0000924168FALSEENERGY FOCUS, INC/DE00009241682023-06-282023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 28, 2023

ENERGY FOCUS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36583 | | 94-3021850 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 32000 Aurora Road Suite B | Solon, | OH | 44139 |

| (Address of principal executive offices) | (Zip Code) |

(440) 715-1300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | EFOI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Sander Securities Purchase Agreement

On June 29, 2023, Energy Focus, Inc. (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with certain purchasers (the “Purchasers”), pursuant to which the Company agreed to issue and sell in a private placement (the “Private Placement”) an aggregate of 746,875 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), for a purchase price per share of $1.76.

Aggregate gross proceeds to the Company in respect of the Private Placement is approximately $1.3 million, before offering expenses payable by the Company. The Private Placement closed on June 29, 2023.

The Private Placement was priced at fair market value under the rules of The Nasdaq Stock Market LLC (“Nasdaq”). The issuance and sale of the Shares pursuant to the Purchase Agreement are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), and were made pursuant to certain exemptions from registration, including Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder, in reliance on the representations and covenants of the Purchasers under the Purchase Agreement.

One of the Purchasers is Chiao Chieh (Jay) Huang, a member of the Company’s board of directors (“Board”). Concurrently with finalizing the Private Placement, the Company agreed to appoint each of Kin-Fu Chen, Dr. Shou-Jang Lee, Jason Tien-Chia Tsai, and Dr. Chao-Jen Huang as a director for a term expiring at the 2024 annual meeting of the Company’s stockholders or his earlier resignation, death or removal in accordance with the Company’s Bylaws. As described below, four previous directors voluntarily resigned from the Board on June 28, 2023.

Item 3.02. Unregistered Sales of Equity Securities

The disclosures in Item 1.01 of this Current Report on Form 8-K are incorporated by reference into this Item 3.02.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 28, 2023, the Company received notices of resignation from the following four members of the Board: Jennifer Cheng, Brian Lagarto, Jeffery Parker, and Stephen Socolof. Their terms as directors would have otherwise expired at the 2024 annual meeting of stockholders of the Company. The resignations did not involve any disagreement with the Company.

On July 2, 2023, the remaining members of the Board unanimously appointed the following four new members to the Board: Kin-Fu Chen, Dr. Shou-Jang Lee, Jason Tien-Chia Tsai, and Dr. Chao-Jen Huang. The Board affirmatively determined that, at the time of his appointment, each of the new members of the Board is an independent director under the corporate governance standards of the Nasdaq.

Kin-Fu Chen, age 59, has founded and managed successful real estate and investment companies, including Yun Fu Yu Co. Ltd., which he has been President of since 2008. Mr. Chen has also established and operated multiple industrial companies and tourism hotels, demonstrating strong leadership, financial acumen, and strategic decision-making skills. He served as a board member for Taiwan's largest private school. Mr. Chen contributed to strategic planning, governance, and policy development, and collaborated with fellow board members to ensure the school's growth and success. In working with the Taiwanese government, Mr. Chen has assisted in legislative affairs, including drafting bills, conducting research, and acted as a contact point between the Taiwanese government and the U.S. Congress. He is experienced in facilitating communication and collaborations between

legislators and stakeholders. Mr. Chen holds a Master of Diplomacy from National Chengchi University. Mr. Chen was not appointed to any Board committees at this time.

Dr. Shou-Jang Lee, age 59, is a published author and contributor to prominent publications in the field of finance and economics. Dr. Lee previously served as a board member of CPE Co., a fuel storage and transporting company, affiliate with the China Petroleum CPC Corporation, Taiwan. He has held key positions in public administration including serving as the General Director of Planning Department within the Yilan County Government, and Secretary to the County Mayor of Yilan County. He is an accomplished financial journalist with expertise in economic and political news coverage and he is recognized as a member of Taiwan's prestigious national think tank. His leadership and management in public administration has expanded the business and gross income for tourism, manufacturing plants, and agriculture for Yilan county. He is also one of the key persons for developing the newly established Yilan Science Park, while also serving as a trusted advisor to high-ranking government officials and executives in the energy industry. Mr. Lee holds a Ph.D. in Economic Policy from National Chengchi University. Dr. Lee was not appointed to any Board committees at this time.

Jason Tien-Chia Tsai, age 51, is currently Principal of JC Partners Financial Advisory Corporation, a leading financial advisory firm. From 2013 to 2014, Mr. Tsai was the Assistant Manager of Taipei Exchange Corporate Strategy Department, Taiwan Land Development, responsible for banking financing and capital market operations. In 2010, he served at Kontron as a Board Director. From 2009 to 2012, Mr. Tsai served as Deputy General Manager, Financial Advisory Division at Jingshan Securities Hong Kong, managing financial advisory services in Taiwan. From 2004 to 2009, Mr. Tsai served as Chief Financial Officer of Yea Shin Development, a listed company, overseeing financial management and operations. From 1998 to 2003, he served as Examiner of Deloitte, Over-The-Counter Securities Exchange, responsible for reviewing and evaluating listing applications. Mr. Tsai has over 20 years of professional experience in the fields of finance, securities, and financial management. Mr. Tsai received his Bachelor of Accounting from National Chengchi University and his Master of Finance and Banking from Ming Chuan University. Mr. Tsai was appointed to chair the Audit and Finance Committee of the Board.

Dr. Chao-Jen Huang is currently Director of Virtual Integrated Business Center, Policy & Economic Alliance Caring of Earth (PEACE) for establishing international collaboration platforms for global resilience and sustainability. From 2013 to 2021, Dr. Huang acted as the director general and distinguished research fellow of Commerce Development Research Institute in Taiwan. In January 2008, Dr. Huang was promoted to director general of the Taiwan Institute of Economic Research and continued to promote economic affairs and cooperation for public and private sectors where he remained until 2011. In February 2005, he became deputy director of the Institute, primarily responsible for Taiwan free trade agreement study, national southbound policy, cross-strait economic cooperation, and Taiwan-Central America comprehensive economic cooperation. From July 1998 to January 2005, Dr. Huang worked as an associate research fellow at the Taiwan Institute of Economic Research, in charge of Taiwan free trade agreement study, national southbound policy and establishing regular economic forums between Taiwan and other nations. From January 1991 to July 1992, Dr. Huang served as senior staff at the Ministry of Foreign Affairs of Taiwan, where he was responsible for Taiwan-United States diplomatic and business exchanges, and economic and trade negotiations and affairs. Dr. Huang was appointed to chair the Nominating and Corporate Governance Committee of the Board.

Each of the new directors will participate in the Company’s standard director compensation program for non-employee directors, which is described on page 35 of the Company’s Proxy Statement for its 2023 annual meeting of stockholders, which was filed with the Securities and Exchange Commission on May 1, 2023. Concurrently with finalizing the Private Placement discussed above, the Company agreed to appoint the new directors. There are no related persons transactions involving any of the new directors that would require disclosure pursuant to Item 404(a) of Regulation S-K.

Following the resignations and new appointments, the Board also made the following committee assignments:

| | | | | | | | |

| Nominating and Corporate Governance Committee | Compensation Committee | Audit and Finance Committee |

| Kaj den Daas | Kaj den Daas | Kaj den Daas |

| Wen-Jeng Chang | Gina Huang | Wen-Jeng Chang |

| Gina Huang | Wen-Jeng Chang (Chair) | Jason Tien-Chia Tsai (Chair) |

| Dr. Chao-Jen Huang (Chair) | | |

Following these committee assignments, the Audit Committee consists of three independent directors in accordance with Nasdaq Listing Rule 5605, which requires that the Company’s Audit and Finance Committee be comprised of at least three directors, all of whom are independent pursuant to the rules of Nasdaq and applicable law.

Item 7.01. Regulation FD Disclosure.

On July 5, 2023, the Company issued a press release announcing the Private Placement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibit 99.1 attached hereto, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and such information shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | |

| Number | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

Dated: July 5, 2023 | | |

| | |

| | |

| ENERGY FOCUS, INC. |

| |

| |

| By: | /s/ Lesley A. Matt |

| Name: | Lesley A. Matt |

| Title: | Chief Executive Officer |

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of June 29, 2023, between Energy Focus, Inc., a Delaware corporation (the “Company”), and each purchaser identified on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and, collectively, the “Purchasers”).

WHEREAS, subject to the terms and conditions set forth in this Agreement and pursuant to Section 4(a)(2) of the Securities Act (as defined below), and Rule 506 promulgated thereunder, the Company desires to issue and sell to each Purchaser, and each Purchaser, severally and not jointly, desires to purchase from the Company, securities of the Company as more fully described in this Agreement.

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE I.

DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 under the Securities Act.

“Board of Directors” means the board of directors of the Company.

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized or required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in The City of New York generally are open for use by customers on such day.

“Closing” means the closing of the purchase and sale of the Securities pursuant to Section 2.1.

“Closing Date” means the Trading Day on which all of the Transaction Documents have been executed and delivered by the applicable parties thereto, but in no event later than the second Trading Day following the date hereof.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the common stock of the Company, par value $0.0001 per share, and any other class of securities into which such securities may hereafter be reclassified or changed.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Liens” means a lien, charge, pledge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

“Material Adverse Effect” shall have the meaning assigned to such term in Section 3.1(a).

“Per Share Purchase Price” equals $1.76, subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Common Stock that occur after the date of this Agreement.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Proceeding” means an action, claim, suit, investigation or proceeding (including, without limitation, an informal investigation or partial proceeding, such as a deposition), whether commenced or threatened.

“Rule 144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“SEC Reports” means all reports, schedules, forms, statements and other documents required to be filed by the Company under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof (or such shorter period as the Company was required by law or regulation to file such material).

“Securities” means the Shares.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Shares” means the shares of Common Stock issued to each Purchaser pursuant to this Agreement.

“Short Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be deemed to include locating and/or borrowing shares of Common Stock).

“Subscription Amount” means, as to each Purchaser, the aggregate amount to be paid for Shares purchased hereunder as specified below such Purchaser’s name on the signature page of this Agreement and next to the heading “Subscription Amount,” in United States dollars and in immediately available funds.

“Trading Day” means a day on which the Nasdaq Capital Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global

Select Market, the New York Stock Exchange, OTCQB or OTCQX (or any successors to any of the foregoing).

“Transaction Documents” means this Agreement, the exhibits and all schedules hereto and any other documents or agreements executed in connection with the transactions contemplated hereunder.

“Transfer Agent” means Broadridge Corporate Issuer Solutions, P.O. Box 1342, Brentwood, New York 11717, and any successor transfer agent of the Company.

ARTICLE II.

PURCHASE AND SALE

2.1 Closing. On the Closing Date, upon the terms and subject to the conditions set forth herein, the Company agrees to sell, and the Purchasers, severally and not jointly, agree to purchase, up to an aggregate of $400,000 of Shares. Each Purchaser’s Subscription Amount as set forth on the signature page hereto executed by such Purchaser shall be made available for “Delivery Versus Payment” settlement with the Company or its designee. The Company shall deliver to each Purchaser its respective Shares, and each Purchaser shall deliver the other items set forth in Section 2.2 at the Closing. The Closing shall occur at the offices of the Company or such other location as the parties shall mutually agree. Unless otherwise directed by the Purchasers, settlement of the Shares shall occur via “Delivery Versus Payment” (i.e., on the Closing Date, the Company shall issue the Shares registered in the respective Purchasers’ names and addresses and released by the Transfer Agent directly to the account(s) identified by each Purchaser; upon receipt of such Shares, payment for such Shares shall be made by the applicable Purchaser (or its clearing firm) by wire transfer to the Company).

2.2 Payment. On or prior to the Closing Date, except as otherwise indicated below, each shall be made available for “Delivery Versus Payment” settlement with the Company or its designee.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. The Company hereby makes the following representations and warranties to each Purchaser:

(a) Organization and Qualification. The Company is an entity duly incorporated or otherwise organized, validly existing and in good standing under the laws of Delaware, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. The Company is not in violation nor default of any of the provisions of its respective certificate of incorporation, bylaws or other organizational or charter documents. The Company is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, would not reasonably be expected to result in (i) a material adverse effect on the legality, validity or enforceability of any Transaction Document, (ii) a material adverse effect on the results of operations, assets, business, or condition (financial or otherwise) of the Company, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document (any of clauses (i), (ii) or (iii), a “Material Adverse Effect”) and no Proceeding has been instituted in any such jurisdiction revoking, limiting

or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and each of the other Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and each of the other Transaction Documents by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith or therewith other than in connection with the Required Approvals. This Agreement and each other Transaction Document to which it is a party has been (or upon delivery will have been) duly executed by the Company and, when delivered in accordance with the terms hereof and thereof, will (assuming due execution, authorization and delivery by the parties thereto) constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law or public policy.

(c) Issuance of the Securities. The Securities are duly authorized. The Shares, when issued and paid for in accordance with the applicable Transaction Documents, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company other than restrictions on transfer provided for in the Transaction Documents. The Company has reserved from its duly authorized capital stock the maximum number of shares of Common Stock issuable pursuant to the Transaction Documents.

3.2 Representations and Warranties of the Purchasers. Each Purchaser, for itself and for no other Purchaser, hereby represents and warrants as of the date hereof and as of the Closing Date to the Company as follows (unless as of a specific date therein, in which case they shall be accurate as of such date):

(a) Organization; Authority. Such Purchaser is an entity duly incorporated or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company or similar power and authority to enter into and to consummate the transactions contemplated by the Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of the Transaction Documents and performance by such Purchaser of the transactions contemplated by the Transaction Documents have been duly authorized by all necessary corporate, partnership, limited liability company or similar action, as applicable, on the part of such Purchaser. Each Transaction Document to which it is a party has been duly executed by such Purchaser, and when delivered by such Purchaser in accordance with the terms thereof, will constitute the valid and legally binding obligation of such Purchaser, enforceable against such Purchaser in accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law or public policy.

(b) Understandings or Arrangements. Such Purchaser understands that the Securities are “restricted securities” and have not been registered under the Securities Act or any applicable state securities law and is acquiring the Securities as principal for its own account and not with a view to or for distributing or reselling such Securities or any part thereof in violation of the Securities Act or any applicable state securities law, has no present intention of distributing any of such Securities in violation of the Securities Act or any applicable state securities law and has no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such Securities in violation of the Securities Act or any applicable state securities law (this representation and warranty not limiting such Purchaser’s right to sell the Securities pursuant to the Registration Statement or otherwise in compliance with applicable federal and state securities laws). Such Purchaser is acquiring the Securities hereunder in the ordinary course of its business.

(c) Purchaser Status. At the time such Purchaser was offered the Securities, it was, and as of the date hereof it is either: (i) an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12), or (a)(13) under the Securities Act or (ii) a “qualified institutional buyer” as defined in Rule 144A(a) under the Securities Act.

(d) Experience of Such Purchaser. Such Purchaser, either alone or together with its representatives, has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Securities, and has so evaluated the merits and risks of such investment. Such Purchaser is able to bear the economic risk of an investment in the Securities and, at the present time, is able to afford a complete loss of such investment.

(e) General Solicitation. Such Purchaser is not purchasing the Securities as a result of any advertisement, article, notice or other communication regarding the Securities published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or, to the knowledge of such Purchaser, any other general solicitation or general advertisement.

(f) Access to Information. Such Purchaser acknowledges that it has had the opportunity to review the Transaction Documents (including all exhibits and schedules thereto) and the SEC Reports and has been afforded, (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the Securities and the merits and risks of investing in the Securities; (ii) access to information about the Company and its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment.

(g) Certain Transactions and Confidentiality. Other than consummating the transactions contemplated hereunder, such Purchaser has not, nor has any Person acting on behalf of or pursuant to any understanding with such Purchaser, directly or indirectly executed any purchases or sales, including Short Sales, of the securities of the Company during the period commencing as of the time that such Purchaser first received information about the offering of the Securities (written or oral) from the Company setting forth the material terms of the transactions contemplated hereunder and ending immediately prior to the execution hereof. Other than to other Persons party to this Agreement or to such Purchaser’s representatives that are bound by confidentiality

obligations, including, without limitation, its officers, directors, partners, legal and other advisors, employees, agents and Affiliates, such Purchaser has maintained the confidentiality of all disclosures made to it in connection with this transaction (including the existence and terms of this transaction).

The Company acknowledges and agrees that the representations contained in this Section 3.2 shall not modify, amend or affect such Purchaser’s right to rely on the Company’s representations and warranties contained in this Agreement or any representations and warranties contained in any other Transaction Document or any other document or instrument executed and/or delivered in connection with this Agreement or the consummation of the transactions contemplated hereby, except to the extent that any such representations and warranties of the Company are made subject to or assuming the accuracy of the Purchaser’s representations contained in this Section 3.2. Notwithstanding the foregoing, for the avoidance of doubt, nothing contained herein shall constitute a representation or warranty, or preclude any actions, with respect to locating or borrowing shares in order to effect Short Sales or similar transactions in the future.

ARTICLE IV.

OTHER AGREEMENTS OF THE PARTIES

4.1 Transfer Restrictions.

(a) The Securities may only be disposed of in compliance with state and federal securities laws. In connection with any transfer of the Securities other than pursuant to an effective registration statement or Rule 144, to the Company or to an Affiliate of a Purchaser, the Company may require the transferor thereof to provide to the Company an opinion of counsel selected by the transferor and reasonably acceptable to the Company, the form and substance of which opinion shall be reasonably satisfactory to the Company, to the effect that such transfer does not require registration of such transferred Securities under the Securities Act. As a condition of transfer, any such transferee shall agree in writing to be bound by the terms of this Agreement and the Registration Rights Agreement and shall have the rights and obligations of a Purchaser under this Agreement and the Registration Rights Agreement.

(b) The Purchasers agree to the imprinting of a legend on any of the Securities in the following form:

THIS SECURITY HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

(c) Each Purchaser, severally and not jointly with the other Purchasers, agrees with the Company that such Purchaser will sell any Securities pursuant to either the registration requirements of the Securities Act, including any applicable prospectus delivery requirements, or an exemption therefrom, and that if Securities are sold pursuant to a registration statement, they will be sold in compliance with the plan of distribution set forth therein, and acknowledges that the removal of the restrictive legend from the

book entries representing Securities will be predicated upon the Company’s reliance upon this understanding.

4.2 Acknowledgment of Dilution. The Company acknowledges that the issuance of the Securities may result in dilution of the outstanding shares of Common Stock, which dilution may be substantial under certain market conditions. The Company further acknowledges that its obligations under the Transaction Documents, including, without limitation, its obligation to issue the Shares pursuant to the Transaction Documents, are unconditional and absolute and not subject to any right of set off, counterclaim, delay or reduction, regardless of the effect of any such dilution or any claim the Company may have against any Purchaser and regardless of the dilutive effect that such issuance may have on the ownership of the other stockholders of the Company.

ARTICLE V.

MISCELLANEOUS

5.1 Termination. This Agreement may be terminated by any Purchaser, as to such Purchaser’s obligations hereunder only and without any effect whatsoever on the obligations between the Company and the other Purchasers, by written notice to the other parties, if the Closing has not been consummated on or before the fifth (5th) Trading Day following the date hereof; provided, however, that no such termination will affect the right of any party to sue for any breach by any other party (or parties).

5.2 Fees and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each party shall pay the fees and expenses of its own advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of the Transaction Documents. The Company shall pay all Transfer Agent fees (including, without limitation, any fees required for same-day processing of any instruction letter delivered by the Company), stamp taxes and other taxes and duties levied in connection with the delivery of any Securities to the Purchasers.

5.3 Entire Agreement. The Transaction Documents, together with the exhibits and schedules thereto, contain the entire understanding of the parties with respect to the subject matter hereof and thereof and supersede all prior agreements and understandings, oral or written, with respect to such matters, which the parties acknowledge have been merged into such documents, exhibits and schedules.

5.4 Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall be deemed given and effective on the earliest of: (a) the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number or email attachment at the email address as set forth on the signature pages attached hereto at or prior to 5:30 p.m. (New York City time) on a Trading Day, (b) the next Trading Day after the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number or email attachment at the email address as set forth on the signature pages attached hereto on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading Day, (c) the second Trading Day following the date of mailing, if sent by United States nationally recognized overnight courier service or (d) upon actual receipt by the party to whom such notice is required to be given. The address for such notices and communications shall be as set forth on the signature pages attached hereto. To the extent that any notice provided pursuant to any Transaction Document constitutes or contains material, non-public information regarding the Company, the Company shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K.

5.5 Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument signed, in the case of an amendment, by the Company and Purchasers which purchased at least a majority in interest of the Shares based on the initial Subscription Amounts hereunder (or, prior to the Closing Date, the Company and each Purchaser) or, in the case of a waiver, by the party against whom enforcement of any such waived provision is sought. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right. Any amendment effected in accordance with this Section 5.5 shall be binding upon each Purchaser and holder of Securities and the Company.

5.6 Headings. The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed to limit or affect any of the provisions hereof.

5.7 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns. The Company may not assign this Agreement or any rights or obligations hereunder without the prior written consent of each Purchaser (other than by merger). Any Purchaser may assign any or all of its rights under this Agreement to any Person to whom such Purchaser assigns or transfers any Securities, provided that such transferee agrees in writing to be bound, with respect to the transferred Securities, by the provisions of the Transaction Documents that apply to the “Purchasers.”

5.8 No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

5.9 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal Proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Agreement and any other Transaction Documents (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of the Transaction Documents), and hereby irrevocably waives, and agrees not to assert in any Action or Proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such Action or Proceeding is improper or is an inconvenient venue for such Proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such Action or Proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If any party shall commence an Action or Proceeding to enforce any provisions of the Transaction Documents, then, in addition to the obligations of the Company under Section 4.9, the prevailing party in such Action or Proceeding shall be reimbursed by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such Action or Proceeding.

5.10 Survival. The representations and warranties contained herein shall survive the Closing and the delivery of the Securities.

5.11 Execution. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission, by e-mail delivery of a “.pdf” format data file, by other electronic signing created on an electronic platform (such as DocuSign) or by digital signing (such as Adobe Sign), such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile, “.pdf”, electronic signing or digital signing signature page were an original thereof.

5.12 Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

5.13 Rescission and Withdrawal Right. Notwithstanding anything to the contrary contained in (and without limiting any similar provisions of) any of the other Transaction Documents, whenever any Purchaser exercises a right, election, demand or option under a Transaction Document and the Company does not timely perform its related obligations within the periods therein provided, then such Purchaser may rescind or withdraw, in its sole discretion from time to time upon written notice to the Company, any relevant notice, demand or election in whole or in part without prejudice to its future actions and rights.

5.14 Replacement of Securities. If any certificate or instrument evidencing any Securities is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation thereof (in the case of mutilation), or in lieu of and substitution therefor (in case of loss, theft or destruction), a new certificate or instrument, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction and (in the case of loss, theft or destruction) of customary indemnity satisfactory to the Company. The applicant for a new certificate or instrument under such circumstances shall also pay any reasonable third-party costs (including customary indemnity) associated with the issuance of such replacement Securities.

5.15 Remedies. In addition to being entitled to exercise all rights provided herein or granted by law, including recovery of damages, each of the Purchasers and the Company will be entitled to specific performance under the Transaction Documents. The parties agree that monetary damages may not be adequate compensation for any loss incurred by reason of any breach of obligations contained in the Transaction Documents and hereby agree to waive and not to assert in any Action for specific performance of any such obligation the defense that a remedy at law would be adequate.

5.16 Payment Set Aside. To the extent that the Company makes a payment or payments to any Purchaser pursuant to any Transaction Document or a Purchaser enforces or exercises its rights thereunder, and such payment or payments or the proceeds of such enforcement or exercise or any part thereof are subsequently invalidated, declared to be

fraudulent or preferential, set aside, recovered from, disgorged by or are required to be refunded, repaid or otherwise restored to the Company, a trustee, receiver or any other Person under any law (including, without limitation, any bankruptcy law, state or federal law, common law or equitable cause of action), then to the extent of any such restoration the obligation or part thereof originally intended to be satisfied shall be revived and continued in full force and effect as if such payment had not been made or such enforcement or setoff had not occurred.

5.17 Independent Nature of Purchasers’ Obligations and Rights. The obligations of each Purchaser under any Transaction Document are several and not joint with the obligations of any other Purchaser, and no Purchaser shall be responsible in any way for the performance or non-performance of the obligations of any other Purchaser under any Transaction Document. Nothing contained herein or in any other Transaction Document, and no action taken by any Purchaser pursuant hereto or thereto, shall be deemed to constitute the Purchasers as a partnership, an association, a joint venture or any other kind of entity, or create a presumption that the Purchasers are in any way acting in concert or as a group with respect to such obligations or the transactions contemplated by the Transaction Documents. Each Purchaser shall be entitled to independently protect and enforce its rights including, without limitation, the rights arising out of this Agreement or out of the other Transaction Documents, and it shall not be necessary for any other Purchaser to be joined as an additional party in any Proceeding for such purpose. Each Purchaser has been represented by its own separate legal counsel in its review and negotiation of the Transaction Documents. The Company has elected to provide all Purchasers with the same terms and Transaction Documents for the convenience of the Company and not because it was required or requested to do so by any of the Purchasers. It is expressly understood and agreed that each provision contained in this Agreement and in each other Transaction Document is between the Company and a Purchaser, solely, and not between the Company and the Purchasers, collectively, and not between and among the Purchasers.

5.18 Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding Business Day.

5.19 Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise the Transaction Documents and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of the Transaction Documents or any amendments thereto. In addition, each and every reference to share prices and shares of Common Stock in any Transaction Document shall be subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Common Stock that occur after the date of this Agreement.

5.20 WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

| | | | | |

ENERGY FOCUS, INC. | Address for Notice: Lesley A. Matt Chief Executive Officer 32000 Aurora Road, Suite B

Solon, OH 44139 |

By:/s/ Lesley A. Matt Name: Lesley A. Matt Title: Chief Executive Officer

With a copy to (which shall not constitute notice): | Email: lmatt@energyfocus.com |

Energy Focus, Inc. James R. Warren Senior Vice President, General Counsel And Corporate Secretary 3200 Aurora Road, Suite B Solon, OH 44139 Email: jwarren@energyfocus.com | |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGE FOR PURCHASER FOLLOWS]

[PURCHASER SIGNATURE PAGES TO EFOI SECURITIES PURCHASE AGREEMENT]

IN WITNESS WHEREOF, the undersigned have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

Name of Purchaser:

Signature of Purchaser:

Name of Authorized Signatory: N/A

Title of Authorized Signatory: N/A

Email Address of Authorized Signatory: ______________________________________________

Address for Notice to Purchaser:

Address for Delivery of Securities to Purchaser (if not same as address for notice):

Subscription Amount: , allocated as follows:

Shares:

EIN Number: _______________________

[SIGNATURE PAGES CONTINUE]

Energy Focus Announces $1.3 Million Investment and Changes to Board of Directors

SOLON, Ohio, July 5, 2023 -- Energy Focus, Inc. (NASDAQ:EFOI), a leader in sustainable, energy-efficient lighting and controls systems for the commercial, military, and maritime markets, today announces that on June 29, 2023 the company entered into a purchase agreement for the issuance and sale of 746,875 shares of the Company’s common stock in a private placement priced at fair market value under the rules of The Nasdaq Stock Market (“Nasdaq”).

The private placement closed on June 29, 2023, and was facilitated by certain purchasers associated with Sander Electronics following the previously announced strategic investment in early 2023.

“Jay Huang, Chairman of the Energy Focus Board of Directors and President of Sander Electronics, has been an essential leader for setting Energy Focus up for future success,” said Lesley Matt, Chief Executive Officer of Energy Focus. “His faith and commitment to bringing innovative energy solutions products to expand our product footprint is essential in developing the road map toward future success. This additional investment will help us to realize those plans.”

Following the Private Placement, the Company appointed Kin-Fu Chen, Dr. Shou-Jang Lee, Jason Tien-Chia Tsai, and Dr. Chao-Jen Huang to the Board of Directors. The new directors bring with them a wide range of expertise in different areas of finance, economics, and business. Four previous directors voluntarily resigned from the Board. These directors fill vacancies created by four resignations from the Board on June 28, 2023.

“I am excited to tap into the new board member’s wide range of knowledge in global trade, financial markets, government affairs and innovation in new energy developments,” said Matt. “I believe their strong backgrounds will bring new perspective to better align with future growth and the expansion of Energy Focus’ product portfolio to include new innovations in energy solutions products.”

Gross proceeds to the Company in respect of the Private Placement is approximately $1.3 million, before offering expenses payable by the Company. Energy Focus intends to use the proceeds from this transaction for general corporate purposes.

The offer and sale of the foregoing securities are being made in a transaction not involving a public offering and have not been registered under the Securities Act of 1933 (the “Securities Act”), or applicable state securities laws. Accordingly, the securities may not be reoffered or resold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws.

About Energy Focus

Energy Focus is an industry-leading innovator of sustainable light-emitting diode (“LED”) lighting and lighting control technologies and solutions. As the creator of the first flicker-free LED lamps, Energy Focus develops

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

high quality LED lighting products and controls that provide extensive energy and maintenance savings, as well as aesthetics, safety, health and sustainability benefits over conventional lighting. In 2023, EFOI announced plans to add high efficiency GaN (gallium nitride) power supply products to its product portfolio. Energy Focus is headquartered in Solon, Ohio. For more information, visit our website at www.energyfocus.com.

Forward-Looking Statements:

Forward-looking statements in this release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “feels,” “seeks,” “forecasts,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could” or “would” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, capital expenditures, and the industry in which we operate. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made in light of the information currently available to us, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this release. We believe that important factors that could cause our actual results to differ materially from forward-looking statements include, but are not limited to: (i) our need for and ability to obtain additional financing in the near term, on acceptable terms or at all, to continue our operations; (ii) our ability to regain and maintain compliance with the continued listing standards of The Nasdaq Stock Market (iii) our ability to refinance or extend maturing debt on acceptable terms or at all; (iv) our ability to continue as a going concern for a reasonable period of time; (v) our ability to realize synergies with our strategic investor; (vi) instability in the U.S. and global economies and business interruptions experienced by us, our customers and our suppliers, particularly in light of supply chain constraints and other long-term impacts of the coronavirus pandemic; (vii) the competitiveness and market acceptance of our LED lighting and control technologies and products; (viii) our ability to compete effectively against companies with lower prices or cost structures, greater resources, or more rapid development capabilities, and new competitors in our target markets; (ix) our ability to extend our product portfolio into new applications and end markets; (x) our ability to increase demand in our targeted markets and to manage sales cycles that are difficult to predict and may span several quarters; (xi) the timing of large customer orders, significant expenses and fluctuations between demand and capacity as we manage inventory and invest in growth opportunities; (xii) our ability to successfully scale our network of sales representatives, agents, distributors and other channel partners to compete with the sales reach of larger, established competitors; (xiii) our ability to implement plans to increase sales and control expenses; (xiv) our reliance on a limited number of customers for a significant portion of our revenue, and our ability to maintain or grow such sales levels; (xv) our ability to add new customers to reduce customer concentration; (xviii) our ability to attract and retain a new chief financial officer; (xvii) our ability to manage the size of our workforce while continuing to attract, develop and retain qualified personnel, and to do so in a timely

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

manner; (xviii) our ability to diversify our reliance on a limited number of third-party suppliers and development partners, our ability to manage third-party product development and obtain critical components and finished products on acceptable terms and of acceptable quality despite ongoing global supply chain challenges, and the impact of our fluctuating demand on the stability of such suppliers; (xix) our ability to timely, efficiently and cost-effectively transport products from our third-party suppliers by ocean marine and other logistics channels despite global supply chain and logistics disruptions; (xx) the impact of any type of legal inquiry, claim or dispute; (xxi) the macro-economic conditions, including rising interest rates and recessionary trends, in the United States and in other markets in which we operate or secure products, which could affect our ability to obtain raw materials, component parts, freight, energy, labor, and sourced finished goods in a timely and cost-effective manner; (xxii) our dependence on military maritime customers and on the levels and timing of government funding available to such customers, as well as the funding resources of our other customers in the public sector and commercial markets; (xxix) business interruptions resulting from geopolitical actions such as war and terrorism, natural disasters, including earthquakes, typhoons, floods and fires, or from health epidemics, or pandemics or other contagious outbreaks; (xxx) our ability to respond to new lighting and control technologies and market trends; (xxxi) our ability to fulfill our warranty obligations with safe and reliable products; (xxxii) any delays we may encounter in making new products available or fulfilling customer specifications; (xxxiii) any flaws or defects in our products or in the manner in which they are used or installed; (xxix) our ability to protect our intellectual property rights and other confidential information, and manage infringement claims by others; (xxx) our compliance with government contracting laws and regulations, through both direct and indirect sale channels, as well as other laws, such as those relating to the environment and health and safety; (xxxi) risks inherent in international markets, such as economic and political uncertainty, changing regulatory and tax requirements and currency fluctuations, including tariffs and other potential barriers to international trade; and (xxix) our ability to maintain effective internal controls and otherwise comply with our obligations as a public company. For additional factors that could cause our actual results to differ materially from the forward-looking statements, please refer to our most recent annual report on Form 10-K and quarterly reports on Form 10-Q filed with the Securities and Exchange Commission.

Investor Relations Contact:

Energy Focus

Investor Relations

440-715-1300

ir@energyfocus.com

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Cover

|

Jun. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 28, 2023

|

| Entity Registrant Name |

ENERGY FOCUS, INC/DE

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36583

|

| Entity Tax Identification Number |

94-3021850

|

| Entity Address, Address Line One |

32000 Aurora Road Suite B

|

| Entity Address, City or Town |

Solon,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44139

|

| City Area Code |

440

|

| Local Phone Number |

715-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

EFOI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000924168

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

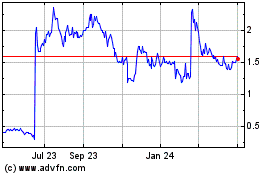

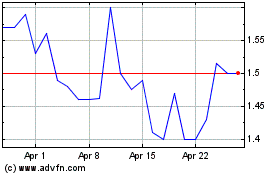

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Apr 2023 to Apr 2024