Filed

pursuant to Rule 424(b)(5)

Registration

Statement No. 333-259664

| Prospectus Supplement |

|

Dated April 13, 2023 |

| (To Prospectus dated September 20, 2021) |

|

|

GLUCOTRACK,

INC..

5,376,472

Shares of Common Stock

Pre-Funded

Warrants to Purchase up to 1,976,470 Shares of Common Stock

We

are offering 5,376,472 shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus. We are

also offering pre-funded warrants to purchase up to an aggregate of 1,976,470 shares of common stock to institutional investors

whose purchase of shares of common stock in this offering would otherwise result in such purchasers, together with their affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the purchasers, 9.99%) of our outstanding shares

of common stock immediately following the closing of this offering. Subject to limited exceptions, a holder of pre-funded warrants will

not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after

giving effect to such exercise. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants

sold in this offering.

Each

pre-funded warrant will have an exercise price per share of common stock equal to $0.001 and will be exercisable at any time after its

original issuance until exercised in full.

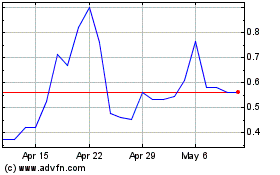

Our

common stock is traded on the Nasdaq Capital Market, or NASDAQ, under the symbol “GCTK.” There is no established trading

market for the pre-funded warrants, and we do not expect a market to develop. We do not intend to apply for a listing for the pre-funded

warrants on any securities exchange or other nationally recognized trading system. On April 12, 2023, the closing sale price of our common

stock on NASDAQ was $2.70 per share.

Investing

in our securities is highly speculative and involves a high degree of risk. You should read carefully and consider the information contained

in and incorporated by reference under “Risk Factors” beginning on page S-19 of this prospectus supplement, and the risk factors

contained in other documents incorporated by reference.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Per Pre-

Funded Warrant | | |

Total | |

| Public offering price | |

$ | 1.36 | | |

$ | 1.359 | | |

$ | 9,998,024.65 | |

| Underwriting discounts and commissions(1) | |

| 0.0714 | | |

| 0.0714 | | |

| 525,000.06 | |

| Proceeds, before expenses, to us(2) | |

| 1.2886 | | |

| 1.2876 | | |

| 9,473,024.59 | |

| (1) |

We have agreed

to reimburse the underwriter for certain expenses. See “Underwriting” for a description of the compensation payable to

the underwriter. |

| |

|

| (2) |

The above summary of offering

proceeds does not give effect to any proceeds from the exercise of the pre-funded warrants being issued in this offering. |

Delivery

of the shares of our common stock and pre-funded warrants against payment is expected to be made on or about April 17,

2023, subject to customary closing conditions.

Sole

Book-Running Manager

AEGIS

CAPITAL CORP.

The

date of this prospectus supplement is April 13, 2023.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information we have provided or incorporated by reference in this prospectus supplement. We have not authorized

anyone to provide you with information different from that contained or incorporated by reference in this prospectus supplement.

This

prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so.

You

should assume that the information contained in this prospectus supplement is accurate only as of their respective dates and that any

information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of

the time of delivery of this prospective supplement for any sale of securities.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus relate to the offering of shares of our common stock and pre-funded warrants. Before

buying any shares of our common stock or pre-funded warrants offered hereby, we urge you to carefully read this prospectus supplement

and the accompanying prospectus, together with the information incorporated herein and therein by reference as described under the headings

“Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” These documents

contain important information that you should consider when making your investment decision.

This

prospectus supplement is part of a registration statement (File No.: 333-259664) that we filed with the Securities and Exchange Commission,

or SEC, utilizing a shelf registration process, which registration statement became effective on September 20, 2021. Under this shelf

registration process, we may, from time to time, sell common stock and other securities, including this offering.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common

stock and pre-funded warrants and also adds to and updates information contained in the accompanying prospectus and the documents incorporated

by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated September

20, 2021, including the documents incorporated by reference, provides more general information, some of which may not apply to this offering.

Generally, when we refer to this prospectus supplement, we are referring to both parts of this document combined.

To

the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in any document incorporated by reference into this prospectus supplement that was filed with the SEC before the date of this

prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of

these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by

reference into this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier

statement.

You

should rely only on the information contained in, or incorporated by reference into this prospectus supplement and in any free writing

prospectus that we may authorize for use in connection with this offering. We have not, and Aegis Capital Corp. has not, authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We are not, and Aegis Capital Corp. is not, making an offer to sell or soliciting an offer to buy our securities in any

jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified

to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this

prospectus supplement, the documents incorporated by reference into this prospectus supplement, and in any free writing prospectus that

we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business,

financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement,

the documents incorporated by reference into this prospectus supplement, and any free writing prospectus that we may authorize for use

in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information

in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find More

Information” and “Incorporation by Reference.”

We

are offering to sell, and seeking offers to buy, shares of common stock and our pre-funded warrants only in jurisdictions where offers

and sales are permitted. The distribution of this prospectus supplement and the offering of the common stock and pre-funded warrants

in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement

must inform themselves about, and observe any restrictions relating to, the offering of the common stock and pre-funded warrants and

the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not

be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement

by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We

obtained statistical data, market data and other industry data, and forecasts used in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference into the prospectus and this prospectus supplement from market research, publicly available

information and industry publications. Industry publications generally state that they obtain their information from sources that they

believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that

the statistical data, market data and other industry data and forecasts used herein are reliable, we have not independently verified

the data, and we do not make any representation as to the accuracy of the information.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into the prospectus supplement and accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

Unless

otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations

refer to GlucoTrack, Inc. and its consolidated subsidiaries. Our logo, trademarks and service marks are the property of GlucoTrack,

Inc. and its consolidated subsidiaries. Other trademarks or service marks appearing in this prospectus supplement are the property

of their respective holders.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein contains forward-looking statements

that reflect our current expectations and views of future events. The forward-looking statements are contained principally in the sections

included or incorporated by reference herein entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” Readers are cautioned that known and unknown risks, uncertainties and other

factors, including those over which we may have no control and others listed in the “Risk Factors” section of this prospectus

supplement, may cause our actual results, performance or achievements to be materially different from those expressed or implied by the

forward-looking statements.

These

forward-looking statements involve numerous risks and uncertainties. Although we believe that our expectations expressed in these forward-looking

statements are reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other

matters that we anticipate could be materially different from our expectations. Important risks and factors that could cause our actual

results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “Regulation” and

other sections included or incorporated by reference in this prospectus supplement. You should thoroughly read this prospectus supplement

and the documents incorporated herein by reference with the understanding that our actual future results may be materially different

from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The

forward-looking statements made in this prospectus supplement relate only to events or information as of the date on which the statements

are made in or incorporated by reference in this prospectus supplement. Except as required by law, we undertake no obligation to update

or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date

on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus supplement, the

documents incorporated by reference into this prospectus supplement and the documents we have filed as exhibits to the registration statement,

of which this prospectus supplement forms a part, completely and with the understanding that our actual future results may be materially

different from what we expect.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us,

the securities being offered and other information you should know before investing in our securities. You should also read and consider

information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find

More Information” and “Incorporation by Reference.”

You

should rely only on this prospectus supplement, the accompanying prospectus, the documents incorporated or deemed to be incorporated

by reference herein or therein and any free writing prospectus prepared by us or on our behalf. We have not, and the underwriters have

not, authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference

in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you

should not rely on it. We and the underwriters are not offering to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or

any free writing prospectus, or incorporated by reference herein, is accurate as of any date other than as of the date of this prospectus

supplement or the accompanying prospectus or any free writing prospectus, as the case may be, or in the case of the documents incorporated

by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus

or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since

those dates.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

Unless

otherwise indicated in this prospectus or the context otherwise requires, all references to “we,” “us,” “our,”

“the Company,” and “GlucoTrack” refer to GlucoTrack, Inc. and its subsidiaries.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution

of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus

supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe

any restrictions as to this offering and the distribution of this prospectus supplement or the accompanying prospectus applicable to

that jurisdiction.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere or incorporated by reference in this prospectus. This summary does not contain all

of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully,

including the “Risk Factors” section contained in this prospectus, our consolidated financial statements and the related

notes thereto and the other documents incorporated by reference in this prospectus.

Our

Company

About

GlucoTrack, Inc.

We

are a medical device company focused on the design, development and commercialization of novel technologies for use by people with diabetes

and prediabetes. We are currently developing two products; a non-invasive glucose monitor for use by those with Type 2 diabetes and prediabetes,

and an implantable continuous glucose monitor for those with Type 1 diabetes and insulin-dependent Type 2 diabetes.

We

were incorporated in Delaware in May 2010 as Integrity Applications, Inc. In July 2010, we completed a reverse triangular merger with

Integrity Israel and Integrity Acquisition Corp. Ltd., an Israeli corporation and a wholly owned subsidiary of ours, pursuant to which

Integrity Acquisition Corp. Ltd. merged with and into Integrity Israel (the “Reorganization”). As a result of the Reorganization,

Integrity Israel became a wholly owned subsidiary of ours. Until recently, we operated primarily through Integrity Israel and moved our

operations primarily to the US in 2022.

In

connection with our application to list our shares on Nasdaq Capital Market (“NASDAQ”), on August 13, 2021, we effected a

reverse split of our Common Stock in a ratio of 1 for 13 (the “Reverse Share Split”). For accounting purposes, all Shares,

options and warrants to purchase Common Stock and loss per share amounts have been adjusted to give retroactive effect to this Reverse

Share Split for all periods presented in these interim consolidated financial statements. Any fractional shares resulting from the Reverse

Share Split were rounded up to the nearest whole share.

On

December 8, 2021 our shares of Common Stock were approved for listing on the Nasdaq Capital Market (“NASDAQ”) and trading

on NASDAQ commenced on December 10, 2021 under the trading symbol, IGAP.

On

March 14, 2022, we completed our corporate name change to GlucoTrack, Inc., and ticker symbol change to GCTK.

The

Company was founded with a mission to develop GlucoTrack®, a noninvasive glucose monitoring device designed to help people with diabetes

and pre-diabetics obtain glucose level readings without the pain, inconvenience, cost and difficulty of conventional (invasive) spot

finger stick devices. The first generation GlucoTrack (“GlucoTrack 1.0”), which successfully received CE Mark approval and

ISO certifications, utilized a combination of ultrasound, electromagnetic and thermal technologies to obtain glucose measurements in

approximately one minute via a small sensor that is clipped onto one’s earlobe and connected to a small, handheld control and display

unit, all without drawing blood or interstitial fluid. After a limited release beta test in Europe and the Middle East, the Company determined

that it would focus on developing its next generation non-invasive monitor (“GlucoTrack 2.0”), and we have since withdrawn

our CE Mark and ISO certifications for GlucoTrack 1.0.

We

are currently developing GlucoTrack 2.0. The current clinical prototype utilizes ultrasound-only sensor technology, reduces the overall

cost and complexity of the device, and reduces the measurement time from approximately sixty seconds to less than two seconds. Initial

testing has produced promising results, suggesting measurement accuracies could be relatively comparable with those of conventional,

already in-the-market CGM technologies. We expect to begin our first-in-human (FIH) study in the second quarter of 2023. Collecting data

for sensor characterization and algorithm development will be the primary goals of the FIH study. The results of this study will also

drive the development of the commercial version of the device, which is expected to commence late in the third quarter of 2023. Once

the development of the commercial device version is complete, we intend to conduct a scaled down version of the FDA pivotal trial to

resolve any lingering device performance or human factors issues prior to executing the larger pivotal trial for FDA submission.

Following

the acquisition of certain IP in the fourth quarter of 2022, we are also developing an implantable continuous glucose monitor for use

by Type 1 diabetes patients as well as insulin-dependent Type 2 patients. Implant longevity is key to the success of such a device, and

we are currently in the feasibility phase to demonstrate the potential of a multi-year implant life. We intend to complete the feasibility

study in the second quarter of 2023. We believe our technology, if successful, has the potential to be more accurate, more convenient

and have a longer duration than other implantable glucose monitors that are either in the market or currently under development.

We

are currently developing our own companion applications and a cloud-based solutions to offer an effective platform to provide real time,

data driven personalized tools to effectively help a user manage their diabetes, which will be utilized during the clinical trials. In

addition to being a critical and effective management tool for the end user, we believe that third parties such as insurers, pharmaceutical

companies and advertisers would be willing to pay for the de-identified data that we will obtain through our platform, and that this

is an opportunity for us to develop an additional revenue source.

After

a home-based short calibration process of approximately thirty minutes consisting of three typical blood glucose reference measurements,

GlucoTrack 1.0 can be used to non-invasively measure glucose levels for six months before a user is required to repeat the calibration

process. The entire calibration process can be performed by the user themselves without the need for a trained calibrator. We believe

the simple-to-perform calibration, as well as the infrequency of the required re-calibration are significant advantages over our competition.

Our

Senior Management team includes; CEO and President, Paul V. Goode PhD, who has a decorated career developing innovative medical technologies,

including at DexCom and MiniMed, James P. Thrower PhD, Vice President of Engineering, a seasoned executive formerly of Sterling Medical

Devices, Mindray DS USA and DexCom, Inc., and Mark Tapsak PhD, Vice President of Sensor Technology, a medical research scientist who

brings over 25 years of experience in the diabetes industry, including previous senior roles at DexCom and Medtronic. Luis J. Malavé,

formerly of Insulet Corp, Medtronic and MiniMed has joined as an independent board member. Several highly talented and accomplished executives

joined the Company as senior advisors to the Board. These include Yair Briman, the former CEO of Philips Healthcare Informatics, Daniel

McCaffrey MBA MA, a world-renowned behavioral scientist and digital health expert formerly at Samsung Health and Dexcom, Inc., Dr. Alexander

Raykhman PhD, a measurement and artificial intelligence expert and Dr. David C. Klonoff, world renowned endocrinologist and diabetes

technology thought leader. We intend to continue to invest in our talent and to expand and strengthen all areas within the Company.

Recent

Events

On

October 19, 2021, Paul V. Goode PhD was appointed as President and Chief Operating Officer of the Company, effective November 1, 2021

(“Effective Date”). He previously served as a member of the Company’s Board of Directors since December 17, 2020. Concurrent

with his new appointment, Dr. Goode stepped down from the Board. In December 2021, Mr. Goode has been appointed Chief Executive Officer.

In

connection with our application to list our shares of common stock on Nasdaq Capital Market (“NASDAQ”), on August 13, 2021,

we effected a reverse split of our common stock in a ratio of 1 for 13 (the “Reverse Share Split”).

On

September 27, 2021, our shelf registration statement on Form S-3 (file no. 333-259664) was declared effective by the SEC. The shelf registration

statement permits us to register up to $100,000,000 of certain equity and debt securities of the Company via prospectus supplement.

On

December 8, 2021, we announced that our shares of common stock were approved for listing on the NASDAQ. Trading on NASDAQ commenced on

December 10, 2021, under the trading symbol IGAP.

On

March 14, 2022, we changed our name to GlucoTrack, Inc. and our trading symbol to GCTK.

On

March 22, 2022, Shalom Shushan, Chief Technology Officer, provided notice of his resignation from the Company, effective May 22, 2022,

for personal reasons. In connection with the Company’s previously announced plans to migrate certain aspects of product development

to the United States, James P. Thrower PhD, Vice President of Engineering, assumed Mr. Shushan’s responsibilities.

In

connection with the Company’s previously announced plans to migrate certain aspects of the product development to the United States,

as well as in preparation for U.S. clinical trials, Erez Ben-Zvi, VP of Product in Israel, resigned from the Company, effective June

12, 2022.

On

October 10, 2022, the Company announced that it has acquired certain IP related to a long-term implantable continuous glucose monitor

and that it intends to develop the technology to address the growing Type 1 and insulin dependent Type 2 diabetes market.

On

October 14, 2022, the Company announced the hiring of Dr. Mark Tapsak as Vice President of Sensor Technology.

On

November 22, 2022, Nasdaq provided notice that pursuant to Nasdaq Listing Rule 5550(b)(1), the Company did not meet the alternatives

of market value of listed securities or net income from continuing operations.

On

January 4, 2023, Nasdaq provided notice that since the Company had not held an annual meeting of shareholders within twelve months of

the end of the Company’s fiscal year end ended December 31, 2021, it no longer complied with Listing Rules for continued listing.

On

February 7, 2023, Nasdaq issued a letter to the Company granting an extension until May 22, 2023 to obtain compliance with the Listing

Rule 5550(b).

On

March 31, 2023, GlucoTrack, Inc. held its 2022 Annual Meeting of Shareholders. The results of the voting with respect to this Annual

Meeting are as set forth below.

| DIRECTORS

INFORMATION |

| DIR

# |

|

VOTES

FOR |

|

|

VOTES

WITHHELD |

|

|

BROKER

NON-VOTE |

|

|

%

VOTES

FOR |

|

| Dr. Robert Fischell |

|

|

2,881,036.00 |

|

|

|

5,250,502.00 |

|

|

|

488,583.00 |

|

|

|

18.58 |

|

| Luis Malave |

|

|

2,880,918.00 |

|

|

|

5,250,620.00 |

|

|

|

488,583.00 |

|

|

|

18.58 |

|

| Andrew Sycoff |

|

|

2,945,847.00 |

|

|

|

5,185,691.00 |

|

|

|

488,583.00 |

|

|

|

19.00 |

|

| Shimon Rapps |

|

|

2,882,073.00 |

|

|

|

5,249,465.00 |

|

|

|

488,583.00 |

|

|

|

18.59 |

|

| Allen Danzig |

|

|

2,880,916.00 |

|

|

|

5,250,622.00 |

|

|

|

488,583.00 |

|

|

|

18.58 |

|

| PROPOSALS

INFORMATION |

|

| PROP

# |

|

VOTES

FOR |

|

|

VOTES

AGAINST |

|

|

VOTES

ABSTAIN |

|

|

BROKER

NON-VOTE |

|

|

% VOTES

FOR |

|

| Ratify Auditor |

|

|

8,612,584.00 |

|

|

|

7,481.00 |

|

|

|

56.00 |

|

|

|

0.00 |

|

|

|

55.55 |

|

| Nonbinding Say on Pay |

|

|

2,844,095.00 |

|

|

|

5,205,181.00 |

|

|

|

82,262.00 |

|

|

|

488,583.00 |

|

|

|

18.34 |

|

Market

Opportunity

Diabetes

Diabetes

is a chronic, life-threatening disease for which there is no known cure. Diabetes is caused by the body’s inability to produce

or effectively utilize the hormone insulin. This inability prevents the body from adequately regulating blood glucose levels. Glucose,

the primary source of energy for cells, must be maintained at certain concentrations in the blood in order to permit optimal cell function

and health. Normally, the pancreas provides control of blood glucose levels by secreting the hormone insulin to decrease blood glucose

levels when concentrations are too high. In people with diabetes, blood glucose levels fluctuate between very high levels, a condition

known as hyperglycemia, and very low levels, a condition known as hypoglycemia. Hyperglycemia can lead to serious long-term complications,

such as blindness, kidney disease, nervous system disease, amputations, stroke and cardiovascular disease. Hypoglycemia can lead to confusion,

loss of consciousness or death.

Diabetes

is typically classified into two major groups: Type 1 and Type 2. Type 1 diabetes is characterized by the body’s inability to produce

insulin, resulting from destruction of the insulin producing cells of the pancreas. Individuals with Type 1 diabetes must rely on frequent

insulin injections in order to regulate and maintain blood glucose levels. Type 1 diabetes is frequently diagnosed during childhood or

adolescence, although disease onset can occur at any age. Type 2 diabetes, the more common form of diabetes, is characterized by the

body’s inability to either properly utilize insulin or produce enough insulin. Type 2 diabetes is associated with older age, obesity,

family history of diabetes, history of gestational diabetes, impaired glucose metabolism, physical inactivity and race or ethnicity.

Depending on the severity of Type 2 diabetes, individuals may require diet and nutrition management, exercise, oral medications or insulin

injections to regulate blood glucose levels.

According

to the Diabetes Atlas (Ninth Edition) published by the International Diabetes Federation in 2021, approximately 537 million adults worldwide,

between the ages of 20 and 79, or approximately 10% of the world’s adult population, were estimated to suffer from diabetes in

2021 (not including those persons who suffer from impaired glucose tolerance or gestational diabetes, diabetic conditions first arising

during pregnancy). The International Diabetes Federation estimates that this number will grow to approximately 784 million adults worldwide

by 2045.

Glucose

Monitoring

Blood

glucose levels can be affected by many factors, including the carbohydrate and fat content of meals, exercise, stress, illness or impending

illness, hormonal releases, medications, variability in insulin absorption and changes in the effects of insulin in the body. Given the

many factors that affect blood glucose levels, maintaining glucose within a normal range can be difficult. Diabetics generally manage

their blood glucose levels by administering insulin or ingesting carbohydrates throughout the day to maintain blood glucose within normal

ranges. Normal ranges in diabetics vary from person to person. In order to maintain blood glucose levels within normal ranges, diabetics

must first measure their blood glucose levels so that they can make the proper therapeutic adjustments. As adjustments are made, additional

blood glucose measurements may be necessary to gauge the individual’s response to the adjustments. More frequent testing of blood

glucose levels provides patients with information that can be used to better understand and manage their diabetes. Testing of blood glucose

levels is usually done before meals, after meals and before going to sleep. Diabetics who take insulin usually need to test more often

than those who do not take insulin.

Clinical

data supports the recommendation that frequent monitoring of blood glucose levels is an important component of effective diabetes management.

The Diabetes Control and Complications Trial1, consisting of patients with Type 2 diabetes, and the 1993 UK Prospective Diabetes

Study2, consisting of patients with Type 2 diabetes, demonstrated that patients who intensely managed blood glucose levels

delayed the onset and slowed the progression of diabetes-related complications. In the Diabetes Control and Complications Trial, a major

component of intensive management was monitoring blood glucose levels at least four times per day using conventional spot finger stick

blood glucose meters. The Diabetes Control and Complications Trial demonstrated that intensive management reduced the risk of complications

by 76% for eye disease, 60% for nerve disease and 50% for kidney disease. Furthermore, a recent meta-analysis of over 25 prospective

studies concluded that chronic hyperglycemia in type 2 diabetes is associated with increased risks of all-cause mortality and cardiovascular

outcomes independently from other conventional risk factors.3 However, despite the evidence that intensive glucose management

reduces the long-term complications associated with diabetes, Karter et al. reported in the 2000 issue of Diabetes Care that 67% of people

with type 2 diabetes fail to routinely monitor their glucose levels.4

Spot

finger stick devices are the most prevalent devices for blood glucose monitoring. These devices require users to insert a strip into

a glucose meter, take a blood sample with a finger stick and place a drop of blood on a test strip that yields a single point in time

blood glucose measurement. Despite continued developments in the field of blood glucose monitors, the routine measurement of glucose

levels remains invasive, painful, inconvenient, difficult and costly. This has resulted in a sub-optimal and irregular measurement regimen

for many diabetics.

1

Group, U. P. D. S. (UKPDS); others Intensive blood-glucose control with sulphonylureas or insulin compared with conventional treatment

and risk of complications in patients with type 2 diabetes (UKPDS 33). The Lancet 1998, 352, 837–853.

2

Diabetes Control and Complications Research Group; others The effect of intensive treatment of diabetes on the development and

progression of long-term complications in insulin-dependent diabetes mellitus. N Engl J Med 1993, 329, 977–986.

3

hang, Y.; Hu, G.; Yuan, Z.; Chen, L. Glycosylated Hemoglobin in Relationship to Cardiovascular Outcomes and Death in Patients with

Type 2 Diabetes: A Systematic Review and Meta-Analysis. PLOS ONE 2012, 7, e42551, doi:10.1371/journal.pone.0042551.

4

Karter, A. J.; Ferrara, A.; Darbinian, J. A.; Ackerson, L. M.; Selby, J. V. Self-monitoring of blood glucose: language and financial

barriers in a managed care population with diabetes. Diabetes Care 2000, 23, 477–483.

The

FDA has approved continuous glucose monitoring system (“CGMS”) devices for blood glucose monitoring, when prescribed by a

doctor. CGMS devices use sensors inserted under the skin to check glucose levels in interstitial fluid. The sensor stays in place for

up to fourteen days and then must be replaced. A transmitter sends information about glucose levels via radio waves from the sensor to

a pager-like wireless monitor.

The

FDA has previously approved a single non-invasive product for glucose trend analysis, the GlucoWatch®, so long as the device was

used with conventional finger stick glucose monitoring devices. However, the device is no longer available commercially. We are not aware

of any other devices that have been approved for use in either the United Stated or the EU for spot or continuous non-invasive blood

glucose measurement.

We

believe that a significant market opportunity exists for our devices which could greatly increase compliance with blood glucose measurement

recommendations and help many suffering from diabetes better manage their disease, providing significant benefits to both patients and

payors.

Our

Products

Our

first generation GlucoTrack (“GlucoTrack 1.0”), which successfully received CE Mark approval and ISO certifications, utilized

a combination of ultrasound, electromagnetic and thermal technologies to obtain glucose measurements in approximately one minute via

a small sensor that is clipped onto one’s earlobe and connected to a small, handheld control and display unit, all without drawing

blood or interstitial fluid. After a limited release beta test in Europe and the Middle East, the Company determined that it would focus

on developing its next generation non-invasive monitor (“GlucoTrack 2.0”), and we have since withdrawn our CE Mark and ISO

certifications for GlucoTrack 1.0.

We

are currently in the development phase of GlucoTrack 2.0. Our development team began our Glucotrack 2.0 redesign program as a project

to miniaturize the Glucotrack 1.0 technology into a smaller wireless ear clip that would connect to a smartphone via Bluetooth. As our

miniaturization project progressed, the glucose sensing landscape evolved as continuous glucose monitoring (CGM) devices in the market

reached similar accuracy as the conventional fingerstick blood glucose monitoring (BGM) devices. This inevitably raised the regulatory

bar for any glucose sensor performance, as regulatory bodies such as the FDA could now point to the accuracy levels of BGM and CGM alternatives

already available to the patient. In addition, the Company recognized the advent and significant growth of digital health. Particularly,

CGM companies set a new bar for a mobile experience with diabetes data and its associated cloud management, with BGM companies quickly

following. Also, from a user experience perspective, while a 60 second measurement time may have been acceptable to the market in the

past, we determined this is no longer the case, and that we needed to significantly reduce the time it took to complete a measurement.

As

a result of these changing dynamics, we concluded that the GlucoTrack 2.0 project scope not only had to reduce the size of our device,

but also had to improve the user experience and to significantly improve sensor accuracy. Accordingly, the Company had to return to a

research mode to design, develop, and test a new, more innovative device that would meet these criteria and to invest in software development

to ensure that the GlucoTrack 2.0 product would be supported by both iOS and Android devices with a cloud-based infrastructure.

By

the end of 2022 we had a clinical prototype of a newly designed system. This system utilizes ultrasound-only sensor technology, reduces

the overall cost and complexity of the device, and reduces the measurement time from 60 seconds to 2 seconds. Initial testing produced

promising results, suggesting measurement accuracies could be relatively comparable to those of conventional, already in-the-market CGM

technologies. Continued testing however, exposed certain human factors that complicated consistent sensor placement. We have identified

several mechanical techniques to address this challenge and we expect to complete this process and begin our first-in-human (FIH) study

in the second quarter of 2023. Collecting data for sensor characterization and algorithm development will be the primary goals of the

FIH study. The results of this study will also drive the development of the commercial version of the device, which is expected to commence

late in the third quarter of 2023. Once the development of the commercial device version is complete, we intend to conduct a scaled down

version of the FDA pivotal trial to resolve any lingering device performance or human factors issues prior to executing the larger pivotal

trial for FDA submission.

In

the fourth quarter of 2022 we acquired certain IP relating to an implantable continuous glucose monitor. We designed and developed a

laboratory CGM sensing system, integrated into a cloud-based automated data collection system and a prototype model of this system was

implemented and validated. We also designed, manufactured, and tested a prototype sensor lead. In addition, we have identified and consummated

key vendor relationships with expertise in designing and manufacturing implantable leads and electronics, and we are developing a sensor

life simulation system that will take real bench data as inputs and predict total enzyme longevity.

Our

focus now is to complete the feasibility assessment of achieving a multi-year implant life. In parallel, we have initiated an implantable

electronics design effort. A paper-based design has been completed, and a physical mock-up is expected in the second quarter of 2023,

with a targeted prototype design for an animal study to commence in the third quarter of 2023.

By

the end of 2023 we intend to have completed the feasibility assessment based on bench data and sensor life modeling/prediction, have

bench data (in solution) demonstrating at least six months of sensor life without significant degradation, have animal data demonstrating

at least three months of sensor life without significant degradation, and have initiated a human clinical device/system design and development

program.

We

have developed our own companion applications and a cloud-based solutions to offer an effective platform to provide real time, data driven

personalized tools to effectively help a user manage their diabetes. In addition to being a critical and effective management tool for

the end user, we believe that third parties such as insurers, pharmaceutical companies and advertisers would be willing to pay for the

de-identified data that we will obtain through our platform, and that this is an opportunity for us to develop an additional revenue

source. These applications will be utilized during the clinical trials.

We

do not have commercial manufacturing facilities and do not intend to build commercial manufacturing facilities of our own in the foreseeable

future. Our suppliers and their manufacturing facilities must comply with applicable regulations in the jurisdictions in which our devices

are to be marketed (including ISO 13485 in the EU), current quality system regulations, which include current good manufacturing practices,

and to the extent laboratory analysis is involved, current good laboratory practices. There can be no assurance that we will be able

to enter into agreements with qualified manufacturers on terms acceptable to us, or at all, or that, once contracted, such manufacturers

will perform as expected.

Research

& Development

We

focus significant time and resources on research and development in connection with our efforts to continue to develop and improve GlucoTrack,

as well as in connection with our development of our implantable continuous glucose monitor. See “Item 7 – Management’s

Discussion and Analysis of Financial Condition and Results of Operation – Results of Operation” below for a discussion of

the research and development expenses for the fiscal years ended 2022 and 2021.

Regulatory

Considerations

Healthcare

is heavily regulated by federal, state and local governments in the United States, and by similar authorities in other countries. Any

product that we develop must receive all relevant regulatory approvals or clearances, as the case may be, before it may be marketed in

a particular country. The laws and regulations affecting healthcare change regularly, thereby increasing the uncertainty and risk associated

with any healthcare- related venture. The United States government has in the past considered, is currently considering and may in the

future consider healthcare policies and proposals intended to curb rising healthcare costs, including those that could significantly

and adversely affect reimbursement for healthcare products such as our devices. These policies have included, and may in the future include:

basing reimbursement policies and rates on clinical outcomes, the comparative effectiveness and costs of different treatment technologies

and modalities; imposing price controls and taxes on medical device providers; and other measures. Future significant changes in the

healthcare systems in any jurisdiction in which our devices, may be cleared for sale could also have a negative impact on the demand

for our devices. These include changes that may reduce reimbursement or payment rates for such products.

In

the United States, the federal government regulates healthcare through various agencies, including but not limited to the following:

(i) the FDA, which administers the Food, Drug, and Cosmetic Act, as well as other relevant laws; (ii) the Centers for Medicare &

Medicaid Services (“CMS”), which administers the Medicare and Medicaid programs; (iii) the Office of Inspector General, which

enforces various laws aimed at curtailing fraudulent or abusive practices including, by way of example, the Anti-Kickback Law, the Anti-Physician

Referral Law, commonly referred to as the Stark Law, the Anti-Inducement Law, the Civil Money Penalty Law, and the laws that authorize

the Office of Inspector General to exclude health care providers and others from participating in federal healthcare programs; and (iv)

the Office of Civil Rights which administers the privacy and security aspects of the Health Insurance Portability and Accountability

Act of 1996 (“HIPAA”). All of the aforementioned are agencies within the Department of Health and Human Services. Healthcare

is also provided or regulated, as the case may be, by the Department of Defense through its TriCare program, the Department of Veterans

Affairs under, among other laws, the Veterans Health Care Act of 1992, the Public Health Service within the Department of Health and

Human Services under the Public Health Service Act, the Department of Justice through the Federal False Claims Act and various criminal

statutes, and state governments under the Medicaid program and their internal laws regulating all healthcare activities. If and when

we receive FDA approval to market our devices in the United States, we will be subject to regulation by some or all of the foregoing

agencies.

The

applicable regulatory schemes in the EU are significantly more diverse than those in the United States and do not lend themselves to

similar summary. Although the CE Mark system and the MDR require a minimum level of harmonization in the EU, each EU member country may

impose additional regulatory requirements. Because there are numerous EU member countries with distinct legal systems, the scope of potential

regulatory requirements in each of the EU countries (additional to the harmonized EU requirements) is difficult to summarize or predict.

Regulation

of the Design, Manufacture and Distribution of Medical Devices

Any

product that we develop must receive all relevant regulatory clearances or approvals, as the case may be, before it may be marketed in

a particular country.

Sales

of medical devices outside the United States are subject to foreign regulatory requirements that vary widely from country to country.

These laws and regulations range from simple product registration requirements in some countries to complex clearance and production

controls in others. As a result, the processes and time periods required to obtain foreign marketing approval may be longer or shorter

than those necessary to obtain FDA approval (as described below). These differences may affect the efficiency and timeliness of international

market introduction of our devices. For countries in the EU, medical devices must display a CE Mark before they may be imported or sold

and must comply with the requirements of the MDR. However, although the MDR is applicable throughout the EU, in practice it does not

ensure uniform regulation throughout the EU. Rather, the MDR requires only a minimum level of harmonization in the EU. Accordingly, member

countries may apply and enforce the MDr’s terms differently, and certain EU member countries may request or require performance

and/or safety data in addition to the MDR’s requirements from time to time, on a case-by-case basis. The CE Mark also permits the

sale in countries that have an MDR Mutual Recognition Agreement with the EU.

In

the United States, under Section 201(h) of the Food, Drug, and Cosmetic Act, a medical device is an article which, among other things,

is intended for use in the diagnosis of disease or other conditions or in the cure, mitigation, treatment or prevention of disease in

man or other animals. We believe that our devices will be classified as medical devices and subject to regulation by numerous agencies

and legislative bodies, including the FDA and its foreign counterparts. Devices are subject to varying levels of regulatory control,

the most comprehensive of which requires that a clinical evaluation be conducted before a device receives approval for commercial distribution.

The FDA classifies medical devices into one of three classes. Class I devices are relatively simple and can be manufactured and distributed

with general controls. Class II devices are somewhat more complex and require greater scrutiny. Class III devices are new and frequently

help sustain life.

In

the United States, a company generally can obtain permission to distribute a new device in two ways – through a so-called “510(k)”

premarket notification application or through a Section 515 premarket approval (“PMA”) application. The 510(k) submission

applies to any device that is substantially equivalent to a device first marketed prior to May 28, 1976 or to another device marketed

after that date, but which was substantially equivalent to a pre-May 28, 1976 device. These devices are either Class I or Class II devices.

Under the 510(k) submission process, the FDA will issue an order finding substantial equivalence to a predicate device (pre-May 28, 1976

or post-May 28, 1976 device that was substantially equivalent to a pre- May 28, 1976 device) and permitting commercial distribution of

that device for its intended use. A 510(k) submission must provide information supporting its claim of substantial equivalence to the

predicate device. The FDA permits certain low risk medical devices to be marketed without requiring the manufacturer to submit a premarket

notification. In other instances, the FDA may require that a premarket notification not only be submitted, but also be accompanied by

clinical data. If clinical data from human experiments are required to support the 510(k) submissions, these data must be gathered in

compliance with investigational device exemption regulations for investigations performed in the United States. The FDA review process

for premarket notifications submitted pursuant to section 510(k) should take about 90 days, but it can take substantially longer if the

FDA has concerns, and there is no guarantee that the FDA will clear the device for marketing, in which case the device cannot be lawfully

distributed in the United States. If the FDA finds that the device subject to the premarket notification is substantially equivalent

to a proper predicate device, then the FDA may “clear” that device for marketing. These devices are not “approved”

by the FDA. There is no guarantee, however, that the FDA will deem the device subject to the 510(k) process, as opposed to the more time-consuming,

resource intensive and problematic PMA application process described below.

The

more comprehensive PMA process applies to a new device that either is not substantially equivalent to a pre-May 28, 1976 product or is

to be used in supporting or sustaining life or preventing impairment. These devices are normally Class III devices and can only be marketed

following approval of a PMA application. For example, most implantable devices are subject to the PMA approval process. Two steps of

FDA approval generally are required before a company can market a product in the U.S. that is subject to Section 515 PMA approval, as

compared to a Section 510(k) clearance. First, a company must comply with investigational device exemption regulations in connection

with any human clinical investigation of the device; however, those regulations permit a company to undertake a clinical study of a “non-significant

risk” device without formal FDA approval. Prior express FDA approval is required if the device is a significant risk device. If

there is any doubt as to whether a device is a “non-significant risk” device, companies normally seek prior approval from

the FDA. Normally, clinical studies of new diagnostic products are conducted in tandem with a cleared or approved device and treatment

decisions are based on the results from the existing diagnostic device. In such a setting, the FDA may consider the clinical trial as

one not posing a significant risk. However, FDA action is always uncertain and dependent on the contours of the design of the clinical

trial and the device and there is no assurance that the FDA would consider any proposed clinical trial as one posing a non-significant

risk. Moreover, before undertaking any clinical trial, the company sponsoring the trial and the investigator conducting the trial are

required by federal law to seek and obtain the approval of institutional review boards (“IRB”). An IRB weighs the risks and

benefits of a proposed trial to ensure that the human subjects are not exposed to unnecessary risk and reviews the informed consent form

to ensure that it meets federal requirements and accurately describes the risks and benefits, if any, of the clinical trial. IRB review

occurs annually, and annual re-approval is required. University medical centers as well as other entities maintain and operate IRB. Second,

the FDA must review a company’s PMA, which contains, among other things, clinical information acquired under the investigational

device exemption. The FDA will approve the PMA if it finds there is reasonable assurance that the device is safe and effective for its

intended use. The premarket approval process takes substantially longer than the 510(k) process.

The

GlucoTrack® 1.0 has not been approved for commercial sale in the United States. The GlucoTrack® 2.0 is still under development

and has not yet been approved for commercial sale in or outside the United States. In prior discussions with the FDA regarding the regulatory

pathway, the FDA is not yet entirely sure whether a de novo pathway is acceptable and recommended that the Company should plan to support

this approach through risk analysis and an explanation of why the new measurement paradigm it is proposing does not introduce greater

risks. FDA noted that no decision has been made that a PMA will be required. The implantable CGM product will most likely fall under

the PMA process.

Even

when a clinical study has been approved or cleared by the FDA or a notified body or deemed approved, the study is subject to factors

beyond a manufacturer’s control, including, but not limited to the fact that the IRB at a given clinical site might not approve

the study, might decline to renew approval which is required annually, or might suspend or terminate the study before the study has been

completed. Also, the interim results of a study may not be satisfactory, in which case the sponsor may terminate or suspend the study

on its own initiative or the FDA or a notified body may terminate or suspend the study. There is no assurance that a clinical study at

any given site will progress as anticipated; there may be an insufficient number of patients who qualify for the study or who agree to

participate in the study, or the investigator at the site may have priorities other than the study. Also, there can be no assurance that

the clinical study will provide sufficient evidence to assure the FDA or a notified body that the product is safe and effective, a prerequisite

for FDA approval of a PMA, or substantially equivalent in terms of safety and effectiveness to a predicate device, a prerequisite for

clearance under 510(k). Even if the FDA or a notified body approves or clears a device, it may limit its intended uses in such a way

that manufacturing and distributing the device may not be commercially feasible.

After

clearance or approval to market is given, the FDA and foreign regulatory agencies, upon the occurrence of certain events, are authorized

under various circumstances to withdraw the clearance or approval or require changes to a device, its manufacturing process or its labeling

or additional proof that regulatory requirements have been met.

A

manufacturer of a device approved through the PMA process is not permitted to make changes to the device which affects its safety or

effectiveness without first submitting a supplement application to its PMA and obtaining FDA approval for that supplement. In some instances,

the FDA may require clinical trials to support a supplement application. A manufacturer of a device cleared through a 510(k) submission

must submit another premarket notification if it intends to make a change or modification in the device that could significantly affect

the safety or effectiveness of the device, such as a significant change or modification in design, material, chemical composition, energy

source or manufacturing process. Any change in the intended uses of a PMA device or a 510(k) device requires an approval supplement or

cleared premarket notification. Exported devices are subject to the regulatory requirements of each country to which the device is exported,

as well as certain FDA export requirements.

The

Patient Protection and Affordable Care Act was signed into law on March 23, 2010, and on March 30, 2010, a reconciliation bill that modifies

certain provisions of the same was signed into law. These two laws are jointly referred to as the “Affordable Care Act” or

“ACA.”

The

principal aim of the ACA was to expand health insurance coverage to approximately 32 million Americans who were uninsured. The law’s

most far-reaching changes did not take effect until 2014, including a requirement that most Americans carry health insurance. The consequences

of these significant coverage expansions on the sales of our products is still unknown and speculative at this point, although the ACA

and certain state initiatives may compel private insurers to reduce coverage or reimbursement for various items and services, including

medical devices of the type that we contemplate distributing.

This

legislation contains many provisions designed to generate the revenues necessary to fund the coverage expansions. The most relevant of

these provisions are those that impose fees or taxes on certain health-related industries, including medical device manufacturers. Beginning

in 2013, each medical device manufacturer is required to pay an excise tax (or sales tax) in an amount equal to 2.3% of the price for

which such manufacturer sells its medical devices. The tax applies to all medical devices, including our products and product candidates.

The ACA also provides for increased enforcement of the fraud and abuse regulations previously mentioned.

There

are ongoing discussions in the EU regarding amending the relevant regulatory framework. It is difficult to predict what effect any amendments

to the existing EU legislation may have. Furthermore, each individual EU member country has the authority to amend its regulations and

requirements additional to the minimum harmonization required by the MDR. Because the EU member countries have diverse legal systems,

it is difficult to predict what, if any, amendments may be implemented in each of the EU member countries and whether they may adversely

affect us.

We

anticipate that sales volumes and prices of our products will depend in large part on the availability of reimbursement from third-party

payors. Third-party payors include governmental programs such as Medicare and Medicaid, private insurance plans and workers’ compensation

plans. These third-party payors may deny reimbursement for a product or therapy if they determine that the product was not medically

appropriate or necessary. Also, third-party payors are increasingly challenging the prices charged for medical products and services.

Some third-party payors must also approve coverage for new or innovative devices before they will reimburse health care providers who

use the products. Even though a new product may have been cleared for commercial distribution, it may find limited demand for the device

until reimbursement approval has been obtained from governmental and private third-party payors.

Inasmuch

as a percentage of the projected patient population that could potentially benefit from our products is elderly, Medicare would likely

be a potential source of reimbursement in the United States. Medicare is a federal program that provides certain hospital and medical

insurance benefits to persons age 65 and over, certain disabled persons, persons with end-stage renal disease and those suffering from

Lou Gehrig’s disease. In contrast, Medicaid is a medical assistance program jointly funded by United States federal and state governments

and administered by each state pursuant to which benefits are available to certain indigent patients. The Medicare and Medicaid statutory

framework is subject to administrative rulings, interpretations and discretion that affect the amount and timing of reimbursement made

under Medicare and Medicaid.

Medicare

reimburses for medical devices in a variety of ways depending on where and how the device is used. However, Medicare only provides reimbursement

if CMS determines that the device should be covered and that the use of the device is consistent with the coverage criteria. A coverage

determination can be made at the local level by the Medicare administrative contractor (formerly called carriers and fiscal intermediaries)

or a private contractor that processes and pays claims on behalf of CMS for the geographic area where the services were rendered, or

at the national level by CMS. There are new statutory provisions intended to facilitate coverage determinations for new technologies

under the Medicare Prescription Drug Improvement and Modernization Act of 2003 §731 and §942, but it is unclear how these new

provisions will be implemented. Coverage presupposes that the device has been cleared or approved by the FDA and, further, that the coverage

will be no broader than the approved intended uses of the device (i.e., the device’s label) as cleared or approved by the FDA,

but coverage can be narrower. In that regard, a narrow Medicare coverage determination may undermine the commercial viability of a device.

Obtaining

a coverage determination, whether local or national, is a time-consuming, expensive and highly uncertain proposition, especially for

a new technology, and inconsistent local determinations are possible. On average, according to an industry report, Medicare coverage

determinations for medical devices lag 15 months to five years or more behind FDA approval for respective devices. Moreover, Medicaid

programs and private insurers are frequently influenced by Medicare coverage determinations. A key component in the reimbursement decision

by most private insurers will be whether our products is reimbursed by virtue of a national coverage determination by CMS. We may negotiate

contracted rates our products with private insurance providers for the purchase of our products by their members pending a coverage determination

by CMS. Our inability to obtain a favorable coverage determination for our products may adversely affect our ability to market our products

and thus, the commercial viability of the product. In international markets, reimbursement and healthcare payment systems vary significantly

by country and many countries have instituted price ceilings on specific product lines. Distributors expressly support the reimbursement

process and, depending on the distribution agreement and geographic area, may assume responsibility for the process.

We

believe that the overall escalating cost of medical products and services has led to, and will continue to lead to, increased pressures

on the healthcare industry to reduce the costs of products and services. Furthermore, deficit reduction and austerity measures in the

United States and abroad may put further pressure on governments to limit coverage of, and reimbursement for, our products. There can

be no assurance that third-party reimbursement and coverage will be available or adequate, or that future legislation, regulation, or

reimbursement policies of third-party payors will not adversely affect the demand for our products or our ability to sell these products

on a profitable basis. The unavailability or inadequacy of third-party payor coverage or reimbursement could have a material adverse

effect on our business, operating results and financial condition. Until reimbursement or insurance coverage is established, patients

will have to bear the financial cost of our products. Third-party coverage may be particularly difficult to obtain while our products

is not approved by the FDA as a replacement for existing single-point finger stick devices.

Outside

the United States, availability of reimbursement from third parties varies widely from country to country. Within the EU, member countries’

medical reimbursement and healthcare coverage regulations and systems differ significantly. It is, therefore, difficult to analyze and

predict the prospect of consistent availability of adequate reimbursement in the various EU member countries.

Anti-Fraud

and Abuse Rule

There

are extensive United States federal and state laws and regulations prohibiting fraud and abuse in the healthcare industry that can result

in significant criminal and civil penalties that can materially affect us, if and when we receive FDA approval to market our products

in the United States. These federal laws include, by way of example, the following:

| |

● |

The anti-kickback

statute (Section 1128B(b) of the Social Security Act), which prohibits certain business practices and relationships that might affect

the provision and cost of healthcare services reimbursable under Medicare, Medicaid and other federal healthcare programs, including

the payment or receipt of remuneration for the referral of patients whose care will be paid by Medicare or other governmental programs; |

| |

● |

The physician

self-referral prohibition (Ethics in Patient Referral Act of 1989, as amended, commonly referred to as the Stark Law, Section 1877

of the Social Security Act), which prohibits referrals by physicians of Medicare or Medicaid patients to providers of a broad range

of designated healthcare services in which the physicians (or their immediate family members) have ownership interests or with which

they have certain other financial arrangements; |

| |

● |

The anti-inducement

provisions of the Civil Monetary Penalties Law (Section 1128A(a)(5) of the Social Security Act), which prohibit providers from offering

anything to a Medicare or Medicaid beneficiary to induce that beneficiary to use items or services covered by either program; |

| |

|

|

| |

● |

The False Claims Act (31

U.S.C. § 3729 et seq.), which prohibits any person from knowingly presenting or causing to be presented false or fraudulent

claims for payment to the federal government (including the Medicare and Medicaid programs); and |

| |

|

|

| |

● |

The Civil Monetary Penalties

Law (Section 1128A of the Social Security Act), which authorizes the United States Department of Health and Human Services to impose

civil penalties administratively for fraudulent or abusive acts. |

Sanctions

for violating these federal laws include criminal and civil penalties that range from punitive sanctions, damage assessments, monetary

penalties, imprisonment and/or denial of Medicare and Medicaid payments or exclusion from the Medicare and Medicaid programs, or both.

These laws also impose an affirmative duty on those receiving Medicare or Medicaid funding to ensure that they do not employ or contract

with persons excluded from the Medicare and other government programs.

Many

states have adopted or are considering legislative proposals similar to the federal fraud and abuse laws, some of which extend beyond

the Medicare and Medicaid programs, to prohibit the payment or receipt of remuneration for the referral of patients and physician self-referrals

regardless of whether the service was reimbursed by Medicare or Medicaid. Many states have also adopted or are considering legislative

proposals to increase patient protections, such as limiting the use and disclosure of patient specific health information. These state

laws also impose criminal and civil penalties similar to the federal laws.

Similarly,

the EU and EU member countries may have similar fraud and abuse laws which would regulate our business in those jurisdictions. However,

given the diversity of legal systems within the EU, it is difficult to predict with specificity what anti-fraud legislation and regulations

may be implemented and the penalties that they impose.

In

the ordinary course of their business, medical device manufacturers and suppliers have been and are subject regularly to inquiries, investigations

and audits by federal and state agencies that oversee these laws and regulations. Recent federal and state legislation has greatly increased

funding for investigations and enforcement actions, which have increased dramatically over the past several years. This trend is expected

to continue. Private enforcement of healthcare fraud also has increased due in large part to amendments to the civil False Claims Act

in 1986 that were designed to encourage private persons to sue on behalf of the government. These whistleblower suits by private persons,

known as qui tam relators, may be filed by almost anyone, including present and former patients or nurses and other employees, as well

as competitors. HIPAA, in addition to its privacy provisions, created a series of new healthcare-related crimes.

As

federal and state budget pressures continue, federal and state administrative agencies may also continue to escalate investigation and

enforcement efforts to root out waste and to control fraud and abuse in governmental healthcare programs. A violation of any of these

federal and state fraud and abuse laws and regulations could have a material adverse effect on a supplier’s liquidity and financial

condition. An investigation into the use of a device by physicians may dissuade physicians from recommending that their patients use

the device. This could have a material adverse effect on our ability to commercialize our products.

The

Privacy Provisions of HIPAA

In

the United States, HIPAA, among other things, protects the privacy and security of individually identifiable health information by limiting

its use and disclosure. HIPAA directly regulates “covered entities,” such as healthcare providers, insurers and clearinghouses,

and regulates “business associates,” with respect to the privacy of patients’ medical information. All entities that

receive and process protected health information are required to adopt certain procedures to safeguard the security of that information.

It is uncertain whether we would be deemed to be a covered entity under HIPAA and, owing to changes in the law, it is uncertain, based

on our current business model, whether we would be a business associate. Nevertheless, we will likely be contractually required to physically

safeguard the integrity and security of any patient information that we receive, store, create or transmit in the United States. If we

fail to adhere to our contractual commitments, then our physician, hospital or insurance customers may be subject to civil monetary penalties,

which could adversely affect our ability to market our devices. Changes in the law wrought by the provisions of Health Information Technology

for Economic and Clinical Health (HITECH) Act, enacted as part of the American Recovery and Reinvestment Act of 2009, increase the duties

of business associates and covered entities with respect to protected health information that thereby subject them to direct government

regulation, increasing its compliance costs and exposure to civil monetary penalties and other government sanctions. While HITECH does

not alter the definition of a business associate, it makes it more likely that covered entities with whom we are likely to do business

in the United States, if and when we receive FDA approval to market GlucoTrack® in the United States, will require us to enter into

business associate agreements.

Intellectual

Property

We

maintain a proactive intellectual property strategy, which includes patent filings in multiple jurisdictions, including the United States

and other commercially significant markets. We currently hold 59 issued patents in various regions including patents issued by the United

States, Australian, Brazilian, Canadian, Chinese, European, Hong Kong, Indian, Israeli, Japanese, Korean, Mexican, Philippine, Russian,

South African, and Taiwanese patent offices that cover various parts of our technology, which include A Method Of Monitoring Glucose