UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

|

|

|

|

001-41208 |

|

|

(Commission File Number) |

|

NOVONIX LIMITED

(Translation of registrant’s name into English)

Level 38

71 Eagle Street

Brisbane, QLD 4000 Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

FORWARD-LOOKING STATEMENTS

The Australian Securities Exchange (“ASX”) announcement filed as Exhibit 99.1 hereto contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in such announcement are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, other factors and assumptions, including those factors identified in our filings with the U.S. Securities and Exchange Commission. We undertake no obligation to update any forward-looking statements made in the ASX announcement filed as Exhibit 99.1 hereto to reflect events or circumstances after the date of such announcement or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

EXHIBIT INDEX

Exhibit No. Description

Exhibit 99.1 Quarterly Activities Report for the three months ended June 30, 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

NOVONIX LIMITED By: /s/ Dr John Christopher Burns Dr. John Christopher Burns Chief Executive Officer |

|

|

|

Date: August 2, 2023

Quarterly Activities Report

For the Three months Ending 30 June 2023

Key Highlights:

▪NOVONIX and LG Energy Solution Entered into a JDA for Artificial Graphite Anode Material

▪NOVONIX issues a US$30 Million Convertible Note to LGES

▪Continued Progress Towards DOE ATVM Loan

▪Continued Negotiations on Terms & Conditions on DOE Grant

▪Progressed Anode Customer Discussions and NAM Operational Targets

▪NOVONIX Cathode Materials from Pilot Line Matched Performance of Commercial Materials

▪Continued to Implement Furnace Enhancements and Capabilities at Riverside

▪NOVONIX Joined Accelerate Coalition to Foster Growing Battery Ecosystem in Canada

Dr. Chris Burns, CEO of NOVONIX, noted, “The second quarter 2023 was highlighted with NOVONIX signing a JDA for synthetic graphite with LGES and receiving a $30 million investment from LGES in the form of a convertible note. This is a significant milestone aligning NOVONIX with a premier cell manufacturer that plans to be one of the largest battery manufacturers in North America. We have continued to progress discussions with other Tier One OEMs and cell manufacturers for potential supply contracts with NOVONIX. Our discussions have continued with the DOE for the ability to utilize both the MESC Grant and LPO Loan to aid in the funding of our overall growth plans.”

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

|

|

|

|

|

|

31 July 2023 |

|

NOVONIX Anode Materials (NAM) |

NOVONIX Anode Materials division (“NAM”), located in Chattanooga, Tennessee, USA, manufactures high-performance synthetic graphite anode materials used to make lithium-ion batteries that power electric vehicles, personal electronics, medical devices, and energy storage units. The Company plans to reach synthetic graphite production capacity of 10,000 tonnes per annum (“tpa”) at its current Riverside facility, beginning deliveries to KORE Power in 2024 at an initial 3,000 tpa rate, and plans to add an incremental 30,000 tpa production capacity by 2025 and reach 150,000 tpa of total production capacity in North America by 2030. In the first quarter of 2023, the Generation 3 production furnaces fully met specification targets for EV-grade synthetic graphite, and in the second quarter the Company continued to optimize the furnaces for performance and efficiency and remains on track for commercial deliveries of anode material to Kore Power in the fourth quarter of 2024.

▪NOVONIX and LG Energy Solution entered into a Joint Research and Development Agreement for Artificial Graphite Anode Material and a US$30 Million Investment Agreement – 7 June 2023.

▪Continued installation and operation at Riverside of NOVONIX’s proprietary Generation 3 graphitization furnaces which are being optimized ahead of the planned start of production in 2024 to support KORE Power’s required volume and other potential customers.

▪Additional grades of customized synthetic graphite under test with other potential customers.

▪Progressed engagements with Tier One cell and automotive manufacturers through additional material sampling and qualification.

▪Advanced site selection process for a new high-performance battery grade synthetic graphite facility.

▪Continued negotiation with the Department of Energy (DOE) on terms and conditions related to the announced US$150m grant. Continued discussions with DOE Loan Programs Office (LPO) and invited to progress to next stage (Stage 3- Due Diligence) of the loan approval process.

▪Engineering continued on the proposed anode material facility with the TAQAT Joint Venture.

NOVONIX-LGES Joint Research and Development Agreement & US$30 Million Investment

NOVONIX and LG Energy Solution, a global battery manufacturer, announced the signing of a joint research and development agreement (JDA) for artificial graphite anode material for lithium-ion batteries. Also, pursuant to a separate agreement, NOVONIX issued an aggregate principal amount of US$30 million unsecured convertible notes to LGES.

Upon successful completion of certain development work under the JDA, LGES and NOVONIX will enter into a separate purchase agreement pursuant to which LGES will have the option to purchase up to 50,000 tons of artificial graphite anode material over a 10-year period from the start of mass production.

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

2 | Page |

|

|

|

|

|

31 July 2023 |

LGES is a leading global battery manufacturer with two stand-alone and five joint venture plants currently operating or being constructed in the U.S.. LGES plans to maximize the benefits from the Inflation Reduction Act (IRA) by expanding local battery production, as well as establish a local supply chain for battery components. In order to solidify its market leadership in North America, LGES further aims to expedite the localization of manufacturing and assembly of battery components, including electrodes, cells, and modules.

Key Investment Agreement Terms:

▪On June 21, 2023, NOVONIX issued US$30 million worth of unsecured convertible notes to LGES with a four percent coupon and a maturity date of June 7, 2028.

▪The convertible notes will mandatorily convert into ordinary shares upon acceptance of the first purchase order under the purchase agreement, although LGES may elect to convert some or all of the notes prior to such time. No interest would be payable on the notes in these circumstances.

▪The convertible notes may be redeemed or converted (at the election of LGES) on the maturity date, in which case interest is payable in cash (in respect of a redemption) or “in-kind” (in the case of conversion). The convertible notes were issued with a conversion price of AUD$1.60 per ordinary share.

▪NOVONIX plans to utilize the proceeds for continued development of anode materials, operational needs and general corporate purposes.

Key JDA Deal Terms:

▪The purpose of the JDA is for the parties to jointly undertake the development of active anode material that meets certain product quality specifications, and the JDA has a term through June 2025. The material for testing will be supplied from NOVONIX’s pilot plant in 2023 and its mass production facilities in 2024 and 2025.

▪Any jointly developed and owned intellectual property will be cross-licensed by LGES and NOVONIX and its subsidiaries. Upon successful development of materials, NOVONIX and LGES will enter into a purchase agreement giving LGES the option to purchase up to 50,000 tons of artificial graphite over 10 years, and if any volume increases are requested by LGES, NOVONIX shall use its best efforts to meet the increased volume. The parties have agreed to a pricing framework under which the final product price will be mutually agreed upon as part of the purchase agreement.

▪The supply by NOVONIX to LGES of the customized products developed under the JDA would initially be subject to a six-year exclusivity period followed by a preferential period of four years (during which any supply to a third party would be subject to a minimum floor price tied to the price offered to LGES).

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

3 | Page |

|

|

|

|

|

31 July 2023 |

U.S. Department of Energy Funding Opportunities

The Biden Administration’s Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) have provided many potential incentives to companies to build out a robust supply chain in the United States. The DOE Loan Programs Office has US$15.1 billion in loan authority to support the manufacture of eligible light-duty vehicles and qualifying components under the Advanced Technology Vehicles Manufacturing Loan Program (ATVM), authorized by the Energy Independence and Security Act of 2007, providing debt capital at U.S. Treasury rates. These government programs provide a significant potential opportunity to support NOVONIX’s financing needs.

NOVONIX was selected to receive US$150M for a greenfield project to produce an initial 30,000 tpa of capacity with additional installed facility and infrastructure to support expansion and supply the EV battery supply chain. NOVONIX remains in active discussions with the DOE Office of Manufacturing and Energy Supply Chains (MESC) regarding the scope and use of this grant funding. In October 2022, NOVONIX formally submitted its application for a loan under the ATVM program. The loan, if received, could contribute a large component of the funding needed for the company’s current expansion plans for NAM’s growth. In May 2023, the NOVONIX was invited by DOE LPO to enter due diligence (Stage 3) and the Company is working with DOE LPO to begin the formal due diligence process. NOVONIX is working with both MESC and LPO to understand how the different sources of financing support can best be used to support the Company’s growth plans.

|

NOVONIX Battery Technology Solutions (BTS) |

NOVONIX Battery Technology Solutions division (“BTS”) focuses on innovative battery research and development, along with providing advanced battery testing equipment and services on a global scale. BTS provides front-line access across the battery value chain and continues to be an industry leader, delivering materials and technologies to support high-performance and cost-effective battery development.

In the three months ended 30 June 2023, BTS continued to build a strong pipeline with distributors to support revenue growth for hardware sales and continued to add and expand key strategic accounts for R&D service offerings.

|

|

|

|

|

|

Quarter Ending |

30 June 2023 |

30 June 2022 |

30 September 2022 |

31 December 2022 |

31 March 2023 |

Revenue |

US$1.68M |

US$2.09M |

US$1.71M |

US$1.33M |

US$2.57M |

Note: Quarterly revenue figures have not been audited.

▪NOVONIX joined Accelerate Coalition to foster growing battery Ecosystem in Canada.

▪New cell testing and analytics software service launched on the cloud to allow access to selected organizations and customers, and on-boarded first users in the second quarter.

▪Expanded UHPC battery testing equipment distribution agreement with AVL to include Canada.

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

4 | Page |

|

|

|

|

|

31 July 2023 |

Cathode Pilot Line

NOVONIX has increased its investment in the intellectual property developed around all-dry zero-waste cathode synthesis technology, which the Company believes could enable a substantial reduction in the cost of producing high energy density (high nickel-based) cathode materials including cobalt-free materials. The Company announced it successfully completed the commissioning of its 10 tpa cathode pilot line in July 2023. The cathode pilot line’s first product, a mid-nickel grade of single-crystal cathode material (“NMC622"), produced using NOVONIX’s patent-pending, all-dry, zero-waste synthesis technology, matches the performance of leading cathode materials from existing suppliers in full-cell testing. NOVONIX will use the pilot line to further demonstrate the manufacturability of the Company’s long-life cathode materials and technology, including high-nickel (e.g., NMC811) and cobalt-free materials, along with their performance in industrial format lithium-ion cells.

The patent-pending process – and the innovations resulting from it – are transformational for the battery industry, decreasing processing complexity which should result in a substantial reduction in costs and waste (e.g. elimination of sodium sulfate) in the cathode manufacturing process.

This progress and the positive performance results seen below allow the Company to progress plans to scale to larger test samples and accelerate commercial discussions with potential partners and customers. BTS’s cathode team has started commercial discussions with precursor and cathode suppliers regarding the Company’s technology and current state of demonstration capability in terms of synthesizing capability and performance.

Cathode Cycle Performance Similar to Commercial Material

|

|

|

|

|

|

Full Cell Cycling Performance of NOVONIX Single Crystal NMC622 |

|

Enhanced Production Process Yields Consistent Performance |

|

|

|

|

|

▪Normalized cycling results in 1Ah pouch cell show that NOVONIX NMC622 has comparable cycling performance to a commercial reference material ▪Scanning Electron Microscope (SEM) images below showing similar single crystal structure NOVONIX and commercial materials ▪Higher nickel and cobalt free materials also being made using NOVONIX’s process technology |

|

|

|

|

|

|

|

|

|

|

Reference NMC622 |

NOVONIX NMC622 |

Product |

Reference |

NOVONIX |

NMC622 |

NMC622 |

Capacity at c300 (%) |

92.5% |

92.1% |

First Cycle Efficiency (%) |

84.9% |

84.9% |

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

5 | Page |

|

|

|

|

|

31 July 2023 |

In the second quarter of 2023, BTS also engaged with multiple established and potential lithium suppliers in material evaluation programs, which build on the Company’s initiatives in cathode precursor as well as final cathode synthesis technology.

Corporate

▪NOVONIX participated in:

▪Citi's 2023 Energy & Climate Technology Conference on 9 May in Boston, MA;

▪Evercore ISI Electrification Metals and Enabling Technologies Conference on 17 May in New York, NY;

▪Rho Motion Q2 EV & Battery Seminar Series Live on 18 May in New York, NY;

▪B. Riley Securities 23rd Annual Institutional Investor Conference on 24 May in Beverly Hills, CA;

▪Benchmark Minerals Battery Gigafactory USA 2023 Conference on 8 June in Washington, DC;

▪Shaw and Partners, ASX Graphite Virtual Conference on 20 June in Melbourne, Australia;

▪Jefferies Sales Desk Briefing Video Conference on 20 June in Sydney, Australia.

▪A total of US$228,000 was paid to directors and their associates for salaries, director fees and superannuation during the quarter ended 30 June 2023.

▪Darcy MacDougald was promoted to COO from President of Battery Testing Services. In his new role, he will have operational oversight of both the NAM and BTS divisions.

Cash Balance

The Company’s cash balance at 30 June 2023 was US$99.1 million.

Capital Expenditures

The company invested US$6.25 million in the second quarter of 2023 inclusive of capital towards production assets at its Riverside facility in Tennessee and the cathode pilot line in Nova Scotia.

ESG Update

The Company has accelerated efforts to enhance NOVONIX’s Environmental, Social and Governance (ESG) policies and reporting. The Company has implemented a standing ESG management committee and is applying its materiality assessment in prioritizing its efforts to develop and expand its ESG program.

NOVONIX recognizes that Environmental, Social, and Governance considerations have a material impact on our business and stakeholders. We are committed to operating a profitable, ethical, and sustainable business and are actively articulating and developing an ESG program aligned with our values. As we continue to develop our ESG program, we are committed to transparency with respect to our

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

6 | Page |

|

|

|

|

|

31 July 2023 |

performance and progress. To follow our sustainability efforts and for more ESG information, click on the link to access NOVONIX’s sustainability page on our website.

|

Environmental As NOVONIX strives to provide clean energy solutions to the battery industry, our new all-dry zero-waste cathode synthesis process eliminates waste-water and solvents. A Life Cycle Assessment (LCA)1 on NOVONIX process for production of GX-23 synthetic graphite material demonstrated a ~60% decrease in global warming potential (GWP) relative to conventional anode grade synthetic graphite and a 30% decrease compared to natural graphite, both supplied from China. Environmental Benefits of NOVONIX’s Anode Technology

|

|

|

|

▪Highest purity input

materials |

▪Proprietary furnace & process technology ▪Increased energy efficiency ▪No chemical purification |

▪NVX materials support

batteries with longer life |

|

|

|

|

Social The health, safety, and well-being of our employees and the communities we operate in are essential to NOVONIX’s success and growth. |

Governance NOVONIX believes healthy corporate governance is central to its business objectives and a critical element contributing to the preservation of shareholder value. Oversight of the Company’s ESG program is the responsibility of the Nominating & Corporate Governance Committee of the Board of Directors. |

This announcement has been authorized for release by NOVONIX Chairman, Admiral Robert J. Natter, USN Ret.

About NOVONIX

NOVONIX is a leading battery technology company revolutionizing the global lithium-ion battery industry with innovative, sustainable technologies, high-performance materials, and more efficient production methods. The Company manufactures industry-leading battery cell testing equipment in Canada and is growing its high-performance synthetic graphite anode material manufacturing operations in the United States. Through advanced R&D capabilities, proprietary technology, and strategic partnerships, NOVONIX has gained a prominent position in the electric vehicle and energy storage systems battery industry and is powering a cleaner energy future. To learn more, visit us at www.novonixgroup.com or on LinkedIn, and Twitter.

1 Life Cycle Assessment (LCA) conducted by Minviro Ltd

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

7 | Page |

|

|

|

|

|

31 July 2023 |

For NOVONIX Limited

Scott Espenshade, ir@novonixgroup.com (investors)

Lori Mcleod, media@novonixgroup.com (media)

Forward-Looking Statements

This communication contains forward-looking statements about the Company and the industry in which we operate. Forward-looking statements can generally be identified by use of words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or other similar expressions. Examples of forward-looking statements in this communication include, among others, statements we make regarding current legislation, graphite and battery markets, our joint research and development agreement with LG Energy Solution, including the qualifications of the anode material, future supply commitments or the development of NOVONIX’s proposed new facility for the production of anode materials for EV batteries and the anticipated performance and benefits and also our joint venture with TAQAT, the Company’s ability to scale-up production of its anode or cathode materials, the development of a new facility for the production of anode materials for EV batteries, the cathode pilot line and the anticipated performance and benefits, the Company’s ability to attract and retain key management and technology personnel and the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing. We have based such statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Such forward-looking statements involve and are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, our ability to achieve the objectives and financial benefits of the joint venture, the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing, and regulatory developments in the Canada, United States, Saudi Arabia, Australia and other jurisdictions. Detailed information regarding these and other factors that could affect our business and results is included in our filings, including the Company's most recent transition and annual reports on Form 20-F, particularly the “Operating and Financial Review and Prospects” and “Risk Factors” sections of those reports. Copies of these filings may be obtained by visiting our Investor Relations website at www.novonixgroup.com or the SEC's website at www.sec.gov.

Forward-looking statements are not guarantees of future performance or outcomes, and actual performance and outcomes may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Accordingly, you should not place undue reliance on forward-looking statements. Any forward-looking statement in this communication is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

8 | Page |

|

|

|

|

|

31 July 2023 |

Industry and Market Data

This Report contains estimates and information concerning our industry and our business, including estimated market size and projected growth rates of the markets for our products. Unless otherwise expressly stated, we obtained this industry, business, market, and other information from reports, research surveys, studies and similar data prepared by third parties, industry, and general publications, government data and similar sources. This Report also includes certain information and data that is derived from internal research. While we believe that our internal research is reliable, such research has not been verified by any third party.

Estimates and information concerning our industry and our business involve a number of assumptions and limitations. Although we are responsible for all the disclosure contained in this Report and we believe the third-party market position, market opportunity and market size data included in this Report are reliable, we have not independently verified the accuracy or completeness of this third-party data. Information that is based on projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in these publications and reports.

|

|

|

|

NOVONIX Limited (ASX: NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane QLD 4000 AUSTRALIA |

www.novonixgroup.com ASX: NVX Nasdaq: NVX |

9 | Page |

31 July 2023

Rule 4.7B

Appendix 4C

Quarterly cash flow report for entities

subject to Listing Rule 4.7B

|

|

|

Name of entity |

NOVONIX LIMITED |

ABN |

|

Quarter ended (“current quarter”) |

54 157 690 830 |

|

30 JUNE 2023 |

|

|

|

|

Consolidated statement of cash flows |

Current quarter

$USD’000 |

Year to date (6 months) $USD’000 |

1. |

Cash flows from operating activities |

1,610 |

4,715 |

1.1 |

Receipts from customers |

1.2 |

Payments for |

(547) |

(1,451) |

|

(a)research and development |

|

(b)product manufacturing and operating costs |

(1,290) |

(2,548) |

|

(c)advertising and marketing |

(45) |

(162) |

|

|

- |

- |

|

|

(2,853) |

(9,180) |

|

(f)administration and corporate costs |

(5,494) |

(12,214) |

1.3 |

Dividends received (see note 3) |

- |

- |

1.4 |

Interest received |

245 |

245 |

1.5 |

Interest and other costs of finance paid |

(468) |

(944) |

1.6 |

Income taxes paid |

- |

- |

1.7 |

Government grants and tax incentives |

- |

- |

1.8 |

Other (provide details if material) |

329 |

397 |

1.9 |

Net cash from / (used in) operating activities |

(8,513) |

(21,142) |

|

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 1 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

|

|

|

|

Consolidated statement of cash flows |

Current quarter

$USD’000 |

Year to date (6 months) $USD’000 |

2. |

Cash flows from investing activities |

- |

- |

2.1 |

Payments to acquire or for: |

|

|

|

|

- |

- |

|

(c)property, plant and equipment |

(6,248) |

(13,200) |

|

|

- |

- |

|

|

- |

- |

|

(f)other non-current assets |

(1) |

(5) |

2.2 |

Proceeds from disposal of: |

- |

- |

|

|

|

|

- |

- |

|

(c)property, plant and equipment |

- |

- |

|

|

- |

- |

|

|

- |

- |

|

(f)other non-current assets |

- |

- |

2.3 |

Cash flows from loans to other entities |

- |

- |

2.4 |

Dividends received (see note 3) |

- |

- |

2.5 |

Other – Refunds / (payments for security deposits |

7,344 |

6,822 |

2.6 |

Net cash from / (used in) investing activities |

1,095 |

(6,383) |

|

3. |

Cash flows from financing activities |

- |

- |

3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

3.2 |

Proceeds from issue of convertible debt securities |

30,000 |

30,000 |

3.3 |

Proceeds from exercise of options |

- |

52 |

3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

(50) |

(52) |

3.5 |

Proceeds from borrowings |

- |

754 |

3.6 |

Repayment of borrowings |

(257) |

(518) |

3.7 |

Transaction costs related to loans and borrowings |

- |

- |

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 2 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

|

|

|

|

Consolidated statement of cash flows |

Current quarter

$USD’000 |

Year to date (6 months) $USD’000 |

3.8 |

Dividends paid |

- |

- |

3.9 |

Other (provide details if material) |

(124) |

(220) |

3.10 |

Net cash from / (used in) financing activities |

29,569 |

30,016 |

|

4. |

Net increase / (decrease) in cash and cash equivalents for the period |

78,707 |

99,039 |

4.1 |

Cash and cash equivalents at beginning of period |

4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(8,513) |

(21,142) |

4.3 |

Net cash from / (used in) investing activities (item 2.6 above) |

1,095 |

(6,383) |

4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

29,569 |

30,016 |

4.5 |

Effect of movement in exchange rates on cash held |

(1,783) |

(2,455) |

4.6 |

Cash and cash equivalents at end of period |

99,075 |

99,075 |

|

|

|

|

5. |

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts |

Current quarter $USD’000 |

Previous quarter $USD’000 |

5.1 |

Bank balances |

64,137 |

78,707 |

5.2 |

Call deposits |

34,938 |

- |

5.3 |

Bank overdrafts |

- |

- |

5.4 |

Other (provide details) |

- |

- |

5.5 |

Cash and cash equivalents at end of quarter (should equal item 4.6 above) |

99,075 |

78,707 |

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 3 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

|

|

|

6. |

Payments to related parties of the entity and their associates |

Current quarter $USD'000 |

6.1 |

Aggregate amount of payments to related parties and their associates included in item 1 |

228 |

6.2 |

Aggregate amount of payments to related parties and their associates included in item 2 |

- |

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. Payments to related parties (directors and Nick Liveris) includes director fees, salary and wages (including STI), and superannuation. |

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 4 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

|

|

|

|

7. |

Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. |

Total facility

amount at quarter

end $USD’000 |

Amount drawn at

quarter end $USD’000 |

7.1 |

Loan facilities |

39,949 |

38,567 |

7.2 |

Credit standby arrangements |

- |

- |

7.3 |

Other (please specify) |

- |

- |

7.4 |

Total financing facilities |

39,949 |

38,567 |

|

|

|

7.5 |

Unused financing facilities available at quarter end |

1,382 |

7.6 |

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. |

•Loan facility with BDC for CAD$2,680,000 secured by first mortgage over the group’s freehold land and buildings. The facility is repayable in monthly instalments ending 15 September 2044. Interest rate is variable and is currently 8.05%. As at 30 June 2023 the facility has been fully drawn down. •On 28 May 2021, the Group purchased commercial land and buildings in Nova Scotia, Canada for CAD$3,550,000 from which the Cathode business operates. The Group entered into a loan facility to purchase the land and buildings. The total available under the facility is CAD $4,985,000 and it has been drawn down to CAD$4,953,060.67 as at 30 June 2023. . Interest rate is variable and is currently 8.05%. The full facility is repayable in monthly instalments, commencing 31 December 2022 and ending 30 November 2047. The land and buildings have been pledged as security for the bank loan. •Loan facility with BDC for CAD$2,300,000 secured by first mortgage over the group’s freehold land and buildings. The facility is repayable in monthly instalments, commencing 31 December 2023 and ending 30 November 2033. Interest rate is variable and is currently 7.05%. As at 30 June 2023 it has been drawn down to CAD$500,000. •Contribution agreement with Atlantic Canada Opportunities Agency (ACOA), for CAD$450,000. As at 30 June 2023 it has been fully drawn down. The facility is interest free and repayable in monthly instalments commencing 1 September 2019 and ending 1 December 2025. •Contribution agreement with Atlantic Canada Opportunities Agency (ACOA), for CAD$500,000. As at 30 June 2023 it has been fully drawn down. The facility is interest free and repayable in monthly instalments commencing 1 April 2020 and ending 1 March 2026. •Contribution agreement with Atlantic Canada Opportunities Agency (ACOA), for CAD$250,000. As at 30 June 2023 it has been fully drawn down. The facility is interest free and repayable in monthly instalments commencing 1 January 2024 and ending 1 December 2026. •Contribution agreement with Atlantic Canada Opportunities Agency (ACOA), for CAD$1,886,000. As at 30 June 2023 it has been fully drawn down. The facility is interest free and repayable in monthly instalments commencing 1 January 2025 and ending 1 December 2036. •On 28 July 2021, the Group purchased commercial land and buildings in Chattanooga for USD $42.6M to expand the NAM business. The Group entered into a loan facility with PNC Real Estate to purchase the land and buildings. The total available amount under the facility is USD$30,100,000 and it has been fully drawn down as at 30 June 2023. The facility is repayable in monthly instalments, commencing September 2021 and ending August 2031. The land and buildings have been pledged as security for the loan. |

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 5 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

|

|

|

8. |

Estimated cash available for future operating activities |

$USD’000 |

8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(8,513) |

8.2 |

Cash and cash equivalents at quarter end (item 4.6) |

99,075 |

8.3 |

Unused finance facilities available at quarter end (item 7.5) |

1,382 |

8.4 |

Total available funding (item 8.2 + item 8.3) |

100,457 |

|

|

|

8.5 |

Estimated quarters of funding available (item 8.4 divided by item 8.1) |

11.8 |

Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. |

8.6 |

If item 8.5 is less than 2 quarters, please provide answers to the following questions: |

|

8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

|

Answer: N/A |

|

8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

|

Answer: N/A |

|

8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

|

Answer: N/A |

|

Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. |

Compliance statement

1.This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2.This statement gives a true and fair view of the matters disclosed.

|

|

|

Date: |

|

31 July 2023 |

|

|

|

|

|

|

Authorised by: |

|

By the Chairman of the Board |

|

|

(Name of body or officer authorising release – see note 4) |

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 6 |

|

|

|

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B |

Notes

1.This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2.If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report.

3.Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4.If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5.If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

|

|

ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. |

Page 7 |

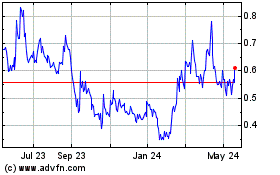

Novonix (PK) (USOTC:NVNXF)

Historical Stock Chart

From Mar 2024 to Apr 2024

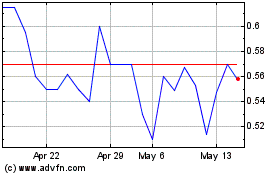

Novonix (PK) (USOTC:NVNXF)

Historical Stock Chart

From Apr 2023 to Apr 2024