Form 8-K - Current report

July 26 2023 - 4:49PM

Edgar (US Regulatory)

0001160791false00011607912023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2023

GOLD RESOURCE CORPORATION

(Exact name of registrant as specified in its charter)

| | |

Colorado | 001-34857 | 84-1473173 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | |

7900 E. Union Ave, Suite 320 | | |

Denver, Colorado | | 80237 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number including area code: (303) 320-7708

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

Common Stock | GORO | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

1.01

Item 2.02 Results of Operations and Financial Condition.

On July 26, 2023, Gold Resource Corporation (“the Company”) issued a news release reporting its production and unaudited financial results for the second quarter of 2023. A copy of the news release is attached as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any of the Company’s filings or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are furnished with this report:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| | |

| | GOLD RESOURCE CORPORATION |

| | | |

Date: July 26, 2023 | | By: | /s/ Allen Palmiere |

| | Name: | Allen Palmiere |

| | Title: | Chief Executive Officer and President |

Exhibit 99.1

GOLD RESOURCE CORPORATION REPORTS MID-YEAR OPERATIONAL RESULTS

MAINTAINS 2023 PRODUCTION GUIDANCE

Denver, Colorado – July 26, 2023 – Gold Resource Corporation (NYSE American: GORO) (the “Company”) is pleased to announce its mid-year and quarterly operational results from its Don David Gold Mine (DDGM) in near Oaxaca, Mexico and a corporate update on its other activities.

Year to Date Highlights Include:

| ● | Produced and sold 10,795 ounces of gold and 569,072 ounces of silver |

| ● | Produced and sold 6,201 tonnes of zinc, 659 tonnes of copper, and 2,734 tonnes of lead |

| ● | Total cash cost after co-product credits for the quarter was $1,333 per gold equivalent ounce |

| ● | Cash balance of $18 million with no debt and working capital of $20.8 million at June 30, 2023 |

“While our quarterly results are lower when compared to last year’s environment of higher base metal prices, our operational results to date remain in line with our 2023 mine plan and guidance,” stated Allen Palmiere, President and CEO for the Company. “Factors that are out of our control and affect our bottom line include a strengthening Mexican Peso to the US dollar, increased local power costs and lower metal prices for our co-product metals of copper, lead and zinc. To offset these factors, we continue to identify and implement opportunities for other cost reductions and operational efficiencies. We are pleased to report that we continue to have encouraging drill results from our underground exploration program at DDGM with the goal to increase the average grade of our life of mine resources and that of our 2024 mine plan.”

Second Quarter Operational Results

Don David Gold Mine

| ● | No lost time incidents during the quarter. Our year-to-date LTIFR safety record is 0.22 as compared to the Mexican average of 0.88 (in US equivalent). Safety at Gold Resource Corporation is paramount. Even with a good track record at the Don David Gold Mine (“DDGM”), the Company continues to strive each quarter for improved measures, awareness, and training. |

| ● | The DDGM diamond drilling program has progressed as planned during the second quarter with encouraging results. Drilling continues to advance at DDGM on two fronts: (1) Infill drilling with the objective of upgrading defined Inferred resources to the Indicated category; and (2) Exploration drilling with the objective of identifying additional Inferred resources via step-out drilling along the South Soledad, Sagrario, Marena and Three Sisters vein systems, as well as on the recently identified Gloria vein system. |

Back Forty Project

| ● | Optimization work related to the metallurgy and the economic model for the Back Forty Project in Michigan, USA is near completion. The Company plans to release these updated results in a report during the third quarter. |

| ● | Updated site layout designs have focused on little to no impact on wetlands and being fully protective of the environment. The U.S. Supreme Court ruling in Sackett v. Environmental Protection Agency limits the federal government’s authority with regards to wetlands and will likely result in not needing a “dredge and fill” wetland permit. The “drawdown” of wetlands will be regulated by Michigan State authorities. |

Financial

| ● | Total cash cost after co-product credits for the quarter was $1,333 per gold equivalent (“AuEq”) ounce and total all-in sustaining cost (“AISC”) after co-product credits for the quarter was $1,990 per AuEq ounce. Although the year-to-date total cash cost after co-product credits of $979 and total AISC after co-product credits of $1,551 are within guidance, the strengthening of the peso and lower zinc prices may result in needing to revise the full year guidance later in the year. (See Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a reconciliation of non-GAAP measures to applicable GAAP measures). |

| ● | The Company’s At The Market Offering Agreement with H.C. Wainwright & Co., LLC (the “Agent”), which was entered into in November 2019 (the “ATM Agreement”), pursuant to which the Agent agreed to act as the Company’s sales agent with respect to the offer and sale from time to time of the Company’s common stock having an aggregate gross sales price of up to $75.0 million was renewed in June 2023. |

2023 Capital and Exploration Investment Summary

| | | | | | |

| | For the six months ended June 30, 2023 | | 2023 full year guidance |

| | (in thousands) |

Sustaining Investments: | | | | | | |

Underground Development | Capital | $ | 2,362 | | | |

Infill Drilling | Capitalized Exploration | | 1,785 | | | |

Other Sustaining Capital | Capital | | 628 | | | |

Surface and Underground Exploration Development & Other | Capitalized Exploration | | 1,079 | | | |

Subtotal of Sustaining Investments: | | | 5,854 | | $ | 9 - 11 million |

Growth Investments: | | | | | | |

DDGM growth: | | | | | | |

Surface Exploration / Other | Exploration | | 1,139 | | | |

Underground Exploration Drilling | Exploration | | 1,295 | | | |

Underground Exploration Development | Capitalized Exploration | | 147 | | | |

Back Forty growth: | | | | | | |

Back Forty Project Optimization & Permitting | Exploration | | 845 | | | |

Subtotal of Growth Investments: | | | 3,426 | | $ | 6 - 7 million |

Total Capital and Exploration: | | $ | 9,280 | | $ | 15 - 18 million |

Trending Highlights

| | | | | | | |

| 2022 | | 2023 |

| Q1 | Q2 | Q3 | Q4 | | Q1 | Q2 |

Operating Data | | | | | | | |

Total tonnes milled | 136,844 | 129,099 | 110,682 | 116,616 | | 117,781 | 113,510 |

Average Grade | | | | | | - | |

Gold (g/t) | 3.00 | 2.63 | 1.98 | 2.51 | | 2.33 | 1.59 |

Silver (g/t) | 81 | 64 | 80 | 109 | | 94 | 86 |

Copper (%) | 0.41 | 0.32 | 0.37 | 0.45 | | 0.37 | 0.37 |

Lead (%) | 1.97 | 1.99 | 1.59 | 1.58 | | 1.73 | 1.64 |

Zinc (%) | 4.89 | 4.00 | 4.21 | 4.27 | | 3.88 | 3.72 |

Metal production (before payable metal deductions) | | | | | | | |

Gold (ozs.) | 11,187 | 9,317 | 5,851 | 7,767 | | 7,171 | 4,637 |

Silver (ozs.) | 332,292 | 249,088 | 261,256 | 370,768 | | 322,676 | 289,816 |

Copper (tonnes) | 431 | 303 | 296 | 406 | | 336 | 334 |

Lead (tonnes) | 2,073 | 2,020 | 1,249 | 1,323 | | 1,559 | 1,389 |

Zinc (tonnes) | 5,562 | 4,282 | 3,901 | 4,198 | | 3,837 | 3,569 |

Metal produced and sold | | | | | | | |

Gold (ozs.) | 8,381 | 8,746 | 5,478 | 7,514 | | 6,508 | 4,287 |

Silver (ozs.) | 265,407 | 231,622 | 225,012 | 335,168 | | 294,815 | 274,257 |

Copper (tonnes) | 408 | 286 | 282 | 372 | | 332 | 327 |

Lead (tonnes) | 1,639 | 1,755 | 1,056 | 941 | | 1,417 | 1,317 |

Zinc (tonnes) | 4,359 | 3,590 | 2,943 | 3,265 | | 3,060 | 3,141 |

Average metal prices realized | | | | | | | |

Gold ($ per oz.) | $ 1,898 | $ 1,874 | $ 1,627 | $ 1,734 | | $ 1,915 | $ 2,010 |

Silver ($ per oz.) | $ 23.94 | $ 22.05 | $ 18.54 | $ 21.25 | | $ 23.04 | $ 24.93 |

Copper ($ per tonne) | $ 10,144 | $ 9,275 | $ 7,115 | $ 8,221 | | $ 9,172 | $ 8,397 |

Lead ($ per tonne) | $ 2,347 | $ 2,168 | $ 1,882 | $ 1,954 | | $ 2,158 | $ 2,153 |

Zinc ($ per tonne) | $ 3,842 | $ 4,338 | $ 3,186 | $ 2,577 | | $ 3,195 | $ 2,485 |

Gold equivalent ounces sold | | | | | | - | |

Gold Ounces | 8,381 | 8,746 | 5,478 | 7,514 | | 6,508 | 4,287 |

Gold Equivalent Ounces from Silver | 3,348 | 2,729 | 2,564 | 4,107 | | 3,547 | 3,402 |

Total AuEq oz | 11,729 | 11,475 | 8,042 | 11,621 | | 10,055 | 7,689 |

Financial Data ($'s in thousands except for per ounce) | | | | | | | |

Total sales, net | $ 45,417 | $ 37,064 | $ 23,869 | $ 32,374 | | $ 31,228 | $ 24,807 |

Total cash cost after co-product credits per AuEq oz sold | $ (163) | $ 247 | $ 1,103 | $ 842 | | $ 711 | $ 1,333 |

Total consolidated all-in sustaining cost after co-product credits per AuEq oz sold | $ 462 | $ 799 | $ 1,831 | $ 1,226 | | $ 1,221 | $ 1,990 |

Production Costs | $ 20,074 | $ 21,722 | $ 19,380 | $ 19,773 | | $ 19,850 | $ 20,302 |

Production Costs/Tonnes Milled | $ 147 | $ 168 | $ 175 | $ 170 | | $ 169 | $ 179 |

Operating Cash Flows | $ 4,230 | $ 7,976 | $ (4,292) | $ 6,243 | | $ 1,024 | $ (551) |

Net income (loss) | $ 4,019 | $ 2,673 | $ (9,730) | $ (3,283) | | $ (1,035) | $ (4,584) |

Earnings (loss) per share - basic | $ 0.05 | $ 0.03 | $ (0.11) | $ (0.04) | | $ (0.01) | $ (0.05) |

About GRC:

Gold Resource Corporation is a gold and silver producer, developer, and explorer with its operations centered on the Don David Gold Mine in Oaxaca, Mexico. Under the direction of an experienced board and senior leadership team, the company’s focus is to unlock the significant upside potential of its existing infrastructure and large land position surrounding the mine in Oaxaca, Mexico and to develop the Back Forty Project in Michigan, USA. For more information, please visit GRC’s website, located at www.goldresourcecorp.com and read the company’s Form 10-K for an understanding of the risk factors associated with its business.

Q2 2023 Conference Call

The Company will host a conference call Thursday, July 27, 2023 at 10:00 a.m. Mountain Time.

The conference call will be recorded and posted to the Company’s website later in the day following the conclusion of the call. Following prepared remarks, Allen Palmiere, President and Chief Executive Officer, Alberto Reyes, Chief Operating Officer and Kim Perry, Chief Financial Officer will host a live question and answer (Q&A) session. There are two ways to join the conference call.

To join the conference via webcast, please click on the following link:

https://viavid.webcasts.com/starthere.jsp?ei=1624501&tp_key=3623edd13a

To join the call via telephone, please use the following dial-in details:

Participant Toll Free: +1 (888) 886-7786

International: +1 (416) 764-8658

Conference ID: 11731488

Please connect to the conference call at least 10 minutes prior to the start time using one of the connection options listed above.

For further information please contact:

Kim Perry

Chief Financial Officer

Kim.Perry@GRC-USA.com

www.GoldResourcecorp.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

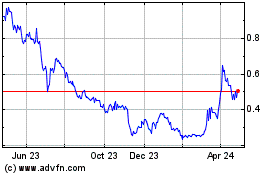

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Mar 2024 to Apr 2024

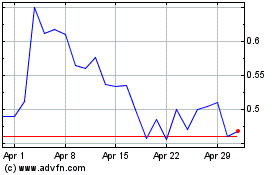

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Apr 2023 to Apr 2024