0001328792

false

0001328792

2023-07-17

2023-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities

and Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 17, 2023

TECHPRECISION CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

000-51378 |

|

51-0539828 |

|

(State or Other Jurisdiction

of Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

1 Bella Drive

Westminster, MA 01473

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(978) 874-0591

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act. |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2b under the Exchange Act. |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Securities registered or to be registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

TPCS |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On July 17,

2023, TechPrecision Corporation (the “Company”) entered into an Employment Agreement with Barbara M. Lilley

(the “Employment Agreement”), with an effective date as of July 14, 2023 and which governs Ms. Lilley’s

employment as Chief Financial Officer of the Company. Pursuant to the Employment Agreement, Ms. Lilley will: (i) receive an

annual base salary of $200,000; and (ii) receive a grant of 15,000 restricted shares of the Company’s common stock pursuant to the

TechPrecision Corporation 2016 Long-Term Incentive Plan, as amended. Under the Employment Agreement, Ms. Lilley also will be

eligible to participate in Company benefits provided to other senior executives as well as benefits available to Company employees generally.

In addition

to the compensation arrangements described above, the Employment Agreement contains customary provisions (i) prohibiting Ms. Lilley from

using or divulging to third parties confidential information or trade secrets of the Company; (ii) confirming that all intellectual

work products generated by Ms. Lilley during the term of her employment with the Company are the sole property of the Company; and

(iii) prohibiting Ms. Lilley from competing against the Company, including by soliciting the Company’s employees or its current

or prospective clients, until the one year anniversary of the termination of her employment. The Employment Agreement has an indefinite

term and each of Ms. Lilley and the Company may terminate the Employment Agreement upon the giving of written notice.

The foregoing

description of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement, a copy

of which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

TECHPRECISION CORPORATION |

|

| |

|

|

|

| Date: July 21, 2023 |

|

|

|

| |

|

|

|

| |

By: |

/s/ Barbara M. Lilley |

|

| |

|

Barbara M. Lilley |

|

| |

|

Chief Financial Officer |

|

Exhibit

10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT

(the “Agreement”) is made as of July 17, 2023 to be effective as of July 14, 2023 (the “Effective Date”),

between TechPrecision Corporation, a Delaware corporation (the “Company”), and Barbara M. Lilley (the “Employee”).

RECITALS

WHEREAS, the Employee is employed

as the controller of Ranor, Inc., a wholly owned subsidiary of the Company;

WHEREAS, the Company now desires

to employ the Employee as its Chief Financial Officer and the Employee desires to accept such position and to be so employed by the Company;

and

WHEREAS, the parties desire

to enter into this Agreement to set forth the terms and conditions of the Employee’s employment with the Company.

NOW, THEREFORE, in consideration

of the foregoing premises and the mutual promises, terms, provisions and conditions set forth in this Agreement, the parties hereto hereby

agree as follows:

1.

Employment. Commencing on the Effective Date, the Company agrees to employ the Employee during the Term specified in Paragraph

2 hereof, and the Employee agrees to accept such employment, upon the terms and conditions hereinafter set forth.

2. Term.

The Company hereby employs the Employee, and the Employee hereby accepts employment with the Company, upon the terms and conditions hereinafter

set forth commencing on the Effective Date and continuing in effect until termination of this Agreement in accordance with the provisions

of Paragraph 6 of this Agreement (the “Term”).

3.

Duties and Responsibilities.

a. The

Employee shall serve as Chief Financial Officer (“CFO”) of the Company during the Term.

b. The

Employee’s powers, duties and responsibilities shall initially consist of such powers, duties and responsibilities as are customary

to the office of CFO of a company and division similar in size and stature to the Company. The Employee shall report to the Company’s

CEO and the Company’s Board of Directors (the “Board”) and others at the direction of the Board at such time

and in such detail as the Board shall reasonably require. Notwithstanding anything contained herein to the contrary, the Employee shall

not be required to perform any act which would constitute or require the violation of any federal, state or local law, rule, regulation,

ordinance or the like.

c. The

Employee shall devote not less than an average of forty (40) hours per week to carrying out Employee’s duties hereunder and to

the business of the Company and its affiliates, and during the Term the Employee agrees that Employee will (i) devote Employee’s

best efforts and all Employee’s skill and ability to the performance of Employee’s duties hereunder; (ii) carry out Employee’s

duties in a competent and professional manner; and (iii) generally promote the interests of the Company and its affiliates. During the

Term it shall not be a violation of this Agreement for the Employee to serve on civic or charitable boards or committees, to perform

speaking engagements, or to manage Employee’s personal passive investments, so long as such activities (individually or collectively)

do not interfere with the performance of the Employee’s responsibilities as an employee of the Company.

4.

Compensation.

a.

As compensation for services hereunder and in consideration of Employee’s agreement not to compete as set forth below, the

Company shall pay the Employee an initial base salary at the annual rate of Two Hundred Thousand Dollars ($200,000). Such base salary

shall be paid in equal installments in accordance with the normal payroll policies of the Company.

b.

The Employee’s base salary under this Agreement may be adjusted by order of the Compensation Committee of the Board or the

full Board, as appropriate.

c. As

soon as reasonably practicable following the date hereof, the Company shall grant 15,000 restricted shares of the Company’s common

stock to the Employee (the “Restricted Shares”) pursuant to TechPrecision’s 2016 Long-Term Incentive Plan, as

amended from time to time (the “Plan”). Once granted, provided that the Employee remains employed by the Company from

the Effective Date through the applicable vesting dates, 5,000 of the Restricted Shares shall vest on each of the first, second, and

third anniversaries of the Effective Date; provided that in the event of a Change in Control (as defined in the Plan) while the Employee

is employed by the Company, all outstanding, unvested Restricted Shares shall become fully vested on the effective date of such Change

in Control, subject to the terms and conditions of the Plan. For the avoidance of doubt, none of the Restricted Shares will vest following

the end of the Employee’s employment with the Company. Any additional future grants will be as the Compensation Committee or the

full Board shall in its sole discretion institute.

5.

Expenses; Fringe Benefits.

a.

The Company agrees to pay or to reimburse the Employee during the Term for all reasonable, ordinary and necessary business expenses

incurred in the performance of Employee’s services hereunder in accordance with the policies of the Company as are from time to

time in effect. The Employee, as a condition to obtaining such payment or reimbursement, shall provide to the Company any and all statements,

bills or receipts evidencing the travel or out-of-pocket expenses for which the Employee seeks payment or reimbursement, and any other

information or materials required by such Company policy or as the Company may otherwise from time to time reasonably require.

b.

During the Term the Employee and, to the extent eligible, Employee’s dependents, shall be entitled to participate in and

receive all benefits under any welfare benefit plans and programs provided by the Company (including without limitation, medical, dental,

disability, group life (including accidental death and dismemberment) and business travel insurance plans and programs) applicable generally

to the employees of the Company, subject, however, to the generally applicable eligibility and other provisions of the various plans and

programs in effect from time to time.

c.

During the Term the Employee shall be entitled to participate in all retirement plans and programs (including without limitation

any profit sharing/40l(k) plan) applicable generally to the employees of the Company, subject, however, to generally applicable eligibility

and other provisions of the various plans and programs in effect from time to time. In addition, during the Term the Employee shall be

entitled to receive fringe benefits and perquisites in accordance with the plans, practices, programs and policies of the Company from

time to time in effect, available generally to the executive officers of the Company and consistent with the generally applicable guidelines

determined by the Board.

d.

The Employee shall be entitled to four (4) weeks’ vacation per year and such holidays, sick days and personal days as are

in accordance with the Company’s policy then in effect for its employees generally, upon such terms as may be provided of general

application to all employees of the Company.

6.

Termination.

a.

The Employee’s employment hereunder shall terminate on the earliest of: (i) on the date set forth in a written notice from

the Board that Employee’s employment with the Company has been or will be terminated; (ii) on the date not less than thirty days

following written notice from the Employee that the Employee is resigning from the Company; or (iii) on the date of Employee’s death.

Upon cessation of Employee’s employment for any reason, unless otherwise consented to in writing by the Board, the Employee shall

resign immediately from any and all officer, director and other positions the Employee then holds with the Company and/or its affiliates.

Upon any cessation of Employee’s employment with the Company, the Employee will be entitled only to such compensation and benefits

as described in this Paragraph 6.

b.

If the Employee’s employment with the Company ceases for any reason then the Company’s obligation to the Employee will

be limited solely to the payment of accrued and unpaid base salary, and PTO, through the date of such cessation of employment, subject

to appropriate offsets (as permitted by applicable law) for debts or money due to the Company, including without limitation personal loans

to the Employee and travel advances. All compensation and benefits will cease at the time of such cessation of employment and, except

as otherwise provided by COBRA, the Company will have no further liability or obligation by reason of such termination. The foregoing

will not be construed to limit the Executive’s right to payment or reimbursement for claims incurred prior to the date of such termination

under any insurance contract funding an employee benefit plan, policy or arrangement of the Company in accordance with the terms of such

insurance contract.

7.

Non-Competition and Protection of Confidential Information.

a.

The Employee agrees that Employee’s services to the Company are of a special, unique, extraordinary and intellectual character

and Employee’s position with the Company places the Employee in a position of confidence and trust with the employees and customers

of the Company and its affiliates. Consequently, the Employee agrees that it is reasonable and necessary for the protection of the goodwill,

intellectual property, trade secrets, designs, proprietary information and business of the Company that the Employee make the covenants

contained herein. Accordingly, the Employee agrees that, during the period of the Employee’s employment hereunder and for the period

of one (1) year immediately following the termination of Employee’s employment hereunder, the Employee shall not, directly or indirectly:

i. own,

operate, manage or be employed by or affiliated with any person or entity headquartered within or with a management office in the United

States that engages in any business then being engaged or planned to be engaged in by the Company or any of its subsidiaries or affiliates;

or

ii.

attempt in any manner to solicit from any customer or supplier business of the type performed for or by the Company or persuade

any customer or supplier of the Company to cease to do business or to reduce the amount of business which any such customer or supplier

has customarily done or contemplates doing with the Company, whether or not the relationship between the Company and such customer or

supplier was originally established in whole or in part through Employee’s efforts; or

iii.

employ as an employee or retain as a consultant, or persuade or attempt to persuade any person who is at the date of termination

of the Employee’s employment with the Company or at any time during the preceding year was, or in the six (6) months following such

termination becomes, an employee of or exclusive consultant to the Company to leave the Company or to become employed as an employee or

retained as a consultant by anyone other than the Company.

iv.

As used in this Paragraph 8, the term: “customer” and “supplier” shall mean any person or entity that is

a customer or supplier of the Company at the date of termination of the Employee’s employment with the Company, or at any time during

the preceding year was, or in the six (6) months following such termination becomes, a customer or supplier of the Company, or if the

Employee’s employment shall not have terminated, at the time of the alleged prohibited conduct.

b.

However, the Employee’s obligations under Paragraph 7(a)(i) shall cease to be in effect in the event that the Company terminates

the Employee’s employment with the Company for a reason other than Cause. For purposes of this clause, “Cause”

shall mean: (i) the Employee’s failure or refusal to perform Employee’s material duties and responsibilities or Employee’s

repeated failure or refusal to follow lawful and reasonable directives of the Board or the CEO; (ii) the willful misappropriation by Employee

of the funds, business opportunities, or property of the Company or its affiliates; (iii) the commission by the Employee of any willful

or intentional act, which Employee should reasonably have anticipated would reasonably be expected to have the effect of injuring the

reputation, business or business relationships of the Company or its affiliates; (iv) use of alcohol to excess or illegal drugs, continuing

after written warning from the Board; or (v) any breach by the Employee of any written agreement with the Company.

c. The

Employee acknowledges that the Employee has been advised of the right to consult with counsel prior to signing this Agreement and that

this Agreement was provided to the Employee at least 10 business days before this Agreement is to be effective.

d.

The Employee agrees that the Employee will not at any time (whether during the Term or after termination of this Agreement for

any reason), disclose to anyone, any confidential information or trade secret of the Company or utilize such confidential information

or trade secret for Employee’s own benefit, or for the benefit of third parties, and all memoranda or other documents compiled by

the Employee or made available to the Employee during the Term pertaining to the business of the Company shall be the property of the

Company and shall be delivered to the Company on the date of termination of the Employee’s employment with the Company or at any

other time, as reasonable, upon request. The term “confidential information or trade secret” does not include any information

which (i) becomes generally available to the public other than by breach of this provision, or (ii) is required to be disclosed by law

or legal process.

e.

If the Employee commits a breach or threatens to commit a breach of any of the provisions of Paragraphs 7(a) or (b) hereof, the

Company shall have the right to have the provisions of this Agreement specifically enforced by any court having jurisdiction without being

required to post bond or other security and without having to prove the inadequacy of any other available remedies, it being acknowledged

and agreed that any such breach will cause irreparable injury to the Company and that money damages will not provide an adequate remedy

to the Company. In addition, the Company may take all such other actions and seek such other remedies available to it in law or in equity

and shall be entitled to such damages as it can show it has sustained by reason of such breach.

f.

The parties acknowledge that the type and periods of restriction imposed in the provisions of Paragraphs 7(a) and (b) hereof are

fair and reasonable and are reasonably required for the protection of the Company and the goodwill associated with the business of the

Company; and that the time, scope, geographic area and other provisions of this Paragraph 7 have been specifically negotiated by sophisticated

parties and accordingly it is reasonable that the restrictive covenants set forth herein are not limited by narrow geographic area. If

any of the covenants in Paragraphs 7(a) or (b) hereof, or any part thereof, is hereafter construed to be invalid or unenforceable, it

is the intention of the parties that the same shall not affect the remainder of the covenant or covenants, which shall be given full effect,

without regard to the invalid portions. If any of the covenants contained in Paragraphs 7(a) or (b), or any part thereof, is held to be

unenforceable because of the duration of such provision or the area covered thereby, the parties agree that the court making such determination

should reduce the duration and/or areas of such provision such that, in its reduced form, said provision shall then be enforceable. The

parties intend to and hereby confer jurisdiction to enforce the covenants contained in Paragraphs 7(a) and (b) upon the courts of any

jurisdiction within the geographical scope of such covenants. In the event that the courts of any one or more of such jurisdictions shall

hold such covenants wholly unenforceable by reason of the breadth of such time, scope or geographic area, it is the intention of the parties

hereto that such determination not bar or in any way affect the Company’s right to the relief provided above in the courts of any

other jurisdiction within the geographical scope of such covenants, as to breaches of such covenants in such other respective jurisdictions,

the above covenants as they relate to each jurisdiction being, for this purpose, severable into diverse and independent covenants.

g. For

purposes of Paragraphs 7 and 8 of this Agreement, the “Company” shall be deemed to include the Company and each of its subsidiaries

and affiliates.

8.

Intellectual Property. During the Term, the Employee will disclose to the Company all ideas, inventions, advertising campaigns,

designs, logos, slogans, processes, operations, products or improvements which may be patentable or copyrightable or subject to any trade

or service mark or name, and business plans developed by the Employee during such period, either individually or in collaboration with

others, which relate to the business of the Company (“Intellectual Property”). The Employee agrees that such Intellectual

Property will be the sole property of the Company and that the Employee will at the Company’s request and cost do whatever is reasonably

necessary to secure the rights thereto by patent, copyright, trademark or otherwise to the Company.

9.

Enforceability. The failure of either party at any time to require performance by the other party of any provision hereunder

shall in no way affect the right of that party thereafter to enforce the same, nor shall it affect any other party’s right to enforce

the same, or to enforce any of the other provisions in this Agreement; nor shall the waiver by either party of the breach of any provision

hereof be taken or held to be a waiver of any subsequent breach of such provision or as a waiver of the provision itself.

10.

Government Agencies. Notwithstanding any provision

in this Agreement to the contrary, nothing in this Agreement limits the Employee’s right to file a charge with, to participate in

a proceeding by, to give testimony to, or to communicate with a court, legislative body, administrative agency, government agency, or

government official, including without limitation the Securities and Exchange Commission.

11.

Assignment. This Agreement is binding on and is for the benefit of the parties hereto and their respective successors, heirs,

executors, administrators and other legal representatives. Neither this Agreement nor any right or obligation hereunder may be sold, transferred,

assigned, pledged or hypothecated by either party hereto without the prior written consent of the other party; provided, the Company may

assign its rights and obligations under the Agreement without written consent in connection with the sale or other transfer of all or

substantially all of the Company’s business (whether by way of sale of stock, assets, merger or otherwise).

12.

Severability. In the event any provision of this Agreement is found to be void and unenforceable by a court of competent

jurisdiction, the remaining provisions of this Agreement shall nevertheless be binding upon the parties with the same effect as though

the void or unenforceable part had been severed and deleted.

13. Life

Insurance. The Employee agrees that the Company shall have the right to obtain life insurance on the Employee’s life, at the

Company’s sole expense and with the Company as the sole beneficiary thereof to that end, the Employee shall (a) cooperate fully

with the Company in obtaining such life insurance, (b) sign any necessary consents, applications and other related forms or documents

and (c) take any reasonably required medical examinations.

14.

Notice. Any notice, request, instrument or other document to be given under this Agreement by either party hereto to the

other shall be in writing and shall be deemed effective (a) upon personal delivery, if delivered by hand, (b) three (3) days after the

date of deposit in the mails, postage prepaid, if mailed by certified or registered mail, or (c) on the next business day, if sent by

a prepaid overnight courier service, and in each case addressed as follows:

| If to the Employee: |

Barbara M. Lilley

***

*** |

| |

|

| If to the Company: |

TechPrecision Corporation |

| |

1 Bella Drive |

| |

Westminster, MA 01473 |

| |

Attention: CEO |

Any party may change the address to which notices

are to be sent by giving notice of such change of address to the other party in the manner herein provided for giving notice.

15.

No Conflict. The Employee represents and warrants that the Employee is not subject to any agreement, instrument, order,

judgment or decree of any kind, or any other restrictive agreement of any character, which would prevent the Employee from entering into

this Agreement or which would be breached by the Employee upon the performance of Employee’s duties pursuant to this Agreement.

16.

Section 409A Compliance. The following rules shall apply, to the extent necessary, with respect to distribution of the payments

and benefits, if any, to be provided to the Employee under this Agreement.

a.

This Agreement is intended to be exempt from or to comply with Section 409A of the Internal Revenue Code of 1986, as amended (to

the extent applicable) (“Section 409A”) and the parties hereto agree to interpret, apply and administer this Agreement

in the least restrictive manner necessary to comply therewith and without resulting in any increase in the amounts owed hereunder by the

Company.

b.

Neither the Employee nor the Company shall have the right to accelerate or defer the delivery of any such payments or benefits

except to the extent specifically permitted or required by Section 409A.

c.

The determination of whether and when the Employee’s separation from service from the Company has occurred shall be made

in a manner consistent with, and based on the presumptions set forth in, Treasury Regulation Section 1.409A-l(h) (or any successor provision).

Solely for purposes of this Section, “Company” shall include all persons with whom the Company would be considered a single

employer as determined under Treasury Regulation Section 1.409A-l(h)(3) (or any successor provision).

d.

All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements

of Section 409A to the extent that such reimbursements or in-kind benefits are subject to Section 409A, including, where applicable, the

requirements that (i) any reimbursement is for expenses incurred during the Employee’s lifetime (or during a shorter period of time

specified in this Agreement), (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses

eligible for reimbursement in any other calendar year, (iii) the reimbursement of an eligible expense will be made on or before the last

day of the calendar year following the year in which the expense is incurred and (iv) the right to reimbursement is not subject to set

off or liquidation or exchange for any other benefit.

e.

Notwithstanding anything herein to the contrary, the Company shall have no liability to the Employee or to any other person if

the payments and benefits provided in this Agreement that are intended to be exempt from or compliant with Section 409A are not so exempt

or compliant.

17.

Miscellaneous.

a.

The headings contained in this Agreement are for reference purposes only, and shall not affect the meaning or interpretation of

this Agreement.

b.

The Company may withhold from any amount payable under this Agreement such federal, state or local taxes as shall be required to

be withheld pursuant to applicable law or regulation.

c. This

Agreement shall be governed by and construed in accordance with the internal laws of the Commonwealth of Massachusetts without giving

effect to any choice or conflict of law provision or rule that would cause the application of the laws of any other jurisdiction. Any

action arising out of the breach or threatened breach of this Agreement shall be commenced in a state court of the State of Delaware

and the parties hereto hereby submit to the jurisdiction of such courts for the purpose of enforcing this Agreement.

d.

This Agreement represents the entire agreement between the Company and the Employee with respect to the subject matter hereof,

and all prior agreements relating to the employment of the Employee, written or oral, are nullified and superseded hereby.

e.

This Agreement may not be orally canceled, changed, modified or amended, and no cancellation, change, modification or amendment

shall be effective or binding, unless in writing and signed by both parties to this Agreement, and any provision hereof may be waived

only by an instrument in writing signed by the party or parties against whom or which enforcement of such waiver is sought.

f.

As used in this Agreement, any gender includes a reference to all other genders and the singular includes a reference to the plural

and vice versa.

IN WITNESS WHEREOF,

the parties have executed this Agreement as of the date first written above.

| COMPANY: |

EMPLOYEE: |

| |

|

| |

|

| TECHPRECISION CORPORATION |

/s/ Barbara M. Lilley |

| |

Barbara M. Lilley |

| By: |

/s/ Alexander Shen |

|

| |

Alexander Shen |

|

| |

Chief Executive Officer |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

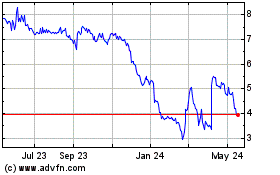

TechPrecision (NASDAQ:TPCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

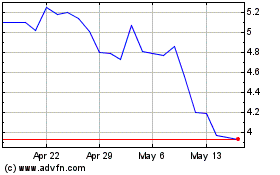

TechPrecision (NASDAQ:TPCS)

Historical Stock Chart

From Apr 2023 to Apr 2024