Current Report Filing (8-k)

May 26 2023 - 4:09PM

Edgar (US Regulatory)

0001017491

false

0001017491

2023-05-23

2023-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 23, 2023

Seelos Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-22245 |

|

87-0449967 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

| 300

Park Avenue, 2nd Floor,

New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (646) 293-2100

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

SEEL |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.01. Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously reported, on November 21, 2022,

Seelos Therapeutics, Inc. (the “Company”) received written notice from The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that, for the previous thirty consecutive business days, the bid price for the Company’s common stock had closed below

the minimum $1.00 per share requirement for continued listing on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2) (“Rule

5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided an initial period of 180 calendar days,

or until May 22, 2023, to regain compliance.

On May 23, 2023, the Listing Qualifications Staff

of Nasdaq (the “Staff”) provided a notice to the Company (the “Nasdaq Notice”) that the Company has not regained

compliance with Rule 5550(a)(2) and is not eligible for a second 180 calendar day compliance period as the Company does not comply with

the minimum $5,000,000 stockholder’s equity requirement for initial listing on the Nasdaq Capital Market. The Nasdaq Notice further

indicated that, unless the Company requests a hearing on an appeal of this determination by the Staff before a Nasdaq Hearings Panel by

no later than May 30, 2023, the Company’s common stock would be scheduled for delisting from the Nasdaq Capital Market and would

be suspended at the opening of business on June 1, 2023. The Company will timely submit a hearing request to Nasdaq’s Hearing Department,

which will stay the suspension of the Company’s common stock until the hearing process concludes

and the Nasdaq Hearings Panel issues a decision, and during which time the Company’s common stock will continue to be listed

on Nasdaq Capital Market under the symbol “SEEL”.

The Company

intends to submit a plan to regain compliance to the Nasdaq Hearings Panel as part of the hearing process, which compliance plan may include

conducting a reverse stock split if necessary to regain compliance with Rule 5550(a)(2). There

can be no assurance that Nasdaq will accept the Company’s compliance plan, that the appeal will be successful, that the Company

will be able to regain compliance with Rule 5550(a)(2) or that the Company will otherwise

be in compliance with other applicable Nasdaq Listing Rules. If the Company’s appeal is denied or if it fails to regain

compliance with Nasdaq’s listing standards during any additional compliance period granted by the Staff, the Company’s common

stock will be subject to delisting from the Nasdaq Capital Market.

Forward-Looking

Statements

Except for the factual

statements made herein, information contained in this Current Report on Form 8-K consists of forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 that involve risks, uncertainties and assumptions that are difficult to predict.

Words and expressions reflecting optimism, satisfaction or disappointment with current prospects or future events, as well as words such

as “believes,” “intends,” “expects,” “plans” and similar expressions, or the use of future

tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Such forward-looking

statements are not guarantees of performance and actual actions or events could differ materially from those contained in such statements.

For example, there can be no assurance that the Company will meet Nasdaq compliance standards during any compliance period or otherwise

in the future, that Nasdaq will grant the Company any relief from delisting as necessary or that the Company can agree to or ultimately

meet applicable Nasdaq requirements for any such relief. A delisting of the Company’s common stock from the Nasdaq Capital Market

could materially adversely affect the Company’s ability to access the capital markets and could result in a default by the Company

under its outstanding debt, and any limitation on market liquidity or reduction in the price of the common stock as a result of such delisting

could adversely affect the Company’s ability to raise capital on terms acceptable to the Company, or at all. Reference is also made

to other factors detailed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission,

including the Company’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The forward-looking

statements contained in this Current Report on Form 8-K speak only as of the date of this Current Report on Form 8-K and the Company assumes

no obligation to publicly update any forward-looking statements to reflect changes in information, events or circumstances after the date

of this Current Report on Form 8-K, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

Seelos Therapeutics, Inc. |

| |

|

| Date: May 26, 2023 |

By: |

/s/ Raj Mehra, Ph.D. |

| |

|

Name: |

Raj Mehra, Ph.D. |

| |

|

Title: |

Chief Executive Officer and President |

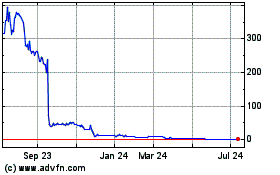

Seelos Therapeutics (NASDAQ:SEEL)

Historical Stock Chart

From Apr 2024 to May 2024

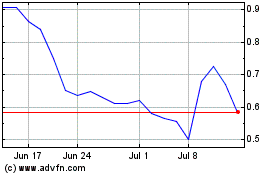

Seelos Therapeutics (NASDAQ:SEEL)

Historical Stock Chart

From May 2023 to May 2024