0001414953false--12-31Q22023200000000.00116327596162306150000000000087500000014149532023-01-012023-06-300001414953mojo:SimpsonMember2022-12-310001414953mojo:SimpsonMember2023-06-300001414953srt:MinimumMembermojo:GlennSimpsonMember2022-02-032022-02-040001414953srt:MaximumMembermojo:GlennSimpsonMember2022-02-032022-02-040001414953mojo:GlennSimpsonMemberus-gaap:StockOptionMember2023-06-300001414953mojo:GlennSimpsonMemberus-gaap:StockOptionMember2022-12-310001414953mojo:RestrictedCommonStockMember2022-01-012022-12-310001414953mojo:GlennSimpsonMembermojo:RestrictedAndNonTradingSharesMember2022-06-010001414953mojo:GlennSimpsonMemberus-gaap:StockOptionMember2023-01-012023-06-300001414953mojo:GlennSimpsonMembermojo:RestrictedAndNonTradingSharesMember2023-01-012023-06-300001414953mojo:CudiaMember2023-01-012023-06-300001414953mojo:MrDevlinMember2023-01-012023-06-300001414953mojo:SimpsonMember2023-01-012023-06-300001414953mojo:MrDevlinMember2022-02-032022-02-040001414953mojo:CudiaMember2022-02-032022-02-040001414953mojo:SimpsonMember2022-02-032022-02-040001414953mojo:MrSimpsonMrDevlinAndMsCudiaMembermojo:RestrictedAndNonTradingSharesMember2022-02-032022-02-040001414953mojo:DirectorAndOfficersMembermojo:RestrictedAndNonTradingSharesMember2022-01-012022-12-310001414953mojo:DirectorAndOfficersMembermojo:RestrictedAndNonTradingSharesMember2023-01-012023-06-300001414953srt:MinimumMembermojo:BoardOfDirectorsMember2022-06-080001414953mojo:BoardOfDirectorsMember2022-06-0800014149532022-07-0500014149532022-07-0400014149532022-06-062022-06-0800014149532022-07-042022-07-050001414953mojo:GlennSimpsonMembermojo:EmploymentAgreementsMembermojo:NonTradingRestrictedCommonStocksMember2023-01-012023-06-300001414953mojo:GlennSimpsonMembermojo:EmploymentAgreementsMember2022-09-010001414953mojo:GlennSimpsonMembermojo:EmploymentAgreementsMember2022-08-292022-09-010001414953us-gaap:StateAndLocalJurisdictionMember2023-01-012023-06-300001414953us-gaap:DomesticCountryMember2023-01-012023-06-300001414953us-gaap:StateAndLocalJurisdictionMember2022-06-300001414953us-gaap:StateAndLocalJurisdictionMember2023-06-300001414953us-gaap:DomesticCountryMember2022-06-300001414953us-gaap:DomesticCountryMember2023-06-300001414953us-gaap:RetainedEarningsMember2023-06-300001414953us-gaap:AdditionalPaidInCapitalMember2023-06-300001414953us-gaap:CommonStockMember2023-06-300001414953us-gaap:RetainedEarningsMember2023-04-012023-06-300001414953us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001414953us-gaap:CommonStockMember2023-04-012023-06-3000014149532023-03-310001414953us-gaap:RetainedEarningsMember2023-03-310001414953us-gaap:AdditionalPaidInCapitalMember2023-03-310001414953us-gaap:CommonStockMember2023-03-3100014149532023-01-012023-03-310001414953us-gaap:RetainedEarningsMember2023-01-012023-03-310001414953us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001414953us-gaap:CommonStockMember2023-01-012023-03-310001414953us-gaap:RetainedEarningsMember2022-12-310001414953us-gaap:AdditionalPaidInCapitalMember2022-12-310001414953us-gaap:CommonStockMember2022-12-310001414953us-gaap:RetainedEarningsMember2022-06-300001414953us-gaap:AdditionalPaidInCapitalMember2022-06-300001414953us-gaap:CommonStockMember2022-06-300001414953us-gaap:RetainedEarningsMember2022-04-012022-06-300001414953us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001414953us-gaap:CommonStockMember2022-04-012022-06-3000014149532022-03-310001414953us-gaap:RetainedEarningsMember2022-03-310001414953us-gaap:AdditionalPaidInCapitalMember2022-03-310001414953us-gaap:CommonStockMember2022-03-3100014149532022-01-012022-03-310001414953us-gaap:RetainedEarningsMember2022-01-012022-03-310001414953us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001414953us-gaap:CommonStockMember2022-01-012022-03-310001414953us-gaap:RetainedEarningsMember2021-12-310001414953us-gaap:AdditionalPaidInCapitalMember2021-12-310001414953us-gaap:CommonStockMember2021-12-3100014149532022-06-3000014149532021-12-3100014149532022-01-012022-06-3000014149532022-04-012022-06-3000014149532023-04-012023-06-3000014149532022-12-3100014149532023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended: June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number: 000-55269

EQUATOR Beverage Company |

(Exact name of registrant as specified in its charter) |

Delaware | | 26-0884348 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

185 Hudson Street, Floor 25 Jersey City, New Jersey | | 07302 |

(Address of principal executive offices) | | (Postal Code) |

Registrant’s telephone number: 929-264-7944

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On June 30, 2023, there were 16,327,596 shares of the registrant’s common stock, par value $0.001, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| | | Page | |

| PART I - FINANCIAL INFORMATION | | | |

| ITEM 1. | FINANCIAL STATEMENTS (Unaudited) | | 3 | |

| Condensed Balance Sheets as of June 30, 2023 and December 31, 2022 | | 3 | |

| Condensed Statements of Operations for the three months ended June 30, 2023 and June 30, 2022 | | 4 | |

| Condensed Statements of Operations for the six months ended June 30, 2023 and June 30, 2022 | | 5 | |

| Condensed Statements of Cash Flows for the six months ended June 30, 2023 and June 30, 2022 | | 6 | |

| Condensed Statement of Changes in Stockholders’ Equity for the six months ended June 30, 2023 and June 30, 2022 | | 7 | |

| Notes to the Condensed Financial Statements | | 8 | |

| | | | |

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 13 | |

ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 15 | |

ITEM 4. | CONTROLS AND PROCEDURES | | 15 | |

| PART II | | | |

ITEM 1. | LEGAL PROCEEDINGS | | 16 | |

ITEM 1a. | RISK FACTORS | | 16 | |

ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | 17 | |

ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | | 17 | |

ITEM 4. | MINE SAFETY DISCLOSURE | | 17 | |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | | 17 | |

ITEM 6. | SELECTED FINANCIAL DATA | | 17 | |

| PART III | | | |

ITEM 7. | Directors, Executive Officer and Corporate Governance | | 18 | |

ITEM 8. | Executive Compensation | | 19 | |

ITEM 9. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 20 | |

| PART IV | | | |

ITEM 10. | Exhibits, Financial Statement Schedules | | 21 | |

| | | |

SIGNATURES | | 22 | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (Unaudited)

EQUATOR BEVERAGE COMPANY

Condensed Balance Sheets (Unaudited)

As of June 30, 2023 and December 31, 2022

| | June 30, 2023 | | | December 31, 2022 | |

ASSETS | | | | | | |

CURRENT ASSETS: | | | | | | |

Cash and cash equivalents | | $ | 35,063 | | | $ | 10,738 | |

Accounts receivable, net | | | 148,056 | | | | 93,852 | |

Inventory | | | 279,252 | | | | 268,289 | |

Supplier deposits | | | 31,500 | | | | 44,772 | |

Prepaid expenses | | | 43,146 | | | | 23,355 | |

Security deposit | | | 113 | | | | 113 | |

Total Current Assets | | $ | 537,130 | | | $ | 441,119 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

CURRENT LIABILITIES: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 75,723 | | | $ | 70,252 | |

Related party loans | | | 290,000 | | | | 225,000 | |

Total Current Liabilities | | | 365,723 | | | | 295,252 | |

| | | | | | | | |

STOCKHOLDERS’ EQUITY | | | | | | | | |

Common stock, 20,000,000 shares authorized at $0.001 par value, 16,327,596 and 16,230,615 shares issued and outstanding, at June 30, 2023 and December 31, 2022, respectively | | | 16,328 | | | | 16,231 | |

Additional paid-in capital | | | 23,761,045 | | | | 23,758,917 | |

Accumulated deficit | | | (23,605,966 | ) | | | (23,629,281 | ) |

Total Stockholders’ Equity | | | 171,407 | | | | 145,867 | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 537,130 | | | $ | 441,119 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Operations (Unaudited)

For the Three Months Ended June 30, 2023 and 2022

| | 2023 | | | 2022 | |

Revenue | | $ | 588,478 | | | $ | 541,102 | |

Cost of Revenue | | | 307,721 | | | | 352,759 | |

Gross Profit | | | 280,757 | | | | 188,343 | |

| | | | | | | | |

Operating Expenses | | | | | | | | |

Selling, general and administrative | | | 258,671 | | | | 188,230 | |

Total Operating Expenses | | | 258,671 | | | | 188,230 | |

Income from Operations | | | 22,086 | | | | 113 | |

Other Expense | | | (3,256 | ) | | | (2,940 | ) |

Income/(Loss) Before Provision for Income Taxes | | | 18,830 | | | | (2,827 | ) |

Net Income/(Loss) | | $ | 18,830 | | | $ | (2,827 | ) |

Net Income/(Loss) per common share, basic and diluted | | $ | 0.00 | | | $ | 0.00 | |

Weighted average number of common shares outstanding, basic and diluted | | | 16,557,928 | | | | 15,810,725 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Operations (Unaudited)

For the Six Months Ended June 30, 2023 and 2022

| | 2023 | | | 2022 | |

Revenue | | $ | 1,104,113 | | | $ | 920,759 | |

Cost of Revenue | | | 621,179 | | | | 585,343 | |

Gross Profit | | | 482,934 | | | | 335,416 | |

| | | | | | | | |

Operating Expenses | | | | | | | | |

Selling, general and administrative | | | 453,583 | | | | 469,796 | |

Total Operating Expenses | | | 453,583 | | | | 469,796 | |

Income/(Loss) from Operations | | | 29,351 | | | | (134,380 | ) |

Other Expense | | | (6,036 | ) | | | (3,826 | ) |

Income/(Loss) Before Provision for Income Taxes | | | 23,315 | | | | (138,206 | ) |

Provision for Income Taxes | | | (13,344 | ) | | | | |

Net Income/(Loss) | | $ | 9,971 | | | $ | (138,206 | ) |

Net Income/(Loss) per common share, basic and diluted | | $ | 0.00 | | | $ | (0.01 | ) |

Weighted average number of common shares outstanding, basic and diluted | | | 16,881,644 | | | | 15,658,344 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Cash Flows (Unaudited)

For the Six Months Ended June 30, 2023 and 2022

| | 2023 | | | 2022 | |

Cash flows from operating activities: | | | | | | |

Net income/(loss) | | $ | 23,315 | | | $ | (138,206 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Stock issued to directors and employees | | | 40,227 | | | | 136,073 | |

| | | | | | | | |

Changes in assets and liabilities: | | | | | | | | |

Increase in accounts receivable | | | (54,204 | ) | | | (58,105 | ) |

Increase in inventory | | | (10,963 | ) | | | (94,245 | ) |

Decrease in supplier deposits | | | 13,272 | | | | - | |

Increase in prepaid expenses and security deposit | | | (19,790 | ) | | | (2,754 | ) |

Increase in accounts payable and accrued expenses | | | 5,470 | | | | 57,221 | |

Net cash used in operating activities | | | (2,673 | ) | | | (100,016 | ) |

Net cash provided by/ (used in) financing activities: | | | | | | | | |

Proceeds from related party loan | | | 170,000 | | | | 352,000 | |

Repayments of from related party loan | | | (105,000 | ) | | | (127,000 | ) |

Proceeds from options exercise | | | - | | | | 25,448 | |

Shares repurchased for cancellation | | | (38,002 | ) | | | (193,188 | ) |

Net cash provided by financing activities | | | 26,998 | | | | 57,260 | |

| | | | | | | | |

Net increase/ (decrease) in cash and cash equivalents | | | 24,325 | | | | (42,756 | ) |

Cash and cash equivalents at beginning of period | | | 10,738 | | | | 46,481 | |

Cash and cash equivalents at end of periods | | $ | 35,063 | | | $ | 3,725 | |

Summary of non-cash investing and financing activity: During the six-month period ended June 30, 2023 the Company issued a total of 477,000 Restricted and Non-Trading shares with an implied value of $40,227 to directors and officers as a result of contractual stock awards. During the six-month period ended June 30, 2022 the Company issued a total of 960,054 Restricted and Non-Trading shares with an implied value of $161,521 to directors and officers as a result of contractual stock awards and to settle obligations payable.

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Changes in Stockholders’ Equity (Unaudited)

For the Three and Six Months Ended June 30, 2023 and 2022

| | Common Stock | | | Additional Paid-In | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

Balance, December 31, 2022 | | | 16,230,615 | | | $ | 16,231 | | | $ | 23,758,917 | | | $ | (23,629,281 | ) | | $ | 145,867 | |

Stock issued to Directors and employees | | | 238,500 | | | | 238 | | | | 13,754 | | | | - | | | | 13,992 | |

Stock repurchased and returned to Treasury | | | - | | | | - | | | | - | | | | - | | | | - | |

Net Income | | | - | | | | - | | | | - | | | | 4,485 | | | | 4,485 | |

Balance, March 31, 2023 | | | 16,469,115 | | | $ | 16,469 | | | $ | 23,772,671 | | | $ | (23,624,796 | ) | | $ | 164,344 | |

Stock issued to Directors and employees | | | 238,500 | | | | 239 | | | | 25,996 | | | | - | | | | 26,235 | |

Stock repurchased and returned to Treasury | | | (380,019 | ) | | | (380 | ) | | | (37,622 | ) | | | - | | | | (38,002 | ) |

Net Income | | | - | | | | - | | | | - | | | | 18,830 | | | | 18,830 | |

Balance, June 30, 2023 | | | 16,327,596 | | | $ | 16,238 | | | $ | 23,761,045 | | | $ | (23,605,966 | ) | | $ | 171,407 | |

| | Common Stock | | | Additional Paid-In | | | Accumulated | | | Total | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | | |

Balance, December 31, 2021 | | | 15,548,903 | | | $ | 15,549 | | | $ | 23,745,449 | | | $ | (23,390,445 | ) | | $ | 370,553 | |

Stock issued to Directors and employees | | | 681,750 | | | | 682 | | | | 111,323 | | | | - | | | | 112,005 | |

Stock repurchased and returned to Treasury | | | (375,000 | ) | | | (375 | ) | | | (100,875 | ) | | | - | | | | (101,250 | ) |

Net loss | | | - | | | | - | | | | - | | | | (135,379 | ) | | | (135,379 | ) |

Balance, March 31, 2022 | | | 15,855,653 | | | $ | 15,856 | | | $ | 23,755,897 | | | $ | (23,525,824 | ) | | $ | 245,929 | |

Stock issued to Directors and employees | | | 119,250 | | | | 119 | | | | 23,949 | | | | - | | | | 24,068 | |

Exercise of Stock Options | | | 159,054 | | | | 159 | | | | 25,289 | | | | - | | | | 25,448 | |

Stock repurchased and returned to Treasury | | | (455,342 | ) | | | (455 | ) | | | (91,483 | ) | | | - | | | | (91,938 | ) |

Net Loss | | | - | | | | - | | | | - | | | | (2,827 | ) | | | (2,827 | ) |

Balance, June 30, 2022 | | | 15,678,615 | | | $ | 15,679 | | | $ | 23,713,652 | | | $ | 23,528,651 | | | $ | 200,680 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Notes to Condensed Financial Statements (Unaudited)

June 30, 2023

NOTE 1 – BUSINESS

Overview

EQUATOR Beverage Company, headquartered in Jersey City, NJ, is a Delaware corporation that specializes in developing, producing, distributing, and marketing new beverage products.

Our beverages have been certified Non-GMO Project Verified and USDA Organic, and we offer both nonalcoholic and ready-to-drink alcoholic options. In addition, we have a line of sparkling energy beverages targeted towards female consumers.

Our beverages can be found in North America, the Caribbean, and Bermuda. We are committed to sustainability and use 100% recyclable, eco-friendly packaging that has a minimal impact on the environment. Furthermore, our products are plant-based, renewable, and eco-friendly.

Coconut water is nature's super hydration drink for skin and body. In each 11 oz serving, there are five essential electrolytes totaling 1043 mg more than other sports drinks. It is a fast rehydration recovery drink which performs faster than water. Coconut water has natural nutrients for skin and hair and vitamins B & C natural - not added. Coconut water is plant based and renewable; great for vegan, kosher, paleo keto and low carb diets. All this comes with a fresh crisp coconut taste. There are no preservatives in this coconut water and it is packaged in an eco-friendly container.

CURRENT OPERATIONS

Sales and Distribution

The Company’s flagship product is MOJO Coconut Water. In addition to Coconut Water, the Company produces Coconut Water + Pineapple Juice, Sparkling Coconut Water Citrus, Sparkling Energy Blood Orange, Sparkling Energy Pink Grapefruit, Cubano Blue Agave Tequila Organic Sparkling Coconut Water Citrus, Cubano Blue Agave Tequila Organic Sparkling Coconut Water Blood Orange and Organic Coconut Water. We seek to grow the market share of our products by expanding our hybrid distribution network through the relationships and efforts of our management and third-party partners and broker network, and new products and packaging. The Company packages its beverages in 100% recyclable, Eco-Friendly packaging that can be recycled infinite times and is not made from carbon oil-based packaging. The packaging has a very low impact on the environment, and does not contribute to landfills and the pollution of our bodies of water. Also, our products are plant-based, Eco-friendly and renewable.

Production

The Company has multiple sources for its production. The Company’s fruit sources are of high quality. The fruit is part of the overall taste and quality of our products. Currently, the Company has multiple production facilities that it could source products from, each of the facilities could supply our forecasted demand.

Competition

The beverage industry is competitive. Competitors in our market compete for brand recognition, ingredient sourcing, product shelf space, and e-commerce page rankings. Our competitors have similar distribution channels and retailers to deliver and sell their products.

Government Regulation

Within the United States, beverages are governed by the U.S. Food and Drug Administration (the “FDA”). As such, it is necessary for the Company to establish, maintain and make available for inspection records as well as to develop labels (including nutrition information) that meet FDA requirements. The Company’s production facilities are subject to FDA regulation.

Employees

As of June 30, 2023, the Company had two employees. The Company also uses the services of contractors, consultants and other third-parties. We contract with food brokers to represent our products to specific specialized sales channels. We utilize the services of direct sales and distribution companies that deliver and sell our products to their customers. We contract with manufacturing facilities to produce our products and outsource the storage and transportation of our products.

CORPORATE HISTORY AND DEVELOPMENT

The Company began producing MOJO branded products in 2016. EQUATOR Beverage Company is headquartered in Jersey City, New Jersey and our internet site is www.EquatorBeverage.com. EQUATOR’s stock is traded on the OTCQB under the symbol MOJO. On June 8, 2022, the Board of Directors and majority stockholder of the Company approved a change of name from MOJO Organics, Inc. to EQUATOR Beverage Company. This change of name was filed with the State of Delaware and became effective July 5, 2022.

Interim Financial Statements

The accompanying unaudited interim condensed financial statements have been prepared pursuant to the rules and regulations for reporting on Form 10-Q and article 10 of Regulation S-X and the related rules and regulations of the Securities and Exchange Commission (“SEC”). Accordingly, certain information and disclosures required by accounting principles generally accepted in the United States of America (“GAAP”) for complete financial statements have been condensed or omitted pursuant to such rules and regulations. However, the Company believes that the disclosures included in these financial statements are adequate to make the information presented not misleading. The unaudited interim condensed financial statements included in this document have been prepared on the same basis as the annual audited financial statements, and in the Company’s opinion, reflect all adjustments necessary for a fair presentation in accordance with GAAP and SEC regulations for interim financial statements. The results for the six months ended June 30, 2023 are not necessarily indicative of the results that the Company will have for any subsequent period. These unaudited condensed financial statements should be read in conjunction with the audited financial statements and the notes to those statements for the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The financial statements are prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). Management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash equivalents include investment instruments and time deposits purchased with a maturity of three months or less. As of June 30, 2023, and June 30, 2022, the Company did not have any cash equivalents.

Accounts Receivable

Accounts receivable are stated at the amount management expects to collect from outstanding balances. The Company provides for probable uncollectible amounts based upon its assessment of the current status of the individual receivables and after using reasonable collection efforts. The allowance for doubtful accounts as of June 30, 2023 and 2022 was zero.

Inventory

Inventory, consisting solely of finished goods, are stated at the lower of cost (first-in, first-out method) or net realizable value (“NRV”). If necessary, the Company provides allowances to adjust the carrying value of its inventories to NRV when NRV is below cost. There were no such adjustments in 2023 or 2022.

Revenue Recognition

Revenue from sales of products is recognized when the related performance obligation is satisfied. The Company’s performance obligation is satisfied upon the shipment or delivery of products to customers. The Company’s products are sold on cash and credit terms which are established in accordance with standardized industry practices and typically require payment within 30 days of delivery. Costs incurred for sales incentives and discounts are accounted for as reductions in revenue.

Deductions from Revenue

Costs incurred for sales incentives and discounts are accounted for as reductions in revenue. These costs include payments to customers for performing merchandising activities on our behalf, including in store displays, promotions for new items and obtaining optimum shelf space.

Shipping and Handling Costs

Shipping and Handling Costs incurred to move finished goods from our distribution center to customer locations are included in the line Selling, General and Administrative Expenses in our Statements of Operations.

Net Income/(Loss) Per Common Share

The Company computes per share amounts in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 260, “Earnings per Share”. ASC Topic 260 requires presentation of basic and diluted EPS. Basic EPS is computed by dividing the loss available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted EPS is based on the weighted average number of shares of common stock and common stock equivalents outstanding during the periods.

There are no potentially dilutive securities that have been excluded from the computation of weighted average shares outstanding.

Income Taxes

The Net Operating Loss Carryforwards for federal taxes was $3,740,158, at June 30, 2023 and 3,748,885 at June 30, 2022. The Net Operating Loss Carryforwards at June 30, 2023 was $3,740,158 and $3,748,885 for the State of New Jersey. The Deferred Tax Assets for federal taxes was $785,433 at June 30, 2023 and $787,266 at June 30, 2022. The Deferred Tax Assets at June 30, 2023 was $336,614 and $337,400 at June 30, 2022 for the State of New Jersey. The total Deferred Tax Assets was $1,122,047 at June 30, 2023 and $1,124,666 at June 30, 2022. The Deferred Tax assets have been fully reserved by valuation allowances beyond that portion which is expected to offset current taxes. As of June 30, 2023, the Company’s Federal income tax payable is $13,344 and State Income Tax payable is $5,719. At June 30, 2022, The Company’s Federal income tax payable and State Income tax payable was zero.

The Company provides for income taxes using the asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect when these differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The Company expects to utilize all Deferred Tax Assets. The Company did not have a deferred tax liability at June 30, 2023 and 2022.

As of June 30, 2023, and June 30, 2022, the Company had no accrued interest or penalties because there were none. The Company had no Federal or State tax examinations in the past nor does it have any at the current time.

| | | | | Deferred Tax Assets as of June 30, | | | Net Operating Loss Carryforward as of June 30, | |

| | Tax Rate | | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Federal | | | 21 | % | | $ | 785,433 | | | $ | 787,266 | | | $ | 3,740,158 | | | $ | 3,748,885 | |

State of New Jersey | | | 9 | % | | $ | 336,614 | | | $ | 337,400 | | | $ | 3,740,158 | | | $ | 3,748,885 | |

Total | | | | | | $ | 1,122,047 | | | $ | 1,124,666 | | | $ | 7,480,316 | | | $ | 7,497,770 | |

Fair value of financial instruments

The carrying amounts of financial instruments, which include cash, accounts receivable, accounts payable and accrued expense, approximate their fair values due to their short-term nature.

NOTE 3 – COMMITMENTS AND CONTINGENCIES

Employment Agreement

Pursuant to Mr. Simpson’s Amended and Restated Employment Agreement (“the Agreement”) dated April 6, 2017 and amended on September 1, 2022, Mr. Simpson is paid a salary of $8,000 per month and a stock award of 67,000 shares of non-trading, restricted Common Stock.

Mr. Simpson is also paid an annual bonus comprised of cash and stock awards for non-trading, restricted Common Stock based on the achievement of performance goals established by the Board of Directors of the Company and set forth in the Agreement. The cash bonus is established at $44,400 per year. The stock award is set at 200,000 shares of non-trading, restricted Common Stock per year through March 31, 2027.

Pursuant to the Agreement, if Mr. Simpson’s employment is terminated without cause, the Company is obligated to pay him all amounts due under the contract for the remaining term of the contract immediately. At June 30, 2023, the potential liability to EQUATOR Beverage Company was $360,000 and 3,015,000 shares of non-trading, restricted Common Stock.

NOTE 4 – STOCKHOLDERS’ EQUITY

On July 5, 2022, the State of Delaware approved the 1-for-2 reverse split and the decrease in Authorized shares from 40,000,000 to 20,000,000 shares.

On June 8, 2022, the Board of Directors of the Company approved a prospective amendment to the Fourth Article of the Company’s Articles of Incorporation to decrease the authorized common stock from 40,000,000 shares, par value $0.001, to 20,000,000 shares, par value $0.001. On June 8, 2022, the majority stockholders approved the decrease in authorized shares amendment by written consent, in lieu of a special meeting of the stockholders. On June 8, 2022, the Board of Directors of the Company approved the prospective amendment to the Company’s Articles of Incorporation to effect a 1-for-2 reverse split of the Company’s Common Stock. On June 8, 2022, stockholders of the Company owning a majority of the Company’s outstanding voting stock approved the reverse stock split by written consent, in lieu of a special meeting of the stockholders. The decrease in authorized shares and reverse stock split was approved by FINRA on July 19, 2022 and effective July 20, 2022. All share and per share data has been retroactively adjusted to reflect the reverse stock split.

Restricted Stock Issuances

During the six months ended June 30, 2023, 477,000 shares of Restricted and Non-Trading Common Stock were issued to Directors and Officers of the Company. These shares have full voting rights but are restricted for sale and transfer.

During the year ended December 31, 2022, 1,353,000 shares of Restricted and Non-Trading Common Stock were issued to Directors and Officers of the Company. These shares have full voting rights but are restricted for sale and transfer.

On June 1, 2022, Mr. Simpson exercised his options to purchase 159,054 shares of Restricted and Non-Trading shares at $0.16 per share. The total exercise value was $25,449.

On February 4, 2022, the board of Directors approved the issuance of 525,000 shares of Restricted and Non-Trading Common Stock to Mr. Simpson, Mr. Devlin and Ms. Cudia for their continued service to the Company. Mr. Simpson was issued 350,000 shares of Restricted and Non-Trading Common Stock. Mr. Devlin and Ms. Cudia were each issued 87,500 shares of Restricted and Non-Trading Common Stock. The value of these shares was recorded as stock awards.

Additionally, Mr. Simpson was issued 402,000 shares of Restricted and Non-Trading Common Stock for his stock awards. Mr. Devlin was issued 75,000 shares of Restricted and Non-Trading Common Stock as for continuing to serve as a Director of the Company. Ms. Cudia was issued 37,500 shares of Restricted and Non-Trading Common Stock for her annual stock awards. The value of these shares was recorded as stock awards.

Stock Purchased for Cancellation

During the quarter ended June 30, 2023, the Company purchased 380,019 shares of its Restricted Common Stock from shareholders at a cost of $38,002.

During the year ended December 31, 2022 the Company purchased 830,342 shares of its Restricted Common Stock from shareholders at a cost of $193,188.

NOTE 5 – STOCK OPTIONS

As of June 30, 2023, there are no outstanding stock options.

On June 1, 2022, Mr. Simpson exercised options to purchase 159,054 shares of Restricted and Non-Trading shares at $0.16 per share. The total exercise value was $25,449.

On February 4, 2022, the Company adjusted the exercise price of the options granted to Mr. Simpson from $0.32 per share to $0.16 per share.

The following table summarizes stock option activity:

| | Issued To | | Expiration Date | | | Days to Expiration | | | Exercise Price | | | Options | |

Outstanding January 1, 2022 | | Glenn Simpson | | 4/6/2024 | | | | 827 | | | $ | 0.16 | | | | 159,054 | |

Exercised June 1, 2022 | | Glenn Simpson | | 4/6/2024 | | | | - | | | $ | 0.16 | | | | (159,054 | ) |

Outstanding June 30, 2023 | | Glenn Simpson | | | - | | | | - | | | | - | | | | 0 | |

During the six months ended June 30, 2023 and 2022, compensation expense related to stock options was $0. As of June 30, 2023, there was no unrecognized compensation cost related to non-vested stock options.

NOTE 6 – RELATED PARTY TRANSACTIONS

During the six months ended June 30, 2023, Mr. Simpson lent funds to the Company. As of June 30, 2023, the loan payable to Mr. Simpson was $290,000.

During the year ended December 31, 2022, Mr. Simpson lent funds to the Company. As of December 31, 2022, the loan payable to Mr. Simpson was $225,000.

On June 1, 2022, Mr. Simpson exercised 159,054 stock options at an exercise price of $0.16. The Company issued 159,054 Restricted and Non-Trading shares of Common Stock in exchange for the total exercise price of $25,449.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is provided in addition to the accompanying financial statements and notes to assist readers in understanding our results of operations, financial condition and cash flows. MD&A is organized as follows:

| ● | Significant Accounting Policies — Accounting policies that we believe are important to understanding the assumptions and judgments incorporated in our reported financial results and forecasts. |

| | |

| ● | Results of Operations — Analysis of our financial results comparing the quarter ended June 30, 2023 to June 30, 2022. |

| | |

| ● | Liquidity and Capital Resources — Analysis of changes in our cash flows, and discussion of our financial condition and potential sources of liquidity. |

This report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this annual report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Significant Accounting Policies

We have prepared our financial statements in conformity with accounting principles generally accepted in the United States, which requires management to make significant judgments and estimates that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. We base these significant judgments and estimates on historical experience and other applicable assumptions we believe to be reasonable based upon information presently available. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. These changes have historically been minor and have been included in the financial statements as soon as they became known. Actual results could materially differ from our estimates under different assumptions, judgments or conditions.

All of our significant accounting policies are discussed in Note 2, Summary of Significant Accounting Policies, to our financial statements, included elsewhere in this Annual Report. We have identified the following as our critical accounting policies and estimates, which are defined as those that are reflective of significant judgments and uncertainties, are the most pervasive and important to the presentation of our financial condition and results of operations and could potentially result in materially different results under different assumptions, judgments or conditions.

We believe the following critical accounting policies reflect our more significant estimates and assumptions used in the preparation of our financial statements:

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). Management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments — Our short-term financial instruments, including cash, accounts receivable, accounts payable and other liabilities, consist primarily of instruments without extended maturities. We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts.

COMPANY OVERVIEW

EQUATOR Beverage Company, headquartered in Jersey City, NJ, is a Delaware corporation that specializes in developing, producing, distributing, and marketing new beverage products.

Our beverages have been certified Non-GMO Project Verified and USDA Organic, and we offer both nonalcoholic and ready-to-drink alcoholic options. In addition, we have a line of sparkling energy beverages targeted towards female consumers.

Our beverages can be found in North America, the Caribbean, and Bermuda. We are committed to sustainability and use 100% recyclable, eco-friendly packaging that has a minimal impact on the environment. Furthermore, our products are plant-based, renewable, and eco-friendly.

Coconut water is nature's super hydration drink for skin and body. In each 11 oz serving, there are five essential electrolytes totaling 1043 mg more than other sports drinks. It is a fast rehydration recovery drink which performs faster than water. Coconut water has natural nutrients for skin and hair and vitamins B & C natural - not added. Coconut water is plant based and renewable; great for vegan, kosher, paleo keto and low carb diets. All this comes with a fresh crisp coconut taste. There are no preservatives in this coconut water and it is packaged in an eco-friendly container.

Results of Operations

Three Months Ended June 30, 2023 and 2022

Revenue

For the three months ended June 30, 2023, the Company reported revenue of $588,479 an increase from revenue of $541,102 for the three months ended June 30, 2022. The $47,377 increase in revenue was due in part to a strong demand for a new product that launched in 2022.

Cost of Revenue

Cost of revenue includes finished goods purchase costs, production costs, raw material costs and freight in costs. Also included in cost of revenue are adjustments made to inventory carrying amounts, including markdowns to market.

For the three months ended June 30, 2023, cost of revenue was $307,721 or 52% of revenue. For the three months ended June 30, 2022, cost of revenue was $352,760 or 65% of revenue. The 13% decrease in cost of revenue was primarily due to lower ocean transportation costs for the quarter ended June 30, 2023 compared to the same period last year.

Operating Expenses

For the three months ended June 30, 2023, selling, general and administrative expenses was $258,671 an increase of $70,441 from the three months ended June 30, 2022 of $188,229.

This increase in operating expenses was due to an increase in Amazon Selling fees coupled with increases in compensation and marketing expenses. Amazon selling fees increased by $35,683. Compensation expense increased by $12,950 and marketing expenses went up by $11,013 compared to the same period last year.

Net Income

For the three months ended June 30, 2023, the net income was $18,830, a $21,657 improvement from a net loss of ($2,827) for the three months ended June 30, 2022.

Six Months Ended June 30, 2023 and 2022

Revenue

For the six months ended June 30, 2023, the Company reported revenue of $1,104,113 an increase from revenue of $920,759 for the six months ended June 30, 2022. The $183,354 increase in revenue was primarily due to Covid having a lesser impact on our business.

Cost of Revenue

Cost of revenue includes finished goods purchase costs, production costs, raw material costs and freight in costs. Also included in cost of revenue are adjustments made to inventory carrying amounts, including markdowns to market.

For the six months ended June 30, 2023, cost of revenue was $621,179 or 56% of revenue. For the six months ended June 30, 2022, cost of revenue was $585,343 or 63% of revenue. The 7% decrease in cost of revenue was due to the lower ocean transportation costs for the first six months of 2023 compared to the same period last year.

Operating Expenses

For the six months ended June 30, 2023, selling, general and administrative expenses was $453,583 a decrease of $16,213 from the six months ended June 30, 2022 of $469,796.

This increase in operating expenses was due to lower stock award expenses offset by increases in Amazon selling expenses, compensation expenses and marketing expenses. During the first six months of 2023, Stock award expenses decreased by $89,520 compared to the same period last year; while Amazon selling expenses increased by $27,280, compensation expenses increased by $26,980 and marketing expenses increased by $11,671 compared to the first six months of 2022.

Net Income

For the six months ended June 30, 2023, the net income was $23,315, a $161,521 improvement from a net loss of ($138,206) for the six months ended June 30, 2022.

Liquidity and Capital Resources

Liquidity

As of June 30, 2023, the Company had working capital of $171,408. Net cash used in operating activities was $2,673 for the six months ended June 30, 2023, compared to net cash used in operating activities for the six months ended June 30, 2022 of $100,016. Net cash provided by financing activities was $26,998 for the six months ended June 30, 2023 compared to $57,260 for the six months ended June 30, 2022. Net cash was provided by financing activities of a related party loan, offset by cash used in financing activities to repurchase EQUATOR Restricted Common Stock for the six months ended June 30, 2023. Net cash was provided by financing activities of a related party loan and proceeds from the exercise of stock options, offset by cash used in financing activities to repurchase EQUATOR Restricted Common Stock for the six months ended June 30, 2022.

Working Capital Needs

Our working capital requirements increase as demand grows for our products. During the six months ended June 30, 2023, the Company had net borrowings of $290,000. This was the direct result of supply chain delays in manufacturing and ocean transport times. In 2022, borrowings were $225,000. Should the Company require additional working capital during the next twelve months, it may seek to raise additional funds. Financing transactions may include the issuance of equity, debt securities and obtaining credit facilities.

OFF BALANCE SHEET ARRANGEMENTS

None

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISKS

Not applicable

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act of 1934 (the “Exchange Act”) is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

Under the supervision and with the participation of the Company’s senior management, consisting of the Company’s principal executive and financial officer and the Company’s principal accounting officer, the Company conducted an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures, as defined in Rules 13a-15€ and 15d-15(e) under the Exchange Act as of the end of the period covered by this report (the “Evaluation Date”). Based on this evaluation, the Company’s principal executive and financial officer concluded, as of the Evaluation Date, that the Company’s disclosure controls and procedures were effective.

Management’s Annual Report on Internal Control over Financial Reporting

The management of EQUATOR Beverage Company is responsible for establishing and maintaining an adequate system of internal control over financial reporting (as defined in Rule 13a-15(f)) under the Exchange Act. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes of accounting principles generally accepted in the United States. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements.

Therefore, even those systems determined to be effective can provide only reasonable assurance of achieving their control objectives. In evaluating the effectiveness of our internal control over financial reporting, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013). Based on this evaluation, our officers concluded that, during the period covered by this annual report, our internal controls over financial reporting were not operating effectively.

As previously reported, the Company does not have an audit committee and is not currently obligated to have one. Management does not believe that the lack of an audit committee is a material weakness.

Changes in Internal Control over Financial Reporting

There was no change in our internal controls over financial reporting during the quarter ended June 30, 2023 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not a party to any legal or administrative proceedings and are not aware of any pending or threatened legal or administrative proceedings against the Company in all material aspects. We could from time to time become a party to various legal or administrative proceedings arising in the course of our business.

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

If we are unable to expand our operations in the marketplace, our growth rate could be negatively affected.

Our success depends in part on our ability to grow our business. We have adopted and implemented a strategic plan to increase awareness of our products, secure additional distribution channels, and foster and strengthen our supply, manufacturing and distribution relationships. Our strategic plan includes addressing changes in the market. There can be no assurance that we will achieve the growth necessary to achieve our objectives.

We could need additional capital in the future to expand our operations and execute our business objectives.

Should we need additional capital to expand our operations, financing transactions may include the issuance of equity, debt securities, and credit facilities.

The challenges of competing with other beverage companies could result in reductions to our revenue and operating margins.

The nonalcoholic beverage segment of the beverage industry is competitive. We compete with numerous beverage companies, including those marketing similar products. All beverages’ companies are competing for stomach share on a daily basis which is approximately 64 oz. of fluid per day, per person. Our success depends on our ability to secure distribution channels for our products, our ability to make consumers aware of our products and the appeal of our products to consumers.

Disruption of supply, increases in costs or shortages of ingredients could affect our operating results.

Availability of supply and the prices charged by the producers of production inputs used in our products can be affected by a variety of factors, including the general demand by other buyers for the same fruits used by us in our products, and country politics and country economics in the area in which our fruit is grown.

The quality of fruit we seek trades on a negotiated basis, depending on supply and demand at the time of the purchase. An increase in the price of any fruit that we use in our products will have a negative effect on our margins should we be unable to increase our sales price. Higher energy costs may increase the cost of transporting our supplies. Changes in emission rules for maritime vessels will likely increase costs of shipping our products. Conversely, lower fruit prices and lower energy prices will have a positive result on transport and packaging costs.

We use independent bottlers for the filling of our products and, as such, are subject to the bottler’s production and quality control.

We use independent bottlers for the production of our products. Accordingly, we are dependent on the bottlers and their ability to meet production demands and to achieve product quality. We play an active role in the production of our beverages, which includes but is not limited to developing our formulations, maintaining control over the labeling and packaging of our beverages, and packaging and function of our packaging and correct FDA labeling. We also review and monitor the safety certifications of the factories including their status with the United States Food and Drug Administration. We also inspect the warehouses that our products are stored in, and monitor the trucking companies that deliver our goods.

Litigation and publicity concerning food quality, health claims, and other issues could expose us to significant liabilities.

The packaged food industry can be adversely affected by litigation and complaints from customers and government authorities resulting from product quality, health claims, allergens, illness, and injury. Adverse publicity about these allegations may negatively affect the Company, regardless of whether the allegations are true. In addition, the food industry has been subject to a number of claims based on the nutritional content of food products they sell, and disclosure and advertising practices. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot predict the ultimate outcome of any such proceedings. An unfavorable outcome will have an adverse impact on our business. In addition, any litigation or regulatory proceedings may result in substantial costs.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

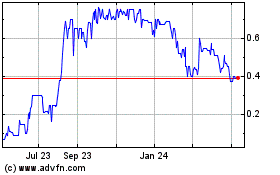

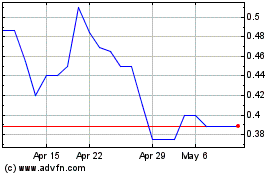

The Company’s Common Stock is currently quoted on the OTCQB under the symbol MOJO.

For the period January 1, 2022 to June 30, 2023, the following table sets forth the high and low closing bid prices by quarter, based upon information obtained from inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions:

Period | | High | | | Low | | | VWAP* | | | Shares Traded | |

Second Quarter 2023 | | $ | 0.35 | | | $ | 0.05 | | | $ | 0.10 | | | | 768,189 | |

First Quarter 2023 | | $ | 0.06 | | | $ | 0.05 | | | $ | 0.06 | | | | 301,445 | |

Fourth Quarter 2022 | | $ | 0.08 | | | $ | 0.05 | | | $ | 0.06 | | | | 332,890 | |

Third Quarter 2022 | | $ | 0.51 | | | $ | 0.06 | | | $ | 0.12 | | | | 1,065,864 | |

Second Quarter 2022 | | $ | 0.22 | | | $ | 0.14 | | | $ | 0.16 | | | | 132,619 | |

First Quarter 2022 | | $ | 0.30 | | | $ | 0.16 | | | $ | 0.20 | | | | 66,677 | |

*Volume-weighted average price

Holders

As of June 30, 2023, there were 16,327,596 shares issued and outstanding. There were 847 shareholders of record.

Dividends

The Company has not declared a cash dividend with respect to its Common Stock. Future payment of dividends is within the discretion of the Board of Directors and will depend on earnings, capital requirements, financial condition and other relevant factors.

Recent Sales of Unregistered Securities, Use of Proceeds from Registered Securities

There were no sales of unregistered securities during the six months ended June 30, 2023 and 2022.

Issuer Purchases of Equity Securities

During the quarter ended June 30, 2023, the Company repurchased 380,019 shares of EQUATOR Restricted Common Stock from shareholders at a total cost of $38,002. The shares were cancelled.

During the year ended December 31, 2022, the Company repurchased 830,342 shares of EQUATOR Restricted Common Stock from shareholders at a total cost of $193,188. The shares were cancelled.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable

PART III

ITEM 7. DIRECTORS, EXECUTIVE OFFICER, AND CORPORATE GOVERNANCE

Executive Officer and Directors

Below are the names and certain information regarding our current executive officer and directors:

Name | | Age | | Title | | Appointed |

Glenn Simpson | | 71 | | Chairman & CEO | | October 27, 2011 |

Jeffrey Devlin | | 76 | | Director | | January 27, 2012 |

Directors are elected to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Biographical information of each current officer and director is set forth below.

Glenn Simpson is Chairman of the Board of Directors and Chief Executive Officer of the Company. Mr. Simpson joined the Company in October 2011. He has extensive experience in the beverage industry. Mr. Simpson was Vice President and Chief Financial Officer of Coca-Cola Bottlers, Inc. in Uzbekistan from 1995 to 2000. His primary responsibilities included corporate strategy, supervision of bottling and distribution operations and facilities construction. His accomplishments included growing revenues from a base at $4 million to over $160 million annually. The company was awarded “Bottler of the Year” by The Coca-Cola Company for two consecutive years under his leadership based upon product quality and revenue growth. From 2009 to 2011, Mr. Simpson was engaged in beverage projects on a consulting basis in Russia and Afghanistan. Mr. Simpson is a Certified Public Accountant and holds an MBA from Columbia University School of Business.

Jeffrey Devlin has served on the Board of Directors of the Company since January 2012. Mr. Devlin has over 35 years of advertising and business development experience. Mr. Devlin currently serves as Chief Marketing Officer – Government, Advertising and Commerce at Deloitte Consulting LLP. He has held various other executive and creative positions over the course of his advertising career, including launching the introduction of Diet Coke for The Coca-Cola Company. Mr. Devlin currently serves on the board of directors of a number of private organizations, as well as on the board of directors of Location Based Technologies, Inc., a publicly traded company. Mr. Devlin received a Bachelor’s degree from Bethel University.

Board Committees

The Company has not established any committees of the Board of Directors. Our Board of Directors may designate from among its members an executive committee and one or more other committees in the future. We do not have a nominating committee or a nominating committee charter. Further, we do not have a policy with regard to the consideration of any director candidates recommended by security holders. To date, no security holders have made any such recommendations. Our two directors perform all functions that would otherwise be performed by committees. Given the present size of our board it is not practical for us to have committees. If we are able to grow our business and increase our operations, we intend to expand the size of our board and allocate responsibilities accordingly.

Shareholder Communications

Currently, we do not have a policy with regard to the consideration of any director candidates recommended by security holders. To date, no security holders have made any such recommendations.

Code of Ethics

We have adopted a written code of ethics (the “Code of Ethics”) that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. We believe that the Code of Ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code. To request a copy of the Code of Ethics, please make written request to our Company at 185 Hudson Street, Floor 25, Jersey City, New Jersey 07302.

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Exchange Act, all executive officers, directors, and each person who is the beneficial owner of more than 10% of the common stock of a company that files reports pursuant to Section 12 of the Exchange Act of 1934, are required to report the ownership of such common stock, options, and stock appreciation rights (other than certain cash only rights) and any changes in that ownership with the SEC. To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the three months ended June 30,2023 all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied with.

ITEM 8. EXECUTIVE COMPENSATION

The following table sets forth information concerning the total compensation paid or earned by each of our named executive officers (as defined under SEC rules).

Name and Principal Position | | Year | | Salary | | | Stock Awards | |

Glenn Simpson, Chairman & CEO | | 2023 | | $ | 48,000 | (1) | | $ | 33,902 | (1) |

| | 2022 | | $ | 30,000 | (2) | | $ | 37,922 | (2) |

| (1) | Pursuant to Mr. Simpson’s employment agreement (the “Amended Simpson Agreement”) amended September 1, 2022, Mr. Simpson is paid a salary of $8,000 per month in cash and the Company is obligated to grant Mr. Simpson 67,000 shares of non-trading, restricted Common Stock per month. Pursuant to this agreement, Mr. Simpson is also entitled to an annual bonus comprised of cash and stock awards for non-trading, restricted Common shares based on performance goals established by the Board of Directors of the Company. The cash bonus is established at $44,400 per year. The stock award is set at 200,000 shares of non-trading, restricted Common Stock per year through March 31, 2027. |

| | |

| (2) | Pursuant to Mr. Simpson’s employment agreement (the “Simpson Agreement”), Mr. Simpson is paid a salary of $5,000 per month in cash and the Company is obligated to grant Mr. Simpson 33,500 shares of non-trading, restricted Common Stock per month. Pursuant to this agreement, Mr. Simpson is also entitled to an annual bonus comprised of cash and stock awards for non-trading, restricted Common shares based on performance goals established by the Board of Directors of the Company. The cash bonus is established at $44,400 per year. The stock award is set at 100,000 shares of non-trading, restricted Common Stock per year through March 31, 2025. |

During the six months ended June 30, 2023, 402,000 shares of Non-trading, Restricted Common Stock were issued to Mr. Simpson for his stock awards.

During the six months ended June 30, 2022, 201,000 shares of Non-trading, Restricted Common Stock were issued to Mr. Simpson for his stock awards. Mr. Simpson was also issued 350,000 shares of Non-Trading Restricted Common Stock as a one-time stock award.

Outstanding Option Awards at June 30

The following table sets forth information regarding stock options held by executive officers at June 30.

| | | | Expiration | | Exercise | | | As of June 30, | |

| | Issued To | | Date | | Price | | | 2023 | | | 2022 | |

Shares underlying options outstanding | | Glenn Simpson | | 4/6/2024 | | $ | 0.16 | | | | 0 | | | | 159,054 | |

On February 4, 2022, the Company adjusted the exercise price of the options granted to Mr. Simpson from $0.32 per share to $0.16 per share.

Option Exercises in 2023 and 2022

On June 1, 2022, Mr. Simpson exercised options to purchase 159,054 Restricted and Non-Trading shares at $0.16 per share. The total exercise value was $25,449.

Director Compensation

The non-employee director did not receive cash compensation for serving as such, for serving on committees (if any) of the Board of Directors or for special assignments. Board members are not reimbursed for expenses incurred in connection with attending meetings.

ITEM 9. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information with respect to the beneficial ownership of our Common Stock known by us as of June 30, 2023 by:

| ● | each director; |

| ● | each named executive officer; and |

| ● | all directors and executive officers as a group. |

Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of our Common Stock owned by them, except to the extent such power may be shared with a spouse.

Name | | Shares | | | Common Stock Percent | |

Glenn Simpson | | | 7,903,892 | | | | 48 | |

Chairman & CEO | | | | | | | | |

Diane Cudia | | | 491,667 | | | | 3 | |

Corporate Controller | | | | | | | | |

Jeffrey Devlin | | | 555,643 | | | | 3 | |

Director | | | | | | | | |

All Officers and Directors | | | 8,951,202 | | | | 54 | |

PART IV

ITEM 10. EXHIBITS

Financial Statement Schedules

The financial statements of EQUATOR Beverage Company are listed on the Index to Financial Statements on this quarterly report on Form 10-Q beginning on page F-1.

The following Exhibits are being filed with this Quarterly Report on Form 10-Q:

101.INS | Inline XBRL Instance Document |

101.SCH | Inline XBRL Taxonomy Extension Schema Document |

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document |

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

(1) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the Securities and Exchange Commission (the “SEC”) on May 18, 2011. |

| |

(2) | Incorporated by reference to the Registrant’s Registration Statement on Form SB-2 as an exhibit, numbered as indicated above, filed with the SEC on December 19, 2007. |

| |

(3) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on May 4, 2011. |

| |

(4) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on January 4, 2012. |

| |

(5) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on October 31, 2011. |

| |

(6) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on April 2, 2013. |

| |

(7) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on February 1, 2013. |

| |

(8) | Incorporated by reference to the Registrant’s Current Report on Form 10-K as an exhibit, numbered as indicated above, filed with the SEC on September 24, 2013. |

| |

(9) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on October 23, 2015. |

| |

(10) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on July 1, 2021. |

| |

(11) | Incorporated by reference to the Registrant’s Current Report on Form 8-K as an exhibit, numbered as indicated above, filed with the SEC on July 20, 2022. |

SIGNATURES

In accordance with the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| EQUATOR BEVERAGE COMPANY | |

| | | |

Dated: August 2, 2023 | By: | /s/ Glenn Simpson | |

| | Glenn Simpson Chairman & CEO (Principal Executive and Principal Financial Officer) | |

nullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2