Filed Pursuant to Rule 424(b)(3)

Registration No. 333-272727

PROSPECTUS

ENZO

BIOCHEM, INC.

1,000,000 Shares of Common Stock Issuable Upon

Exercise of Warrants

2,527,808 Shares of Common Stock Issuable

Upon Conversion of Debentures

This prospectus relates to

the resale, from time to time, of up to 3,527,808 shares (the “Shares”) of our common stock, $0.01

par value per share (“Common Stock”), by the selling stockholders identified in this prospectus under the section “Selling

Stockholders” (the “Selling Stockholders”). The Shares covered by this prospectus consist of (x) 1,000,000 shares of

Common Stock issuable upon exercise of warrants to purchase Common Stock (the “Warrants”) and (y) 2,527,808 shares of Common

Stock issuable upon conversion of debentures (the “Debentures”), in each case, issued to the Selling Stockholders in a private

placement as described in this prospectus.

On May 19, 2023, Enzo

Biochem, Inc. (the “Company”) consummated the closing of a private placement of Company debentures and warrants (the

“Private Placement”), pursuant to the terms and conditions of the Securities Purchase Agreement, dated May 19, 2023 (the “Securities

Purchase Agreement”), by and among the Company and certain purchasers (the “Purchasers”) and JGB Collateral, LLC, a

Delaware limited liability company, as collateral agent for the Purchasers (the “Agent”). Pursuant to a registration rights

agreement, dated May 19, 2023 (the “Registration Rights Agreement”), entered into between the Company and each of the Purchasers,

we granted certain registration rights to the Purchasers with respect to the Shares issuable upon exercise of their Warrants and upon

conversion of their Debentures. The aggregate gross proceeds to the Company from the Private Placement were approximately $7,000,000,

before deducting offering expenses payable by the Company. In connection with the Private Placement, on May 19, 2023, we, along with certain

of our domestic subsidiaries (the “Guarantors”), entered into a Security Agreement with the Purchasers and the Agent. See

“Private Placement of Securities.” We will not receive any proceeds from the sale of the Shares by the Selling Stockholders

under this prospectus. We will, however, receive proceeds from any portion of the Warrants that are exercised through the payment of their

respective exercise price in cash. We intend to use the proceeds, if any, for general corporate purposes. The Selling Stockholders will

bear all commissions and discounts, if any, attributable to the sale of the Shares. We will bear all costs, expenses and fees in connection

with the registration of the Shares.

The Selling Stockholders may

offer such shares from time to time as they may determine through public or private transactions or through other means described in the

section entitled “Plan of Distribution” at prevailing market prices, at prices related to prevailing market prices

or at privately negotiated prices. This prospectus does not necessarily mean that the Selling Stockholders will offer or sell the Shares.

We cannot predict when or in what amounts the Selling Stockholders may sell any of the Shares offered by this prospectus. Any shares of

Common Stock subject to resale hereunder will have been issued by us and acquired by the Selling Stockholders prior to any resale of such

shares pursuant to this prospectus.

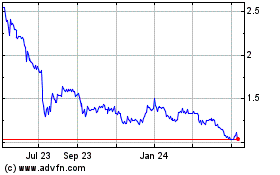

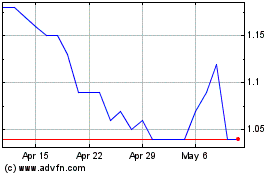

Our Common Stock is listed

on the New York Stock Exchange under the symbol “ENZ.” The last reported sale price of the common stock on July 18, 2023 was

$1.38 per share.

You should read this prospectus

and any prospectus supplement carefully before you invest in any of our securities.

Investing in our securities

involves a high degree of risk. You should carefully consider the risk factors described in the applicable prospectus supplement and

certain of our filings with the Securities and Exchange Commission, as described under “Risk Factors” on page 6. You should

also consider that if the sale under the Purchase Agreement (as defined below) is not completed, our board of directors will evaluate

other strategic alternatives that may be available, which alternatives may not be as favorable to our stockholders as the sale under

the Purchase Agreement and may include a bankruptcy and liquidation of the Company, in which case holders of our Common Stock will likely

receive no recovery at all. See “Private Placement of Securities” on page 14.

This prospectus may not be

used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 18,

2023.

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration

process. Under the shelf registration process, the Selling Stockholders may, from time to time, offer and sell the Shares described in

this prospectus in one or more offerings. Information about the Selling Stockholders may change over time. We will not receive any of

the proceeds from the sale of our Common Stock by the Selling Stockholders under this prospectus, although we will receive proceeds from

any portion of the Warrants that are exercised through the payment of their respective exercise price in cash.

We may also file a prospectus

supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information

relating to these offerings. The prospectus supplement or post-effective amendment may also add, update, or change information contained

in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable

prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable.

Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus

supplement, together with the additional information described under the heading “Where You Can Find More Information” and

“Incorporation of Certain Information by Reference.” We incorporate by reference important business and financial information

about us into this prospectus and any prospectus supplement or any free writing prospectus we may authorize to be delivered to you. You

may obtain the information incorporated by reference into this prospectus without charge by following the instructions under “Where

You Can Find More Information.” All references in this prospectus to “Enzo Biochem,” “Enzo,” the “Company,”

“we,” “us” or “our” mean Enzo Biochem, Inc., unless we state otherwise or the context otherwise requires.

Neither we nor the Selling

Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in or

incorporated by reference into this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on

behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for and can provide no assurance

as to the reliability of any other information that others may give you. The Selling Stockholders will not make an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus,

any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective

cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains,

and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are

based on independent industry publications and other publicly available information. We believe this information is reliable as of the

applicable date of its publication, however, we have not independently verified the accuracy or completeness of the information included

in or assumptions relied on in these third-party publications. In addition, the market and industry data and forecasts that may be included

in or incorporated by reference into this prospectus, any post-effective amendment or any prospectus supplement may involve estimates,

assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the

heading “Risk Factors” contained in this prospectus, any post-effective amendment, the applicable prospectus supplement and

otherwise incorporated by reference herein. Accordingly, investors should not place undue reliance on this information.

An investment in our securities

involves certain risks that should be carefully considered by prospective investors. See “Risk Factors.”

SUMMARY

The following summary provides

an overview of certain information about our company and the offering and may not contain all the information that may be important to

you. This summary is qualified in its entirety by and should be read together with the information contained in other parts of this prospectus.

You should carefully read this entire prospectus before making a decision about whether to invest in any of our securities.

Enzo Biochem, Inc.

Overview

Enzo

Biochem, Inc. (the “Company”, “we”, “our”, or “Enzo”) is an integrated diagnostics, clinical

lab, and life sciences company focused on delivering and applying advanced technology capabilities to produce affordable reliable products

and services that enable our customers to meet their clinical needs. Through a connection with the market, we provide advanced biotechnology

solutions to the global community as affordable and flexible quality products and services. We develop, manufacture and sell our proprietary

technology solutions and platforms to clinical laboratories, specialty clinics, researchers and physicians globally. Enzo’s structure

and business strategy represent the culmination of years of extensive planning and work. The Company has the ability to offer low

cost, high performance products and services for diagnostic testing, which ideally positions us to capitalize on the reimbursement

pressures facing diagnostic labs. Our pioneering work in genomic analysis coupled with our extensive patent estate and enabling platforms

have positioned the Company to continue to play an important role in the rapidly growing molecular medicine marketplaces.

Enzo

develops low cost diagnostic platform products and related services. Our platform development includes automation-compatible reagent systems

and associated products for sample collection and processing through analysis. We develop affordable products and services to improve

healthcare, one of the greatest challenges today. Enzo combines over 40 years of expertise in technology development with assay development

capabilities and diagnostic testing services to create high performance, cost-effective, and open assay solutions. The ability to combine

these assets in one company is uncommon. With our strong intellectual property portfolio integrated with assay development know-how, production,

distribution, validation and services capabilities, we have enabled sustainable products and services for a market that is facing increasing

pressure in costs and reimbursement.

Enzo

technology solutions and platforms and unique operational structure are designed to reduce overall healthcare costs for both government

and private insurers. Our proprietary technology platforms reduce our customers’ need for multiple, specialized instruments, and

offer a variety of high throughput capabilities together with a demonstrated high level of accuracy and reproducibility. Our genetic test

panels are focused on large and growing markets primarily in the areas of personalized medicine, women’s health, infectious diseases

and genetic disorders.

In

the course of our research and development activities, we have built a substantial portfolio of intellectual property assets, comprised

of approximately 472 issued patents worldwide and over 64 pending patent applications, along with extensive enabling technologies and

platforms.

Operating Segments

Below are brief descriptions

of our two operating segments. For a more detailed description, see Note 11 – Segment Reporting in the Notes to Consolidated Financial

Statements in our Quarterly Report on Form 10-Q filed on June 14, 2023:

Enzo Clinical Services is

a clinical reference laboratory providing a wide range of clinical services to physicians, medical centers, other clinical labs and pharmaceutical

companies. The Company believes having a Clinical Laboratory Improvement Amendments of 1988 (“CLIA”) certified and College

of American Pathologists (“CAP”) accredited medical laboratory located in New York provides us the opportunity to more rapidly

introduce cutting edge products and services to the clinical marketplace. Enzo Clinical Labs offers an extensive menu of molecular and

other clinical laboratory tests and procedures used in patient care by physicians to establish or support a diagnosis, monitor treatment

or medication, and search for an otherwise undiagnosed condition. Our laboratory is equipped with state-of-the-art communication and connectivity

solutions enabling the rapid transmission, analysis and interpretation of generated data. We operate a full service clinical laboratory

in Farmingdale, New York, a network of over 30 patient service centers throughout New York, New Jersey and Connecticut, two free standing

“STAT” or rapid response laboratories in New York City and Connecticut, an in-house logistics department, and an information

technology department. Under our license in New York State, we are able to offer testing services to clinical laboratories and physicians

nationwide.

The Clinical Laboratory Services

segment is impacted by various risk factors, including among others, loss of a substantial portion of revenues from COVID-19 testing,

reduced reimbursements from third party payers for testing performed and from recent health care legislation.

On March 16, 2023, the Company

entered into an Asset Purchase Agreement with respect to the sale of assets and assignment of certain liabilities of the Clinical Labs

division. The sale is expected to close in July 2023, at which time we will exit the clinical laboratory services business.

Enzo Products manufactures,

develops and markets products and tools for clinical research, drug development and bioscience research customers worldwide. Underpinned

by broad technological capabilities, Enzo Life Sciences has developed proprietary products used in the identification of genomic information

by laboratories around the world. Information regarding our technologies can be found in the “Core Technologies” section of

our most recently filed Form 10-K. We are internationally recognized and acknowledged as a leader in the development, manufacturing validation

and commercialization of numerous products serving not only the clinical research market, but also the life sciences markets in the fields

of cellular analysis and drug discovery, among others. Our operations are supported by global operations allowing for the efficient marketing

and delivery of our products around the world.

Recent Developments

Clinical Labs Purchase Agreement

On March 16, 2023, the Company

filed a Form 8-K indicating that it and Enzo Clinical Labs, Inc. (the “Subsidiary” and, together with the Company, the “Seller”)

entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Laboratory Corporation of America Holdings, a Delaware

corporation (the “Buyer”). Pursuant to the Purchase Agreement, the Seller has agreed to sell substantially all operating assets

and assign certain liabilities of its clinical labs business (the “Business”) to the Buyer which are necessary to operate

the Business in exchange for approximately $146,000,000 in cash (subject to certain adjustments), on and subject to the terms and conditions

set forth therein (such transaction, the “Transaction”).

The Purchase Agreement contains

customary representations, warranties, covenants and termination rights for a transaction of this nature, including, among other things,

customary covenants: (i) relating to the conduct of the Business between the signing of the Purchase Agreement and the closing of

the Transaction and (ii) regarding the efforts of the parties to cause the Transaction to be consummated, including obtaining certain

consents and approvals. The consummation of the Transaction is subject to the satisfaction or waiver of customary closing conditions,

including the expiration or termination of any required waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976

(“HSR”). The parties to the Purchase Agreement made the filings required under the HSR on March 30, 2023, and the waiting

period under the HSR expired on May 1, 2023 at 11:59 p.m. Eastern time.

The Purchase Agreement also

includes customary termination provisions for both the Company and Buyer and provides that, in connection with the termination of the

Purchase Agreement under specified circumstances, including termination by the Company to accept and enter into a definitive agreement

with respect to an unsolicited Superior Proposal, the Company will be required to pay Buyer a termination fee of $5,000,000 or reimbursement

of Buyer’s expenses of up to $5,000,000.

Subject to the terms and conditions

stated in the Purchase Agreement, Buyer will be obligated to pay a fee to the Company for each day until the closing of the Transaction.

At the closing of the Transaction, such fee will be wholly or partially credited against the purchase price.

On

April 13, 2023, the Company filed a preliminary proxy statement (the “Preliminary Proxy Statement”) and, on April 24, 2023,

the Company filed a definitive proxy statement (the “Definitive Proxy Statement” and, together with the Preliminary Proxy

Statement, the “Proxy Statement”) with the SEC and commenced mailing of the Proxy Statement to the Company’s shareholders

to solicit the approval of the Transaction and adopt the Purchase Agreement at a special meeting of shareholders held on May 22, 2023

(the “Special Meeting”). At the Special Meeting, the Company’s shareholders approved the Transaction and adopted the

Purchase Agreement.

On

July 3, 2023, the Company, the Subsidiary and the Buyer entered into Amendment No. 1 to the Purchase Agreement (the “Purchase Agreement

Amendment”), which, among other things, adjusted the purchase price for the Business from $146 million to $113.25 million payable

as a $30 million refundable earnest money deposit on July 17, 2023 with the remainder, subject to offsetting credits and deductions as

provided in the Purchase Agreement, payable at the closing of the Transaction. The Purchase Agreement Amendment also provides that (i)

Buyer may offset from the purchase price amounts outstanding for reference testing services performed by Buyer or its Affiliates (as

defined in the Purchase Agreement) prior to the closing, (ii) the closing, which is subject to the satisfaction or waiver of customary

conditions to closing, shall, at the earliest, occur 127 days after execution of the Purchase Agreement (or July 24, 2023), and (iii)

the Company shall indemnify Buyer in connection with any proceeding challenging the Transaction (and related matters) as contemplated

by the Purchase Agreement Amendment. In addition, pursuant to the Purchase Agreement Amendment, the parties waived all breaches that

existed prior to entering into the Purchase Agreement Amendment (provided that the parties were aware of such breach) solely for purposes

of determining that closing conditions under the Purchase Agreement have been satisfied.

The

sale is expected to close in July 2023, at which time we will exit the clinical laboratory services business. There can be no assurances

that the Purchase Agreement will close and if it does close, the exact proceeds to be received by the Company. If the sale under the

Purchase Agreement is not completed, our board of directors, in discharging its fiduciary obligations to our stockholders, will evaluate

other strategic alternatives that may be available, which alternatives may not be as favorable to our stockholders as the Asset Sale

and may include a bankruptcy and liquidation of the Company, in which case holders of our Common Stock will likely receive no recovery

at all.

Credit Facility

On

March 31, 2023, the Company entered into a Revolving Loan and Security Agreement (the “Credit Facility”) among the Subsidiary

and Enzo Life Sciences, Inc., as borrowers (the “Borrowers”), the Company and certain of its domestic subsidiaries, as guarantors

(the “Guarantors”), and Gemino Healthcare Finance, LLC (d/b/a SLR Healthcare ABL), as lender.

The

Credit Facility provides for a maximum $8 million revolving line of credit. The commitment under the Credit Facility will expire after

one year and all outstanding borrowings under the Credit Facility will become due and payable at that time. Prior to its expiration, the

Borrowers will prepay and terminate the Credit Facility upon closing of the Purchase Agreement, and a standard termination fee will be

payable.

The

Credit Facility is secured by a first priority perfected security interest in the collateral. The collateral includes substantially all

the U.S. assets of the Borrowers and the Guarantors, including among other assets, cash, receivables, inventory and fixed assets.

Borrowings

under the Credit Facility accrue interest at the rate per annum equal to Term SOFR (Secured Overnight Financing Rate) for a three-month

tenor plus 5.50%. Other fees, such as an unused line fee and a collateral monitoring fee, also apply. The Borrowers borrowed $5.5 million

under the Credit Facility upon the closing thereof.

The

Credit Facility includes customary affirmative and negative covenants for revolving credit facilities of this nature, including certain

limitations on the incurrence of additional indebtedness and liens. In addition, the Credit Facility requires the Borrowers to maintain

certain minimum liquidity levels as of the last day of each calendar month. The levels decline over time, starting at $4 million as of

April 30, 2023, then $3 million as of May 31, 2023 and $2 million as of the end of each month thereafter. On June 12, 2023, SLR and the

Company agreed to a waiver limited to the specific event of default with respect to the minimum liquidity covenant.

The

Credit Facility includes customary events of default for revolving credit facilities of this nature, including failure to pay outstanding

principal or interest, failure of applicable representations or warranties to be correct in any material respects, failure to perform

any other term, covenant or agreement, certain defaults upon obligations under the Employee Retirement Income Security Act, bankruptcy

or a change in control. Such events of default would require the repayment of any outstanding borrowings and the termination of the right

to borrow additional funds under the Credit Facility.

Ransomware Attack

On April 6, 2023, the Company experienced a ransomware

attack that impacted certain critical information technology systems. In response, we promptly deployed containment measures, including

disconnecting our systems from the internet, launched an investigation with assistance from third-party cybersecurity experts, and notified

law enforcement. We adhered to our disaster recovery plan, which enabled us to maintain operations throughout the incident response process.

The Company’s facilities are open, and continue to provide services to patients and partners. The Company has incurred, and may

continue to incur, certain expenses related to this attack, including expenses to respond to, remediate and investigate this matter. Further,

the Company remains subject to risks and uncertainties as a result of the incident, including as a result of the data that was accessed

or exfiltrated from the Company’s network. Additionally, security and privacy incidents have led to, and may continue to lead to,

additional regulatory scrutiny and class action litigation exposure. We are in the process of evaluating the full scope of the costs and

related impacts of this incident. During the disaster recovery, our ability to perform clinical reference testing was severely curtailed

and we were forced to outsource much of the testing to third parties, including Labcorp. This negatively impacted the 2023 period’s

services revenue and increased the cost of outsourcing the testing to third parties.

The Company has identified

several purported class action complaints that have been filed against Enzo Biochem, Inc. and Enzo Clinical Labs, Inc. arising from the

recent ransomware attack and data breach on Enzo’s computer network. All of the actions that we have identified and remain

pending were commenced in the United States District Court for the Eastern District or Supreme Court of the State of New York, County

of New York. The complaints generally allege that Enzo failed to adequately secure and safeguard the private and confidential information

of the class members entrusted to it. The complaints assert various common law claims and seek money damages, restitution and injunctive

relief.

Controlled Equity Offering

In May 2023, the Company

entered into a sales agreement (the “Sales Agreement”) with B. Riley Securities, Inc. as sales agent (“Riley”).

Under the Sales Agreement, the Company may offer and sell, from time to time, through Riley, shares of the Company’s common stock,

par value $0.01 per share (“Shares”) having an aggregate offering price of up to $30 million. The Company pays Riley a commission

of 3.0% of the aggregate gross proceeds received under the Sale Agreement. The Company is not obligated to make any sales of Shares under

the Sales Agreement. The offering of Shares pursuant to the Sales Agreement will terminate upon the earlier of (a) the sale of all of

the Shares subject to the Sales Agreement or (b) the termination of the Sales Agreement by Riley or the Company, as permitted therein.

To date, there have been no sales of Shares under the Sales Agreement. In May 2023, the Company filed with the SEC a “shelf”

registration statement and sales agreement prospectus covering the Sales Agreement and issuance and sale of our Common Stock that may

be sold under that agreement in an aggregate amount of up to $30 million. Such registration statement was declared effective on June

21, 2023. A total of $150 million of securities, including those covered by the Sales Agreement, may be sold under the shelf registration.

Private Placement of Securities and Warrants (“Private Placement”)

Securities Purchase

Agreement

On May 19, 2023, the Company

entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with each of the purchasers that are parties

thereto (each, including its successors and assigns, a “Purchaser” and collectively, the “Purchasers”) and JGB

Collateral, LLC, a Delaware limited liability company, as collateral agent for the Purchasers (the “Agent”). Pursuant to the

Securities Purchase Agreement, the Company agreed to sell to the Purchasers (i) 10% Original Issue Discount Secured Convertible Debentures

with an aggregate principal amount of $7,608,696 and (ii) warrants to purchase up to 1,000,000 shares of the Company’s common stock,

par value $0.01 per share, for an exercise price of $2.31 per share, the average of the three (3) daily volume weighted average prices

of the Company’s common stock as defined in the Securities Purchase Agreement prior to the closing date (the “JBG Warrants”),

subject to adjustments as set forth in the JBG Warrants, for a total purchase price of $7,000,000. The Securities Purchase Agreement contains

customary representations, warranties and covenants. In connection with the Securities Purchase Agreement, the Company and the Purchasers

entered into a Registration Rights Agreement and the Company, certain of the Company’s domestic subsidiaries, the Purchasers and

the Agent entered into a Security Agreement. The transactions contemplated by the Securities Purchase Agreement were consummated on May

19, 2023.

For more information

see the section entitled “Private Placement of Securities.”

Corporate Information

Our offices are located at

81 Executive Blvd., Suite 3, Farmingdale, New York 11735, and our telephone number is (631) 755-5500. We maintain a website at www.enzo.com.

Our website and the information contained therein or connected thereto are not incorporated by reference and are not a part of this prospectus.

The Offering

| Issuer |

Enzo Biochem, Inc. |

| |

|

|

Shares of Common Stock offered

by the Selling Stockholders |

Up to 3,527,808 shares (the “Shares”). |

| |

|

Shares of Common Stock

outstanding prior to this offering |

49,728,084 shares as of July 14, 2023 |

| |

|

| Use of proceeds |

We will not receive any proceeds from the resale of the Shares by the Selling Stockholders in this offering. We will, however, receive proceeds from any portion of the Warrants that are exercised through the payment of their respective exercise price in cash. For additional information, refer to the section entitled “Use of Proceeds.” |

| |

|

| Terms of this offering |

The Selling Stockholders may sell, transfer or otherwise dispose of any or all of the Shares offered by this prospectus from time to time on the New York Stock Exchange or any other stock exchange, market or trading facility on which the Shares are traded, or in private transactions. Th Shares may be offered and sold or otherwise disposed of by the Selling Stockholders at fixed prices, market prices prevailing at the time of sale, prices related to prevailing market prices, or privately negotiated prices. See the section entitled “Plan of Distribution.” |

| |

|

| Risk factors |

An investment in our common stock involves a high degree of risk. See

“Risk Factors” beginning on page 6 of this prospectus, the “Risk Factors” section in our most

recent Annual Report on Form 10-K and any subsequent Quarterly Reports filed on Form 10-Q, and any amendment or update

thereto reflected in subsequent filings with the SEC, which are incorporated by reference herein, and other information included in

this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common

stock. |

| |

|

| Market for our common stock |

Our Common Stock is traded on the New York Stock Exchange under the symbol “ENZ.” |

RISK FACTORS

Before you invest in our securities,

in addition to the other information, documents or reports included or incorporated by reference in this prospectus and in any prospectus

supplement, you should carefully consider the risk factors set forth in the section entitled “Risk Factors” in any prospectus

supplement as well as in “Part I, Item 1A. Risk Factors” in our most recent annual report on Form 10-K and in “Part

II, Item 1A. Risk Factors” in our quarterly reports on Form 10-Q filed subsequent to such Form 10-K, which are incorporated by reference

into this prospectus and any prospectus supplement in their entirety, as the same may be updated from time to time by our future filings

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each of the risks described in these sections

and documents could materially and adversely affect our business, financial condition, results of operations and prospects and the market

price of our shares and any other securities we may issue. Moreover, the risks and uncertainties discussed in the foregoing documents

are not the only risks and uncertainties that we face, and our business, financial condition, results of operations and prospects and

the market price of our shares and any other securities we may issue could be materially adversely affected by other matters that are

not known to us or that we currently do not consider to be material risks to our business.

Risks Related to the Company and its Recently

Announced Asset Purchase Agreement

The Company may not be able to continue

as a going concern.

During the nine months ended

April 30, 2023, the Company incurred a net loss of $37.1 million and used cash in operating activities of $19.9 million, and had as of

April 30, 2023 a working capital deficit of $10.2 million. The Company believes that based on its fiscal 2023 forecast, its current cash

and cash equivalents level is not sufficient for its foreseeable liquidity and capital resource needs over at least the next twelve (12)

months, which conditions raise substantial doubt about the Company’s ability to continue as a going concern for one year after the

date that the April 30, 2023 unaudited interim financial statements were issued. In response to these conditions, the Company evaluated

and acted upon various financing strategies to obtain sufficient additional liquidity to meet its operating and capital requirements for

the next twelve months following the date of issuance of the unaudited interim consolidated financial statements.

Specifically, the Company

entered into a revolving line of credit for up to $8 million based on eligible receivables in March 2023, sold 10% convertible debentures

and warrants for proceeds of $7 million in May 2023, and as previously disclosed entered into an agreement to sell substantially all

the operating assets and assign certain liabilities of our clinical laboratory business in March, with an expected closing in July 2023.

Additionally, in May 2023, we filed a Form S-3 “shelf” registration statement and sales agreement prospectus covering the

offering, issuance and sale of our Common Stock that can be issued and sold under the sales agreement in an aggregate amount of up to

$30 million. Such registration statement was declared effective on June 21, 2023.

There can be no assurance

that these capital raising strategies will ultimately prove to be successful, and the Company may need to raise additional capital during

the current fiscal year. Our liquidity plans are subject to a number of risks and uncertainties, some of which are outside our control.

The revolving line of credit agreement and the 10% convertible debenture securities are dependent on our closing the asset sale with

Labcorp within a given time frame. If the sale under the Purchase Agreement is not completed, our board of directors will evaluate other

strategic alternatives that may be available, which alternatives may not be as favorable to our stockholders as the Asset Sale and may

include a bankruptcy and liquidation of the Company, in which case holders of our Common Stock will likely receive no recovery at all.

See “Private Placement of Securities.” Macroeconomic conditions could limit our ability to successfully execute our

business plans and therefore adversely affect our liquidity plans. The April 30, 2023 unaudited interim financial statements do not include

any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications

of liabilities that may result should the Company be unable to continue as a going concern.

There can be no guarantee that the asset

sale will be completed and, if not completed, we may have to file for bankruptcy and liquidation.

The consummation of the

Asset Sale is subject to the satisfaction or waiver of various conditions, including the approval of the Asset Sale by our stockholders,

which we obtained on May 22, 2023. We cannot guarantee that the closing conditions set forth in the Asset Purchase Agreement will be

satisfied. If we are unable to satisfy our closing conditions under the Purchase Agreement or if other mutual closing conditions are

not satisfied, Buyer will not be obligated to complete the Asset Sale. If the Asset Sale is not completed, our board of directors, in

discharging its fiduciary obligations to our stockholders, will evaluate other strategic alternatives that may be available, which alternatives

may not be as favorable to our stockholders as the Asset Sale and may include a bankruptcy and liquidation of the Company, in which case

holders of our Common Stock will likely receive no recovery at all.

The Company has incurred and will continue

to incur substantial expenses, including transaction-related costs, pending the asset sale.

Claims, liabilities and expenses

from operations, such as operating costs, salaries, directors’ and officers’ insurance, payroll and local taxes, legal, accounting

and consulting fees and office expenses will continue to be incurred by us during the pendency of the Asset Sale. Further, Enzo has incurred,

and expects to continue to incur, a number of non-recurring transaction-related costs in initiating and completing the Asset Sale. Non-recurring

transaction costs include, but are not limited to, fees paid to Enzo’s financial, legal and accounting advisors, filing fees and

printing costs. These fees and costs have been, and will continue to be, substantial. We cannot estimate what the aggregate of these expenses

will be and these costs may be higher than expected. There can be no assurance of the exact amount of net cash proceeds Enzo will

receive from the Asset Sale or the exact timing at which it will receive such proceeds. Therefore, it is uncertain the extent to which

our financial condition and operations will benefit from or improve as a result of or after the Asset Sale.

The Purchase Agreement also

includes customary termination provisions for both the Company and Buyer and provides that, in connection with the termination of the

Purchase Agreement under specified circumstances, including termination by the Company to accept and enter into a definitive agreement

with respect to an unsolicited Superior Proposal, the Company will be required to pay Buyer a termination fee of $5 million, or reimbursement

of Buyer’s expenses of up to $5 million.

Subject to the terms and conditions

stated in the Purchase Agreement, after shareholder approval of the Transaction, which occurred on May 22, 2023, Buyer is be obligated

to pay a fee to the Company for each day after the date of such approval until the closing of the Transaction. At the closing of the Transaction,

such fee will be wholly or partially credited against the purchase price. On May 31, 2023, the Company received the May portion of the

fee.

There can be no assurance

that the Purchase Agreement will close and that if it does close, the exact proceeds to be received by the Company.

Risks Related to our Common Stock

Our stock price has been volatile, which

could result in substantial losses for investors.

Our common stock is quoted

on the New York Stock Exchange, and there has been historical volatility in the market price of our common stock. The trading price of

our common stock has been, and is likely to continue to be, subject to significant fluctuations due to a variety of factors, including:

| |

● |

fluctuations in our quarterly operating and earnings per share results; |

| |

|

|

| |

● |

the gain or loss of significant contracts; |

| |

|

|

| |

● |

the carrying value of our goodwill and intangible assets; |

| |

|

|

| |

● |

announcements of technological innovations or new commercial products by our competitors or us; |

| |

|

|

| |

● |

loss of key personnel; |

| |

|

|

| |

● |

delays in the development and introduction of new products; |

| |

|

|

| |

● |

legislative or regulatory changes; |

| |

|

|

| |

● |

general trends in the industries we operate; |

| |

|

|

| |

● |

recommendations and/or changes in estimates by equity and market research analysts; |

| |

|

|

| |

● |

biological or medical discoveries; |

| |

|

|

| |

● |

disputes and/or developments concerning intellectual property, including patents and litigation matters; |

| |

|

|

| |

● |

public concern as to the safety of new technologies; |

| |

|

|

| |

● |

sales of common stock of existing holders; |

| |

|

|

| |

● |

securities class action or other litigation; |

| |

|

|

| |

● |

developments in our relationships with current or future customers and suppliers; and |

| |

|

|

| |

● |

general economic conditions, both in the United States and worldwide. |

In addition, the stock market

in general has experienced extreme price and volume fluctuations that have affected the market price of our common stock, as well as the

stock of many companies in our industries. Often, price fluctuations are unrelated to operating performance of the specific companies

whose stock is affected.

In the past, following periods

of volatility in the market price of a company’s stock, securities class action litigation has occurred against the issuing company.

If we were subject to this type of litigation in the future, we could incur substantial costs and a diversion of our management’s

attention and resources, each of which could have a material adverse effect on our revenue and earnings. Any adverse determination in

this type of litigation could also subject us to significant liabilities.

Because we do not intend to pay cash dividends

on our common stock, an investor in our common stock will benefit only if it appreciates in value.

Except in the case of a potential

distribution of cash in connection with the Clinical Labs disposition discussed elsewhere herein, we currently intend to retain our retained

earnings and future earnings, if any, to finance the expansion of our business and do not expect to pay any cash dividends on our common

stock in the foreseeable future. As a result, the success of an investment in our common stock will depend entirely upon any future appreciation.

There is no guarantee that our common stock will appreciate in value or even maintain the price at which investors purchased their shares.

Adverse capital and credit market conditions

could affect our liquidity.

Adverse capital and credit

market conditions could affect our ability to meet liquidity needs, as well as our access to capital and cost of capital. The capital

and credit markets have experienced extreme volatility and disruption in recent years. Our results of operations, financial condition,

cash flows and capital position could be materially adversely affected by continued disruptions in the capital and credit markets.

It may be difficult for a third party to

acquire us, which could inhibit stockholders from realizing a premium on their stock price.

We are subject to the New

York anti-takeover laws regulating corporate takeovers. These anti-takeover laws prohibit certain business combinations between a New

York corporation and any “interested shareholder” (generally, the beneficial owner of 20% or more of the corporation’s

voting shares) for five years following the time that the shareholder became an interested shareholder, unless the corporation’s

board of directors approved the transaction prior to the interested shareholder becoming interested.

Our certificate of incorporation,

as amended, and by-laws contain provisions that could have the effect of delaying, deferring or preventing a change in control of us that

stockholders may consider favorable or beneficial. These provisions could discourage proxy contests and make it more difficult for stockholders

to elect directors and take other corporate actions. These provisions could also limit the price that investors might be willing to pay

in the future for shares of our common stock. These provisions include advance notice requirements for the submission by stockholders

of nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting.

General Risk Factors

Enzo has concluded that there are material

weaknesses in its internal control over financial reporting, which, if not remediated, could materially adversely affect its ability to

timely and accurately report its results of operations and financial condition. The accuracy of Enzo’s financial reporting depends

on the effectiveness of its internal controls over financial reporting.

Internal controls over financial

reporting can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements and may

not prevent or detect misstatements. Failure to maintain effective internal controls over financial reporting, or lapses in disclosure

controls and procedures, could undermine the ability to provide accurate disclosure (including with respect to financial information)

on a timely basis, which could cause investors to lose confidence in Enzo’s disclosures (including with respect to financial information),

require significant resources to remediate the lapse or deficiency, and expose it to legal or regulatory proceedings. In connection with

our April 30, 2023 unaudited consolidated financial statements, Enzo’s management identified a deficiency, which it considers to

be a “material weakness,” which, could reasonably result in a material misstatement in the Company’s financial statements.

The Company has begun remediation measures during and after the April 30, 2023 period end and continues to assess additional necessary

remediation measures. The material weakness cannot be considered completely remediated until the applicable controls have operated for

a sufficient period of time and management has concluded, through testing, that these controls are operating effectively. Enzo cannot

guarantee that it will be successful in remediating the material weakness it identified or that its internal control over financial reporting,

as modified, will enable it to identify or avoid material weaknesses in the future.

We rely on network

and information systems and other technology whose failure or misuse could cause, and has caused, a disruption of services or loss or

improper disclosure of personal data, business information, including intellectual property, or other confidential information, resulting

in increased costs, loss of revenue or other harm to our business.

Network

and information systems and other technologies, including those related to the Company’s network management, are important to its

business activities. The Company also relies on third party providers for certain technology and “cloud-based” systems and

services that support a variety of business operations. Network and information systems-related events affecting the Company’s systems,

or those of third parties upon which the Company’s business relies, such as computer compromises, cyber threats and attacks, ransomware

attacks, computer viruses, worms or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious

social engineering or other malicious activities, or any combination of the foregoing, as well as power outages, equipment failure, natural

disasters (including extreme weather), terrorist activities, war, human or technological error or malfeasance that may affect such systems,

could result in disruption of the Company’s business and/or loss, corruption or improper disclosure of personal data, business information,

including intellectual property, or other confidential information. In addition, any design or manufacturing defects in, or the improper

implementation of, hardware or software applications the Company develops or procures from third parties could unexpectedly compromise

information security. In recent years, there has been a rise in the number of cyber-attacks and ransomware attacks on companies’

network and information systems, and such attacks have become more sophisticated, targeted and difficult to detect and prevent against.

As a result, the risks associated with such an event continue to increase, particularly as the Company’s digital businesses expand.

The Company’s security measures and internal controls that are designed to protect personal data, business information, including

intellectual property, and other confidential information, to prevent data loss, and to prevent or detect security breaches, have not

always provided, and cannot provide, absolute security and have at times failed and may not be successful in preventing these events from

occurring, particularly given that techniques used to access, disable or degrade service, or sabotage systems change frequently, and any

network and information systems-related events have required and could continue to require the Company to expend significant resources

to remedy such event. Moreover, the development and maintenance of these measures is costly and requires ongoing monitoring and updating

as technologies change and efforts to overcome security measures become more sophisticated. The Company’s cyber risk insurance may

not be sufficient to cover all losses from any future breaches of our systems.

A

significant cyber attack, ransomware attack, failure, compromise, breach or interruption of the Company’s systems, or those of third

parties upon which its business relies, could result in a disruption of its operations, customer, audience or advertiser dissatisfaction,

damage to its reputation or brands, regulatory investigations and enforcement actions, lawsuits, remediation costs, a loss of customers,

advertisers or revenues and other financial losses. If any such failure, interruption or similar event results in the improper disclosure

of information maintained in the Company’s information systems and networks or those of its vendors, including financial, personal,

credit card, confidential and proprietary information relating to personnel, customers, vendors and the Company’s business, including

its intellectual property, the Company could also be subject to liability under relevant contractual obligations and laws and regulations

protecting personal data and privacy. In addition, media or other reports of perceived security vulnerabilities to our systems or those

of third parties upon which the Company’s business relies, even if nothing has actually been attempted or occurred, could also adversely

impact our brand and reputation and materially affect our business.

On

April 6, 2023, the Company experienced a ransomware attack that impacted certain critical information technology systems. The Company

has incurred, and may continue to incur, certain expenses related to this attack and remains subject to risks and uncertainties as a result

of the incident, including as a result of the data that was accessed or exfiltrated from the Company’s network. Additionally, security

and privacy incidents have led to, and may continue to lead to, additional regulatory scrutiny and class action litigation exposure. This

incident severely curtailed our ability to perform clinical reference testing and we were forced to outsource much of the testing to third

parties, including Labcorp, which negatively impacted the 2023 period’s services revenue and increased the cost of outsourcing the

testing to third parties. See “Recent Developments – Ransomware Attack” for additional information.

Cyber security risks and the failure to

maintain the confidentiality, integrity, and availability of our computer hardware, software, and Internet applications and related tools

and functions could result in damage to the Company’s reputation and/or subject the Company to costs, fines, or lawsuits.

The integrity and protection

of our own data, and that of our customers and employees, is critical to the Company’s business. The regulatory environment governing

information, security and privacy laws is increasingly demanding and continues to evolve. Maintaining compliance with applicable security

and privacy regulations may increase the Company’s operating costs and/or adversely impact the Company’s ability to market

its products and services to customers. Although the Company’s computer and communications hardware is protected through physical

and software safeguards, it is still vulnerable to cyber threat actors, fire, storm, flood, power loss, earthquakes, telecommunications

failures, physical or software break-ins, software viruses, and similar events. These events could lead to the unauthorized access, disclosure

and use of non-public information. The techniques used by criminal elements to attack computer systems are sophisticated, change frequently

and may originate from less regulated and remote areas of the world. As a result, the Company may not be able to address these techniques

proactively or implement adequate preventative measures. If the Company’s computer systems are compromised, it could be subject

to fines, damages, litigation, and enforcement actions, customers could curtail or cease using its applications, and the Company could

lose trade secrets, the occurrence of which could harm its business.

FORWARD-LOOKING STATEMENTS

This prospectus, the documents

we have filed with the SEC that are incorporated by reference herein and any related free writing prospectus may contain forward-looking

statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements are based on our current expectations, assumptions, estimates and projections about our business and our industry, and

involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievement

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking

statements.

In some cases, you can identify

forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions intended to identify forward-looking statements.

Forward-looking statements include information concerning possible or assumed future results of operations of our business, the expected

completion and timing of the Transaction and other information relating to the Transaction, including pro forma information regarding

the Company assuming the Transaction is consummated, including our pro forma results of operations and financial condition as reflected

in our unaudited pro forma condensed consolidated financial information incorporated by reference in this prospectus, and may involve

known and unknown risks over which we have no control, including, without limitation: (i) the satisfaction of the conditions to consummate

the Transaction; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Purchase

Agreement; (iii) the outcome of any legal proceedings that may be instituted against us and others following the announcement of the Purchase

Agreement; (iv) the amount of the costs, fees, expenses and charges related to the Transaction; (v) the effect of the announcement of

the Transaction on our customer relationships, operating results and business generally, including the ability to retain key employees;

and (vi) the amount of cash we will hold after the Transaction or our net proceeds from the Transaction. While we believe that we have

a reasonable basis for each forward-looking statement, we caution you that these statements are based on a combination of facts and factors

currently known by us and our projections of the future, about which we cannot be certain. We discuss many of these risks, uncertainties

and other factors in greater detail under the heading “Risk Factors” contained in this prospectus. Given these risks, uncertainties

and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent

our estimates and assumptions only as of the date such forward-looking statements are made. You should read carefully this prospectus,

together with the documents we have filed with the SEC that are incorporated by reference herein and any related free writing prospectus,

completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify

all of our forward-looking statements by these cautionary statements.

Except as required by law,

we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from

those anticipated in these forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

All proceeds from the resale

of the Shares of Common Stock offered by this prospectus will belong to the Selling Stockholders. We will not receive any proceeds from

the resale of the Shares of Common Stock by the Selling Stockholders. We will, however, receive proceeds from any portion of the Warrants

that are exercised through the payment of their respective exercise price in cash. We intend to use the proceeds, if any, for general

corporate purposes.

The Selling Stockholders will

pay any underwriting fees, discounts, selling commissions, stock transfer taxes and certain legal expenses incurred by such Selling Stockholder

in disposing of its Shares of Common Stock, and we will bear all other costs, fees and expenses incurred in effecting the registration

of the securities covered by this prospectus, including, without limitation, all registration and filing fees, Nasdaq listing fees and

fees and expenses of our counsel and our independent registered public accountants.

DESCRIPTION OF CAPITAL STOCK

General Matters

Pursuant to our Certificate

of Incorporation, as amended, the total amount of our authorized capital stock is 100,000,000 shares, which consists of 75,000,000 shares

of authorized common stock, par value $0.01 per share, and 25,000,000 shares of authorized preferred stock, par value $0.01 per share.

As of July 14, 2023, we had outstanding 49,728,084 shares of common stock and no shares of preferred stock. As of July 14, 2023, we had

approximately 741 holders of record of our common stock.

The following summary of our

capital stock does not purport to be complete and is subject to and qualified in its entirety by, our Certificate of Incorporation, as

amended, and our Amended and Restated By-laws, which are filed as exhibits to the registration statement of which this prospectus forms

a part.

Common Stock

The holders of shares of common

stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. All shares of our

common stock are entitled to share equally in any dividends our board of directors may declare from legally available sources. Our common

stock is traded on the New York Stock Exchange under the symbol “ENZ”. The section below entitled “Certain Provisions

of New York Law and of the Company’s Charter and By-laws” contains additional information regarding the rights and preferences

of our common stock. The transfer agent and registrar for our common stock is Equiniti.

Preferred Stock

Our

board of directors has the authority, without further action by the stockholders, to issue shares of preferred stock in one or more series

and to fix and determine the following terms of the preferred stock by resolution: variations in the designations, preferences, and relative,

participating, optional or other special rights (including, without limitation, special voting rights, of conversion in common stock or

other securities, redemption provisions or sinking fund provisions) as between series and between the preferred stock and any series thereof

and the common stock, and the qualifications, limitations or restrictions of such rights, all as shall be stated in a resolution of the

board of directors. Shares of preferred stock or any series thereof may have full or limited voting powers, or be without voting powers,

all as shall be stated in a resolution of the board of directors.

Any

or all of these rights may be greater than the rights of our common stock. We currently have no issued and outstanding preferred stock.

Our

board of directors, without stockholder approval, can issue preferred stock with voting, conversion or other rights that could negatively

affect the voting power and other rights of the holders of our common stock. Preferred stock could thus be issued quickly with terms calculated

to delay or prevent a change in control of the Company or to make it more difficult to remove the Company’s management. Additionally,

the issuance of preferred stock may have the effect of decreasing the market price of our common stock.

PRIVATE

PLACEMENT OF SECURITIES

JGB Private Placement

On May 19, 2023, the Company

entered into a Securities Purchase Agreement with the Purchasers and JGB Collateral, LLC, pursuant to which the Company agreed to sell

to the Purchasers (i) Debentures with an aggregate principal amount of $7,608,696 and (ii) the JGB Warrants, for a total purchase price

of $7,000,000. The Securities Purchase Agreement contains customary representations, warranties and covenants. The transactions contemplated

by the Securities Purchase Agreement were consummated on May 19, 2023.

Debentures

The Debentures bear interest

at a rate of 10% per annum (which interest rate is increased to 18% per annum five days after the occurrence and continuance of an Event

of Default (as defined in the Debentures)), have a maturity date of May 20, 2024 and are convertible, at any time after their issuance

date at the option of the Purchasers, into shares of Common Stock at a conversion price equal to $3.01 per share (the “Conversion

Price”), subject to adjustment as set forth in the Debentures. Following the consummation of the Company’s sale of substantially

all of the assets and business of Enzo Clinical Labs, Inc., a wholly-owned subsidiary of the Company, to Laboratory Corporation of American

Holdings pursuant to the Asset Purchase Agreement, dated March 16, 2023, and as further described in the Company’s definitive Proxy

Statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on April 24, 2023 (the “Asset Sale”), the

Company shall either, at the option of the Company upon written notice delivered to the Purchasers within three (3) trading days after

the consummation of the Asset Sale, (i) prepay $4,000,000 of the outstanding principal amount of the Debentures (to be applied pro rata

among the outstanding Debentures based on the relative outstanding principal balance of each Debenture) or (ii) deposit $4,000,000 in

cash, as collateral for the Company’s obligations, into a deposit account subject to a deposit account control agreement, among

the Company, the depository bank and the Agent and otherwise acceptable to Agent (in its sole absolute discretion) in form and substance.

The Company’s obligations

under the Debentures may be accelerated, at the Purchasers’ election, upon the occurrence of certain events of default, including

if the asset sale with Labcorp is not consummated by October 15, 2023. In the event of a default and acceleration of the Company’s

obligations, the Company would be required to pay the greater of (i) the outstanding principal amount of the Debentures, all accrued

and unpaid interest, plus the amount of additional interest that would accrue on such principal through the date of maturity, divided

by the conversion price on the date accelerated payment is either (A) demanded (if demand or notice is required to create an Event of

Default) or otherwise due or (B) paid in full, whichever has a lower conversion price, multiplied by the VWAP on the date the accelerated

payment is either (x) demanded or otherwise due or (y) paid in full, whichever has a higher VWAP, or (ii) 130% of the outstanding principal

amount of the Debentures, plus all accrued and unpaid interest, plus the amount of additional interest that would accrue on such principal

through the date of maturity. Such accelerated payment would also include all other amounts, costs, expenses or liquidated damages due

under the Debentures. The occurrence of an event of default, including failing to consummate the asset sale with Labcorp by October 15,

2023, may result in the acceleration of the Company’s obligations under the Debentures. If this were to occur, the Company may

neither have sufficient cash on hand nor have access to liquidity to be able to repay such obligations, which could result in the Company

pursuing less favorable strategic alternatives, including bankruptcy and liquidation, in which case holders of our Common Stock will

likely receive no recovery at all.

The Debentures contain customary

representations, warranties and covenants including among other things and subject to certain exceptions, covenants that restrict the

Company from incurring additional indebtedness, creating or permitting liens on assets, amending its charter documents and bylaws, repurchasing

or otherwise acquiring more than a de minimis number of its Common Stock or equivalents thereof, repaying outstanding indebtedness, paying

dividends or distributions, assigning or selling certain assets, making or holding any investments, and entering into transactions with

affiliates.

Security Agreement

and Subsidiary Guarantees

In

connection with the Purchase Agreement, on May 19, 2023, the Company, certain of the Company’s domestic subsidiaries (“Guarantors”),

the Purchasers and the Agent entered into a Security Agreement (the “Security Agreement”), pursuant to which the Company and

the Guarantors granted, for the benefit of the Purchasers, to secure the Company’s obligations under the Purchase Agreement and

the Debentures, (i) second-priority liens on certain collateral (the “SLR Collateral”) that secures on a first-priority basis

the Revolving Loan and Security Agreement between the Company, as borrower, and Gemino Healthcare Finance, LLC d/b/a SLR Healthcare ABL,

as lender (the “Credit Facility”), and (ii) first-priority liens on the collateral (the “Non-SLR Collateral” and

together with the Non-SLR Collateral, the “Collateral”) that does not secure the Credit Facility, in each case subject to

permitted liens described in the Indenture. Upon an event of default under the Security Agreement, subject to the security interests under

the Credit Agreement, the Purchasers may, among other things, take possession of the Collateral and enter any premises where the Collateral,

or any part thereof, is or may be placed and remove the Collateral. In addition, on May 19, 2023, the Company and all of the Guarantors

entered into Subsidiary Guarantees (the “Subsidiary Guarantees”), pursuant to which they guaranteed all of the Company’s

obligations under the Purchase Agreement and the Debentures.

JGB Warrants

The JGB Warrants are exercisable

for five years from May 19, 2023, at an exercise price of $2.31 per share, which is the average of three (3) daily VWAPs prior to the

closing date, subject, with certain exceptions, to adjustments in the event of stock splits, dividends, subsequent dilutive offerings

and certain fundamental transactions, as more fully described in the JGB Warrant.

If, at the time a Purchaser

exercises its JGB Warrant, there is no effective registration statement available for an issuance of the shares underlying the JGB Warrant

to the Purchasers, then in lieu of making the cash payment otherwise contemplated to be made to the Company upon the exercise of the JGB

Warrant, the Purchaser may elect to receive upon exercise (either in whole or in part) on a cashless basis the net number of shares of

Common Stock determined according to a specified formula (as set forth in the JGB Warrant).

Registration Rights

Agreement

In

connection with the Purchase Agreement, on May 19, 2023, the Company and the Purchasers entered into a Registration Rights Agreement,

pursuant to which the Company is obligated to register the shares of Company Common Stock issuable upon exercise of the Debentures and

the Warrants by June 19, 2023 (the “Registration Deadline”). If the Company fails to meet the Registration Deadline or maintain

the effectiveness of the Registration Statement for the required effectiveness period, subject to certain permitted exceptions, the Company

will be required to pay liquidated damages to the Purchasers. The Company also agreed, among other things, to indemnify the selling holders

under the Registration Statement from certain liabilities and to pay all fees and expenses incident to the Company’s performance

of or compliance with the Registration Rights Agreement.

The

foregoing descriptions of the terms of the Purchase Agreement, Debentures, Security Agreement, Subsidiary Guarantees, Warrants and Registration

Rights Agreement and the transactions contemplated thereby do not purport to be complete and are qualified in their entirety by reference

to the Purchase Agreement, form of Debenture, Security Agreement, form of Subsidiary Guarantee, form of Warrant and Registration Rights

Agreement, which are incorporated herein by reference.

SELLING

STOCKHOLDERS

The common stock being offered

by the selling shareholders are those issuable to the selling shareholders, upon the conversion of the Debentures and the exercise of

the warrants. For additional information regarding the issuances of Debentures and warrants, see “Private Placement of Securities”

above. We are registering the shares of common stock in order to permit the selling shareholders to offer the shares for resale from time

to time. Except for the ownership of the Debentures and the warrants, the selling shareholders have not had any material relationship

with us within the past three years.

The table below lists

the selling shareholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling

shareholders. The second column lists the number of shares of common stock beneficially owned by each selling shareholder, based on its

ownership of the Debentures and warrants, as of July 14, 2023, assuming the conversion of the Debentures and the exercise of the warrants

held by the selling shareholders on that date, without regard to any limitations on exercises.

The third column lists the

shares of common stock being offered by this prospectus by the selling shareholders.

In accordance with the terms

of a registration rights agreement with the selling shareholders, this prospectus generally covers the resale of the sum of the maximum

number of shares of common stock issuable upon conversion of the Debentures and the exercise of the warrants, determined as if the outstanding

Debentures and warrants were converted or exercised, as applicable, in full as of the trading day immediately preceding the date this

registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination

and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the

warrants. The fourth column assumes the sale of all of the shares offered by the selling shareholders pursuant to this prospectus.

Under the terms of the Debentures

and warrants, a selling shareholder may not convert such Debentures or exercise the such warrants, as applicable, to the extent such conversion

or exercise would cause such selling shareholder, together with its affiliates and attribution parties, to beneficially own a number of

shares of common stock which would exceed 4.99% of our then outstanding common stock following such conversion or such exercise, excluding

for purposes of such determination shares of common stock issuable upon exercise of such Debentures and such warrants which have not been

exercised. The number of shares in the second and fourth columns do not reflect this limitation. The selling shareholders may sell all,

some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder(1) | |

Number of Shares of Common Stock Beneficially Owned Prior to Offering(2) | | |

Percentage of Common Stock Beneficially Owned Prior to Offering(3)(4) | | |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus(5) | | |

Number of Shares of Common Stock Beneficially Owned After Offering(3) | | |

Percentage of Common Stock Beneficially Owned After Offering(4) | |

| JGB Capital, L.P. | |

| 12,599 | | |

| * | | |

| 12,599 | | |

| - | | |

| - | |

| JGB (Cayman) Sussex Ltd. | |

| 1,234,733 | | |

| 2.5 | % | |

| 1,234,733 | | |

| - | | |

| - | |

| JGB Partners, L.P. | |

| 2,280,476 | | |

| 4.6 | % | |

| 2,280,476 | | |

| - | | |

| - | |

| * |

Represents beneficial ownership of less than 1%. |

| (1) |

Information concerning named Selling Stockholders or future transferees, pledgees, assignees, distributees, donees or successors-in-interest of or from any such stockholder or others who later hold any Selling Stockholders’ interests will be set forth in supplements to this prospectus, absent circumstances indicating that the change is material. In addition, post-effective amendments to the registration statement of which this prospectus forms a part will be filed to disclose any material changes to the plan of distribution from the description in the final prospectus. |

| (2) |

Includes shares issuable upon exercise of the Warrants and conversion of the Debentures. |

| (3) |

Beneficial ownership

is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a

person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our Common

Stock, or convertible or exercisable into shares of our Common Stock within 60 days of July 14, 2023, are deemed outstanding. Such

shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Amounts reported

in the fifth column assumes that the Selling Stockholders will sell all of the Shares offered pursuant to this prospectus. |

| (4) |

Based on 49,728,084 shares of Common Stock outstanding

as of July 14, 2023. |

| (5) |

Includes the maximum number of Shares issuable upon exercise of the Warrants and conversion of the Debentures, which Shares are being registered by the registration statement of which this prospectus forms a part. |

PLAN OF DISTRIBUTION