UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A/A

Amendment No. 1

Dated: July 14, 2023

OFFERING STATEMENT UNDER THE SECURITIES ACT OF 1933

|

EMO CAPITAL CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

(State of other jurisdiction of incorporation or organization)

|

|

10409 Pacific Palisades Ave, Las Vegas, NV 89144

(661) 519-5708

www.emrgt.com

|

|

(Address, including zip code, and telephone number, including area code of issuer's principal executive office)

|

|

5261

|

|

93-2327059

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

Company is classified as a shell company as defined in Rule 405 and Rule 12b-2 of the Exchange Act.

This Offering Circular is following the Offering Circular format described in Part II (a)(1)(ii) of Form 1-A.

This Preliminary Offering Circular shall only be qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the terms of Regulation A.

PART II — INFORMATION REQUIRED IN OFFERING CIRCULAR

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR AMENDMENT NO. 1

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

DATED: JULY 14, 2023

EMO CAPITAL, CORP.

10409 Pacific Palisades Ave, Las Vegas, NV 89144

$1,500,000

1,500,000,000 SHARES OF COMMON STOCK

$0.001 PER SHARE

This is the public offering of securities of Emo Capital, Corp., a Nevada corporation (hereinafter the “Company”, “Our”, “We”, or “Us”). We are offering 1,500,000,000 shares of our Common Stock, par value $0.001 (“Common Stock”), at an offering price of $0.001 per share (the “Offered Shares”) by the Company. None of the Securities Offered Are Being Sold By Present Security Holders. This Offering will terminate on twelve months from the day the Offering is qualified or the date on which the maximum offering amount is sold (such earlier date, the “Termination Date”). The minimum purchase requirement per investor is 5,000,000 Offered Shares ($5,000); however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion. See "The Offering" - Page 4 and "Securities Being Offered" - Page 50 For Further Details.

These securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “ Risk Factors” section on page 5 of this Offering Circular.

No Escrow

The proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best efforts basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the

Use of Proceeds

.

Subscriptions are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

The Company, by determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration without notice to subscribers. The aggregate offering price is based on the price at which the securities are offered for cash. Any portion of the aggregate offering price or aggregate sales attributable to cash received in a foreign currency will be translated into United States currency at a currency exchange rate in effect on, or at a reasonable time before, the date of the sale of the securities. If securities are not sold for cash, the aggregate offering price or aggregate sales will be based on the value of the consideration as established by bona fide sales of that consideration made within a reasonable time, or, in the absence of sales, on the fair value as determined by an accepted standard. Valuations of non-cash consideration will be reasonable at the time made.

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts in an attempt to offer and sell the Shares. Our Officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

Our Common Stock is quoted on the OTC Pink Marketplace under the stock symbol “NUVI.”

| |

|

Per

Share |

|

|

Total

Maximum |

|

| Public Offering Price (1)(2) |

|

$ |

0.001 |

|

|

$ |

1,500,000 |

|

| Underwriting Discounts and Commissions (3) |

|

$ |

0.000 |

|

|

$ |

0.000 |

|

| Proceeds to Company |

|

$ |

0.001 |

|

|

$ |

1,500,000 |

|

|

(2)

|

This is a “best-efforts” offering. The proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best-efforts basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. See “

Distribution – Procedures for Subscribing.

”

|

|

(3)

|

We are offering these securities without an underwriter.

|

Our Board of Directors used its business judgment in setting a value of $0.001 per share to the Company as consideration for the stock to be issued under the Offering. The sales price per share bears no relationship to our book value or any other measure of our current value or worth.

No sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular under “ Distribution—State Law Exemption and Offerings to ‘Qualified Purchasers’” (page 19). No sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

TABLE OF CONTENTS

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, references to “Emo”, “we”, the “Company”, “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of Emo Capital, Corp.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

|

●

|

The speculative nature of the business we intend to develop;

|

|

●

|

Our reliance on suppliers and customers;

|

|

●

|

Our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to continue as a “going concern;

|

|

●

|

Our ability to effectively execute our business plan;

|

|

●

|

Our ability to manage our expansion, growth and operating expenses;

|

|

●

|

Our ability to finance our businesses;

|

|

●

|

Our ability to promote our businesses;

|

|

●

|

Our ability to compete and succeed in highly competitive and evolving businesses;

|

|

●

|

Our ability to respond and adapt to changes in technology and customer behavior; and

|

|

●

|

Our ability to protect our intellectual property and to develop, maintain and enhance strong brands.

|

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

SUMMARY

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company Information

Emo Capital, Corp. (“we”, “our, “Emo”, the “Company”) is a for profit corporation established under the corporate laws of the State of Nevada on August 23, 2006 to create and develop a new social networking website targeted to the Chinese speaking market.

On February 28, 2008, the Company's registration statement on Form SB-2 was declared effective by the staff of the Securities and Exchange Commission (“SEC”). In that registration statement, the Company registered shares of common stock for sale in a self-underwritten offering and for public resale by certain stockholders identified in the registration statement. Upon the effective date of the registration statement, the Company became subject to the reporting requirements of Section 12(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and commenced filing reports under the Exchange Act through the quarter ended April 30, 2017.

On March 12, 2019, the Eight Judicial District Court of Nevada entered an order appointing Bryan Glass as custodian of the Company, authorizing and directing him to, among other things, take any action reasonable, prudent and for the benefit of the Company, including reinstating the Company under Nevada law, appointing officers and convening an annual meeting of stockholders (the “Order”). Mr. Glass was not a shareholder of the Company on the date that he applied to serve as a custodian of the Company. Thereafter, the board of directors and Mr. Glass, in his role as custodian, appointed himself to serve as the President of the Company.

From time to time, Mr. Glass has submitted and may in the future submit applications to the courts of the state of Nevada to be appointed as the custodian of corporations in which he already is a shareholder that have forfeited their right to exist as a corporation for reasons such as failure to file annual reports or to pay required fees, and such applications may or may not be successful. If the court approves the application, Mr. Glass is appointed to serve as the custodian of such corporations. In the past, he either has contributed assets to these corporations or sold them to third parties.

On March 19, 2019, (i) the Company was reinstated as a corporation under the laws of Nevada and (ii) the Company filed a Certificate of Amendment to the Articles of Incorporation Filed By Custodian specifically to advise the secretary of state that Mr. Glass did not have a previous history of criminal, administrative, civil or National Association of Securities Dealers or SEC investigations, violations or convictions against him or any of his affiliates. By resolutions dated March 19, 2019, Mr. Glass, in his capacity as the custodian of the Company, appointed himself to serve as the president, secretary and treasurer of the Company. In addition, on March 19, 2019, the Company issued to Mr. Glass 60,000,000 shares of common stock at a price of $0.001 per share for an aggregate cost of $660,000, which sum was paid by the performance of services to the Company and the reimbursement of expenses incurred by Mr. Glass on the Company's behalf in the amount of $16,065. The expenses incurred by Mr. Glass included $6,065 to the state of Nevada for fees in connection with reinstating the Company and other filings to bring the Company current under the requirements of Nevada corporate law, and $10,000 to the transfer agent for outstanding fees.

On May 20, 2019, the Company held a shareholders meeting at which the holders of 60,001,000 shares, representing a majority of the outstanding shares of common stock of the Company as of such date, were present and voted. At the meeting, the holders of all of the shares of common stock voting at the meeting appointed Bryan Glass to serve as a director of the Company.

On September 6, 2019, the Company filed a Form 15 with the SEC terminating the registration of its class of common stock under Section 12(g) of the Exchange Act and its duty to file periodic and other reports with the SEC.

On September 23, 2020, Mr. Glass sold 58,000,000 million shares of common stock, representing approximately 96.67% of the shares he owned in the Company, and equal to approximately 60.73% of the total number of outstanding shares of the Company's common stock, to Collingswood Capital Group for the sum of $85,000. Mr. Robertson, the principal of Collingswood Capital Group, became acquainted with Mr. Glass through a mutual associate and they subsequently negotiated a deal for his control block of shares in the Company. Concurrent with the sale of his shares, Mr. Glass resigned as a director of and from all positions he held with the Company but prior thereto the board of directors appointed Mr. Adeeb Tadros as a director and as the president of the Company.

Due to the default status of the Company with NVSOS, Mr. Guo as a shareholder was appointed as the custodian in the July of 2022. Mr. Guo appointed himself as the sole officer as the Company and renewed the articles of the Company with NVSOS. On August 9, 2022, the Company filed a Form 15 with the SEC terminating the registration of its class of common stock under Section 12(g) of the Exchange Act and its duty to file periodic and other reports with the SEC. In addition, on September 2, 2022, the Company issued to Mr. Guo 1,000 Series C preferred stock shares at a price of $0.001 per share for an aggregate cost of $1,000.00, which sum was paid by the performance of services to the Company.

On January 3, 2023, Mr. Ming Du and Mr. Wei Zhou were appointed to the Board of Directors.

Emo Capital, Corp. is dedicated to organic fertilizer and relevant agriculutre services. Company management recently has made a decision to expand company's business to cannabis nursery sector. With this offering, we plan to build a cannabis nursery facility in California City to provide cannabis seedlings* to meet the growing demand of cannabis cultivators in California. We will offer a diverse selection of strains**. Company is still in the stage of raising funds thorough grant applications and Reg A offering registration. Currently, Company has yet to start any construction of nursery facilicity and operation of seedling production. Meanwhile, Company will continue to engage in the organic fertilizer business and other relevant agriculture services.

The trading symbol for our Common Stock is “NUVI.”

The Issuer does not have a physical office currently. We maintain a website at http://www.emrgt.com. We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

* A cannabis seedling refers to the initial stage of growth in a cannabis plant's life cycle. It begins when a cannabis seed germinates and develops into a small plant with a few sets of leaves.

** A strain is a designated group of offspring that are either descended from a modified plant (produced by conventional breeding or by biotechnological means), or which result from genetic mutation.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers’ duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and, the FINRA’s toll free telephone number and the central number of the North American Securities Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Dividends

The Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable future. The board of directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company’s earnings, capital requirements and other factors.

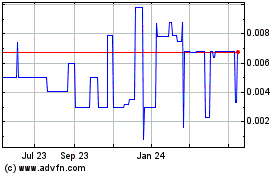

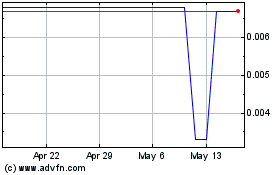

Trading Market

Our Common Stock is quoted on the OTC Pink Marketplace under the symbol “NUVI.”

THE OFFERING

|

Issuer:

|

|

Emo Capital, Corp.

|

|

|

|

|

|

Securities offered:

|

|

A maximum of 1,500,000,000 shares of our Common Stock, par value $0.001 (“Common Stock”) at an offering price of $0.001 per share (the “Offered Shares”). (See “Distribution”).

|

|

|

|

|

|

Number of shares of Common Stock outstanding before the offering

|

|

95,500,000 issued and outstanding as of this filing date.

|

|

|

|

|

|

Number of shares of Common Stock to be outstanding after the offering

|

|

1,595,500,000 shares, if the maximum amount of Offered Shares are sold.

|

|

|

|

|

|

Price per share:

|

|

$0.001

|

|

|

|

|

|

Maximum offering amount:

|

|

1,500,000,000 shares at $0.001 per share, or $1,500,000 (See “Distribution”).

|

|

|

|

|

|

Trading Market:

|

|

Our Common Stock is quoted on the OTC Pink Marketplace under the symbol “NUVI.”

|

|

|

|

|

|

Investor Suitability Standards:

|

|

The Offered Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and (b) all other investors so long as their investment in the Offered Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

|

|

|

|

|

|

Use of proceeds:

|

|

If we sell all of the shares being offered, our net proceeds will be $1,500,000. We will use these net proceeds for working capital and other general corporate purposes.

|

|

|

|

|

|

Risk factors:

|

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares.

|

|

|

|

|

|

Continuing Reporting Requirements Under Regulation A:

|

|

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Securities Exchange Act of 1934. Our continuing reporting obligations under Regulation A are deemed to be satisfied, as long as we comply with our Section 13(a) reporting requirements. As a Tier 2 issuer under Regulation A, we will be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering.

|

RISK FACTORS

You should carefully consider the risks described below and other information in this prospectus, including the financial statements and related notes that appear at the end of this prospectus, before deciding to invest in our securities. These risks should be considered in conjunction with any other information included herein, including in conjunction with forward-looking statements made herein. If any of the following risks actually occur, they could materially adversely affect our business, financial condition, operating results or prospects. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial may also impair our business, financial condition, operating results and prospects.

Risks Relating to Our Company

Our operations are limited and we do not generate any revenue. We are dependent entirely upon our principal stockholder to fund our operations who is not obligated to do so. Any failure of our principal stockholder to fund our operations or our inability to obtain funding from a third party may cause us to discontinue operations and investors would lose the entire amount of their investment.

We are not generating any revenues and possess limited capital to fund our operations, including for such purposes as preparing and filing periodic reports under the Exchange Act. We will not generate revenues unless we start operating based on business plan to generate positive cash flow. Over the next twelve months, we anticipate that we will incur costs and expenses in connection with preparing and filing reports under the Exchange Act, implementing appropriate corporate governance mechanisms and internal controls and procedures, leasing property, purchasing equipment to start our operation. We estimate, based upon discussions with our legal and financial professionals and our EDGAR filing agent, that we will incur costs and expenses in connection with the preparation and filing of reports under the Exchange Act and implementing corporate governance mechanisms and internal controls and procedures of approximately $10,000 - $20,000 over the next twelve months, assuming that we remain a shell company and without giving effect to any costs we may incur in connection with business operation. We are unable to provide an estimate of the costs and expenses we may incur in connection with starting business operation at this time given the multitude of variables associated with such activities.

Since August 1, 2018, all of our expenses have been paid by our principal stockholders, and we currently are dependent entirely on our principal stockholder to fund our operations until we start business operation to generate cash flow, if ever. In the event that we cannot find financial resources to fund our capital requirements, we may not be able to continue operations and stockholders could lose the entire amount of their investment in our Company.

The balance sheets of the Company included in the financial statements filed include a series of demand loans made to the Company by an unidentified shareholder prior to the date on which current management assumed control of the Company. If the lender were to demand payment of the amount due, current management may not have the financial resources to satisfy the loans, in which case, we may have to suspend or discontinue operations, which could result in stockholders losing the entire amount of their investment in our Company.

The balance sheets of the Company included in the financial statements include a line item titled "Loans Payable" in the amount of $13,425 (the “Loans”). The Loans were received by the Company prior to the date on which previous management assumed control of the Company and are included in the balance sheets of the Company as of and prior to April 30, 2017, the last quarterly period for which a periodic report was filed by the Company prior to the date on which the Company discontinued filing reports under the Exchange Act (the “Prior Reports”). The notes to the financial statements included in the Prior Reports state that the Loans were made by a shareholder without interest or fixed term of repayment and that they are due on demand. Current management does not have any documents evidencing the Loans and has no information relating to the Loans, including the identity of the lender, other than what is included in the Prior Reports. Accordingly, current management is required to post these Loans in the balance sheets of the Company included in the financial statements filed with this offering statement based on the information included in the Prior Report. If the lender were to demand payment of the Loans, the Company may not have the financial resources to make such payment, in which case, we may have to suspend or discontinue operations, which could result in stockholders losing the entire amount of their investment in our Company.

In addition to the shareholder loan referenced in the foregoing risk factor, as of July 31, 2022, we had additional total liabilities of $46,990 of accounts payable which were incurred prior April 30, 2015. If demand is made by the creditors for the amounts due, we cannot assure investors that we would be able to continue operations, in which case stockholders would lose the entire amount of their investment in our Company.

We are a thinly capitalized company and rely on our principal stockholder to provide working capital to cover our operating expenses, though such individual is under no obligation to do so. We cannot predict whether our creditors will seek to collect the amounts due to them. If we are required to paw any or all of our outstanding liabilities, we may not be able to do so and we might have to discontinue operations, in which case stockholders could lose the entire amount of their investment in our Company.

We may have material liabilities since the Company discontinued filing periodic reports with the SEC during the periods of 2017-July 2019 and July 2020 - present and the Company may have incurred additional liabilities that we have not discovered.

The Company last filed financial statements with the SEC with its quarterly and annual report for the period ended April 30, 2017 and July 31, 2020. As a result, the Company may have incurred material liabilities since that date and prior to the date on which the Company's corporate existence was reinstated with Nevada in 2019 and the date after July 31, 2020 till to the renewal date with Nevada in July 2022, which cave not been discovered or asserted. We could experience losses as a result of any such undisclosed liabilities that are discovered in the future, which could materially harm our business and financial condition. As a result, our current and future stockholders will bear some, or all, of the risks relating to any such unknown or undisclosed liabilities.

Our limited operation history and absence of revenues raise substantial doubt about our ability to continue as a going concern.

The report of our financial statements included in this offering statement indicate that the Company has suffered losses from operations, has a net capital deficiency and has yet to generate cash flow, and that these factors raise substantial doubt about the Company's ability to continue as a going concern. In addition, we have no significant assets or financial resources. We will continue to sustain operating expenses without corresponding revenues. This will result in continued net operating losses that will increase. In light of our limited resources, we cannot assure you that we will be able to continue operations.

Our directors and officers are, or may become, in their individual capacities, officers, directors, controlling shareholder and/or partners of other entities engaged in a variety of businesses. Our directors may have conflicts of interest which may not be resolved favorably to us.

Our directors and officers are, or may become, in their individual capacities, officers, directors, controlling shareholder and/or partners of other entities engaged in a variety of businesses. Certain conflicts of interest may exist between our directors and us. Our directors have other business interests to which they devote their attention and may be expected to continue to do so although management time should be devoted to our business. As a result, conflicts of interest may arise that can be resolved only through exercise of such judgment as is consistent with fiduciary duties to us.

Our officers and directors who volunteer to help with the development of company business..

Company has no full-time employees, except its officers and directors who volunteer to help with the development of company business on a part-time basis, and that the Company has not made any empolyement agreement with and paid any compensation to our officers and directors since August 1, 2018. Accordingly, if they terminate their service with us, such a departure may have a material adverse effect on our business, and our future success depends on our ability to identify, attract, hire or engage, retain and motivate other well-qualified personnel. There can be no assurance that these professionals will be available in the market, or that we will be able to retain existing professionals.

We may depend upon outside consultants/advisors who may not be available on reasonable terms and as needed.

To supplement the business experience of our officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, it is anticipated that such persons may be engaged on an “as needed” basis without a continuing fiduciary or other obligation to us. In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able to provide the required services.

We have material weakness in our controls and procedures.

We have conducted an evaluation of our internal control over financial reporting based on the framework in “Internal Control Integrated Framework” issued by the Committee of Sponsoring Organizations for the Treadway Commission (“COSO”) and published in 2013, and subsequent guidance prepared by COSO specifically for smaller public companies. Based on that evaluation, management concluded that our internal control over financial reporting was not effective as of January 31, 2023 for the reasons discussed below:

|

|

● |

The Company’s lack of segregation of duties.

|

|

|

|

|

|

|

●

|

Lack of an audit committee

|

|

|

|

|

|

|

●

|

Lack of control procedures that include multiple levels of review over financial reporting.

|

|

|

|

|

|

|

●

|

Management has not established appropriate and rigorous procedures for evaluating internal controls over financial reporting. Due to limited resources and lack of segregation of duties, documentation of the limited control structure has not been accomplished.

|

|

|

|

|

|

|

●

|

We employ policies and procedures for reconciliation of the financial statements and note disclosures, however, these processes are not appropriately documented.

|

|

|

|

|

|

|

●

|

Management has not established methodical and consistent data back-up procedures to ensure loss of data will not occur.

|

The management of the Company believes that these material weaknesses will remain until such time that the Company has the resources to increase the number of personnel committed to the performance of its financial duties that such weaknesses can be specifically addressed. This will include, but not limited to, the following:

|

|

●

|

Hiring of additional personnel to adequately segregate financial reporting duties.

|

|

|

●

|

The retention of outside consultants to review our controls and procedures

|

A significant deficiency is a deficiency, or combination of deficiencies in internal control over financial reporting, that adversely affects the entity’s ability to initiate, authorize, record, process, or report financial data reliably in accordance with generally accepted accounting principles such that there is more than a remote likelihood that a misstatement of the entity’s financial statements that is more than inconsequential will not be prevented or detected by the entity’s internal control.

A material weakness is a deficiency or a combination of deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim consolidated financial statements will not be prevented or detected on a timely basis.

We expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses.

We estimate that it will cost approximately $75,000 annually to maintain the proper management and financial controls for our filings required as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and adversely affect our ability to raise capital.

Other potential health risks from environmental conditions can adversely affect the levels of cannabis seedling purchases.

Real or perceived health risks from local environmental conditions in the areas in which farmers operate cultivation activities could adversely affect the levels of cannabis seedling purchases. Further, as a seller of high-end consumer products, we must compete for discretionary spending with a wide variety of other cultivation activities and consumer purchases.

Economic conditions and farmer spending patterns can have a material adverse effect on our business, financial condition, and results of operations.

General economic conditions and farmer spending patterns can negatively impact our operating results. Unfavorable local, regional, national, or global economic developments or uncertainties regarding future economic prospects could reduce farmer spending in the markets we serve and adversely affect our business.

In an economic downturn, farmer discretionary spending levels generally decline, at times resulting in disproportionately large reductions in the purchaswe of cananibs seedlings. Farmers cultivating cannabis also may decline as a result of lower level of seedling market, even if prevailing economic conditions are favorable. As a result, an economic downturn could impact us more than certain of our competitors due to our strategic focus on a relatively small business sector.

More recently, inflation has increased in the United States and throughout the world. To the extent such inflation continues, increases, or both, it may reduce consumer's purchase of our seedlings and reduce our margins and have a material adverse effect on our financial performance.

Our sales may be adversely impacted by a material increase in interest rates and adverse changes in fiscal policy or credit market conditions.

Over the past several years, our economy has been positively impacted by historically unprecedented low interest rates. Such interest rates, driven by the policies of the Federal Reserve, can be a political issue in the United States. Any change by the Federal Reserve to raise its benchmark interest rate in the future or market expectations of such change may result in significantly higher long-term interest rates, which may negatively impact our customers’ willingness or desire to purchase and use our seedlings to cultivate.

Our ability to use our net operating loss carry-forwards and certain other tax attributes may be limited.

We have incurred substantial losses during our history. To the extent that we continue to generate taxable losses, unused losses will carry forward to offset future taxable income, if any, until such unused losses expire. Under Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change,” generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability to use its pre-change net operating loss carry-forwards, or NOLs, and other pre-change tax attributes (such as research tax credits) to offset its post-change income may be limited. We may experience ownership changes in the future as a result of subsequent shifts in our stock ownership. As a result, if we earn net taxable income, our ability to use our pre-change net operating loss carry-forwards to offset U.S. federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In addition, at the state level, there may be periods during which the use of NOLs is suspended or otherwise limited, which could accelerate or permanently increase state taxes owed.

Being a public company significantly increases the Company’s administrative costs.

The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC and listing requirements subsequently adopted by the NYSE Amex in response to Sarbanes-Oxley, have required changes in corporate governance practices, internal control policies and audit committee practices of public companies. Although the Company is a relatively small public company, these rules, regulations, and requirements for the most part apply to the same extent as they apply to all major publicly traded companies. As a result, they have significantly increased the Company’s legal, financial, compliance and administrative costs, and have made certain other activities more time consuming and costly, as well as requiring substantial time and attention of our senior management. The Company expects its continued compliance with these and future rules and regulations to continue to require significant resources. These rules and regulations also may make it more difficult and more expensive for the Company to obtain director and officer liability insurance in the future and could make it more difficult for it to attract and retain qualified members for the Company’s Board of Directors, particularly to serve on its audit committee.

General Business Risks

Our business operation is very limited. We expect to incur significant operating losses for the foreseeable future

We are authorized to issue up to 450,000,000 shares of common stock. As of the date of this filing, there are 95,500,000 issued and outstanding shares of common stock. Consequently, our stockholders may experience more dilution in their ownership of our Company in the future, which could have an adverse effect on the trading market for our shares of common stock.

The report of our independent registered public accounting firm on our financial statements for the year ended July 31, 2020 contains an explanatory paragraph regarding our ability to continue as a going concern based upon our minimal cash and no source of revenues which are insufficient to cover our operating costs. These factors, among others, raise substantial doubt about our ability to continue as a going concern.

While operating our online systems and attracting a good number of followers to date, we have not yet generated any meaningful revenue from marketplace users. At the date of this document, we do not have any paying customers and we cannot guarantee we ever will have any. Even if we start our business operation and obtain new customers, there is no guarantee that we will generate a profit. If we cannot generate a profit, we will have to suspend or cease operations.

The company is reliant upon its management, creditors and related parties to pay for operating expenses until we generate revenues sufficient to cover our expenses. There is no obligation of these parties to continue making such payments.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of the Company

Though not now, we may be or in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation. In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders. The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of us from doing so if it cannot obtain the approval of our board of directors.

We will need to raise additional capital to continue operations over the coming year.

We anticipate the need to raise approximately $1,500,000 in capital to fund our operations through July 31, 2024 based on the capital expenditures. We cannot guarantee that we will be able to raise these required funds or generate sufficient revenue to remain operational.

We may be unable to manage growth, which may impact our potential profitability.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we will need to:

|

|

●

|

Establish definitive business strategies, goals and objectives;

|

|

|

●

|

Maintain a system of management controls; and

|

|

|

●

|

Attract and retain qualified personnel, as well as, develop, train and manage management-level and other employees.

|

If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed, and our stock price may decline.

Our lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

We may in the future be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. While neither Nevada law nor our Articles of Incorporation or bylaws require us to indemnify or advance expenses to our officers and directors involved in such a legal action, we have entered into an indemnification agreement with our President and intend to enter into similar agreements with other officers and directors in the future. Without adequate D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business.

If the registration of our common stock is revoked in the future, our business opportunities will cease to exist.

In the event our securities registration was to be revoked, we would not have the ability to raise money through the issuance of shares and would lose the ability to continue the business plan set out in this filing. Common stock issued and outstanding at that time would no longer be tradable.

Our business operations have been and may continue to be materially and adversely affected by the outbreak of the novel respiratory illness coronavirus (“COVID-19”).

On March 11, 2020, the World Health Organization declared the outbreak of the novel respiratory illness COVID-19 a pandemic. The new strain of COVID-19 is considered to be highly contagious and poses a serious public health threat.

Any outbreak of such epidemic illness or other adverse public health developments may materially and adversely affect the global economy, our markets and our business.

We cannot foresee whether the outbreak of COVID-19 will be effectively contained, nor can we predict the severity and duration of its impact. If the outbreak of COVID-19 is not effectively and timely controlled, our business operations and financial condition may be materially and adversely affected as a result of the deteriorating market outlook for retail and online sales, the slowdown in regional and national economic growth, weakened liquidity and financial condition of our customers or other factors that we cannot foresee. Any of these factors and other factors beyond our control could have an adverse effect on the overall business environment, cause uncertainties in the regions where we conduct business, cause our business to suffer in ways that we cannot predict and materially and adversely impact our business, financial condition and results of operations.

Risks Related to the Regulatory Environment

The following risks relate to our proposed business and the effects upon us assuming we obtain financing in a sufficient amount.

Cannabis Remains Illegal at the Federal Law Level and in Many Other States.

A number of states have enacted laws allowing their citizens to purchase and use recreational marijuana, medical marijuana and to operate medical marijuana cultivation, production or dispensary facilities. Cultivating and distributing marijuana for medical and recreational use is permitted in California where the Company is based and where all of the Company's cannabis products are grown, manufactured and sold, provided the Company remains in compliance with applicable state and local laws, rules and regulations. However, at the time this Offering commenced, marijuana is illegal under United States federal law, and under the laws of many states and foreign countries. The United States Supreme Court has confirmed that the federal government has the right to regulate and criminalize cannabis, including for medical purposes, and that federal law criminalizing the use of cannabis pre-empts state laws that legalize its use. Strict enforcement of federal law regarding marijuana would likely result in the inability to proceed with the business plans of the Company, even if they successfully procure all licenses for the cultivation, production and/or distribution of their cannabis products in California and could expose the Company to potential criminal liability and subject their properties to civil forfeiture. Additionally, certain state or foreign country laws could affect the Company if the state or foreign country believes the Company is violating those laws.

Regulatory Approval and Permits.

The Company may be required to obtain and maintain certain permits, licenses and approvals in the jurisdictions where its products are licensed. There can be no assurance that the Company will be able to obtain or maintain any necessary licenses, permits or approvals. Any material delay or inability to receive these items is likely to delay and/or inhibit the Company's ability to conduct its business, and would have an adverse effect on its business, financial condition and results of operations.

Additionally, the failure to obtain licenses could occur through no fault of the Company. Due to complicated and often contradictory legislative efforts at the state, county and local level in California, some cannabis businesses have been unable to obtain licenses, renew licenses, or move from temporary or provisional licenses to permanent ones. In some cases, this could be due to the state or local legislative bodies not passing laws or regulations that allow licensing to take place or that allow temporary licenses to expire with no additional means to continue operating a licensed business. Should any of these situations, or others that are unanticipated at this time, prevent the Company obtaining the necessary licenses, permits, authorizations or accreditations it requires, even if it makes its best efforts to do so, it could result in restrictions on the Company's ability to operate its business, which could have a material adverse effect on the Company and your investment.

Great Uncertainty as to Federal Law Enforcement for Investors in Cannabis-Related Companies.

.

While cannabis-related stocks and securities are currently accepted by, and trade on national securities exchanges including the New York Stock Exchange, and while federal securities regulators such as the SEC have not issued any prohibition against selling or issuing cannabis related securities, there is still uncertainty in the investment world as to the possible effects that cannabis being illegal under the federal Controlled Substances Act could have on cannabis-related company investors. In theory, investing in the Company or any a cannabis-related business could be found to violate the federal Controlled Substances Act. As a Shareholder and owner of the Company, it is theoretically possible that federal law enforcement officials could issue indictments to investors under federal law, and all of the assets an investor contributes to a cannabis business like the Company, could be subject to asset forfeiture because cannabis is still federally illegal. While the Company believes this risk is limited by its legal and compliant operation of its cannabis business under California law, the Company cannot assure any investor that the present federal climate, which seems to not be interested in prosecuting those involved with the growing legal cannabis business in states such as California, will continue to not prosecute those involved in cannabis-related businesses. The Company is not aware of any investor ever being prosecuted for simply investing in a cannabis related company by the United States federal government, but there is no assurance that such a prosecution will not occur in the future.

Furthermore, investors in cannabis-related businesses could be subject to a suspicious activity report (SAR) being the investor transfers funds to purchase the securities, under the theory that transferring funds to a business that is legally growing and selling cannabis in California is still violating federal law, making the need for a suspicious activity report to be filed. Although the Company has not been able to find any relevant precedent or confirmed media reports related to this issue, it remains theoretically possible that investors could get flagged for money laundering when they transfer funds to purchase cannabis-related stocks, and it is also possible that a bank could shut down the accounts of such investors.

The Company may be Deemed to be Aiding and Abetting Illegal Activities Through the Products that it Grows and Sells.

As a result, the Company may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect the Company's business and may affect investors directly. Under federal law, and more specifically the Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Under certain laws of various states, the possession, use, cultivation, and/or transfer of cannabis is also illegal. The Company's business involves the cultivation, and/or sale of cannabis which is legal in California where the Company grows, manufactures and sells its cannabis products. Despite being legal in California, federal law enforcement authorities, and perhaps even other states law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against the Company or its officers, directors and/or investors, not only based on the cultivating and sale of cannabis, but also possibly claims of aiding and abetting another's criminal activities. As a result of such an action, the Company may be forced to cease operations and its investors could lose their entire investment. Such an action would have a material negative effect on the Company's business and operations, and could have a negative effect on investors directly.

It is also possible that additional federal or state legislation could be enacted in the future that would prohibit or limit the Company from selling cannabis and cannabis-related products and services, and, if such legislation were enacted, the Company's revenues would decline. Further, additional government disruption in the cannabis industry could cause potential customers and users to be reluctant to use the Company's products, which would be detrimental to the Company. The Company cannot predict the nature of any future laws, regulations, interpretations or applications, nor can it determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on the Company's business, or on investors directly.

The Company's Business is Dependent on California State Laws.

As of the date of this Offering, California has legalized cannabis for adult use at the state level. Continued development of the cannabis industry is dependent upon continued legislative authorization of cannabis at the state and local level in additional states. Any number of factors could slow or halt progress in this area. Further, progress in the cannabis industry, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Further legalization attempts at the state level that create bad public policy could slow or stop further development of the cannabis industry. Any one of these or other factors could slow or halt use of cannabis, which would negatively impact the Company's business.

Table of contents

In addition, because of the burdensome, inconsistent and in some instances, incomplete legislation and regulation at the state and local levels, some believe that the California legal cannabis industry is in a contracting phase, and that some laws and regulations (or the lack thereof where needed) could result in a collapse of the legal cannabis industry in California. Defects in current legislation and regulation, expiring temporary licenses without timely renewals, over-regulation and over-taxation, and the costs of compliance (including attorneys and accountants) could negatively impact the Company's business.

Uncertainty in many Related Business Industries Caused by Federal Laws or State Laws Outside of California.

DSeveral industries that are used by most businesses have limitations or prohibitions on their use in cannabis related industries, and such limitations or prohibitions could have a detrimental effect on the Company's business, and on your investment. The following list are several examples of such limitations or prohibitions, and others exist or will exist in the future, that make investment into the Company, or any cannabis-related company, subject to a high level of risk:

• Advertising and marketing of cannabis and cannabis-related products is often limited or prohibited, including by such major companies as Google, Facebook and Twitter, and by the television industry. The inability to advertise and market the Company's products could have a significant effect on the Company's revenues and growth potential.

• The Company's access to real estate could be limited, its rights to such real estate could be voidable, and it could be forced to incur substantial costs. Some property owners may believe cannabis businesses contribute to an undesirable environment for a variety of alleged reasons including that cash accumulations and the presence of cannabis create a target for theft; and some processes, such as extraction, can create unpleasant odors.

• The Company's ability to attract qualified senior management and directors may be hampered by the uncertainty of the legal status of cannabis at the federal level.

• The Company's ability to transport its products is limited. Interstate commerce in cannabis products is illegal. Transportation of cannabis products from one state to another, even if cannabis is legal in both states, is prohibited or severely limited. Within a state, transportation via air or sea is subject to federal regulation, and therefore could be considered illegal. Arguably, transportation intrastate on federal highways could be seen as illegal.

• The Company may not be accorded the protection of bankruptcy laws because most bankruptcy law is federal law. While any cannabis company that wishes to obtain temporary protection from creditors may seek protection under state laws or common law relating to creditors' rights, it may not be able to use the protections afforded under provisions of the federal Bankruptcy Code.

Difficulty in Acquiring Insurance.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors' and officers' insurance, is more difficult for cannabis-related companies to find and more expensive than for other businesses. There are no guarantees that the Company will be able to find all such desired insurance coverages in the future, or that the cost will be affordable to the Company. If the Company are forced to go without certain insurance, it may prevent the Company from entering into certain business sectors, may inhibit the Company's growth, and may expose the Company to additional risk and financial liabilities.

Limited Accessibility to the Service of Banks.

Despite recent rules issued by the United States Department of the Treasury mitigating the risk to banks who do business with cannabis companies operating in compliance with applicable state laws, banks remain wary of accepting funds from businesses in the cannabis industry. Since the use of cannabis remains illegal under federal law, there remains a compelling argument that banks may be in violation of federal law when accepting for deposit funds derived from the sale or distribution of cannabis. Consequently, businesses involved in the cannabis industry continue to have trouble establishing banking relationships. Although the Company currently has bank accounts, its inability to open additional bank accounts or maintain its current account may make it difficult for the Company to do business. The inability to bank would also create a number of risks for the Company, including the possibility of a lack of verifiable financial records and accumulation of cash.

Table of contents

Uncertainty as to Federal Taxation for Cannabis-Related Businesses.

Because of federal laws making cannabis illegal, and because of certain provisions of the Internal Revenue Code, certain normal business expenses for other companies that are deductible by those companies, when incurred by cannabis-related companies, may not be deductible when calculating income tax liability and this can be detrimental to the Company's business. For example, Internal Revenue Code Section 280E prohibits businesses from deducting their ordinary and necessary business expenses other than costs of goods sold, where the business operations consist of activities that violate the federal Controlled Substances Act. Consequently, as long as cannabis remains subject to the federal Controlled Substances Act, cannabis companies including the Company may be at a disadvantage when it comes to profitability, compared to conventional companies. The effective tax rate on a cannabis-related business may depend on how large its ratio of nondeductible expenses is to its total revenues. Therefore, the Company's cannabis-related business may be less profitable than it could otherwise be.

Potential Growth Continues to be Subject to New and Changing State and Local Laws and Regulations.

Continued development of the cannabis industry is dependent upon continued legislative legalization of cannabis at the state level, and a number of factors could slow or halt progress in this area, even where there is public support for legislative action. Any delay or halt in the passing or implementation of legislation legalizing cannabis use, or its sale and distribution, or the re-criminalization or restriction of cannabis at the state level, particularly in California, could negatively impact the Company's business. Additionally, changes in applicable state and local laws or regulations could restrict the products and services the Company offer or impose additional compliance costs on the Company or its customers. Violations of applicable laws, or allegations of such violations, could disrupt the Company's business and result in a material adverse effect on its operations. The Company cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible that regulations may be enacted in the future that will be materially adverse to the Company's business.

The Cannabis Industry Faces Significant Opposition.

The Company is substantially dependent on the continued market acceptance, and the proliferation of consumers, of medical and recreational cannabis, particularly in California. The Company believes that with further legalization, cannabis will become more accepted, resulting in a growth in consumer demand. However, the Company cannot predict the future growth rate or future market potential, and any negative outlook on the cannabis industry may adversely affect the Company's business operations. Additionally, large, well-funded business sectors may have strong economic reasons to oppose the development of the cannabis industry. For example, medical cannabis may adversely impact the existing market for the certain medications sold by mainstream pharmaceutical companies. Should cannabis displace other drugs or products, the medical cannabis industry could face a material threat from the pharmaceutical industry, which is well-funded and possesses a strong and experienced lobby. Any inroads the pharmaceutical, or any other potentially displaced, industry or sector could make in halting or impeding the cannabis industry could have a detrimental impact on the Company's business.

The Company Operates in an Evolving Industry.

If the legal cannabis industry develops more slowly than the Company expects, its operating results and growth prospects could be harmed. in addition, the Company's future growth depends on the growth of the legal cannabis industry. The legal cannabis industry is a relatively new and rapidly evolving industry, making the Company's business and prospects difficult to evaluate. If new developments in the legal cannabis industry occur, particularly new laws or regulations or adverse interpretations of existing laws and regulations, technologies or if the Company is unable to successfully compete with current and new competitors, its business will be harmed, and it may not be able to survive. The growth and profitability of this industry, as it exists today, and the level of demand and market acceptance for the Company's products, are subject to a high degree of uncertainty. The Company believes that the continued growth of legal cannabis industry will depend on many factors, some of which cannot be foreseen at present. This nascent industry may develop more slowly than the Company expects, which could adversely impact the Company's operating results and its ability to grow its business.

Table of contents

Federal Regulation and Enforcement may Adversely affect the Implementation of Medical and Recreational Marijuana Laws and Regulations May Negatively Impact the Company's Revenues and Profits.

Currently, there are many states plus the District of Columbia that have laws and/or regulations that recognize, in one form or another, legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Currently, there are states such as California, Colorado Nevada, Oregon and others that have laws and/or regulations that recognize, in one form or another, legal or decriminalized recreational sale and use of cannabis. Many other states are considering similar legislation allowing the medical sale and use of marijuana and/or recreational sale and use of marijuana. Conversely, under the federal Controlled Substance Act the policies and regulations of the Federal government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and the personal use of cannabis is prohibited at the federal level. Many states have similar prohibitions. Unless and until Congress amends the CSA with respect to medical marijuana, or as to recreational marijuana, there can be no assurance of the legal sale and use of cannabis-related products such as those of the Company, and there is a risk that federal authorities may enforce current federal law. If so, the Company may be deemed to be producing, cultivating or dispensing marijuana in violation of federal law or certain state laws. Active enforcement of the current federal regulatory position on cannabis, or similar enforcement actions by certain states, may indirectly and adversely affect the Company's revenues and profits. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings and stated federal policy remains uncertain. The risk of strict enforcement of the state laws outside of California, as to the Company's business, also remains uncertain.

The Judicial System May Adversely Affect the Implementation of Medical and Recreational Marijuana Laws and Regulations May Negatively Impact the Company's Revenues and Profits.

Judicial interpretation of various state and federal laws related to cannabis could have a significant effect on the Company and its business. For example, in the recent past, the U.S. Supreme Court declined to hear a case brought by San Diego County, California that sought to establish federal preemption over state medical marijuana laws after the preemption claim was rejected by every court that reviewed the case, including the California 4th District Court of Appeals who wrote in its unanimous ruling, "Congress does not have the authority to compel the states to direct their law enforcement personnel to enforce federal laws." However, in another case, the U.S. Supreme Court held that, as long as the federal Controlled Substance Act contains prohibitions against marijuana, under the Commerce Clause of the United States Constitution, the United States may criminalize the production and use of homegrown cannabis even where states approve its use for medical purposes. The inconsistencies of judicial rulings from court to court, and from state court to federal court, creates an atmosphere of uncertainty for the cannabis industry. Should judicial rulings occur that directly or indirectly prohibits or limits the ability of the Company to cultivate, process and sell cannabis, or that prohibit the sale or purchase or cannabis related products by others, the Company's business and your investment could be significantly affected.

Volatility of Agricultural Commodities.

The Company uses certain agricultural commodities in the manufacturing of its products. Commodity markets are volatile and unexpected changes in commodity prices can reduce the Company's profit margin and make budgeting difficult. Many factors can affect commodity prices, including but not limited to political and regulatory changes, weather, seasonal variations, technology and market conditions. Some of the commodities used by the Company may not be easily substituted. Any of such events or occurrences could have a material adverse effect on the Company's financial results and on your investment.

Significant Risks Associated with Cultivating and Farming any Agricultural Crop.

The Company is in the business of growing and cultivating cannabis and other agricultural crops. There are significant risks involved with the Company's business as a result. The uncertainties inherent in weather, yields, prices, government policies, global markets, and other factors that impact farming can cause wide swings in farm income. For example, crop loss due to many factors is a very realistic possibility in the future, and has already occurred with the Company. Crop loss for the Company can occur as a result of many factors, including but not limited to, pesticide use, governmental testing of crops, weather, disease, mold and pests. Any and all crop loss by the Company for any reason could have a material adverse effect on the Company's financial results and on your investment.

Table of contents

Additionally, other risks inherent in the Company's business as a grower and cultivator of an agricultural crop include, but are not limited to (1) production risk derived from the uncertain natural growth processes of crops; (2) price or market risk such as uncertainty about the prices the Company will receive for their crops or the prices they must pay for inputs; (3) institutional risk resulting from uncertainties surrounding government actions such as regulations related to cannabis, tax laws, regulations for chemical use and rules for waste disposal; and (4) human or personal risk such as accidents, illness and death of the Company's farmers, employees, contractors and staff. Any of such events or occurrences could have a material adverse effect on the Company's financial results and on your investment.

Significant Risks Associated with a Possible Oversupply of Cannabis in the Marketplace.