Acutus Medical, Inc. (“Acutus” or the “Company”) (Nasdaq: AFIB), an

arrhythmia management company focused on improving the way cardiac

arrhythmias are diagnosed and treated, today reported results for

the second quarter of 2023.

Recent Highlights:

- Second quarter revenue

of $5.3 million grew 30% year-over-year, reflecting strong

procedure volume growth and improved capital sales

- Quarterly AcQMap

procedure volumes set a new record and increased 21% compared to

the second quarter of 2022

- Received FDA 510K

clearance for AcQMap 9 next generation software platform featuring

advanced algorithms and automation to improve diagnostic

capabilities and procedure workflow

- Significant

improvements in non-GAAP gross margin and cash burn resulting from

disciplined focus on operational excellence

“Our second quarter performance reflects

significant progress on our key strategic initiatives to return our

business to growth while driving further operational improvement.

During the second quarter of 2023, we achieved record procedure

volumes, as focused commercial execution, pull through from the

AcQMap 8.5 software launch, and the positive results from the

RECOVER AF study supported accelerated AcQMap adoption,” said David

Roman, President & CEO of Acutus Medical. “The strategic

actions we have successfully undertaken over the past year, along

with our team’s crisp execution, are driving momentum in our

business and enabling our mission to create a new paradigm for the

diagnosis and treatment of complex cardiac arrhythmias.”

Second Quarter

2023 Financial Results

Revenue was $5.3 million for the second quarter of

2023, an increase of 30% compared to $4.1 million for the second

quarter of 2022. The improvement over the same quarter last year

was primarily driven by disposables sales, higher capital

conversions, increases in service, rent and other revenue, and

sales through the Company’s distribution agreement with

Medtronic.

Non-GAAP gross margin was negative 49% for the

second quarter of 2023 compared to negative 129% for the same

quarter last year. The improvement was driven by higher production

volumes, improved product and geographic mix, lower manufacturing

variances, and a reduced manufacturing overhead structure.

Non-GAAP operating expenses were $14.5 million for

the second quarter of 2023 compared with $19.7 million in the same

quarter last year. The decrease in operating expenses resulted from

the Company’s restructuring actions in the first half of 2022,

reduced discretionary spend, and the reprioritization of certain

research and development programs.

Non-GAAP net loss for the second quarter of 2023

was $17.6 million, or $0.60 per share on a weighted average basic

and diluted outstanding share count of 29.0 million, compared

to non-GAAP net loss of $26.2 million, or $0.93 per share on a

weighted average basic and diluted outstanding share count of

28.3 million, for the second quarter of 2022.

Cash, cash equivalents, marketable securities and

restricted cash were $61.5 million as of June 30, 2023.

2023 Outlook

The company now expects full year 2023 revenue to

be in a range from $20.0-$22.0 million.

Non-GAAP Financial Measures

This press release includes references to non-GAAP

net loss and non-GAAP basic and diluted net loss per share, which

are non-GAAP financial measures, to provide information that may

assist investors in understanding the Company’s financial results

and assessing its prospects for future performance. The Company

believes these non-GAAP financial measures are important indicators

of its operating performance because they exclude items that are

primarily non-cash accounting line items unrelated to, and may not

be indicative of, the Company’s core operating results. These

non-GAAP financial measures, as Acutus calculates them, may not

necessarily be comparable to similarly titled measures of other

companies and may not be appropriate measures for comparing the

performance of other companies relative to the Company. These

non-GAAP financial results are not intended to represent and should

not be considered to be more meaningful measures than, or

alternatives to, measures of operating performance as determined in

accordance with GAAP. Non-GAAP net loss is defined as net loss

before income taxes, adjusted for stock-based compensation,

amortization of acquisition-related intangibles, employee retention

credit, goodwill impairment, restructuring charges, changes in the

fair value of contingent consideration, gain on sale of business,

loss on debt extinguishment and change in fair value of warrant

liability and other adjustments. To the extent such non-GAAP

financial measures are used in the future, the Company expects to

calculate them using a consistent method from period to period. A

reconciliation of the most directly comparable GAAP financial

measure to the non-GAAP financial measure has been provided under

the heading “Reconciliation of GAAP Results to Non-GAAP Results” in

the financial statement tables attached to this press release.

Webcast and Conference Call

Information

Acutus will host a conference call to discuss the

second quarter 2023 financial results after market close on Monday,

August 7, 2023 at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern

Time. To access the live call via telephone, please register in

advance using the link:

https://register.vevent.com/register/BI93bb82b6296f43ae9eb227af3e9a6f7f.

Upon registering, each participant will receive an email

confirmation with dial-in numbers and a unique personal PIN that

can be used to join the call. The live webinar of the call may be

accessed at https://ir.acutusmedical.com.

About Acutus

Acutus is an arrhythmia management company focused

on improving the way cardiac arrhythmias are diagnosed and treated.

Acutus is committed to advancing the field of electrophysiology

with a unique array of products and technologies which will enable

more physicians to treat more patients more efficiently and

effectively. Through internal product development, acquisitions and

global partnerships, Acutus has established a global sales presence

delivering a broad portfolio of highly differentiated

electrophysiology products that provide its customers with a

complete solution for catheter-based treatment of cardiac

arrhythmias. Founded in 2011, Acutus is based in Carlsbad,

California.

Caution Regarding Forward-Looking

Statements

This press release includes statements that may

constitute “forward-looking” statements, usually containing the

words “believe,” “estimate,” “project,” “expect” or similar

expressions. Forward-looking statements inherently involve risks

and uncertainties that could cause actual results to differ

materially from the forward-looking statements. Factors that would

cause or contribute to such differences include, but are not

limited to, the Company’s ability to continue to manage expenses

and cash burn rate at sustainable levels, continued acceptance of

its products in the marketplace, the effect of global economic

conditions on the ability and willingness of customers to purchase

the Company’s systems and the timing of such purchases, competitive

factors, changes resulting from healthcare policy in the United

States and globally including changes in government reimbursement

of procedures, dependence upon third-party vendors and

distributors, timing of regulatory approvals, the impact of the

coronavirus (COVID-19) pandemic and Acutus’ response to it and

other risks discussed in the Company’s periodic and other filings

with the Securities and Exchange Commission. By making these

forward-looking statements, Acutus undertakes no obligation to

update these statements for revisions or changes after the date of

this release, except as required by law.

|

Investor Contact: |

Media Contact: |

|

Caroline Corner |

Rhiannon Pickus |

|

Westwicke ICR |

Acutus Medical, Inc. |

|

D: 415-202-5678 |

M: 442-232-6094 |

|

caroline.corner@westwicke.com |

Rhiannon.Pickus@acutus.com |

|

ACUTUS MEDICAL, INC.Condensed Consolidated

Balance Sheets(in thousands, except per share

amounts) |

| |

| |

June 30, 2023 |

|

December 31, 2022 |

| |

(unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

23,055 |

|

|

$ |

25,584 |

|

|

Marketable securities, short-term |

|

31,461 |

|

|

|

44,863 |

|

|

Restricted cash, short-term |

|

7,002 |

|

|

|

5,764 |

|

|

Accounts receivable |

|

7,670 |

|

|

|

21,085 |

|

|

Inventory |

|

15,671 |

|

|

|

13,327 |

|

|

Employer retention credit receivable |

|

— |

|

|

|

4,703 |

|

|

Prepaid expenses and other current assets |

|

2,444 |

|

|

|

2,541 |

|

|

Total current assets |

|

87,303 |

|

|

|

117,867 |

|

| |

|

|

|

|

Property and equipment, net |

|

7,245 |

|

|

|

9,221 |

|

|

Right-of-use asset, net |

|

3,533 |

|

|

|

3,872 |

|

|

Intangible assets, net |

|

1,483 |

|

|

|

1,583 |

|

|

Other assets |

|

731 |

|

|

|

897 |

|

|

Total assets |

$ |

100,295 |

|

|

$ |

133,440 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

5,492 |

|

|

$ |

4,721 |

|

|

Accrued liabilities |

|

9,759 |

|

|

|

9,686 |

|

|

Contingent consideration, short-term |

|

— |

|

|

|

1,800 |

|

|

Operating lease liabilities, short-term |

|

466 |

|

|

|

319 |

|

|

Warrant liability |

|

2,504 |

|

|

|

3,346 |

|

|

Total current liabilities |

|

18,221 |

|

|

|

19,872 |

|

| |

|

|

|

|

Operating lease liabilities, long-term |

|

3,679 |

|

|

|

4,103 |

|

|

Long-term debt |

|

34,634 |

|

|

|

34,434 |

|

|

Other long-term liabilities |

|

20 |

|

|

|

12 |

|

|

Total liabilities |

|

56,554 |

|

|

|

58,421 |

|

| |

|

|

|

|

Commitments and contingencies |

|

|

|

| |

|

|

|

|

Stockholders' equity |

|

|

|

| Preferred stock, $0.001 par

value; 5,000,000 shares authorized as of June 30, 2023 and

December 31, 2022; 6,666 shares of the preferred stock,

designated as Series A Common Equivalent Preferred Stock, are

issued and outstanding as of June 30, 2023 and

December 31, 2022 |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value; 260,000,000 shares authorized as of June 30, 2023 and

December 31, 2022; 29,206,570 and 28,554,656 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively |

|

29 |

|

|

|

29 |

|

|

Additional paid-in capital |

|

597,578 |

|

|

|

594,173 |

|

|

Accumulated deficit |

|

(552,975 |

) |

|

|

(518,314 |

) |

|

Accumulated other comprehensive loss |

|

(891 |

) |

|

|

(869 |

) |

|

Total stockholders' equity |

|

43,741 |

|

|

|

75,019 |

|

|

Total liabilities and stockholders' equity |

$ |

100,295 |

|

|

$ |

133,440 |

|

|

ACUTUS MEDICAL, INC.Condensed Consolidated

Statements of Operations and Comprehensive Income

(Loss)(in thousands, except per share amounts) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(unaudited) |

|

Revenue |

$ |

5,289 |

|

|

$ |

4,076 |

|

|

$ |

9,458 |

|

|

$ |

7,757 |

|

|

Cost of products sold |

|

8,063 |

|

|

|

9,697 |

|

|

|

14,852 |

|

|

|

16,638 |

|

|

Gross profit |

|

(2,774 |

) |

|

|

(5,621 |

) |

|

|

(5,394 |

) |

|

|

(8,881 |

) |

| |

|

|

|

|

|

|

|

|

Operating expenses (income): |

|

|

|

|

|

|

|

|

Research and development |

|

6,799 |

|

|

|

7,935 |

|

|

|

12,916 |

|

|

|

15,938 |

|

|

Selling, general and administrative |

|

9,284 |

|

|

|

14,143 |

|

|

|

18,849 |

|

|

|

28,528 |

|

|

Goodwill impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,026 |

|

|

Restructuring |

|

463 |

|

|

|

— |

|

|

|

475 |

|

|

|

949 |

|

|

Change in fair value of contingent consideration |

|

(77 |

) |

|

|

948 |

|

|

|

123 |

|

|

|

955 |

|

|

Gain on sale of business |

|

(2,072 |

) |

|

|

(43,575 |

) |

|

|

(3,279 |

) |

|

|

(43,575 |

) |

|

Total operating expenses (income) |

|

14,397 |

|

|

|

(20,549 |

) |

|

|

29,084 |

|

|

|

14,821 |

|

|

Income (loss) from operations |

|

(17,171 |

) |

|

|

14,928 |

|

|

|

(34,478 |

) |

|

|

(23,702 |

) |

| |

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

Loss on debt extinguishment |

|

— |

|

|

|

(7,947 |

) |

|

|

— |

|

|

|

(7,947 |

) |

|

Change in fair value of warrant liability |

|

(604 |

) |

|

|

— |

|

|

|

842 |

|

|

|

— |

|

|

Interest income |

|

824 |

|

|

|

27 |

|

|

|

1,676 |

|

|

|

51 |

|

|

Interest expense |

|

(1,395 |

) |

|

|

(1,290 |

) |

|

|

(2,701 |

) |

|

|

(2,701 |

) |

|

Total other expense, net |

|

(1,175 |

) |

|

|

(9,210 |

) |

|

|

(183 |

) |

|

|

(10,597 |

) |

|

(Loss) income before income taxes |

|

(18,346 |

) |

|

|

5,718 |

|

|

|

(34,661 |

) |

|

|

(34,299 |

) |

|

Income tax benefit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net (loss) income |

$ |

(18,346 |

) |

|

$ |

5,718 |

|

|

$ |

(34,661 |

) |

|

$ |

(34,299 |

) |

| |

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

(8 |

) |

|

|

18 |

|

|

|

4 |

|

|

|

(39 |

) |

|

Foreign currency translation adjustment |

|

(85 |

) |

|

|

(387 |

) |

|

|

(26 |

) |

|

|

(553 |

) |

|

Comprehensive income (loss) |

$ |

(18,439 |

) |

|

$ |

5,349 |

|

|

$ |

(34,683 |

) |

|

$ |

(34,891 |

) |

| |

|

|

|

|

|

|

|

|

Basic net income (loss) per common share |

$ |

(0.63 |

) |

|

$ |

0.16 |

|

|

$ |

(1.20 |

) |

|

$ |

(1.22 |

) |

|

Diluted net income (loss) per common share |

$ |

(0.63 |

) |

|

$ |

0.16 |

|

|

$ |

(1.20 |

) |

|

$ |

(1.22 |

) |

| |

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

29,039,732 |

|

|

|

28,339,362 |

|

|

|

28,902,808 |

|

|

|

28,229,338 |

|

|

Diluted weighted average shares outstanding |

|

29,039,732 |

|

|

|

28,349,429 |

|

|

|

28,902,808 |

|

|

|

28,229,338 |

|

|

ACUTUS MEDICAL, INC.Condensed Consolidated

Statements of Cash Flows(in thousands) |

| |

| |

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(unaudited) |

|

Cash flows from operating activities |

|

|

|

|

Net loss |

$ |

(34,661 |

) |

|

$ |

(34,299 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation expense |

|

2,473 |

|

|

|

3,145 |

|

|

AcQMap Systems converted to sales |

|

238 |

|

|

|

110 |

|

|

Sales-type lease gain |

|

(310 |

) |

|

|

(57 |

) |

|

Amortization of intangible assets |

|

100 |

|

|

|

320 |

|

|

Non-cash stock-based compensation expense |

|

3,639 |

|

|

|

5,613 |

|

|

(Accretion of discounts) amortization of premiums on marketable

securities, net |

|

(1,037 |

) |

|

|

264 |

|

|

Amortization of debt issuance cost |

|

212 |

|

|

|

641 |

|

|

Amortization of operating lease right-of-use assets |

|

339 |

|

|

|

321 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

7,947 |

|

|

Goodwill impairment |

|

— |

|

|

|

12,026 |

|

|

Gain on sale of business, net |

|

(3,279 |

) |

|

|

(43,575 |

) |

|

Direct costs paid related to sale of business |

|

— |

|

|

|

(2,488 |

) |

|

Change in fair value of warrant liability |

|

(842 |

) |

|

|

— |

|

|

Loss on disposal of property and equipment |

|

277 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

123 |

|

|

|

955 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(204 |

) |

|

|

1,037 |

|

|

Inventory |

|

(2,344 |

) |

|

|

1,101 |

|

|

Employer retention credit receivable |

|

4,703 |

|

|

|

— |

|

|

Prepaid expenses and other current assets |

|

432 |

|

|

|

(3,592 |

) |

|

Other assets |

|

452 |

|

|

|

223 |

|

|

Accounts payable |

|

824 |

|

|

|

236 |

|

|

Accrued liabilities |

|

(1,963 |

) |

|

|

(386 |

) |

|

Operating lease liabilities |

|

(277 |

) |

|

|

(203 |

) |

|

Other long-term liabilities |

|

8 |

|

|

|

(45 |

) |

|

Net cash used in operating activities |

|

(31,097 |

) |

|

|

(50,706 |

) |

| |

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Proceeds from sale of business |

|

17,000 |

|

|

|

50,000 |

|

|

Purchases of available-for-sale marketable securities |

|

(33,880 |

) |

|

|

— |

|

|

Sales of available-for-sale marketable securities |

|

— |

|

|

|

13,099 |

|

|

Maturities of available-for-sale marketable securities |

|

48,250 |

|

|

|

27,787 |

|

|

Purchases of property and equipment |

|

(984 |

) |

|

|

(1,718 |

) |

|

Net cash provided by investing activities |

|

30,386 |

|

|

|

89,168 |

|

| |

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Repayment of debt |

|

— |

|

|

|

(44,550 |

) |

|

Penalty fees paid for early prepayment of debt |

|

— |

|

|

|

(1,074 |

) |

|

Borrowing under new debt |

|

— |

|

|

|

35,000 |

|

|

Payment of debt issuance costs |

|

— |

|

|

|

(624 |

) |

|

Proceeds from the exercise of stock options |

|

4 |

|

|

|

66 |

|

|

Repurchase of common shares to pay employee withholding taxes |

|

(263 |

) |

|

|

(45 |

) |

|

Proceeds from employee stock purchase plan |

|

25 |

|

|

|

182 |

|

|

Payment of contingent consideration |

|

— |

|

|

|

(598 |

) |

|

Net cash used in financing activities |

|

(234 |

) |

|

|

(11,643 |

) |

| |

|

|

|

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

|

(346 |

) |

|

|

(323 |

) |

| |

|

|

|

|

Net change in cash, cash equivalents and restricted cash |

|

(1,291 |

) |

|

|

26,496 |

|

|

Cash, cash equivalents and restricted cash, at the beginning of the

period |

|

31,348 |

|

|

|

24,221 |

|

|

Cash, cash equivalents and restricted cash, at the end of

the period |

$ |

30,057 |

|

|

$ |

50,717 |

|

| |

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

Cash paid for interest |

$ |

2,458 |

|

|

$ |

2,073 |

|

| |

|

|

|

| |

|

|

|

| |

Six Months Ended June 30, |

| |

|

2023 |

|

|

|

2022 |

|

| |

(unaudited) |

|

Supplemental disclosure of noncash investing and financing

activities: |

|

|

|

|

Accounts receivable from sale of business |

$ |

3,381 |

|

|

$ |

— |

|

|

Change in unrealized (gain) loss on marketable securities |

$ |

(4 |

) |

|

$ |

39 |

|

|

Change in unpaid purchases of property and equipment |

$ |

(54 |

) |

|

$ |

42 |

|

|

Contingent consideration escrow release |

$ |

— |

|

|

$ |

157 |

|

|

Net book value on AcQMap system sales-type leases |

$ |

238 |

|

|

$ |

110 |

|

|

Amount of debt proceeds allocated to warrant liability |

$ |

— |

|

|

$ |

3,379 |

|

|

Unpaid transaction costs from sale of business |

$ |

— |

|

|

$ |

429 |

|

|

Unpaid debt issuance costs |

$ |

— |

|

|

$ |

177 |

|

|

ACUTUS MEDICAL, INC.Reconciliation of GAAP

Results to Non-GAAP Results(in thousands)(unaudited) |

|

|

|

Three Months Ended June 30, 2023 |

|

Cost of Products Sold |

|

Research and Development |

|

Selling,General and Administrative |

|

Loss from Operations |

|

OtherExpense, Net |

|

Net Loss |

|

Basic andDiluted EPS |

|

|

|

Reported |

|

$ |

8,063 |

|

|

$ |

6,799 |

|

|

$ |

9,284 |

|

|

$ |

(17,171 |

) |

|

$ |

(1,175 |

) |

|

$ |

(18,346 |

) |

|

$ |

(0.63 |

) |

|

|

|

Amortization of acquired intangibles |

|

|

(50 |

) |

|

|

— |

|

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

50 |

|

|

|

0.00 |

|

|

|

|

Stock-based compensation |

|

|

(153 |

) |

|

|

(336 |

) |

|

|

(1,245 |

) |

|

|

1,734 |

|

|

|

— |

|

|

|

1,734 |

|

|

|

0.06 |

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

463 |

|

|

|

— |

|

|

|

463 |

|

|

|

0.02 |

|

|

|

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

604 |

|

|

|

604 |

|

|

|

0.02 |

|

|

|

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(77 |

) |

|

|

— |

|

|

|

(77 |

) |

|

|

0.00 |

|

|

|

|

Gain on sale of business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,072 |

) |

|

|

— |

|

|

|

(2,072 |

) |

|

|

(0.07 |

) |

|

|

|

Adjusted |

|

$ |

7,860 |

|

|

$ |

6,463 |

|

|

$ |

8,039 |

|

|

$ |

(17,073 |

) |

|

$ |

(571 |

) |

|

$ |

(17,644 |

) |

|

$ |

(0.60 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2022 |

|

Cost of Products Sold |

|

Research and Development |

|

Selling,General and Administrative |

|

Income (Loss) fromOperations |

|

OtherExpense, Net |

|

Net Income (Loss) |

|

Net income allocated to common stockholders |

|

Basic and Diluted EPS |

|

Reported |

|

$ |

9,697 |

|

|

$ |

7,935 |

|

|

$ |

14,143 |

|

|

$ |

14,928 |

|

|

$ |

(9,210 |

) |

|

$ |

5,718 |

|

|

$ |

4,521 |

|

|

$ |

0.16 |

|

|

Amortization of acquired intangibles |

|

|

(155 |

) |

|

|

— |

|

|

|

(5 |

) |

|

|

160 |

|

|

|

— |

|

|

|

160 |

|

|

|

160 |

|

|

|

0.01 |

|

|

Stock-based compensation |

|

|

(225 |

) |

|

|

(554 |

) |

|

|

(1,802 |

) |

|

|

2,581 |

|

|

|

— |

|

|

|

2,581 |

|

|

|

2,581 |

|

|

|

0.09 |

|

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

948 |

|

|

|

— |

|

|

|

948 |

|

|

|

948 |

|

|

|

0.03 |

|

|

Gain on sale of business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(43,575 |

) |

|

|

— |

|

|

|

(43,575 |

) |

|

|

(43,575 |

) |

|

|

(1.54 |

) |

|

Loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,947 |

|

|

|

7,947 |

|

|

|

7,947 |

|

|

|

0.28 |

|

|

Net income allocated to participating securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,197 |

|

|

|

0.04 |

|

|

Adjusted |

|

$ |

9,317 |

|

|

$ |

7,381 |

|

|

$ |

12,336 |

|

|

$ |

(24,958 |

) |

|

$ |

(1,263 |

) |

|

$ |

(26,221 |

) |

|

$ |

(26,221 |

) |

|

$ |

(0.93 |

) |

ACUTUS MEDICAL, INC.Key

Business Metrics(unaudited)

Installed Base and Procedure

Volumes

The total installed base which includes AcQMap

Systems as of June 30, 2023 and 2022 are as follows:

| |

As of June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Acutus |

|

|

|

|

|

|

|

|

U.S. |

|

27 |

|

|

|

37 |

|

|

Outside the U.S. |

|

51 |

|

|

|

38 |

|

|

Total Acutus net system placements |

|

78 |

|

|

|

75 |

|

Procedure volumes for the three and six months

ended June 30, 2023 and 2022 are as follows:

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Procedure volumes |

|

584 |

|

|

|

481 |

|

|

|

1,035 |

|

|

|

948 |

|

Revenue

The following table sets forth the Company’s

revenue for disposables, systems and service/other for the three

and six months ended June 30, 2023 and 2022 (in

thousands):

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Disposables |

$ |

3,914 |

|

|

$ |

3,334 |

|

|

$ |

7,340 |

|

|

$ |

6,545 |

|

|

Systems |

|

691 |

|

|

|

346 |

|

|

|

691 |

|

|

|

346 |

|

|

Service / other |

|

684 |

|

|

|

396 |

|

|

|

1,427 |

|

|

|

866 |

|

|

Total revenue |

$ |

5,289 |

|

|

$ |

4,076 |

|

|

$ |

9,458 |

|

|

$ |

7,757 |

|

The following table presents revenue by geographic

location for the three and six months ended June 30, 2023 and

2022 (in thousands):

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

United States |

$ |

3,125 |

|

|

$ |

2,037 |

|

|

$ |

5,373 |

|

|

$ |

4,060 |

|

|

Outside the United States |

|

2,164 |

|

|

|

2,039 |

|

|

|

4,085 |

|

|

|

3,697 |

|

|

Total revenue |

$ |

5,289 |

|

|

$ |

4,076 |

|

|

$ |

9,458 |

|

|

$ |

7,757 |

|

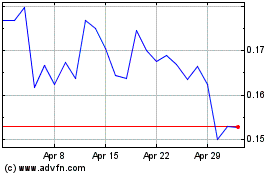

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

From Apr 2023 to Apr 2024