0000934549FALSE00009345492023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 3, 2023

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37721 | 95-4405754 |

(State or other jurisdiction of

incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

| 767 Third Avenue, | |

| 6th Floor | |

| New York, | |

| NY | 10017

|

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code): (332) 236-8500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ACTG | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02.Results of Operations and Financial Condition.

On August 3, 2023, Acacia Research Corporation (the “Corporation) issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of that release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

The information contained within this Report and the exhibit attached hereto as Exhibit 99.1 are being furnished pursuant to Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section. The information in this Report and the exhibit attached hereto as Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, regardless of any general incorporation by reference language in such filings, except as shall be expressly set forth by specific reference in such filing.

Item 9.01.Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: August 3, 2023 | |

| ACACIA RESEARCH CORPORATION |

| |

| By: | /s/ Martin D. McNulty Jr. |

| Name: | Martin D. McNulty Jr. |

| Title: | Interim Chief Executive Officer |

Exhibit 99.1

Acacia Research Reports Second Quarter 2023 Financial Results

New York, NY, August 3, 2023 - Acacia Research Corporation (Nasdaq: ACTG) (“Acacia” or the “Company”) today reported financial results for the three and six months ended June 30, 2023.

Key Business Highlights

•On July 13, 2023, completed its recapitalization transaction with Starboard Value LP, and as part of this transaction:

◦Starboard converted 350,000 shares of Acacia’s Series A Convertible Preferred Stock into 9,616,746 shares of Common Stock, including 27,704 shares of Common Stock issued in respect of accrued and unpaid dividends.

◦Starboard also exercised 31,506,849 of the Company’s Series B Warrants (the “Series B Warrants”) through a combination of a “Note Cancellation” and a “Limited Cash Exercise” for an aggregate total of 31,506,849 shares of Common Stock

◦Pursuant to the Series B Warrants exercise, the Company cancelled $60 million aggregate principal amount of senior secured notes held by Starboard and received aggregate gross proceeds of approximately $55 million.

◦As a result of the Recapitalization Transactions, Starboard holds 61,123,595 shares of Common Stock, representing approximately 61.2% of Acacia’s Common Stock

•Generated $7.9 million in consolidated revenue for the quarter compared to $16.7 million in revenue in the second quarter of 2022.

•Recorded $1.4 million of net realized and unrealized losses during the quarter.

Second Quarter 2023 Financial Highlights

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| Intellectual property operations | $ | 0.4 | | | $ | 8.1 | | | $ | 4.6 | | | $ | 10.7 | |

| Industrial operations | 7.5 | | | 8.7 | | | 18.1 | | | 19.5 | |

| Total revenues | $ | 7.9 | | | $ | 16.7 | | | $ | 22.7 | | | $ | 30.2 | |

| Operating loss | $ | (12.5) | | | $ | (5.7) | | | $ | (21.9) | | | $ | (14.2) | |

Unrealized gains (losses) 1 | $ | 6.6 | | | $ | (57.6) | | | $ | 10.0 | | | $ | (229.9) | |

| Realized (losses) gains | $ | (8.0) | | | $ | 11.5 | | | $ | (9.4) | | | $ | 78.4 | |

Non-cash derivative liability (losses) gains 2 | $ | (9.9) | | | $ | (35.1) | | | $ | 6.7 | | | $ | (7.0) | |

| GAAP Net loss | $ | (18.8) | | | $ | (61.5) | | | $ | (9.3) | | | $ | (134.8) | |

| GAAP Diluted loss per share | $ | (0.36) | | | $ | (1.44) | | | $ | (0.26) | | | $ | (3.06) | |

| | | | | | | |

1 Unrealized gains and (losses) are related to the change in fair value of equity securities as of the end of the reported period. |

2 The non-cash derivative liability gains and (losses) are related to the change in fair value of Acacia’s Series A and B warrants and embedded derivatives. |

Martin D. McNulty, Jr. “MJ”, Interim Chief Executive Officer, stated, “We successfully completed the recapitalization transaction with Starboard Value LP, which follows on the heels of our transformation of Acacia by revamping our processes for identifying and pursuing transactions and establishing the framework to support acquisitions of both public and private companies. I am confident that we have the right team and processes in place, along with incentives to create

value. Our pipeline of acquisition targets has grown and matured, and we are methodically advancing specific opportunities.”

“We have a number of late-stage targets in our pipeline, and we are optimistic about our prospects,” continued Mr. McNulty. “Predicting the specific timing of deals remains impossible, and we maintain rigor in our processes, but I am confident in the progress. Additionally, we have successfully enhanced operations at Printronix.”

Second Quarter 2023 Financial Summary:

•Total revenues were $7.9 million, compared to $16.7 million in the same quarter last year.

◦Printronix generated $7.5 million in revenue during the quarter, compared to $8.7 million in the same quarter last year.

◦The Intellectual Property business generated $394,000 in licensing and other revenue during the quarter, compared to $8.1 million in the same quarter last year.

•General and administrative expenses were $9.4 million, compared to $10.7 million in the same quarter of last year due to the decrease in personnel costs and compensation costs related to reduced headcount.

•Operating loss of $12.5 million, compared to an operating loss of $5.7 million in the same quarter of last year, with the increase due to lower revenues generated.

◦Printronix contributed $513,000 in operating loss which included $774,000 of non-cash depreciation and amortization expense.

•GAAP net loss of $18.8 million, or a loss of $0.36 per diluted share, compared to GAAP net loss of $61.5 million, or $1.44 per diluted share, in the second quarter of last year.

◦Net loss included $8.0 million in realized losses and $6.6 million in unrealized gains related to the increase in share price of certain holdings.

◦The Company recognized non-cash expense of $9.9 million related to the change in fair value of the Starboard Series B warrants and embedded derivative liabilities in the Series A Preferred Stock. The change in fair value was primarily due to the increase in stock price.

◦The second quarter included $2.4 million in non-recurring charges related to severance, legal and other professional fees associated with the separation from our former CEO, and other non-recurring charges.

Life Sciences Portfolio

Acacia has generated $504.3 million in proceeds from sales and royalties of the Life Sciences Portfolio through June 30, 2023, which was purchased for an aggregate price of $301.4 million. At the end of the second quarter, the remaining positions in the Life Sciences Portfolio represent $67.9 million in book value:

•Acacia continues to hold 33.0 million shares of Arix Bioscience plc (LSE: ARIX), valued at $42.2 million.

•Acacia holds interests in three private companies, valued at an aggregate of $25.7 million, net of non-controlling interest, including a 26% interest in Viamet Pharmaceuticals, Inc., a 18% interest in AMO Pharma, and a 4% interest in NovaBiotics. Values are based on cost or equity accounting.

Balance Sheet and Capital Structure

•Cash, cash equivalents and equity investments measured at fair value totaled $408 million at June 30, 2023 compared to $349.4 million at December 31, 2022. The increase in cash was primarily due to the completed Rights Offering and concurrent Private Rights Offering.

•Equity securities without readily determinable fair value totaled $5.8 million at June 30, 2023, which amount was unchanged from December 31, 2022.

•Investment securities representing equity method investments totaled $19.9 million at June 30, 2023 (net of noncontrolling interests), which amount was unchanged from December 31, 2022. Acacia owns 64% of MalinJ1, which results in a 26% ownership stake in Viamet Pharmaceuticals, Inc. for Acacia.

•Total indebtedness, which represents the Senior Secured Notes issued to Starboard, was $60.5 million at June 30, 2023.

•The Company’s book value totaled $335.4 million, or $5.71 per share, at June 30, 2023, compared to $269.3 million, or $6.19 per share, at December 31, 2022. Acacia’s book value reflects the balance of the warrant and embedded derivative liabilities, which were subsequently extinguished on July 13, 2023 as part of the recapitalization transaction. An as adjusted book value analysis can be found below.

•Assuming the full impact of the recent completed Recapitalization Transactions with Starboard, as adjusted to give effect to the transactions as if they had been completed as of June 30, 2023, Acacia’s adjusted book value would decline to $502.2 million, or $5.03 per share.

As Adjusted Book Value and Changes to Derivative Valuations

At June 30, 2023, book value was $335.4 million and there were 58.8 million shares of common stock outstanding, for a book value per share of $5.71, compared to $269.3 million, or $6.19 per share at December 31, 2022. The decrease in book value per share since December 31, 2022 is due to the $5.25 per share price of shares issued in the Rights Offering and concurrent private Rights Offering. Total liabilities for warrants and convertible preferred stock to be eliminated upon exercise or expiration of all such warrants and convertible preferred stock were $94.9 million at June 30, 2023.

Book value and book value per share calculations are performed in accordance with GAAP. The calculation of book value under GAAP requires the Company to reflect the impact of liabilities associated with issuances of shares related to the exercise of the Company’s Series B warrants and conversion of the Company’s Series A preferred stock. The value of those liabilities varies over time based on fluctuations in the trading price of the Common Stock. The previously announced agreement reached with Starboard to streamline the Company’s capital structure and strengthen its financial position (the “recapitalization transactions”) eliminated all of these instruments and the associated liabilities.

Management believes that providing investors with a presentation of adjusted book value and adjusted book value per share that reflect the impact of the completion of each component of the recapitalization transactions (as adjusted to give effect to the transaction as if they had been completed as of June 30, 2023) may assist investors in understanding the Company’s financial condition and capital structure (see below for a description of the material components of the recapitalization transactions). However, these adjusted calculations have limitations and should not be considered in isolation or as a substitute for the actual book value and book value per share amounts reflected in the Company’s balance sheet at June 30, 2023. These adjusted calculations have been presented for informational purposes only and do not purport to project the future financial position of the Company.

Book value at June 30, 2023 reflects the following:

•$60.0 million in principal amount of Senior Secured Notes issued to Starboard;

•$35.0 million in face value ($23.2 million in book value) of Series A preferred stock issued to Starboard; and

•$94.9 million of warrants and embedded derivative liabilities associated with all preferred stock and warrants held by Starboard.

In connection with the recently completed recapitalization transactions with Starboard, which occurred on July 13, 2023:

•In the first quarter of 2023, Starboard purchased 15.0 million new shares in a private Rights Offering, at $5.25 per share, for total proceeds of $78.8 million;

•$35.0 million in face value of Series A preferred stock was eliminated, and 9.6 million shares of common stock were issued in Q3 2023;

•$60.5 million of liabilities attributable to the Senior Secured Notes were converted into equity, and Starboard invested an additional $55.0 million in cash related to the Series B warrant exercise, and 31.5 million shares of common stock was issued in Q3 2023;

•$94.9 million of total warrant and embedded derivative liabilities attributable to the Series B warrants and Series A preferred stock was eliminated in Q3 2023;

•Acacia paid Starboard a total of $66.0 million, representing a negotiated settlement of the foregone time value of the Series B warrants and the Series A preferred stock (which amount was paid through a reduction in the exercise price of the Series B Warrants) in Q3 2023; and

•Acacia incurred approximately $250,000 in transaction costs associated with the consummation of the recapitalization transactions.

The completion of the recapitalization transactions resulted in an incremental $166.8 million increase in book value, and an incremental 41.1 million increase in shares outstanding. Adjusted book value as adjusted to give effect to the transaction as if it had been completed on June 30, 2023 would be $502.2 million, and diluted shares outstanding would be 99.9 million, resulting in adjusted book value per share of $5.03 at June 30, 2023.

See Attachment A which illustrates the sequential impact of each component of the recapitalization transactions on book value and book value per share as adjusted to give effect to the transactions as if they had been completed on June 30, 2023.

In previous quarterly reports, prior to the approval of the recapitalization transactions, Acacia had presented a similar adjusted book value per share calculation assuming the exercise of all outstanding Series A and Series B warrants, as well

as the conversion of the Series A preferred stock. This resulted in a reported adjusted book value per share of $5.10 at March 31, 2023, $5.18 at December 31, 2022, $5.22 at September 30, 2022, $5.87 at June 30, 2022, $5.91 at March 31, 2022 and $6.51 at December 31, 2021. The $5.25 per share cash exercise feature of 68.5 million Series B warrants expired on October 28, 2022 and 5.0 million $3.65 per share Series A warrants were exercised on November 1, 2022.

Investor Conference Call

The Company will host a conference call today, August 3, 2023 at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time).

To access the live call, please dial 888-506-0062 (U.S. and Canada) or 973-528-0011 (international) and if requested, reference conference ID 435061. The conference call will also be simultaneously webcasted on the investor relations section of the Company’s website at http://www.acaciaresearch.com under Events & Presentations. Following the conclusion of the live call, a replay of the webcast will be available on the Company's website for at least 30 days.

About the Company

Acacia is an opportunistic capital platform with a strategy to purchase businesses based on the differentials between public and private market valuations. Acacia leverages its (i) disciplined focus on identifying opportunities where it can be an advantaged buyer, initiate a transaction opportunity spontaneously, avoid a traditional sale process and complete the purchase of a business, division or other asset at an attractive price, (ii) willingness to invest across industries and in off-the-run, often misunderstood assets that suffer from a complexity or multi-factor discount, (iii) relationships and partnership abilities across functions and sectors, and (iv) strong expertise in corporate governance and operational transformation. Acacia seeks to identify opportunities where it believes it is an advantaged buyer, where it can avoid structured sale processes and create the opportunity to purchase businesses, divisions and/or assets of companies at an attractive price due to Acacia’s unique capabilities, relationships or expertise, or Acacia believes the target would be worth more to it than to other buyers. Acacia operates its businesses based on three key principles of people, process and performance and has built a management team with demonstrated expertise in research, transactions and execution, and operations and management. Additional information about Acacia and its subsidiaries is available at www.acaciaresearch.com.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon the Company’s current expectations and speak only as of the date hereof. This news release attempts to identify forward-looking statements by using words such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” or other forms of these words or similar words or expressions or the negative thereof, although not all forward-looking statements contain these terms. The Company’s actual results may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, including the Company’s ability to successfully implement its strategic plan, changes to our relationship and arrangements with Starboard Value LP, the ability to successfully identify and complete strategic acquisitions of businesses, divisions, and/or assets, the ability to successfully develop licensing programs and attract new business, changes in demand for current and future intellectual property rights, legislative, regulatory and competitive developments addressing licensing and enforcement of patents and/or intellectual property in general, the decrease in demand for Printronix' products, general economic conditions, and the success of the Company’s investments. The Company’s Annual Report on Form 10-K, and other SEC filings discuss these and other important risks and uncertainties that may affect the Company’s business, results of operations and financial condition. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

The results achieved by the Company in prior periods are not necessarily indicative of the results to be achieved by us in any subsequent periods. It is currently anticipated that the Company’s financial results will vary, and may vary significantly, from quarter to quarter.

Investor Contact:

FNK IR

Rob Fink, 646-809-4048

rob@fnkir.com

ACACIA RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | |

| |

| June 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 355,188 | | | $ | 287,786 | |

| Equity securities | 52,853 | | | 61,608 | |

| Equity securities without readily determinable fair value | 5,816 | | | 5,816 | |

| Equity method investments | 30,934 | | | 30,934 | |

| | | |

| Accounts receivable, net | 6,267 | | | 8,231 | |

| Inventories | 14,006 | | | 14,222 | |

| Prepaid expenses and other current assets | 20,728 | | | 19,388 | |

| Total current assets | 485,792 | | | 427,985 | |

| | | |

| | | |

| Property, plant and equipment, net | 2,950 | | | 3,537 | |

| Goodwill | 7,541 | | | 7,541 | |

| | | |

| Other intangible assets, net | 30,590 | | | 36,658 | |

| Leased right-of-use assets | 910 | | | 2,005 | |

| | | |

| Other non-current assets | 6,925 | | | 5,202 | |

| Total assets | $ | 534,708 | | | $ | 482,928 | |

| | | |

| LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 5,789 | | | $ | 6,036 | |

| Accrued expenses and other current liabilities | 4,461 | | | 14,058 | |

| Accrued compensation | 5,505 | | | 4,737 | |

| Royalties and contingent legal fees payable | 579 | | | 699 | |

| | | |

| Deferred revenue | 1,022 | | | 1,229 | |

| Senior secured notes payable | 60,450 | | | 60,450 | |

| Total current liabilities | 77,806 | | | 87,209 | |

| | | |

| Deferred revenue, net of current portion | 535 | | | 568 | |

| | | |

| Series A embedded derivative liabilities | 12,881 | | | 16,835 | |

| Series B warrant liabilities | 82,018 | | | 84,780 | |

| Long-term lease liabilities | 898 | | | 1,873 | |

| Deferred income tax liabilities, net | 125 | | | 742 | |

| Other long-term liabilities | 1,858 | | | 1,675 | |

| Total liabilities | 176,121 | | | 193,682 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Series A redeemable convertible preferred stock, par value $0.001 per share; stated value $100 per share; 350,000 shares authorized, issued and outstanding as of June 30, 2023 and December 31, 2022; aggregate liquidation preference of $35,000 as of June 30, 2023 and December 31, 2022 | 23,154 | | | 19,924 | |

| | | |

| Stockholders' equity: | | | |

| Preferred stock, par value $0.001 per share; 10,000,000 shares authorized; no shares issued or outstanding | — | | | — | |

| Common stock, par value $0.001 per share; 300,000,000 shares authorized; 58,754,795 and 43,484,867 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 58 | | | 43 | |

| Treasury stock, at cost, 16,183,703 shares as of June 30, 2023 and December 31, 2022 | (98,258) | | | (98,258) | |

| Additional paid-in capital | 738,712 | | | 663,284 | |

| Accumulated deficit | (316,121) | | | (306,789) | |

| Total Acacia Research Corporation stockholders' equity | 324,391 | | | 258,280 | |

| | | |

| Noncontrolling interests | 11,042 | | | 11,042 | |

| | | |

| Total stockholders' equity | 335,433 | | | 269,322 | |

| | | |

| Total liabilities, redeemable convertible preferred stock, and stockholders' equity | $ | 534,708 | | | $ | 482,928 | |

ACACIA RESEARCH CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Intellectual property operations | $ | 394 | | | $ | 8,062 | | | $ | 4,570 | | | $ | 10,677 | |

| Industrial operations | 7,510 | | | 8,655 | | | 18,137 | | | 19,547 | |

| Total revenues | 7,904 | | | 16,717 | | | 22,707 | | | 30,224 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of revenues - intellectual property operations | 5,010 | | | 4,634 | | | 9,748 | | | 9,198 | |

| Cost of sales - industrial operations | 3,933 | | | 4,592 | | | 9,153 | | | 8,784 | |

| Engineering and development expenses - industrial operations | 205 | | | 145 | | | 421 | | | 335 | |

| Sales and marketing expenses - industrial operations | 1,859 | | | 2,294 | | | 3,772 | | | 4,310 | |

| General and administrative expenses | 9,426 | | | 10,722 | | | 21,466 | | | 21,775 | |

| Total costs and expenses | 20,433 | | | 22,387 | | | 44,560 | | | 44,402 | |

| Operating loss | (12,529) | | | (5,670) | | | (21,853) | | | (14,178) | |

| | | | | | | |

| Other (expense) income: | | | | | | | |

| Equity securities investments: | | | | | | | |

| Change in fair value of equity securities | 6,617 | | | (57,647) | | | 9,960 | | | (229,850) | |

| (Loss) gain on sale of equity securities | (7,999) | | | 11,498 | | | (9,360) | | | 78,374 | |

| Earnings on equity investment in joint venture | — | | | 42,085 | | | — | | | 42,085 | |

| Net realized and unrealized (loss) gain | (1,382) | | | (4,064) | | | 600 | | | (109,391) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Change in fair value of the Series A and B warrants and embedded derivatives | (9,935) | | | (35,146) | | | 6,716 | | | (7,048) | |

| Gain (loss) on foreign currency exchange | 15 | | | (1,814) | | | 95 | | | (2,627) | |

| Interest expense on Senior Secured Notes | (900) | | | (1,859) | | | (1,800) | | | (4,460) | |

| Interest income and other, net | 4,307 | | | 863 | | | 7,748 | | | 1,870 | |

| Total other (expense) income | (7,895) | | | (42,020) | | | 13,359 | | | (121,656) | |

| | | | | | | |

| Loss before income taxes | (20,424) | | | (47,690) | | | (8,494) | | | (135,834) | |

| | | | | | | |

| Income tax benefit (expense) | 1,645 | | | 200 | | | (838) | | | 15,078 | |

| | | | | | | |

| Net loss including noncontrolling interests in subsidiaries | (18,779) | | | (47,490) | | | (9,332) | | | (120,756) | |

| | | | | | | |

| Net income attributable to noncontrolling interests in subsidiaries | — | | | (14,013) | | | — | | | (14,013) | |

| | | | | | | |

| Net loss attributable to Acacia Research Corporation | $ | (18,779) | | | $ | (61,503) | | | $ | (9,332) | | | $ | (134,769) | |

| | | | | | | |

| Loss per share: | | | | | | | |

| Net loss attributable to common stockholders - Basic | $ | (21,155) | | | $ | (63,443) | | | $ | (13,962) | | | $ | (138,560) | |

| Weighted average number of shares outstanding - Basic | 58,408,711 | | | 43,988,677 | | | 53,219,152 | | | 45,259,435 | |

| Basic net loss per common share | $ | (0.36) | | | $ | (1.44) | | | $ | (0.26) | | | $ | (3.06) | |

| Net loss attributable to common stockholders - Diluted | $ | (21,155) | | | $ | (63,443) | | | $ | (13,962) | | | $ | (138,560) | |

| Weighted average number of shares outstanding - Diluted | 58,408,711 | | | 43,988,677 | | | 53,219,152 | | | 45,259,435 | |

| Diluted net loss per common share | $ | (0.36) | | | $ | (1.44) | | | $ | (0.26) | | | $ | (3.06) | |

Attachment A

The following table illustrates the sequential impact of each component of the recapitalization transactions on book value as of June 30, 2023 on an as adjusted basis to give effect to each such component of the recapitalization as if it had been completed as of June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As Adjusted Book Value at 6/30/2023 | | | | Series A Preferred Conversion | | Series B Warrant Transactions |

| $ Millions | | Basic | | Series A Preferred Converted | Remove Liability | 6/30/2023 As Adjusted | | Senior Secured Notes Converted | Series B Warrants Exercised | Series B Payment* | Transaction Fees | Remove Liability | 6/30/2023 As Adjusted |

| | | | | | | | | | | | | |

| Cash and cash equivalents | | 355.2 | | | | | 355.2 | | | (0.5) | | 55.0 | | (66.0) | | (0.3) | | | 343.4 | |

| Equity securities at fair value | | 52.9 | | | | | 52.9 | | | | | | | | 52.9 | |

| Equity securities without readily determinable fair value | | 5.8 | | | | | 5.8 | | | | | | | | 5.8 | |

| Investment securities - equity method investments | | 30.9 | | | | | 30.9 | | | | | | | | 30.9 | |

| Other assets | | 89.9 | | | | | 89.9 | | | | | | | | 89.9 | |

| Total assets | | 534.7 | | | — | | — | | 534.7 | | | (0.5) | | 55.0 | | (66.0) | | (0.3) | | — | | 523.0 | |

| | | | | | | | | | | | | |

| Notes payable | | (60.5) | | | | | (60.5) | | | 60.5 | | | | | | — | |

| Warrant and derivative liabilities | | (94.9) | | | | 12.9 | | (82.0) | | | | | | | 82.0 | | — | |

| Other liabilities | | (20.8) | | | | | (20.8) | | | | | | | | (20.8) | |

| Total liabilities | | (176.1) | | | — | | 12.9 | | (163.2) | | | 60.5 | | — | | — | | — | | 82.0 | | (20.8) | |

| | | | | | | | | | | | | |

| Preferred stock | | (23.2) | | | 23.2 | | | — | | | | | | | | $ | — | |

| Total liabilities and preferred stock | | (199.3) | | | 23.2 | | 12.9 | | (163.2) | | | $ | 60.5 | | $ | — | | $ | — | | $ | — | | $ | 82.0 | | $ | (20.8) | |

| | | | | | | | | | | | | |

| Book value - stockholders equity | | 335.4 | | | 23.2 | | 12.9 | | 371.5 | | | 60.0 | | 55.0 | | (66.0) | | (0.3) | | 82.0 | | 502.2 | |

| Shares outstanding - basic | | 58.8 | | | 9.6 | | — | | 68.3 | | | 16.4 | | 15.1 | | — | | — | | — | | 99.9 | |

| Book value per share | | | | | | | | | | | | | 5.03 | |

| | | | | | | | | | | | | |

| KPIs: | | | | | | | | | | | | | |

| Cash and cash equivalents | | 355.2 | | | | | 355.2 | | | | | | | | 343.4 | |

| Cash and equity securities at fair value | | 408.0 | | | | | 408.0 | | | | | | | | 396.3 | |

| Cash and equity securities at fair value / share | | | | | | | | | | | | | 3.97 | |

| | | | | | | | | | | | | |

*Note: This amount reflects the $66.0 million payment the Company subsequently made to Starboard in consideration for the early exercise of the Series B warrants, and convertible preferred stock. | | | | | | | | | | |

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity Registrant Name |

ACACIA RESEARCH CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37721

|

| Entity Tax Identification Number |

95-4405754

|

| Entity Address, Address Line One |

767 Third Avenue,

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

332

|

| Local Phone Number |

236-8500

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ACTG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000934549

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

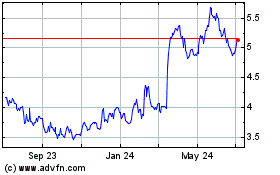

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

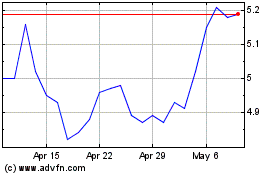

From Mar 2024 to Apr 2024

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024