SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of August, 2023

Commission File Number: 000-31215

MIND C.T.I. LTD.

(Translation of registrant's name into English)

2 HaCarmel St., Yoqneam

Ilit 2066724, Israel

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐

No ☒

If "Yes"

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

INCORPORATION BY REFERENCE

The Registrant's GAAP financial statements attached to the press release

in Exhibit 1 to this Report on Form 6-K are hereby incorporated by reference into: (i) the Registrant's Registration Statement on Form S-8, Registration No. 333-181383; (ii) the Registrant's Registration Statement on Form S-8, Registration No. 333-117054; (iii) the Registrant's

Registration Statement on Form S-8, Registration No. 333-100804; and (iv) the Registrant's Registration Statement on Form S-8, Registration

No. 333-54632.

CONTENTS

This report on Form 6-K of the registrant consists of the following

Exhibit, which is attached hereto and incorporated by reference herein:

Press Release: MIND CTI Reports Second Quarter 2023 Results

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By Order of the Board of Directors, |

| |

|

| Date: August 8, 2023 |

/s/ Monica Iancu |

| |

Title: |

Monica Iancu |

| |

|

President and Chief Executive Officer |

EXHIBIT INDEX

Exhibit Number Description of Exhibit

4

Exhibit

1

MIND

CTI Reports Second Quarter 2023 Results

Yoqneam, Israel, August 8, 2023 MIND C.T.I.

LTD. – (NasdaqGM:MNDO), a leading provider of convergent end-to-end prepaid/postpaid billing and customer care product-based solutions

for service providers, unified communications analytics and call accounting solutions for enterprises as well as enterprise messaging

solutions, today announced results for its second quarter ended June 30, 2023.

The following will summarize our major developments

in the second quarter of 2023 as well as our business. The financial results can be found in the Company News section of our website at

http://www.mindcti.com/company/news/ and in our Form 6-K.

Financial Highlights

| ● | Revenues of $5.3 million, compared with $5.2 million in the

second quarter of 2022. |

| ● | Operating income of $1.1 million, or 20% of total revenues,

compared with $1.3 million, or 25% of total revenues in the second quarter of 2022. |

| ● | Net income was $1.1 million, or $0.06 per share, compared

with $1.2 million, or $0.06 per share in the second quarter of 2022. |

| ● | New win after quarter end. |

| ● | Cash flow from operating activities in the quarter of $1.9 million, compared with $1.6 million in the

second quarter of 2022. |

Six Month Financial Highlights

| ● | Revenues of $10.7 million, compared with $10.9 million in the first six months of 2022. |

| ● | Operating income of $2.4 million, or 22% of total revenues, compared with $2.9 million or 27% of total

revenues in the first six months of 2022. |

| ● | Net income of $2.5 million, or $0.12 per share, compared with $2.7 million, or $0.14 per share in the

first six months of 2022. |

| ● | Cash flow from operating activities in the first six months of 2023 was $2.4 million, compared with $2.1

million in the first six months of 2022. |

Monica Iancu, MIND CTI CEO, commented: “We

are pleased to announce that after a very long selection process, we were chosen to supply our comprehensive billing and customer care

solution to a telecommunications customer, which operates in Europe. The new contract, closed after second quarter end, includes implementation

revenues that are expected to be recognized in the coming three quarters and additional revenues starting the second quarter of 2024,

encompassing managed services, support and license subscription.

“We continue to invest in our product suite

and we cautiously mention that we see a modest increase in search for billing solutions from telcos that are looking for system replacements.

“At the same time, we continue to promote

our online store / e-commerce platform to existing customers and potential new ones. We believe that our ongoing investment in maintaining

up-to-date technology and infrastructure with increased security and additional functionality, keep us relevant and competitive.”

Cash Position

Our cash position, including short-term deposits

and marketable securities, was $15 million as of June 30, 2023, compared with $15.1 million as of June 30, 2022.

As previously announced, the Board declared on

March 8, 2023, a cash dividend of $0.24 per share before withholding tax. The dividend sum of approximately $4.8 million was distributed

in April 2023.

Revenue Distribution for Q2 2023

Europe represented

50% (including the messaging segment revenues in Germany that represented 35%), the Americas represented 38%, and the rest of the world

represented 12% of total revenues.

Customer care and billing software totaled $2.9

million, or 54% of total revenues, enterprise messaging and payment solutions were $1.8 million, or 35% of total revenues and enterprise

call accounting software totaled $0.5 million, or 11% of total revenues.

Licenses totaled $0.1 million, or 2% of total

revenues, while maintenance and additional services were $5.1 million, or 98% of total revenues.

Revenue Distribution for the First Six Months

of 2023

Europe represented 52% (including the messaging

segment revenues in Germany that represented 37%), the Americas represented 38%, and the rest of the world represented 10% of total revenues.

Customer care and billing software totaled $5.7

million, or 53% of total revenues, enterprise messaging and payment solutions were $3.9 million, or 37% of total revenues and enterprise

call accounting software totaled $1.1 million, or 10% of total revenues.

Licenses totaled $0.3 million, or 3% of total

revenues, while maintenance and additional services were $10.4 million, or 97% of total revenues.

About MIND

MIND CTI Ltd. is a leading provider of convergent

end-to-end billing and customer care product-based solutions for service providers, unified communications analytics and call accounting

solutions for enterprises as well as enterprise messaging solutions. MIND provides a complete range of billing applications for any business

model (license, SaaS, managed service or complete outsourced billing service) for Wireless, Wireline, Cable, IP Services and Quad-play

carriers. A global company, with over twenty-five years of experience in providing solutions to carriers and enterprises, MIND operates

from offices in the United States, Romania, Germany and Israel.

Cautionary Statement for Purposes of the “Safe

Harbor” Provisions of the Private Securities Litigation Reform Act of 1995: All statements other than historical facts included in

the foregoing press release regarding the Company’s business strategy are “forward-looking statements”, including estimations

relating to the impact of the political situation in Ukraine, expectations of the results of the Company’s business optimization

initiative, integration of the company’s acquisitions and its projected outlook and results of operations. These statements are

based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements are not

guarantees of future performance, and actual results may materially differ. The forward-looking statements involve risks, uncertainties,

and assumptions, including, but not limited to, economic conditions in our key markets, as well as the risks discussed in the Company’s

annual report and other filings with the United States Securities Exchange Commission. The Company does not undertake to update any forward-looking

information.

For more information please contact:

Andrea Dray

MIND C.T.I. Ltd.

Tel: +972-4-993-6666

investor@mindcti.com

MIND C.T.I. LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months | | |

Six Months | |

| | |

Ended June 30, | | |

Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

U.S. dollars in thousands (except per share data) | |

| REVENUES | |

$ | 5,252 | | |

$ | 5,238 | | |

$ | 10,739 | | |

$ | 10,929 | |

| COST OF REVENUES | |

| 2,535 | | |

| 2,378 | | |

| 5,322 | | |

| 4,985 | |

| GROSS PROFIT | |

| 2,717 | | |

| 2,860 | | |

| 5,417 | | |

| 5,944 | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 905 | | |

| 848 | | |

| 1,805 | | |

| 1,792 | |

| Selling and marketing | |

| 299 | | |

| 286 | | |

| 564 | | |

| 433 | |

| General and administrative | |

| 439 | | |

| 417 | | |

| 668 | | |

| 786 | |

| Total operating expenses | |

| 1,643 | | |

| 1,551 | | |

| 3,037 | | |

| 3,011 | |

| OPERATING INCOME | |

| 1,074 | | |

| 1,309 | | |

| 2,380 | | |

| 2,933 | |

| FINANCIAL

INCOME (EXPENSES), net | |

| 142 | | |

| (68 | ) | |

| 290 | | |

| (61 | ) |

| INCOME BEFORE TAXES ON INCOME | |

| 1,216 | | |

| 1,241 | | |

| 2,670 | | |

| 2,872 | |

| TAXES ON INCOME | |

| 78 | | |

| 17 | | |

| 187 | | |

| 147 | |

| NET INCOME | |

$ | 1,138 | | |

$ | 1,224 | | |

$ | 2,483 | | |

$ | 2,725 | |

| | |

| | | |

| | | |

| | | |

| | |

| EARNINGS

PER SHARE - in U.S. dollars | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.06 | | |

$ | 0.06 | | |

$ | 0.12 | | |

$ | 0.14 | |

| Diluted | |

$ | 0.06 | | |

$ | 0.06 | | |

$ | 0.12 | | |

$ | 0.13 | |

| | |

| | | |

| | | |

| | | |

| | |

WEIGHTED AVERAGE NUMBER OF SHARES USED IN COMPUTATION OF EARNINGS PER SHARE - in thousands: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 20,202 | | |

| 20,105 | | |

| 20,149 | | |

| 20,086 | |

| Diluted | |

| 20,469 | | |

| 20,360 | | |

| 20,440 | | |

| 20,377 | |

MIND C.T.I. LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

U.S. dollars in thousands | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 6,125 | | |

$ | 5,265 | |

| Short-term bank deposits | |

| 8,702 | | |

| 12,040 | |

| Marketable securities | |

| 175 | | |

| 174 | |

| Accounts receivable, net | |

| 2,476 | | |

| 2,357 | |

| Other current assets | |

| 362 | | |

| 293 | |

| Prepaid expenses | |

| 276 | | |

| 169 | |

| Total current assets | |

| 18,116 | | |

| 20,298 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Accounts receivable | |

| 97 | | |

| 58 | |

| Severance pay fund | |

| 1,929 | | |

| 1,914 | |

| Deferred income taxes | |

| 147 | | |

| 143 | |

| Property and equipment, net | |

| 232 | | |

| 225 | |

| Right-of-use assets, net | |

| 820 | | |

| 946 | |

| Intangible assets, net | |

| 321 | | |

| 374 | |

| Goodwill | |

| 7,828 | | |

| 7,785 | |

| Total assets | |

$ | 29,490 | | |

$ | 31,743 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 1,057 | | |

$ | 937 | |

| Other current liabilities and accruals | |

| 1,356 | | |

| 1,978 | |

| Current maturities of lease liabilities | |

| 276 | | |

| 271 | |

| Deferred revenues | |

| 2,530 | | |

| 1,986 | |

| Total current liabilities | |

| 5,219 | | |

| 5,172 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Deferred revenues | |

| 100 | | |

| 107 | |

| Lease liabilities, net of current maturities | |

| 478 | | |

| 615 | |

| Accrued severance pay | |

| 1,936 | | |

| 1,930 | |

| Deferred income taxes | |

| 96 | | |

| 112 | |

| Total liabilities | |

| 7,829 | | |

| 7,936 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY: | |

| | | |

| | |

| Share capital | |

| 54 | | |

| 54 | |

| Additional paid-in capital | |

| 27,647 | | |

| 27,546 | |

| Accumulated other comprehensive loss | |

| (1,008 | ) | |

| (1,073 | ) |

| Accumulated deficit | |

| (4,017 | ) | |

| (1,662 | ) |

| Treasury shares | |

| (1,015 | ) | |

| (1,058 | ) |

| Total shareholders’ equity | |

| 21,661 | | |

| 23,807 | |

| Total liabilities and shareholders’ equity | |

$ | 29,490 | | |

$ | 31,743 | |

MIND C.T.I. LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Three Months | | |

Six Months | |

| | |

Ended June 30, | | |

Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

U.S. dollars in thousands | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net income | |

$ | 1,138 | | |

$ | 1,224 | | |

$ | 2,483 | | |

$ | 2,725 | |

| Adjustments to reconcile net income to net cash provided | |

| | | |

| | | |

| | | |

| | |

| by operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 51 | | |

| 43 | | |

| 100 | | |

| 89 | |

| Deferred income taxes, net | |

| (10 | ) | |

| (22 | ) | |

| (22 | ) | |

| (29 | ) |

| Accrued severance pay | |

| 12 | | |

| 16 | | |

| 19 | | |

| 10 | |

| Unrealized loss (gain) from marketable securities, net | |

| (16 | ) | |

| 18 | | |

| (1 | ) | |

| 31 | |

| Employees share-based compensation expenses | |

| 73 | | |

| 68 | | |

| 141 | | |

| 115 | |

| Changes in operating asset and liability items: | |

| | | |

| | | |

| | | |

| | |

| Decrease (increase) in accounts receivable, net | |

| 383 | | |

| (326 | ) | |

| (139 | ) | |

| (804 | ) |

| Decrease (increase) in other current assets | |

| 44 | | |

| (129 | ) | |

| (68 | ) | |

| (193 | ) |

| Decrease (increase) in prepaid expenses | |

| (23 | ) | |

| 34 | | |

| (107 | ) | |

| (15 | ) |

| Increase (decrease) in accounts payable | |

| 43 | | |

| (79 | ) | |

| 105 | | |

| 189 | |

| Decrease in other current liabilities and accruals | |

| (628 | ) | |

| (154 | ) | |

| (630 | ) | |

| (617 | ) |

| Change in operating lease liability | |

| (4 | ) | |

| (80 | ) | |

| (6 | ) | |

| (104 | ) |

| Increase in deferred revenues | |

| 795 | | |

| 993 | | |

| 537 | | |

| 698 | |

| Net cash provided by operating activities | |

| 1,858 | | |

| 1,606 | | |

| 2,412 | | |

| 2,095 | |

| | |

| | | |

| | | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | | |

| | |

| Purchase of property and equipment | |

| (2 | ) | |

| (56 | ) | |

| (44 | ) | |

| (68 | ) |

| Severance pay funds | |

| (14 | ) | |

| (15 | ) | |

| (28 | ) | |

| (32 | ) |

| Investment in marketable securities | |

| - | | |

| (797 | ) | |

| - | | |

| (797 | ) |

| Proceeds from short-term bank deposits | |

| 2,285 | | |

| 4,093 | | |

| 3,338 | | |

| 4,882 | |

| Net cash provided by investing activities | |

| 2,269 | | |

| 3,225 | | |

| 3,266 | | |

| 3,985 | |

| | |

| | | |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | | |

| | |

| Dividend paid | |

| (4,839 | ) | |

| (5,227 | ) | |

| (4,839 | ) | |

| (5,227 | ) |

| Net cash used in financing activities | |

| (4,839 | ) | |

| (5,227 | ) | |

| (4,839 | ) | |

| (5,227 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| TRANSLATION ADJUSTMENTS ON CASH AND CASH EQUIVALENTS | |

| 2 | | |

| (89 | ) | |

| 21 | | |

| (117 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| (710 | ) | |

| (485 | ) | |

| 860 | | |

| 736 | |

| BALANCE OF CASH

AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | |

| 6,835 | | |

| 5,403 | | |

| 5,265 | | |

| 4,182 | |

| BALANCE OF CASH

AND CASH EQUIVALENTS AT END OF PERIOD | |

$ | 6,125 | | |

$ | 4,918 | | |

$ | 6,125 | | |

$ | 4,918 | |

5

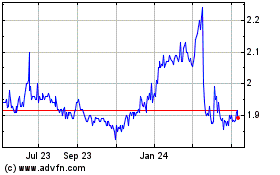

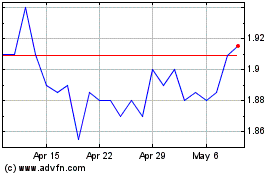

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Mar 2024 to Apr 2024

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Apr 2023 to Apr 2024