UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Amendment 1)

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT

OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

¨ Definitive

Additional Materials

¨

Soliciting Material under §240.14a-12

MULLEN AUTOMOTIVE INC.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨

Fee paid previously with preliminary materials.

¨

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Explanatory Note

The following information relates to and amends

(the “Amendment”) the definitive proxy statement (the “Proxy Statement”) of Mullen Automotive Inc.

(the “Company”), furnished to stockholders of the Company in connection with the special meeting of stockholders (the

“Special Meeting”) to be held on December 23, 2022 at 9:30 a.m. Pacific Standard Time, which was filed with

the Securities and Exchange Commission on November 25, 2022.

The purpose of this Amendment is to (a) withdraw

from stockholder consideration at the Special Meeting the Reincorporation Proposal (Proposal No. 3) set forth in the Proxy Statement,

(b) clarify certain matters regarding the vote required to approve the Reverse Stock Proposal (Proposal No. 1) and the Authorized

Share Increase Proposal (Proposal No. 2), and (c) provide information about a recent litigation matter related to the Special

Meeting.

Except as specifically amended or supplemented

by the information contained herein, this Amendment does not change the proposals to be acted on at the Special Meeting or the recommendation

of the Board with respect to any proposals and all information set forth in the Proxy Statement continues to apply and should be considered

in voting your shares. Capitalized but undefined terms used herein shall have the meaning given them in the Proxy Statement.

Withdrawal of Proposal No. 3 (the

Reincorporation Proposal) From Stockholder Consideration

The Board of Directors has determined not to proceed with the Reincorporation

Proposal (Proposal No. 3) at the Special Meeting, which proposal asked for stockholder approval to change the Company’s state

of incorporation from the State of Delaware to the State of Maryland. Accordingly, the Company will not be presenting this matter to a

vote at the Special Meeting, and the Proxy Statement is hereby amended to remove Proposal No. 3. As a result, the

Reincorporation will not be consummated and the Company will continue to remain incorporated in the State of Delaware at this time.

The Company intends

to hold the Special Meeting as previously scheduled, and at the Special Meeting, the Company intends to hold the vote on all matters

in the Proxy Statement, except Proposal No. 3. No vote will be taken with respect to Proposal No. 3 at the Special

Meeting. Therefore, any votes cast regarding Proposal No. 3 will neither be tabulated nor reported.

The Board reserves the

right to revisit the possibility of changing the Company’s state of incorporation from the State of Delaware to the State of Maryland

or any alternative proposal at any point in the future on such terms as may be determined at that time to be in the best interest of the

Company and its stockholders.

Certain Matters Regarding the 2022 Annual Meeting

of Stockholders

On July 26, 2022, the Company held its Annual

Meeting of Stockholders (the “2022 Annual Meeting”), at which stockholders voted on, among other things, a proposal

to increase the Company’s authorized number of shares of Common Stock to 1,750,000,000. The proxy statement for the 2022 Annual

Meeting stated that the number of shares of Common Stock issued and outstanding as of the June 2, 2022 record date (the “Annual

Meeting Record Date”), and eligible to vote on the increase in authorized shares, was 477,510,822. The proxy statement for the

2022 Annual Meeting also stated that the number of shares of Series B Preferred Stock issued and outstanding as of the Annual Meeting

Record Date was 0. The Company stated in its Form 8-K, filed on July 27, 2022 (the “July 2022 8-K”),

that there were 480,294,481 shares of Common Stock entitled to vote at the 2022 Annual Meeting as of the Annual Meeting Record Date, which

figure gave effect to the conversion into Common Stock of all shares of the Company’s previously outstanding Series B Preferred

Stock by the holder thereof prior to the Annual Meeting Record Date. The July 2022 8-K stated that 302,018,291 votes were represented

at the 2022 Annual Meeting, which figure included the shares of Common Stock into which the holder of the Company’s previously outstanding

Series B Preferred Stock had converted. The total number of shares of Common Stock, when considered separately as a class, who voted

in favor of the increase in authorized shares at the 2022 Annual Meeting, was 240,446,654. That vote total exceeds a majority of the total

number of shares of Common Stock as of the Annual Meeting Record Date when including the shares of Common Stock into which the holder

of the Company’s previously outstanding Series B Preferred Stock had converted.

Required Votes for Each Proposal to Pass

The first two rows of the table in the section

entitled “Required Votes for Each Proposal to Pass” on page 5 of the Proxy Statement shall read as follows:

| Proposal |

|

Vote Required |

|

Broker

Discretionary

Vote Allowed |

| Reverse Stock Split |

|

The affirmative vote of a majority of the voting power of the outstanding shares of our Common Stock, Series A Preferred Stock, Series B Preferred Stock (voting on an as-converted to Common Stock basis), our Series C Preferred Stock (voting on an as-converted to Common Stock basis), and the share of Series AA Preferred Stock, entitled to vote thereon, all voting together. The Series AA Preferred Stock will vote as described under “Record Date; Voting - Series AA Preferred Stock” and PROPOSAL NO. 1: THE REVERSE STOCK SPLIT PROPOSAL - Vote Required for Approval of this Proposal and Recommendation.” The Company will also perform a separate tabulation of the “Alternative Vote” as described under the heading “PROPOSAL NO. 1: THE REVERSE STOCK SPLIT PROPOSAL - Vote Required for Approval of this Proposal and Recommendation” below. |

|

Yes |

| |

|

|

|

|

| Authorized Share Increase |

|

The affirmative vote of a majority of the voting power of (i) the outstanding shares of our Common Stock, entitled to vote thereon, voting as a separate class, and (ii) the outstanding shares of our Common Stock, Series A Preferred Stock, Series B Preferred Stock (voting on an as-converted to Common Stock basis), and our Series C Preferred Stock (voting on an as-converted to Common Stock basis), entitled to vote thereon, all voting together. |

|

Yes |

The first full paragraph under the table in the section entitled

“Required Votes for Each Proposal to Pass” on page 5 of the Proxy Statement shall read as follows:

Abstentions and broker non-votes (as applicable) will count as votes

against the Authorized Share Increase Proposal, but abstentions and broker non-votes (as applicable) will not have an effect on the Nasdaq

Listing Rule 5635(d) Proposal and the Adjournment Proposal. If the Series AA Preferred Stock was not issued and outstanding,

then abstentions and broker non-votes would have the same effect as a vote against the Reverse Stock Split Proposal. However, since the

Series AA Preferred Stock will mirror only votes cast, abstentions and broker non-votes will not have any effect on the votes cast

by the holders of the Series AA Preferred Stock on the Reverse Stock Split Proposal. The Company intends to ask the inspector of

elections to perform a separate tabulation to determine if the Reverse Stock Split Proposal would have been approved and adopted if the

Series AA Preferred Stock was excluded from the stock entitled to vote thereon. If the Series AA Preferred Stock was excluded

from the stock entitled to vote on the Reverse Stock Split Proposal, this proposal would require approval by the affirmative vote of a

majority of the voting power of all outstanding shares of our stock entitled to vote thereon, all voting together (the “Alternative

Vote”). In performing the tabulation of the Alternative Vote, abstentions and broker non-votes would have the same effect as

a vote against the Alternative Vote. If the Alternative Vote is favorable, then the Reverse Stock Split Proposal will be approved even

without considering the votes cast by the holders of the Series AA Preferred Stock.

PROPOSAL NO. 1: THE REVERSE STOCK SPLIT PROPOSAL

Vote Required for Approval of this Proposal

and Recommendation

The second sentence in the first paragraph

of the section entitled “Vote Required for Approval of this Proposal and Recommendation” on page 14 of the Proxy Statement

shall read as follows:

Approval of the Reverse Stock Split Proposal will require the affirmative

vote of a majority of the voting power of the outstanding shares of our Common Stock, Series A Preferred Stock, Series B Preferred

Stock (voting on an as-converted to Common Stock basis), our Series C Preferred Stock (voting on an as-converted to Common Stock

basis), and the share of Series AA Preferred Stock, entitled to vote thereon, all voting together.

The second paragraph in the section entitled “Vote Required

for Approval of this Proposal and Recommendation” on page 14 of the Proxy Statement shall read as follows:

Proposal No. 1 is a routine matter. If you own shares through

a bank, broker or other holder of record, those shares may be voted on Proposal No. 1 by such bank, broker or other holder of record

without your instructions. Accordingly, the Company does not anticipate that there will be broker non-votes on this proposal. If the Series AA

Preferred Stock was not issued and outstanding, then abstentions and broker non-votes would have the same effect as a vote against the

Reverse Stock Split Proposal. However, since the Series AA Preferred Stock will mirror only votes cast, abstentions and broker non-votes

will not have any effect on the votes cast by the holders of the Series AA Preferred Stock on the Reverse Stock Split Proposal. The

Company intends to ask the inspector of elections to perform a separate tabulation to determine if the Reverse Stock Split Proposal would

have been approved and adopted if the Series AA Preferred Stock was excluded from the stock entitled to vote thereon. If the Series AA

Preferred Stock was excluded from the stock entitled to vote on the Reverse Stock Split Proposal, this proposal would require approval

by the affirmative vote of a majority of the voting power of all outstanding shares of our stock entitled to vote thereon, all voting

together (the “Alternative Vote”). In performing the tabulation of the Alternative Vote, abstentions and broker non-votes

would have the same effect as a vote against the Alternative Vote. If the Alternative Vote is favorable, then the Reverse Stock Split

Proposal will be approved even without considering the votes cast by the holders of the Series AA Preferred Stock. Abstentions and

broker non-votes will be considered present for the purpose of determining the presence of a quorum. If the stockholders do not approve

Proposal No. 1, the Reverse Stock Split will not be implemented.

PROPOSAL NO. 2: THE AUTHORIZED SHARE INCREASE

PROPOSAL

Vote Required for Approval of this Proposal

and Recommendation

The section entitled “Vote Required for

Approval of this Proposal and Recommendation” on pages 16 and 17 of the Proxy Statement shall read as follows:

You may vote in favor of or against this proposal or you may abstain

from voting. Approval of the Authorized Share Increase Proposal will require the affirmative vote of a majority of the voting power of

(i) the outstanding shares of our Common Stock, voting as a separate class, and (ii) the outstanding shares of our Common Stock,

Series A Preferred Stock, Series B Preferred Stock (voting on an as-converted to Common Stock basis) and Series C Preferred

Stock (voting on an as-converted to Common Stock basis) entitled to vote thereon, all voting together. If stockholders do not specify

the manner in which their shares represented by a validly executed proxy solicited by the Board are to be voted on this proposal, such

shares will be voted in favor of the approval of the Authorized Share Increase Proposal.

Proposal No. 2 is a routine matter. If you own shares through

a bank, broker or other holder of record, those shares may be voted on Proposal No. 2 by such bank, broker or other holder of record.

Accordingly, the Company does not anticipate that there will be broker non-votes on this Proposal. Abstentions and broker non-votes will

have the same effect as a vote against this proposal. Abstentions and broker non-votes will be considered present for the purpose of determining

the presence of a quorum.

Important Matters

Regarding Voting

| · | The Record Date for determining the stockholders entitled to receive notice of, and to vote at, the Special

Meeting has been set and remains as the close of business on November 21, 2022. |

| · | The Company will not make available or distribute, and you do not need to sign new proxy cards or submit

new voting instructions solely as a result of this Amendment. |

| · | Proxy cards or voting instructions received with direction on Proposal No. 3 will not be voted on

Proposal No. 3. Proxy cards or voting instructions received and providing direction on the remaining proposals to be considered at

the Special Meeting (i.e., Proposals No. 1, 2, 4 and 5) will remain valid, and will be voted on those proposals as directed. |

| · | If you already submitted a proxy card or voting instructions, you do not need to resubmit proxies or voting

instructions with different directions, unless you wish to change votes previously cast on the remaining proposals. You may change your

vote at any time prior to the Special Meeting. |

You may vote your shares by using one of the following methods:

| (1) | you may vote by mail by marking your proxy card, and then date, sign and return it in the postage-paid envelope provided; or |

| (2) | you may vote electronically by accessing the website located at www.proxyvote.com and following the on-screen instructions; or |

| (3) | you may vote by using a telephone at 1 (800) 690-6903 and following the voting instructions. |

Litigation

On December 7, 2022, a putative stockholder class action was filed

in the Court of Chancery of the State of Delaware, styled as Robbins v. Michery, et al., C.A. No. 2022-1131-LWW (the “Robbins

Action”). On December 13, 2022, a second putative stockholder class action was filed in the Court of Chancery of the State of

Delaware, styled as Foley v. Michery, et al., C.A. No. 2022-1147-LWW (the “Foley Action” and, together

with the Robbins Action, the “Stockholder Actions”). The defendants in the Stockholder Actions are the

Company, David Michery, Ignacio Novoa, Mary Winter, Mark Betor, John K. Anderson, William Miltner, Kent Puckett, and Jonathan New. The

plaintiffs in the Stockholder Actions filed complaints alleging that the number of number of shares of Common Stock issued and outstanding

as of the Annual Meeting Record Date was 477,510,822 and that, based on this eligible share total, a majority of shares of Common Stock,

when considered separately as a class, did not vote in favor of the increase in authorized shares at the 2022 Annual Meeting. The plaintiffs

in the Stockholder Actions also alleged that the Company’s board of directors misstated certain information material to the stockholders’

votes. Lastly, the plaintiffs in the Stockholder Actions alleged that the Series AA Preferred Stock impermissibly subverts the voting

standard applicable to the Reverse Stock Split Proposal. The plaintiffs in the Stockholder Actions have moved the Court of Chancery of

the State of Delaware for, among other things, entry of a status quo order to preserve the issues raised in the Stockholder Actions

for adjudication.

While the Company believes that the Stockholder Actions lack merit

and that the disclosures set forth in the Proxy Statement comply fully with applicable law, in order to moot plaintiffs’ disclosure

claims, avoid nuisance and expense associated with litigation and provide additional information to our stockholders, the Company has

determined to voluntarily supplement the Proxy Statement. This supplemental information shall not be deemed an admission of the legal

necessity or materiality under applicable law of any of the disclosures provided herein. To the contrary, the Company specifically denies

all allegations that any additional disclosure was or is required in the Proxy Statement. The defendants intend to defend themselves

against the Stockholder Actions. There can be no assurances that the court will not enjoin the Special Meeting or the consummation of

the transactions contemplated thereby.

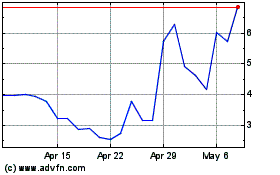

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Mar 2024 to Apr 2024

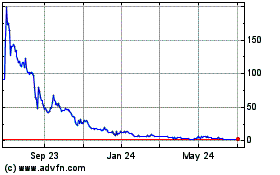

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Apr 2023 to Apr 2024