TIDMLRE

LANCASHIRE HOLDINGS LIMITED

27 July 2022

Hamilton, Bermuda

Lancashire Holdings Limited ("Lancashire" or "the Group") announces its results

for the six months ended 30 June 2022.

Highlights:

* Gross premiums written increased by 34.6% year-on-year to $938.1 million

* Group RPI (Renewal Price Index) of 106%

* Excellent underwriting performance, with a combined ratio of 78.2%

* Profit before tax of $78.0 million

* Total net investment return of negative 3.8%, primarily driven by

unrealised losses

* Interim dividend of $0.05 per common share, in line with our dividend

policy

Six months ended

30 June 2022 30 June 2021

Financial highlights ($m)

Gross premiums written

938.1 697.2

Net premiums written

622.6 427.9

Underwriting profit

164.5 127.1

Profit before tax

78.0 54.1

Comprehensive (loss) income1

(7.1) 33.6

Change in FCBVS2 0.0% 2.4%

Financial ratios

Total investment return (3.8%) 0.3%

Net loss ratio 37.9% 38.4%

Combined ratio 78.2% 80.7%

Per share data

Fully converted book value per share $5.67 $6.33

Dividends per common share for the financial $0.05 $0.05

year

Diluted earnings per share $0.30 $0.19

1 These amounts are attributable to Lancashire and exclude non-controlling

interests.

2 Defined as the change in fully converted book value per share, adjusted for

dividends. See the section headed "Alternative Performance Measures" below.

Alex Maloney, Group Chief Executive Officer, commented:

"The Group delivered strong premium growth in the first half of the year with a

34.6% increase in gross premiums written year-on-year to $938.1 million. We

continue to see attractive rate increases across a number of business lines

with a renewal price index for the first six months of 106%.

Over the past few years, we have successfully diversified our underwriting

portfolio. I am pleased that we are seeing a strong performance from a number

of these newer classes of business while we are also continuing to benefit from

those products where we have longer-standing expertise. This has resulted in an

excellent underwriting performance for the first half of 2022 with a combined

ratio of 78.2% and profit before tax of $78.0 million.

We previously gave a range of $20 million to $30 million for potential incurred

losses within Ukraine. Our ultimate net losses incurred within Ukraine since

the start of the conflict are towards the lower end of our initial range at

$22.0 million (excluding the impact of reinstatement premiums).

We continue to closely monitor our exposure with regards to Russia, which

remains a complex and fluid situation. We believe that any potential losses

would be within our risk tolerances, and would not impact our strategy or our

ability to deliver on our ambitious growth plans.

While broader macro-economic issues are impacting the outlook for the global

economy, we believe that the strong rate environment for many of our products

is the best we have seen for more than a decade and that it will continue

through the second half of 2022 and into 2023. This includes risk-adjusted rate

rises and attractive opportunities across lines impacted by the conflict in

Ukraine.

During the first half of 2022, the investment environment has proved volatile

and the upwards trend in US interest rates has resulted in a negative

investment performance of 3.8% or in dollar terms an investment loss of $85.8

million. This includes $83.0 million of unrealised losses on our fixed maturity

AFS portfolio due to market value changes. Overall, our investment strategy

remains conservative and the return to a higher interest rate environment

should boost future earnings in our portfolio.

We continue to be strongly capitalised giving us the firepower to execute our

long-term strategy to grow premiums where we believe there are attractive

returns while retaining our strict focus on underwriting discipline.

In June we were pleased to announce a number of senior underwriting

appointments, all of which were promotions from within our existing teams.

Ensuring we have the right talent in the right roles is critical to our success

as we look to maximise the Group's underwriting prospects. Lancashire has

always attracted some of the best people in the industry and we continue to

develop our employees, wherever they work in the business, and give them

opportunities to thrive in our positive and vibrant corporate culture.

As always, I would like to thank all our colleagues for their hard work and

commitment and our brokers, clients and shareholders for their continued

support."

Underwriting results

Six months ended 30 June

Gross premiums written 2022 2021 Change Change RPI

$m $m $m % %

Property and casualty reinsurance 107

548.0 377.0 171.0 45.4

Property and casualty insurance 105

149.6 106.5 43.1 40.5

Aviation 106

58.3 58.4 (0.1) (0.2)

Energy 103

115.4 107.6 7.8 7.2

Marine 106

66.8 47.7 19.1 40.0

Total 106

938.1 697.2 240.9 34.6

Property and casualty reinsurance

The substantial growth in the property and casualty reinsurance segment was

mainly due to new business in the casualty reinsurance and financial lines

classes of business, which also benefitted from significant written premium

being recognised from new policies bound in 2021. The RPI for this segment also

remained strong at 107% further contributing to the premium increase.

Property and casualty insurance

The growth in the property and casualty insurance segment reflects the

continued build-out of the property direct and facultative book of business,

including our recent expansion in Australia and new business in property

construction. This class had an overall RPI of 106%.

Aviation

The first half of the year was not a major renewal period for the aviation

segment and, as a result, the gross premium written remained comparable to the

prior year.

Energy

Most of our energy classes of business grew through the addition of new

underwriting teams and product expansion across underwriting platforms to take

advantage of the improving market conditions. Our decision to exit the Gulf of

Mexico class resulted in a reduction in premium that was more than offset by

new business in other classes.

Marine

Growth in the marine segment was primarily driven by new business particularly

in the marine cargo and marine liability classes of business. The marine

liability class also had a strong RPI of 115% compared to the same period in

the prior year.

Outwards reinsurance premiums

Although the proportion of outwards reinsurance premiums to gross written

premium has decreased year-on-year, in dollar terms the spend increased by

$46.2 million or 17.2% compared to the first six months of 2021.

Net insurance losses

The Group's net loss ratio for the six months ended 30 June 2022 was 37.9%

compared to 38.4% in 2021. The accident year loss ratio for the six months

ended 30 June 2022, including the impact of foreign exchange revaluations, was

53.5% compared to 56.3% in the same period in 2021.

During the first six months of 2022, the Group experienced net losses from the

ongoing events in Ukraine and the Australian floods, as well as a number of

smaller weather and risk losses. None of these events was individually material

for the Group.

The first half of 2021 included $51.2 million of net losses for Winter Storm

Uri, excluding the impact of reinstatement premiums. Absent Winter Storm Uri

our net loss ratio would have been 22.6% in the same period.

Prior year favourable development for the first six months of 2022 was $64.4

million, compared to $53.6 million of favourable development in 2021. The

favourable development in 2022 was primarily due to general IBNR releases on

the 2021 accident year across most lines of business due to a lack of reported

claims as well as favourable development on some large claims from the 2018 and

2017 accident years.

In the prior half year, the Group benefited from general IBNR releases across

most lines of business due to a lack of reported claims. The Group also

experienced favourable development from reserve releases on the 2017 and prior

accident years.

The table below provides further detail of the prior years' loss development by

class, excluding the impact of foreign exchange revaluations.

For the six months ended 30 June 2022 2021

$m $m

Property and casualty reinsurance

23.1 6.7

Property and casualty insurance

16.7 17.6

Aviation

7.5 9.4

Energy

12.0 17.8

Marine

5.1 2.1

Total

64.4 53.6

Note: Positive numbers denote favourable development.

The table below provides further detail of the prior years' loss development by

accident year, excluding the impact of foreign exchange revaluations.

For the six months ended 30 June 2022 2021

$m $m

2017 accident year and prior 29.6

19.1

2018 accident year (1.6)

10.6

2019 accident year 1.8

4.9

2020 accident year 23.8

8.6

2021 accident year

21.2 -

Total 53.6

64.4

Note: Positive numbers denote favourable development.

Investments

Net investment income, excluding realised and unrealised gains and losses, was

$17.3 million for the first six months of 2022, an increase of 17.7% compared

to 2021.

The Group's investment portfolio, including unrealised gains and losses,

returned a negative investment performance of 3.8% or in dollar terms an

investment loss of $85.8 million. This includes $83.0 million of unrealised

losses on our fixed maturity AFS portfolio for the first six months of 2022.

The losses were primarily driven by the Federal Reserve's response to inflation

and volatile financial markets. The yield curve flattened significantly, and

spreads widened for investment grade corporate debt and bank loans.

The Group's investment portfolio, including unrealised gains and losses,

returned 0.3% (gain of $7.4 million) for the first six months of 2021. Fixed

maturity portfolio returns were flat to slightly negative offset by positive

returns from other investments, including the hedge funds and principal

protected notes.

The managed portfolio was as follows:

As at As at As at

30 June 2022 31 December 2021 30 June 2021

Fixed maturity 85.2% 78.4% 77.7%

securities

Cash and cash 4.7% 11.2% 12.1%

equivalents

Private investment funds 4.6% 4.6% 4.3%

Hedge funds 4.3% 4.5% 4.5%

Index linked securities 1.3% 1.3% 1.3%

Other investments (0.1%) 0.1%

-

Total 100.0% 100.0% 100.0%

Key investment portfolio statistics for our fixed maturities and managed cash

were:

As at As at As at

30 June 2022 31 December 2021 30 June 2021

Duration 1.8 years 1.8 years 1.8 years

Credit quality A+ A+ A+

Book yield 1.9% 1.3% 1.3%

Market yield 3.5% 1.0% 0.8%

Third Party Capital Management

The total contribution from third party capital activities consisted of the

following items:

For the six months ended 30 June 2022 2021

$m $m

Lancashire Capital Management underwriting fees

0.9 2.4

Lancashire Capital Management profit commission

0.1 3.6

Lancashire Syndicates' fees and profit commission

1.3 1.0

Total other income

2.3 7.0

Share of profit of associate

2.4 0.3

Total net third party capital management income

4.7 7.3

The amount of Lancashire Capital Management profit commission recognised is

driven by the timing of loss experience, settlement of claims and collateral

release and therefore varies year on year. The share of profit of associate

reflects Lancashire's equity interest in the Lancashire Capital Management

managed vehicle.

Other operating expenses

Other operating expenses were $68.4 million in the first six months of 2022

compared to $66.1 million in the first six months of 2021. A growth in

headcount has resulted in higher underlying employee remuneration costs

compared to the prior year alongside an increase in audit fees, travel costs

and fees and subscriptions. The weakening Sterling/U.S. Dollar exchange rate

relative to the prior year partly offset this increase in the underlying cost

base.

Capital

As at 30 June 2022, total capital available to Lancashire was approximately

$1.8 billion, comprising shareholders' equity of $1.4 billion and $0.4 billion

of long-term debt. Tangible capital was $1.7 billion. Leverage was 24.5% on

total capital and 26.9% on total tangible capital. Total capital and total

tangible capital as at 30 June 2021 were $2.0 billion and $1.8 billion

respectively.

Share repurchases

During the six months ended 30 June 2022, Lancashire repurchased 2,431,517 of

its common shares (out of a maximum Board-approved limit for this share

repurchase of 3,000,000 common shares). These repurchases were made pursuant to

and in accordance with the general authority granted by shareholders at

Lancashire's Annual General Meeting held on 27 April 2022 and will be used to

satisfy a number of future exercises of awards under the Company's Restricted

Share Scheme.

Further intention to purchase own shares

Pursuant to and in accordance with the general authority granted by

shareholders at Lancashire's Annual General Meeting held on 27 April 2022,

Lancashire intends to purchase up to a further 3,000,000 of its common shares

of $0.50 each in order to satisfy a number of future exercises of awards under

its Restricted Share Scheme. A further announcement in accordance with Listing

Rule 12.4 will be made in due course.

Dividends

Lancashire's Board of Directors declared on 26 July 2022 an interim dividend of

$0.05 (approximately £0.04) per common share, which will result in an aggregate

payment of approximately $12.0 million. The dividend will be paid in Pounds

Sterling on 2 September 2022 (the "Dividend Payment Date") to shareholders of

record on 5 August 2022 (the "Record Date") using the £ / $ spot market

exchange rate at 12 noon London time on the Record Date.

Shareholders interested in participating in the dividend reinvestment plan

("DRIP"), or other services including international payment, are encouraged to

contact the Group's registrars, Link Asset Services, for more details.

Financial Information

The Unaudited Condensed Interim Consolidated Financial Statements for the six

months ended 30 June 2022 are published on Lancashire's website at

www.lancashiregroup.com .

Analyst and Investor Earnings Conference Call

There will be an analyst and investor conference call on the results at 1:00pm

UK time / 9:00am Bermuda time / 8:00am EDT on Wednesday 27 July 2022. The

conference call will be hosted by Lancashire management.

Participant Access:

Dial in 5-10 minutes prior to the start time using the number / confirmation

code below:

United Kingdom Toll-Free: 08003589473

United Kingdom Toll: +44 3333000804

United States Toll-Free: +1 855 85 70686

United States Toll: +1 6319131422

PIN code: 80848891#

URL for additional international dial in numbers:

https://events-ftp.arkadin.com/ev/docs/

NE_W2_TF_Events_International_Access_List.pdf

The call can also be accessed via webcast, for registration and access:

https://onlinexperiences.com/Launch/QReg/ShowUUID=

AD44C7F8-612E-4DA6-9DC9-B2E299EA3555

A webcast replay facility will be available for 12 months and accessible at:

https://www.lancashiregroup.com/en/investors/

results-reports-and-presentations.html

For further information, please contact:

Lancashire Holdings Limited

Christopher Head +44 20 7264 4145

chris.head@lancashiregroup.com

Jelena Bjelanovic +44 20 7264 4066

jelena.bjelanovic@lancashiregroup.com

FTI Consulting +44 07703 330 199

Edward Berry Edward.Berry@FTIConsulting.com

Tom Blackwell Tom.Blackwell@FTIConsulting.com

About Lancashire

Lancashire, through its UK and Bermuda-based operating subsidiaries, is a

provider of global specialty insurance and reinsurance products. The Group

companies carry the following ratings (unchanged from 2021):

Financial Financial Long Term

Strength Strength Issuer

Rating(1) Outlook(1) Rating(2)

A.M. Best A (Excellent) Stable bbb+

S&P Global Ratings A- Stable BBB

Moody's A3 Stable Baa2

(1) Financial Strength Rating and Financial Strength Outlook apply to

Lancashire Insurance Company Limited and Lancashire Insurance Company (UK)

Limited.

(2) Long Term Issuer Rating applies to Lancashire Holdings Limited.

Lancashire Syndicates Limited benefits from Lloyd's ratings: A.M. Best: A

(Excellent); S&P Global Ratings: A+ (Strong); and Fitch: AA- (Very Strong).

Lancashire has capital of approximately $1.8 billion and its common shares

trade on the premium segment of the Main Market of the London Stock Exchange

under the ticker symbol LRE. Lancashire has its head office and registered

office at Power House, 7 Par-la-Ville Road, Hamilton HM 11, Bermuda.

The Bermuda Monetary Authority ("BMA") is the Group Supervisor of the

Lancashire Group.

For more information, please visit Lancashire's website at

www.lancashiregroup.com.

This release contains information, which may be of a price sensitive nature,

that Lancashire is making public in a manner consistent with the Market Abuse

Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of

the European Union (Withdrawal) Act 2018, as amended, and other regulatory

obligations. The information was submitted for publication, through the agency

of the contact persons set out above, at 07:00 BST on 27 July 2022.

Alternative Performance Measures (APMs)

As is customary in the insurance industry, the Group also utilises certain

non-GAAP measures in order to evaluate, monitor and manage the business and to

aid users' understanding of the Group. Management believes that the APMs

included in the Financial Statements are important for understanding the

Group's overall results of operations and may be helpful to investors and other

interested parties who may benefit from having a consistent basis for

comparison with other companies within the industry. However, these measures

may not be comparable to similarly labelled measures used by companies inside

or outside the insurance industry. In addition, the information contained

herein should not be viewed as superior to, or a substitute for, the measures

determined in accordance with the accounting principles used by the Group for

its audited consolidated financial statements or in accordance with GAAP.

In compliance with the Guidelines on APMs of the European Securities and

Markets Authority, as applied by the FCA, information on APMs which the Group

uses is described below. This information has not been audited. All amounts,

excluding share data, ratios, percentages or where otherwise stated, are in

millions of U.S. dollars.

Net loss ratio:

Ratio, in per cent, of net insurance losses to net premiums earned. This ratio

gives an indication of the amount of claims expected to be paid out per $1.00

of net premium earned in the financial year. The net loss ratio may also be

presented with net insurance losses absent catastrophe and other large losses.

30 June 30 June

2022 2021

Net insurance losses 166.9 121.1

Divided by net 440.5 315.3

premiums earned

Net loss ratio 37.9% 38.4%

Net acquisition cost ratio:

Ratio, in per cent, of net insurance acquisition expenses to net premiums

earned. This ratio gives an indication of the amount expected to be paid out to

insurance brokers and other insurance intermediaries per $1.00 of net premium

earned in the financial year.

30 June 30 June

2022 2021

Net acquisition 109.1 67.1

expense

Divided by net 440.5 315.3

premiums earned

Net acquisition cost 24.8% 21.3%

ratio

Net expense ratio:

Ratio, in per cent, of other operating expenses, excluding restricted stock

expenses, to net premiums earned. This ratio gives an indication of the amount

of operating expenses expected to be paid out per $1.00 of net premium earned

in the financial year.

30 June 30 June

2022 2021

Other operating 68.4 66.1

expenses

Divided by net 440.5 315.3

premiums earned

Net expense ratio 15.5% 21.0%

Combined ratio (KPI):

Ratio, in per cent, of the sum of net insurance losses, net acquisition

expenses and other operating expenses to net premiums earned. The Group aims to

price its business to ensure that the combined ratio across the cycle is less

than 100%.

30 June 30 June

2022 2021

Net loss ratio 37.9% 38.4%

Net acquisition cost 24.8% 21.3%

ratio

Net expense ratio 15.5% 21.0%

Combined Ratio 78.2% 80.7%

Accident year loss ratio:

The accident year loss ratio is calculated using the accident year ultimate

liability revalued at the current balance sheet date, divided by net premiums

earned. This ratio shows the amount of claims expected to be paid out per $1.00

of net premium earned in an accident year.

30 June 30 June

2022 2021

Net insurance losses 231.3 175.2

current accident

year

Dividend by net 432.2 311.0

premiums earned

current accident

year*

Accident year loss 53.5% 56.3%

ratio

*For the accident year loss ratio, net premiums earned excludes inwards and

outwards reinstatement premium from prior accident years.

Fully converted book value per share ('FCBVS') attributable to the Group:

Calculated based on the value of the total shareholders' equity attributable to

the Group and dilutive restricted stock units as calculated under the treasury

method, divided by the sum of all shares and dilutive restricted stock units,

assuming all are exercised. Shows the Group net asset value on a diluted per

share basis for comparison to the market value per share.

30 June 2022 30 June 2021

Shareholders' 1,372,753,750 1,553,600,727

equity attributable

to the Group

Common voting 240,122,621 242,754,618

shares outstanding*

Shares relating to

dilutive restricted 1,949,260 2,859,880

stock

Fully converted 242,071,881 245,614,498

book value

denominator

Fully converted $ $

book value per 5.67 6.33

share

*Common voting shares outstanding comprise issued share capital less amounts

held in the Employee Benefit Trust.

Change in FCBVS (KPI):

The internal rate of return of the change in FCBVS in the period plus accrued

dividends. Sometimes referred to as ROE. The Group's aim is to maximise

risk-adjusted returns for shareholders across the cycle through a purposeful

and sustainable business culture.

30 June 30 June

2022 2021

Opening FCBVS $ $

(5.77) (6.28)

Q1 dividend per $ $

share - -

Q2 dividend per $ $

share 0.10 0.10

Closing FCBVS $ $

5.67 6.33

Change in FCBVS* -% 2.4%

*Calculated using the internal rate of return.

Total investment return (KPI):

Total investment return in percentage terms, is calculated by dividing the

total investment return excluding foreign exchange by the investment portfolio

net asset value, including managed cash on a daily basis. These daily returns

are then annualized through geometric linking of daily returns. The return can

be approximated by dividing the total investment return excluding foreign

exchange by the average portfolio net asset value, including managed cash. The

Group's primary investment objectives are to preserve capital and provide

adequate liquidity to support the Group's payment of claims and other

obligations. Within this framework we aim for a degree of investment portfolio

return.

30 June 30 June

2022 2021

Total investment (85.8) 7.4

return

Average invested 2,271.7 2,139.3

assets*

Approximate total (3.8%) 0.3%

investment return

Reported total (3.8%) 0.3%

investment return

*Calculated as the average between the opening and closing investments and our

externally managed cash.

Gross premiums written under management (KPI):

The gross premiums written under management equals the total of the Group's

consolidated gross premiums written plus the external names portion of the

gross premiums written in LSL Syndicate 2010 plus the gross premiums written in

LCM. The Group aims to operate nimbly through the cycle. We will grow in

existing and new classes where favourable and improving market conditions

exist, whilst monitoring and managing our risk exposures and not seek top-line

growth for the sake of it in markets where we do not believe the right

opportunities exist.

30 June 30 June

2022 2021

Gross premiums

written by the group 938.1 697.2

LSL Syndicate 2010 -

external Names 100.0 90.8

portion of gross

premiums written

(unconsolidated)

LCM gross premiums

written 38.4 124.5

(unconsolidated)

Total gross premiums

written under 1,076.5 912.5

management

NOTE REGARDING RPI METHODOLOGY

THE RENEWAL PRICE INDEX ("RPI") IS AN INTERNAL METHODOLOGY THAT MANAGEMENT USES

TO TRACK TRS IN PREMIUM RATES OF A PORTFOLIO OF INSURANCE AND REINSURANCE

CONTRACTS. THE RPI WRITTEN IN THE RESPECTIVE SEGMENTS IS CALCULATED ON A PER

CONTRACT BASIS AND REFLECTS MANAGEMENT'S ASSESSMENT OF RELATIVE CHANGES IN

PRICE, TERMS, CONDITIONS AND LIMITS AND IS WEIGHTED BY PREMIUM VOLUME. THE RPI

DOES NOT INCLUDE NEW BUSINESS, TO OFFER A CONSISTENT BASIS FOR ANALYSIS. THE

CALCULATION INVOLVES A DEGREE OF JUDGEMENT IN RELATION TO COMPARABILITY OF

CONTRACTS AND THE ASSESSMENT NOTED ABOVE. TO ENHANCE THE RPI METHODOLOGY,

MANAGEMENT MAY REVISE THE METHODOLOGY AND ASSUMPTIONS UNDERLYING THE RPI, SO

THE TRS IN PREMIUM RATES REFLECTED IN THE RPI MAY NOT BE COMPARABLE OVER

TIME. CONSIDERATION IS ONLY GIVEN TO RENEWALS OF A COMPARABLE NATURE SO IT DOES

NOT REFLECT EVERY CONTRACT IN THE PORTFOLIO OF CONTRACTS. THE FUTURE

PROFITABILITY OF THE PORTFOLIO OF CONTRACTS WITHIN THE RPI IS DEPENT UPON

MANY FACTORS BESIDES THE TRS IN PREMIUM RATES.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS

SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR

HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION,

STATEMENTS CONTAINING THE WORDS "BELIEVES", "AIMS", "ANTICIPATES", "PLANS",

"PROJECTS", "FORECASTS", "GUIDANCE", "INTS", "EXPECTS", "ESTIMATES",

"PREDICTS", "MAY", "CAN", "LIKELY", "WILL", "SEEKS", "SHOULD", OR, IN EACH

CASE, THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. SUCH FORWARD-LOOKING STATEMENTS

INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT

COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE

MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED

OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. FOR A DESCRIPTION OF SOME OF

THESE FACTORS, SEE THE GROUP'S ANNUAL REPORT AND ACCOUNTS FOR THE YEARED 31

DECEMBER 2021. IN ADDITION TO THOSE FACTORS CONTAINED IN THE GROUP'S 2021

ANNUAL REPORT AND ACCOUNTS, ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS

RELEASE MAY BE AFFECTED BY: THE IMPACT OF THE ONGOING CONFLICT IN UKRAINE,

INCLUDING ANY ESCALATION OR EXPANSION THEREOF, ON THE GROUP'S CLIENTS,

RESERVES, THE CONTINUED UNCERTAINTY OF THE SITUATION IN RUSSIA, INCLUDING

ISSUES RELATING TO COVERAGE AND THE IMPACT OF SANCTIONS, THE SECURITIES IN OUR

INVESTMENT PORTFOLIO AND ON GLOBAL FINANCIAL MARKETS GENERALLY, AS WELL AS ANY

GOVERNMENTAL OR REGULATORY CHANGES, ARISING THEREFROM; AND A CONTINUATION IN

FINANCIAL MARKET VOLATILITY AND OTHER ADVERSE MARKET CONDITIONS GENERALLY. ALL

FORWARD-LOOKING STATEMENTS IN THIS RELEASE OR OTHERWISE SPEAK ONLY AS AT THE

DATE OF PUBLICATION. LANCASHIRE EXPRESSLY DISCLAIMS ANY OBLIGATION OR

UNDERTAKING (SAVE AS REQUIRED TO COMPLY WITH ANY LEGAL OR REGULATORY

OBLIGATIONS INCLUDING THE RULES OF THE LONDON STOCK EXCHANGE) TO DISSEMINATE

ANY UPDATES OR REVISIONS TO ANY FORWARD-LOOKING STATEMENT TO REFLECT ANY

CHANGES IN THE GROUP'S EXPECTATIONS OR CIRCUMSTANCES ON WHICH ANY SUCH

STATEMENT IS BASED. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS

ATTRIBUTABLE TO THE GROUP OR INDIVIDUALS ACTING ON BEHALF OF THE GROUP ARE

EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THIS NOTE. PROSPECTIVE INVESTORS

SHOULD SPECIFICALLY CONSIDER THE FACTORS IDENTIFIED IN THIS RELEASE AND THE

REPORT AND ACCOUNTS NOTED ABOVE WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER

BEFORE MAKING AN INVESTMENT DECISION.

Consolidated statement of comprehensive (loss) income

For the six months ended 30 June 2022

Six months 2022 Six

months 2021

$m $m

Gross premiums written 938.1

697.2

Outwards reinsurance premiums (315.5)

(269.3)

Net premiums written 622.6

427.9

Change in unearned premiums (300.5)

(210.6)

Change in unearned premiums on premiums ceded 118.4

98.0

Net premiums earned 440.5

315.3

Net investment income 17.3

14.7

Net other investment (losses) income (9.4)

1.5

Net realised (losses) gains and impairments (10.7)

5.7

Share of profit (loss) of associate 2.4

0.3

Other income 2.3

7.0

Net foreign exchange (losses) gains (1.6)

1.6

Total net revenue 440.8

346.1

Insurance losses and loss adjustment expenses 207.5

136.2

Insurance losses and loss adjustment expenses (40.6)

recoverable (15.1)

Insurance acquisition expenses 127.2

82.3

Insurance acquisition expenses ceded (18.1)

(15.2)

Equity based compensation 3.7

7.0

Other operating expenses 68.4

66.1

Total expenses 348.1

261.3

Results of operating activities 92.7

84.8

Financing costs 14.7

30.7

Profit (loss) before tax 78.0

54.1

Tax charge (3.6)

(6.2)

Profit (loss) after tax 74.4

47.9

Profit (loss) for the period attributable to:

Equity shareholders of LHL 74.4

47.7

Non-controlling interests

- 0.2

Net change in unrealised losses on investments (83.0)

(14.5)

Tax credit on net change in unrealised losses on 1.5

investments 0.4

Other comprehensive loss (81.5)

(14.1)

Total comprehensive (loss) income attributable to (7.1)

Lancashire 33.6

Net loss ratio 37.9% 38.4%

Net acquisition cost ratio 24.8% 21.3%

Administrative expense ratio 15.5% 21.0%

Combined ratio 78.2% 80.7%

Consolidated balance sheet

As at 30 June 2022

As at 30 As at 30 As at 31

June June December

2022 2021 2021

$m $m $m

Assets

Cash and cash equivalents

390.6 563.4 517.7

Accrued interest receivable

8.3 7.2 7.1

Investments

2,132.8 1,977.9 2,048.1

Inwards premiums receivable from insureds and

cedants 755.5 550.7 490.6

Reinsurance assets

- Unearned premiums on premiums ceded

236.2 195.4 117.8

- Reinsurance recoveries

428.8 281.6 418.8

- Other receivables

41.5 22.3 38.2

Other receivables

32.0 21.0 18.8

Investment in associate

87.6 89.0 118.7

Property, plant and equipment

0.6 1.1 0.8

Right-of-use assets

12.1 14.8 13.4

Deferred acquisition costs

173.9 117.8 121.6

Intangible assets

162.3 154.5 157.9

Total assets

4,462.2 3,996.7 4,069.5

Liabilities

Insurance contracts

- Losses and loss adjustment expenses

1,311.4 978.0 1,291.1

- Unearned premiums

898.4 668.5 597.9

- Other payables

30.6 20.7 20.3

Amounts payable to reinsurers

295.3 214.6 205.6

Deferred acquisition costs ceded

25.9 19.9 27.0

Other payables

51.9 58.7 37.4

Corporation tax payable

1.7 2.4 1.6

Deferred tax liability

12.8 14.9 12.2

Lease liability

15.1 19.8 17.9

Long-term debt

445.9 445.5 445.7

Total liabilities

3,089.0 2,443.0 2,656.7

Shareholders' equity

Share capital

122.0 122.0 122.0

Own shares

(23.5) (12.1) (18.1)

Other reserves

1,218.8 1,218.3 1,221.6

Accumulated other comprehensive (loss) income

(78.6) 19.5 2.9

Retained earnings

134.0 205.9 83.9

Total shareholders' equity attributable to equity

shareholders of LHL 1,372.7 1,553.6 1,412.3

Non-controlling interests

0.5 0.1 0.5

Total shareholders' equity

1,373.2 1,553.7 1,412.8

Total liabilities and shareholders' equity

4,462.2 3,996.7 4,069.5

Consolidated statement of cash flows

For the six months ended 30 June 2022

Six months 2022 Six months 2021

$m $m

Cash flows from operating activities

Profit (loss) before tax 78.0 54.1

Tax paid (1.3) (1.6)

Depreciation 1.5 1.6

Interest expense on long-term debt 12.9 12.6

Interest expense on lease liabilities 0.5 0.6

Interest income (17.2) (18.7)

Net amortisation of fixed maturity securities 1.4 3.6

Redemption cost on senior and subordinated loan notes 12.8

-

Net realised / unrealised losses on interest rate swaps 3.4

-

Equity based compensation 3.7 7.0

Foreign exchange gains (2.4) (0.5)

Share of (profit) loss of associate (2.4) (0.3)

Net other investment losses (income) 9.2 (1.9)

Net realised losses (gains) and impairments 10.7 (5.7)

Changes in operational assets and liabilities

- Insurance and reinsurance contracts (18.7) 57.3

- Other assets and liabilities (0.6) 15.8

Net cash flows from operating activities 75.3 140.1

Cash flows used in investing activities

Interest received 19.5 23.1

Purchase of property, plant and equipment (0.7)

-

Internally generated intangible asset (4.4)

-

Investment in associate 33.5 38.5

Purchase of investments (700.7) (808.0)

Proceeds on sale of investments 507.7 672.3

Net cash flows used in investing activities (144.4) (74.8)

Cash flows (used in) from financing activities

Interest paid (12.9) (7.6)

Interest rate swap (3.4)

-

Lease liabilities paid (1.8) (2.1)

Proceeds from issue of long-term debt 445.4

-

Redemption of long-term debt (339.6)

-

Dividends paid (24.3) (24.3)

Dividend paid to minority interest holders (0.5)

-

Share repurchases (11.7) -

Distributions by trust (0.4) (1.0)

Net cash flows (used in) from financing activities (51.1) 66.9

Net (decrease) increase in cash and cash equivalents (120.2) 132.2

Cash and cash equivalents at the beginning of year 517.7 432.4

Effect of exchange rate fluctuations on cash and cash (6.9) (1.2)

equivalents

Cash and cash equivalents at end of period 390.6 563.4

END

(END) Dow Jones Newswires

July 27, 2022 02:00 ET (06:00 GMT)

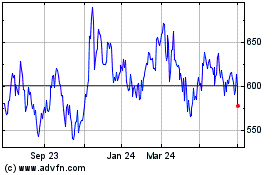

Lancashire (LSE:LRE)

Historical Stock Chart

From Aug 2024 to Sep 2024

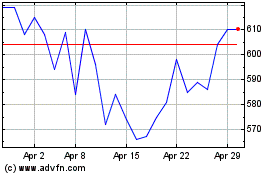

Lancashire (LSE:LRE)

Historical Stock Chart

From Sep 2023 to Sep 2024