Jowell Global Ltd. (“Jowell” or the “Company”) (NASDAQ: JWEL), one

of the leading cosmetics, health and nutritional supplements, and

household products e-commerce platforms in China, today announced

its unaudited financial results for the six months ended June 30,

2022.

First Half 2022 Financial and Operational

Highlights

- Total revenues were $100.4 million, an

increase of 47.5% from $68.1 million in the same period of

2021.

- Net loss was $8.0 million, an increase of

1052.8% compared to a net loss of $0.7 million in the same period

of 2021.

- Total GMV (Gross Merchandise Value) transacted

in our online shopping mall was $145.5 million, an increase of

61.8% from $89.9 million in the same period of 2021.

- Total VIP members1 as of June 30, 2022 were

approximately 2.4 million, an increase of 15.1% compared to

approximately 2.1 million as of June 30, 2021.

- Total LHH stores2 as of June 30, 2022 were

26,224, an increase of 2.5% compared to 25,588 as of June 30,

2021.

Mr. Zhiwei Xu, Chief Executive Officer and

Chairman of Jowell Global Ltd., commented: “We remain confident

about the enormous long-term potential of China’s consumer market.

Although multiple cities in China implemented quarantine and

restrictive measure to contain the spread of COVID-19 in the first

half of the year, we achieved 62% and 48% year-over-year growth in

GMV and revenues respectively, through a series of promotional

activities which strengthened our existing and expanded new

customer bases. As of the end of June, 2022, we grew our VIP

members to approximately 2.4 million and LHH stores to 26,224.”

Ms. Mei Cai, Chief Financial Officer, added:

“During the first half of this year, we carried out long lasting

promotional activities in order to keep inventory at a healthy

level, which have brought us more new customer orders and higher

priced premium product orders. As a result, sales of our cosmetic

products and household products achieved 68% and 114%

year-over-year growth, respectively. During the second quarter, we

have completed private placements for approximately $6.3 million

and believe our cash position will meet our operating needs for at

least one year.”

|

1 |

|

“Total VIP members refers to the total number of members registered

on Jowell’s platform as of June 30, 2022. |

| 2 |

|

LHH stores: the brand name of “Love Home Store”. Authorized

retailers may operate as independent stores or store-in-shop (an

integrated store), selling products they purchased through Jowell’s

online platform LHH Mall under their retailer accounts which

provides them with major discounts. |

Impact of COVID-19 Pandemic

Beginning in late 2019, there was an outbreak of

COVID-19 (coronavirus) which spread quickly across many parts of

China, the U.S. and worldwide. In March 2020, the World Health

Organization declared the COVID-19 a pandemic. With an aim to

contain the COVID-19 outbreak, the Chinese government imposed

various measures across the country including, but not limited to,

travel restrictions, mandatory quarantine requirements, and

postponed resumption of business operations until after the 2020

Chinese New Year holiday. Starting from March 2020, businesses in

China began to reopen and interruptions to businesses were

gradually removed. However, due to the outbreak of Omicron variant

in the first half of 2022 in China, many cities in China have

imposed new restrictions, quarantine and testing requirements and

office closures, including Shanghai, where our headquarters are

located. Employees of our VIE in Shanghai office worked from home

from March 30, 2022 to June 1, 2022.

During the first half of 2022, the outbreak of

COVID-19 and related control measures in China have caused negative

impact on our product shipping and delivery as well as marketing

activities and expenses due to travel restrictions and quarantine

requirements. In response to the challenges, we implemented

additional sales promotion measures to attract consumers and reduce

the inventory during the period. Although, the outbreak has been

generally under control in most parts of China now, it is hard to

predict the impact of the COVID-19 pandemic on our business

operations and financial results for remaining months of 2022,

which is highly dependent on numerous factors beyond our control,

such as the duration and spread of the pandemic, COVID-19

resurgence or new variant outbreak like Omicron, COVID-19 vaccine

efficacy and distribution, and COVID-19 containment actions

implemented by government authorities or other entities and the

implementation of zero COVID policy in China, such as the

restrictions and office closures in Shanghai and other cities in

China, almost all of which are beyond our control.

First Half 2022 Financial Results

Total Revenues

Total revenues for the first half 2022 were

$100.4 million, representing an increase of 47.5% from $68.1

million in the same period of 2021, primarily due to increase in

the weighted average unit price of our products sold. Our weighted

average unit price was $5.66 per unit for the first half of 2022,

which increased by 45.0% from $3.90 per unit for the same period of

2021. In the first half of 2022, we have broadened our product

offerings and focused on promoting premium brand products with

higher average selling prices, which increased average selling

prices for cosmetic products and household products. By selling

these products, we have also attracted orders from more

distributors in the first half of 2022, during which Shanghai

Juhao Information Technology Co., Ltd. (“Shanghai Juhao”) has sold

products to 291 distributors when compared to 188 distributors in

the same period of 2021, and sales to distributors have also

increased, representing approximately 86% of total revenue in the

first half 2022 when compared to 68% in the same period of

2021.

|

|

|

First Half Ended June 30 |

|

|

% |

|

| Revenues |

|

2022 |

|

|

2021 |

|

|

change |

|

|

(in thousand) |

|

US$ |

|

|

US$ |

|

|

YoY* |

|

| Product sales |

|

|

|

|

|

|

|

|

|

|

● Cosmetic products |

|

|

46,135.7 |

|

|

|

27,537.1 |

|

|

|

67.5 |

% |

|

● Health and nutritional

supplements |

|

|

23,048.1 |

|

|

|

26,018.5 |

|

|

|

-11.4 |

% |

|

● Household products |

|

|

31,053.2 |

|

|

|

14,501.8 |

|

|

|

114.1 |

% |

|

● Others |

|

|

170.0 |

|

|

|

18.1 |

|

|

|

841.2 |

% |

| Total |

|

|

100,407.0 |

|

|

|

68,075.4 |

|

|

|

47.5 |

% |

Total operating expenses were

$108.9 million in the first half of 2022, an increase of 58.5% from

$68.7 million in the same period of 2021.

- Cost of revenues were $96.5 million

in the first half of 2022, an increase of 52.7% from $63.2 million

in the same period of 2021. The increase was primarily due to

increased weighted average unit cost. Our weighted average unit

cost was $5.44 per unit for the first half of 2022, which increased

by 50.1% from $3.62 per unit for the same period of 2021. This is

because we have sold more premium brand products, which are higher

in unit cost than our self-branded and other generic products. Cost

of sales as a percentage of total revenues was 96.1%, up from 92.9%

in the same period of 2021. The Company periodically purchases

merchandise from a related party controlled by the Chief Executive

Officer and Chairman of the Company, during the ordinary course of

business. For the first half of 2022, products purchased from this

related party were $38.0 million or 21.27% of the total purchases

of the Company.

- Fulfillment expenses primarily

consist of costs related to order fulfillment, including expenses

we paid for order preparing, packaging, outbound freight, and

physical storage. Fulfillment expenses were $1.8 million in the

first half of 2022, an increase of 77.4% from $1.0 million in the

same period of 2021. The increase was primarily due to $0.4 million

increase in shipping costs led by the increase in average shipping

cost, as we sold more premium products with higher value, which

required higher shipping charge; and $0.3 million increase in

warehouse rent as we rented more spaces since the third quarter of

2021 to meet our business growth needs. Fulfillment expenses as a

percentage of total revenues were 1.7%, up from 1.4% in the same

period of 2021.

- Marketing expenses primarily

consist of targeted online advertising, payroll and related

expenses for personnel engaged in marketing and selling activities.

Marketing expenses were $6.2 million in the first half of 2022, an

increase of 152.4% from $2.5 million in the same period of 2021.

Specifically, we incurred approximately $1.4 million more costs in

advertising and promotional activities and approximately $1.0

million more marketing consulting fees as compared to the same

period of 2021, in order to further enhance brand awareness in

strategic geographic areas; and approximately $0.9 million more

payroll and social security costs as compared to the same period of

2021, as we have expanded our sales team in order to obtain more

orders from large corporate customers. Marketing expense as

percentage of total revenues was 6.2% in the first half of 2022, up

from 3.6% in the same period of 2021.

- General and administrative expenses

mainly consist of payroll, depreciation, office supplies and upkeep

expenses. General and administration expenses were $4.5 million in

the first half of 2022, an increase of 117.1% from $2.1 million in

the same period of 2021. The increase was primarily due to $0.9

million in bad debt expenses due to the increase of aged

receivables and advance to suppliers, and $1.2 million increase in

share-based compensation for services provided by executives and

employees. General and administration expenses as percentage of

total revenues was 4.4% in the first half of 2022, up from 3.0% in

the same period of 2021.

Operating loss

Operating loss was $8.5 million, compared to the

operating loss of $0.6 million in the same period of 2021.

Operating loss was primarily due to the implementation of our

business expansion plan, which has significantly increased our cost

of revenues, marketing expenses and general and administrative

expenses.

Net loss

Net loss was $8.0 million, an increase of 1052.8% compared to

net loss of $0.7 million in the same period of 2021.

Earnings (Loss) per share

The Company computes earnings (loss) per share

(“EPS”) in accordance with ASC 260, “Earnings per Share” (“ASC

260”). The Company’s each Preferred Share has voting rights equal

to two Ordinary Shares of the Company and each Preferred Share is

convertible into one Ordinary Share at any time by its holder.

Except for voting rights and conversion rights, the Ordinary Shares

and the Preferred Shares shall rank pari passu with one another and

shall have the same rights, preferences, privileges and

restrictions. For the first half ended June 30, 2022 and 2021, the

Company had no potential ordinary shares outstanding that could

potentially dilute EPS in the future.

Cash and cash equivalents

As of June 30, 2022, the Company had cash and

restricted cash of $10.3 million, among which $2.5 million of

the cash were held by Shanghai Juhao with banks and financial

institutions inside China as the Company conducted its operations

primarily through Shanghai Juhao, a consolidated variable interest

entity (“VIE”) of the Company in China.

For the first half of 2022, the Company reported

a net loss of $8.03 million and a negative operating cash flows of

$16.19 million. Since the Company went public in March 2021, we

have focused on implementation of our business expansion plan,

which has significantly increased our cost of revenues, marketing

expenses and general and administrative

expenses.

Presently, the Company’s principal sources of

liquidity are from its operations, proceeds from its recent private

placements of $6.3 million, and the bank loan. With the uncertainty

of the current market and the impact of the COVID-19 pandemic,

management believes it is necessary to enhance the collection of

our accounts receivable, control of our expenses, and be cautious

on operational decisions and project selections. As of August 31,

2022, approximately $4.2 million, or 81%, of our accounts

receivable balance as of June 30, 2022 had been collected.

Based on the latest business plan of the

Company, Shanghai Juhao has reduced its promotion efforts and

marketing expenditures since the second half of 2022, which will

reduce its cash flow used in operating activities. Therefore,

management believes that the above-mentioned measures, as well as

existing cash and restricted cash on hand of approximately

$10.3 million, will collectively provide sufficient liquidity

for the Company to meet its future liquidity and capital

requirements for at least next twelve months from the date the

Company’s condensed consolidated financial statements are

issued.

About Jowell Global Ltd.

Jowell Global Ltd. (the “Company”) is one of the

leading cosmetics, health and nutritional supplements and household

products e-commerce platforms in China. We offer our own brand

products to customers and also sell and distribute health and

nutritional supplements, cosmetic products and certain household

products from other companies on our platform. In addition, we

allow third parties to open their own stores on our platform for a

service fee based upon sale revenues generated from their online

stores and we provide them with our unique and valuable information

about market needs, enabling them to better manage their sales

effort, as well as an effective platform to promote their brands.

The Company also sells its products through authorized retail

stores all across China, which operate under the brand names of

“Love Home Store” or “LHH Store” and “Juhao Best Choice Store”. For

more information, please visit http://ir.1juhao.com/.

Exchange Rate

The Company’s financial information is presented

in U.S. dollars (“USD”). The functional currency of the Company is

the Chinese Yuan, Renminbi (“RMB”), the currency of the PRC. Any

transactions which are denominated in currencies other than RMB are

translated into RMB at the exchange rate quoted by the People’s

Bank of China prevailing at the dates of the transactions, and

exchange gains and losses are included in the statements of

operations as foreign currency transaction gain or loss. The

consolidated financial statements of the Company have been

translated into U.S. dollars in accordance with ASC 830, “Foreign

Currency Matters”.

This press release contains translations of

certain RMB amounts into U.S. dollars (“USD” or “$”) at specified

rates solely for the convenience of the reader. The exchange rates

in effect as of June 30, 2022 and December 31, 2021 were RMB1 for

$0.1493 and $0.1572, respectively. The average exchange rates for

the six months ended June 30, 2022 and 2021 were RMB1 for $0.1543

and $0.1545, respectively.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement. In some cases, forward-looking

statements can be identified by words or phrases such as “may,”

“will,” “expect,” “anticipate,” “target,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “potential,” “continue,” “is/are

likely to” or other similar expressions. The Company may also make

written or oral forward-looking statements in its reports filed

with, or furnished to, the U.S. Securities and Exchange Commission,

in its annual reports to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. These statements are

subject to uncertainties and risks including, but not limited to,

the following: the Company’s goals and strategies; the Company’s

future business development; financial condition and results of

operations; product and service demand and acceptance; reputation

and brand; the impact of competition and pricing; changes in

technology; government regulations; fluctuations in general

economic and business conditions in China and assumptions

underlying or related to any of the foregoing and other risks

contained in reports filed by the Company with the SEC. For these

reasons, among others, investors are cautioned not to place undue

reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company’s filings with the

SEC, which are available for review at www.sec.gov. The Company

undertakes no obligation to publicly revise these forward-looking

statements to reflect events or circumstances that arise after the

date hereof.

For investor and media inquiries, please

contact:

In China:Jowell Global Ltd.Ms. Jessie ZhaoEmail:

IR@1juhao.com

The Blueshirt GroupMs. Ally WangEmail:

ally@blueshirtgroup.com

In the United States:

The Blueshirt GroupMs. Julia QianEmail:

Julia@blueshirtgroup.com

JOWELL GLOBAL

LTDCONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited)

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| ASSETS |

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

Cash |

|

$ |

7,294,808 |

|

|

$ |

18,249,737 |

|

|

Restricted cash |

|

|

3,000,000 |

|

|

|

2,999,990 |

|

|

Accounts receivable |

|

|

4,724,102 |

|

|

|

4,966,226 |

|

|

Accounts receivable - related parties |

|

|

268,505 |

|

|

|

480,111 |

|

|

Advance to suppliers |

|

|

5,610,921 |

|

|

|

5,211,542 |

|

|

Advance to suppliers - related parties |

|

|

9,893,840 |

|

|

|

- |

|

|

Inventories, net |

|

|

13,045,643 |

|

|

|

12,316,766 |

|

|

Prepaid expenses and other current assets |

|

|

1,944,721 |

|

|

|

2,082,409 |

|

|

Total current assets |

|

|

45,782,540 |

|

|

|

46,306,781 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term investment |

|

|

4,784,212 |

|

|

|

4,861,824 |

|

|

Property and equipment, net |

|

|

1,119,279 |

|

|

|

524,428 |

|

|

Intangible assets, net |

|

|

988,999 |

|

|

|

386,510 |

|

|

Right of use lease assets, net |

|

|

4,411,567 |

|

|

|

5,284,379 |

|

|

Other non-current asset |

|

|

267,606 |

|

|

|

1,090,471 |

|

|

Deferred tax assets |

|

|

560,635 |

|

|

|

273,525 |

|

|

Total Assets |

|

$ |

57,914,838 |

|

|

$ |

58,727,918 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Short-term loan |

|

$ |

2,538,033 |

|

|

$ |

2,672,366 |

|

|

Accounts payable |

|

|

7,348,227 |

|

|

|

5,054,867 |

|

|

Accounts payable - related parties |

|

|

17,616 |

|

|

|

2,333,455 |

|

|

Deferred revenue |

|

|

4,076,437 |

|

|

|

2,060,872 |

|

|

Deferred revenue - related parties |

|

|

7,746 |

|

|

|

93,170 |

|

|

Current portion of operating lease liabilities |

|

|

1,338,337 |

|

|

|

1,317,006 |

|

|

Accrued expenses and other liabilities |

|

|

1,485,404 |

|

|

|

1,341,690 |

|

|

Due to related parties |

|

|

174,417 |

|

|

|

134,381 |

|

|

Taxes payable |

|

|

360,116 |

|

|

|

43,019 |

|

|

Total current liabilities |

|

|

17,346,333 |

|

|

|

15,050,826 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current portion of operating lease liabilities |

|

|

3,083,191 |

|

|

|

3,993,641 |

|

|

Total liabilities |

|

|

20,429,524 |

|

|

|

19,044,467 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 450,000,000 shares authorized,

31,458,215 and 25,677,965 issued and outstanding at June 30,

2022 and December 31, 2021, respectively |

|

|

3,146 |

|

|

|

2,568 |

|

|

Preferred stock, $0.0001 par value, 50,000,000 shares authorized,

750,000 issued and outstanding at June 30, 2022 and December

31, 2021, respectively |

|

|

75 |

|

|

|

75 |

|

|

Additional paid-in capital |

|

|

48,260,633 |

|

|

|

40,827,231 |

|

|

Statutory reserves |

|

|

394,541 |

|

|

|

394,541 |

|

|

Accumulated deficit |

|

|

(11,071,015 |

) |

|

|

(3,036,045 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

(102,066 |

) |

|

|

1,495,081 |

|

|

Total Stockholders’ Equity |

|

|

37,485,314 |

|

|

|

39,683,451 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

57,914,838 |

|

|

$ |

58,727,918 |

|

|

|

5

JOWELL GLOBAL

LTDCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS(Unaudited)

|

|

|

For the Six Months EndedJune

30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

Net Revenues |

|

|

|

|

|

|

|

Revenues - third party |

|

$ |

100,314,724 |

|

|

$ |

66,822,990 |

|

|

Revenues - related party |

|

|

92,318 |

|

|

|

1,252,451 |

|

|

Total Net Revenues |

|

|

100,407,042 |

|

|

|

68,075,441 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(96,499,119 |

) |

|

|

(63,212,058 |

) |

|

Fulfillment expenses |

|

|

(1,751,330 |

) |

|

|

(986,971 |

) |

|

Marketing expenses |

|

|

(6,209,824 |

) |

|

|

(2,460,195 |

) |

|

General and administrative expenses |

|

|

(4,463,950 |

) |

|

|

(2,056,529 |

) |

|

Total operating expenses |

|

|

(108,924,223 |

) |

|

|

(68,715,753 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss From Operations |

|

|

(8,517,181 |

) |

|

|

(640,312 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses), net |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(60,013 |

) |

|

|

(30,544 |

) |

|

Investment income |

|

|

172,416 |

|

|

|

- |

|

|

Other income (expense), net |

|

|

58,780 |

|

|

|

(7,687 |

) |

|

Other Income (expenses), net |

|

|

171,183 |

|

|

|

(38,231 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss Before Income Taxes |

|

|

(8,345,998 |

) |

|

|

(678,543 |

) |

|

|

|

|

|

|

|

|

|

|

|

Provision (Benefit) for Income Taxes |

|

|

(311,028 |

) |

|

|

18,444 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,034,970 |

) |

|

$ |

(696,987 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss Per share – Basic and Diluted |

|

$ |

(0.30 |

) |

|

$ |

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding – Basic and

diluted |

|

|

26,404,465 |

|

|

|

23,594,306 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,034,970 |

) |

|

$ |

(696,987 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other Comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

|

(1,597,147 |

) |

|

|

269,397 |

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Loss |

|

$ |

(9,632,117 |

) |

|

$ |

(427,590 |

) |

|

|

JOWELL GLOBAL

LTDCONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

STOCKHOLDERS’ EQUITYFOR THE SIX MONTHS ENDED JUNE

30, 2022 AND 2021(Unaudited)

|

|

|

Commom Stock |

|

Preferred Stock |

|

AdditionalPaid-in |

|

Statutory |

|

RetainedEarnings(Accumulated |

|

|

AccumulatedOtherComprehensive |

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

Shares |

|

|

Amount |

|

Capital |

|

Reserves |

|

deficit) |

|

|

Income (loss) |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2022 |

|

25,677,965 |

|

|

$ |

2,568 |

|

750,000 |

|

|

$ |

75 |

|

$ |

40,827,231 |

|

$ |

394,541 |

|

$ |

(3,036,045 |

) |

|

$ |

1,495,081 |

|

|

$ |

39,683,451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private placements issuance |

|

5,230,000 |

|

|

|

523 |

|

- |

|

|

|

- |

|

|

6,275,477 |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

6,276,000 |

|

|

Share-based compensation |

|

550,250 |

|

|

|

55 |

|

- |

|

|

|

- |

|

|

1,157,925 |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

1,157,980 |

|

|

Net loss for the period |

|

- |

|

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

- |

|

|

(8,034,970 |

) |

|

|

- |

|

|

|

(8,034,970 |

) |

|

Foreign currency translation loss |

|

- |

|

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

(1,597,147 |

) |

|

|

(1,597,147 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2022 |

|

31,458,215 |

|

|

$ |

3,146 |

|

750,000 |

|

|

$ |

75 |

|

$ |

48,260,633 |

|

$ |

394,541 |

|

$ |

(11,071,015 |

) |

|

$ |

(102,066 |

) |

|

$ |

37,485,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2021 |

|

21,149,425 |

|

|

$ |

2,115 |

|

750,000 |

|

|

$ |

75 |

|

$ |

14,171,120 |

|

$ |

394,541 |

|

$ |

3,353,031 |

|

|

$ |

823,862 |

|

|

$ |

18,744,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares, net of offering expenses |

|

4,271,429 |

|

|

|

427 |

|

- |

|

|

|

- |

|

|

25,684,937 |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

25,685,364 |

|

|

Share-based compensation |

|

50,000 |

|

|

|

5 |

|

- |

|

|

|

- |

|

|

155,848 |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

155,853 |

|

|

Net loss for the period |

|

- |

|

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

- |

|

|

(696,987 |

) |

|

|

- |

|

|

|

(696,987 |

) |

|

Foreign currency translation gain |

|

- |

|

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

269,397 |

|

|

|

269,397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2021 |

|

25,470,854 |

|

|

$ |

2,547 |

|

750,000 |

|

|

$ |

75 |

|

$ |

40,011,905 |

|

$ |

394,541 |

|

$ |

2,656,044 |

|

|

$ |

1,093,259 |

|

|

$ |

44,158,371 |

|

|

|

JOWELL GLOBAL

LTDCONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)

|

|

|

For the Six Months EndedJune

30, |

|

|

|

|

2022 |

|

|

2021 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,034,970 |

) |

|

$ |

(696,987 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

195,420 |

|

|

|

52,738 |

|

|

Income from long-term investment |

|

|

(172,416 |

) |

|

|

- |

|

|

Allowance for doubtful accounts |

|

|

906,484 |

|

|

|

- |

|

|

Amortization of operating lease right-of-use assets |

|

|

663,044 |

|

|

|

441,527 |

|

|

Inventory reserve |

|

|

337,630 |

|

|

|

7,269 |

|

|

Deferred income taxes |

|

|

(311,028 |

) |

|

|

- |

|

|

Share-based compensation |

|

|

1,157,980 |

|

|

|

155,853 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivables |

|

|

(442,472 |

) |

|

|

(4,206,937 |

) |

|

Accounts receivable - related Parties |

|

|

193,809 |

|

|

|

(129,681 |

) |

|

Trade notes receivable |

|

|

- |

|

|

|

(139,067 |

) |

|

Inventories |

|

|

(1,731,202 |

) |

|

|

(7,635,775 |

) |

|

Advance to suppliers |

|

|

(1,155,484 |

) |

|

|

(6,205,813 |

) |

|

Advance to suppliers - related parties |

|

|

(10,228,261 |

) |

|

|

588,886 |

|

|

Prepaid expenses and other current assets |

|

|

36,012 |

|

|

|

(1,569,793 |

) |

|

Accounts payables |

|

|

2,633,562 |

|

|

|

(1,617,395 |

) |

|

Accounts payables - related parties |

|

|

(2,186,368 |

) |

|

|

5,440,124 |

|

|

Trade notes payable |

|

|

- |

|

|

|

(576,517 |

) |

|

Deferred revenue |

|

|

2,107,320 |

|

|

|

1,118,553 |

|

|

Operating lease liabilities |

|

|

(678,538 |

) |

|

|

(484,933 |

) |

|

Taxes payable |

|

|

330,050 |

|

|

|

(576,478 |

) |

|

Accrued expenses and other liabilities |

|

|

192,449 |

|

|

|

(85,487 |

) |

|

Net cash used in operating activities |

|

|

(16,186,980 |

) |

|

|

(16,119,913 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Due from related parties |

|

|

- |

|

|

|

(20,000 |

) |

|

Purchase of intangible assets |

|

|

- |

|

|

|

(11,647 |

) |

|

Purchase of equipment |

|

|

(686,560 |

) |

|

|

(261,649 |

) |

|

Net cash used in investing activities |

|

|

(686,560 |

) |

|

|

(293,296 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Private placements issuance |

|

|

6,276,000 |

|

|

|

- |

|

|

Net proceeds from the Initial Public Offering |

|

|

- |

|

|

|

25,685,364 |

|

|

Procceds from short-term loans |

|

|

- |

|

|

|

2,626,821 |

|

|

Proceeds from related party loans |

|

|

48,372 |

|

|

|

- |

|

|

Repayment of related party loans |

|

|

- |

|

|

|

(595,103 |

) |

|

Net cash provided by financing activities |

|

|

6,324,372 |

|

|

|

27,717,082 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and restricted

cash |

|

|

(405,752 |

) |

|

|

224,059 |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and restricted

cash |

|

|

(10,954,919 |

) |

|

|

11,527,933 |

|

|

Cash and restricted cash, beginning of period |

|

|

21,249,727 |

|

|

|

18,244,055 |

|

|

Cash and restricted cash, end of period |

|

$ |

10,294,808 |

|

|

$ |

29,771,988 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information: |

|

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

- |

|

|

$ |

4,565 |

|

|

Cash paid for interest |

|

$ |

60,013 |

|

|

$ |

30,544 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental non-cash activities: |

|

|

|

|

|

|

|

|

|

Cash paid in prior year for purchase of fixed assets |

|

$ |

- |

|

|

$ |

122,997 |

|

|

Cash paid in prior year for purchase of intangible assets |

|

$ |

794,010 |

|

|

$ |

- |

|

|

Right of use assets obtained in exchange for operating lease

obligations |

|

$ |

35,341 |

|

|

$ |

1,791,495 |

|

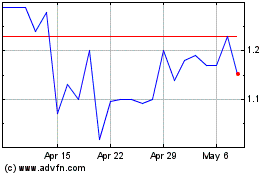

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Apr 2023 to Apr 2024