As filed with the Securities and Exchange Commission

on August 3, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

O-I GLASS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

22-2781933 |

(State or other jurisdiction of incorporation or

organization) |

|

(I.R.S. Employer Identification No.) |

One Michael Owens Way

Perrysburg, Ohio 43551-2999

(Address of Principal Executive Offices) (Zip Code)

O-I GLASS, INC. FOURTH AMENDED AND RESTATED

2017 INCENTIVE AWARD PLAN

(Full title of the plan)

| Darrow A. Abrahams |

|

Copy to: |

| Senior Vice President, General |

|

Julia A. Thompson |

| Counsel and Corporate Secretary |

|

Latham & Watkins LLP |

| O-I Glass, Inc. |

|

555 11th Street, NW |

| One Michael Owens Way |

|

Suite 1000 |

| Perrysburg, Ohio 43551-2999 |

|

Washington, DC 20004 |

| (567) 336-5000 |

|

(202) 637-2200 |

(Name and address of agent for service)

(Telephone number, including area code, of agent

for service)

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

x |

Accelerated filer |

¨ |

| |

Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This Registration Statement

on Form S-8 (the “Registration Statement”) is being filed in order to register 6,250,000 additional shares of common

stock, $0.01 par value per share (“Common Stock”), of O-I Glass, Inc. (the “Company” or the “Registrant”)

that may be issued to participants pursuant to the O-I Glass, Inc. Fourth Amended and Restated 2017 Incentive Award Plan (the “Plan”).

On May 9, 2023, stockholders of the Company approved an amendment and restatement of the Plan at the Company’s 2023 Annual

Meeting of Share Owners, which increased the number of shares available to be granted as awards under the Plan by 6,250,000 shares.

This Registration Statement

hereby incorporates by reference the contents of the Company’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission (“SEC”) on November 3, 2022 (File No. 333-268132) to the extent not modified or superseded

hereby or by any subsequently filed document that is incorporated by reference herein or therein.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Not required to be filed with this Registration

Statement.

| Item 2. | Registrant Information and Employee Plan Annual Information. |

Not required to be filed with this Registration

Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The Company has filed the following documents with

the Securities and Exchange Commission (“SEC”), which are hereby incorporated by reference in this Registration Statement:

| 2. | The Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023,

filed with the SEC on April 26, 2023 and August 2, 2023, respectively; |

| 4. | The description of the Company’s Common Stock contained in Owens-Illinois, Inc.’s Registration Statement on Form 8-A

filed on December 3, 1991, as amended. |

All documents subsequently filed by the Company

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities

offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into

this Registration Statement and to be part of this Registration Statement from the date of the filing of such documents, except as to

any portion of any document, including portions of a Current Report furnished under Items 2.02 or 7.01 of Form 8-K, that is not deemed

filed under such provisions.

Any statement contained in a document incorporated

or deemed to be incorporated by reference in this Registration Statement is deemed to be modified or superseded for purposes of this Registration

Statement to the extent that such statement conflicts with a statement contained in this Registration Statement or in any subsequently

filed document which also is or is deemed to be incorporated by reference in this Registration Statement.

Exhibit

Number |

|

Description |

| 4.1 |

|

Amended and Restated Certificate of Incorporation of O-I Glass, Inc. (filed as Exhibit 3.2 to O-I Glass, Inc.’s, Paddock Enterprises, LLC’s and Owens-Illinois Group, Inc.’s Form 8-K12B dated December 25, 2019, File Nos. 1-9576 and 1-10956, and incorporated herein by reference). |

| 4.2 |

|

Amended and Restated By-Laws of O-I Glass, Inc. (filed as Exhibit 3.1 to O-I Glass, Inc.’s Form 8-K dated December 6, 2022, File No. 1-9576, and incorporated herein by reference). |

| 5.1 |

|

Opinion of Latham & Watkins LLP. |

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm. |

| 23.2 |

|

Consent of Latham & Watkins LLP (included in Exhibit 5.1). |

| 24.1 |

|

Power of Attorney (included on the signature page of this Registration Statement). |

| 99.1 |

|

O-I Glass, Inc. Fourth Amended and Restated 2017 Incentive Award Plan (filed as Appendix B to O-I Glass, Inc.’s Definitive Proxy Statement on Schedule 14A, filed March 29, 2023, File No. 1-9576, and incorporated herein by reference). |

| 107 |

|

Filing Fee Table |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city

of Perrysburg, state of Ohio, on the 3rd day of August, 2023.

| |

O-I GLASS, INC. |

| |

|

| |

By: |

/s/ Darrow A. Abrahams |

| |

|

Darrow A. Abrahams |

| |

|

Senior Vice President, General Counsel and Corporate Secretary |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person

whose signature appears below constitutes and appoints jointly and severally, Andres A. Lopez, John A. Haudrich and Darrow A. Abrahams

and each of them, his or her attorney-in-fact, each with the power of substitution, for him or her in any and all capacities, to sign

any and all amendments to this Registration Statement on Form S-8 (including post-effective amendments) and to file the same, with

all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in and about the foregoing, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents, or their substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Andres A. Lopez |

|

President and Chief Executive Officer (Principal Executive Officer) and Director |

|

August 3, 2023 |

| Andres A. Lopez |

|

|

|

| |

|

|

|

|

| /s/ John A. Haudrich |

|

Senior Vice President and Chief Financial Officer (Principal Financial Officer; Principal Accounting Officer) |

|

August 3, 2023 |

| John A. Haudrich |

|

|

|

| |

|

|

|

|

| /s/ John H. Walker |

|

Chairman of the Board |

|

August 3, 2023 |

| John H. Walker |

|

|

|

|

| |

|

|

|

|

| /s/ Samuel R. Chapin |

|

Director |

|

August 3, 2023 |

| Samuel R. Chapin |

|

|

|

|

| |

|

|

|

|

| /s/ David V. Clark, II |

|

Director |

|

August 3, 2023 |

| David V. Clark, II |

|

|

|

|

| |

|

|

|

|

| /s/ Gordon J. Hardie |

|

Director |

|

August 3, 2023 |

| Gordon J. Hardie |

|

|

|

|

| |

|

|

|

|

| /s/ John Humphrey |

|

Director |

|

August 3, 2023 |

| John Humphrey |

|

|

|

|

| |

|

|

|

|

| /s/ Alan J. Murray |

|

Director |

|

August 3, 2023 |

| Alan J. Murray |

|

|

|

|

| |

|

|

|

|

| /s/ Hari N. Nair |

|

Director |

|

August 3, 2023 |

| Hari N. Nair |

|

|

|

|

| |

|

|

|

|

| /s/ Catherine I. Slater |

|

Director |

|

August 3, 2023 |

| Catherine I. Slater |

|

|

|

|

| |

|

|

|

|

| /s/ Carol A. Williams |

|

Director |

|

August 3, 2023 |

| Carol A. Williams |

|

|

|

|

Exhibit 5.1

|

555 Eleventh Street, N.W., Suite 1000

Washington, D.C. 20004-1304

Tel: +1.202.637.2200 Fax: +1.202.637.2201

www.lw.com |

| |

| FIRM / AFFILIATE OFFICES |

| Austin |

Milan

|

August 3, 2023

|

Beijing

|

Munich

|

| Boston

|

New

York |

| Brussels |

Orange

County |

| Century City

|

Paris

|

| Chicago |

Riyadh |

| Dubai |

San

Diego |

| Düsseldorf

|

San

Francisco |

| Frankfurt

|

Seoul

|

| Hamburg |

Shanghai |

O-I Glass, Inc. |

Hong Kong |

Silicon

Valley |

| Houston |

Singapore

|

| London |

Tel

Aviv

|

| Los Angeles

|

Tokyo |

| Madrid

|

Washington,

D.C. |

One Michael Owens Way

Perrysburg, Ohio 43551-2999

Attention: Darrow A. Abrahams

| Re: | Registration Statement on Form S-8; 6,250,000 shares of common

stock, $0.01 par value per share |

Ladies and Gentlemen:

We have acted as special counsel to O-I Glass, Inc.,

a Delaware corporation (the “Company”), in connection with the proposed issuance of up to 6,250,000 shares

of common stock, $0.01 par value per share (the “Shares”), to be issued pursuant to the O-I Glass, Inc.

Fourth Amended and Restated 2017 Incentive Award Plan (the “Plan”). The Shares are included in a registration

statement on Form S-8 under the Securities Act of 1933, as amended (the “Act”), filed with the Securities

and Exchange Commission (the “Commission”) on August 3, 2023 (the “Registration Statement”).

This opinion is being furnished in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion

is expressed herein as to any matter pertaining to the contents of the Registration Statement or related prospectus, other than as expressly

stated herein with respect to the issue of the Shares.

As such counsel, we have examined such matters

of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon

certificates and other assurances of officers of the Company and others as to factual matters without having independently verified such

factual matters. We are opining herein as to the General Corporation Law of the State of Delaware, and we express no opinion with

respect to any other laws.

August 3, 2023

Page 2

Subject to the foregoing and the other matters

set forth herein, it is our opinion that, as of the date hereof, when the Shares shall have been duly registered on the books of the

transfer agent and registrar therefor in the name or on behalf of the recipient and have been issued by the Company for legal consideration

in excess of par value in the circumstances contemplated by the Plan, assuming in each case that the individual grants or awards under

the Plan are duly authorized by all necessary corporate action and duly granted or awarded and exercised in accordance with the requirements

of law and the Plan (and the agreements and awards duly adopted thereunder and in accordance therewith), the issue and sale of the Shares

will have been duly authorized by all necessary corporate action of the Company, and the Shares will be validly issued, fully paid and

nonassessable. In rendering the foregoing opinion, we have assumed that the Company will comply with all applicable notice requirements

regarding uncertificated shares provided in the General Corporation Law of the State of Delaware.

This opinion is for your benefit in connection

with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions

of the Act. We consent to your filing this opinion as an exhibit to the Registration Statement. In giving such consent, we

do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and

regulations of the Commission thereunder.

| |

Sincerely, |

| |

|

| |

/s/

Latham & Watkins LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in the Registration Statement

(Form S-8) pertaining to the O-I Glass, Inc. Fourth Amended and Restated 2017 Incentive Award Plan of our reports dated February 8,

2023, with respect to the consolidated financial statements and schedule of O-I Glass, Inc. and the effectiveness of internal control

over financial reporting of O-I Glass, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2022,

filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Toledo, Ohio

August 3, 2023

Exhibit 107

CALCULATION OF FILING FEES TABLE

FORM S-8

(Form Type)

O-I GLASS, INC.

(Exact name of registrant as specified in its charter)

Table 1: Newly Registered Securities

Security

Type | |

Security Class

Title | |

Fee

Calculation Rule | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering

Price

Per

Share(2) | | |

Maximum

Aggregate

Offering

Price | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Common Stock, $0.01 par value per share | |

Other | |

| 6,250,000 | | |

$ | 23.26 | | |

$ | 145,375,000 | | |

| 0.00011020 | | |

$ | 16,020.33 | |

| Total Offering Amounts | | |

| | | |

$ | 145,375,000 | | |

| | | |

$ | 16,020.33 | |

| Total Fee Offsets | | |

| | | |

| | | |

| | | |

| — | |

| Net Fee Due | | |

| | | |

| | | |

| | | |

$ | 16,020.33 | |

| (1) |

This Registration Statement registers 6,250,000 additional shares of common stock, $0.01 par value per share (“Common Stock”), of O-I Glass, Inc. (the “Registrant”) that may be issued to participants pursuant to the O-I Glass, Inc. Fourth Amended and Restated 2017 Incentive Award Plan (the “Plan”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional shares of common stock of the Registrant that become issuable under the Plan by reason of any stock dividend, stock split, recapitalization or similar transaction effected without the Registrant’s receipt of consideration which would increase the number of outstanding shares of common stock. |

| (2) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) and Rule 457(c) promulgated under the Securities Act. The Proposed Maximum Offering Price Per Share is based on the average of the high and the low price of Common Stock as reported on the New York Stock Exchange on July 28, 2023. |

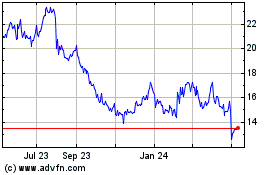

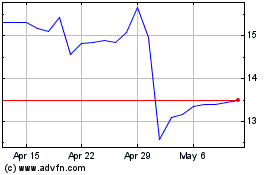

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024