SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of August, 2022

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha

Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(7):

Yes ☐ No ☒

2nd QUARTER 2022 EARNINGS WEBCAST AUGUST

11TH, 2022

IMPORTANT NOTICE Safe harbor statement

under the U.S. Private Securities Litigation Reform Act of 1995 (the “Private Securities Litigation Reform Act”). This document contains statements that YPF believes constitute forward-looking statements under within the meaning of the

Private Securities Litigation Reform Act. These forward-looking statements may include statements regarding the intent, belief, plans, current expectations or objectives of YPF and its management, including statements with respect to YPF’s

future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s

plans, expectations or objectives with respect to future capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking

statements may also include assumptions regarding future economic and other conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices,

margins, exchange rates or other events and are subject to material risks, uncertainties, changes and other factors which may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial,

operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects,

exploration activities, ownership interests, divestments, cost savings and dividend payout policies, as well as actual future economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ

materially from those expressed or implied in any such forward-looking statements. Important factors that could cause such differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency

fluctuations, exploration, drilling and production results, changes in reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in

developing countries, legislative, tax, legal and regulatory developments, economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and

lack of approvals, as well as those factors described in the filings made by YPF and its affiliates with the Securities and Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and

“Item 5. Operating and Financial Review and Prospects” in YPF’s Annual Report on Form 20-F for the fiscal year ended December 31, 2021, filed with the U.S. Securities and Exchange Commission (the “SEC”). In light of the

foregoing, the forward-looking statements included in this document may not occur. Except as required by law, YPF does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear

that the projected performance, conditions or events expressed or implied therein will not be realized. These materials do not constitute an offer to sell or the solicitation of any offer to buy any securities of YPF S.A. in any jurisdiction.

Securities may not be offered or sold in the United States absent registration with the SEC or an exemption from such registration. Cautionary Note to U.S. Investors — The United States SEC permits oil and gas companies, in their filings with

the SEC, to separately disclose proved, probable and possible reserves that a company has determined in accordance with the SEC rules. We may use certain terms in this presentation, such as resources, that the SEC’s guidelines strictly

prohibit us from including in filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No. 1-12102 available on the SEC website www.sec.gov. Our estimates of EURs, included in our Development Costs,

are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited history.

Actual locations drilled and quantities that may be ultimately recovered from our concessions will differ substantially. Ultimate recoveries will be dependent upon numerous factors including actual encountered geological conditions and the impact of

future oil and gas pricing. Unless otherwise indicated, the calculation of the main financial figures in U.S. dollars is derived from the calculation of the consolidated financial results expressed in Argentine pesos using the average exchange rate

for each period. From 1Q 2019 onwards, the calculation of the main financial figures in U.S. dollars is derived from the sum of: (1) YPF S.A. individual financial results expressed in Argentine pesos divided by the average exchange rate of the

period and (2) the financial results of YPF S.A.’s subsidiaries expressed in Argentine pesos divided by the exchange rate at the end of period.

US$ 798mn +3.2x Q/Q n.m. Y/Y NET INCOME

US$ 1,500mn Adj. EBITDA (1) US$ 932mn +25% Q/Q +61% Y/Y CAPEX US$ 310mn Flat Q/Q +9% Y/Y FCF (2) US$ 5,843mn (US$70mn) Q/Q (US$656mn) Y/Y NET DEBT +54% Q/Q +38% Y/Y PRODUCTION BOE/D 504k -21% Q/Q Flat Y/Y MAIN HIGHLIGHTS 2Q 2022 (1) Adjusted EBITDA

= EBITDA that excludes IFRS 16 and IAS 29 effects +/- one-off items. (2) FCF = Cash flow from Operations less capex (investing activities), M&A (investing activities), and interest and leasing payments (financing activities).

INTER-ANNUAL PRODUCTION GROWTH REMAINED

STRONG, LED BY SHALE OPERATIONS TOTAL PRODUCTION TOTAL PRODUCTION BREAKDOWN LIFTING COST YPF O&G AVERAGE REALIZATION PRICES 506 504 KBOE/D 461 -9% Y/Y +62% Y/Y KBOE/D Conventional Shale Tight 506 504 +1.4 -1.3 -2.2 +9% 4 US$/bbl -11% Y/Y +1.4%

+21% -2%

CORE HUB – DEVELOPMENT COST (2)

US$/BOE DRILLING SPEED (1) -19% +59% (1) Operated wells. +48% +81% NET SHALE PRODUCTION KBBL/D & KBOE/D (2) These values are subject to variation according to the best estimate of the EUR of the connected wells during the period. The values for

the past including herein have been restated according with recent EUR estimations. Meters/Day Calculated as the average drilling speed per well FRAC SPEED # Stages/Set per month +36% OUR FOCUS IN OPERATING EFFICIENCIES IN VACA

MUERTA CONTINUED RENDERING VERY POSITIVE RESULTS UNCONVENTIONAL HORIZONTAL WELLS(1) # of Wells

Net of commissions, deductions, freights,

turnover tax and other products which prices are taxes. Basket of other refined and petrochemicals. 01 Rapidly attended and contained some disruptions in the normal supply to customers in a context of local logistic constraints. 02 Active

pricing policy in the quarter, with tailored adjustments between fuels and wholesales´ segments, compensating currency devaluation and further reducing the gap with international reference prices. 03 DOMESTIC FUELS’ SALES VS 2019(1) KM3/%

(1) Imports as % of total fuels´ sales.. REFINING UTILIZATION % & FUELS’ IMPORTS(1) F.O.B REFINERY / TERMINAL PRICE(2) & OTHER REFINED PRODUCTS(3) US$/BBL %/KBBLD RECORD-HIGH LOCAL DIESEL DEMAND TACKLED THROUGH HIGHER PROCESSING

LEVELS, INCREASED BIOFUELS´ BLENDING, IMPORTS, AND INVENTORY DRAWDOWN Record diesel sales on seasonal demand from agrobusiness, rebound of activity in certain industrial segments and higher demand in border Provinces. 5% 13% 8%

IMPORTS

ANOTHER QUARTER WITH POSITIVE FREE CASH

FLOW, ACCUMMULATING US$2 BILLION SINCE 2Q20 CONSOLIDATED STATEMENT OF ADJUSTED CASH FLOW(1) In Millions of US$ CUMULATIVE FREE CASH FLOW In Millions of US$ Quarterly FCF Cash and equivalents at the end of 2Q 2022 converted to US$ using June 30,2022

exchange rate of AR$125.13 to US$1.00. Cash and equivalents at the end of 1Q 2022 converted to US$ using the March 31,2022 exchange rate of AR$110.91 to US$1.00. Cash & equivalents include Argentine sovereign bonds and Treasury notes. Includes

mainly payment of leasing, FX differences and net payments for financial assets. Includes cash position in dollars, Sovereign bonds, peso-denominated debt and tax moratorium debt. Includes long-term investments in financial assets which mature in

less than 24 months. 211 394 678 989 1,134 1,276 1,667 1,977 Market volatility resulted in a -3.5% net impact in the market value of our financial investments, as of June 30th 73% of consolidated liquidity is either dollarized or

hedged(3)(4)

STRONG LIQUIDITY POSITION AND EASILY

MANAGEABLE SHORT-TERM MATURITIES CONSOLIDATED PRINCIPAL DEBT AMORTIZATION SCHEDULE(1) In Millions of US$ LIQUIDITY VS NEXT 12 MONTH MATURITIES In Millions of US$ (1) As of June 30, 2022, converted to US$ using the exchange rate of AR$125.13 to

US$1.00. Excludes IFRS 16 effects. 977 917 3,156 318 1,418 146 Net leverage ratio down to 1.31x Liquidity covers over 18 months of debt maturities Less than 3% of total consolidated debt exposed to floating interest rates Excess liquidity applied to

pre-pay local bank financing

UPDATED GUIDANCE 2022 ORIGINAL GUIDANCE

CAPEX TOTAL HYDROCARBON PRODUCTION ADJ. EBITDA NET LEVERAGE RATIO US$3.7 bn +10% +8% +1pp - ~US$5 bn <= 2x <= 1.3x UPDATED GUIDANCE

QUESTIONS 2nd QUARTER 2022 EARNINGS

WEBCAST AND ANSWERS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima |

|

|

|

|

| Date: August 10, 2022 |

|

|

|

By: |

|

/s/ Pablo Calderone |

|

|

|

|

Name: |

|

Pablo Calderone |

|

|

|

|

Title: |

|

Market Relations Officer |

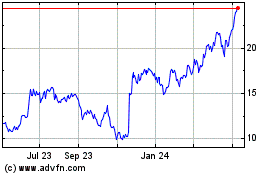

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

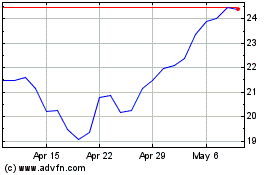

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024