As filed with the Securities and Exchange Commission

on May 19, 2022.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

G MEDICAL INNOVATIONS HOLDINGS LTD.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

3841 |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

| G Medical Innovations Ltd. |

|

G Medical Innovations USA Inc. |

| 5 Oppenheimer St. |

|

12708 Rita Vista Cir Ste A-103 |

| Rehovot 7670105, Israel |

|

Austin, TX 78727 |

| Tel: +972.8.9584777 |

|

Tel: 800.595.2898 |

| (Address, including zip code, and telephone number, including |

|

(Name, address, including zip code, and telephone |

| area code, of registrant’s principal executive offices) |

|

number, including area code, of agent for service) |

Copies to:

| Oded Har-Even, Esq. |

| Eric Victorson, Esq. |

| Sullivan & Worcester LLP |

| 1633 Broadway |

| New York, NY 10019 |

| Tel: (212) 660-3000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended,

or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED MAY 19, 2022 |

Up to 12,000,002 Ordinary Shares

G Medical Innovations Holdings Ltd.

This prospectus relates to

the resale, by the selling shareholders identified in this prospectus of up to 12,000,002 ordinary shares, par value $0.09 per share,

or Ordinary Shares, consisting of 2,133,334 Ordinary Shares, 3,200,000 Ordinary Shares underlying pre-funded warrants and 6,666,668 Ordinary

Shares underlying Ordinary Share purchase warrants, as further described below under “Prospectus Summary—Recent Financing.”

The selling shareholders are

identified in the table commencing on page 8 . No Ordinary Shares are being registered

hereunder for sale by us. We will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholders. All net proceeds

from the sale of the Ordinary Shares covered by this prospectus will go to the selling shareholders. We will receive cash proceeds equal

to the total exercise price of warrants that are exercised for cash, of approximately $10 million, based on an exercise price of $1.50

per share (subject to adjustments), if all warrants are exercised. See “Use of Proceeds.” The selling shareholders may sell

all or a portion of the Ordinary Shares from time to time in market transactions through any market on which our Ordinary Shares are then

traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price

or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods

of sale. See “Plan of Distribution.”

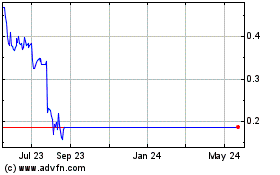

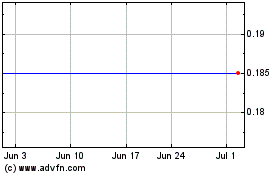

Our Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “GMVD.” The last reported sale price of our Ordinary Shares on May 17, 2022

was $0.75 per share.

We are an emerging growth

company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are subject to reduced public company reporting

requirements.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus and in our Annual

Report on Form 20-F for the fiscal year ended December 31, 2021, or 2021 Annual Report, which is incorporated by reference into this

prospectus.

Neither the Securities

and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2022.

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred

you. Neither we nor the selling shareholders have authorized anyone to provide you with different information. Neither we nor the selling

shareholders are offering to sell the Ordinary Shares, nor we are seeking offers to buy the Ordinary Shares, in any jurisdictions where

offers and sales are not permitted. The information contained in this prospectus and the documents incorporated by reference into this

prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the

Ordinary Shares.

For investors outside of the

United States: Neither we nor the selling shareholders have done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to

inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,”

“us,” “our,” the “Company” and “G Medical Innovations Holdings” refer to G Medical Innovations

Holdings Ltd., a Cayman Islands exempted company, and its subsidiaries: G Medical Innovations Ltd., an Israeli corporation, G Medical

Innovations USA Inc., a Delaware corporation, G Medical Innovations MK Ltd., a Macedonian corporation, G Medical Innovations Asia Limited,

a Hong Kong corporation, G Medical Diagnostic Services, Inc., a Texas corporation, Telerhythmics, LLC, a company formed under the laws

of the state of Tennessee, G Medical Mobile Health Solutions, Inc., an Illinois corporation, G Medical Innovations UK Ltd., a UK corporation,

G Medical Tests and Services, Inc., a Delaware corporation, all of which are wholly-owned subsidiaries, G-Medical Lab services Inc., a

Delaware corporation, our 80%-owned subsidiary, and Guangzhou Yimei Innovative Medical Science and Technology Co., Ltd., a China corporation,

the 70%-owned subsidiary of G Medical Innovations Asia Limited.

Our reporting currency and

functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus

to “dollars” or “$” mean U.S. dollars, and references to “A$” are to Australian dollars. Unless derived

from our consolidated financial statements or otherwise indicated, U.S. dollar translations of A$ amounts presented in this prospectus

are translated using the rate of A$1.41 to $1.00, based on the exchange rates certified for customs purposes by the Federal Reserve Bank

of New York on May 6, 2022.

This prospectus includes statistical,

market and industry data and forecasts which we obtained from publicly available information and independent industry publications and

reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain

their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information.

Although we believe that these sources are reliable, we have not independently verified the information contained in such publications.

We report under International

Financial Reporting Standards as issued by the International Accounting Standards Board, or the IASB. None of the financial statements

were prepared in accordance with generally accepted accounting principles in the United States.

On October 29, 2020, our shareholders

approved, at an extraordinary general shareholders meeting, a 1-for-18 consolidation of our Ordinary Shares pursuant to which holders

of our Ordinary Shares received one Ordinary Share for every 18 Ordinary Shares held, or the October 2020 Reverse Stock Split.

In addition, on March 25,

2021, our shareholders approved, at an extraordinary general shareholders meeting, a one-for-five consolidation of our Ordinary Shares

pursuant to which holders of our Ordinary Shares received one Ordinary Share for every five Ordinary Shares held, or the March 2021

Reverse Stock Split. Unless the context expressly dictates otherwise, all references to share and per share amounts referred to herein

reflect the October 2020 Reverse Stock Split and the March 2021 Reverse Stock Split.

ABOUT THIS PROSPECTUS

This prospectus

describes the general manner in which the selling shareholders identified in this prospectus may offer from time to time up to 12,000,002

Ordinary Shares consisting of 2,133,334 Ordinary Shares, 3,200,000 Ordinary Shares underlying pre-funded warrants and 6,666,668 Ordinary

Shares underlying Ordinary Share purchase warrants. If necessary, the specific manner in which the Ordinary Shares may be offered and

sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained

in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement,

you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent

with a statement in another document having a later date—for example, any prospectus supplement—the statement in the document

having the later date modifies or supersedes the earlier statement.

PROSPECTUS SUMMARY

This summary

highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider

before investing in our Ordinary Shares. Before you decide to invest in our Ordinary Shares, you should read the entire prospectus carefully,

including the “Risk Factors” section, and the financial statements and related notes thereto and the other information incorporated

by reference herein.

Our Company

We are an early

commercial stage healthcare company engaged in the development of next generation mobile health and telemedicine solutions and monitoring

service platforms. We believe we are at the forefront of the digital health revolution in developing the next generation mobile technologies

and services that are designed to empower consumers, patients and providers to better monitor, manage and improve clinical and personal

health outcomes, especially for those who suffer from cardiovascular disease, pulmonary disease and diabetes.

Using

our proprietary suite of devices, software solutions, algorithms and monitoring services, we intend to drive recurring revenue streams

in two vertical markets, with a focus on markets in the United States and China as well as other markets: B2B: professional healthcare

markets (including hospitals, clinics and senior care facilities); and B2B2C and B2C: consumer healthcare markets.

G Medical Tests

and Services, Inc. currently operates five locations performing point-of-care tests in communities surrounding the Los Angeles area including

Pico Rivera, Compton, Bellflower, and Newhall with another operating in Northern California in the City of Stockton. We plan to offer

Same-Day Rapid PCR results for a fee to the patient.

Our management team

is led by individuals with over 30 years of combined experience in developing mobile embedded medical sensors, and with over 48 medical

devices approved by the U.S. Food and Drug Administration, or the U.S. FDA, including devices approved when the members of our management

team were employed at other companies. Our management has proven their ability to execute our go-to-market strategy as described below,

with over 25 years of medical device development and commercialization experience in the United States, China, parts of Europe, Australia,

South Africa, Japan, the Asia Pacific region and Brazil.

Recent Financing

In April 2022, we

completed a series of private placements, or the April 2022 Private Placements, as follows: on April 18, 2022, we entered into a definitive

securities purchase agreement, or the Armistice Purchase Agreement, with Armistice Capital Master Fund Ltd., or Armistice, for the issuance,

in a private placement, of an aggregate of 1,800,000 Ordinary Shares, pre-funded warrants to purchase 3,200,000 Ordinary Shares, or the

Pre-Funded Warrants, and warrants to purchase 6,250,000 Ordinary Shares, or the Armistice Ordinary Warrants.

The Armistice Ordinary

Warrants have an exercise price of $1.50 per share and have a term of five years. The Ordinary Shares or Pre-Funded Warrants, and the

associated Armistice Ordinary Warrants, were sold at a price of $1.50 each, including the Pre-Funded Warrant exercise price of $0.0001

per Ordinary Share, if applicable. The Pre-Funded Warrants will be exercisable at any time upon payment of the exercise price.

The sale of securities

pursuant to the Armistice Purchase Agreement resulted in gross proceeds to the Company of approximately $7.5 million. The closing of the

sale occurred on April 20, 2022.

We also entered

into an agreement with A.G.P./Alliance Global Partners, as sole placement agent, or the Placement Agent, dated April 18, 2022, for the

April 2022 Private Placements. We paid the Placement Agent a cash placement fee equal to 7% of the gross proceeds received in the offering.

In addition, we issued the Placement Agent warrants, or the Placement Agent Warrants, to purchase 250,000 Ordinary Shares, or 5% of the

Ordinary Shares and Ordinary Shares issuable upon exercise of the Pre-Funded Warrants issued pursuant to the Armistice Purchase Agreement.

The Placement Agent Warrants will be exercisable six months after their issuance, will be exercisable for five years from their initial

exercisability and will have an exercise price of $1.50 per share.

As a result of the

Armistice Purchase Agreement, on April 20, 2022, Lind Global Fund II LP an investment fund managed by The Lind Partners, a New York based

institutional fund manager, or Lind Global, exercised its right of participation, and we entered into a definitive securities purchase

agreement, or the Lind Purchase Agreement, with Lind Global for the issuance, in a private placement, of an aggregate of 333,334 Ordinary

Shares and ordinary warrants, or, together with the Armistice Ordinary Warrants, the Ordinary Warrants, to purchase up to an aggregate

of 416,668 Ordinary Shares, at a purchase price of $1.50 per Ordinary Share and associated warrants, for gross proceeds of approximately

$500,000.

The

terms of the Lind Purchase Agreement are substantially similar to the terms of the Armistice Purchase Agreement and the terms of the Ordinary

Warrants issued pursuant to the Lind Purchase Agreement are substantially similar to the terms of the warrants issued pursuant to the

Armistice Purchase Agreement.

In

addition, we entered into an amendment with each of the holders of warrants issued in a series of private placements completed in January

and February 2022, or the January 2022 Private Placements, as follows: (i) an amendment to warrants to purchase up to an aggregate of

2,400,000 Ordinary Shares, with a purchase price of $5.00 per Ordinary Share, issued to Armistice pursuant to a securities purchase agreement

dated January 30, 2022, or the January 2022 Purchase Agreement; and , (ii) an amendment to warrants to purchase up to an aggregate of

20,000 Ordinary Shares, with a purchase price of $5.00 per Ordinary Share, issued to Lind Global pursuant to a securities purchase agreement

dated February 1, 2022, or the February 2022 Purchase Agreement. In each case, the amendment modified the purchase price per Ordinary

Share of the warrants to $1.50.

Following the April 2022 Private

Placements, we repaid $3,380,000 to Lind Global as repayment in full of that certain senior convertible

note dated December 15, 2021 issued pursuant to a definitive securities purchase agreement, or the December 2021 Purchase Agreement, we

entered into with Lind Global.

Corporate Information

We are a company incorporated

and registered in the Cayman Islands and were incorporated in 2014. Our Cayman Islands address is P.O. Box 10008, Willow House, Cricket

Square Grand Cayman, KY1-1001, Cayman Islands and our principal executive offices are located at 5 Oppenheimer St. Rehovot 7670105, Israel.

Our telephone number in the United States is +1.800.595.2898. Our website address is https://gmedinnovations.com/. The information contained

on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus

solely as an inactive textual reference.

THE OFFERING

|

This prospectus relates

to the resale by the selling shareholders identified in this prospectus of up to 12,000,002 Ordinary Shares, consisting of 2,133,334 Ordinary

Shares, 3,200,000 Ordinary Shares underlying pre-funded warrants, and 6,666,668 Ordinary Shares underlying Ordinary Warrants. All of the

Ordinary Shares, when sold, will be sold by this selling shareholders. The selling shareholders may sell their Ordinary Shares from time

to time at prevailing market prices. We will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholders.

|

| Ordinary Shares currently issued and outstanding |

|

24,386,680 (assumes the exercise in full of the Pre-Funded Warrants but not the Ordinary Warrants) |

| |

|

|

|

Ordinary Shares

offered by the selling shareholders |

|

Up to 12,000,002 Ordinary Shares. |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholders. All net proceeds from the sale of the Ordinary Shares covered by this prospectus will go to the selling shareholders. However, we will receive cash proceeds equal to the total exercise price of the Ordinary Warrants that are exercised for cash, of approximately $10 million based on an exercise price of $1.50 per Ordinary Share (subject to adjustments), if all warrants are exercised. See the section of this prospectus titled “Use of Proceeds.” |

| |

|

|

| Risk factors |

|

Investing in our Ordinary Shares involves a high degree of risk. You should read the “Risk Factors” section starting on page 4 of this prospectus and “Item 3. - Key Information – D. Risk Factors” in our 2021 Annual Report, incorporated by reference herein, and other information included or incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in the Ordinary Shares. |

| |

|

|

| Nasdaq Capital Market symbol: |

|

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “GMVD.” |

The number of the

Ordinary Shares to be issued and outstanding immediately after this offering as shown above is based on 24,386,680 Ordinary Shares issued

and outstanding as of the date of this prospectus. This number excludes:

| |

● |

6,666,668 Ordinary Shares issuable upon the exercise of the Ordinary Warrants; |

| |

● |

9,547,415 Ordinary Shares issuable upon the exercise of warrants outstanding as of such date, at exercise prices ranging from $1.24 to $24.93; |

| |

● |

3,450,000 Ordinary Shares issuable upon the exercise of tradable warrants outstanding as of such date, at an exercise price of $6.25, which were issued as part of the units in our initial public offering; |

| |

● |

2,534,071 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our Global Equity Plan, or the Global Plan, outstanding as of such date, at a weighted average exercise price of $2.57, of which 8,961 were vested as of such date; |

| |

● |

3,208,841 Ordinary Shares reserved for future issuance under our Global Plan; and |

| |

● |

4,104,443 Ordinary Shares issuable pursuant to performance rights. |

Unless otherwise indicated, all information

in this prospectus assumes or gives effect to:

| |

● |

the exercise in full of the Pre-Funded Warrants; |

| |

● |

the October 2020 Reverse Stock Split; and |

| |

● |

the March 2021 Reverse Stock Split. |

See “Description of Share Capital

and Governing Documents” for additional information.

RISK FACTORS

An investment in the Ordinary

Shares involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties.

You should consider carefully the risk factors described below and the risks described under the caption “Item 3. Key Information

- D. Risk Factors” in our 2021 Annual Report, which is incorporated by reference in this prospectus, before deciding whether

to invest in the Ordinary Shares. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently

known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these

risks actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. This

could cause the trading price of the Ordinary Shares to decline, and you may lose all or part of your investment.

Risks

Related to Our Business

We have recently

invested significant capital in our new COVID-19 related services, including the purchase of COVID-19 testing kits, however, the future

of COVID-19 related services is uncertain.

In

December 2021 we launched our COVID-19 testing business, which entailed a significant investment of capital, including, among others,

to establish a number of testing facilities and laboratories throughout the state of California and the purchase of COVID-19 testing kits.

The level of demand for COVID-19 testing has varied depending on, among other things, changes in the number of reported cases of COVID-19,

discoveries of new variants or subvariants of the virus, different COVID-19 mitigation efforts and policies adopted by various governments

or businesses, all of which are subject to change and beyond our control. Moreover, the future of COVID-19 related services may be dependent

on changes to laws and regulations governing healthcare service providers, including measures to

control costs, or reductions in reimbursement levels from government payors or insurance companies. While we believe that there

will continue to be a market for COVID-19 testing in the near future, the future outcome and circumstances of the COVID-19 pandemic continues

to rapidly evolve and remains uncertain, and there can be no assurance that there will be a continued market for COVID-19 testing, the

absence or reduction of which could have a material adverse effect on our business, financial condition

and results of operations.

Risks Related to an Investment in Our Securities

and this Offering

Our management will have immediate and broad

discretion over the use of the net proceeds from this offering and may not use them effectively.

We currently intend to use

the net proceeds from the exercise of the Ordinary Warrants for general working capital purposes. See “Use of Proceeds.” However,

our management will have broad discretion in the application of any such net proceeds. Our shareholders may not agree with the manner

in which our management chooses to allocate the net proceeds from the exercise of the Ordinary Warrants. The failure by our management

to apply these funds effectively could have a material adverse effect on our business, financial condition and results of operation. Pending

their use, we may invest the net proceeds from the exercise of the Ordinary Warrants in a manner that does not produce income. The decisions

made by our management may not result in positive returns on your investment and you will not have an opportunity to evaluate the economic,

financial or other information upon which our management bases its decisions.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made

under “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” and elsewhere in this prospectus, including

in our 2021 Annual Report incorporated by reference herein, and other information included or incorporated by reference in this prospectus,

constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential” “intends” or “continue,” or the negative

of these terms or other comparable terminology.

Forward-looking statements include, but are not

limited to, statements about:

| |

● |

our expectation regarding the sufficiency of our existing cash and cash equivalents to fund our current operations; |

| |

|

|

| |

● |

our ability and plans to manufacture, market and sell our products and services, including those related to our new COVID-19 testing business; |

| |

|

|

| |

● |

the commercial launch and future sales of our existing products or services or any other future potential product candidates or services; |

| |

|

|

| |

● |

planned pilot programs with healthcare providers for our products; |

| |

|

|

| |

● |

our plan to further expand by targeting healthcare providers who can benefit from our comprehensive service offerings; |

| |

|

|

| |

● |

our intention to drive multiple recurring revenue streams, across consumer and professional healthcare verticals and in geographical territories; |

| |

|

|

| |

● |

our expectations regarding future growth; |

| |

|

|

| |

● |

our planned level of capital expenditures; |

| |

|

|

| |

● |

our plans to continue to invest in research and development to develop technology for both existing and new products; |

| |

|

|

| |

● |

our anticipation that we will penetrate a higher number of distribution channels and markets with a relatively low overhead; |

| |

|

|

| |

● |

our anticipation that the monitoring services will continue to grow thereby increasing monthly recurring revenues payable to us; |

| |

|

|

| |

● |

anticipated actions of the U.S. FDA, state regulators, if any, or other similar foreign regulatory agencies, including approval to conduct clinical trials, the timing and scope of those trials and the prospects for regulatory approval or clearance of, or other regulatory action with respect to our products or services; |

| |

|

|

| |

● |

our ability to launch and penetrate markets in new locations, including taking steps to expand our activities; |

| |

|

|

| |

● |

our ability to retain key executive members; |

| |

|

|

| |

● |

our ability to internally develop new inventions and intellectual property; |

| |

|

|

| |

● |

interpretations of current laws and the passages of future laws; |

| |

|

|

| |

● |

acceptance of our business model by investors; |

| |

|

|

| |

● |

our expectations regarding the use of proceeds from this offering; and |

| |

|

|

| |

● |

those factors referred to in “Item 3. Key Information – D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” of our 2021 Annual Report as well other factors in our 2021 Annual Report |

These statements are only

current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s

actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking

statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors” and elsewhere

in this prospectus. You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance,

or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as

a result of new information, future events or otherwise, after the date of this prospectus.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the Ordinary Shares by the selling shareholders. All net proceeds from the sale of the Ordinary Shares will go to the

selling shareholders.

We may receive proceeds from

the exercise of the Ordinary Warrants to the extent that the Ordinary Warrants are exercised for cash. The Ordinary Warrants may, however,

be exercisable on a cashless basis under certain circumstances. If the entire Ordinary Warrants were exercised for cash in full, the proceeds

to the Company would be $10,000,002. We intend to use the net proceeds of such warrant exercise, if any, for general working capital purposes.

We can make no assurances that any of the Ordinary Warrants will be exercised, or if exercised, that it will be exercised for cash, the

quantity which will be exercised or in the period in which it will be exercised.

DIVIDEND POLICY

We currently intend to retain

all available funds and any future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying

any cash dividends in the foreseeable future. Any future determination to pay dividends will be made at the discretion of our board of

directors and will depend on various factors, including applicable laws, our results of operations, financial condition, future prospects

and any other factors deemed relevant by our board of directors.

Under the Cayman Islands Companies

Law and our Amended and Restated Memorandum and Articles of Association, a Cayman Islands company may pay a dividend out of its realized

or unrealized profit or share premium account, but a dividend may not be paid if this would result in the company being unable to pay

its debts as they fall due in the ordinary course of business. According to our Amended and Restated Memorandum and Articles of Association,

dividends can be declared and paid out of funds lawfully available to us. Dividends may be declared and paid in cash or in kind (including

paid up share capital or securities in another corporate body). Dividends, if any, would be paid in proportion to the number of Ordinary

Shares a shareholder holds. Any dividend unclaimed after a period of three years from the date the dividend became due for payment shall

be forfeited and shall revert to us.

CAPITALIZATION

The following table sets forth

our cash and cash equivalents and our capitalization as of December 31, 2021:

| |

● |

on an actual basis; |

| |

|

|

| |

● |

on a pro forma basis to give effect to (i) the issuance of 4,650,000 performance shares to management and members of our board of directors, (ii) the issuance of 1,620,000 Ordinary Shares and pre-funded warrants to purchase 800,000 Ordinary Shares pursuant to the January 2022 Private Placements, (iii) the issuance of 54,314 Ordinary Shares to a service provider and employees, (iv) the issuance of 2,133,334 Ordinary Shares and Pre-Funded Warrants to purchase 3,200,000 Ordinary Shares pursuant to the April 2022 Private Placements, (v) the issuance of 2,000,000 Ordinary Shares and 2,000,0000 warrants to Dr. Yacov Geva on April 28, 2022, and (vi) repayments of a convertible note to Lind Global Fund II, LP which were issued in December 2021 as if such issuances and repayments had occurred on December 31, 2021; and |

| |

|

|

| |

● |

on a pro forma as adjusted basis to give effect to the exercise of the Ordinary Warrants issued pursuant to the April 2022 Private Placements. |

You should read this table

in conjunction with the sections titled “Item 5. Operating and Financial Review and Prospects” and our financial statements

and related notes included in our 2021 Annual Report, incorporated by reference herein.

| | |

As of December 31, 2021 | |

| U.S. dollars in thousands | |

Actual | | |

Pro

Forma | | |

Pro Forma As Adjusted | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 6,034 | | |

| 17,544 | | |

| 27,544 | |

| | |

| | | |

| | | |

| | |

| Long term debt | |

| 5,048 | | |

| 341 | | |

| 341 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity (deficit): | |

| | | |

| | | |

| | |

| Share capital | |

| 1,222 | | |

| 2,195 | | |

| 2,795 | |

| Additional paid in capital | |

| 81,879 | | |

| 104,349 | | |

| 113,749 | |

| Other reserve and translation reserve | |

| 1,502 | | |

| 1,502 | | |

| 1,502 | |

| Accumulated deficit | |

| (90,634 | ) | |

| (95,325 | ) | |

| (95,325 | ) |

| Non- controlling interest | |

| 3,219 | | |

| 3,219 | | |

| 3,219 | |

| Total shareholders’ equity (deficit) | |

| (2,812 | ) | |

| 15,940 | | |

| 25,940 | |

| | |

| | | |

| | | |

| | |

| Total capitalization | |

$ | 2,236 | | |

| 16,281 | | |

| 26,281 | |

As of May 9, 2022,

the cash position of the company was approximately $3.4 million.

The number of the

Ordinary Shares to be issued and outstanding immediately after this offering as shown above is based on 24,386,680 Ordinary Shares issued

and outstanding as of the date of this prospectus. This number excludes:

| |

● |

6,666,668 Ordinary Shares issuable upon the exercise of the Ordinary Warrants; |

| |

● |

9,547,415 Ordinary Shares issuable upon the exercise of warrants outstanding as of such date, at exercise prices ranging from $1.24 to $24.93; |

| |

● |

3,450,000 Ordinary Shares issuable upon the exercise of tradable warrants outstanding as of such date, at an exercise price of $6.25, which were issued as part of the units in our initial public offering; |

| |

● |

2,534,071 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our Global Plan outstanding as of such date, at a weighted average exercise price of $2.57, of which 8,961 were vested as of such date; |

| |

● |

3,208,841 Ordinary Shares reserved for future issuance under our Global Plan; and |

| |

● |

4,104,443 Ordinary Shares issuable pursuant to performance rights. |

SELLING SHAREHOLDERS

The selling shareholders acquired

the Ordinary Shares being registered for resale pursuant to this prospectus, pursuant to contractual agreements as detailed above in “Prospectus

Summary— Recent Financing”. We have agreed to file this registration statement covering the resale of the Ordinary Shares

sold in the offering. We are registering the Ordinary Shares in order to permit the selling shareholders to offer the Ordinary Shares

for resale from time to time.

Other than the relationships

described herein, to our knowledge, the selling shareholders are not employees or suppliers of ours or our affiliates. Within the past

three years, other than the relationships described herein, the selling shareholders have not held a position as an officer or a director

of ours, nor have any of the selling shareholders had any material relationship of any kind with us or any of our affiliates. All information

with respect to share ownership has been furnished by the selling shareholders, unless otherwise noted. The Ordinary Shares being offered

are being registered to permit public secondary trading of such Ordinary Shares and each selling shareholders may offer all or part of

the Ordinary Shares it owns for resale from time to time pursuant to this prospectus. None of the selling shareholders have any family

relationships with our officers, directors or controlling shareholders.

The term “selling shareholder(s)”

also includes any transferees, pledgees, donees, or other successors in interest to the selling shareholders named in the table below.

Unless otherwise indicated, to our knowledge, the person named in the table below has sole voting and investment power (subject to applicable

community property laws) with respect to the Ordinary Shares set forth opposite such person’s name. We will file a supplement to

this prospectus (or a post-effective amendment hereto, if necessary) to name successors to the named selling shareholders who are able

to use this prospectus to resell the Ordinary Shares offered hereby.

The table below lists the

selling shareholders and other information regarding the beneficial ownership of the Ordinary Shares held by the selling shareholders.

The second column lists the number of Ordinary Shares beneficially owned by the selling shareholders based on their ownership of Ordinary

Shares as of May 19, 2022.

The third column lists the

Ordinary Shares being offered by this prospectus by the selling shareholders.

In accordance with the terms

of a registration rights agreement with the selling shareholders, this prospectus generally covers the resale of at least a number of

Ordinary Shares issued, or underlying warrants issued, to them in the April 2022 Private Placements. Because the number of Ordinary Shares

may be adjusted for reverse and forward share splits, share dividends, share combinations and other similar transactions, the number of

Ordinary Shares that will actually be issued may be more or less than the number of Ordinary Shares being offered by this prospectus.

The fourth column assumes the sale of all of the Ordinary Shares offered by the selling shareholders pursuant to this prospectus. The

selling shareholders may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

| Name of Selling Shareholder | |

Ordinary

Shares

Beneficially

Owned

Prior to

Offering (1) | | |

Maximum

Number of

Ordinary

Shares to

be Sold

Pursuant to this

Prospectus | | |

Ordinary

Shares Owned

Immediately

After Sale of

Maximum

Number of

Shares in this

Offering | |

| Lind Global Partners II, LP (2) | |

| 1,936,791 | (3) | |

| 750,002 | | |

| 1,186,789 | |

| Armistice Capital Master Fund Ltd(4) | |

| 16,050,000 | (5) | |

| 11,250,000 | | |

| 4,800,000 | |

| (1) |

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. Ordinary Shares subject to warrants currently exercisable, or exercisable within 60 days of May 19, 2022 are counted as outstanding for computing the percentage of the selling shareholder holding such options or warrants but are not counted as outstanding for computing the percentage of any other selling shareholder. |

| (2) |

Lind Global Partners II, LP, is a Delaware limited partnership. The address of Lind Global Partners II, LP is 444 Madison Avenue, Floor 41, New York, NY 10022. Jeff Easton is the Managing Member of Lind Global Partners II, LLC, which is the General Partner of Lind Global Fund II LP, and in such capacity has the right to vote and dispose of the securities held by such entities. Mr. Easton disclaims beneficial ownership over the securities listed except to the extent of his pecuniary interest therein. |

| (3) |

Consists of: (A) 1,146,789 Ordinary Shares issuable upon the exercise of warrants pursuant to the December 2021 Purchase Agreement; (B) (i) 20,000 Ordinary Shares and (ii) 20,000 Ordinary Shares issuable upon the exercise of warrants issued pursuant to the February 2022 Purchase Agreement; and (C) (i) 333,334 Ordinary Share and (ii) 416,668 Ordinary Shares issuable upon the exercise of warrants issued pursuant to the Lind Purchase Agreement. |

| (4) |

Armistice Capital Master Fund Ltd. is a Cayman Islands exempt company. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC 510 Madison Avenue, 7th Floor, New York NY 10022. Armisitce Capital, LLC is the Investment Manager of Armistice Capital Master Fund Ltd. |

| (5) |

Consists of: (A) (i) 2,400,000 Ordinary Shares, and (ii) 2,400,000 Ordinary Shares issuable upon the exercise of warrants issued pursuant to the January 2022 Purchase Agreement; and (B) 1,800,000 Ordinary Shares, (ii) 3,200,000 Ordinary Shares issuable upon the exercise of the Pre-Funded Warrants and (iii) 6,250,000 Ordinary Shares issuable upon the exercise of the Armistice Ordinary Warrants. |

PLAN OF DISTRIBUTION

We are registering the Ordinary

Shares previously issued, and Ordinary Shares underlying warrants previously issued, to permit the resale of these Ordinary Shares by

the holder of these securities from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale

by the selling shareholders of the Ordinary Shares.

Each selling shareholder of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the principal trading market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A selling shareholder may use any one or more of the following

methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through broker-dealers that agree with the selling shareholders to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such methods of sale; or |

| |

● |

any other method permitted pursuant to applicable law. |

The selling shareholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under

this prospectus.

Broker-dealers engaged by

the selling shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in

compliance with FINRA Rule 2121.

In connection with the sale

of the securities or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

shareholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling shareholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling shareholders has informed us that it does not have any written or oral agreement or understanding, directly or indirectly,

with any person to distribute the securities.

We are required to pay all

fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify the selling shareholders

against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the selling shareholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the ordinary shares for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling shareholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the ordinary shares by the selling

shareholders or any other person. We will make copies of this prospectus available to the selling shareholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

We will pay all expenses

of the registration of the Ordinary Shares pursuant to the registration rights agreement with the selling shareholders, estimated to

be $45,827 in total, including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue

sky” laws; provided, however, that the selling shareholders will pay all underwriting discounts and selling commissions, if

any.

DESCRIPTION OF SHARE CAPITAL AND GOVERNING DOCUMENTS

General

As of the date of this prospectus,

our authorized share capital consists of 2,000,000,000 Ordinary Shares, par value $0.09 per share, of which 24,386,680 shares were issued

and outstanding as of such date. All of our issued and outstanding Ordinary Shares have been validly issued, fully paid and non-assessable.

Our Ordinary Shares are not redeemable and are not subject to any preemptive right.

On October 29, 2020, our shareholders

approved the October 2020 Reverse Stock Split of our Ordinary Shares pursuant to which holders of our Ordinary Shares received one Ordinary

Share for every 18 Ordinary Shares held, or the October 2020 Reverse Stock Split.

In addition, on March 25,

2021, our shareholders approved the March 2021 Reverse Stock Split of our Ordinary Shares pursuant to which holders of our Ordinary Shares

received one Ordinary Share for every five Ordinary Shares held.

Ordinary Shares

In the last three years, we

have issued an aggregate of 20,128,475 Ordinary Shares in several private placements, to employees, advisors, consultants, and public

offerings for aggregate net proceeds of approximately $45.2 million, which amount includes the issuance of Ordinary Shares upon the conversion

of options, warrants and performance rights.

Warrants and Options

In addition to Ordinary Shares,

in the last three years, we have issued warrants to purchase an aggregate of 19,569,033 Ordinary Shares to advisors, consultants and investors,

with exercise prices ranging from $1.24 to A$35.2 (approximately $24.93) per share, of which no warrants have been exercised, and granted

options to purchase an aggregate of 2,525,000 Ordinary Shares to directors, officers, employees and service providers with exercise prices

ranging from $1.98 to $3.27 per share, of which, no options have been exercised.

Performance Rights

In the last three years we

have granted 5,399,998 performance rights classified into twelve classes to certain of our officers, directors, employees and service

providers as incentive securities. In July 2020 and in January 2022, 5,556 Class D performance rights and 1,000,000 Class E were vested

and converted into Ordinary Shares, respectively. On January 19, 2022, 289,999 performance rights were forfeited.

Our Amended and Restated Memorandum and Articles of Association

The following are summaries of

material provisions of our Amended and Restated Memorandum and Articles of Association and the Cayman Islands Companies Law insofar as

they relate to the material terms of our share capital. This discussion does not purport to be complete and is qualified in its entirety

by reference to our Amended and Restated Memorandum and Articles of Association. The form of our Amended and Restated Memorandum and Articles

of Association is filed as an exhibit to this registration statement of which this prospectus forms a part.

Share Capital

Our Amended and Restated Memorandum

and Articles of Association permit us to alter our share capital by way of the passing of ordinary resolution, including: (i) to increase

our authorized share capital by the creation of additional authorized but unissued shares, (ii) to reduce our authorized share capital

by the cancellation of authorized but unissued shares, (iii) to consolidate the shares forming our then authorized share capital into

a lower number of shares of a proportionally greater par value, and (iv) to subdivide the shares forming our share capital into a larger

number of shares of a proportionally lesser par value. We may by way of the passing of special resolution and by order from the Grand

Court of the Cayman Islands reduce our share capital in any way, including by reducing the par value of our issued share capital, cancelling

any paid-up share capital which is lost or unrepresented by available assets, and extinguishing or reducing the liability of any of our

shares. See “Voting Rights and Thresholds” below.

Share Repurchase

Subject to Nasdaq Stock Market

Rules, the Cayman Islands Companies Law, our Amended and Restated Memorandum and Articles of Association and any rights conferred on the

holders of any Ordinary Shares or attached to any class of shares, our board of directors may cause us to repurchase or otherwise acquire

shares in such manner, upon such terms and subject to such conditions as they think fit. Pursuant to the Cayman Islands Companies Law,

the repurchase of any share may be paid out of our profits, out of the share premium account or out of the proceeds of a fresh issuance

of shares made for the purpose of such repurchase, or, out of capital if we are able to pay our debts, if any, as they fall due in the

ordinary course of our business.

Voting Rights and Thresholds

At any general meeting of our

shareholders, a resolution put to the vote of the meeting must be decided on a show of hands unless a poll is demanded. On a show of hands,

each shareholder present in person or represented by proxy or (in the case of a shareholder that is a non-natural person) by authorized

representative shall have one vote for each share held by that shareholder.

A poll may instead be demanded:

| |

● |

before the show of hands on that resolution is taken;

|

| |

|

|

| |

● |

before the result of the show of hands on that resolution

is declared; or

|

| |

|

|

| |

● |

immediately after the result of the show of hands on that resolution is declared. |

In the event that a poll is demanded,

each shareholder present in person or represented by proxy or (in the case of a shareholder that is a non-natural person) by authorized

representative has one vote for each share held by that shareholder.

To be passed at a general meeting

of shareholders, ordinary resolutions require the affirmative vote of a simple majority of the votes cast by such shareholders as, being

entitled to do so, attend and vote at the general meeting of shareholders in person, by proxy, or (in the case of a shareholder that is

a non-natural person) by authorized representative; and special resolutions require the affirmative vote of not less than two-thirds majority

of the votes cast by such shareholders as, being entitled to do so, attend and vote at the general meeting in person, by proxy, or (in

the case of a shareholder that is a non-natural person) by authorized representative.

Generally, all matters to be transacted

at a general meeting of shareholders are passed as ordinary resolutions, save for certain matters specified under our Amended and Restated

Memorandum and Articles of Association or the Cayman Islands Companies Law as requiring a special resolution such as appointing a voluntary

liquidator, changing our name, amending our Amended and Restated Memorandum and Articles of Association and for other matters such as

transferring treasury shares at a discount to employees or subordinate companies.

Special resolutions and ordinary

resolutions may also be passed by a unanimous written resolution of all the shareholders having the right to attend and vote at the general

meeting.

Dividends

Under the Cayman Islands Companies

Law and our Amended and Restated Memorandum and Articles of Association, our board of directors may declare and authorize the payment

of dividends and distributions out of our realized or unrealized profits, out of the share premium account (provided that we will, immediately

following that dividend or distribution, be able to pay any our debts, if any, which we may have undertaken in the ordinary course of

our business), or as otherwise permitted by the Cayman Islands Companies Law.

Except as provided by our Amended

and Restated Memorandum and Articles of Association or the rights attached to any of our Ordinary Shares, dividends shall be declared

and paid according to the amounts paid up on the nominal value of the Ordinary Shares on which the dividend is paid. Dividends may be

declared and paid in cash or in kind (including paid up share capital or securities in another body corporate). Any dividend unclaimed

after a period of three years from the date the dividend became due for payment shall be forfeited and shall revert to us.

Liquidation

Subject to any special rights,

privileges or restrictions as to the distribution of available surplus assets on liquidation applicable to any class or classes of shares,

(1) if we are wound up and the assets available for distribution among our shareholders are more than sufficient to repay the entirety

of the paid-up capital at the commencement of the winding up, the excess shall be distributed pari passu among our shareholders in proportion

to the par value of the shares held by them at the commencement of the winding up subject to a deduction from those shares in respect

of which there are monies due, of all monies payable to us, respectively, and (2) if we are wound up and the assets available for distribution

among our shareholders as such are insufficient to repay the entirety of the paid-up capital, those assets shall be distributed so that,

as nearly as may be, the losses shall be borne by our shareholders in proportion to the par value of the shares held by them.

If we are wound up, the liquidator

may, with the sanction of a special resolution, and any other sanction required by the Cayman Islands Companies Law, divide among our

shareholders in specie the entirety or any part of our assets and may, for such purpose, value any assets and may determine how such division

shall be carried out as between the shareholders or different classes of shareholders. The liquidator may also, with the sanction of an

ordinary resolution, vest any part of these assets in trustees upon such trusts for the benefit of our shareholders as the liquidator

shall think fit, but so that no shareholder will be compelled to accept any assets, shares or other securities upon which there is a liability.

Transfer of Shares

Subject to the restrictions of

our Amended and Restated Memorandum and Articles of Association, certificated shares may be transferred, by an instrument of transfer

in writing in any usual form or in another form approved by the board of directors or prescribed by Nasdaq, which must be executed by

or on behalf of the transferor and (in the case of a transfer of a share which is not fully paid) by or on behalf of the transferee. Uncertificated

shares may be transferred, without a written instrument in accordance with the rules or regulations of any electronic trading systems

permitted by Nasdaq.

Our board of directors may decline

to register any transfer of an uncertificated share or depositary interest (i) if the transfer is in favor of more than four persons jointly

(in the case of an uncertificated share); and (ii) in any other circumstance permitted by the rules or regulations of any electronic trading

systems permitted by Nasdaq in which the share is held.

If our board of directors refuses

to register a transfer of a share, they shall, within two months after the date on which the transfer was delivered to us, send notice

of the refusal to the transferee.

Variation of Rights of Shares

Under our Amended and Restated

Memorandum and Articles, if at any time our share capital is divided into different classes of shares, all or any of the rights attached

to any class of shares may be varied in such manner as those rights may provide or, if no such provision is made, either:

| |

● |

with the consent in writing of holders of not less than two-thirds of the issued shares of that class; or |

| |

|

|

| |

● |

with the sanction of a resolution passed at a separate meeting of the holders of the shares of that class by not less than a two-thirds majority of the holders of the shares of that class present and voting at such meeting (whether in person or by proxy). |

For these purposes, our directors

may treat two or more or all of the classes of shares as forming one class of shares if we consider that such classes of shares would

be affected by the proposed variation in the same way. Rights attaching to a class of shares shall not, unless otherwise expressly provided

in the rights attaching to or the terms of issue of such shares, be deemed to be varied, modified or abrogated by the creation or issue

of further shares with rights that are equal to the rights of such existing class of shares, by the reduction of capital paid up on such

shares or by the repurchase, redemption, surrender or conversion of any shares in accordance with the Cayman Islands Companies Law and

our Amended and Restated Memorandum and Articles.

Inspection of Books and Records

Holders of shares will have no

general right to inspect or obtain copies of our register of members or corporate records, except as conferred by the Cayman Islands Companies

Law, by order of the court, authorized by the board of directors, or by ordinary resolution of the shareholders.

Borrowing Powers

Under our Amended and Restated

Memorandum and Articles, our board of directors may exercise all of our powers to borrow money and to mortgage or charge all, or any part,

of our undertaking and property and to issue debentures, debenture stock, mortgages, bonds and other such securities whether outright

or as security for any debt, liability or obligation incurred by us or by any third-party.

Differences in Corporate Law

We are incorporated under the

laws of The Cayman Islands. The Cayman Islands Companies Law is modeled after the corporate legislation of the United Kingdom but does

not follow recent United Kingdom statutory enactments and differs from laws applicable to United States corporations and their shareholders.

Set forth below is a summary of the significant differences between the provisions of the Cayman Islands Companies Law applicable to us

and the laws applicable to companies incorporated in Delaware and their shareholders.

This

discussion does not purport to be a complete statement of the rights of holders of our Ordinary Shares under applicable Cayman Islands

law and our Amended and Restated Memorandum and Articles or the rights of holders of the common stock of a typical corporation under applicable

Delaware law and a typical certificate of incorporation and bylaws.

| |

|

Delaware |

|

Cayman Islands Companies Law / our Amended and Restated Memorandum and Articles |

| |

|

|

|

|

| Dividends |

|

The Delaware General Corporation Law, or the DGCL, generally provides that, subject to certain restrictions, the directors of a corporation may declare and pay dividends upon the shares of its capital stock either out of the corporation’s surplus or, if there is no such surplus, out of its net profits for the fiscal year in which the dividend is declared or the preceding fiscal year, as long as the amount of capital of the corporation following the declaration and payment of the dividend is not less than the aggregate amount of the capital represented by issued and outstanding shares having a preference upon the distribution of assets. Further, the holders of preferred or special stock of any class or series may be entitled to receive dividends at such rates, on such conditions and at such times as stated in the certificate of incorporation. |

|

Under the Cayman Islands Companies Law, dividends may (subject to anything to the contrary in a company’s articles of association) be declared and paid to shareholders out of (a) “profits” (which is not defined by the Cayman Islands law, but under applicable common law may include both retained earnings and realized and unrealized gains) and (b) “share premium” (which represents the excess of the aggregate price paid to the us for our total issued share capital over the aggregate par or nominal value of our total issued share capital). Under the Cayman Islands Companies Law, distributions out of “share premium” may only be made if, immediately following the date on which the dividend is proposed to be paid, we are able to pay our debts, if any, as they fall due in the ordinary course of our business (the “statutory solvency test”). |

| Repurchases and redemptions of shares |

|

A Delaware corporation may purchase or redeem shares of any class except when its capital is impaired or would be impaired by the purchase or redemption. A corporation may, however, purchase or redeem out of capital shares that are entitled upon any distribution of its assets to a preference over another class or series of its shares if the shares are to be retired and the capital reduced. |

|

Under the Cayman Islands Companies Law, shares may

be redeemed or repurchased out of (a) profits, (b) share premium (subject to the statutory solvency test), (c) the proceeds of a fresh

issuance of shares made for that purpose, or (d) capital, provided that payments out of capital are subject to the statutory solvency

test and must be specifically authorized by a company’s articles of association.

Ordinary Shares are not redeemable, but under our Amended and Restated Memorandum and Articles of Association, our board of directors

may determine to repurchase shares on such terms as the board of directors determines. The repurchase of any share may be paid out of

our profits, out of the share premium account or out of the proceeds of a fresh issuance of shares made for the purpose of such repurchase,

or out of capital if we are able to, immediately following such repurchase, pay our debts, if any, as they fall due in the ordinary course

of our business. No shareholder approval is required under the Cayman Islands Companies Law or our Amended and Restated Memorandum and

Articles of Association for any repurchases.

Shares that have been repurchased or redeemed may either be cancelled or held by a company as treasury shares. Shares held in treasury shall not have voting rights or dividend rights, and may be sold or otherwise transferred on such terms and conditions as our board of directors determine.

|

| General meetings of shareholders |

|

Under the DGCL, a corporation must hold an annual meeting of stockholders in a place designated by the certificate of incorporation or bylaws, whether inside or outside of Delaware, or, if not so designated, as determined by the board of directors and on a date and at a time designated in the bylaws, except as otherwise provided by law. Written notice of every meeting of stockholders must be given to each stockholder of record not less than ten or more than 60 days before the date of the meeting. |

|

As an exempted company, we are not required under

the Cayman Islands Companies Law to hold annual general meetings, but our Amended and Restated Memorandum and Articles of Association,

provide that we shall in each calendar year hold an annual general meeting, and that the maximum period between annual general meetings

shall not exceed 15 months. General meetings may be held at such place within or outside the Cayman Islands as our board of directors

shall consider appropriate.

Annual general meetings of shareholders may be held

at such place as the board of directors determines, whether within or outside the Cayman Islands.

The Cayman Islands Companies Law provides shareholders with only limited rights to requisition a general meeting. However, these rights

may be provided in a company's articles of association. Our Amended and Restated Memorandum and Articles of Association provide that,

subject to certain procedure prescribed therein being satisfied, shareholders holding not less than one-tenth of the paid-up share capital

of our issued voting shares have the right, by written requisition to us, to require a general meeting of the shareholders to be called

by the board of directors. If this right is exercised, the board of directors is required to call a general meeting within 21 days of

the receipt of such requisition.

The Cayman Islands Companies Law does not specify

a minimum attendance threshold for general meetings of shareholders to be quorate. Our Amended and Restated Memorandum and Articles of

Association provide that a quorum for a general meeting is twenty five percent (25%) of shareholders present in person, by proxy or (in

the case of a shareholder that is a non-natural person) by a duly authorized representative and entitled to vote on the business to be

transacted, unless the Company has only one shareholder in which case that shareholder alone constitutes a quorum. |

| |

|

|

|

|

| Matters to be decided by supermajority shareholder resolution |

|

Under the DGCL, certain fundamental changes such as amendments to the certificate of incorporation, a merger, consolidation, sale, lease, exchange or other disposition of all or substantially all of the property of a corporation not in the usual and regular course of the corporation’s business, or a dissolution of the corporation, are generally required to be approved by the holders of a majority of the outstanding stock entitled to vote on the matter, unless the certificate of incorporation requires a higher percentage. |

|

Under the Cayman Islands Companies Law and our Amended

and Restated Memorandum and Articles of Association, certain matters are required to be approved by a “special resolution,”

which is a supermajority resolution passed by either (a) not less than a two-thirds majority of votes cast (in person or by proxy) at

a quorate general meeting of shareholders or (b) by unanimous written resolution.

Under the Cayman Islands Companies Law, the principal matters relevant to us that require a special resolution are as follows: (a) amendments

to the memorandum and articles of association; (b) change our name; (c) appointment of inspectors for the purpose of examining our affairs;

(d) placing us into voluntary or court-supervised liquidation; (e) authorizing our statutory merger with one or more other companies in

accordance with the Cayman Islands Companies Law; and (f) approving a reduction of share capital.

|

| |

|

|

|

|

| Appointment and removal of directors |

|

Under Delaware law, unless otherwise specified in

the certificate of incorporation or bylaws of the corporation, directors shall be elected by a plurality of the votes of the shares present

in person or represented by proxy at the meeting and entitled to vote on the election of directors.

In addition, the office of a director shall be vacated automatically if, among other things, he or she (1) becomes prohibited by law from

being a director, (2) becomes bankrupt or makes any arrangement or composition with his or her creditors, (3) dies or is in the opinion

of all his or her co-directors, incapable by reason of mental disorder of discharging his or her duties as director (4) resigns his or

her office by notice to us or (5) has for more than six months been absent without permission of the directors from meetings of the board

of directors held during that period, and the remaining directors resolve that his or her office be vacated.

|

|

The Cayman Islands Companies Law does not provide shareholders

with any statutory rights to appoint or remove directors. Any such rights will be as prescribed in the articles of association of a Cayman

Islands company.

The provisions regarding the appointment and removal

of our directors by shareholders (and the maximum and minimum number of directors) are as described above. See “Management—Appointment

and Removal of Directors” in our 2021 Annual Report. |

| |

|

|

|

|

| Director’s duties |

|

Under Delaware law, the business and affairs of a corporation are managed by or under the direction of its board of directors. In exercising their powers, directors are charged with a fiduciary duty of care to protect the interests of the corporation and a fiduciary duty of loyalty to act in the best interests of its shareholders. The duty of care requires that directors act in an informed and deliberative manner and inform themselves, prior to making a business decision, of all material information reasonably available to them. The duty of care also requires that directors exercise care in overseeing and investigating the conduct of the corporation’s employees. The duty of loyalty may be summarized as the duty to act in good faith, not out of self-interest, and in a manner which the director reasonably believes to be in the best interests of the shareholders.

Subject to the limitations described below, a certificate of incorporation may provide for the elimination or limitation of the personal liability of a director to the corporation or its shareholders for monetary damages for a breach of fiduciary duty as a director. Such provision cannot limit liability for breach of loyalty, bad faith, intentional misconduct, unlawful payment of dividends or unlawful share purchase or redemption. In addition, the certificate of incorporation cannot limit liability for any act or omission occurring prior to the date when such provision becomes effective.