

|

20-3191847 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

|

30 Jericho Executive Plaza, Suite 400E

Jericho, NY |

|

11753 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 967-5120

(Former name or former address, if changed since

last report)

Not Applicable

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

PALT |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. o

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial

Condition.

On August 8, 2023, Paltalk,

Inc. issued a press release announcing its financial results for the quarter ended June 30, 2023. The press release is furnished as Exhibit

99.1.

The information in this Current

Report on Form 8-K (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation

language in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 8, 2023 |

|

|

| |

PALTALK, INC. |

| |

|

|

| |

By: |

/s/ Jason Katz |

| |

|

Jason Katz |

| |

|

Chief Executive Officer |

2

Exhibit

99.1

Paltalk,

Inc. Reports 12% Revenue Growth to $3.0 Million in Second Quarter 2023

Reports

Significant Improvements in Net Income and Adjusted EBITDA

Jericho,

NY – August 8, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- Paltalk, Inc. (“Paltalk,” the “Company,”

“we,” “our” or “us”) (Nasdaq: PALT), a communications software innovator that powers multimedia

social applications, today announced financial and operational results for the second quarter ended June 30, 2023.

Key

Financial Highlights for Second Quarter Ended June 30, 2023 Compared to Prior Year Period

| ● | Revenue

increased 12% to $3.0 million |

| ● | Subscription

revenue increased over 12% to $2.9 million |

| ● | Advertising

revenue decreased 15% to $0.1 million |

| ● | Net

income was $0.1 million compared to a net loss of $1.1 million, a change of 112% |

| ● | Adjusted

EBITDA loss was $14,945 compared to Adjusted EBITDA loss of $0.9 million |

Key

Financial Highlights for Six Months Ended June 30, 2023 Compared to Prior Year Period

| ● | Revenue

decreased slightly by 1% to $5.5 million |

| ● | Subscription

revenue remained relatively unchanged at $5.4 million |

| ● | Advertising

revenue decreased over 20% to $129,360 |

| ● | Net

loss decreased almost 68% to $0.6 million compared to a net loss of $1.9 million |

| ● | Adjusted

EBITDA loss decreased over 50% to $0.7 million compared to Adjusted EBITDA loss of $1.4 million |

| ● | Deferred

revenue increased 18% to $2.2 million as of June 30, 2023 |

| ● | The

Company had $13.7 million in cash and no long-term debt on its balance sheet as of June 30, 2023 |

Near

Term Business Objectives

| ● | Leveraging

our recently completed integration of the ManyCam product into our Paltalk product through upselling initiatives |

| ● | Further

optimizing marketing spend to effectively realize a positive return on our investment |

| ● | Developing

a user-friendly version of ManyCam that will be optimized for both consumer and enterprise applications |

| ● | Continuing

to implement several enhancements to our live video chat applications as well as the integration of card and board games and other features

focused on retention and monetization, which collectively are intended to increase user engagement and revenue opportunities |

| ● | Continuing

to explore strategic opportunities, including, but not limited to, potential mergers or acquisitions of other assets or entities that

are synergistic to our businesses |

| ● | Continuing

to develop our consumer application platform strategy by seeking potential partnerships with large third-party communities to whom we

could promote a co-branded version of our video chat products and potentially share in the incremental revenues generated by these partner

communities |

| ● | Continuing

to defend our intellectual property |

Management

Commentary

Jason

Katz, Chairman and CEO of Paltalk, commented, “We are very pleased with our return to revenue growth and profitability in the second

quarter. All of our attention and efforts to optimize our platforms and streamline our costs have paid off and improved our

foundation. Our infrastructure is capable of supporting additional business, so if we continue to expand revenue, we are confident

that it would result in increased profitability. We believe that this business scalability, along with the $13.7 million in

cash on our balance sheet at quarter’s end, puts us in an excellent position.”

Katz

concluded, “We have already met one of our key objectives for 2023 with our return to increased revenue. Additionally,

as we surpassed the one-year anniversary of our asset acquisition of ManyCam, and with the successful integration of ManyCam into

Paltalk and our team’s effort in developing a new and easier version, we expect the one-year annual auto renewals of existing ManyCam

subscriptions to help contribute to growth in subscription revenue in future periods. While our trial against Cisco was pushed

back to an expected trial date late in the fourth quarter of 2023, the Court recently denied Cisco’s motion for summary

judgement, and we look forward to continuing to defend our intellectual property.”

Patent

Litigation

On

July 23, 2021, a wholly owned subsidiary of the Company, Paltalk Holdings, Inc., filed a patent infringement lawsuit against WebEx Communications,

Inc., Cisco WebEx LLC, and Cisco Systems, Inc. (collectively, “Cisco”), in the U.S. District Court for the Western District

of Texas (the “Court”). The Company alleges that certain of Cisco’s products have infringed U.S. Patent No. 6,683,858,

and that the Company is entitled to damages.

A

Markman hearing took place on February 24, 2022. On September 7, 2022, the United States Patent Office issued a reexamination of U.S.

Patent No. 6,683,858, and on January 19, 2023, the Examiner issued an Ex Parte Reexamination Certificate, ending

the reexamination and confirming the patentability of claims 1-10 of U.S. Patent No. 6,683,858. On June 29, 2023, the Court held

a pretrial conference with the parties and denied Cisco’s motion for summary judgement. The trial is expected to be scheduled for

late in the fourth quarter of this year.

Financial

Results for Three Months Ended June 30, 2023

| ● | Revenue

for the three months ended June 30, 2023 increased by 11.8% to $3.0 million, compared to $2.6 million for the three months ended June

30, 2022. The increase in revenue was primarily attributed to an increase in virtual goods revenue and new subscribers as well as a full

year of sales from ManyCam. These increases were partially offset by a decrease in advertising revenue of 15.2%; |

| ● | Loss

from operations for the three months ended June 30, 2023 decreased by 74.4%, or $0.8 million, to a loss of $0.3 million, compared to

a loss of $1.1 million for the three months ended June 30, 2022. The decrease in loss from operations was attributed to increased revenue

for the three months ended June 30, 2023; |

| ● | Net

income for the three months ended June 30, 2023 increased 112.0% to $0.1 million, compared to a net loss of $1.1 million the three months

ended June 30, 2022. The increase in net income was due to the increase in subscription revenue, the reduction of operating expenses,

and $0.3 million of other income recognized in connection with the Company’s recording of a refundable employee retention tax credit;

and |

| ● | Adjusted

EBITDA loss for the three months ended June 30, 2023 decreased by 98.4%, to an Adjusted EBITDA loss of $14,945, compared to Adjusted

EBITDA loss of $0.9 million for the three months ended June 30, 2022. |

Financial

Results for Six Months Ended June 30, 2023

| ● | Revenue

for the six months ended June 30, 2023 decreased by 0.9% to $5.5 million, compared to $5.6 million for the six months ended June 30,

2022. The decline in revenue was attributed to a slight decrease in subscription revenue; |

| ● | Loss

from operations for the six months ended June 30, 2023 decreased by 34.0%, or $0.6 million, to a loss of $1.2 million, compared to a

loss of $1.8 million for the six months ended June 30, 2022. The decrease in loss from operations was primarily attributable to reduced

operating expenses in connection with the implementation of operating efficiencies; |

| ● | Net

loss for the six months ended June 30, 2023 decreased by 67.7%, or $1.3 million, to $0.6 million, compared to a net loss of $1.9 million

for the six months ended June 30, 2022. The decrease in net loss was attributed to decreases in operating expenses as well as an increase

in other income in connection with the Company’s recording of a refundable employee retention tax credit; |

| ● | Adjusted

EBITDA loss for the six months ended June 30, 2023 decreased by 52.4%, or $0.7 million, to an Adjusted EBITDA loss of $0.7 million, compared

to Adjusted EBITDA loss of $1.4 million for the six months ended June 30, 2022; |

| ● | Cash

and cash equivalents totaled $13.7 million at June 30, 2023, a decrease of $1.0 million compared to $14.7 million at December 31, 2022;

and |

| ● | The

Company had no long-term debt on its balance sheet at June 30, 2023. |

Key

Financial and Operating Metrics from Operations:

(in

thousands, except for percentages)

| | |

Three Months Ended | | |

| | |

| |

| | |

June 30, (unaudited) | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | |

| Subscription revenue | |

$ | 2,885 | | |

$ | 2,561 | | |

$ | 324 | | |

| 12.7 | % |

| Advertising revenue | |

$ | 71 | | |

$ | 84 | | |

$ | (13 | ) | |

| (15.2 | )% |

| Total revenues | |

$ | 2,956 | | |

$ | 2,644 | | |

$ | 312 | | |

| 11.8 | % |

| Loss from operations | |

$ | (278 | ) | |

$ | (1,084 | ) | |

$ | 806 | | |

| (74.4 | )% |

| Net income (loss) | |

$ | 136 | | |

$ | (1,129 | ) | |

$ | 1,264 | | |

| 112.0 | % |

| Net cash used in operating activities | |

$ | (194 | ) | |

$ | (411 | ) | |

$ | 217 | | |

| (52.8 | )% |

| Adjusted EBITDA (a non-GAAP measure) | |

$ | (15 | ) | |

$ | (909 | ) | |

$ | 894 | | |

| 98.4 | % |

| | |

Six Months Ended | | |

| | |

| |

| | |

June 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | |

| Subscription revenue | |

$ | 5,391 | | |

$ | 5,407 | | |

$ | (16 | ) | |

| (0.2 | )% |

| Advertising revenue | |

$ | 129 | | |

$ | 164 | | |

$ | (35 | ) | |

| (21.3 | )% |

| Total revenues | |

$ | 5,520 | | |

$ | 5,571 | | |

$ | (51 | ) | |

| (0.9 | )% |

| Loss from operations | |

$ | (1,187 | ) | |

$ | (1,797 | ) | |

$ | 594 | | |

| (34.0 | )% |

| Net loss | |

$ | (603 | ) | |

$ | (1,868 | ) | |

$ | 1,350 | | |

| (67.7 | )% |

| Net cash used in operating activities | |

$ | (997 | ) | |

$ | (1,644 | ) | |

$ | 562 | | |

| (34.2 | )% |

| Adjusted EBITDA (a non-GAAP measure) | |

$ | (663 | ) | |

$ | (1,393 | ) | |

$ | 730 | | |

| 52.4 | % |

ABOUT

PALTALK, INC. (Nasdaq: PALT)

Paltalk,

Inc. is a communications software innovator that powers multimedia social applications. Our product portfolio includes Paltalk and Camfrog,

which together host a large collection of video-based communities. Our other products include ManyCam, Tinychat and Vumber. The Company

has an over 20-year history of technology innovation and holds 10 patents. For more information, please visit: http://www.paltalk.com.

To

be added to our news distribution list, please visit: http://www.paltalk.com/investor-alerts/.

FORWARD-LOOKING

STATEMENTS:

This

press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,”

“will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,”

“aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements

are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties,

many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, any economic

recession and the overall inflationary environment on our results of operations and our business; our ability to effectively market and

generate revenue from our applications; our ability to generate and maintain active users and to effectively monetize our user base;

our ability to improve, market and promote the ManyCam software; the Company’s ability to retain the listing of its common stock

on The Nasdaq Capital Market; our ability to release new applications or improve upon or add features to existing applications on schedule

or at all; risks and uncertainties related to our increasing focus on the use of new and novel technologies to enhance our applications,

and our ability to timely complete development of applications using new technologies; our ability to effectively compete with existing

competitors and new market entrants; our ability to effectively secure new software development and licensing customers; our ability

to protect our intellectual property rights; the use of the internet and privacy and protection of user data; our ability to consummate

favorable acquisitions and effectively integrate any companies or properties that we acquire; and our ability to manage our partnerships

and strategic alliances. More detailed information about the Company and the risk factors that may affect the realization of forward-looking

statements is set forth in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Company’s

most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents

free of charge on the SEC’s website at www.sec.gov.

All

forward-looking statements speak only as of the date on which they are made. The Company undertakes no obligation to update any forward-looking

statement or statements to reflect events or circumstances after the date on which such statement was made, except to the extent required

by applicable securities laws.

Investor

Contacts:

IR@paltalk.com

ClearThink

nyc@clearthink.capital

917-658-7878

PALTALK,

INC.

RECONCILIATION

OF GAAP TO NON-GAAP RESULTS

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, (Unaudited) | | |

June 30, (Unaudited) | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of net income (loss) to Adjusted EBITDA: | |

| | |

| | |

| | |

| |

| Net income (loss) | |

$ | 135,629 | | |

$ | (1,128,706 | ) | |

$ | (602,669 | ) | |

$ | (1,867,651 | ) |

| Interest (income) expense, net | |

| (171,341 | ) | |

| 1,595 | | |

| (292,508 | ) | |

| 3,457 | |

| Other (income) expense | |

| (343,045 | ) | |

| 38,772 | | |

| (343,045 | ) | |

| 46,658 | |

| Income tax expense | |

| 101,059 | | |

| 4,753 | | |

| 51,505 | | |

| 20,784 | |

| Impairment loss on digital tokens | |

| -- | | |

| 7,262 | | |

| | | |

| 7,262 | |

| Depreciation and amortization expense | |

| 205,583 | | |

| 108,176 | | |

| 411,167 | | |

| 184,440 | |

| Stock-based compensation expense | |

| 57,170 | | |

| 59,149 | | |

| 112,311 | | |

| 211,620 | |

| Reported Adjusted EBITDA | |

$ | (14,945 | ) | |

$ | (908,999 | ) | |

$ | (663,239 | ) | |

$ | (1,393,430 | ) |

Non-GAAP

Financial Measures and Key Metrics

The

Company has provided in this release Adjusted EBITDA, a non-GAAP financial measure, to supplement the consolidated financial statements,

which are prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Adjusted EBITDA

is defined as net income (loss) adjusted to exclude interest (income) expense, net, other (income) expense, income taxes (benefit) expense,

impairment loss on digital tokens, depreciation and amortization expense, and stock-based compensation expense.

Management

uses Adjusted EBITDA internally in analyzing the Company’s financial results to assess operational performance and to determine

the Company’s future capital requirements. The presentation of this financial information is not intended to be considered in isolation

or as a substitute for the financial information prepared in accordance with GAAP. The Company believes that both management and investors

benefit from referring to Adjusted EBITDA in assessing its performance and when planning, forecasting and analyzing future periods. The

Company believes Adjusted EBITDA is useful to investors and others to understand and evaluate the Company’s operating results and

it allows for a more meaningful comparison between the Company’s performance and that of competitors. Our use of Adjusted EBITDA

has limitations as an analytical tool, and you should not consider this performance measure in isolation from or as a substitute for

analysis of our results as reported under GAAP. Some of these limitations are that Adjusted EBITDA does not reflect, among other things:

interest (income) expense, net, income tax (benefit) expense, depreciation and amortization expense, other (income) expense, net, and

stock-based compensation. Other companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces

its usefulness as a comparative measure.

Because

of these limitations, you should consider Adjusted EBITDA along with other financial performance measures, including total revenues,

subscription revenue, deferred revenue, net income (loss), cash and cash equivalents, restricted cash, net cash used in operating activities

and our financial results presented in accordance with GAAP.

PALTALK,

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 13,650,942 | | |

$ | 14,739,933 | |

| Accounts receivable, net of allowances of $3,648 as of June 30, 2023 and December 31, 2022 | |

| 126,654 | | |

| 122,297 | |

| Employee retention tax credit receivable, net | |

| 246,629 | | |

| - | |

| Prepaid expense and other current assets | |

| 789,099 | | |

| 543,199 | |

| Total current assets | |

| 14,813,324 | | |

| 15,405,429 | |

| Operating lease right-of-use asset | |

| 118,330 | | |

| 159,181 | |

| Goodwill | |

| 6,326,250 | | |

| 6,326,250 | |

| Intangible assets, net | |

| 3,115,644 | | |

| 3,526,811 | |

| Other assets | |

| 13,937 | | |

| 13,937 | |

| Total assets | |

$ | 24,387,485 | | |

$ | 25,431,608 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 679,082 | | |

$ | 1,013,637 | |

| Accrued expenses and other current liabilities | |

| 211,225 | | |

| 225,193 | |

| Operating lease liabilities, current portion | |

| 83,367 | | |

| 82,176 | |

| Contingent consideration | |

| - | | |

| 85,000 | |

| Deferred subscription revenue | |

| 2,169,454 | | |

| 2,257,452 | |

| Total current liabilities | |

| 3,143,128 | | |

| 3,663,458 | |

| Operating lease liabilities, non-current portion | |

| 34,963 | | |

| 77,005 | |

| Deferred tax liability | |

| 732,723 | | |

| 716,903 | |

| Total liabilities | |

| 3,910,814 | | |

| 4,457,366 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.001 par value, 25,000,000 shares authorized, 9,864,120 shares issued and 9,222,157 and 9,227,349 shares outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 9,864 | | |

| 9,864 | |

| Treasury stock, 641,963 and 636,771 shares repurchased as of June 30, 2023

and December 31, 2022, respectively | |

| (1,199,337 | ) | |

| (1,192,124 | ) |

| Additional paid-in capital | |

| 36,086,046 | | |

| 35,973,735 | |

| Accumulated deficit | |

| (14,419,902 | ) | |

| (13,817,233 | ) |

| Total stockholders’ equity | |

| 20,476,671 | | |

| 20,974,242 | |

| Total liabilities and stockholders’ equity | |

$ | 24,387,485 | | |

$ | 25,431,608 | |

PALTALK,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three

Months Ended

June 30, |

|

|

Six

Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Subscription

revenue |

|

$ |

2,884,989 |

|

|

$ |

2,560,706 |

|

|

$ |

5,390,659 |

|

|

$ |

5,407,045 |

|

| Advertising revenue |

|

|

71,013 |

|

|

|

83,762 |

|

|

|

129,360 |

|

|

|

164,124 |

|

| Total revenues |

|

|

2,956,002 |

|

|

|

2,644,468 |

|

|

|

5,520,019 |

|

|

|

5,571,169 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

774,028 |

|

|

|

661,548 |

|

|

|

1,576,503 |

|

|

|

1,313,644 |

|

| Sales and marketing expense |

|

|

220,512 |

|

|

|

484,133 |

|

|

|

475,380 |

|

|

|

895,615 |

|

| Product development expense |

|

|

1,163,640 |

|

|

|

1,521,764 |

|

|

|

2,412,222 |

|

|

|

3,051,905 |

|

| General and administrative

expense |

|

|

1,075,520 |

|

|

|

1,053,347 |

|

|

|

2,242,631 |

|

|

|

2,099,495 |

|

| Impairment loss on digital

tokens |

|

|

-- |

|

|

|

7,262 |

|

|

|

-- |

|

|

|

7,262 |

|

| Total costs and expenses |

|

|

3,233,700 |

|

|

|

3,728,054 |

|

|

|

6,706,736 |

|

|

|

7,367,921 |

|

| Loss from operations |

|

|

(277,698 |

) |

|

|

(1,083,586 |

) |

|

|

(1,186,717 |

) |

|

|

(1,796,752 |

) |

| Interest income (expense),

net |

|

|

171,341 |

|

|

|

(1,595 |

) |

|

|

292,508 |

|

|

|

(3,457 |

) |

| Other income (expense),

net |

|

|

343,045 |

|

|

|

(38,772 |

) |

|

|

343,045 |

|

|

|

(46,658 |

) |

| Income (loss) from operations before provision for

income taxes |

|

|

236,688 |

|

|

|

(1,123,953 |

) |

|

|

(551,164 |

) |

|

|

(1,846,867 |

) |

| Income tax expense |

|

|

(101,059 |

) |

|

|

(4,753 |

) |

|

|

(51,505 |

) |

|

|

(20,784 |

) |

| Net income (loss) |

|

$ |

135,629 |

|

|

$ |

(1,128,706 |

) |

|

$ |

(602,669 |

) |

|

$ |

(1,867,651 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share of common

stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.01 |

|

|

$ |

(0.12 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.19 |

) |

| Diluted |

|

$ |

0.01 |

|

|

$ |

(0.12 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.19 |

) |

| Weighted

average number of shares of common stock used in calculating net income (loss) income per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

9,222,157 |

|

|

|

9,771,608 |

|

|

|

9,222,256 |

|

|

|

9,801,715 |

|

| Diluted |

|

|

9,222,157 |

|

|

|

9,771,608 |

|

|

|

9,222,256 |

|

|

|

9,801,715 |

|

PALTALK,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (602,669 | ) | |

$ | (1,867,651 | ) |

| Adjustments to reconcile net loss from operations to net cash used in operating activities: | |

| | | |

| | |

| Depreciation of property and equipment | |

| - | | |

| 51,918 | |

| Amortization of intangible assets | |

| 411,167 | | |

| 132,522 | |

| Amortization of operating lease right-of-use assets | |

| 40,851 | | |

| 39,924 | |

| Impairment loss on digital tokens | |

| - | | |

| 7,262 | |

| Deferred tax expense | |

| 15,820 | | |

| | |

| Stock-based compensation | |

| 112,311 | | |

| 211,620 | |

| Changes in operating assets and liabilities: | |

| - | | |

| | |

| Accounts receivable | |

| (4,357 | ) | |

| 46,657 | |

| Operating lease liability | |

| (40,851 | ) | |

| (39,924 | ) |

| Prepaid expense and other current assets | |

| (245,900 | ) | |

| (120,686 | ) |

| Accounts payable, accrued expenses and other current liabilities | |

| (381,523 | ) | |

| (29,932 | ) |

| Employee retention tax credit receivable, net | |

| (213,629 | ) | |

| - | |

| Deferred subscription revenue | |

| (87,998 | ) | |

| (75,644 | ) |

| Net cash used in operating activities | |

| (996,778 | ) | |

| (1,643,934 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of ManyCam assets | |

| - | | |

| (2,700,000 | ) |

| Acquisition related costs of ManyCam assets | |

| - | | |

| (228,928 | ) |

| Payment of contingent consideration | |

| (85,000 | ) | |

| - | |

| Net cash used in investing activities | |

| (85,000 | ) | |

| (2,928,928 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Purchase of treasury stock | |

| (7,213 | ) | |

| (213,180 | ) |

| Net cash used in financing activities | |

| (7,213 | ) | |

| (213,180 | ) |

| Net decrease in cash and cash equivalents | |

| (1,088,991 | ) | |

| (4,786,042 | ) |

| Balance of cash and cash equivalents at beginning of period | |

| 14,739,933 | | |

| 21,636,860 | |

| Balance of cash and cash equivalents at end of period | |

$ | 13,650,942 | | |

$ | 16,850,818 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the periods: | |

| | | |

| | |

| Interest | |

$ | 512 | | |

$ | - | |

| Taxes | |

$ | 18,551 | | |

$ | - | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Write-off of property and equipment | |

$ | - | | |

$ | 1,475,649 | |

| Deferred tax liability associated with the acquisition of ManyCam assets | |

$ | | | |

$ | 806,493 | |

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-38717

|

| Entity Registrant Name |

PALTALK, INC.

|

| Entity Central Index Key |

0001355839

|

| Entity Tax Identification Number |

20-3191847

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

30 Jericho Executive Plaza

|

| Entity Address, Address Line Two |

Suite 400E

|

| Entity Address, City or Town |

Jericho

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11753

|

| City Area Code |

(212)

|

| Local Phone Number |

967-5120

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

PALT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

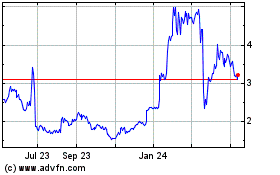

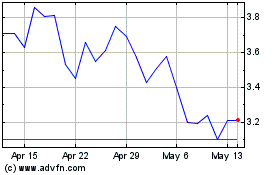

Paltalk (NASDAQ:PALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paltalk (NASDAQ:PALT)

Historical Stock Chart

From Apr 2023 to Apr 2024