First Bank (Nasdaq Global Market: FRBA) today announced results for

the second quarter of 2022, accentuated by net income of $8.8

million, or $0.45 per diluted share. Return on average assets,

return on average equity, and return on average tangible equityi

for the second quarter of 2022 were 1.38%, 12.92% and 13.93%,

respectively. In the second quarter of 2021, First Bank reported

net income of $8.9 million, or $0.45 per diluted share, and return

on average assets, return on average equity, and return on average

tangible equityi of 1.48%, 14.26% and 15.37%, respectively.

Second Quarter 2022

Highlights:

- Total loans of $2.22 billion on

June 30, 2022, reflected growth of $68.5 million, or 3.2%, from the

end of the first quarter of 2022 and were up $108.2 million, or

5.1%, from December 31, 2021. Loan growth, excluding the decline in

Paycheck Protection Program (PPP) loans, totaled $84.0 million in

the second quarter of 2022, representing a 15.8% annualized

increase.

- Total deposits of $2.17 billion on

June 30, 2022, were down $12.7 million, or 0.6%, from the end of

the linked first quarter and up $50.6 million, or 2.4%, from

December 31, 2021.

- Asset quality metrics remained

solid during the quarter, with annualized net charge offs to

average loans of 0.07% and nonperforming loans to total loans

of 0.57% as of June 30, 2022, compared to 0.62% on December 31,

2021, and 0.59% on March 31, 2022.

- Continued focus on managing

expenses resulted in the sixth consecutive quarter of an efficiency

ratioii below 50%, at 46.81% for the second quarter of 2022.

President and Chief Executive Officer, Patrick

L. Ryan, said, “We are pleased with our performance during the

second quarter. Our continued focus on developing new and existing

customer relationships facilitated another quarter of robust loan

growth. Total deposits remained relatively stable as we continued

to shift our deposit mix with non-interest bearing deposits

representing 27.7% of total deposits at quarter-end. Loan growth,

improving asset yields and managing deposit costs contributed to a

19 basis point improvement in our net interest margin which was

3.76% for the second quarter of 2022 compared to 3.57% for the

first quarter of 2022. We remain focused on driving organic growth

as we continue to manage expenses to achieve greater

profitability.”

“Asset quality metrics also remain strong,

reflected by our eighth consecutive quarter end with our

nonperforming loans to total loans ratio under 65 basis points.

Annualized net charge offs were only 0.07% of average loans for the

quarter ended June 30, 2022, and primarily related to one small

business loan.”

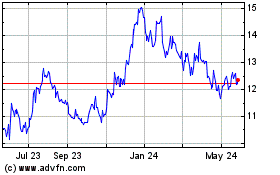

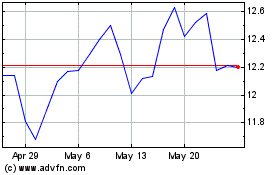

“In our continuous effort to drive long-term

shareholder value, we are pleased to announce another $0.06

quarterly dividend, reflecting an annualized yield of 1.69% based

on our July 22, 2022, closing price of $14.18. We also have an

active share repurchase program and from January 1, 2022, through

July 22, 2022, we have repurchased 241,284 shares of our common

stock at an aggregate cost of $3.4 million, or an average price of

$13.99 per share.”

“Overall, we are very pleased with our

performance through the first half of the year and our financial

performance provides us with the confidence that we are well

positioned to continue to generate strong results during the second

half of 2022.”

Income Statement

First Bank’s (the “Bank’s”) net interest income

for the second quarter of 2022 was $22.9 million, an increase of

$2.5 million, or 12.2%, compared to $20.4 million in the second

quarter of 2021 and an increase of $1.8 million, or 8.3%, compared

to $21.1 million in the first quarter of 2022. The increase from

the comparable prior year quarter was due to an increase in

interest and dividend income of $2.0 million coupled with a decline

of $444,000 in total interest expense. The increase from the linked

first quarter of 2022 was due to an increase in interest and

dividend income of $2.0 million offset somewhat by an increase in

total interest expense of $216,000.

The increase in interest income during the

second quarter of 2022 compared to the second quarter of 2021 and

the first quarter of 2022 was primarily due to an increase in

average loans combined with a 7 basis point and 18 basis point

increase, respectively, in the average rate on loans. Interest

income increased compared to the year-ago quarter and the linked

first quarter despite a decrease in PPP loan fees, as loan growth

and the rising rate environment led to improved interest income.

Interest income from loans included $493,000 in PPP loan fees in

the second quarter of 2022 compared to $1.3 million in the second

quarter of 2021 and $860,000 in the linked first quarter of 2022.

Also impacting loan interest income in the second quarter of 2022

was loan prepayment income of $682,000, compared to $730,000 for

the quarter ended June 30, 2021, and $459,000 for the quarter ended

March 31, 2022. As a result of the Bank’s concerted effort to

control deposit costs, the average rate on interest bearing

deposits was lower during the quarter ended June 30, 2022, compared

to the quarter ended June 30, 2021, and increased only 6 basis

points compared to the first quarter of 2022, despite the rising

rate environment during the second quarter of 2022.

Net interest income for the six months ended

June 30, 2022, totaled $44.1 million, an increase of $3.6 million,

or 8.9%, compared to $40.5 million for the same period in 2021. The

increase in the 2022 year to date net interest income was also

driven by solid growth in average loans, which increased by $115.2

million, or 5.6%, from the prior year period, along with a 16 basis

point decrease in the average rate on interest-bearing

deposits.

The second quarter 2022 tax equivalent net

interest margin was 3.76%, an increase of 19 basis points compared

to the comparable prior year quarter and from the first quarter of

2022. The Bank’s margin continues to benefit from the increase in

average non-interest bearing deposits, improving asset yields and

actively managing the cost of funds. The year-to-date tax

equivalent net interest margin was 3.67%, an increase of 9 basis

points compared to the prior year period. The increase in the

six-month net interest margin was principally a result of the lower

cost of interest bearing deposits, partially offset by lower

earning asset yields.

The Bank’s provision for loan losses was $1.3

million for the second quarter of 2022, compared to a $162,000

credit to the provision for loan losses in the second quarter of

2021 and a provision for loan losses of $642,000 for the linked

first quarter 2022. The Bank’s provision for loan losses was $1.9

million for the six months ended June 30, 2022, compared to a

credit to the provision for loan losses of $1.2 million for the

same period in 2021. The provision for loan losses for the three

and six months ended June 30, 2022, reflects consistent organic

loan growth and continued strong asset quality. The credit to the

provision for loan losses for the three and six months ended June

30, 2021, reflected a reduction in qualitative factors that were

increased significantly in 2020 due to the economic uncertainties

created by the COVID-19 pandemic.

Second quarter 2022 non-interest income of $1.5

million compares to $1.3 million during the second quarter of 2021.

The increase between the periods was primarily the result of higher

income from service fees from deposit accounts and higher gains on

recovery of acquired loans. Non-interest income totaled $2.7

million for the six months ended June 30, 2022, compared to $3.6

million for the same period in 2021. This decrease in non-interest

income for the first six months of 2022 was a result of lower gains

on sale of loans, lower loan fees and lower gains on recovery of

acquired loans. The decrease was primarily the result of a

reduction in Small Business Administration loan sales and a decline

in loan swap activity, primarily due to the current market

conditions.

Non-interest expense for second quarter 2022 of

$11.4 million, increased $1.3 million, or 12.3%, compared to $10.2

million for the prior year quarter. The higher non-interest expense

compared to second quarter 2021 was primarily a result of a

$768,000, or 13.0%, increase in salaries and employee benefits,

along with lesser increases in other professional fees, travel and

entertainment, and other expense. These increases were partially

offset by lower legal fees, directors’ fees, and marginal declines

in certain other non-interest expense categories. The increase in

salaries and employee benefits was due primarily to salary

increases and an increase in the number of employees, partially due

to the employees added from our acquisition of two branches during

the fourth quarter of 2021.

On a linked quarter basis, second quarter 2022

non-interest expense of $11.4 million, increased $287,000, or 2.6%,

compared to $11.1 million for the first quarter of 2022. This

increase was also primarily due to salary and employee benefits

increases which was primarily due to annual salary increases that

occurred at the end of the first quarter of 2022.

Non-interest expense for the first six months of

2022 totaled $22.5 million, an increase of $1.7 million, or 8.3%,

compared to $20.8 million for the same period in 2021. The increase

was primarily a result of higher salaries and employee benefits and

higher other professional fees, offset somewhat by lower occupancy

and equipment expenses.

Income tax expense for the three months ended

June 30, 2022, was $2.8 million with an effective tax rate of

24.4%, compared to $2.9 million with an effective tax rate of 24.4%

for the second quarter of 2021 and $2.5 million with an effective

tax rate of 23.4% for the first quarter of 2022. Income tax expense

for the six months ended June 30, 2022, was $5.3 million with an

effective tax rate of 23.9%, compared to $6.0 million for the first

six months of 2021 with an effective tax rate of 24.3%.

Balance Sheet

Total assets at June 30, 2022, were $2.57

billion, an increase of $57.8 million, or 2.3%, from December 31,

2021. Total loans increased $108.2 million, or 5.1%, to $2.22

billion at June 30, 2022, compared to $2.11 billion at December 31,

2021. The increase in loans during the six-month period ended June

30, 2022, reflects net non-PPP organic loan growth of $149.3

million, offset somewhat by a decline in PPP loans of $41.0

million, as such loans continue to be forgiven. Total loans as of

June 30, 2022, increased $68.5 million, or 3.2%, from $2.15 billion

on March 31, 2022, reflecting organic, net non-PPP loan growth of

$84.0 million, offset somewhat by a decline in PPP loans of $15.5

million. PPP loans outstanding on June 30, 2022, were $10.0

million.

Total deposits were $2.17 billion on June 30,

2022, an increase of $50.6 million, or 2.4%, from $2.11 billion at

December 31, 2021. Non-interest-bearing deposits totaled $600.4

million on June 30, 2022, an increase of $41.6 million, or 7.4%,

from December 31, 2021. The Bank continues to focus on enhancing

its deposit mix and, as of June 30, 2022, had grown non-interest

bearing deposits to 27.7% and lowered time deposits to 14.7% of

total deposits. Total deposits declined by $12.7 million, or 0.6%,

from March 31, 2022, with interest bearing deposits declining $15.8

million, offset somewhat by a $3.1 million increase in non-interest

bearing deposits.

Stockholders’ equity was $274.7 million on June

30, 2022, compared to $266.7 million on December 31, 2021. The

growth of $8.0 million, or 3.0%, was primarily a result of

year-to-date net income of $17.0 million, partially offset by a

$5.1 million increase in accumulated other comprehensive loss, $2.7

million in treasury stock purchases and cash dividends paid of $2.3

million during the six months ended June 30, 2022. The increase in

accumulated other comprehensive loss was due to an increase in

unrealized losses on the Bank’s available for sale investment

securities, primarily resulting from the current interest rate

environment.

As of June 30, 2022, the Bank continued to

exceed all regulatory capital requirements to be considered well

capitalized, with a Tier 1 Leverage ratio of 10.19%, a Tier 1

Risk-Based capital ratio of 10.28%, a Common Equity Tier 1 Capital

ratio of 10.28%, and a Total Risk-Based capital ratio of

12.46%.

Asset Quality

First Bank’s asset quality metrics remained

stable and favorable during the three and six months ended June 30,

2022. Net charge offs of $404,000 for the second quarter of 2022

were 0.07% of average loans on an annualized basis. This compares

to net charge offs of $116,000, or an annualized 0.02% of average

loans, for the second quarter of 2021 and net charge offs of

$247,000, or an annualized 0.05%, for the first quarter of 2022.

Nonperforming loans were $12.7 million on June 30, 2022, down from

$13.0 million on December 31, 2021. Nonperforming loans as a

percentage of total loans on June 30, 2022, were 0.57%, compared

with 0.62% at December 31, 2021, and 0.59% at March 31, 2022. The

allowance for loan losses to nonperforming loans was 197.06% on

June 30, 2022, compared with 182.65% at December 31, 2021, and

191.72% on March 31, 2022.

COVID-19 Response

First Bank participated in the PPP, established

by the Coronavirus Aid, Relief, and Economic Securities Act (CARES

Act), during 2020 and 2021. The PPP was a specialized low-interest

loan program funded by the U.S. Treasury Department and

administered by the Small Business Administration. The PPP provided

borrower guarantees for lenders, as well as loan forgiveness

incentives for borrowers that utilized the loan proceeds to cover

compensation and other business-related operating costs. The PPP

ended on May 31, 2021, but the PPP loan forgiveness process is

ongoing. As of June 30, 2022, First Bank had 99 PPP loans with

outstanding balances of $10.0 million. During the quarter ended

June 30, 2022, PPP loans totaling $15.5 million were forgiven and

the Bank realized $493,000 in loan fees on these loans as any

deferred fees remaining on the forgiven loans were accelerated. As

of June 30, 2022, the Bank had $336,000 in remaining unamortized

fees associated with outstanding balances of PPP loans.

Cash Dividend Declared

On July 19, 2022, First Bank’s Board of

Directors declared a quarterly cash dividend of $0.06 per share to

common stockholders of record at the close of business on August

12, 2022, payable on August 26, 2022.

Conference Call

First Bank will host its earnings call on

Wednesday, July 27, 2022, at 9:00 AM eastern time. The direct dial

toll free number for the live call is 1-844-200-6205 and the access

code is 212059. For those unable to participate in the call, a

replay will be available by dialing 1-866-813-9403 (access code

861313) from one hour after the end of the conference call until

October 24, 2022. Replay information will also be available on

First Bank’s website at www.firstbanknj.com under the “About Us”

tab. Click on “Investor Relations” to access the replay of the

conference call.

About First Bank

First Bank is a New Jersey state-chartered bank

with 18 full-service branches in Cinnaminson, Cranbury, Delanco,

Denville, Ewing, Flemington (2), Hamilton, Lawrence, Monroe,

Pennington, Randolph, Somerset and Williamstown, New Jersey; and

Doylestown, Trevose, Warminster and West Chester, Pennsylvania.

With $2.6 billion in assets as of June 30, 2022, First Bank offers

a full range of deposit and loan products to individuals and

businesses throughout the New York City to Philadelphia corridor.

First Bank's common stock is listed on the Nasdaq Global Market

under the symbol “FRBA.”

Forward Looking Statements

This press release contains certain

forward-looking statements, either express or implied, within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include information regarding First

Bank’s future financial performance, business and growth strategy,

projected plans and objectives, and related transactions,

integration of acquired businesses, ability to recognize

anticipated operational efficiencies, and other projections based

on macroeconomic and industry trends, which are inherently

unreliable due to the multiple factors that impact economic trends,

and any such variations may be material. Such forward-looking

statements are based on various facts and derived utilizing

important assumptions, current expectations, estimates and

projections about First Bank, any of which may change over time and

some of which may be beyond First Bank’s control. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. Further, certain factors that could affect our future

results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not

limited to: whether First Bank can successfully implement its

growth strategy, including identifying acquisition targets and

consummating suitable acquisitions, sustain its internal growth

rate, and provide competitive products and services that appeal to

its customers and target markets; difficult market conditions and

unfavorable economic trends in the United States generally, and

particularly in the market areas in which First Bank operates and

in which its loans are concentrated, including the effects of

inflation and declines in housing market values; the impact of

disease pandemics, including COVID-19, on First Bank’s operations,

customers and employees; an increase in unemployment levels and

slowdowns in economic growth; First Bank's level of nonperforming

assets and the costs associated with resolving any problem loans

including litigation and other costs; changes in market interest

rates may increase funding costs and reduce earning asset yields

thus reducing margin; the impact of changes in interest rates and

the credit quality and strength of underlying collateral and the

effect of such changes on the market value of First Bank's

investment securities portfolio; the extensive federal and state

regulation, supervision and examination governing almost every

aspect of First Bank's operations, including changes in regulations

affecting financial institutions and expenses associated with

complying with such regulations; uncertainties in tax estimates and

valuations, including due to changes in state and federal tax law;

First Bank's ability to comply with applicable capital and

liquidity requirements, including First Bank’s ability to generate

liquidity internally or raise capital on favorable terms, including

continued access to the debt and equity capital markets; and

possible changes in trade, monetary and fiscal policies, laws and

regulations and other activities of governments, agencies, and

similar organizations. For discussion of these and other risks that

may cause actual results to differ from expectations, please refer

to “Forward-Looking Statements” and “Risk Factors” in First Bank’s

Annual Report on Form 10-K and any updates to those risk factors

set forth in First Bank’s proxy statement, subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K. If one or more

events related to these or other risks or uncertainties

materialize, or if First Bank’s underlying assumptions prove to be

incorrect, actual results may differ materially from what First

Bank anticipates. Accordingly, you should not place undue reliance

on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and First

Bank does not undertake any obligation to publicly update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. All forward-looking

statements, expressed or implied, included in this communication

are expressly qualified in their entirety by this cautionary

statement. This cautionary statement should also be considered in

connection with any subsequent written or oral forward-looking

statements that First Bank or persons acting on First Bank’s behalf

may issue.

CONTACT: Andrew Hibshman, Chief

Financial Officer(609) 643-0058,

andrew.hibshman@firstbanknj.com

_______________i Return on average tangible

equity is a non-U.S. GAAP financial measure and is calculated by

dividing net income by average tangible equity (average equity

minus average goodwill and other intangible assets). For a

reconciliation of this non-U.S. GAAP financial measure, along with

the other non-U.S. GAAP financial measures in this press release,

to their comparable U.S. GAAP measures, see the financial

reconciliations at the end of this press release.

ii The efficiency ratio is a non-U.S. GAAP financial measure and

is calculated by dividing non-interest expense less merger-related

expenses by adjusted total revenue (net interest income plus

non-interest income). For a reconciliation of this non-U.S. GAAP

financial measure, along with the other non-U.S. GAAP financial

measures in this press release, to their comparable U.S. GAAP

measures, see the financial reconciliations at the end of this

press release.

|

FIRST BANK AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION |

|

(in thousands, except for share data,

unaudited) |

|

|

| |

|

|

|

| |

June 30, 2022 |

|

December 31, 2021 |

|

Assets |

|

|

|

|

Cash and due from banks |

$ |

27,392 |

|

|

$ |

25,076 |

|

|

Interest bearing deposits with banks |

|

61,186 |

|

|

|

129,431 |

|

|

Cash and cash equivalents |

|

88,578 |

|

|

|

154,507 |

|

|

Interest bearing time deposits with banks |

|

1,542 |

|

|

|

2,170 |

|

|

Investment securities available for sale, at fair value |

|

97,152 |

|

|

|

94,584 |

|

|

Investment securities held to maturity (fair value of

$41,003 at June 30, 2022 and $39,718 at December 31,

2021) |

|

43,426 |

|

|

|

39,547 |

|

|

Restricted investment in bank stocks |

|

5,705 |

|

|

|

5,856 |

|

|

Other investments |

|

8,095 |

|

|

|

8,062 |

|

|

Loans, net of deferred fees and costs |

|

2,220,223 |

|

|

|

2,111,991 |

|

|

Less: Allowance for loan losses |

|

25,034 |

|

|

|

23,746 |

|

|

Net loans |

|

2,195,189 |

|

|

|

2,088,245 |

|

|

Premises and equipment, net |

|

10,067 |

|

|

|

9,883 |

|

|

Other real estate owned, net |

|

293 |

|

|

|

772 |

|

|

Accrued interest receivable |

|

6,028 |

|

|

|

5,681 |

|

|

Bank-owned life insurance |

|

57,376 |

|

|

|

56,633 |

|

|

Goodwill |

|

17,826 |

|

|

|

17,826 |

|

|

Other intangible assets, net |

|

1,942 |

|

|

|

2,145 |

|

|

Deferred income taxes |

|

12,680 |

|

|

|

11,081 |

|

|

Other assets |

|

22,238 |

|

|

|

13,306 |

|

|

Total assets |

$ |

2,568,137 |

|

|

$ |

2,510,298 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Liabilities: |

|

|

|

|

Non-interest bearing deposits |

$ |

600,402 |

|

|

$ |

558,775 |

|

|

Interest bearing deposits |

|

1,564,761 |

|

|

|

1,555,827 |

|

|

Total deposits |

|

2,165,163 |

|

|

|

2,114,602 |

|

|

Borrowings |

|

74,479 |

|

|

|

81,835 |

|

|

Subordinated debentures |

|

29,675 |

|

|

|

29,620 |

|

|

Accrued interest payable |

|

308 |

|

|

|

399 |

|

|

Other liabilities |

|

23,810 |

|

|

|

17,176 |

|

|

Total liabilities |

|

2,293,435 |

|

|

|

2,243,632 |

|

|

Stockholders' Equity: |

|

|

|

|

Preferred stock, par value $2 per share; 10,000,000 shares

authorized; no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

Common stock, par value $5 per share; 40,000,000 shares authorized;

21,050,594 shares issued and 19,483,415 shares outstanding at June

30, 2022 and 20,851,506 shares issued and 19,472,364 shares

outstanding at December 31, 2021 |

|

104,390 |

|

|

|

103,704 |

|

|

Additional paid-in capital |

|

80,039 |

|

|

|

79,563 |

|

|

Retained earnings |

|

110,559 |

|

|

|

95,924 |

|

|

Accumulated other comprehensive loss |

|

(5,280 |

) |

|

|

(206 |

) |

|

Treasury stock, 1,571,179 shares at June 30, 2022 and 1,379,142

shares at December 31, 2021 |

|

(15,006 |

) |

|

|

(12,319 |

) |

|

Total stockholders' equity |

|

274,702 |

|

|

|

266,666 |

|

|

Total liabilities and stockholders' equity |

$ |

2,568,137 |

|

|

$ |

2,510,298 |

|

| |

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

(in thousands, except for share data,

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Interest and Dividend Income |

|

|

|

|

|

|

|

|

Investment securities—taxable |

$ |

689 |

|

|

$ |

550 |

|

|

$ |

1,265 |

|

|

$ |

1,025 |

|

|

Investment securities—tax-exempt |

|

33 |

|

|

|

45 |

|

|

|

70 |

|

|

|

93 |

|

|

Interest bearing deposits with banks, |

|

|

|

|

|

|

|

|

Federal funds sold and other |

|

260 |

|

|

|

185 |

|

|

|

390 |

|

|

|

356 |

|

|

Loans, including fees |

|

23,881 |

|

|

|

22,038 |

|

|

|

46,024 |

|

|

|

44,195 |

|

|

Total interest and dividend income |

|

24,863 |

|

|

|

22,818 |

|

|

|

47,749 |

|

|

|

45,669 |

|

|

|

|

|

|

|

|

|

|

|

Interest Expense |

|

|

|

|

|

|

|

|

Deposits |

|

1,262 |

|

|

|

1,463 |

|

|

|

2,271 |

|

|

|

3,313 |

|

|

Borrowings |

|

250 |

|

|

|

493 |

|

|

|

538 |

|

|

|

1,007 |

|

|

Subordinated debentures |

|

441 |

|

|

|

441 |

|

|

|

881 |

|

|

|

881 |

|

|

Total interest expense |

|

1,953 |

|

|

|

2,397 |

|

|

|

3,690 |

|

|

|

5,201 |

|

|

Net interest income |

|

22,910 |

|

|

|

20,421 |

|

|

|

44,059 |

|

|

|

40,468 |

|

|

Provision for loan losses |

|

1,298 |

|

|

|

(162 |

) |

|

|

1,940 |

|

|

|

(1,215 |

) |

|

Net interest income after provision for loan losses |

|

21,612 |

|

|

|

20,583 |

|

|

|

42,119 |

|

|

|

41,683 |

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Income |

|

|

|

|

|

|

|

|

Service fees on deposit accounts |

|

243 |

|

|

|

165 |

|

|

|

495 |

|

|

|

341 |

|

|

Loan fees |

|

102 |

|

|

|

134 |

|

|

|

347 |

|

|

|

815 |

|

|

Income from bank-owned life insurance |

|

370 |

|

|

|

343 |

|

|

|

743 |

|

|

|

672 |

|

|

Gains on sale of loans |

|

253 |

|

|

|

315 |

|

|

|

290 |

|

|

|

849 |

|

|

Gains on recovery of acquired loans |

|

210 |

|

|

|

141 |

|

|

|

334 |

|

|

|

511 |

|

|

Other non-interest income |

|

285 |

|

|

|

244 |

|

|

|

521 |

|

|

|

454 |

|

|

Total non-interest income |

|

1,463 |

|

|

|

1,342 |

|

|

|

2,730 |

|

|

|

3,642 |

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Expense |

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

6,698 |

|

|

|

5,930 |

|

|

|

13,242 |

|

|

|

11,698 |

|

|

Occupancy and equipment |

|

1,381 |

|

|

|

1,299 |

|

|

|

2,805 |

|

|

|

3,237 |

|

|

Legal fees |

|

172 |

|

|

|

253 |

|

|

|

314 |

|

|

|

500 |

|

|

Other professional fees |

|

692 |

|

|

|

528 |

|

|

|

1,379 |

|

|

|

1,059 |

|

|

Regulatory fees |

|

233 |

|

|

|

228 |

|

|

|

426 |

|

|

|

496 |

|

|

Directors' fees |

|

180 |

|

|

|

219 |

|

|

|

398 |

|

|

|

435 |

|

|

Data processing |

|

589 |

|

|

|

608 |

|

|

|

1,185 |

|

|

|

1,143 |

|

|

Marketing and advertising |

|

177 |

|

|

|

187 |

|

|

|

341 |

|

|

|

375 |

|

|

Travel and entertainment |

|

111 |

|

|

|

24 |

|

|

|

199 |

|

|

|

39 |

|

|

Insurance |

|

186 |

|

|

|

138 |

|

|

|

351 |

|

|

|

292 |

|

|

Other real estate owned expense, net |

|

114 |

|

|

|

30 |

|

|

|

197 |

|

|

|

81 |

|

|

Other expense |

|

876 |

|

|

|

711 |

|

|

|

1,694 |

|

|

|

1,450 |

|

|

Total non-interest expense |

|

11,409 |

|

|

|

10,155 |

|

|

|

22,531 |

|

|

|

20,805 |

|

|

Income Before Income Taxes |

|

11,666 |

|

|

|

11,770 |

|

|

|

22,318 |

|

|

|

24,520 |

|

|

Income tax expense |

|

2,843 |

|

|

|

2,877 |

|

|

|

5,337 |

|

|

|

5,966 |

|

|

Net Income |

$ |

8,823 |

|

|

$ |

8,893 |

|

|

$ |

16,981 |

|

|

$ |

18,554 |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.45 |

|

|

$ |

0.45 |

|

|

$ |

0.87 |

|

|

$ |

0.94 |

|

|

Diluted earnings per common share |

$ |

0.45 |

|

|

$ |

0.45 |

|

|

$ |

0.86 |

|

|

$ |

0.93 |

|

|

Cash dividends per common share |

$ |

0.06 |

|

|

$ |

0.03 |

|

|

$ |

0.12 |

|

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

19,586,103 |

|

|

|

19,677,002 |

|

|

|

19,559,605 |

|

|

|

19,674,523 |

|

|

Diluted weighted average common shares outstanding |

|

19,794,657 |

|

|

|

19,883,076 |

|

|

|

19,780,953 |

|

|

|

19,859,091 |

|

|

|

|

|

|

|

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

AVERAGE BALANCE SHEETS WITH INTEREST AND AVERAGE

RATES |

|

(dollars in thousands, unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

| |

|

2022 |

|

|

|

2021 |

|

| |

Average |

|

|

|

Average |

Average |

|

|

|

Average |

| |

Balance |

|

Interest |

|

Rate (5) |

|

Balance |

|

Interest |

|

Rate (5) |

|

Interest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities (1) (2) |

$ |

141,412 |

|

|

$ |

729 |

|

|

2.07 |

% |

|

$ |

120,238 |

|

|

$ |

605 |

|

|

2.02 |

% |

|

Loans (3) |

|

2,181,197 |

|

|

|

23,881 |

|

|

4.39 |

% |

|

|

2,044,789 |

|

|

|

22,038 |

|

|

4.32 |

% |

|

Interest bearing deposits with banks, |

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds sold and other |

|

107,903 |

|

|

|

171 |

|

|

0.64 |

% |

|

|

117,787 |

|

|

|

71 |

|

|

0.24 |

% |

|

Restricted investment in bank stocks |

|

5,424 |

|

|

|

65 |

|

|

4.81 |

% |

|

|

8,089 |

|

|

|

98 |

|

|

4.86 |

% |

|

Other investments |

|

8,090 |

|

|

|

24 |

|

|

1.19 |

% |

|

|

6,525 |

|

|

|

16 |

|

|

0.98 |

% |

|

Total interest earning assets (2) |

|

2,444,026 |

|

|

|

24,870 |

|

|

4.08 |

% |

|

|

2,297,428 |

|

|

|

22,828 |

|

|

3.99 |

% |

|

Allowance for loan losses |

|

(24,469 |

) |

|

|

|

|

|

|

(23,512 |

) |

|

|

|

|

|

Non-interest earning assets |

|

148,886 |

|

|

|

|

|

|

|

136,437 |

|

|

|

|

|

|

Total assets |

$ |

2,568,443 |

|

|

|

|

|

|

$ |

2,410,353 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing demand deposits |

$ |

329,702 |

|

|

$ |

137 |

|

|

0.17 |

% |

|

$ |

210,494 |

|

|

$ |

49 |

|

|

0.09 |

% |

|

Money market deposits |

|

737,041 |

|

|

|

642 |

|

|

0.35 |

% |

|

|

602,221 |

|

|

|

424 |

|

|

0.28 |

% |

|

Savings deposits |

|

181,390 |

|

|

|

180 |

|

|

0.40 |

% |

|

|

183,289 |

|

|

|

192 |

|

|

0.42 |

% |

|

Time deposits |

|

321,378 |

|

|

|

303 |

|

|

0.38 |

% |

|

|

482,657 |

|

|

|

798 |

|

|

0.66 |

% |

|

Total interest bearing deposits |

|

1,569,511 |

|

|

|

1,262 |

|

|

0.32 |

% |

|

|

1,478,661 |

|

|

|

1,463 |

|

|

0.40 |

% |

|

Borrowings |

|

68,024 |

|

|

|

250 |

|

|

1.47 |

% |

|

|

130,441 |

|

|

|

493 |

|

|

1.52 |

% |

|

Subordinated debentures |

|

29,658 |

|

|

|

441 |

|

|

5.95 |

% |

|

|

29,547 |

|

|

|

441 |

|

|

5.97 |

% |

|

Total interest bearing liabilities |

|

1,667,193 |

|

|

|

1,953 |

|

|

0.47 |

% |

|

|

1,638,649 |

|

|

|

2,397 |

|

|

0.59 |

% |

|

Non-interest bearing deposits |

|

606,874 |

|

|

|

|

|

|

|

505,912 |

|

|

|

|

|

|

Other liabilities |

|

20,547 |

|

|

|

|

|

|

|

15,649 |

|

|

|

|

|

|

Stockholders' equity |

|

273,829 |

|

|

|

|

|

|

|

250,143 |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

2,568,443 |

|

|

|

|

|

|

$ |

2,410,353 |

|

|

|

|

|

|

Net interest income/interest rate spread (2) |

|

|

|

22,917 |

|

|

3.61 |

% |

|

|

|

|

20,431 |

|

|

3.40 |

% |

|

Net interest margin (2) (4) |

|

|

|

|

3.76 |

% |

|

|

|

|

|

3.57 |

% |

|

Tax equivalent adjustment (2) |

|

|

|

(7 |

) |

|

|

|

|

|

|

(10 |

) |

|

|

|

Net interest income |

|

|

$ |

22,910 |

|

|

|

|

|

|

$ |

20,421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average balance of investment securities available for sale is

based on amortized cost. |

|

|

|

|

|

|

|

(2) Interest and average rates are presented on a tax equivalent

basis using a federal income tax rate of 21%. |

|

|

|

|

|

(3) Average balances of loans include loans on nonaccrual

status. |

|

|

|

|

|

|

|

|

|

|

|

(4) Net interest income divided by average total interest earning

assets. |

|

|

|

|

|

|

|

|

|

(5) Annualized. |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

AVERAGE BALANCE SHEETS WITH INTEREST AND AVERAGE

RATES |

|

(dollars in thousands, unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, |

| |

|

2022 |

|

|

|

2021 |

|

| |

Average |

|

|

|

Average |

Average |

|

|

|

Average |

| |

Balance |

|

Interest |

|

Rate (5) |

|

Balance |

|

Interest |

|

Rate (5) |

|

Interest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities (1) (2) |

$ |

137,742 |

|

|

$ |

1,350 |

|

|

1.98 |

% |

|

$ |

109,058 |

|

|

$ |

1,138 |

|

|

2.10 |

% |

|

Loans (3) |

|

2,156,244 |

|

|

|

46,024 |

|

|

4.30 |

% |

|

|

2,041,074 |

|

|

|

44,195 |

|

|

4.37 |

% |

|

Interest bearing deposits with banks, |

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds sold and other |

|

114,626 |

|

|

|

221 |

|

|

0.39 |

% |

|

|

113,315 |

|

|

|

140 |

|

|

0.25 |

% |

|

Restricted investment in bank stocks |

|

5,519 |

|

|

|

128 |

|

|

4.68 |

% |

|

|

8,267 |

|

|

|

185 |

|

|

4.51 |

% |

|

Other investments |

|

8,081 |

|

|

|

41 |

|

|

1.02 |

% |

|

|

6,518 |

|

|

|

31 |

|

|

0.96 |

% |

|

Total interest earning assets (2) |

|

2,422,212 |

|

|

|

47,764 |

|

|

3.98 |

% |

|

|

2,278,232 |

|

|

|

45,689 |

|

|

4.04 |

% |

|

Allowance for loan losses |

|

(24,265 |

) |

|

|

|

|

|

|

(24,053 |

) |

|

|

|

|

|

Non-interest earning assets |

|

147,788 |

|

|

|

|

|

|

|

134,326 |

|

|

|

|

|

|

Total assets |

$ |

2,545,735 |

|

|

|

|

|

|

$ |

2,388,505 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing demand deposits |

$ |

314,074 |

|

|

$ |

198 |

|

|

0.13 |

% |

|

$ |

205,896 |

|

|

$ |

114 |

|

|

0.11 |

% |

|

Money market deposits |

|

721,790 |

|

|

|

1,090 |

|

|

0.30 |

% |

|

|

597,015 |

|

|

|

944 |

|

|

0.32 |

% |

|

Savings deposits |

|

185,782 |

|

|

|

344 |

|

|

0.37 |

% |

|

|

176,180 |

|

|

|

396 |

|

|

0.45 |

% |

|

Time deposits |

|

335,721 |

|

|

|

639 |

|

|

0.38 |

% |

|

|

495,234 |

|

|

|

1,859 |

|

|

0.76 |

% |

|

Total interest bearing deposits |

|

1,557,367 |

|

|

|

2,271 |

|

|

0.29 |

% |

|

|

1,474,325 |

|

|

|

3,313 |

|

|

0.45 |

% |

|

Borrowings |

|

72,234 |

|

|

|

538 |

|

|

1.50 |

% |

|

|

137,995 |

|

|

|

1,007 |

|

|

1.47 |

% |

|

Subordinated debentures |

|

29,645 |

|

|

|

881 |

|

|

5.94 |

% |

|

|

29,533 |

|

|

|

881 |

|

|

5.97 |

% |

|

Total interest bearing liabilities |

|

1,659,246 |

|

|

|

3,690 |

|

|

0.45 |

% |

|

|

1,641,853 |

|

|

|

5,201 |

|

|

0.64 |

% |

|

Non-interest bearing deposits |

|

595,273 |

|

|

|

|

|

|

|

485,149 |

|

|

|

|

|

|

Other liabilities |

|

19,218 |

|

|

|

|

|

|

|

15,571 |

|

|

|

|

|

|

Stockholders' equity |

|

271,998 |

|

|

|

|

|

|

|

245,932 |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

2,545,735 |

|

|

|

|

|

|

$ |

2,388,505 |

|

|

|

|

|

|

Net interest income/interest rate spread (2) |

|

|

|

44,074 |

|

|

3.53 |

% |

|

|

|

|

40,488 |

|

|

3.40 |

% |

|

Net interest margin (2) (4) |

|

|

|

|

3.67 |

% |

|

|

|

|

|

3.58 |

% |

|

Tax equivalent adjustment (2) |

|

|

|

(15 |

) |

|

|

|

|

|

|

(20 |

) |

|

|

|

Net interest income |

|

|

$ |

44,059 |

|

|

|

|

|

|

$ |

40,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average balance of investment securities available for sale is

based on amortized cost. |

|

|

|

|

|

|

|

(2) Interest and average rates are presented on a tax equivalent

basis using a federal income tax rate of 21%. |

|

|

|

|

|

(3) Average balances of loans include loans on nonaccrual

status. |

|

|

|

|

|

|

|

|

|

|

|

(4) Net interest income divided by average total interest earning

assets. |

|

|

|

|

|

|

|

|

|

(5) Annualized. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

QUARTERLY FINANCIAL HIGHLIGHTS |

|

(in thousands, except for share and employee data,

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of or For the Quarter Ended |

| |

|

6/30/2022 |

|

3/31/2022 |

|

12/31/2021 |

|

9/30/2021 |

|

6/30/2021 |

| EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

22,910 |

|

|

$ |

21,149 |

|

|

$ |

20,641 |

|

|

$ |

20,781 |

|

|

$ |

20,421 |

|

|

Provision for loan losses |

|

|

1,298 |

|

|

|

642 |

|

|

|

825 |

|

|

|

158 |

|

|

|

(162 |

) |

|

Non-interest income |

|

|

1,463 |

|

|

|

1,267 |

|

|

|

2,211 |

|

|

|

1,901 |

|

|

|

1,342 |

|

|

Non-interest expense |

|

|

11,409 |

|

|

|

11,122 |

|

|

|

11,825 |

|

|

|

10,522 |

|

|

|

10,155 |

|

|

Income tax expense |

|

|

2,843 |

|

|

|

2,494 |

|

|

|

2,363 |

|

|

|

2,966 |

|

|

|

2,877 |

|

|

Net income |

|

|

8,823 |

|

|

|

8,158 |

|

|

|

7,839 |

|

|

|

9,036 |

|

|

|

8,893 |

|

| |

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

|

1.38 |

% |

|

|

1.31 |

% |

|

|

1.27 |

% |

|

|

1.46 |

% |

|

|

1.48 |

% |

|

Adjusted return on average assets (1) (2) |

|

|

1.38 |

% |

|

|

1.31 |

% |

|

|

1.33 |

% |

|

|

1.48 |

% |

|

|

1.48 |

% |

|

Return on average equity (1) |

|

|

12.92 |

% |

|

|

12.25 |

% |

|

|

11.77 |

% |

|

|

13.86 |

% |

|

|

14.26 |

% |

|

Adjusted return on average equity (1) (2) |

|

|

12.92 |

% |

|

|

12.25 |

% |

|

|

12.36 |

% |

|

|

14.04 |

% |

|

|

14.26 |

% |

|

Return on average tangible equity (1) (2) |

|

|

13.93 |

% |

|

|

13.22 |

% |

|

|

12.63 |

% |

|

|

14.90 |

% |

|

|

15.37 |

% |

|

Adjusted return on average tangible equity (1) (2) |

|

|

13.93 |

% |

|

|

13.22 |

% |

|

|

13.26 |

% |

|

|

15.09 |

% |

|

|

15.37 |

% |

|

Net interest margin (1) (3) |

|

|

3.76 |

% |

|

|

3.57 |

% |

|

|

3.52 |

% |

|

|

3.54 |

% |

|

|

3.57 |

% |

|

Total cost of deposits (1) |

|

|

0.23 |

% |

|

|

0.19 |

% |

|

|

0.21 |

% |

|

|

0.25 |

% |

|

|

0.30 |

% |

|

Efficiency ratio (2) |

|

|

46.81 |

% |

|

|

49.62 |

% |

|

|

49.57 |

% |

|

|

45.75 |

% |

|

|

46.66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| SHARE

DATA |

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding |

|

|

19,483,415 |

|

|

|

19,634,744 |

|

|

|

19,472,364 |

|

|

|

19,464,388 |

|

|

|

19,678,528 |

|

|

Basic earnings per share |

|

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.40 |

|

|

$ |

0.46 |

|

|

$ |

0.45 |

|

|

Diluted earnings per share |

|

|

0.45 |

|

|

|

0.41 |

|

|

|

0.40 |

|

|

|

0.46 |

|

|

|

0.45 |

|

|

Adjusted diluted earnings per share (2) |

|

|

0.45 |

|

|

|

0.41 |

|

|

|

0.42 |

|

|

|

0.46 |

|

|

|

0.45 |

|

|

Tangible book value per share (2) |

|

|

13.08 |

|

|

|

12.79 |

|

|

|

12.67 |

|

|

|

12.45 |

|

|

|

12.02 |

|

|

Book value per share |

|

|

14.10 |

|

|

|

13.81 |

|

|

|

13.69 |

|

|

|

13.37 |

|

|

|

12.94 |

|

| |

|

|

|

|

|

|

|

|

|

|

| MARKET

DATA |

|

|

|

|

|

|

|

|

|

|

|

Market value per share |

|

$ |

13.98 |

|

|

$ |

14.22 |

|

|

$ |

14.51 |

|

|

$ |

14.09 |

|

|

$ |

13.54 |

|

|

Market value / Tangible book value |

|

|

106.84 |

% |

|

|

111.14 |

% |

|

|

114.53 |

% |

|

|

113.21 |

% |

|

|

112.61 |

% |

|

Market capitalization |

|

$ |

272,378 |

|

|

$ |

279,206 |

|

|

$ |

282,544 |

|

|

$ |

274,253 |

|

|

$ |

266,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

| CAPITAL &

LIQUIDITY |

|

|

|

|

|

|

|

|

|

|

|

Tangible stockholders' equity / tangible assets (2) |

|

|

10.00 |

% |

|

|

9.84 |

% |

|

|

9.91 |

% |

|

|

10.01 |

% |

|

|

9.76 |

% |

|

Stockholders' equity / assets |

|

|

10.70 |

% |

|

|

10.53 |

% |

|

|

10.62 |

% |

|

|

10.67 |

% |

|

|

10.42 |

% |

|

Loans / deposits |

|

|

102.54 |

% |

|

|

98.80 |

% |

|

|

99.88 |

% |

|

|

97.96 |

% |

|

|

100.87 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| ASSET

QUALITY |

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs (recoveries) |

|

$ |

404 |

|

|

$ |

247 |

|

|

$ |

6 |

|

|

$ |

(121 |

) |

|

$ |

116 |

|

|

Nonperforming loans |

|

|

12,704 |

|

|

|

12,591 |

|

|

|

13,001 |

|

|

|

11,488 |

|

|

|

9,558 |

|

|

Nonperforming assets |

|

|

12,997 |

|

|

|

12,884 |

|

|

|

13,773 |

|

|

|

11,967 |

|

|

|

10,038 |

|

|

Net charge offs (recoveries) / average loans (1) |

|

|

0.07 |

% |

|

|

0.05 |

% |

|

|

0.00 |

% |

|

|

(0.02 |

%) |

|

|

0.02 |

% |

|

Nonperforming loans / total loans |

|

|

0.57 |

% |

|

|

0.59 |

% |

|

|

0.62 |

% |

|

|

0.57 |

% |

|

|

0.47 |

% |

|

Nonperforming assets / total assets |

|

|

0.51 |

% |

|

|

0.50 |

% |

|

|

0.55 |

% |

|

|

0.49 |

% |

|

|

0.41 |

% |

|

Allowance for loan losses / total loans |

|

|

1.13 |

% |

|

|

1.12 |

% |

|

|

1.12 |

% |

|

|

1.14 |

% |

|

|

1.10 |

% |

|

Allowance for loan losses / total loans (excluding PPP loans) |

|

|

1.13 |

% |

|

|

1.13 |

% |

|

|

1.15 |

% |

|

|

1.19 |

% |

|

|

1.18 |

% |

|

Allowance for loan losses / nonperforming loans |

|

|

197.06 |

% |

|

|

191.72 |

% |

|

|

182.65 |

% |

|

|

199.57 |

% |

|

|

236.95 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| OTHER

DATA |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

2,568,137 |

|

|

$ |

2,573,845 |

|

|

$ |

2,510,298 |

|

|

$ |

2,438,020 |

|

|

$ |

2,443,047 |

|

|

Total loans |

|

|

2,220,223 |

|

|

|

2,151,751 |

|

|

|

2,111,991 |

|

|

|

2,004,289 |

|

|

|

2,053,938 |

|

|

Total deposits |

|

|

2,165,163 |

|

|

|

2,177,895 |

|

|

|

2,114,602 |

|

|

|

2,045,966 |

|

|

|

2,036,228 |

|

|

Total stockholders' equity |

|

|

274,702 |

|

|

|

271,068 |

|

|

|

266,666 |

|

|

|

260,179 |

|

|

|

254,571 |

|

|

Number of full-time equivalent employees (4) |

|

|

233 |

|

|

|

219 |

|

|

|

217 |

|

|

|

209 |

|

|

|

215 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) Annualized. |

|

|

|

|

|

|

|

|

|

|

| (2) Non-U.S. GAAP

financial measure that we believe provides management and investors

with information that is useful in understanding our financial

performance and condition. See accompanying table, "Non-U.S.

GAAP Financial Measures," for calculation and reconciliation. |

| (3) Tax equivalent using a

federal income tax rate of 21%. |

|

|

|

|

|

|

|

|

|

|

| (4) Includes 8

and 4 full-time equivalent seasonal interns as of June 30, 2022 and

2021, respectively. |

| |

|

|

|

|

|

|

|

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

QUARTERLY FINANCIAL HIGHLIGHTS |

|

(dollars in thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of the Quarter Ended |

| |

|

6/30/2022 |

|

3/31/2022 |

|

12/31/2021 |

|

9/30/2021 |

|

6/30/2021 |

|

LOAN COMPOSITION |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

$ |

321,205 |

|

|

$ |

321,979 |

|

|

$ |

350,103 |

|

|

$ |

308,991 |

|

|

$ |

379,916 |

|

|

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

Owner-occupied |

|

|

517,791 |

|

|

|

493,999 |

|

|

|

470,022 |

|

|

|

444,635 |

|

|

|

427,094 |

|

|

Investor |

|

|

917,905 |

|

|

|

888,622 |

|

|

|

848,021 |

|

|

|

832,727 |

|

|

|

814,762 |

|

|

Construction and development |

|

|

117,011 |

|

|

|

96,585 |

|

|

|

109,292 |

|

|

|

112,112 |

|

|

|

127,329 |

|

|

Multi-family |

|

|

201,269 |

|

|

|

193,865 |

|

|

|

173,728 |

|

|

|

145,245 |

|

|

|

142,015 |

|

|

Total commercial real estate |

|

|

1,753,976 |

|

|

|

1,673,071 |

|

|

|

1,601,063 |

|

|

|

1,534,719 |

|

|

|

1,511,200 |

|

|

Residential real estate: |

|

|

|

|

|

|

|

|

|

|

|

Residential mortgage and first lien home equity loans |

|

|

98,841 |

|

|

|

99,992 |

|

|

|

106,204 |

|

|

|

103,890 |

|

|

|

108,842 |

|

|

Home equity–second lien loans and revolving lines of credit |

|

|

30,491 |

|

|

|

30,485 |

|

|

|

31,375 |

|

|

|

29,998 |

|

|

|

29,422 |

|

|

Total residential real estate |

|

|

129,332 |

|

|

|

130,477 |

|

|

|

137,579 |

|

|

|

133,888 |

|

|

|

138,264 |

|

|

Consumer and other |

|

|

19,694 |

|

|

|

30,096 |

|

|

|

27,762 |

|

|

|

31,946 |

|

|

|

31,584 |

|

|

Total loans prior to deferred loan fees and costs |

|

|

2,224,207 |

|

|

|

2,155,623 |

|

|

|

2,116,507 |

|

|

|

2,009,544 |

|

|

|

2,060,964 |

|

|

Net deferred loan fees and costs |

|

|

(3,984 |

) |

|

|

(3,872 |

) |

|

|

(4,516 |

) |

|

|

(5,255 |

) |

|

|

(7,026 |

) |

|

Total loans |

|

$ |

2,220,223 |

|

|

$ |

2,151,751 |

|

|

$ |

2,111,991 |

|

|

$ |

2,004,289 |

|

|

$ |

2,053,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN MIX |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

|

14.5 |

% |

|

|

15.0 |

% |

|

|

16.6 |

% |

|

|

15.4 |

% |

|

|

18.5 |

% |

|

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

Owner-occupied |

|

|

23.3 |

% |

|

|

23.0 |

% |

|

|

22.3 |

% |

|

|

22.2 |

% |

|

|

20.8 |

% |

|

Investor |

|

|

41.3 |

% |

|

|

41.3 |

% |

|

|

40.1 |

% |

|

|

41.5 |

% |

|

|

39.7 |

% |

|

Construction and development |

|

|

5.3 |

% |

|

|

4.5 |

% |

|

|

5.2 |

% |

|

|

5.6 |

% |

|

|

6.2 |

% |

|

Multi-family |

|

|

9.1 |

% |

|

|

9.0 |

% |

|

|

8.2 |

% |

|

|

7.2 |

% |

|

|

6.9 |

% |

|

Total commercial real estate |

|

|

79.0 |

% |

|

|

77.8 |

% |

|

|

75.8 |

% |

|

|

76.5 |

% |

|

|

73.5 |

% |

|

Residential real estate: |

|

|

|

|

|

|

|

|

|

|

|

Residential mortgage and first lien home equity loans |

|

|

4.4 |

% |

|

|

4.6 |

% |

|

|

5.0 |

% |

|

|

5.2 |

% |

|

|

5.3 |

% |

|

Home equity–second lien loans and revolving lines of credit |

|

|

1.4 |

% |

|

|

1.4 |

% |

|

|

1.5 |

% |

|

|

1.5 |

% |

|

|

1.4 |

% |

|

Total residential real estate |

|

|

5.8 |

% |

|

|

6.0 |

% |

|

|

6.5 |

% |

|

|

6.7 |

% |

|

|

6.7 |

% |

|

Consumer and other |

|

|

0.9 |

% |

|

|

1.4 |

% |

|

|

1.4 |

% |

|

|

1.7 |

% |

|

|

1.6 |

% |

|

Net deferred loan fees and costs |

|

|

(0.2 |

%) |

|

|

(0.2 |

%) |

|

|

(0.3 |

%) |

|

|

(0.3 |

%) |

|

|

(0.3 |

%) |

|

Total loans |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST BANK AND SUBSIDIARIES |

|

QUARTERLY FINANCIAL HIGHLIGHTS |

|

(dollars in thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of the Quarter Ended |

| |

|

6/30/2022 |

|

3/31/2022 |

|

12/31/2021 |

|

9/30/2021 |

|

6/30/2021 |

|

DEPOSIT COMPOSITION |

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing demand deposits |

|

$ |

600,402 |

|

|

$ |

597,333 |

|

|

$ |

558,775 |

|

|

$ |

536,905 |

|

|

$ |

534,475 |

|

|

Interest bearing demand deposits |

|

|

318,687 |

|

|

|

314,564 |

|

|

|

293,647 |

|

|

|

241,869 |

|

|

|

211,074 |

|

|

Money market and savings deposits |

|

|

929,075 |

|

|

|

936,848 |

|

|

|

871,074 |

|

|

|

845,607 |

|

|

|

817,424 |

|

|

Time deposits |

|

|

316,999 |

|

|

|

329,150 |

|

|

|

391,106 |

|

|

|

421,585 |

|

|

|

473,255 |

|

|

Total Deposits |

|

$ |

2,165,163 |

|

|

$ |

2,177,895 |

|

|

$ |

2,114,602 |

|

|

$ |

2,045,966 |

|

|

$ |

2,036,228 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSIT MIX |

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing demand deposits |

|

|

27.7 |

% |

|

|

27.4 |

% |

|

|

26.4 |

% |

|

|

26.3 |

% |

|

|

26.3 |

% |

|

Interest bearing demand deposits |

|

|

14.7 |

% |

|

|

14.5 |

% |

|

|

13.9 |

% |

|

|

11.8 |

% |

|

|

10.4 |

% |

|

Money market and savings deposits |

|

|

42.9 |

% |

|

|

43.0 |

% |

|

|

41.2 |

% |

|

|

41.3 |

% |

|

|

40.1 |

% |

|

Time deposits |

|

|

14.7 |

% |

|

|

15.1 |

% |

|

|

18.5 |

% |

|

|

20.6 |

% |

|

|

23.2 |

% |

|

Total Deposits |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|