Current Report Filing (8-k)

November 25 2022 - 4:06PM

Edgar (US Regulatory)

Beachbody Company, Inc. false 0001826889 0001826889 2022-11-23 2022-11-23 0001826889 body:CommonStockClassXMember 2022-11-23 2022-11-23 0001826889 us-gaap:WarrantMember 2022-11-23 2022-11-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 23, 2022

The Beachbody Company, Inc.

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-39735 |

|

85-3222090 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 400 Continental Blvd, Suite 400 El Segundo, California |

|

|

|

90245 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

(310) 883-9000

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

|

BODY |

|

The New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for one Class A common stock at an exercise price of $11.50 |

|

BODY WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On November 23, 2022, The Beachbody Company, Inc. (the “Company”) received notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that as of November 22, 2022 it was not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”) because the average closing price of the Company’s Class A Common Stock (the “Common Stock”) was less than $1.00 per share over a consecutive 30 trading-day period. The Notice has no immediate impact on the listing of the Common Stock on the NYSE, subject to the Company’s compliance with the NYSE’s other continued listing requirements.

Pursuant to Section 802.01C, the Company has a period of six months following the receipt of the Notice to regain compliance with the minimum share price requirement. The Company may regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the six-month cure period the Common Stock has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month. If the Company is unable to regain compliance with the $1.00 share price rule within this period, the NYSE will initiate procedures to suspend and delist the Common Stock. However, if the Company determines that it will cure the price condition by taking an action that will require shareholder approval, the Company must so inform the NYSE and must obtain shareholder approval no later than its next annual meeting, and must implement the action promptly thereafter.

Section 802.01C requires the Company to notify the NYSE, within 10 business days of receipt of the Notice, of its intent to cure this deficiency. The Company intends to notify the NYSE of its intent to regain compliance with the requirements of Section 802.01C.

The Notice does not affect the Company’s business operations or its reporting obligations with the Securities and Exchange Commission.

| Item 7.01 |

Regulation FD Disclosure |

On November 25, 2022, the Company issued a press release related to the foregoing. A copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated by reference to this Item 7.01.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any filing by Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language contained in such filing, unless otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report on Form 8-K includes statements that may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s ability to maintain the listing of its Class A Common Stock on the NYSE and the Company’s anticipated business and financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include the Company’s ability to remain in compliance with and not in default under its credit facility, the ability to timely procure additional financing or other strategic options on favorable terms, or at all, and the risks and uncertainties described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities laws.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

The Beachbody Company, Inc. |

|

|

|

|

| Date: November 25, 2022 |

|

|

|

By: |

|

/s/ Blake Bilstad |

|

|

|

|

Name: |

|

Blake T. Bilstad |

|

|

|

|

Title: |

|

Chief Legal Officer and Corporate Secretary |

Beachbody (NYSE:BODY)

Historical Stock Chart

From Aug 2024 to Sep 2024

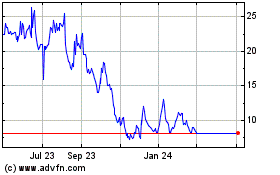

Beachbody (NYSE:BODY)

Historical Stock Chart

From Sep 2023 to Sep 2024