0001084267

false

--12-31

0001084267

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): July

31, 2023

MOBIQUITY

TECHNOLOGIES, INC.

(Exact Name of Registrant

as Specified in Its Charter)

| New York |

|

001-41117 |

|

11-3427886 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

35 Torrington Lane

Shoreham, New York |

|

11786 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (516) 246-9422

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act: Common Stock, $0.0001 par value per share; Common Stock Purchase Warrants.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On July 31, 2023, Mobiquity

Technologies, Inc (the “Company”) was notified that the Hearing Panel of The Nasdaq Stock Market has given a grace period

until October 31,2023 to regain compliance of the bid price of its common stock closing at $1.00 per share or more for a minimum of ten

consecutive business days and a grace period until November 14, 2023 to regain shareholder equity of at least $2.5 million. In order to

meet the minimum bid requirement, we have filed a certificate of amendment to our restated certificate of incorporation to effectuate

a reverse stock split of 1-for-15 shares of our issued and outstanding common stock. Trading of our common stock on a post-split basis

will commence at market open on August 7, 2023. All new share certificates issued will be rounded up to the nearest whole number in lieu

of issuing fractional common shares. See Items 5.03 and 8.01 below.

There can be no assurance

that the Company’s reverse stock split will accomplish the goal of regaining compliance of the bid price of its common stock closing

at $1.00 per share or more for a minimum of ten consecutive business days prior to October 31, 2023. Further, while our shareholder equity

at June 30, 2023 was over $2.9 million, there can be no assurances that the shareholder equity requirement will remain over $2.5 million

at November 14, 2023.

If the Company’s common

stock is delisted, it could be more difficult to buy or sell the Company’s common stock or to obtain accurate quotations, and the

price of the Company’s common stock could suffer a material decline. Delisting could also impair the Company’s ability to

raise capital.

Forward-Looking Statements

This current report contains

“forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements can

be identified by words such as “projects,” “may,” “will,” “could,”

“would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “plans,” “potential,” “promise”

or similar references to future periods. Examples of forward-looking statements in this current report include, without limitation, statements

regarding the Company’s intent or ability to regain compliance with the minimum stockholders’ equity requirement, the Company’s

intention to appeal the Staff’s determination, the Company’s expectation that a request for a Panel hearing would stay delisting

of its common stock pending the conclusion of the hearing process, the timing of any hearing before the Panel, whether the Company will

require an oral or written hearing, the outcome of the Panel’s review of any Company appeal of the Staff’s determination,

and any courses of action to regain compliance with the Nasdaq Capital Market’s continued listing requirements. Forward-looking

statements are statements that are not historical facts, nor assurances of future performance. Instead, they are based on the Company’s

current beliefs, expectations and assumptions regarding the future of its business, future plans, strategies, projections, anticipated

events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent risks and uncertainties, and actual results may differ materially from those set forth in the forward-looking statements.

Important factors that could cause actual results to differ include, without limitation, there can be no assurance that the Company will

meet the stockholders’ equity requirement during any compliance period or otherwise in the future, otherwise meet Nasdaq’s

compliance standards, that Nasdaq will grant the Company any relief from delisting as necessary or whether the Company can ultimately

meet applicable Nasdaq requirements for any such relief, and the other important factors described under the caption “Risk Factors”

in (a) the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”)

on November 7, 2022, and (b) the Company’s Annual Report on Form 10-K filed with the SEC on March 31, 2023 and its other filings

with the SEC. Any forward-looking statement made by the Company in this current report is based only on information currently available

and speaks only as of the date on which it is made. Except as required by applicable law, the Company expressly disclaims any obligation

to publicly update any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

| Item 3.03. |

Material Modification to Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K,

the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On August 2, 2023, Mobiquity Technologies, Inc.

(the “Company”) filed a Certificate of Amendment (the “Certificate of Amendment”) to the Company’s Certificate

of Incorporation with the Secretary of State of the State of New York to effect a 1-for-15 reverse stock split (the “Reverse Stock

Split”) of the outstanding shares of the Company’s Common Stock, par value $0.0001 per share (the “Common Stock”).

As previously reported, on July 21,2023, the Company

held a special meeting of stockholders, at which the Company’s shareholders approved an amendment to the Certificate of Incorporation

to effect a reverse stock split of the Common Stock at a ratio of not less than 1-for-2 and not more than 1-for-15, with the exact ratio

to be set within that range at the discretion of the Company’s Board of Directors (the “Board”). On July 28, 2023, the

Board approved the implementation of the Reverse Stock Split at a ratio of 1-for-15.

As a result of the Reverse Stock Split, every

15 shares of issued and outstanding shares of Common Stock were automatically combined into one issued and outstanding share of Common

Stock. No fractional shares will be issued as a result of the Reverse Stock Split. Shareholders who would otherwise be entitled to a fractional

share of Common Stock due to the Reverse Stock Split are instead entitled to receive one whole share in lieu of such fractional shares.

The Reverse Stock Split reduces to number of issued and outstanding shares of Common Stock from 38,611,261 shares to 2,574,085 shares,

subject to adjustment due to rounding up any fractional shares which holders would be entitled to receive on account of the Reverse Stock

Split to whole shares. The Reverse Stock Split affects all Common Stock holders uniformly and does not alter any shareholder’s percentage

interest in the Company’s outstanding Common Stock, except for adjustments that may result from the treatment of fractional shares.

The Reverse Stock Split does not change the par value of the Common Stock or the authorized number of shares of Common Stock.

The foregoing summary of the Certificate of Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy

of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

The Company today issued a

press release announcing the Reverse Stock Split. The Reverse Stock Split is designed to maintain the Company's compliance with the minimum

bid price requirement for listing its Common Stock on The Nasdaq Capital Market ("Nasdaq"). Mobiquity Technology's Common Stock

will begin trading on Nasdaq on a split-adjusted basis as of the market open on August 7, 2023. The new CUSIP number for the Common Stock

following the Reverse Stock Split will be 60743F607 The trading symbol for the Common Stock will remain “MOBQ”. A copy of

the press release containing this information is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

As a result of the Reverse

Stock Split, the Mobiquity Technologies Common Stock Purchase Warrants which trade on Nasdaq under the symbol “MOBQW” will

be exercisable on the basis of 15 warrants for one share of Common Stock at an exercise price of $74.70 per share.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: August 4, 2023 |

MOBIQUITY TECHNOLOGIES, INC. |

| |

|

| |

|

| |

By: /s/ Dean L. Julia |

| |

Dean L. Julia, Chief Executive Officer |

Exhibit 3.1

STATE OF N E W YORK DEPARTMENT OF STATE I hereby certify that the annexed copy for MOBIQUITY TECHNOLOGIES, INC., File Number 230802003712 has been compared with the original document in the custody of the Secretary of State and that the same is true copy of said original. WITNESS my hand and official seal of the Department of State, at the City of Albany, on August 02 , 2023 . Brendan C. Hughes Executive Deputy Secretary of State Authentication Number: 100004061330 To Verify the authenti city of this document you may access the Division of Corporation's Document Authentication Website at htt p :/ /ecorp do s. nv.gov

CERTIFICATE OF AMENDMENT OF THE CERTIFICATE OF INCORPORATION OF MOBIQUITV TECHNOLOGIES, INC. Under Section 805 of the Business Corporation Law IT IS HEREBY CERTIFIED THAT: I. The nwne of the corporation is MOBIQUITY TECHNOLOGIES, INC. 2 . The certificate of inoorporation was Ii led by the New York Department of State on the 26 "' day of March 1998 under the Corporation's original name Ace Marketing & Promotions, Inc . , (the "Certificate of Incorporation") . J . Upon filing of this Certificate of Amendment to the Certificate oflncorporation (the "Effective Time") . the corporation shall effect a one - for - fifteen reverse split of its issued and outstanding shares of common stock, par value 0 . 0001 per share . Immediately prior to the Effective Time 38 , 611 , 261 shares of common stock, par value $ 0 . 000 I per share, are issued and outstanding, and 61 , 388 , 739 shares of common stock, par value $ 0 . 0001 per share, arc w,issued . As a result of the reverse stock split, at the Effective Time, 2 , 574 , 085 shares of common stock, par value $ 0 . 0001 per share, shall be issued and outstanding, and 97 , 425 , 915 shares of common stock, par value $ 0 . 0001 per share, shall be unissued (subject toadjustment due torounding up any frnctional shares which holders would be entitled to receive on account of the reverse stock split to whole shares) . 4 . At the Effective Time, the Certificate of Incorporation is further amended to add a new Section 8 to Article FOURTH which shall read as follows : "Pursuant to the Business Corporation Law of the State of New York, at the Effective Time each fifteen ( 15 ) shares of the corporation's common stock, par value $ 0 . 0001 per share, issued and outstanding immediately prior tothe Effective Time (the "Old Shares") shall automatically be combined into one (I) validly issued, fully paid and non - assessable share of common stock, par value $ 0 . 0001 per share, without any funher action by the corporation or the holder thereof, subject to the treatment of fractional share interests as described below (the "Reverse Stock Split") . The corporation shall not issue fractional shares in connection with the Reverse Stock Split . Holders of Old Shares who would otherwise be entitled to receive a fraction of a share on account of the Reverse Stock Split shall have their fractional share rounded up to the nearest whole number as of the Effective Time . " 4 . This Certificate of Amendment was duly adopted in accordance with Section 803 ofthe Business Corporation Law ofthe State of New York (the"BCL") by the Board of Directors of the corporation by unanimous written consent of the Board of Directors of the corporation pursuant to Section 708 (b) of the BCL, and by the combined (a) affirmative vote of theholders ofa majority of all outstanding shares of Common Stock entitled t() vote thereon, and (b) the holder of all the outstanding shares of the Series F Preferred Stock entitled lo vote thereon voting a majority of the votes thereof in the aflirmalive, in accordance with Section 803 (a) of the BCL . IN WITNESS WHEREOF, the undersigned hereby affirms that statements made herein are true and under penalties of perjury. Dated: August 2, 2023 Isl Dean L. Julia Dean L. Julia, CEO Filed with the NYS Department of State on 08/01/2023 Filing Nwnber: 230802003712 DOS ID: 2243131

CSC - 45 CERTIFICATE OF AMENDMENT OF CERTIFICATE OF INCORPORATION OF MOBIQUITY TECHNOLOGIES, INC. Under Section 805 of the Business Corporation Law. Filed by: Ruskin Moscou Faltischek, P.C. 1425 RXR Plaz.a Uniondale, NY 11556 REF# 912024 9AM Filed with the NYS Department of State on 08/01/2023 Filing Number: 230802003712 DOS ID: 2243131

Exhibit 99.1

Mobiquity Technologies, Inc. Announces Reverse Stock Split and Extension

from Nasdaq Hearings Panel

NEW YORK, August 4, 2023 (GLOBE NEWSWIRE) -- Mobiquity Technologies,

Inc. (Nasdaq: MOBQ), a leading provider of next-generation data intelligence and advertising technology solutions, announces that it is

implementing a 1-for-15 reverse stock split ("reverse split") of its common stock.

The reverse split is designed to maintain the Company's compliance

with the minimum bid price requirement for listing its common stock on The Nasdaq Capital Market ("Nasdaq"). The Company filed

an Amendment to its Certificate of Incorporation to effectuate the reverse split with the New York Secretary of State on August 2, 2023.

Mobiquity Technology's common stock will begin trading on Nasdaq on a split-adjusted basis as of the market open on August 7, 2023, under

the same "MOBQ" symbol. The new CUSIP number for the common stock following the reverse split will be 60743F607.

As previously disclosed on June 1, 2023, the Company received a delist

letter from Nasdaq, stating non-compliance with the minimum $2,500,000 stockholders' equity requirement for continued listing, as specified

in Nasdaq Listing Rule 5550(b). In response, the Company promptly requested a hearing with Nasdaq to present its plan to regain compliance.

Prior to the Nasdaq Hearing held on July 27, 2023, Mobiquity Technologies

filed its second quarter Quarterly Report on Form 10-Q, demonstrating compliance with Listing Rule 5550(b) by exhibiting stockholders'

equity exceeding the required $2,500,000. On July 31, 2023, the Company received a decision letter from the Nasdaq Hearings Panel, granting

the requested extension through November 14, 2023, to demonstrate long-term compliance with stockholders' equity requirements.

In response to this positive development, Mobiquity's CEO, Dean Julia,

expressed gratitude to the Nasdaq Hearings Panel for providing the Company with the opportunity to present their long-term compliance

plan and for granting the requested extension. Julia stated, "We are also happy to let our shareholders know that we will continue

to trade on the Nasdaq Stock Market while we execute our plan. The Company remains committed to delivering value to our shareholders and

maintaining our position as a superior provider of data intelligence and advertising technology solutions.

About Mobiquity Technologies:

Mobiquity Technologies, Inc. (Nasdaq: MOBQ) is a leading provider of next-generation data intelligence and

advertising technology solutions. The Company's innovative offerings empower businesses to unlock valuable insights and drive successful

advertising campaigns in today's dynamic market. Mobiquity Technologies’ current platforms; Advangelists (www.advangelists.com)

and MobiExchange (www.mobiexchange.com) provide programmatic advertising technologies, data insights on consumer behavior, automated ad

copy and omni-channel delivery options. For more information, please visit: www.mobiquitytechnologies.com.

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the "safe harbor" provisions of the

U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company's

beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases, forward-looking

statements can be identified by words or phrases such as "may," "will," "expect," "anticipate,"

"target," "aim," "estimate," "intend," "plan," "believe," "potential,"

"continue," "is/are likely to" or other similar expressions. Further information regarding these and other risks,

uncertainties or factors is included in the Company's filings with the SEC. All information provided in this press release is as of the

date of this press release, and the Company does not undertake any duty to update such information, except as required under applicable

law.

Mobiquity Technologies, Inc. Investor Relations:

Columbia Marketing Group

Email: john@TheColumbiaMarketingGroup.com

Phone: 646-736-1900

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

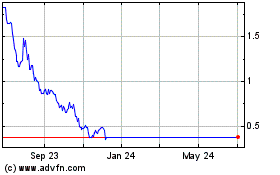

Mobiquity Technologies (NASDAQ:MOBQ)

Historical Stock Chart

From Apr 2024 to May 2024

Mobiquity Technologies (NASDAQ:MOBQ)

Historical Stock Chart

From May 2023 to May 2024