Glencore Profit Plunges on Commodity-Price Decline

August 08 2023 - 2:57AM

Dow Jones News

By Giulia Petroni

Glencore reported a drop in first-half profit after the

weakening of energy markets, inflationary pressures and limited

global economic growth contributed to the material decline of

commodity prices in the period.

The Anglo-Swiss commodity mining and trading company on Tuesday

reported net profit of $4.57 billion for the six months ended June

30 compared with $12.09 billion a year earlier.

Adjusted earnings before interest, taxes, depreciation and

amortization--a closely watched figure--decreased 50% on year to

$9.40 billion, reflecting the normalization of energy market

imbalances and volatility from 2022 levels.

Net debt stood at $1.54 billion at the end of June from $75

million at the end of last year.

Glencore said it has lifted the total 2023 shareholder returns

to around $9.3 billion through a special cash distribution of

around $1 billion and a $1.2-billion buyback program planned to run

until the release of full-year results in February 2024.

Looking ahead, the company said that moderating inflation and

supportive government policy in China across end-user sectors are

bringing a more positive macroeconomic backdrop in the second

half.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

August 08, 2023 02:42 ET (06:42 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

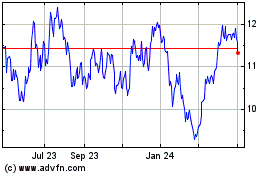

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

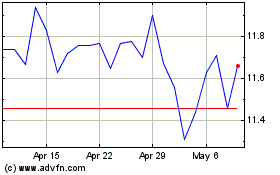

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024