Filed pursuant to Rule 424(b)(3)

Registration

No. 333-272589

PROSPECTUS

BUNKER

HILL MINING CORP.

112,082,390

Shares of Common Stock

92,172,716 Shares of Common Stock

Issuable upon Exercise of Warrants

This

Prospectus (this “Prospectus”) relates to the resale of shares of common stock (“Common Shares”)

of Bunker Hill Mining Corp. (“we”, “our” or the “Company”) and Common Shares

issuable upon exercise of common stock purchase warrants (the “Warrants”) held by the selling security holders named

herein under “Selling Shareholders and Certain Beneficial Owners” (the “Selling Shareholders”),

including Common Shares issuable upon exercise of special warrants of the Company (the “Special Warrants”) issued

on March 27, 2023 that will be automatically exercised (without payment of any further consideration and subject to customary

anti-dilution adjustments) into one unit of the Company (a “Unit”) comprised of one Common Share (each, a “Unit

Share”) and one common stock purchase warrant of the Company (each, a “Warrant”) on the date (the

“Automatic Exercise Date”) that is the earlier of: (i) the date that is three business days following the date

on which we have obtained notification that the registration statement of which this Prospectus is a part has been declared effective

by the SEC (as hereinafter defined); and (ii) September 27, 2023. Each whole Warrant entitles the holder thereof to acquire one Common

Share (a “Warrant Share”, and together with the Unit Shares, the “Underlying Shares”) at an exercise

price of C$0.15 per Warrant Share until March 27, 2026, subject to adjustment in certain events. In accordance with the Special Warrant

Indenture, dated as of March 27, 2023, between the Company and Capital Transfer Agency ULC (the “Special Warrant Indenture”)

that governs the terms and conditions of the Special Warrants, in the event that effectiveness of the registration statement of

which this Prospectus is a part is not obtained on or before 5:00 p.m. (EST) on July 27, 2023, each unexercised Special Warrant will

be deemed exercised on the Automatic Exercise Date into one penalty unit of the Company (a “Penalty Unit”) (instead

of one Unit), with each Penalty Unit being comprised of 1.2 Unit Shares and 1.2 Warrant Shares, provided that any fractional Penalty

Unit will be rounded up to the next greater whole number of Penalty Units if the fractional entitlement is equal to or greater than 0.5

and will, without any additional compensation, be rounded down to the next lesser whole number of Penalty Units if the fractional entitlement

is less than 0.5 (the “Penalty Provision”). Pursuant to the Special Warrant Indenture, the Company is obligated to

use commercially reasonable efforts to register the resale of the Underlying Shares, including any additional Underlying Shares that

are issued pursuant to the Penalty Provision. We will not receive any proceeds from the resale of the Common Shares, although we

may receive proceeds from the exercise of the warrants. The selling shareholders may offer all or part of the Common Shares for resale

from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The Company

is paying for all registration, listing and qualification fees, printing fees and legal fees.

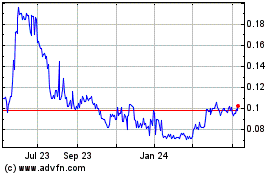

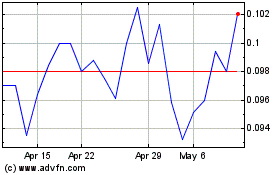

Our

Common Shares are quoted on the OTCQB under the ticker symbol “BHLL.” On July 10, 2023, the closing price of our Common

Shares was US$0.157 per Common Share.

We

are a “smaller reporting company” as defined under the federal securities laws and, as such, may elect to comply with certain

reduced public company reporting requirements. The purchase of the securities offered through this Prospectus involves a high degree

of risk. See section entitled “Risk Factors” starting on page 11.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES

OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Dated

July 11, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

Prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

pursuant to which the selling shareholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of

our common stock covered by this Prospectus. You should not assume that the information contained in this Prospectus is accurate on any

date subsequent to the date set forth on the front cover of this Prospectus or that any information we have incorporated by reference

is correct on any date subsequent to the date of the document incorporated by reference, even though this Prospectus is delivered or

common shares are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained

in this Prospectus in making your investment decision. You should also read and consider the information in the documents to which we

have referred you under “Where You Can Find Additional Information.”

We

have not authorized anyone to give any information or to make any representation to you other than those contained in this Prospectus.

You must not rely upon any information or representation not contained in this Prospectus. This Prospectus does not constitute an offer

to sell or the solicitation of an offer to buy any of our common shares other than the shares of our common stock covered hereby, nor

does this Prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person

to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this Prospectus in

jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering

and the distribution of this Prospectus applicable to those jurisdictions.

PROSPECTUS

SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this Prospectus To understand this

offering fully, you should read carefully the entire Prospectus, including “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements.” Unless the context indicates or suggests otherwise, references to “we,” “our,”

“us,” the “Company,” or the “Registrant” refer to Bunker Hill Mining Corp., a Nevada corporation,

and its subsidiaries. References to “$” refer to monetary amounts expressed in U.S. dollars. All references to “C$”

refer to monetary amounts expressed in Canadian dollars.

Our

Business

The

Company’s sole focus is the development and restart of its 100% owned flagship asset, the Bunker Hill mine (the “Mine”)

in Idaho, USA. The Mine remains the largest single producing mine by tonnage in the Silver Valley region of northwest Idaho, producing

over 165 million ounces of silver and 5 million tons of base metals between 1885 and 1981. The Bunker Hill Mine is located within Operable

Unit 2 of the Bunker Hill Superfund site (EPA National Priorities Listing IDD048340921), where cleanup activities have been completed.

In

early 2020, a new management team comprised of former executives from Barrick Gold Corp. assumed leadership of the Company. Since that

time, the Company conducted multiple exploration campaigns, published multiple economic studies and Mineral Resource Estimates, and advanced

the rehabilitation and development of the Mine. In December 2021, it announced a project finance package with Sprott Private Resource

Streaming & Royalty Corp. (“Sprott”), an amended Settlement Agreement with the U.S. Environmental Protection Agency

(“the EPA”), and the purchase of the Bunker Hill Mine, setting the stage for a rapid restart of the Mine.

In

January 2022, with the closing of the purchase of the Bunker Hill Mine, the funding of the $8,000,000 Royalty Convertible Debenture and

$6,000,000 Series Convertible Debenture, and the announcement of a Memorandum (“MOU”) for the purchase of the Pend

Oreille process plant from a subsidiary of Teck Resources Limited, the Company embarked on a program of activities with the goal of achieving

a restart of the Mine. Key milestones and achievements from January 2022 onwards have included the closing of the purchase of the Pend

Oreille process plant, the demobilization of the process plant to the Bunker Hill site, the completion of demolition activities at the

Pend Oreille site, a Prefeasibility Study envisaging the restart of the Mine, and the completion of the primary portion of the ramp decline

connecting the 5 and 6 Levels of the Bunker Hill Mine.

The

Company was incorporated for the initial purpose of engaging in mineral exploration activities at the Mine. The Company has moved into

the development stage concurrent with (i) purchasing the Mine and a process plant, (ii) completing successive technical and economic

studies, including a Prefeasibility Study, (iii) delineating mineral reserves, and (iv) conducting the program of activities outlined

above.

Lease

and Purchase of the Bunker Hill Mine

The

Company purchased the Bunker Hill Mine in January 2022, as described below.

Prior

to purchasing the Mine, the Company had entered into a series of agreements with Placer Mining Corporation (“Placer Mining”),

the prior owner, for the lease and option to purchase the Mine. The first of these agreements was announced on August 28, 2017, with

subsequent amendments and/or extensions announced on November 1, 2019, July 7, 2020, and November 20, 2020.

Under

the terms of the November 20, 2020 amended agreement (the “Amended Agreement”), a purchase price of $7,700,000 was

agreed, with $5,700,000 payable in cash (with an aggregate of $300,000 to be credited toward the purchase price of the Mine as having

been previously paid by the Company) and $2,000,000 in shares of common stock of the Company (“Common Shares”). The

Company agreed to make an advance payment of $2,000,000, credited toward the purchase price of the Mine, which had the effect of decreasing

the remaining amount payable to purchase the Mine to an aggregate of $3,400,000 payable in cash and $2,000,000 in Common Shares of the

Company.

The

Amended Agreement also required payments pursuant to an agreement with the EPA whereby for so long as the Company leases, owns and/or

occupies the Mine, the Company would make payments to the EPA on behalf of Placer Mining in satisfaction of the EPA’s claim for

historical water treatment cost recovery in accordance with the Settlement Agreement reached with the EPA in 2018. Immediately prior

to the purchase of the Mine, the Company’s liability to EPA in this regard totaled $11,000,000.

The

Company completed the purchase of the Bunker Hill Mine on January 7, 2022. The terms of the purchase price were modified to $5,400,000

in cash, from $3,400,000 of cash and $2,000,000 of Common Shares. Concurrent with the purchase of the Mine, the Company assumed incremental

liabilities of $8,000,000 to the EPA, consistent with the terms of the amended Settlement Agreement with the EPA that was executed in

December 2021 (see “EPA 2018 Settlement Agreement & 2021 Amended Settlement Agreement” section below).

EPA

2018 Settlement Agreement & 2021 Amended Settlement Agreement

Bunker

Hill entered into a Settlement Agreement and Order on Consent with the EPA on May 15, 2018. This agreement limits the Company’s

exposure to the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) liability for past

environmental damage to the mine site and surrounding area to obligations that include:

| |

● |

Payment

of $20,000,000 for historical water treatment cost recovery for amounts paid by the EPA from 1995 to 2017 |

| |

|

|

| |

● |

Payment

for water treatment services provided by the EPA at the Central Treatment Plant (“CTP”) in Kellogg, Idaho until

such time that Bunker Hill either purchases or leases the CTP or builds a separate EPA-approved water treatment facility |

| |

|

|

| |

● |

Conducting

a work program as described in the Ongoing Environmental Activities section of this study |

In

December 2021, in conjunction with its intention to purchase the mine complex, the Company entered into an amended Settlement Agreement

(the “Amendment”) between the Company, Idaho Department of Environmental Quality, US Department of Justice and the

EPA modifying the payment schedule and payment terms for recovery of historical environmental response costs at Bunker Hill Mine incurred

by the EPA. With the purchase of the mine in early 2022, the remaining payments of the EPA cost recovery liability were assumed by the

Company, resulting in a total of $19,000,000 liability to the Company, an increase of $8,000,000. The new payment schedule included a

$2,000,000 payment to the EPA within 30 days of execution of this amendment, which was made.

The

remaining $17,000,000 will be paid on the following dates:

| Date | |

Amount | |

| November 1, 2024 | |

$ | 3,000,000 | |

| November 1, 2025 | |

$ | 3,000,000 | |

| November 1, 2026 | |

$ | 3,000,000 | |

| November 1, 2027 | |

$ | 3,000,000 | |

| November 1, 2028 | |

$ | 3,000,000 | |

| November 1, 2029 | |

$ | 2,000,000 plus accrued interest | |

The

resumption of payments in 2024 was agreed in order to allow the Company to generate sufficient revenue from mining activities at the

Bunker Hill Mine to address remaining payment obligations from free cash flow.

The

changes in payment terms and schedule were contingent upon the Company securing financial assurance in the form of performance bonds

or letters of credit deemed acceptable to the EPA totaling $17,000,000, corresponding to the Company’s cost recovery obligations

to be paid in 2024 through 2029 as outlined above. Should the Company fail to make its scheduled payment, the EPA can draw against this

financial assurance. The amount of the bonds or letters of credit will decrease over time as individual payments are made. If the Company

failed to post the final financial assurance within 180 days of the execution of the Amendment, the terms of the original agreement would

be reinstated.

In

June 2022, the Company was successful in obtaining financial assurance. Specifically, a $9,999,000 payment bond and a $7,001,000 letter

of credit were secured and provided to the EPA. This milestone provides for the Company to recognize the effects of the change in terms

of the EPA liability as outlined in the December 20, 2021, agreement. Once the financial assurance was put into place, the restructuring

of the payment stream under the Amendment occurred with the entire $17,000,000 liability being recognized as long-term in nature. The

aforementioned payment bond and letter of credit were secured by $2,475,000 and $7,001,000 of cash deposits, respectively as of September

30, 2022.

In

October 2022, the Company reported that it had been successful in securing a new payment bond to replace the aforementioned $7,001,000

letter of credit, in two stages. Initially, the letter of credit was reduced to $2,000,001 as a result of a new $5,000,000 payment bond

obtained through an insurance company. The collateral for the new payment bond is comprised of a $2,000,000 letter of credit and land

pledged by third parties, with whom the Company has entered into a financing cooperation agreement that contemplates a monthly fee of

$20,000 (payable in cash or common shares of the Company, at the Company’s election). The new payment bond is scheduled to increase

to $7,001,000 (from $5,000,000) upon the advance of the multi-metals stream from Sprott Private Resource Streaming & Royalty Corp.

Project

Finance Package with Sprott Private Resource Streaming & Royalty Corp.

On

December 20, 2021, the Company executed a non-binding term sheet outlining a $50,000,000 project finance package with Sprott Private

Resource Streaming and Royalty Corp. (“Sprott Streaming” or “SRSR”). The non-binding term sheet with SRSR

outlined a project financing package that the Company expects to fulfill the majority of its funding requirements to restart the Mine.

The term sheet consisted of an $8,000,000 royalty convertible debenture (the “RCD”), a $5,000,000 convertible debenture

(the “CD1”), and a multi-metals stream of up to $37,000,000 (the “Stream”). The CD1 was subsequently

increased to $6,000,000, increasing the project financing package to $51,000,000.

On

June 17, 2022, the Company consummated a new $15,000,000 convertible debenture (the “CD2”). As a result, total potential

funding from SRSR was further increased to $66,000,000 including the RCD, CD1, CD2 and the Stream (together, the “Project Financing

Package”).

The

Company closed the $8,000,000 RCD on January 7, 2022. The RCD bears interest at an annual rate of 9.0%, payable in cash or Common Shares

at the Company’s option, until such time that SRSR elects to convert a royalty, with such conversion option expiring at the earlier

of advancement of the Stream or July 7, 2023 (subsequently amended as described below). In the event of conversion, the RCD will cease

to exist and the Company will grant a royalty for 1.85% of life-of-mine gross revenue from mining claims considered to be historically

worked, contiguous to current accessible underground development, and covered by the Company’s 2021 ground geophysical survey (the

“SRSR Royalty”). A 1.35% rate will apply to claims outside of these areas. The RCD was initially secured by a share

pledge of the Company’s operating subsidiary, Silver Valley, until a full security package was put in place concurrent with the

consummation of the CD1. In the event of non-conversion, the principal of the RCD will be repayable in cash.

Concurrent

with the funding of the CD2 in June 2022, the Company and SRSR agreed to a number of amendments to the terms of the RCD, including an

amendment of the maturity date from July 7, 2023, to March 31, 2025. The parties also agreed to a Royalty Put Option such that in the

event the RCD is converted into a royalty as described above, the holder of the royalty will be entitled to resell the royalty to the

Company for $8,000,000 upon default under the CD1 or CD2 until such time that the CD1 and CD2 are paid in full.

The

Company closed the $6,000,000 CD1 on January 28, 2022, which was increased from the previously announced $5,000,000. The CD1 bears interest

at an annual rate of 7.5%, payable in cash or shares at the Company’s option, and matures on July 7, 2023 (subsequently amended,

as described below). The CD1 is secured by a pledge of the Company’s properties and assets. Until the closing of the Stream, the

CD1 was to be convertible into Common Shares at a price of C$0.30 per Common Share, subject to stock exchange approval (subsequently

amended, as described below). Alternatively, SRSR may elect to retire the CD1 with the cash proceeds from the Stream. The Company may

elect to repay the CD1 early; if SRSR elects not to exercise its conversion option at such time, a minimum of 12 months of interest would

apply.

Concurrent

with the funding of the CD2 in June 2022, the Company and SRSR agreed to a number of amendments to the terms of the CD1, including that

the maturity date would be amended from July 7, 2023, to March 31, 2025, and that the CD1 would remain outstanding until the new maturity

date regardless of whether the Stream is advanced, unless the Company elects to exercise its option of early repayment.

The

Company closed the $15,000,000 CD2 on June 17, 2022. The CD2 bears interest at an annual rate of 10.5%, payable in cash or shares at

the Company’s option, and matures on March 31, 2025. The CD2 is secured by a pledge of the Company’s properties and assets.

The repayment terms include 3 quarterly payments of $2,000,000 each beginning June 30, 2024, and $9,000,000 on the maturity date. Concurrent

with the funding of the CD2 in June 2022, the Company and SRSR agreed that the minimum quantity of metal delivered under the Stream,

if advanced, will increase by 10% relative to the amounts noted above.

On

December 6, 2022, the Company closed a new $5,000,000 loan facility with Sprott (the “Bridge Loan”). The Bridge Loan,

which was primarily utilized to pay outstanding water treatment payables to the EPA, is secured by the same security package that is

in place with respect to the RCD, CD1, and CD2. The Bridge Loan bears interest at a rate of 10.5% per annum and matures at the earlier

of (i) the advance of the Stream, or (ii) June 30, 2024. In addition, the minimum quantity of metal delivered under the Stream, if advanced,

would increase by 5% relative to amounts previously announced.

The non-binding term sheet (taking

into account subsequent amendments concurrent with closing of the CD2 and Bridge Loan, as outlined above) also envisaged that a minimum

of $27,000,000 and a maximum of $37,000,000 (the “Stream Amount”) would be made available under the Stream, at the

Company’s option, once the conditions of availability of the Stream have been satisfied including confirmation of full project

funding by an independent engineer appointed by SRSR. Thereunder, if the Company draws the maximum funding of $37,000,000, the Stream

would apply to 10% of payable metals sold until a minimum quantity of metal is delivered consisting of, individually, 63.5 million pounds

of zinc, 40.4 million pounds of lead, and 1.2 million ounces of silver (including amendments agreed concurrent with closing of the CD2

and Bridge Loan, as described above). Thereafter, the Stream would apply to 2% of payable metals sold. If the Company elects to draw

less than $37,000,000 under the Stream, the percentage and quantities of payable metals streamed will adjust pro-rata. The delivery price

of streamed metals will be 20% of the applicable spot price. The Company may buy back 50% of the Stream Amount at a 1.40x multiple of

the Stream Amount between the second and third anniversary of the date of funding, and at a 1.65x multiple of the Stream Amount between

the third and fourth anniversary of the date of funding.

The terms of the Project Financing Package

were further amended, as described in the Recent Developments section below.

Process

Plant

On

January 25, 2022, the Company announced that it had entered into a non-binding Memorandum of Understanding (“MOU”)

with Teck Resources Limited (“Teck”) for the purchase of a comprehensive package of equipment and parts inventory

from its Pend Oreille site (the “Process Plant”) in eastern Washington State, approximately 145 miles from the Bunker

Hill Mine by road. The package comprises substantially all processing equipment of value located at the site, including complete crushing,

grinding and flotation circuits suitable for a planned ~1,500 ton-per-day operation at Bunker Hill, and total inventory of nearly 10,000

components and parts for mill, assay lab, conveyer, field instruments, and electrical spares. The Company paid a $500,000 non-refundable

deposit in January 2022.

On

March 31, 2022, the Company announced that it had reached an agreement with a subsidiary of Teck to satisfy the remaining purchase price

for the Process Plant by way of an equity issuance of the Company. Teck will receive 10,416,667 units of the Company (the “Teck

Units”) at a deemed issue price of C$0.30 per unit. Each Teck Unit consists of one Common Share and one Common Share purchase

warrant (the “Teck Warrants”). Each whole Teck Warrant entitles the holder to acquire one Common Share at a price

of C$0.37 per Common Share for a period of three years. The equity issuance and purchase of the Process Plant occurred on May 13, 2022.

On

August 30, 2022, the Company entered into an agreement to purchase a ball mill from D’Angelo International LLC for $675,000. The

purchase of the mill is to be made in three cash payments. The first two payments were made as follows:

| |

● |

$100,000

on September 15, 2022, as a non-refundable deposit |

| |

|

|

| |

● |

$100,000

on October 13, 2022, as a refundable deposit |

The

Company has not made the final payment of $475,000 as of the issuance of this report.

Recent

Developments

On

June 23, 2023, the Company and Silver Valley Metals Corp., an Idaho corporation and wholly owned subsidiary of the Company

(“Silver Valley”), entered into (i) a metals purchase agreement (the “Metals Purchase Agreement”)

with an affiliate of Sprott Private Resource Streaming & Royalty Corp. (“Sprott Streaming”), (ii) a loan

agreement (the “Loan Agreement”) with two affiliates Sprott Streaming (collectively, the “Lenders”),

and (iii) a fourth omnibus amendment agreement with certain affiliates of Sprott Streaming and the other parties named therein (the “Omnibus

Amendment Agreement”) for an upsized $67 million project financing package. The package consists of a $46 million multi-metals

stream (the “Stream”) and a $21 million new debt facility (the “Debt Facility”) that is

available for draw, subject to certain terms and conditions, for two years at the Company’s election. Including the previously

funded $8 million Royalty Convertible Debenture (the “RCD”), $6 million Series 1 Convertible Debenture (the “CD1”),

and $15 million Series 2 Convertible Debenture (the “CD2”), the total commitment of Sprott Streaming and

its affiliates to the Bunker Hill Mine restart increased to $96 million. The transactions contemplated by the Metals

Purchase Agreement, the Loan Agreement, and the Omnibus Amendment Agreement closed on June 23, 2023.

Metals

Purchase Agreement and Royalty Agreement

Pursuant

to the Metals Purchase Agreement, the maximum amount of refined silver, lead and zinc under the Stream increased from $37

million to $46 million (the “Stream Amount”). The terms of the Stream are unchanged from those announced in December

2021, applying to 10% of payable metals sold until a minimum quantity of metal is delivered consisting of, individually, approximately

63.5 million pounds of zinc, 40.4 million pounds of lead, and 1.2 million ounces of silver. Thereafter, the Stream will apply

to 2% of payable metals sold. The delivery price of streamed metals will be 20% of the applicable spot price. The Company may buy back

50% of the Stream Amount at a 1.40x multiple of the Stream Amount between the second and third anniversary of the date of funding, and

at a 1.65x multiple of the Stream Amount between the third and fourth anniversary of the date of funding.

As

previously contemplated, upon funding of the Stream, the RCD was repaid by the Company, and Silver Valley granted an affiliate

of Sprott Streaming a royalty for 1.85% of life-of-mine gross revenue (the “Royalty”) from mining claims considered

to be historically worked (the “Primary Claims”), contiguous to current accessible underground development, and covered

by the Company’s 2021 ground geophysical survey, pursuant to a royalty agreement, dated as of June 23, 2023, among the Company,

Silver Valley, and an affiliate of Sprott Streaming (the “Royalty Agreement”). A 1.35% rate will apply to claims

outside of these areas (the “Secondary Claims”). The previously announced royalty put option permits Sprott Streaming

to resell the Royalty to the Company for $8 million upon default under the CD1 or CD2 until such time that they are repaid in full.

The

Company agreed to guarantee the payment and performance of all of the covenants and obligations of Silver Valley under the Metals Purchase

Agreement.

Loan Agreement

Pursuant

to the Loan Agreement, the Lenders agreed to make available to the Company the Debt Facility to finance, in part, the construction and

development of the Bunker Hill Mine. The Debt Facility

consists of a $21 million facility that is available for draw at the Company’s election for a period of two years. Any amounts

drawn will bear interest of 10% per annum, payable annually in cash or capitalized until three years from closing of the Debt Facility

at the Company’s election, and thereafter payable in cash only. The maturity date of any drawings under the Debt Facility is

June 23, 2027. For every $5 million or part thereof advanced under the Debt

Facility, the Company will grant a new 0.5% life-of-mine gross revenue royalty, on the same terms as the Royalty, to a maximum of 2.0%

on the Primary Claims and 1.4% on the Secondary Claims. The Company may buy back 50% of these royalties for $20 million.

Omnibus

Amendment Agreement

Pursuant

to the Omnibus Amendment Agreement, the parties extended the maturities of the CD1 and CD2 to March 31, 2026, when the

full $6 million and $15 million, respectively, will become due.

Concentrate

Offtake Agreement and Offtake Financing Discussions

On

May 23, 2023, the Company announced that Teck Resources Limited (“Teck”) exercised its option to acquire 100% of the

zinc and lead concentrate production from the Bunker Hill Mine for a five-year period. The transaction is subject to the negotiation

of definitive transaction documents and the approval of those documents by the Company’s board of directors. The transaction would

secure a long-term, sustainable revenue source for the Bunk Hill Mine.

The

Company remains in discussions with potential providers of offtake financing. Any agreement with a metal trader, in lieu of the Debt

Facility, would be subject to approval by Teck and Sprott Streaming.

Director Appointment

On July 5, 2023, the Company’s board

of directors appointed Paul Smith as a director of the Company and as Chair of the new Growth Committee of the board, in each case effective

as of July 6, 2023. On July 6, 2023, Mr. Smith entered into a board member agreement with the Company (the “Board

Member Agreement”) to establish the terms and conditions of his service as a member of the board. The Board Member Agreement

sets forth the services and responsibilities of Mr. Smith as a director of the Company and as Chair of the Growth Committee of the

board, including with respect to professionalism, standards of conduct, fiduciary duties, conflicts of interest, and confidentiality,

among other matters. The compensation to be provided to Mr. Smith as set forth in the Board Member Agreement is materially consistent

with the compensation that is provided to the other non-executive directors of the Company. In addition, he will be compensated for his

service as Chair of the newly formed Growth Committee, which will advise the executive team and the board on the development of the Company’s

growth strategy, the disciplined review of M&A opportunities and the timely execution of any transactions. The Board Member Agreement

provides that fees for any formal mergers and acquisitions advisory work conducted, or introductions made by, Mr. Smith or his associated

businesses on behalf of the Company will be negotiated in accordance with the needs of each transaction and will be reported as a related

party transaction in accordance with the applicable regulations and policies.

Business

Operations

The

Mine is a zinc-lead-silver Mine. When back in production, the Company intends to mill mineral resources on-site to produce both zinc

and lead-silver concentrates which will then be shipped to a third-party smelter for processing.

Infrastructure

The

Mine includes all mining rights and claims, surface rights, fee parcels, mineral interests, easements, existing infrastructure at Milo

Gulch, and the majority of machinery and buildings at the Kellogg Tunnel portal level, as well as all equipment and infrastructure anywhere

underground at the Bunker Hill Mine Complex. It also includes all current and historic data relating to the Bunker Hill Mine Complex,

such as drill logs, reports, maps, and similar information located at the Mine site or any other location.

For

further detail, please refer to the “Project Infrastructure” section below.

Government

Regulation and Approval

Exploration

and development activities, and any future mining operations, are subject to extensive laws and regulations governing the protection

of the environment, waste disposal, worker safety, mine construction, and protection of endangered and protected species. The Company

has made, and expects to make in the future, significant expenditures to comply with such laws and regulations. Future changes in applicable

laws, regulations and permits or changes in their enforcement or regulatory interpretation could have an adverse impact on the Company’s

financial condition or results of operations.

It

may be necessary to obtain the following environmental permits or approved plans prior to commencement of mine operations:

| |

● |

Reclamation

and Closure Plan |

| |

|

|

| |

● |

Water

Discharge Permit |

| |

|

|

| |

● |

Air

Quality Operating Permit |

| |

|

|

| |

● |

Industrial

Artificial (tailings) pond permit |

| |

|

|

| |

● |

Obtaining

Water Rights for Operations |

If

these permits are required, there can be no assurance that the Company will be able to obtain them in a timely manner or at all. For

further detail, please refer to the “Environmental Studies and Permitting” section of the “Technical Report Summary”

below.

Property

Description

The

Company has mineral rights to approximately 440 patented mining claims covering over 5700 acres. Of these claims, 35 include surface

ownership of approximately 259 acres. It also has certain parcels of fee property which include mineral and surface rights but not patented

mining claims. Mining claims and fee properties are located in Townships 47, 48 North, Range 2 East, Townships 47, 48 North, Range 3

East, Boise Meridian, Shoshone County, Idaho.

Patented

mining claims in the State of Idaho do not require permits for underground mining activities to commence on private lands. Other permits

associated with underground mining may be required, such as water discharge and site disturbance permits. The water discharge is being

handled by the EPA at the existing CTP. The Company expects to take on the water treatment responsibility in the future and obtain an

appropriate discharge permit.

For

further detail, please refer to the “Property Description and Ownership” section of the “Technical Report Summary”

below.

Competition

The

Company competes with other mining and exploration companies in connection with the acquisition of mining claims and leases on zinc and

other base and precious metals prospects as well as in connection with the recruitment and retention of qualified employees. Many of

these companies are much larger than the Company, have greater financial resources and have been in the mining business for much longer

than it has. As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration

and development properties. The Company may not be able to compete against these companies in acquiring new properties and/or qualified

people to work on its current project, or any other properties that may be acquired in the future.

Given

the size of the world market for base precious metals such as silver, lead and zinc, relative to the number of individual producers and

consumers, it is believed that no single company has sufficient market influence to significantly affect the price or supply of these

metals in the world market.

Employees

The

Company has ten employees. The balance of the Company’s operations is contracted for as consultants.

Smaller

Reporting Company Status

Rule

12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) defines a “smaller reporting company”

as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller

reporting company and that:

| |

● |

had

a public float of less than $75,000,000 as of the last business day of its most recently completed second fiscal quarter, computed

by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the

price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market

for the common equity; or |

| |

|

|

| |

● |

in

the case of an initial registration statement under the United States Securities Act of 1933, as amended (the “Securities

Act”), or Exchange Act for shares of its common equity, had a public float of less than $75,000,000 as of a date within

30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares

held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares

included in the registration statement by the estimated public offering price of the shares; or |

| |

|

|

| |

● |

in

the case of an issuer whose public float as calculated under the first and second bulleted paragraph above of this definition was

zero, had annual revenues of less than $50,000,000 during the most recently completed fiscal year for which audited financial statements

are available. |

As

a smaller reporting company, we will not be required and may not include a Compensation Discussion and Analysis section in our proxy

statements; we will provide only two years of financial statements; and we need not provide the table of selected financial data. We

also will have other “scaled” disclosure requirements that are less comprehensive than issuers that are not smaller reporting

companies which could make our Common Shares less attractive to potential investors, which could make it more difficult for our shareholders

to sell their shares.

SUMMARY

OF THE OFFERING

Common

Shares offered by Selling

Shareholders and Certain Beneficial

Owners |

204,255,106

Common Shares, including: |

| |

● |

51,633,727

Common Shares issuable pursuant to the Special Warrants issued on March 27, 2023; |

| |

|

|

| |

● |

51,633,727

Common Shares issuable upon exercise of the common stock purchase warrant component of the Special Warrants issued on March 27, 2023; |

| |

|

|

| |

● |

37,849,325

Common Shares issuable upon exercise of the common stock purchase warrant component of the special warrants issued on April 1, 2022; |

| |

|

|

| |

● |

20,833,334

Common Shares issued to Teck Resource Limited on a private placement basis in May 2022 and upon the exercise of warrants in March

2023; |

| |

|

|

| |

● |

26,308,745

Common Shares issued to Sprott Private Resource Streaming & Royalty Corp.; |

| |

|

|

| |

● |

8,132,533

Common Shares issued pursuant to awards granted under the Company’s equity compensation plans; |

| |

|

|

| |

● |

5,174,051

Common Shares issued in other private placement transactions; and |

| |

|

|

| |

● |

2,689,664

Common Shares issuable upon exercise of the common stock purchase warrant component of warrants issued in other private placements. |

| |

|

|

| Common

Shares outstanding before the offering |

|

265,810,755

Common Shares as of July 7, 2023 (not

including shares issuable upon exercisable warrants). |

| |

|

|

| Offering

Price |

|

Determined

at the time of sale by the selling shareholders. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of shares by the selling shareholders, although we may receive proceeds from the exercise

of common stock purchase warrants. Any such proceeds will we used for general working capital purposes. |

| |

|

|

| Canadian

Securities Exchange (CSE) Trading Symbol |

|

BNKR |

| |

|

|

| OTCQB

Trading Symbol |

|

BHLL |

| |

|

|

| Risk

Factors |

|

The

Common Shares offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of

their entire investment. See “Risk Factors”. |

SUMMARY

OF FINANCIAL INFORMATION

The

following selected financial information is derived from the Financial Statements appearing elsewhere in this Prospectus and should be

read in conjunction with the Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus. The amounts below

are expressed in United States dollars.

| | |

Three

Months

Ended | | |

Three Months

Ended | | |

Year

Ended | | |

Year

Ended | |

| | |

31-Mar-23 | | |

31-Mar-22 | | |

31-Dec-22 | | |

31-Dec-21 | |

| | |

($) | | |

($) | | |

($) | | |

($) | |

| Operating Statement Data: | |

| | | |

| | | |

| | | |

| | |

| Revenues | |

| Nil | | |

| Nil | | |

| Nil | | |

| Nil | |

| Loss from operations | |

| (2,185,488 | ) | |

| (5,486,674 | ) | |

| (16,487,161 | ) | |

| (18,752,504 | ) |

| Net income (loss) | |

| 1,791,149 | | |

| (2,880,886 | ) | |

| 898,591 | | |

| (6,402,277 | ) |

| Net income (loss) per common share – basic and fully diluted | |

| 0.01 | | |

| (0.02 | ) | |

| 0.00 | | |

| (0.04 | ) |

| Balance Sheet Data: | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

| 36,929,798 | | |

| 19,089,557 | | |

| 32,929,892 | | |

| 4,071,796 | |

| Total liabilities | |

| 56,152,235 | | |

| 54,291,835 | | |

| 59,106,835 | | |

| 38,314,164 | |

| Total shareholders’ deficiency | |

| 19,222,437 | | |

| 35,202,278 | | |

| 26,176,943 | | |

| 34,242,368 | |

| Total number of common shares issued and outstanding | |

| 256,099,174 | | |

| 164,435,442 | | |

| 229,501,661 | | |

| 164,435,826 | |

RISK

FACTORS

You

should carefully consider the risks described below together with all other information included in our public filings before making

an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic

facts are forward- looking statements are subject to risks and uncertainties that could cause actual results to differ materially from

those set forth in or implied by forward- looking statements. While the risks described below are the ones we believe are most important

for you to consider, these risks are not the only ones that we face. If any of the following events described in these risk factors actually

occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our Common Shares

could decline, and you may lose all or part of your investment.

General

Risk Factors

The

Company’s ability to operate as a going concern is in doubt.

The

audit opinion and notes that accompany the Company’s Financial Statements disclose a going concern qualification to its ability

to continue in business. The accompanying Financial Statements have been prepared under the assumption that the Company will continue

as a going concern. The Company is an exploration and development stage company and has incurred losses since its inception. The Company

has incurred losses resulting in an accumulated deficit of $71,592,559 as of December 31, 2022 and further losses are anticipated in

the development of its business.

The

Company currently has no historical recurring source of revenue and its ability to continue as a going concern is dependent on its ability

to raise capital to fund its future exploration and working capital requirements or its ability to profitably execute its business plan.

The Company’s plans for the long-term return to and continuation as a going concern include financing its future operations through

sales of its Common Shares and/or debt and the eventual profitable exploitation of the Mine. Additionally, the volatility in capital

markets and general economic conditions in the U.S. and elsewhere can pose significant challenges to raising the required funds. These

factors raise substantial doubt about the Company’s ability to continue as a going concern.

The

Company’s consolidated financial statements do not give effect to any adjustments required to realize its assets and discharge

its liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying Financial

Statements.

A

concentrate offtake agreement with Teck Resources may not be reached, which could result in less favorable commercial terms for the sale

of concentrates envisaged to be produced by the Bunker Hill Mine and could also impact the Company’s ability to secure offtake

financing. Regardless of actions taken by Teck, there can be no assurance that the Company will be able to secure or close offtake financing,

which could have an adverse effect on the Company’s financial position and negative impact the Company’s ability to secure

additional funding from Sprott or an alternative capital provider.

The

Company may not be able to execute a concentrate offtake agreement for the sale of concentrates to Teck Resources at its Trail smelter,

as contemplated with Teck’s option to acquire 100% of zinc and lead concentrate produced in the first five years at the Bunker

Hill Mine. If such an agreement cannot be reached, the Company may not be able to sell its zinc and lead concentrate to Teck, which could

result in difficulties securing alternative commercial arrangements for the sale of concentrate, less favorable commercial terms in the

event that alternative commercial arrangements can be secured, and/or higher transportation and other costs. In addition, the Company

may not be able to secure or close offtake financing, regardless of whether an agreement is reached with Teck; the terms of any offtake

financing might not be favorable to the Company; and/or the Company may incur substantial fees and costs related to such financing. The

Company’s inability to secure or close offtake financing, or arrange a suitable alternative, may have an adverse effect on the

Company’s operations and financial position.

The

Bunker Hill Mine restart is now expected to take place in 2024, with first concentrate production targeted for mid-2024. Changes to this

timeline, or other factors impacting the restart project budget, could increase the Company’s required capital needs through the

completion of the project, which would adversely affect the Company’s ability to secure additional funding, thereby adversely affecting

its financial condition.

On

February 28, 2023, the Company announced that primarily due to the inability to procure certain long-lead items that were planned to

be ordered by February 2023, and longer estimated delivery times thereof, the Company now expects the Bunker Hill Mine restart to be

achieved in 2024. On March 10, 2023, the Company announced that it has maintained the integrity of its total pre-production budget, under

the assumption of first concentrate production in the second quarter of 2024.

In

the event that the Company is unable to secure sufficient funding to materially advance the restart of the Mine in the second quarter

of 2023, from Sprott or an alternative capital provider, it is likely that the restart timeline will be further delayed with a potentially

materially adverse effect on the pre-production budget.

Notwithstanding

financing-related risks, the Company’s pre-production budget estimates are subject to change based on factors beyond its control,

including but not limited to cost inflation and supply chain dynamics. An increase in the Company’s pre-production budget estimates

could have a materially adverse impact on its ability to secure project financing. This could have a material adverse effect on its financial

condition, results of operations, or prospects. Sales of substantial amounts of securities may have a highly dilutive effect on the Company’s

ownership or share structure. Sales of a large number of shares of the Company’s Common Shares in the public markets, or the potential

for such sales, could decrease the trading price of the Common Shares and could impair the Company’s ability to raise capital through

future sales of Common Shares. The Company has not yet commenced commercial production at any of its properties and, therefore, has not

generated positive cash flows to date and has no reasonable prospects of doing so unless successful commercial production can be achieved

at the Mine. The Company expects to continue to incur negative investing and operating cash flows until such time as it enters into successful

commercial production. This will require the Company to deploy its working capital to fund such negative cash flow and to seek additional

sources of financing. There is no assurance that any such financing sources will be available or sufficient to meet the Company’s

requirements, or if available, available upon terms acceptable to the Company. There is no assurance that the Company will be able to

continue to raise equity capital or to secure additional debt financing, or that the Company will not continue to incur losses.

Payment

bonds securing $17,000,000 due by the Company to the EPA for cost recovery may not be renewable or may only be renewable on terms that

are unfavorable to the Company, which would adversely affect its financial condition or cause a default under the revised settlement

agreement with the EPA and Sprott.

In

2022, the Company secured financial assurance in the form of payment bonds in accordance with the revised settlement agreement with the

EPA, in relation to $17,000,000 of payments due to the EPA for cost recovery between 2024-2029. These bonds are renewed annually, and

currently require $6,476,000 of collateral in the form of letters of credit. To the extent that the parties providing the payment bonds

demand additional collateral beyond the current requirements, or other unfavorable terms or conditions, the Company may not be able to

renew the payment bonds on favorable conditions, or at all. This could have a materially adverse impact on the Company, including a potential

default under the revised settlement agreement with the EPA.

The

Company has a limited operating history on which to base an evaluation of its business and prospects.

Since

its inception, the Company has had no revenue from operations. The Company has no history of producing products from the Bunker Hill

property. The Mine is a historic, past producing mine with very little recent exploration work. Advancing the Mine through the development

stage will require significant capital and time, and successful commercial production from the Mine will be subject to completing the

requisite studies, permitting and re-commissioning of the Mine, constructing a processing plant, and other related works and infrastructure.

As a result, the Company is subject to all of the risks associated with developing and establishing new mining operations and business

enterprises, including:

| |

● |

completion

of studies to verify reserves and commercial viability, including the ability to find sufficient ore reserves to support a commercial

mining operation; |

| |

|

|

| |

● |

the

timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of

infrastructure, mining and processing facilities; |

| |

|

|

| |

● |

the

availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; |

| |

|

|

| |

● |

the

availability and cost of appropriate smelting and/or refining arrangements, if required; |

| |

|

|

| |

● |

compliance

with stringent environmental and other governmental approval and permit requirements; |

| |

|

|

| |

● |

the

availability of funds to finance exploration, development, and construction activities, as warranted; |

| |

|

|

| |

● |

potential

opposition from non-governmental organizations, local groups or local inhabitants that may delay or prevent development activities; |

| |

|

|

| |

● |

potential

increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and |

| |

|

|

| |

● |

potential

shortages of mineral processing, construction, and other facilities related supplies. |

The

costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of its properties

and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems

and delays during drill programs and, if commenced, development, construction, and mine start-up. In addition, the Company’s management

and workforce will need to be expanded, and sufficient housing and other support systems for its workforce will have to be established.

This could result in delays in the commencement of mineral production and increased costs of production. Accordingly, the Company’s

activities may not result in profitable mining operations and it may not succeed in establishing mining operations or profitably producing

metals at any of its current or future properties, including the Mine.

The

Company has a history of losses and expects to continue to incur losses in the future.

The

Company has incurred losses since inception, has had negative cash flow from operating activities, and expects to continue to incur losses

in the future. The Company has incurred the following losses from operations during each of the following periods:

| |

● |

$2,185,488

for the three months ended March 31, 2023; |

| |

|

|

| |

● |

$16,487,161

for the year ended December 31, 2022; |

The

Company expects to continue to incur losses unless and until such time as the Mine enters into commercial production and generates sufficient

revenues to fund continuing operations. The Company recognizes that if it is unable to generate significant revenues from mining operations

and dispositions of its properties, the Company will not be able to earn profits or continue operations. At this early stage of its operation,

the Company also expects to face the risks, uncertainties, expenses, and difficulties frequently encountered by smaller reporting companies.

The Company cannot be sure that it will be successful in addressing these risks and uncertainties and its failure to do so could have

a materially adverse effect on its financial condition.

Epidemics,

pandemics or other public health crises, including COVID-19, could adversely affect the Company’s business.

The

Company’s operations could be significantly adversely affected by the effects of a widespread outbreak of epidemics, pandemics

or other health crises, including the recent outbreak of respiratory illness caused by the novel coronavirus (“COVID-19”),

which was declared a pandemic by the World Health Organization on March 12, 2020. The Company cannot accurately predict the impact COVID-19

or some future variant would have on its operations and the ability of others to meet their obligations with the Company, including uncertainties

relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of

travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases

in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of

many countries, resulting in an economic downturn that could further affect the Company’s operations and ability to finance its

operations.

The

Russia/Ukraine crisis, including the impact of sanctions or retributions thereto, could adversely affect the Company’s business.

The

Company’s operations could be adversely affected by the effects of the escalating Russia/Ukraine crisis and the effects of sanctions

imposed against Russia or that country’s retributions against those sanctions, embargos or further-reaching impacts upon energy

prices, food prices and market disruptions. The Company cannot accurately predict the impact the crisis will have on its operations and

the ability of contractors to meet their obligations with the Company, including uncertainties relating the severity of its effects,

the duration of the conflict, and the length and magnitude of energy bans, embargos and restrictions imposed by governments. In addition,

the crisis could adversely affect the economies and financial markets of the United States in general, resulting in an economic downturn

that could further affect the Company’s operations and ability to finance its operations. Additionally, the Company cannot predict

changes in precious metals pricing or changes in commodities pricing which may alternately affect the Company either positively or negatively.

Risks

Related to Mining and Exploration

The

Company is in the development stage.

The

nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration

for and the production of minerals is highly speculative and involves much greater risk than many other businesses. Most exploration

programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality

to be profitably mined. The Company’s operations are, and any future development or mining operations the Company may conduct will

be, subject to all of the operating hazards and risks normally incidental to exploring for and development of mineral properties, including,

but not limited to:

| |

● |

economically

insufficient mineralized material; |

| |

|

|

| |

● |

fluctuation

in production costs that make mining uneconomical; |

| |

|

|

| |

● |

labor

disputes; |

| |

|

|

| |

● |

unanticipated

variations in grade and other geologic problems; |

| |

|

|

| |

● |

environmental

hazards; |

| |

● |

water

conditions; |

| |

|

|

| |

● |

difficult

surface or underground conditions; |

| |

|

|

| |

● |

industrial

accidents; |

| |

|

|

| |

● |

metallurgic

and other processing problems; |

| |

|

|

| |

● |

mechanical

and equipment performance problems; |

| |

|

|

| |

● |

failure

of dams, stockpiles, wastewater transportation systems, or impoundments; |

| |

|

|

| |

● |

unusual

or unexpected rock formations; and |

| |

|

|

| |

● |

personal

injury, fire, flooding, cave-ins and landslides. |

Any

of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates,

costs and expenditures, potential revenues, and production dates. If the Company determines that capitalized costs associated with any

of its mineral interests are not likely to be recovered, the Company would incur a write-down of its investment in these interests. All

of these factors may result in losses in relation to amounts spent that are not recoverable, or that result in additional expenses.

Commodity

price volatility could have dramatic effects on the results of operations and the Company’s ability to execute its business plan.

The

price of commodities varies on a daily basis. The Company’s future revenues, if any, will likely be derived from the extraction

and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected

by numerous factors beyond its control including economic and political trends, expectations of inflation, currency exchange fluctuations,

interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments

and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the

economic viability of the Company’s business, could negatively affect its ability to secure financing or its results of operations.

The

Company’s development and production plans, and cost estimates, in the Technical Report Summary may vary and/or not be achieved.

There

is no certainty that the Technical Report Summary will be realized. The decision to implement the Mine restart scenario to be included

in the Technical Report Summary will not be based on a feasibility study of mineral reserves demonstrating economic and technical viability,

and therefore there is increased risk that the Technical Report Summary results will not be realized. If the Company is unable to achieve

the results in the Technical Report Summary, it may have a material negative impact on the Company and its capital investment to implement

the restart scenario may be lost.

Costs

charged to the Company by the Idaho Department of Environmental Quality (“IDEQ”) for treatment of wastewater fluctuate a

great deal and are not within the Company’s control.

The

Company is billed annually for water treatment activities performed by the IDEQ for the EPA. The water treatment costs that Bunker Hill

is billed for are partially related to the EPA’s direct cost of treating the water emanating from the Bunker Hill Mine, which are

comprised of lime and flocculant usage, electricity consumption, maintenance and repair, labor and some overhead. Rate of discharge of

effluent from the Bunker Hill Mine is largely dependent on the level of precipitation within a given year and how close in the calendar

year the Company is to the spring run-off. Increases in water infiltrations and gravity flows within the mine generally increase after

winter and result in a peak discharge rate in May. Increases in gravity flow and consequently the rate of water discharged by the mine

have a highly robust correlation with metal concentrations and consequently metals loads of effluent.

Hydraulic

loads (quantities of water per unit of time) and metal loads (quantities of metals per unit of volume of effluent per unit of time) are

the two main determinants of cost of water treatment by the EPA in the relationship with the Bunker Hill Mine because greater metal loads

consume more lime and more flocculent and more electricity to remove the increased levels of metals and make the water clean. The scale

of the treatment plant is determined by how much total water can be processed (hydraulic load) at any one point in time. This determines

how much labor is required to operate the plant and generally determines the amount of overhead required to run the EPA business.

The

EPA has completed significant upgrades to the water treatment capabilities of the CTP and is now capable of producing treated water than

can meet a much higher discharge standard (which Bunker Hill will be forced to meet beyond May 2023). While it was understood that improved

performance capability would increase the cost of operating the plant, it was unclear to EPA, and consequently to Bunker Hill, how much

the costs would increase by.

These

elements described above, and others, impact the direct costs of water treatment. A significant portion of the total amount invoiced

by EPA each year is indirect cost that is determined as a percentage of the direct cost. Each year the indirect costs percentage changes

within each region of the EPA. Bunker Hill has no ability to impact the percentage of indirect cost that is set by the EPA regional office.

Bunker Hill also has no advanced notice of what the percentage of indirect cost will be until it receives its invoice in June of the

year following the billing period. The Company remains unable to estimate EPA billings to a high degree of accuracy.

Estimates

of mineral reserves and resources are subject to evaluation uncertainties that could result in project failure.

Its

exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict

the quantity and quality of mineral resources/reserves within the earth using statistical sampling techniques. Estimates of any mineral

resource/reserve on the Mine would be made using samples obtained from appropriately placed trenches, test pits, underground workings,

and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to

each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details

that have not been identified or correctly appreciated at the current level of accumulated knowledge about the Mine. This could result

in uncertainties that cannot be reasonably eliminated from the process of estimating mineral resources/reserves. If these estimates were

to prove to be unreliable, the Company could implement an exploitation plan that may not lead to commercially viable operations in the

future.

Any

material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property

into production and a property’s return on capital.

As

the Company has not commenced actual production, mineral resource estimates may require adjustments or downward revisions. In addition,

the grade of ore ultimately mined, if any, may differ from that indicated by future feasibility studies and drill results. Minerals recovered

in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The

Company’s exploration activities may not be commercially successful, which could lead the Company to abandon its plans to develop

the Mine and its investments in exploration.

The

Company’s long-term success depends on its ability to identify mineral deposits on the Mine and other properties the Company may

acquire, if any, that the Company can then develop into commercially viable mining operations. Mineral exploration is highly speculative

in nature, involves many risks, and is frequently non-productive. These risks include unusual or unexpected geologic formations, and

the inability to obtain suitable or adequate machinery, equipment, or labor. The success of commodity exploration is determined in part

by the following factors:

| |

● |

the

identification of potential mineralization based on surficial analysis; |

| |

|

|

| |

● |

availability

of government-granted exploration permits; |

| |

|

|

| |

● |

the

quality of its management and its geological and technical expertise; and |

| |

|

|

| |

● |

the

capital available for exploration and development work. |

Substantial

expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes

to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral

deposit will be commercially viable depends on a number of factors that include, without limitation, the particular attributes of the

deposit, such as size, grade, and proximity to infrastructure; commodity prices, which can fluctuate widely; and government regulations,

including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals,

and environmental protection. The Company may invest significant capital and resources in exploration activities and may abandon such

investments if the Company is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have

an adverse effect on the market value of the Company’s securities and the ability to raise future financing.

The

Company is subject to significant governmental regulations that affect its operations and costs of conducting its business and may not

be able to obtain all required permits and licenses to place its properties into production.

The

Company’s current and future operations, including exploration and development of the Mine, do and will require permits from governmental

authorities and will be governed by laws and regulations, including:

| |

● |

laws

and regulations governing mineral concession acquisition, prospecting, development, mining, and production; |

| |

|

|

| |

● |

laws

and regulations related to exports, taxes, and fees; |

| |

|

|

| |

● |

labor

standards and regulations related to occupational health and mine safety; and |

| |

|

|

| |

● |

environmental

standards and regulations related to waste disposal, toxic substances, land use reclamation, and environmental protection. |

Specifically,

it may be necessary to obtain the following environmental permits or approved plans prior to commencement of mine operations:

| |

● |

Reclamation

and Closure Plan |

| |

|

|

| |

● |

Water

Discharge Permit |

| |

|

|

| |

● |

Air

Quality Operating Permit |

| |

|

|

| |

● |

Industrial

Artificial (tailings) pond permit |

| |

|

|

| |

● |

Obtaining

Water Rights for Operations |

If

these permits are required, there can be no assurance that the Company will be able to obtain them in a timely manner or at all.

Companies

engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need

to comply with applicable laws, regulations, and permits. Failure to comply with applicable laws, regulations, and permits may result

in enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial

authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation

of additional equipment, or costly remedial actions. The Company cannot predict if all permits that it may require for continued exploration,

development, or construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms, if at all.

Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay its planned exploration and development

activities. The Company may be required to compensate those suffering loss or damage by reason of the mineral exploration or its mining

activities, if any, and may have civil or criminal fines or penalties imposed for violations of, or its failure to comply with, such

laws, regulations, and permits.

Existing

and possible future laws, regulations, and permits governing operations and activities of exploration companies, or more stringent implementation

of such laws, regulations and permits, could have a material adverse impact on the Company’s business and cause increases in capital

expenditures or require abandonment or delays in exploration. The Mine is located in Northern Idaho and has numerous clearly defined

regulations with respect to permitting mines, which could potentially impact the total time to market for the project.

The

Company’s activities are subject to environmental laws and regulations that may increase its costs of doing business and restrict

its operations.

Both

mineral exploration and extraction require permits from various federal, state, and local governmental authorities and are governed by

laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation,

labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters.

There can be no assurance that the Company will be able to obtain or maintain any of the permits required for the exploration of the

mineral properties or for the construction and operation of the Mine at economically viable costs. If the Company cannot accomplish these

objectives, its business could fail. The Company believes that it is in compliance with all material laws and regulations that currently

apply to its activities but there can be no assurance that the Company can continue to remain in compliance. Current laws and regulations

could be amended, and the Company might not be able to comply with them, as amended. Further, there can be no assurance that the Company

will be able to obtain or maintain all permits necessary for its future operations, or that it will be able to obtain them on reasonable

terms. To the extent such approvals are required and are not obtained, the Company may be delayed or prohibited from proceeding with

planned exploration or development of the mineral properties.

The

Company’s activities are subject to extensive laws and regulations governing environmental protection. The Company is also subject

to various reclamation-related conditions. Although the Company closely follows and believes it is operating in compliance with all applicable

environmental regulations, there can be no assurance that all future requirements will be obtainable on reasonable terms. Failure to

comply may result in enforcement actions causing operations to cease or be curtailed and may include corrective measures requiring capital

expenditures. Intense lobbying over environmental concerns by non-governmental organizations has caused some governments to cancel or

restrict development of mining projects. Current publicized concern over climate change may lead to carbon taxes, requirements for carbon